Compound Feed Market Report

Published Date: 02 February 2026 | Report Code: compound-feed

Compound Feed Market Size, Share, Industry Trends and Forecast to 2033

This market report covers the Compound Feed industry, providing insights on market trends, size, segmentation, regional dynamics, and future forecasts from 2023 to 2033.

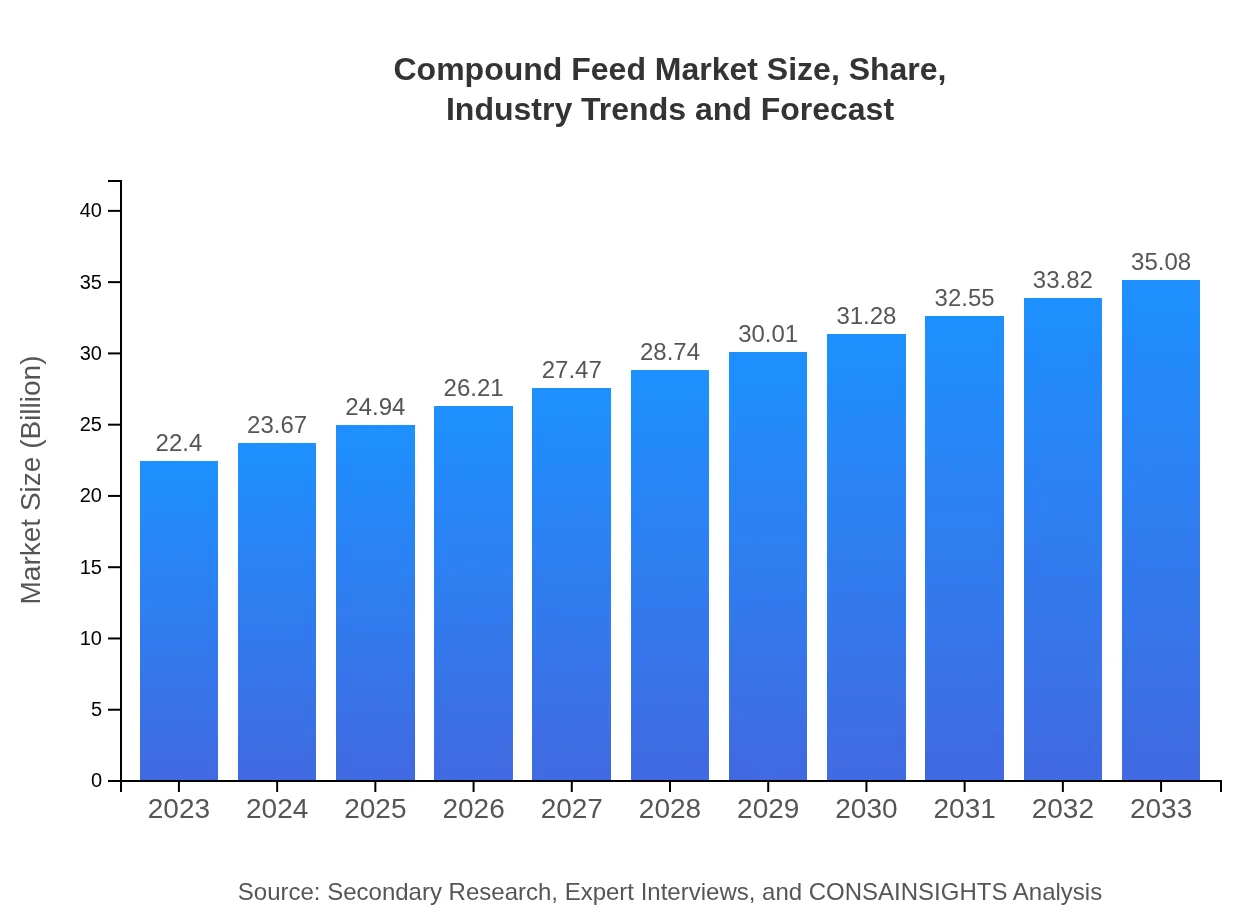

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $22.40 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $35.08 Billion |

| Top Companies | Cargill, Incorporated, Archer Daniels Midland Company, Alltech, Inc., Nutreco N.V., Land O'Lakes, Inc. |

| Last Modified Date | 02 February 2026 |

Compound Feed Market Overview

Customize Compound Feed Market Report market research report

- ✔ Get in-depth analysis of Compound Feed market size, growth, and forecasts.

- ✔ Understand Compound Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compound Feed

What is the Market Size & CAGR of Compound Feed market in 2023?

Compound Feed Industry Analysis

Compound Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compound Feed Market Analysis Report by Region

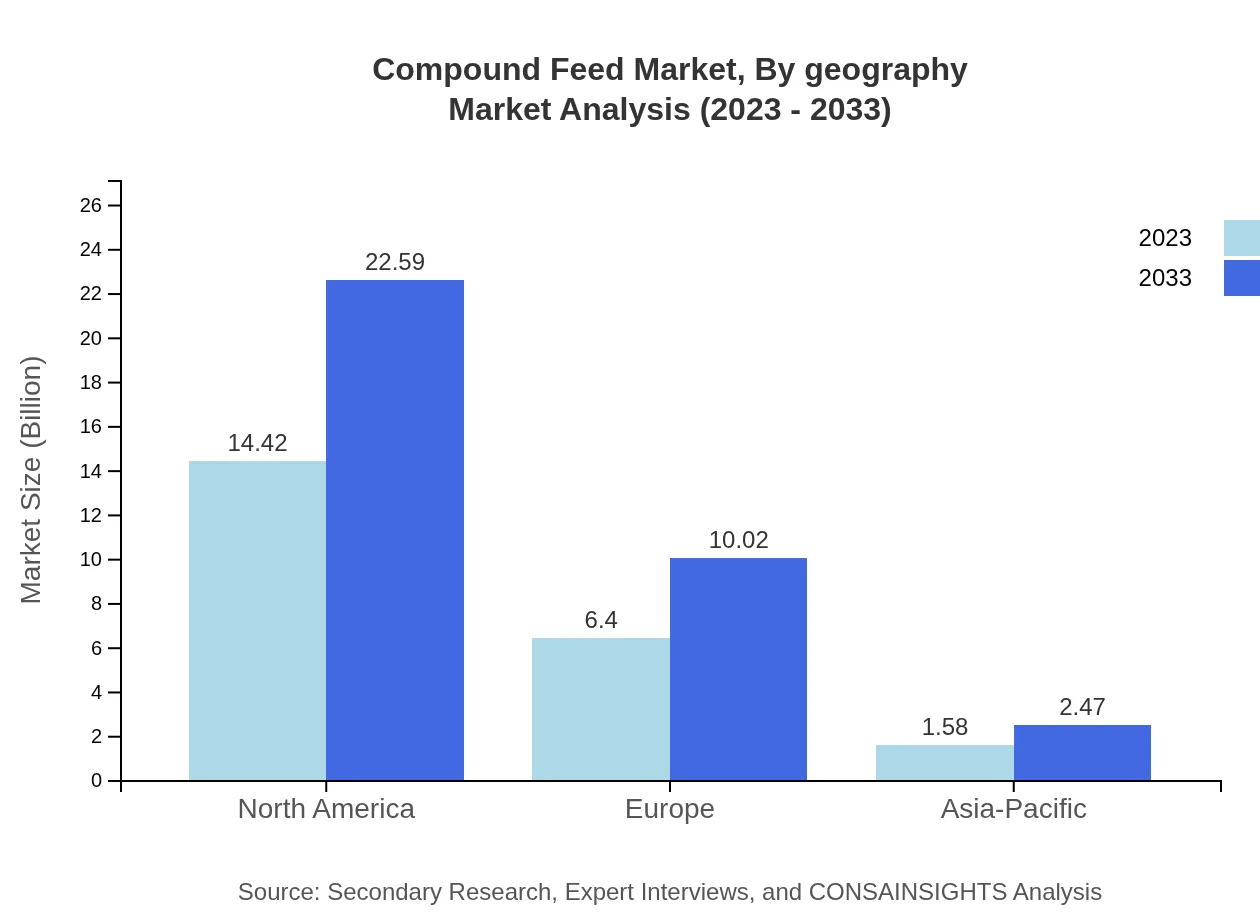

Europe Compound Feed Market Report:

Europe's Compound Feed market is estimated at $5.64 billion in 2023, with projections of growing to $8.84 billion by 2033. The region's stringent feed safety regulations and the rise of organic and non-GMO feed options are notable trends affecting the market.Asia Pacific Compound Feed Market Report:

In the Asia Pacific region, the Compound Feed market was valued at $4.28 billion in 2023, anticipated to grow to $6.71 billion by 2033. The rapid increase in livestock production and the rising demand for pork and poultry products drive this growth, alongside government initiatives to improve feed efficiency and safety standards.North America Compound Feed Market Report:

North America dominates the Compound Feed market, with a valuation of approximately $7.96 billion in 2023, likely to reach $12.47 billion by 2033. The robust agricultural infrastructure and high meat consumption levels, alongside technological advancements in feed production, underpin this growth.South America Compound Feed Market Report:

The South American market is projected to increase from $1.77 billion in 2023 to $2.77 billion by 2033, fueled by an expanding livestock sector particularly in Brazil and Argentina. As the region looks to enhance its global meat production capabilities, the demand for high-quality feed blends is on the rise.Middle East & Africa Compound Feed Market Report:

The Middle East and Africa are expected to see an increase from $2.74 billion in 2023 to approximately $4.30 billion by 2033. This growth is driven by increasing urbanization, a growing middle class, and the consequent demand for high-quality animal protein.Tell us your focus area and get a customized research report.

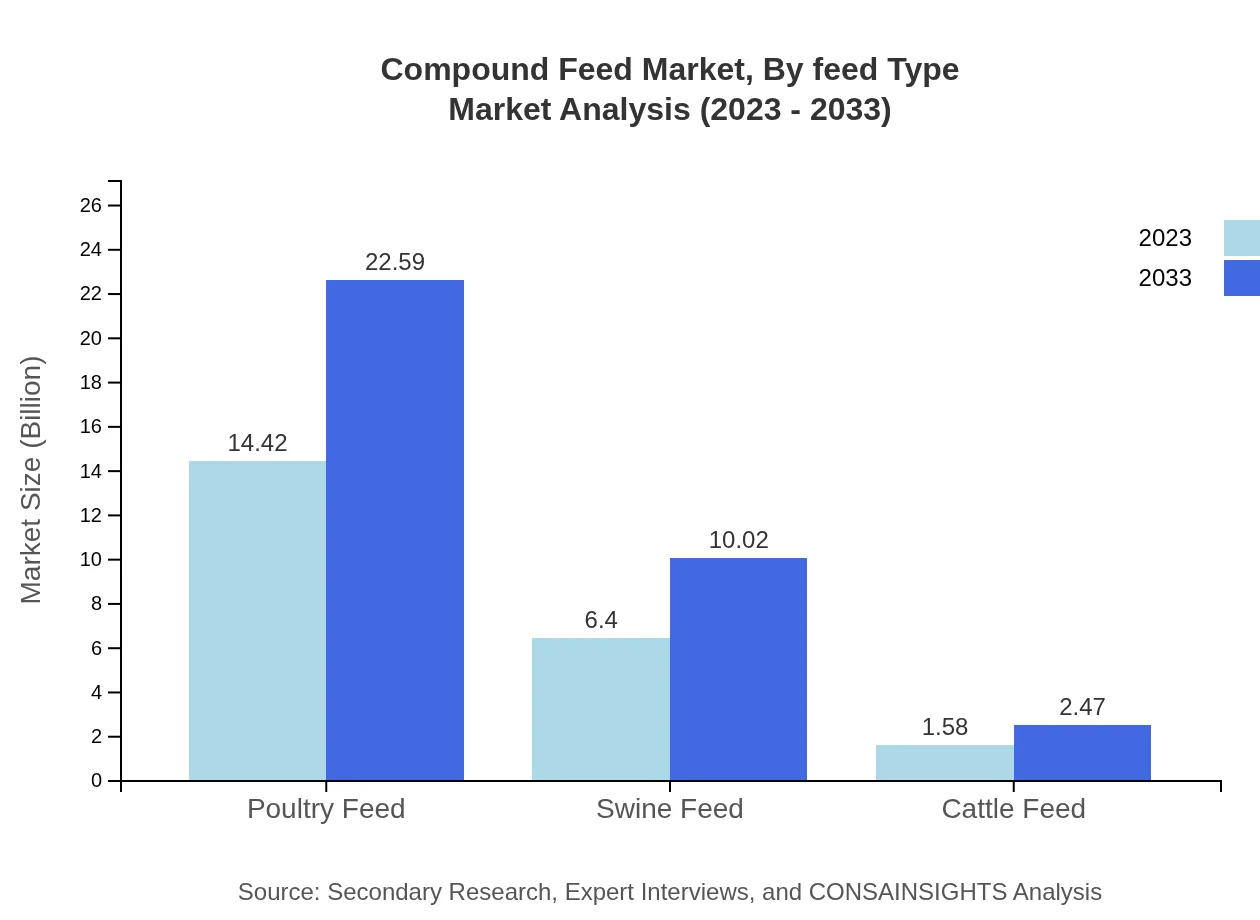

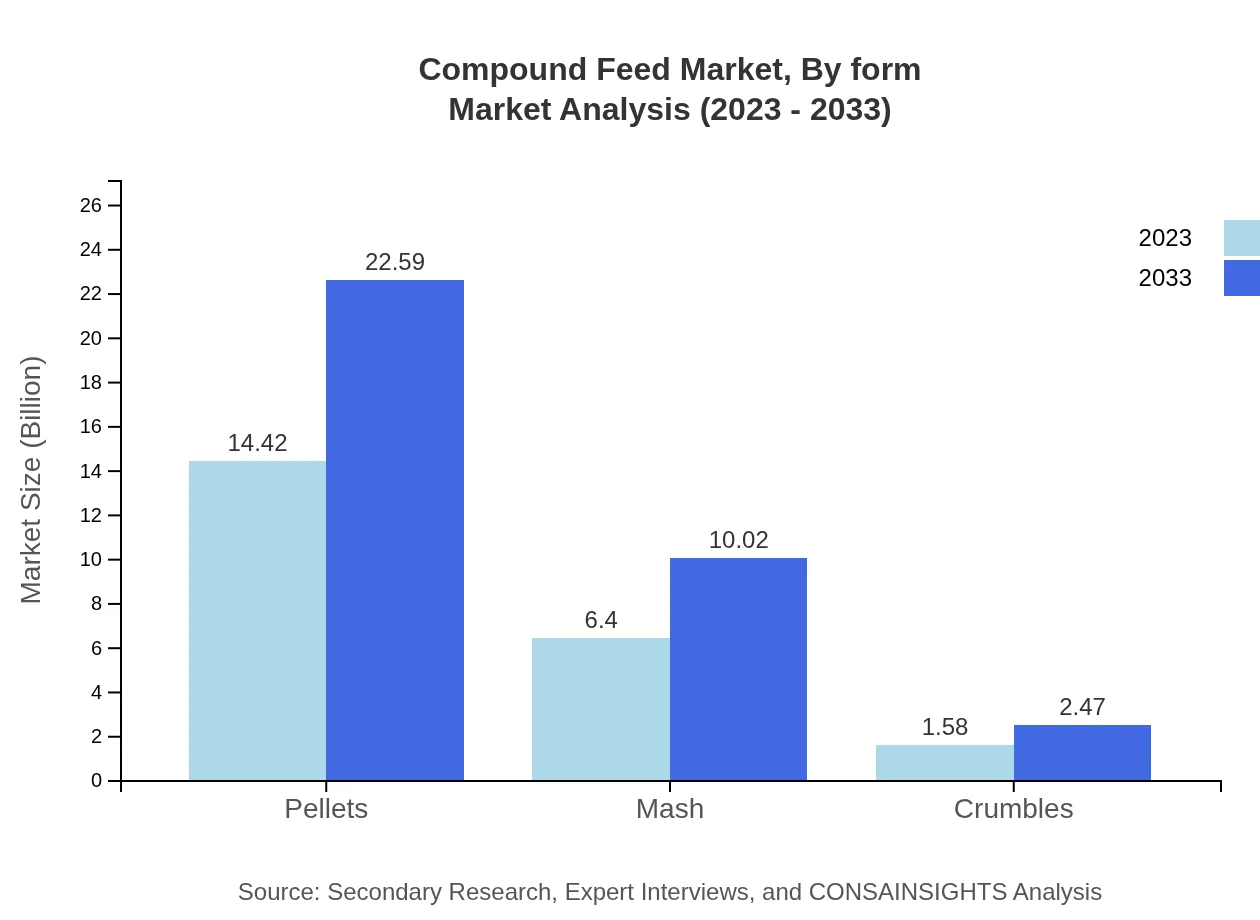

Compound Feed Market Analysis By Feed Type

The feed type segment includes pellets, mash, and crumbles. In 2023, pellets are leading in market size at approximately $14.42 billion, expected to grow to $22.59 billion by 2033, holding a consistent market share of 64.38%. Mash follows with a size of $6.40 billion in 2023, projected to increase to $10.02 billion by 2033, representing 28.57% market share. Crumbles constitute a smaller segment at $1.58 billion in 2023, increasing to $2.47 billion by 2033, which is 7.05% market share.

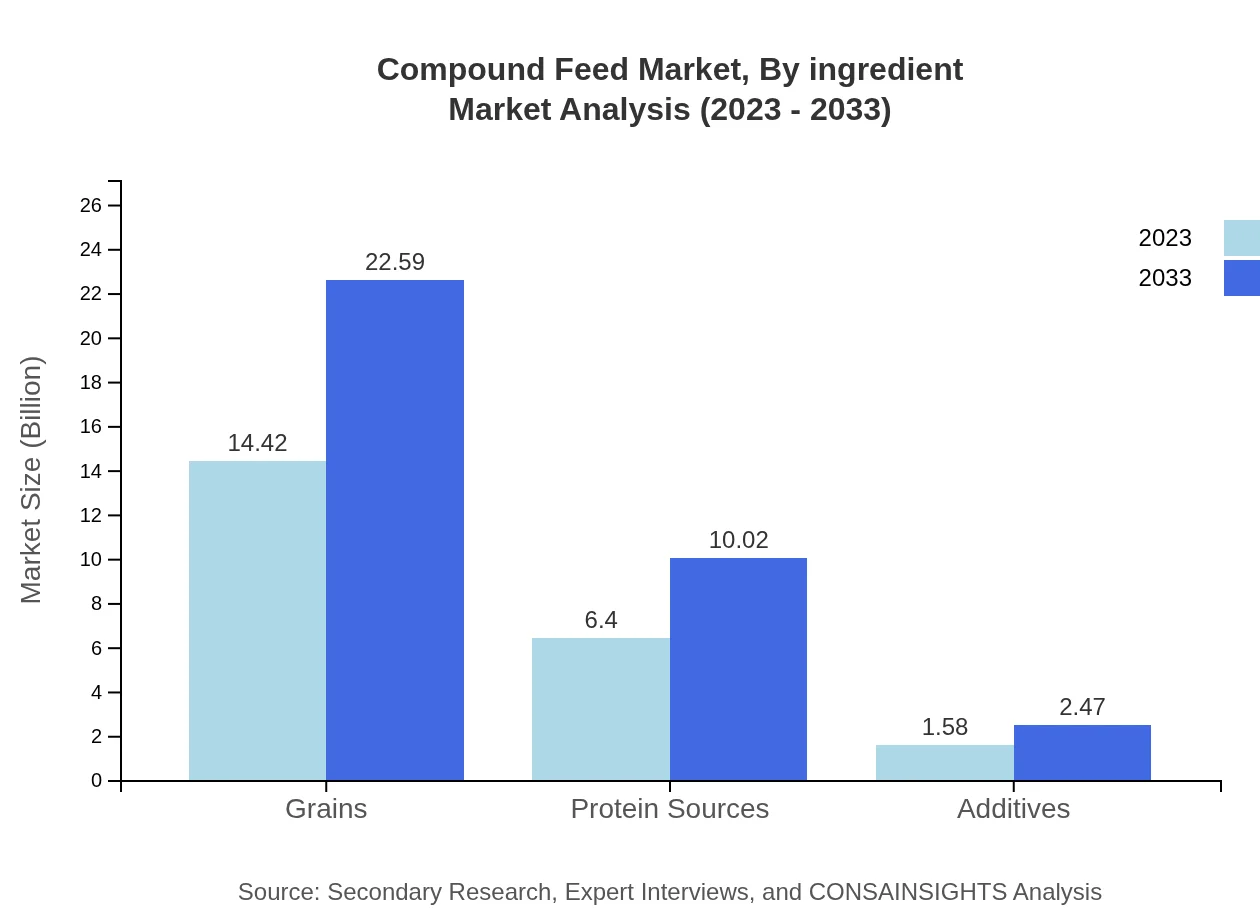

Compound Feed Market Analysis By Ingredient

Grains dominate the ingredient segment, projected to maintain a market size of $14.42 billion in 2023 and reaching $22.59 billion by 2033, with a share of 64.38%. Protein sources follow, starting at $6.40 billion and expected to grow to $10.02 billion, holding 28.57%, while additives account for $1.58 billion and are anticipated to rise to $2.47 billion, reflecting 7.05% market share.

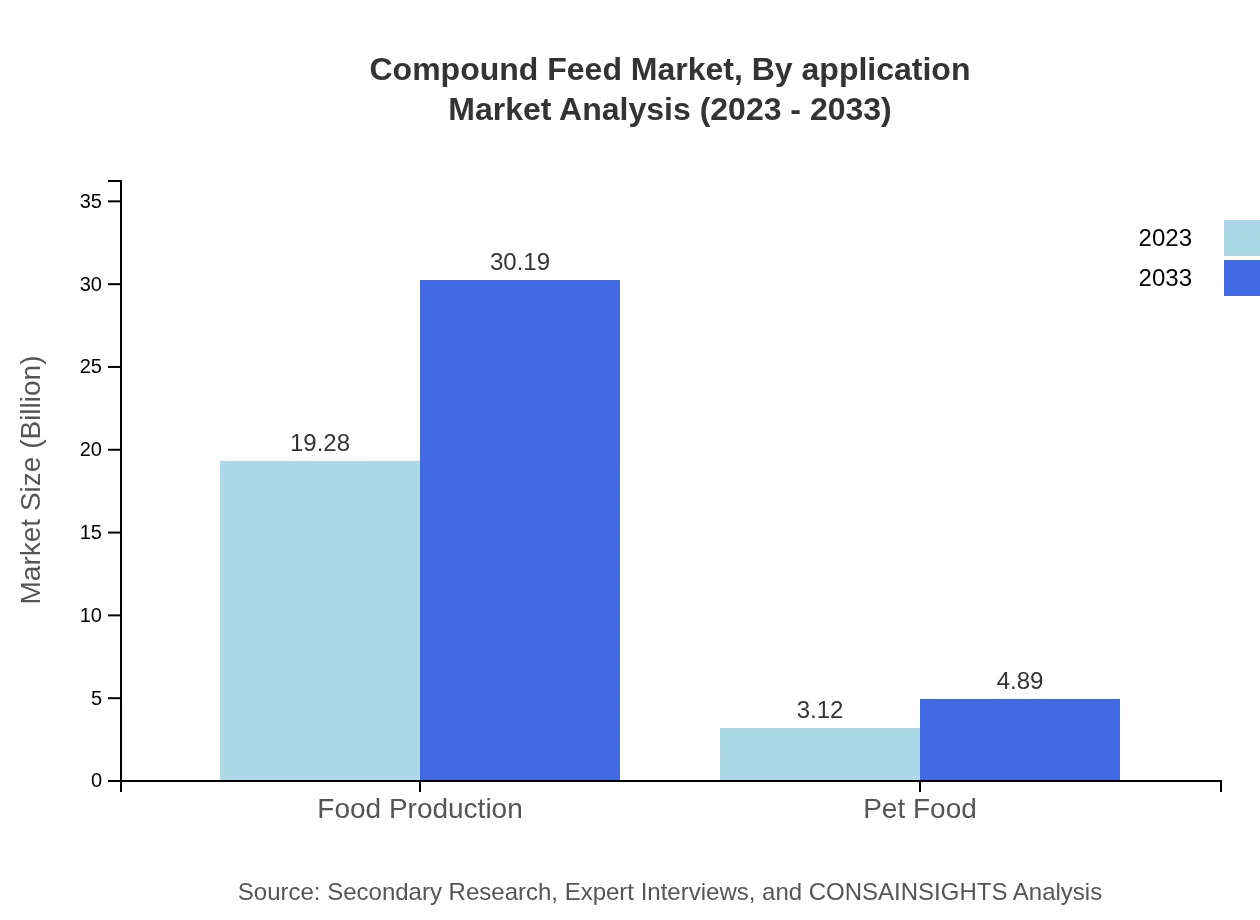

Compound Feed Market Analysis By Application

The application segment is divided into food production and pet food. Food production accounts for a significant portion of the market, valued at $19.28 billion in 2023, growing to $30.19 billion by 2033 with an 86.06% share. In contrast, the pet food segment, starting at $3.12 billion in 2023, rising to $4.89 billion by 2033, comprises 13.94% of the total market.

Compound Feed Market Analysis By Form

In terms of form, the market analysis reveals significant demand for pelleted feed due to its efficient nutrient delivery and ease of use. Mash and crumbles have substantial shares as well, catering to specific livestock needs. Understanding these forms aids producers in targeting their products to the right markets.

Compound Feed Market Analysis By Geography

Geographically, North America, Europe, and Asia-Pacific dominate the Compound Feed market. These regions showcase unique characteristics; North America benefits from advanced technology applications, Europe emphasizes organic growth, and Asia-Pacific leverages a rapidly expanding livestock sector, presenting opportunities for growth across the board.

Compound Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compound Feed Industry

Cargill, Incorporated:

A global leader in animal nutrition products and services, Cargill focuses on sustainable innovations in feed formulation.Archer Daniels Midland Company:

ADM operates in various segments of the agriculture and food supply chain, emphasizing sustainable feed solutions for livestock.Alltech, Inc.:

Alltech specializes in natural animal nutrition and health solutions, offering innovative feed products for poultry and livestock.Nutreco N.V.:

Nutreco is renowned for its specialized animal nutrition products and aquaculture feeds, aiming to enhance feed efficiency and sustainability.Land O'Lakes, Inc.:

Land O'Lakes provides dairy and animal feed products, promoting nutrition-driven feeding programs for optimal livestock performance.We're grateful to work with incredible clients.

FAQs

What is the market size of compound Feed?

The compound-feed market is valued at $22.4 billion in 2023, with a projected CAGR of 4.5% over the next decade, indicating steady growth in demand across various segments.

What are the key market players or companies in this compound Feed industry?

Key players in the compound-feed industry include Cargill, Archer Daniels Midland Company, and BASF. These companies are major contributors, leveraging innovative practices and technologies to enhance their market share.

What are the primary factors driving the growth in the compound Feed industry?

Growth in the compound-feed industry is driven by increasing meat consumption, technological advancements in feed production, and a surge in animal husbandry practices globally, leading to heightened demand for quality feed.

Which region is the fastest Growing in the compound Feed market?

North America holds the fastest growth, projected to rise from $7.96 billion in 2023 to $12.47 billion by 2033. This is due to a robust livestock sector and advancements in feed formulation technologies.

Does ConsaInsights provide customized market report data for the compound Feed industry?

Yes, ConsaInsights offers customized market report data that caters to specific needs within the compound-feed industry, allowing clients to focus on relevant segments and geographical areas.

What deliverables can I expect from this compound Feed market research project?

Deliverables include comprehensive market analysis, key player insights, segmentation data, regional trends, and forecasts for the compound-feed market over multiple years.

What are the market trends of compound Feed?

Current trends in the compound-feed market involve increased use of alternative protein sources, focus on sustainability, and innovations in feed efficiency to meet growing global demand for animal products.