Compound Fertilizer Market Report

Published Date: 31 January 2026 | Report Code: compound-fertilizer

Compound Fertilizer Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Compound Fertilizer market, highlighting key insights and data, including market size analysis, regional performance, and trends spanning the forecast period from 2023 to 2033.

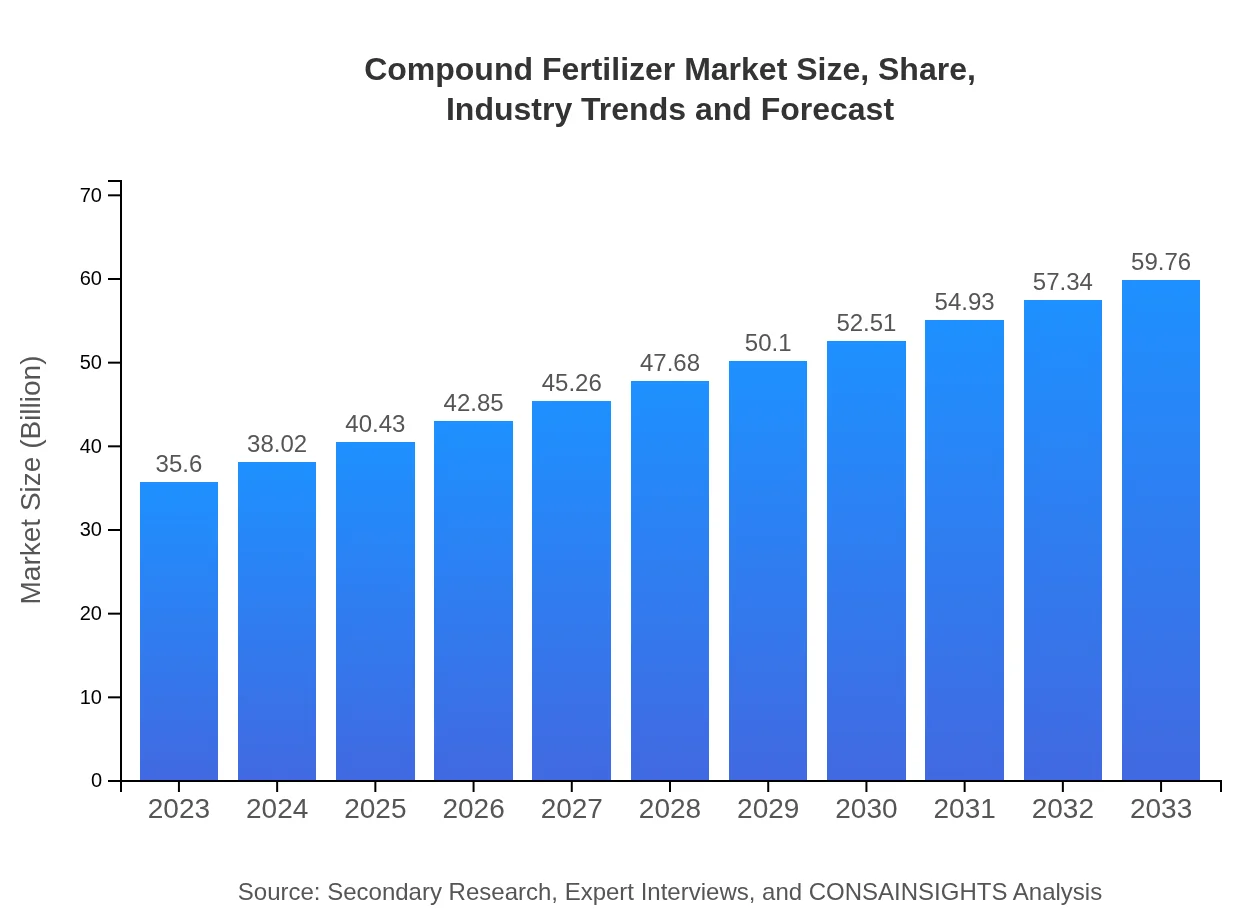

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $59.76 Billion |

| Top Companies | Nutrien, Yara International, CF Industries, BASF SE, The Mosaic Company |

| Last Modified Date | 31 January 2026 |

Compound Fertilizer Market Overview

Customize Compound Fertilizer Market Report market research report

- ✔ Get in-depth analysis of Compound Fertilizer market size, growth, and forecasts.

- ✔ Understand Compound Fertilizer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compound Fertilizer

What is the Market Size & CAGR of Compound Fertilizer Market in 2023?

Compound Fertilizer Industry Analysis

Compound Fertilizer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compound Fertilizer Market Analysis Report by Region

Europe Compound Fertilizer Market Report:

The Compound Fertilizer market in Europe is projected to grow from $12.23 billion in 2023 to $20.52 billion by 2033. The European market is increasingly focused on sustainable fertilizers due to strict regulations governing chemical use in agriculture. The rising trend of organic farming is also influencing product formulations.Asia Pacific Compound Fertilizer Market Report:

The Asia Pacific region accounts for a significant portion of the global Compound Fertilizer market, valued at $6.45 billion in 2023, projected to grow to $10.82 billion by 2033. This growth is driven by the expansion of agricultural activities, government initiatives for increasing food production, and a rising population. Countries like India and China are leading the market due to their vast agricultural sectors.North America Compound Fertilizer Market Report:

North America, with a market value of $11.99 billion in 2023, is estimated to grow to $20.13 billion by 2033. The region benefits from advanced agricultural practices and high adoption of technology. The U.S. remains a significant player, emphasizing sustainable agricultural solutions.South America Compound Fertilizer Market Report:

In South America, the Compound Fertilizer market is smaller, valued at $0.23 billion in 2023 and expected to reach $0.39 billion by 2033. The growth is propelled by increasing investment in agriculture, particularly in Brazil and Argentina, focusing on enhancing crop outputs through effective fertilization strategies.Middle East & Africa Compound Fertilizer Market Report:

The Middle East and Africa market is expected to grow from $4.70 billion in 2023 to $7.89 billion by 2033, supported by a growing need for food security in the region. Investments in agricultural technologies and water management are prompting increased use of fertilizers.Tell us your focus area and get a customized research report.

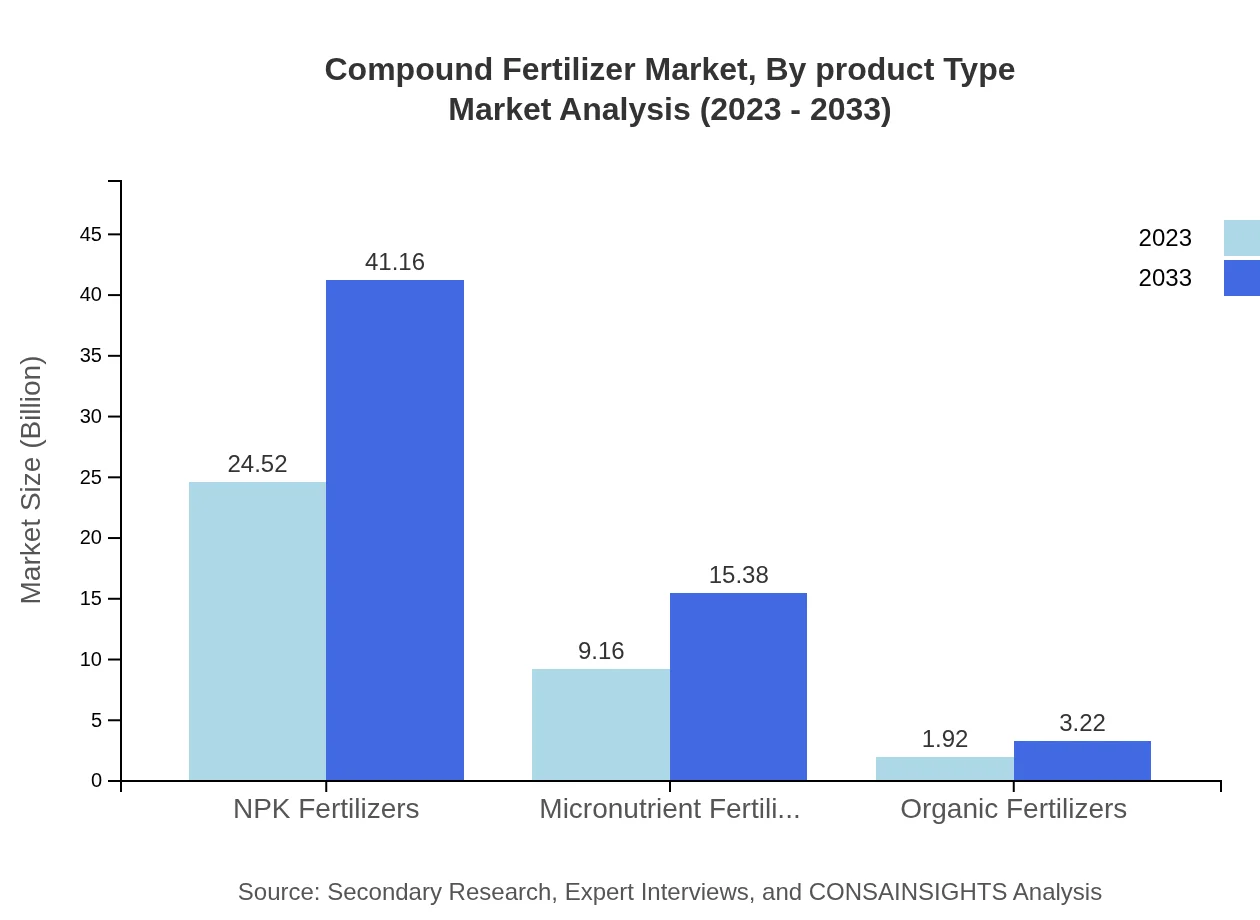

Compound Fertilizer Market Analysis By Product Type

In 2023, the granulated segment dominates the Compound Fertilizer market with a size of $24.52 billion, projected to grow to $41.16 billion by 2033, representing a market share of 68.87%. Liquid fertilizers hold a market size of $9.16 billion, expected to increase to $15.38 billion, with a share of 25.74%. The powder form, while smaller, contributes around $1.92 billion in 2023 and is expected to reach $3.22 billion by 2033, maintaining a share of 5.39%.

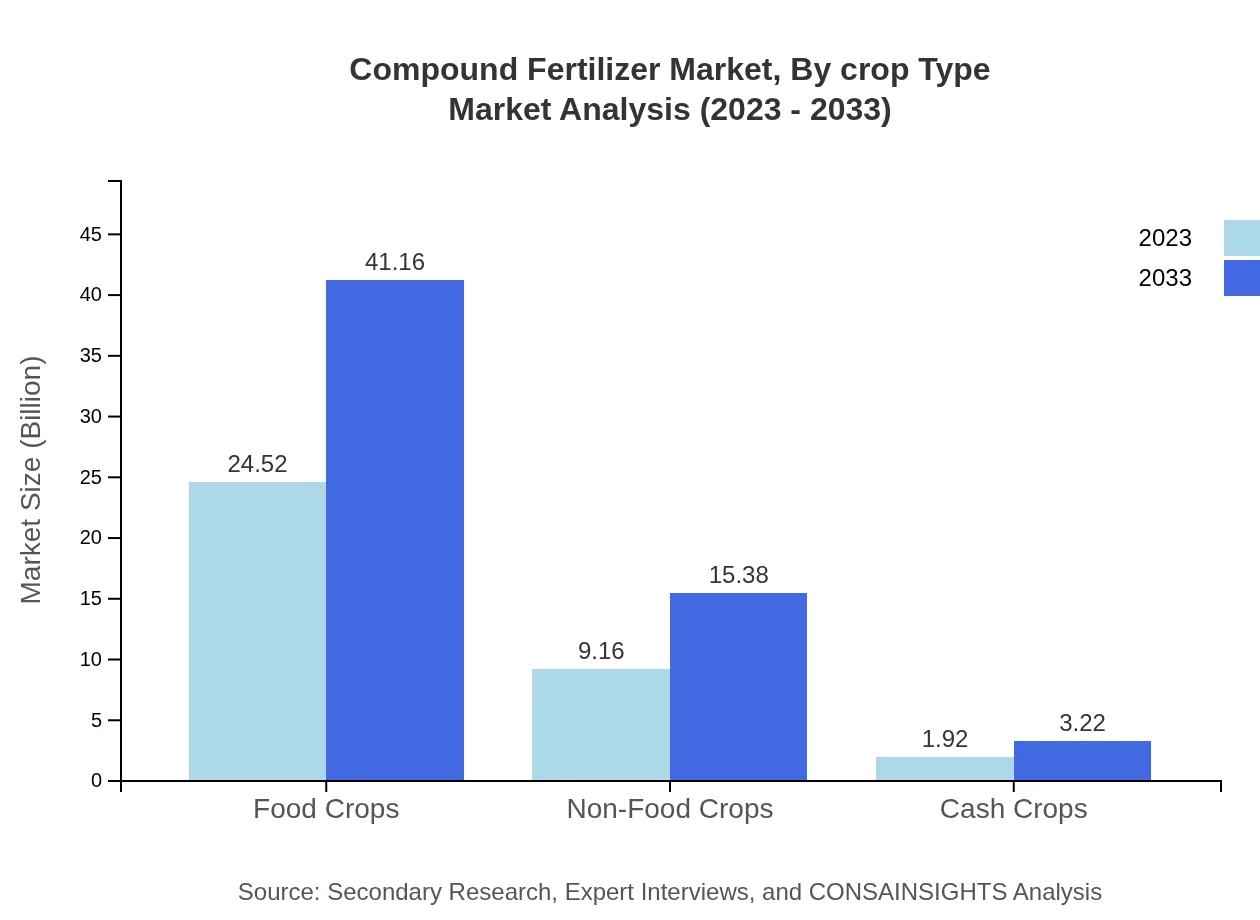

Compound Fertilizer Market Analysis By Application

The application of Compound Fertilizers is segmented into food crops, non-food crops, and cash crops. Food crops dominate with a market size of $24.52 billion in 2023, moving to $41.16 billion by 2033, capturing 68.87% of the market share. Non-food crops follow with a value of $9.16 billion in 2023, predicted to grow to $15.38 billion (25.74% share). Cash crops currently sit at $1.92 billion and are anticipated to increase to $3.22 billion, maintaining a 5.39% share.

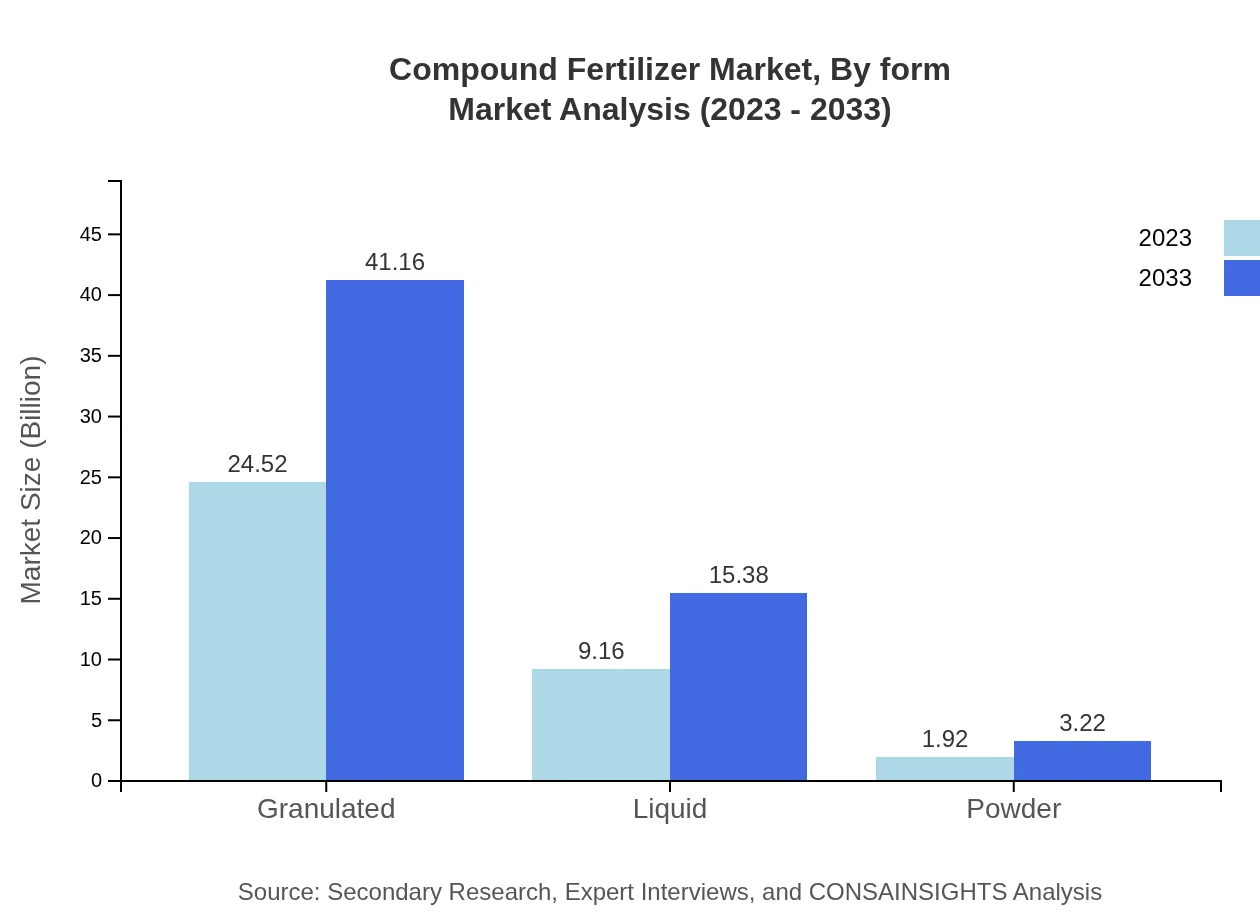

Compound Fertilizer Market Analysis By Form

In terms of product form, granulated fertilizers lead the market due to their ease of application and storage. Granulated fertilizers account for $24.52 billion in market size as of 2023, with a growth forecast to $41.16 billion by 2033, holding 68.87% of the share. Liquid fertilizers are also significant in the market, going from $9.16 billion in 2023 to $15.38 billion in 2033, at a 25.74% market share.

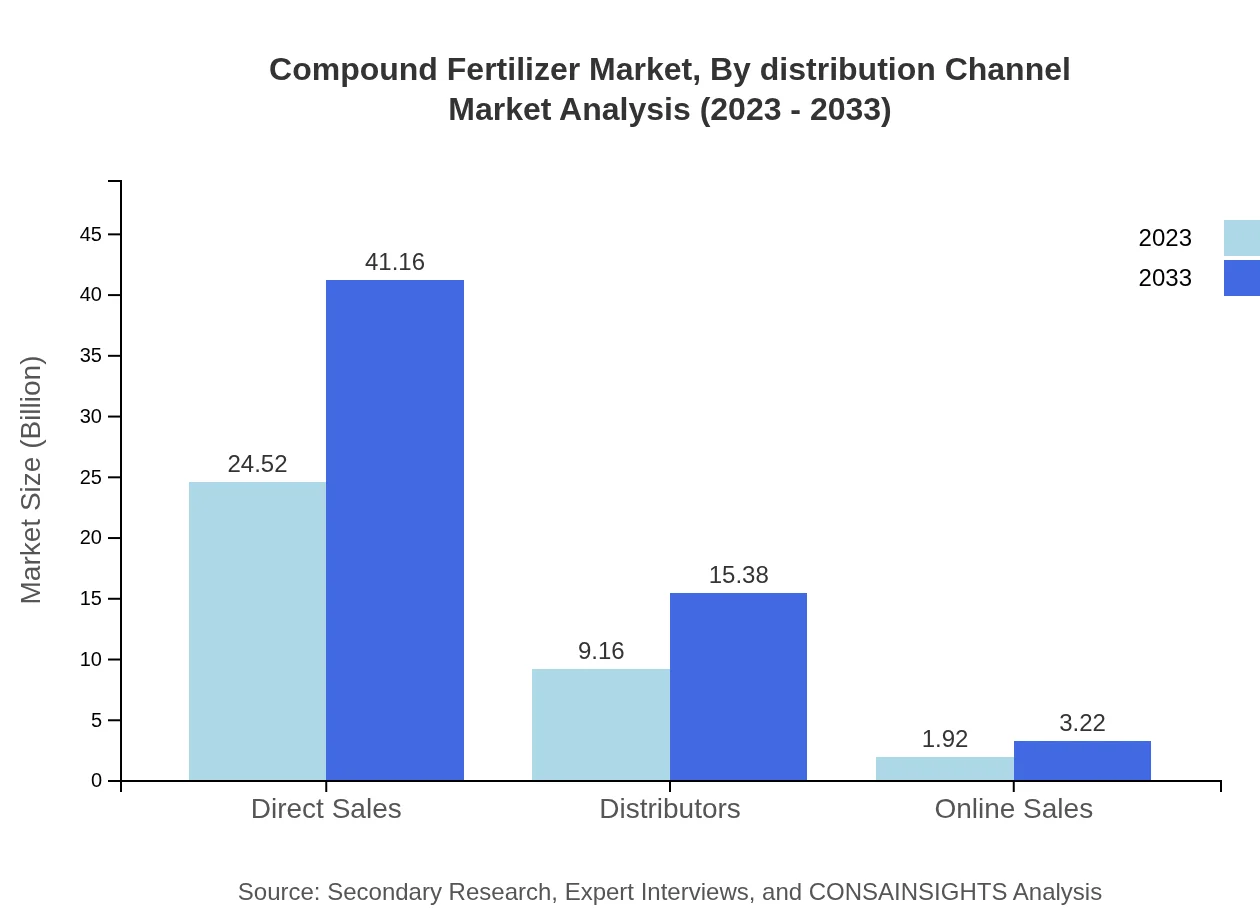

Compound Fertilizer Market Analysis By Distribution Channel

The distribution channels for Compound Fertilizers can be categorized into direct sales, distributors, and online sales. Direct sales lead the segment with a market size of $24.52 billion in 2023, projected to grow to $41.16 billion (68.87% share). Distributors show a size of $9.16 billion, expected to reach $15.38 billion (25.74% share). Online sales, while smaller, are growing in popularity, forecasted from $1.92 billion to $3.22 billion, holding a 5.39% share.

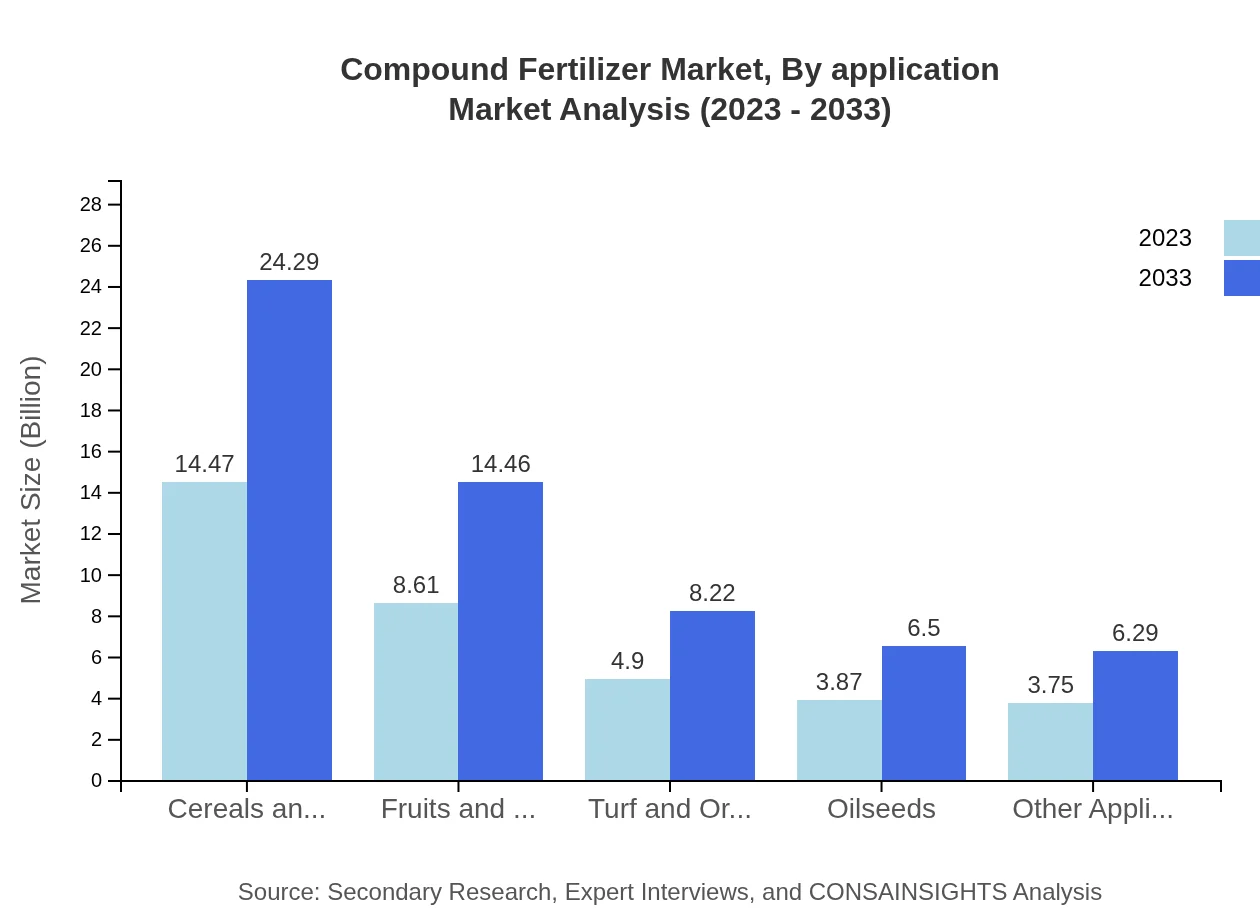

Compound Fertilizer Market Analysis By Crop Type

The market is segmented by crop types including cereals and grains, fruits and vegetables, turf and ornamentals, oilseeds, and other applications. The cereals and grains segment has a market size of $14.47 billion in 2023, projected to grow to $24.29 billion (40.65% share). Fruits and vegetables hold $8.61 billion, moving to $14.46 billion (24.19% share), while turf and ornamentals are valued at $4.90 billion, forecasted to increase to $8.22 billion (13.76% share). Oilseeds account for $3.87 billion in 2023, expected to reach $6.50 billion (10.88% share). Other applications contribute $3.75 billion, growing to $6.29 billion (10.52% share).

Compound Fertilizer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compound Fertilizer Industry

Nutrien:

Nutrien is one of the world’s largest providers of crop inputs and services, operating a diverse range of fertilizers and solutions to enhance agricultural production.Yara International:

Yara is a global leader in the production of nitrogen-based fertilizers and has a strong commitment to sustainability, providing products designed to improve crop efficiency.CF Industries:

CF Industries is a leading manufacturer of hydrogen and nitrogen products, focused on agricultural and industrial applications, with a commitment to sustainable farming.BASF SE:

BASF is a global chemical company offering a wide range of fertilizers and agricultural solutions designed to improve yield and enhance sustainability in farming.The Mosaic Company:

The Mosaic Company specializes in phosphate and potash, critical nutrients for plant growth, and has a significant global presence in the fertilizer market.We're grateful to work with incredible clients.

FAQs

What is the market size of compound Fertilizer?

The compound fertilizer market is currently valued at approximately $35.6 billion and is projected to grow at a CAGR of 5.2% over the next decade. This growth indicates a robust demand for such fertilizers, reflecting their essential role in agricultural productivity.

What are the key market players or companies in this compound Fertilizer industry?

The compound fertilizer industry includes notable players such as Nutrien Ltd., Yara International ASA, The Mosaic Company, and CF Industries. These companies are pivotal in market innovation and meet the increasing global agricultural demands.

What are the primary factors driving the growth in the compound Fertilizer industry?

Key growth drivers for the compound fertilizer market include rising global food demand, advancements in agricultural practices, and the increasing adoption of sustainable farming methods. Additionally, government initiatives promoting agricultural productivity further stimulate market expansion.

Which region is the fastest Growing in the compound Fertilizer market?

The fastest-growing region in the compound fertilizer market is Europe. It is projected to expand from $12.23 billion in 2023 to $20.52 billion by 2033, fueled by technological advancements and increased adoption of high-efficiency fertilizers.

Does ConsaInsights provide customized market report data for the compound Fertilizer industry?

Yes, ConsaInsights provides tailored market report data for the compound fertilizer industry. Clients can obtain specific insights that cater to their unique requirements, ensuring they receive relevant and actionable market intelligence.

What deliverables can I expect from this compound Fertilizer market research project?

Clients can expect comprehensive deliverables including market size analysis, growth projections, competitive landscape insights, regional breakdowns, and segment data. Detailed reports aim to aid strategic decision-making and market positioning.

What are the market trends of compound Fertilizer?

Current trends in the compound fertilizer market show a shift toward eco-friendly products, increased investment in fertilizer innovation, and a focus on digital farming technologies. These trends aim to enhance crop yield while minimizing environmental impact.