Compound Management Market Report

Published Date: 02 February 2026 | Report Code: compound-management

Compound Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Compound Management market, projecting growth from 2023 to 2033. It encompasses insights on market size, trends, segmentation, regional analyses, and forecasts, offering an in-depth look at the dynamics driving this industry.

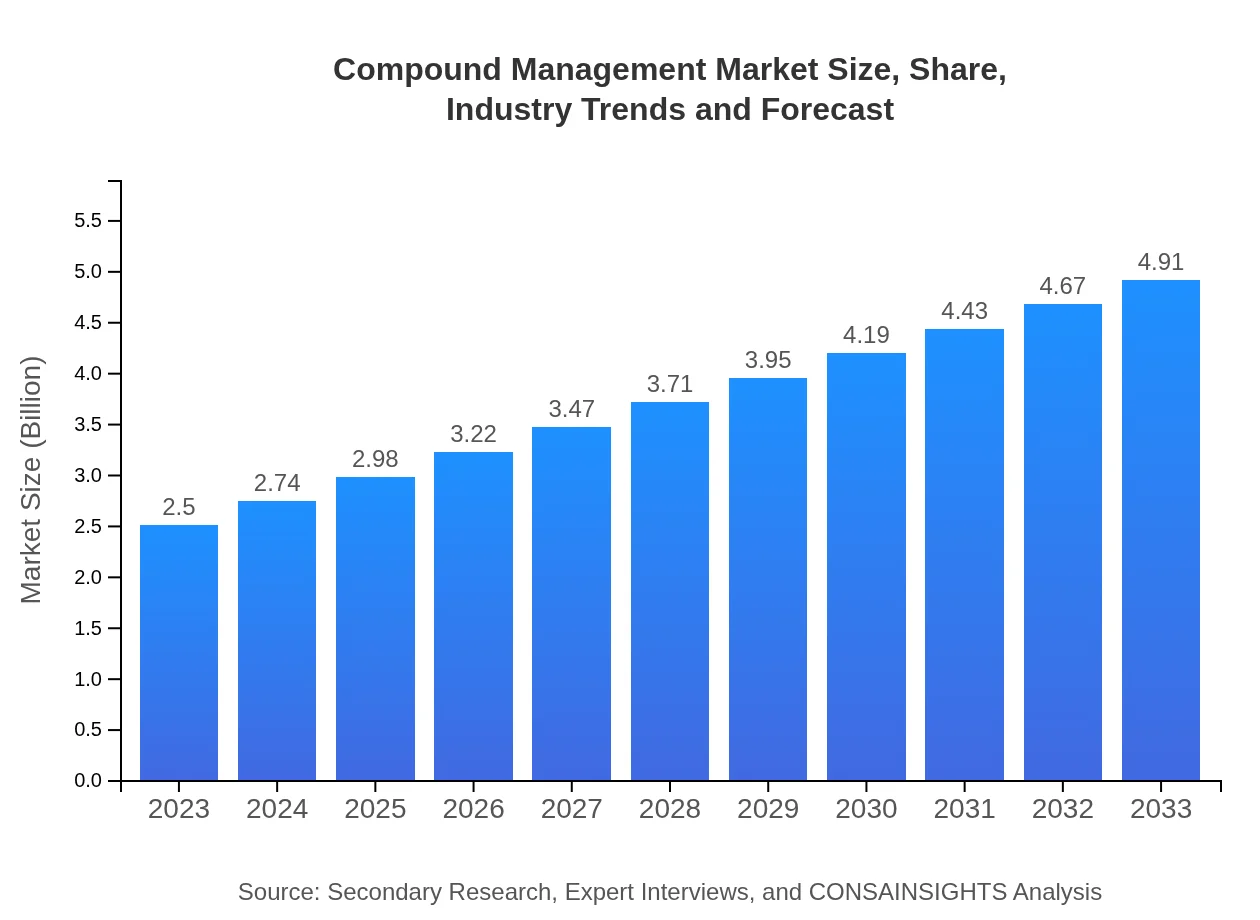

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Thermo Fisher Scientific, Boehringer Ingelheim, Sigma-Aldrich, Evotec |

| Last Modified Date | 02 February 2026 |

Compound Management Market Overview

Customize Compound Management Market Report market research report

- ✔ Get in-depth analysis of Compound Management market size, growth, and forecasts.

- ✔ Understand Compound Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compound Management

What is the Market Size & CAGR of the Compound Management market in 2023?

Compound Management Industry Analysis

Compound Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compound Management Market Analysis Report by Region

Europe Compound Management Market Report:

Europe's market is set to experience significant growth from $0.77 billion in 2023 to $1.51 billion by 2033. The region's robust regulatory framework and increasing demand for personalized medicines are notable factors driving this growth.Asia Pacific Compound Management Market Report:

In the Asia Pacific region, the Compound Management market is projected to grow from $0.45 billion in 2023 to $0.88 billion by 2033. This growth is attributed to increasing investments in research activities, along with a growing number of pharmaceutical and biotechnology firms in countries like China and India, which are establishing robust drug discovery pipelines.North America Compound Management Market Report:

North America dominates the Compound Management market, projected to expand from $0.94 billion in 2023 to $1.85 billion by 2033. This growth is fueled by the presence of major pharmaceutical companies, substantial R&D investments, and advanced technology adoption across the industry.South America Compound Management Market Report:

The South American market, albeit smaller, is transitioning from $0.04 billion in 2023 to $0.08 billion by 2033. The rise in local pharmaceutical production and increasing governmental support for research initiatives are expected to contribute to gradual growth in this region.Middle East & Africa Compound Management Market Report:

The market in the Middle East and Africa is also on an upward trajectory, growing from $0.31 billion in 2023 to $0.61 billion by 2033. Enhanced investment in public health research and partnerships with international firms are key drivers in this region.Tell us your focus area and get a customized research report.

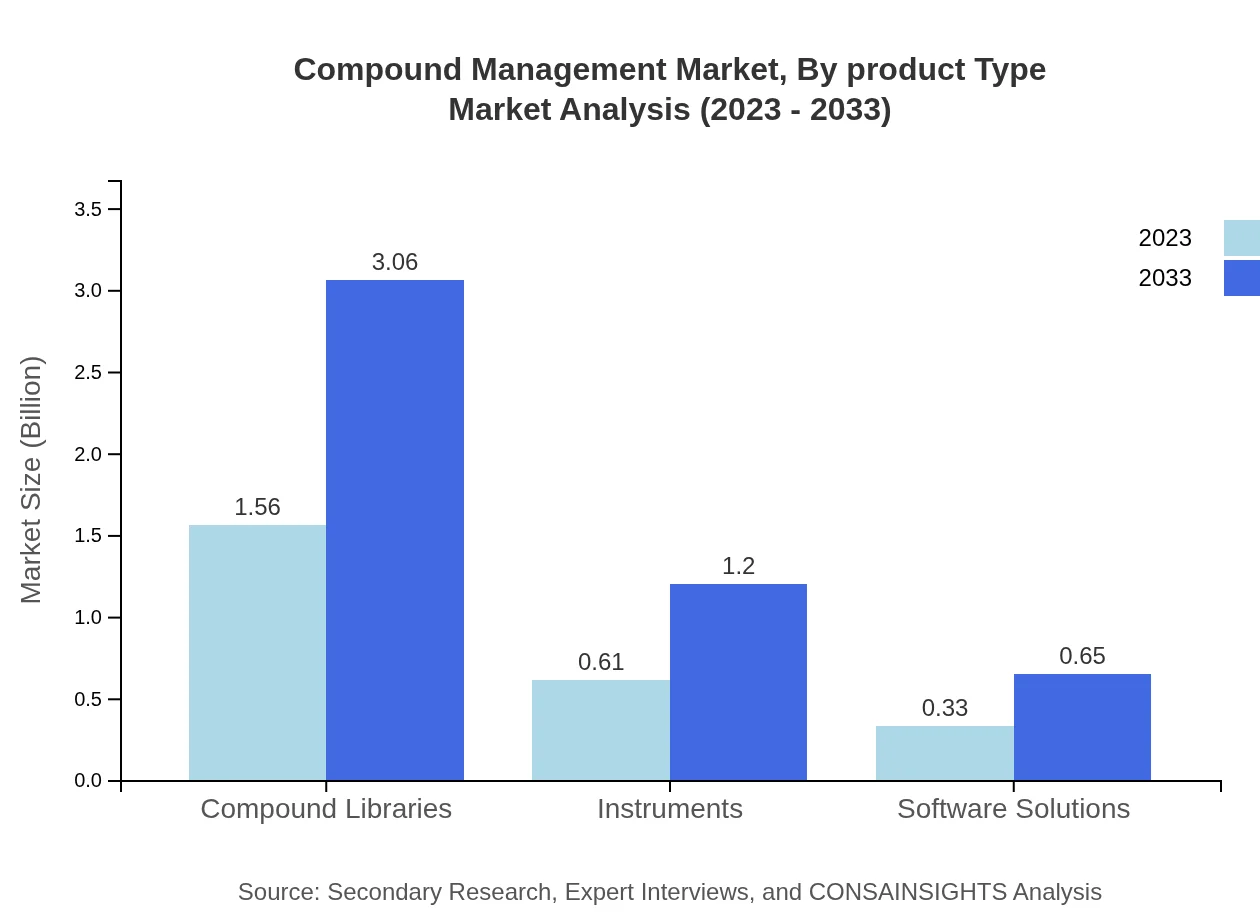

Compound Management Market Analysis By Product Type

The Compound Libraries segment leads the market with a projected increase from $1.56 billion in 2023 to $3.06 billion by 2033, maintaining a share of 62.24%. Instruments and Software Solutions account for the remaining market shares, expected to grow significantly due to technological advancements and increasing reliance on automated processes.

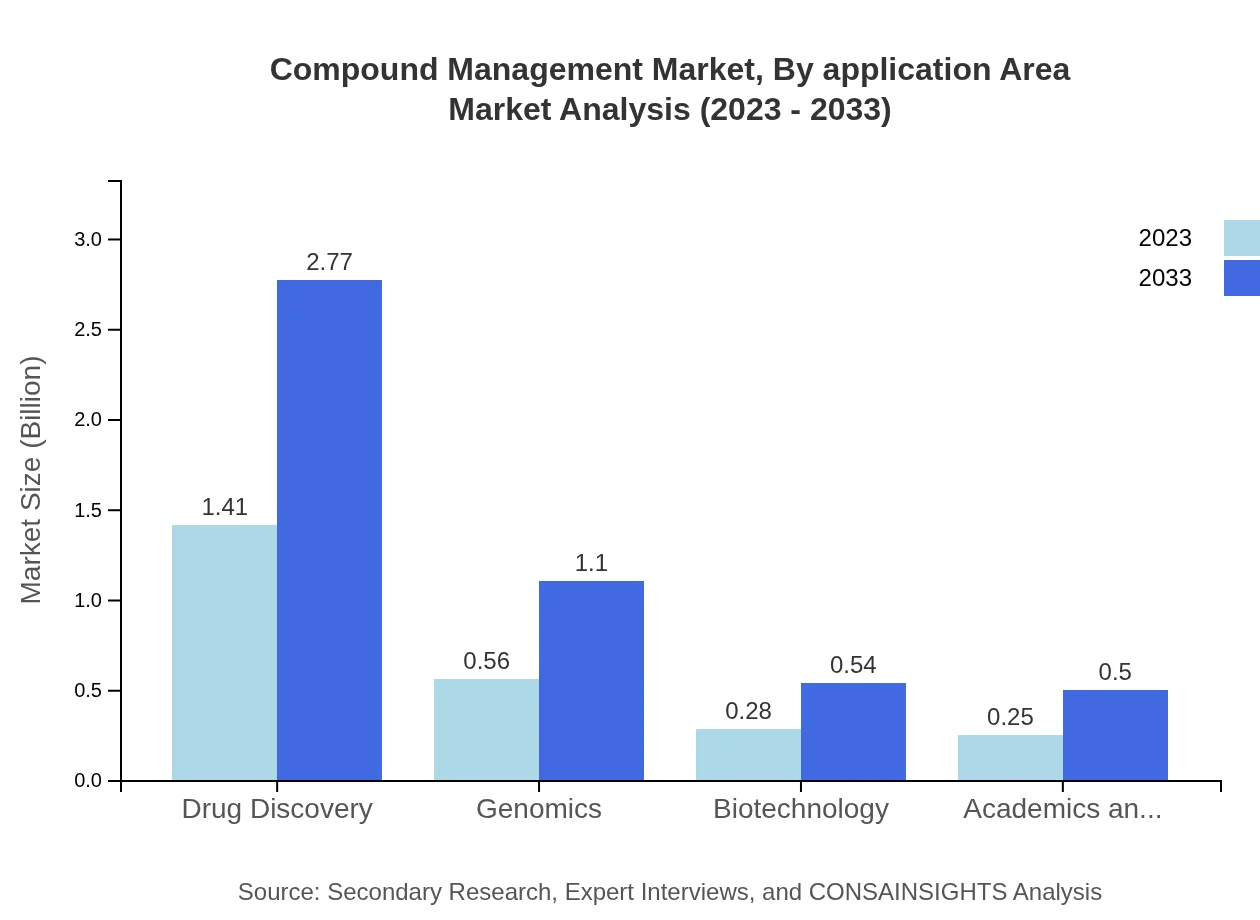

Compound Management Market Analysis By Application Area

Key applications in the Compound Management market include Pharmaceutical Companies, Biotechnology Firms, and Government Research Institutes. The Drug Discovery application leads with a market size predicted to grow from $1.41 billion in 2023 to $2.77 billion by 2033, capturing a notable share of 56.31% in this segment.

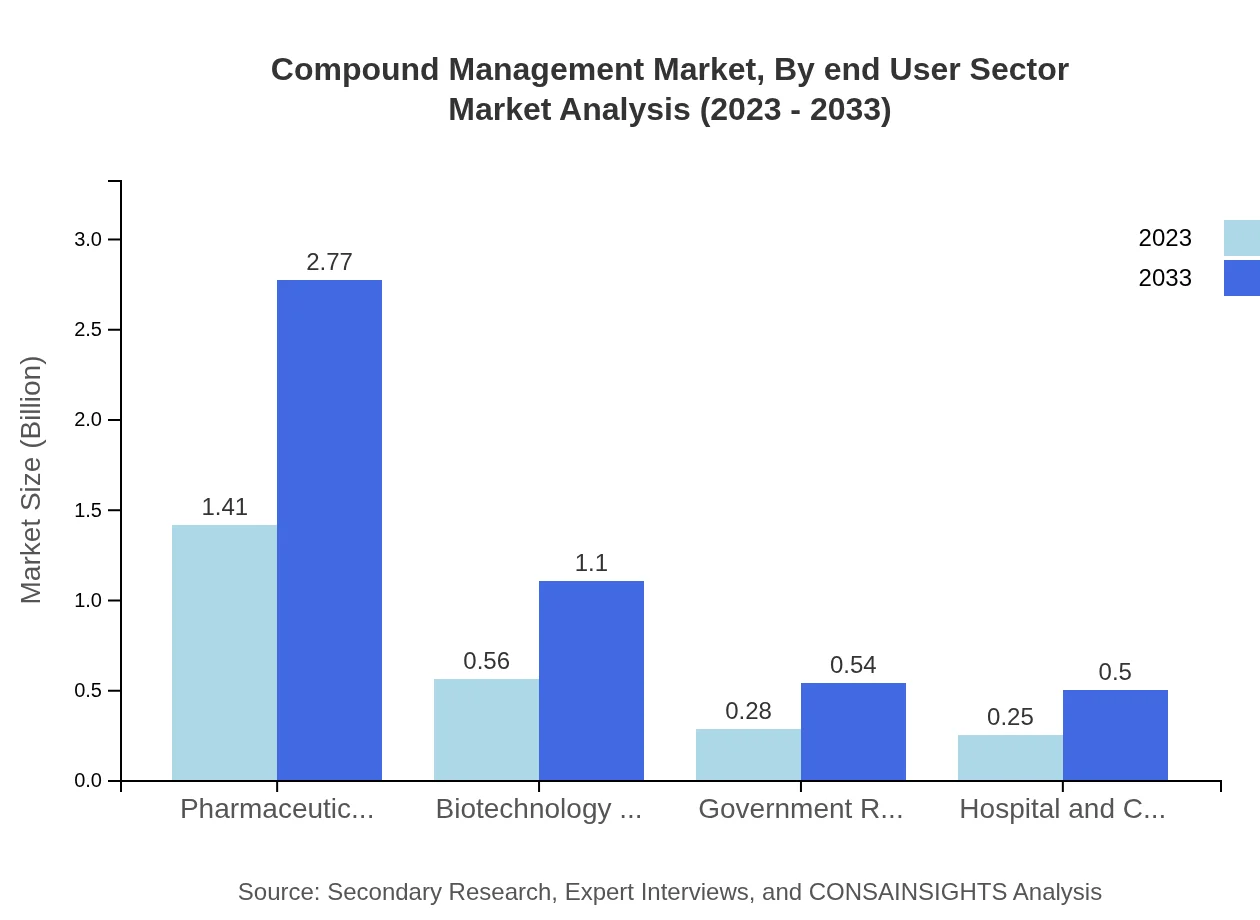

Compound Management Market Analysis By End User Sector

End-user segments are critical for market dynamics. The Pharmaceutical Companies' market segment leads with a size increase from $1.41 billion in 2023 to $2.77 billion in 2033, leveraging the emerging need for faster drug development cycles and R&D efficiency.

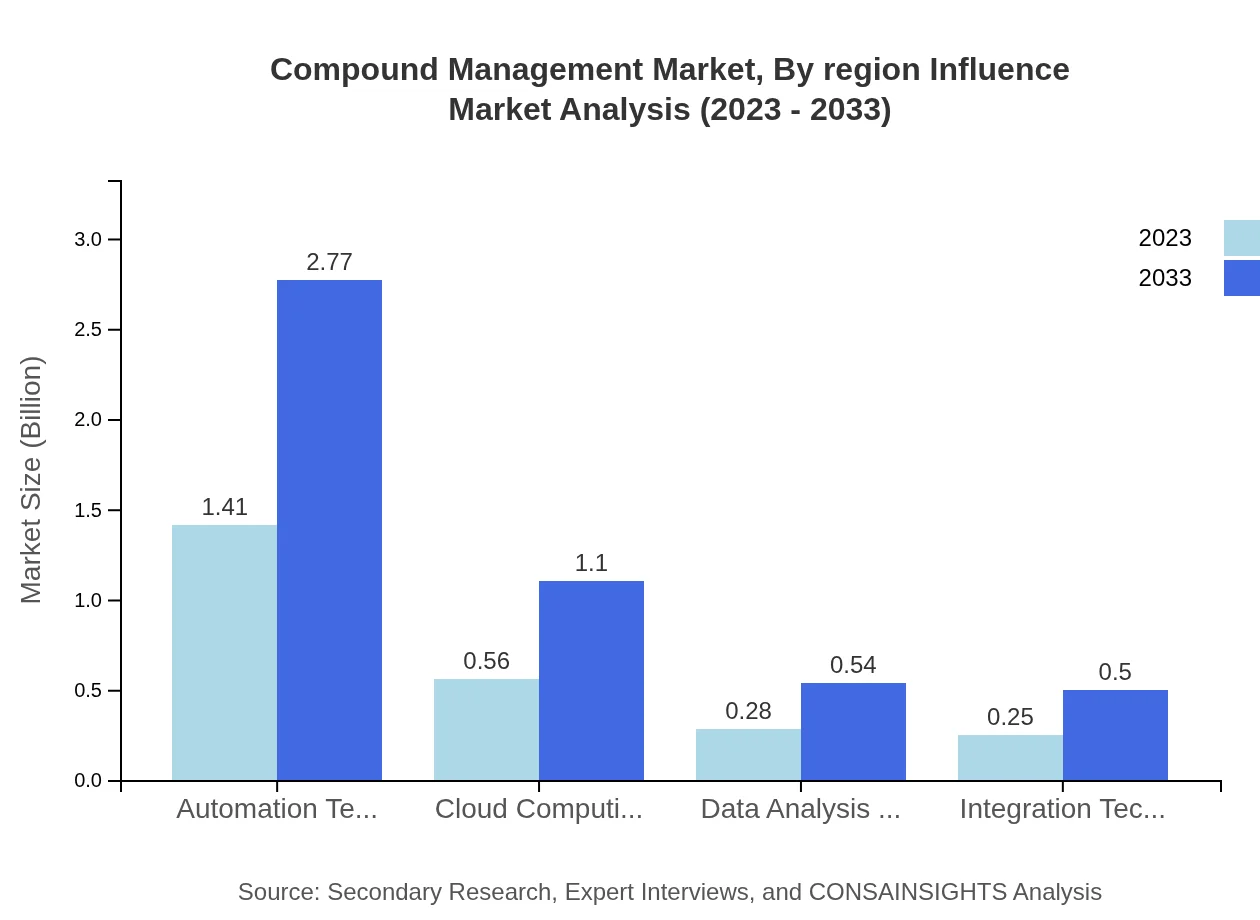

Compound Management Market Analysis By Region Influence

Prominent trends influencing the Compound Management market include advancements in Automation Technologies, Cloud Computing, and Data Analysis Techniques. Each of these segments is projected to see growth, with Cloud Computing expanding from $0.56 billion in 2023 to $1.10 billion by 2033.

Compound Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compound Management Industry

Thermo Fisher Scientific:

A leader in the provision of laboratory services, providing innovative solutions for compound management and drug discovery.Boehringer Ingelheim:

A key player focusing on R&D in pharmaceuticals, known for its compound libraries and drug development efficiencies.Sigma-Aldrich:

Provides a wide range of chemical compounds and is known for its strong position in compound management services.Evotec:

A biotech company that specializes in drug discovery, providing comprehensive compound management services to accelerate drug development.We're grateful to work with incredible clients.

FAQs

What is the market size of compound Management?

The global compound management market is currently valued at approximately $2.5 billion with a compound annual growth rate (CAGR) of 6.8%. Projections suggest significant growth by 2033, reflecting increasing demand and innovation within the industry.

What are the key market players or companies in this compound Management industry?

Key players in the compound management industry include prominent pharmaceutical companies, biotechnology firms, and technology providers of software and automation solutions. These companies are pivotal in driving growth and advancements in compound libraries and data analysis techniques.

What are the primary factors driving the growth in the compound Management industry?

The growth of the compound management industry is driven by advancements in automation technologies, increasing focus on drug discovery, and the rise of data analysis techniques. These factors enhance the efficiency and effectiveness of compound management processes across various sectors.

Which region is the fastest Growing in the compound Management?

North America is the fastest-growing region in the compound management market, projected to grow from $0.94 billion in 2023 to $1.85 billion by 2033. Europe and Asia Pacific also show notable growth, driven by increasing investments in biotechnology and pharmaceutical research.

Does ConsaInsights provide customized market report data for the compound Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the compound management industry. Clients can obtain detailed insights and analyses that align with their strategic goals and operational requirements.

What deliverables can I expect from this compound Management market research project?

Deliverables from the compound management market research project include comprehensive market analysis reports, detailed segment data and forecasts, competitive landscape assessments, and insights into emerging trends and opportunities within the industry.

What are the market trends of compound Management?

Market trends in compound management include a shift towards automation and digital transformation, increased reliance on cloud computing solutions, and a focus on collaborative research initiatives. These trends enhance operational efficiencies and foster innovation across various sectors.