Compressor Oil Market Report

Published Date: 22 January 2026 | Report Code: compressor-oil

Compressor Oil Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Compressor Oil market, covering market size, growth trajectories, segmentation by product and applications, and regional insights for the forecast period of 2023 to 2033.

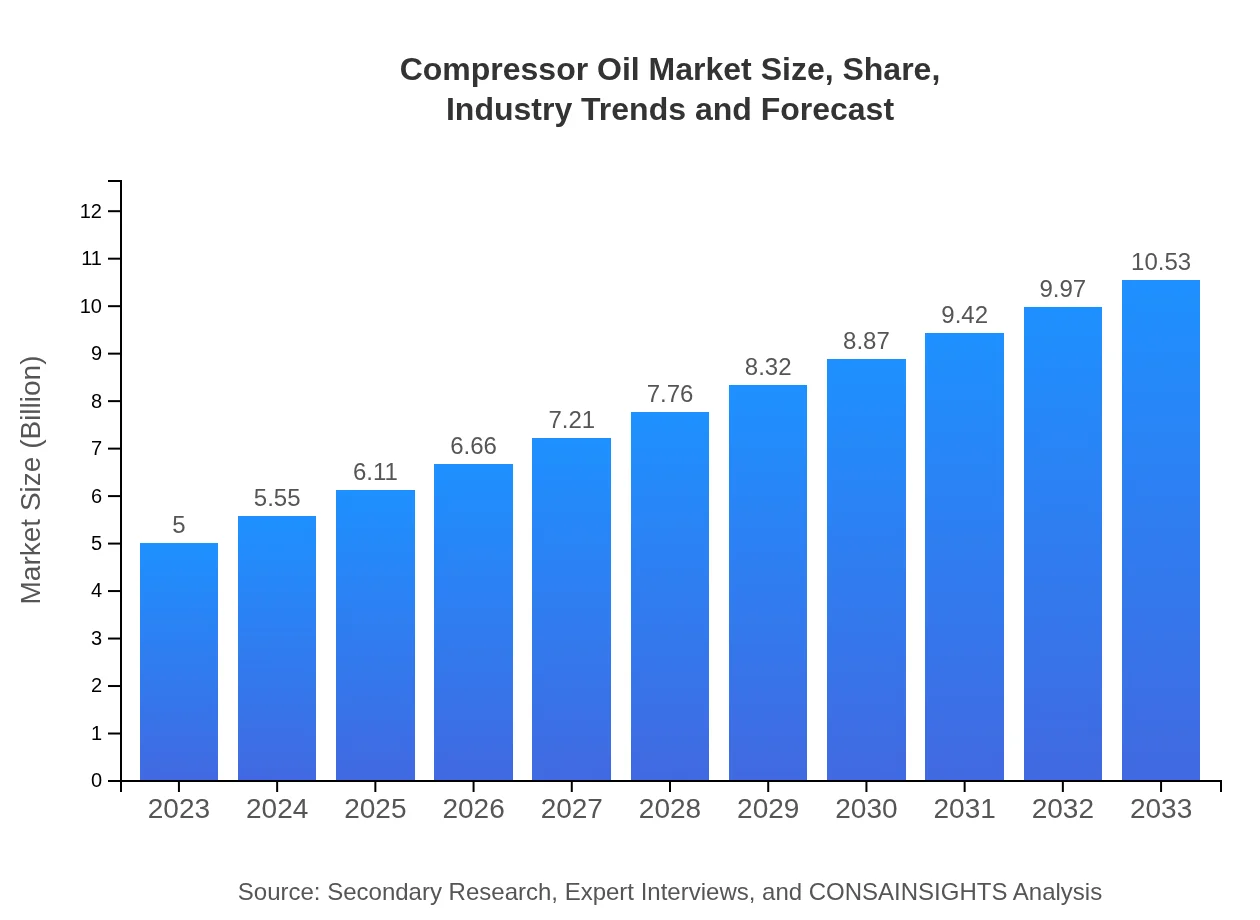

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | ExxonMobil, Royal Dutch Shell, BP plc, Chevron, Fuchs Petrolub SE |

| Last Modified Date | 22 January 2026 |

Compressor Oil Market Overview

Customize Compressor Oil Market Report market research report

- ✔ Get in-depth analysis of Compressor Oil market size, growth, and forecasts.

- ✔ Understand Compressor Oil's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compressor Oil

What is the Market Size & CAGR of Compressor Oil market in 2023?

Compressor Oil Industry Analysis

Compressor Oil Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compressor Oil Market Analysis Report by Region

Europe Compressor Oil Market Report:

Europe accounts for a significant market share, initially valued at 1.56 billion USD in 2023, likely doubling to 3.28 billion USD by 2033. The push for sustainable lubricants and stringent regulations enhance growth potential.Asia Pacific Compressor Oil Market Report:

In the Asia Pacific region, the Compressor Oil market was valued at approximately 0.98 billion USD in 2023 and is projected to reach 2.07 billion USD by 2033. The growth is driven by rapid industrialization, urbanization, and increasing automotive production.North America Compressor Oil Market Report:

North America is anticipated to grow from 1.65 billion USD in 2023 to 3.48 billion USD in 2033. The automotive and manufacturing sectors in this region are pivotal, supported by robust technological advancements.South America Compressor Oil Market Report:

The South America market, starting at 0.36 billion USD in 2023, is expected to grow to 0.76 billion USD by 2033. The region is focusing on enhancing infrastructure and manufacturing capabilities, driving compressor oil demand.Middle East & Africa Compressor Oil Market Report:

The Middle East and Africa market is expected to grow from 0.45 billion USD in 2023 to 0.94 billion USD in 2033, driven by expanding industrial activities and increasing investments in oil and gas sectors.Tell us your focus area and get a customized research report.

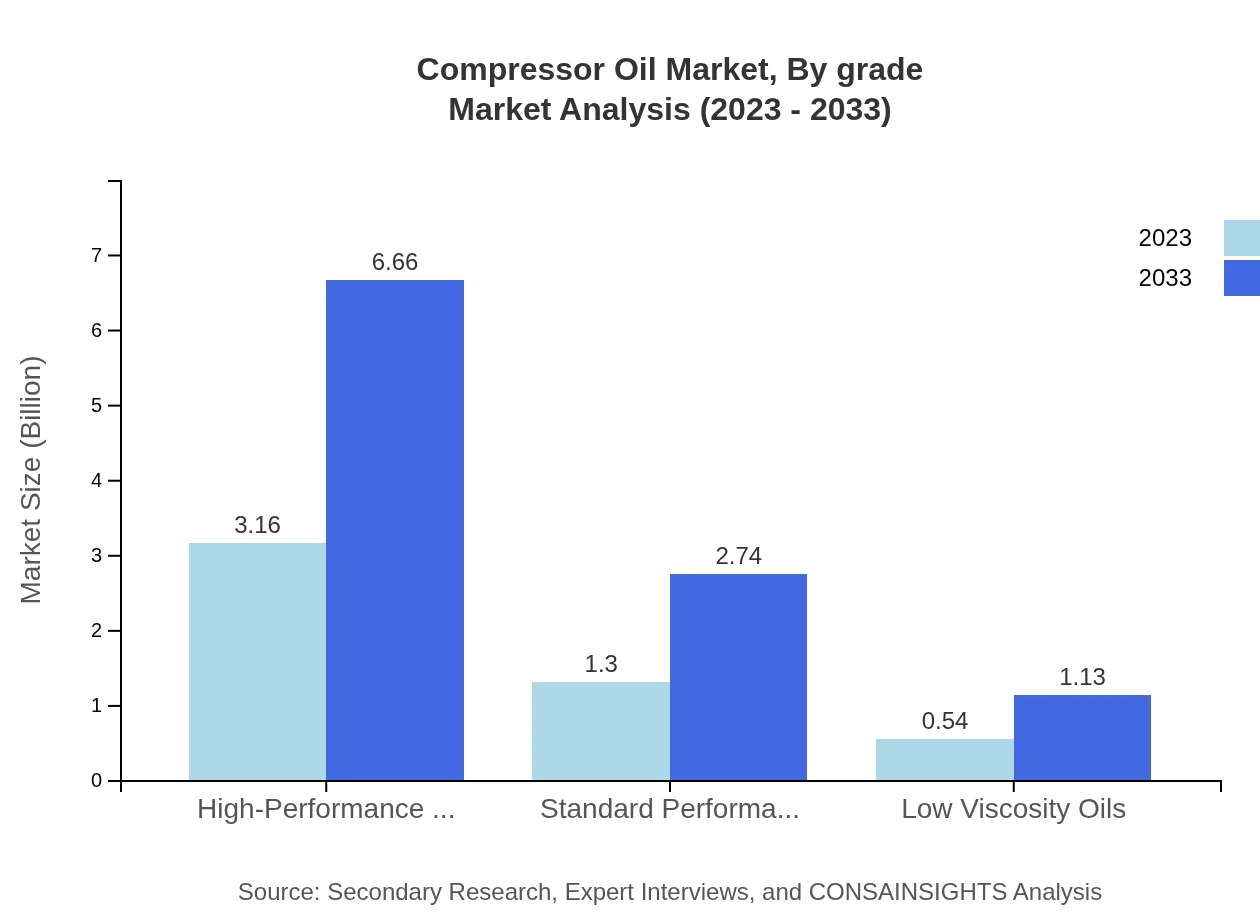

Compressor Oil Market Analysis By Product Type

The Compressor Oil market showcases diverse product types: High-Performance Oils dominate the market, valued at 3.16 billion USD in 2023 and projected to reach 6.66 billion USD by 2033. Standard Performance Oils and Low Viscosity Oils also play crucial roles, each experiencing growth from 1.30 billion USD to 2.74 billion USD and 0.54 billion USD to 1.13 billion USD, respectively. The trends indicate a substantial shift towards synthetic and bio-based oils, driven by consumer demand for sustainability.

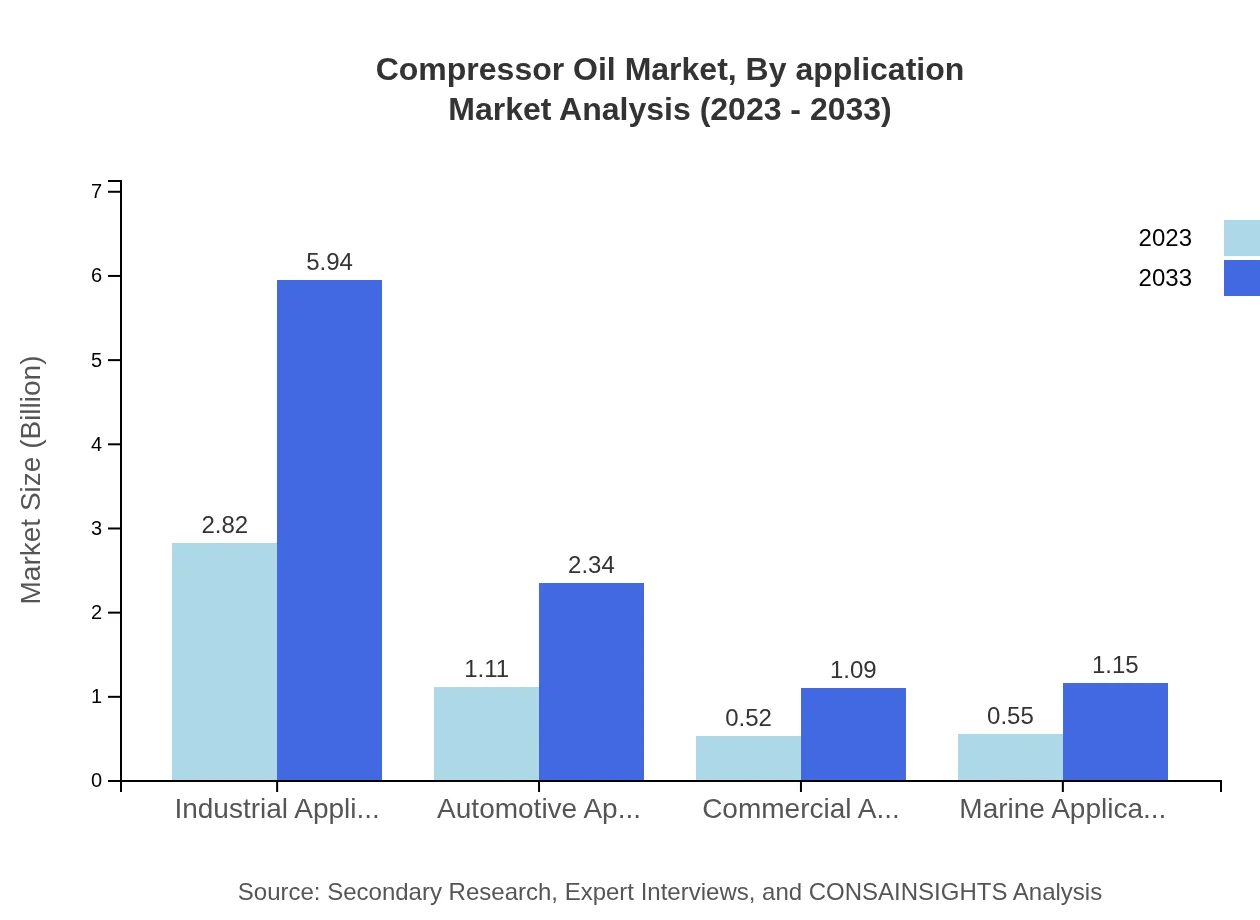

Compressor Oil Market Analysis By Application

Applications of Compressor Oil span varied sectors: Industrial Applications lead with a market share of 56.48% and a size of 2.82 billion USD in 2023, projected to reach 5.94 billion USD by 2033. Automotive Applications follow, growing from 1.11 billion USD to 2.34 billion USD capturing a 22.24% share. Commercial, Marine, and other applications present opportunities with moderate growth over the forecast period.

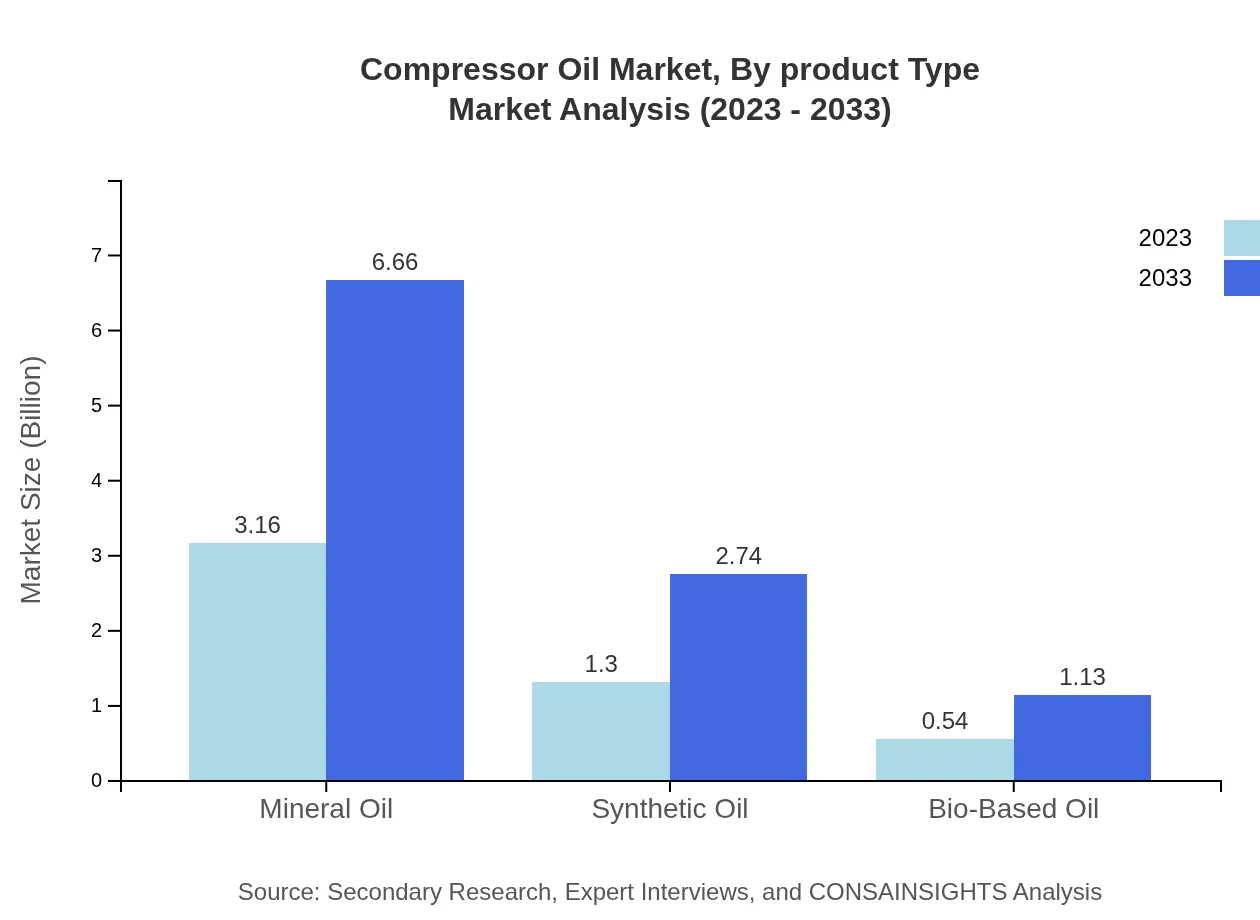

Compressor Oil Market Analysis By Grade

In terms of grade, the market splits primarily into Mineral Oil, Synthetic Oil, and Bio-Based Oil. Mineral Oil retains the highest market share at 3.16 billion USD in 2023, maintaining a significant component of the overall market. Synthetic Oil, considered a premium choice due to better performance characteristics, is growing steadily, while Bio-Based Oil is gaining traction as sustainability becomes a priority across industries.

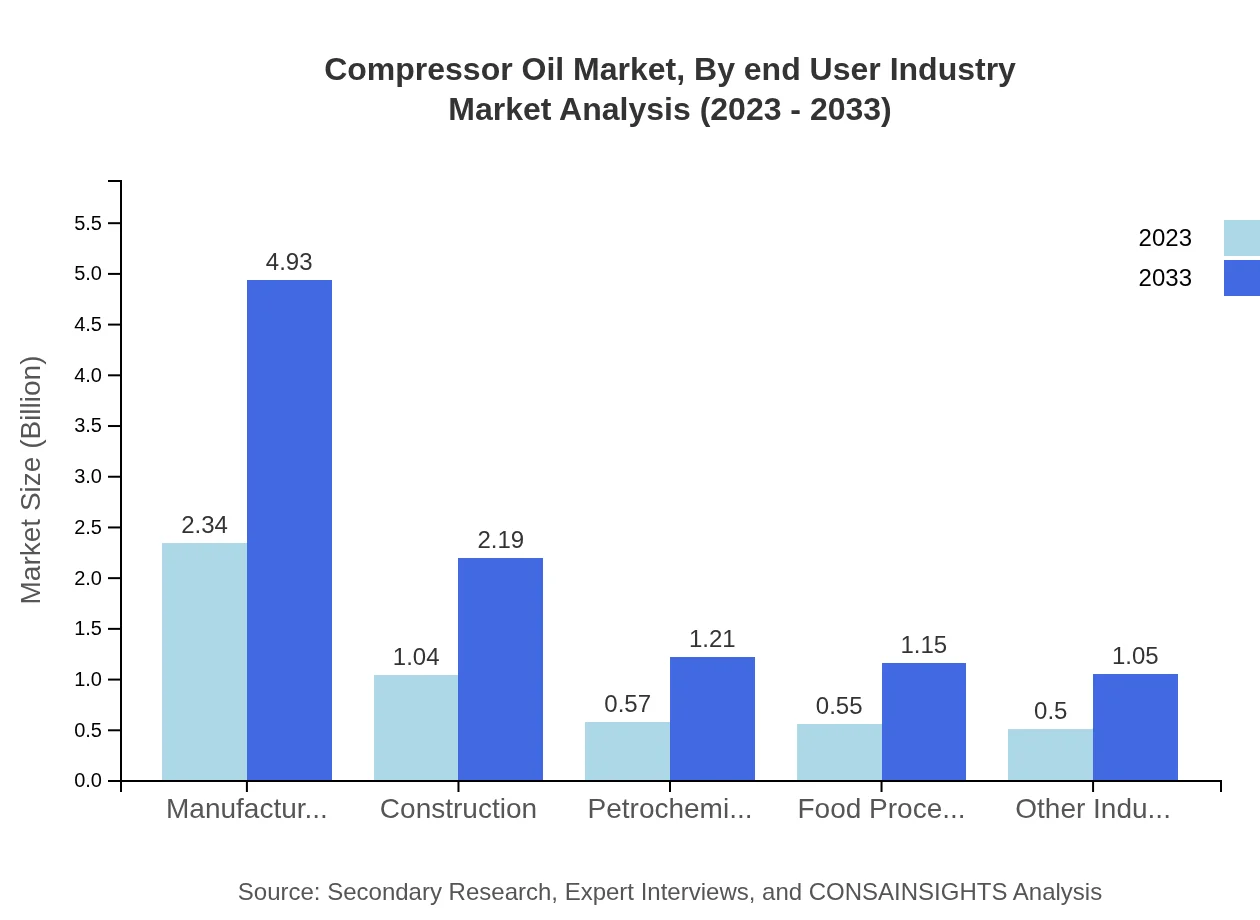

Compressor Oil Market Analysis By End User Industry

Key end-user industries include Manufacturing, Construction, Petrochemical, Food Processing, and others. Manufacturing leads with 2.34 billion USD in 2023, poised to increase to 4.93 billion USD by 2033, holding 46.81% of the market share. The construction and petrochemical sectors are also significant contributors, reflecting growing investments and innovative practices.

Compressor Oil Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compressor Oil Industry

ExxonMobil:

A leading global oil and gas company that provides a range of lubricants, including high-performance compressor oils, known for their efficiency and durability.Royal Dutch Shell:

Shell is a major player in the lubricant industry, offering advanced products tailored for compressor systems that meet various industrial needs.BP plc:

BP provides a comprehensive portfolio of lubricants, including environmentally friendly options, focusing on sustainability in compressor oil solutions.Chevron:

Chevron is recognized for its innovative products in the lubricant sector, catering to diverse applications, from automotive to industrial compressors.Fuchs Petrolub SE:

A global independent manufacturer of lubricants, Fuchs offers a wide range of compressor oils with a strong emphasis on quality and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of the compressor oil industry?

The compressor oil market is valued at approximately $5 billion in 2023, with an expected CAGR of 7.5% through 2033. This growth reflects heightened demand in various sectors, promoting technological advancements and improved formulations in oil production.

What are the key market players or companies in the compressor oil industry?

Key players in the compressor oil market include major global producers specializing in lubricants and oils. These companies are well-positioned to innovate and meet regional demands, enhancing their market presence and competitive strategies in this evolving industry.

What are the primary factors driving the growth in the compressor oil industry?

Growth in the compressor oil industry is mainly driven by increased industrial activity, technological advancements in machinery, and the rising demand for high-performance oils. Regulation compliance and sustainable practices also significantly influence market expansion, promoting innovative product development.

Which region is the fastest Growing in the compressor oil industry?

The Asia Pacific region is the fastest-growing market for compressor oil, projected to increase from $0.98 billion in 2023 to $2.07 billion by 2033. This growth is fueled by expanding industrial sectors and rising investment in infrastructure and manufacturing capabilities.

Does ConsaInsights provide customized market report data for the compressor oil industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the compressor oil industry. Clients can request detailed analysis, segmentation studies, and insights that align with their business strategies and market positions.

What deliverables can I expect from this compressor oil market research project?

Expect comprehensive insights including market size data, growth projections, competitive analysis, and regional trends. Additionally, customizable reports will provide segmented information on applications and products, ensuring actionable strategies for stakeholders.

What are the market trends of compressor oil?

Current trends in the compressor oil market include a shift towards bio-based and synthetic oils due to environmental regulations. Increased focus on efficiency in mechanical applications and the adoption of high-performance oils also significantly influence market dynamics.