Compressor Rental Market Report

Published Date: 22 January 2026 | Report Code: compressor-rental

Compressor Rental Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Compressor Rental market, offering insights into its current state, size, and growth projections through 2033. It covers industry analysis, regional breakdown, segmentation, technology trends, and profiles of leading companies in the sector.

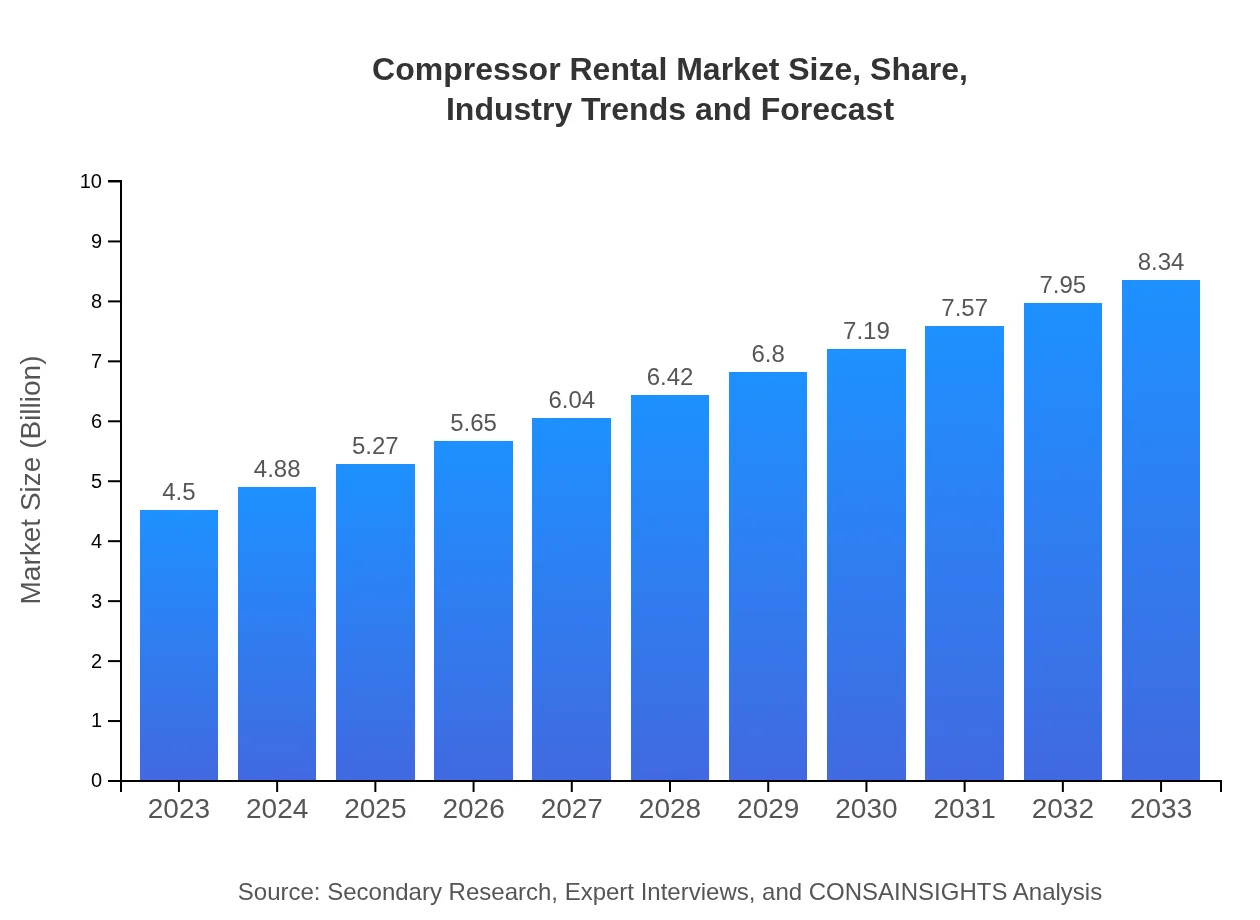

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $8.34 Billion |

| Top Companies | United Rentals Inc., Sunbelt Rentals, Inc., Atlas Copco AB, Ingersoll Rand Inc. |

| Last Modified Date | 22 January 2026 |

Compressor Rental Market Overview

Customize Compressor Rental Market Report market research report

- ✔ Get in-depth analysis of Compressor Rental market size, growth, and forecasts.

- ✔ Understand Compressor Rental's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compressor Rental

What is the Market Size & CAGR of Compressor Rental market in 2023?

Compressor Rental Industry Analysis

Compressor Rental Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compressor Rental Market Analysis Report by Region

Europe Compressor Rental Market Report:

Europe's Compressor Rental market is projected to grow from USD 1.42 billion in 2023 to USD 2.63 billion by 2033. Stringent environmental regulations promote the use of energy-efficient compressors, further driving market expansion.Asia Pacific Compressor Rental Market Report:

The Asia Pacific region represents a substantial share of the Compressor Rental market, valued at USD 0.92 billion in 2023, with projected growth to USD 1.71 billion by 2033. This growth is fueled by rapid industrialization and infrastructure development in countries like China and India.North America Compressor Rental Market Report:

North America is a key player in the global market, with a market size of USD 1.47 billion in 2023, expected to grow to USD 2.73 billion by 2033. The rise in construction and oil & gas activities fuels demand for compressor rental services.South America Compressor Rental Market Report:

In South America, the market is valued at USD 0.29 billion in 2023 with a forecast to reach USD 0.53 billion by 2033. The region’s growth is driven by increasing investments in mining and energy sectors.Middle East & Africa Compressor Rental Market Report:

The Middle East and Africa market is valued at USD 0.40 billion in 2023, with growth to USD 0.74 billion by 2033. Rising oil and gas production activities and construction projects in the Gulf countries stimulate market demand.Tell us your focus area and get a customized research report.

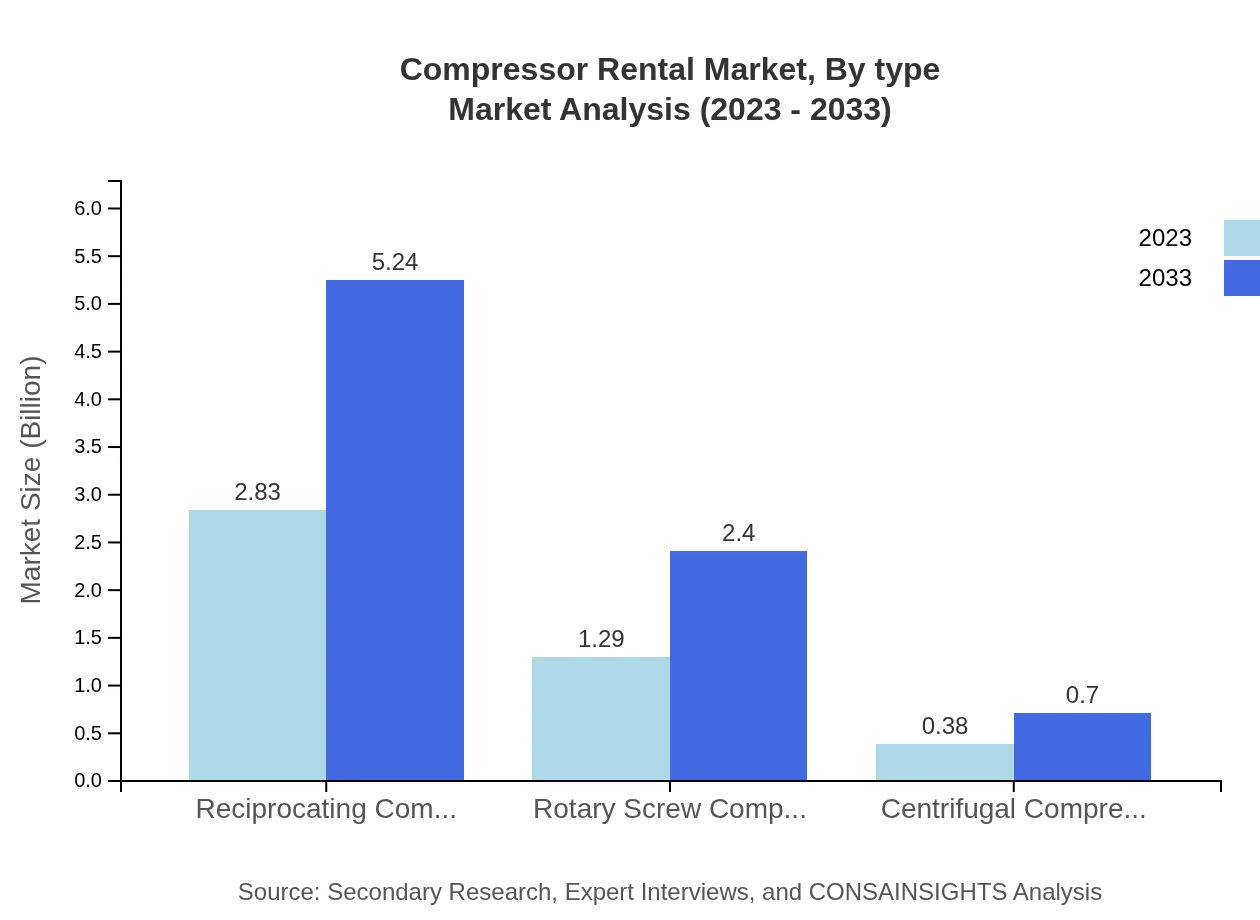

Compressor Rental Market Analysis By Type

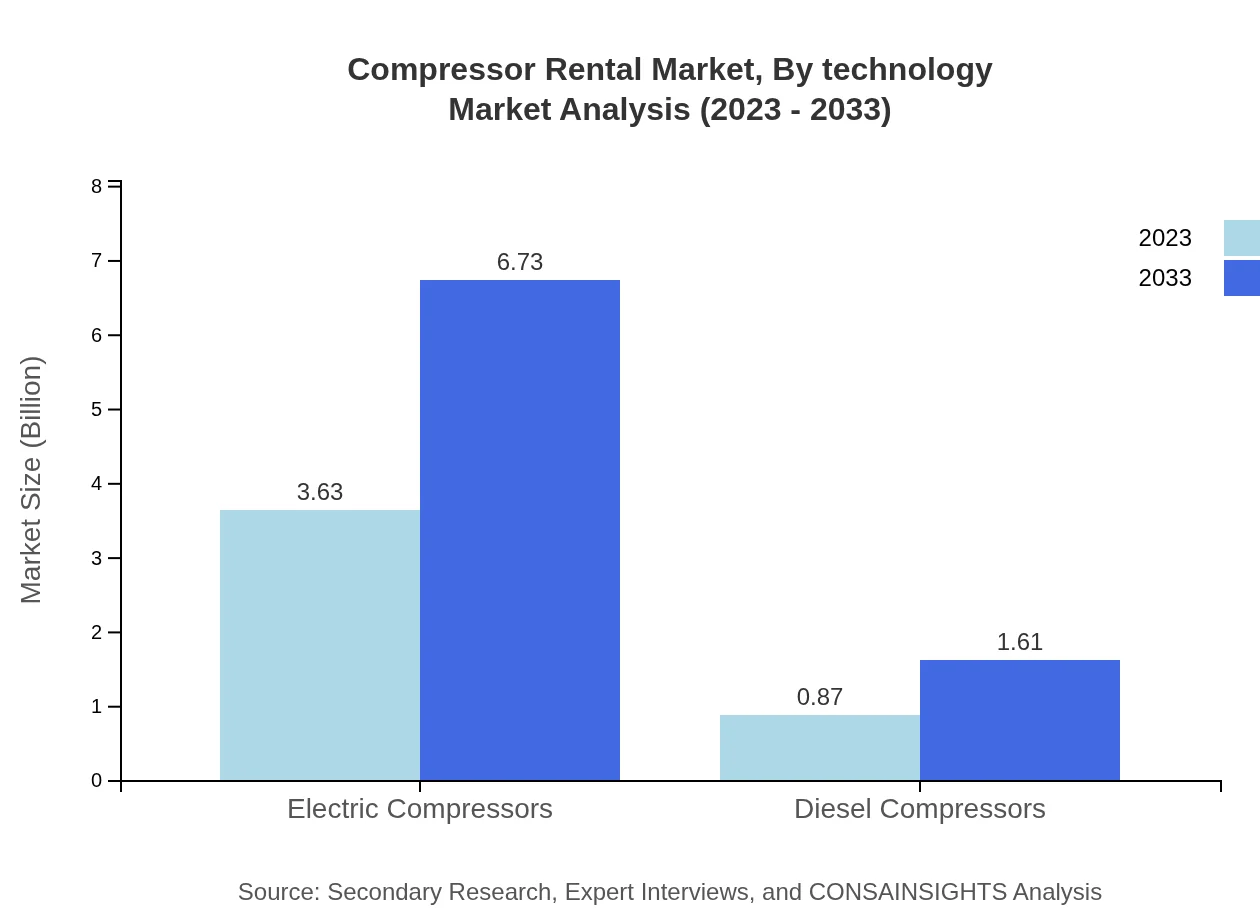

The Compressor Rental market segmented by type features several product categories: Reciprocating Compressors (USD 2.83 billion in 2023) hold a major share (62.83%) and are expected to grow significantly. Rotary Screw Compressors have a market size of USD 1.29 billion, contributing to 28.74% of the market. Centrifugal Compressors, while smaller in size at USD 0.38 billion, maintain an 8.43% share. Electric Compressors dominate the rental sector, constituting 80.72% of the market, valued at USD 3.63 billion in 2023, reflecting a trend towards energy efficiency.

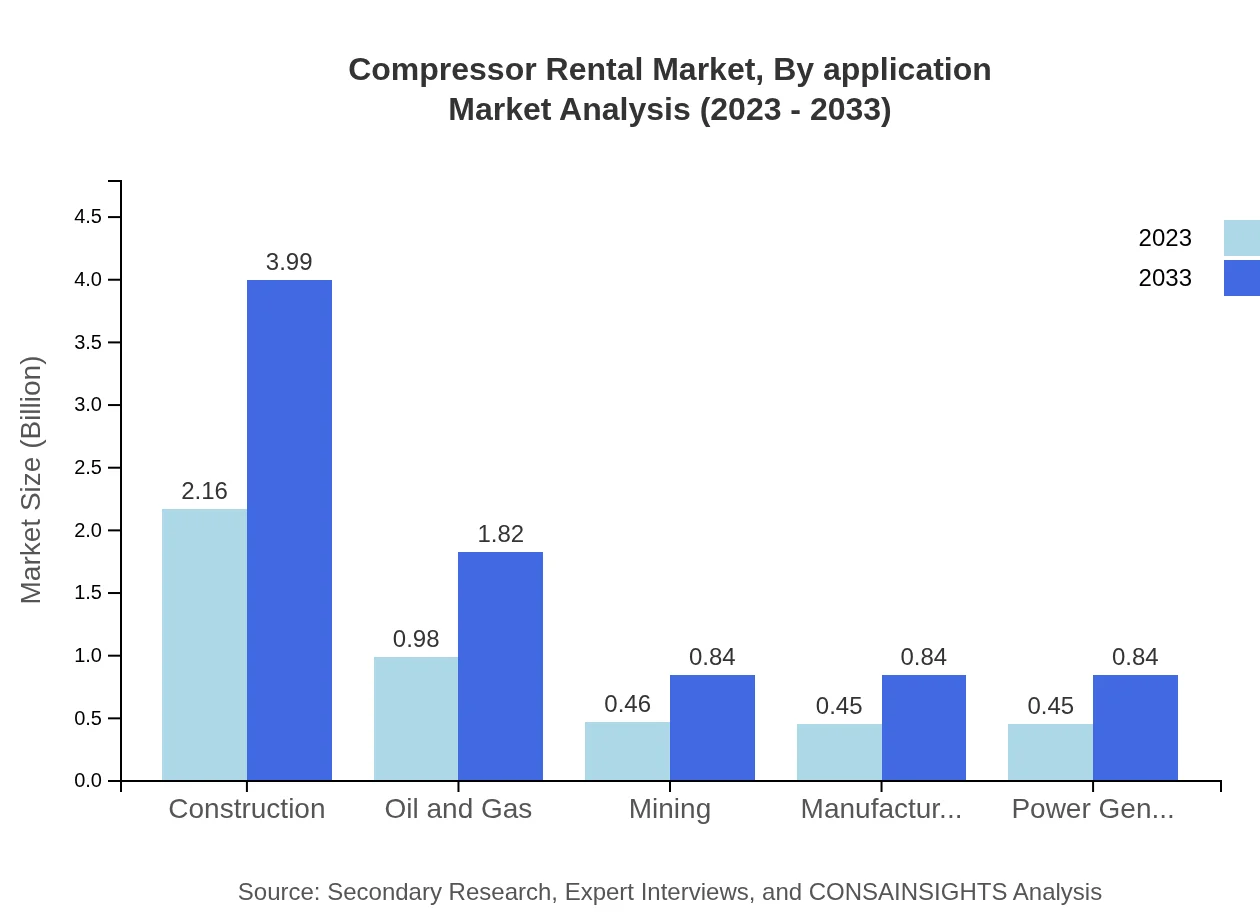

Compressor Rental Market Analysis By Application

Applications in the Compressor Rental market include sectors such as Construction (USD 2.16 billion, 47.91% share), Oil and Gas (USD 0.98 billion, 21.88% share), and Mining (USD 0.46 billion, 10.12% share). The construction sector's dominance underscores the reliance on temporary equipment solutions, while oil and gas rentals are driven by ongoing projects in exploration and refining.

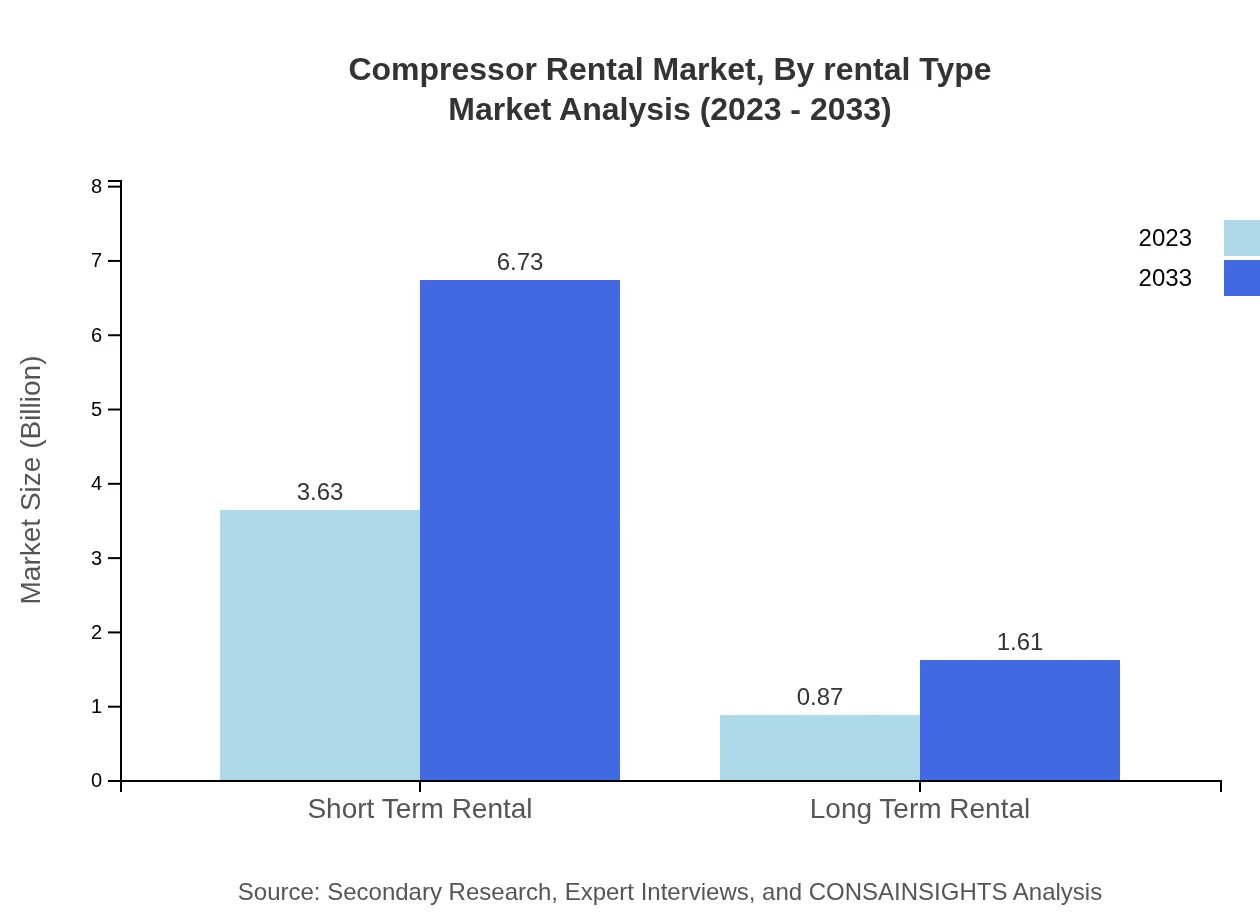

Compressor Rental Market Analysis By Rental Type

The market is bifurcated into Short Term Rentals (USD 3.63 billion, 80.72% share) and Long Term Rentals (USD 0.87 billion, 19.28% share). Short-term rentals are preferred for their flexibility and cost-effectiveness, catering to projects that require temporary air solutions.

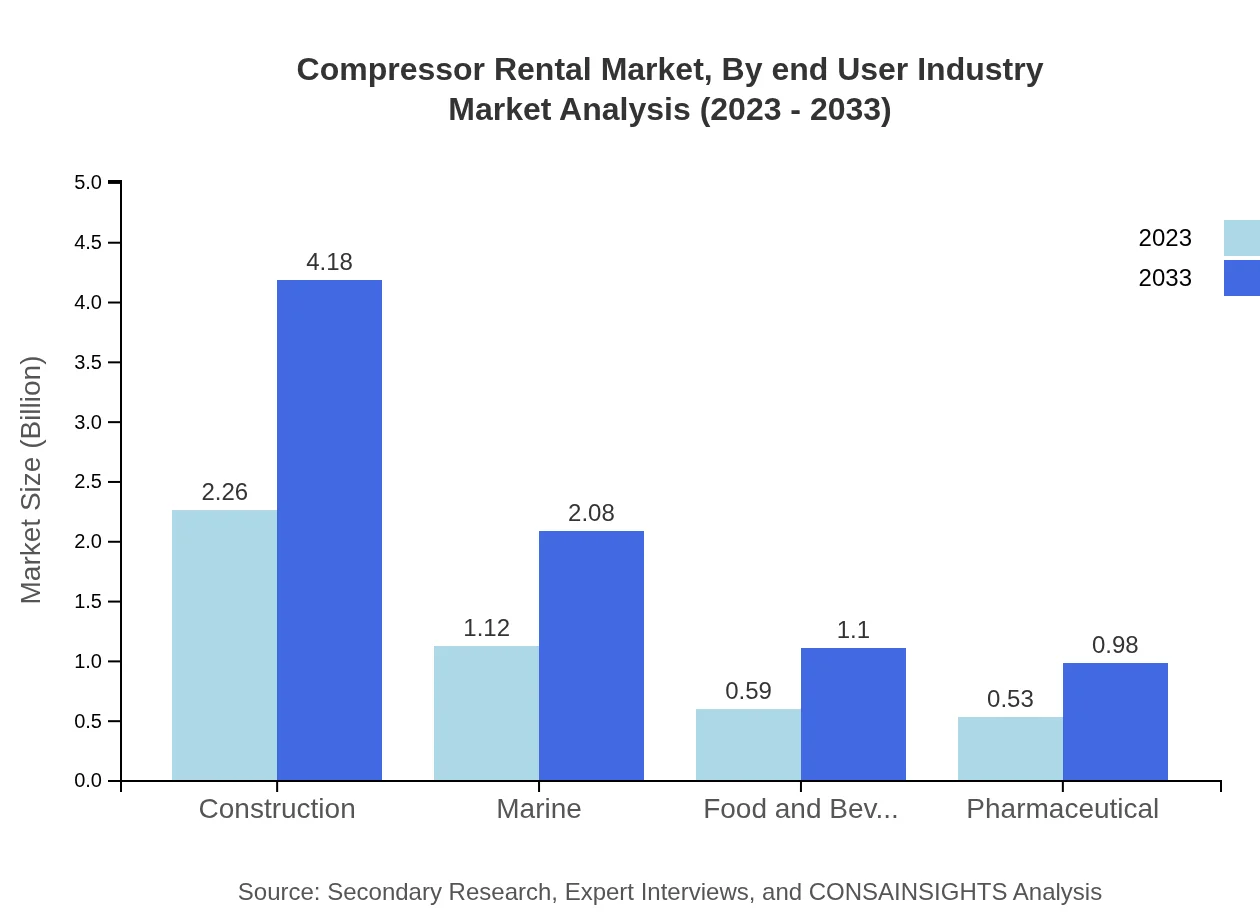

Compressor Rental Market Analysis By End User Industry

End-user industries in the Compressor Rental market comprise Construction (USD 2.26 billion, 50.12% share), Marine (USD 1.12 billion, 24.92% share), Food & Beverage (USD 0.59 billion, 13.17% share), Pharmaceutical (USD 0.53 billion, 11.79% share), showcasing sector-specific demand for temporary equipment to support ongoing operations.

Compressor Rental Market Analysis By Technology

The technological aspect of the Compressor Rental market is evolving, with innovations focusing on enhancing efficiency and reducing environmental impact. Technologies facilitating remote management and IoT capabilities are emerging to cater to the need for connectivity and monitoring of equipment performance.

Compressor Rental Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compressor Rental Industry

United Rentals Inc.:

A leading equipment rental company, United Rentals offers a wide range of compressors and related equipment, focusing on construction and industrial sectors.Sunbelt Rentals, Inc.:

Sunbelt Rentals provides comprehensive rental solutions, specializing in air compressor rentals, with a commitment to quality service and customer satisfaction.Atlas Copco AB:

A global leader in industrial technology, Atlas Copco is renowned for its efficient compressor solutions and dominates the market with innovative rental options.Ingersoll Rand Inc.:

Ingersoll Rand is well-known for its durable and efficient compressors available through rental services, focusing on enhancing operational efficiency in diverse industries.We're grateful to work with incredible clients.

FAQs

What is the market size of compressor rental?

The global compressor rental market is valued at $4.5 billion in 2023, with a projected CAGR of 6.2% through 2033. This growth indicates a rising demand for rental services across various sectors.

What are the key market players or companies in the compressor rental industry?

Key players in the compressor rental industry include Ingersoll Rand, Atlas Copco, and Aggreko. These companies dominate the market due to their extensive service networks and innovative equipment, driving competitive growth.

What are the primary factors driving the growth in the compressor rental industry?

Growth in the compressor rental industry is primarily driven by increasing demand in construction, oil & gas sectors, awareness of energy efficiency, and the shift towards rental services over ownership to reduce capital expenditure.

Which region is the fastest Growing in the compressor rental market?

The Asia-Pacific region is the fastest-growing market for compressor rental, projected to expand from $0.92 billion in 2023 to $1.71 billion by 2033, fueled by rapid industrialization and infrastructural developments.

Does ConsaInsights provide customized market report data for the compressor rental industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the compressor rental industry, providing detailed insights and data to support strategic decision-making.

What deliverables can I expect from this compressor rental market research project?

Deliverables from the compressor rental market research include a comprehensive report, data analytics, market forecasts, and strategic recommendations to guide business growth and understanding of market dynamics.

What are the market trends of compressor rental?

Market trends in compressor rental show a shift toward electric and energy-efficient models, a rise in short-term rentals, and increased demand in emerging markets, reflecting a broader shift towards temporary solutions over permanent investments.