Computed Tomography Ct Market Report

Published Date: 31 January 2026 | Report Code: computed-tomography-ct

Computed Tomography Ct Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Computed Tomography (CT) market, focusing on market dynamics, segmentation, and forecasts from 2023 to 2033. Insights into regional performance, technological advancements, and key market players are also covered.

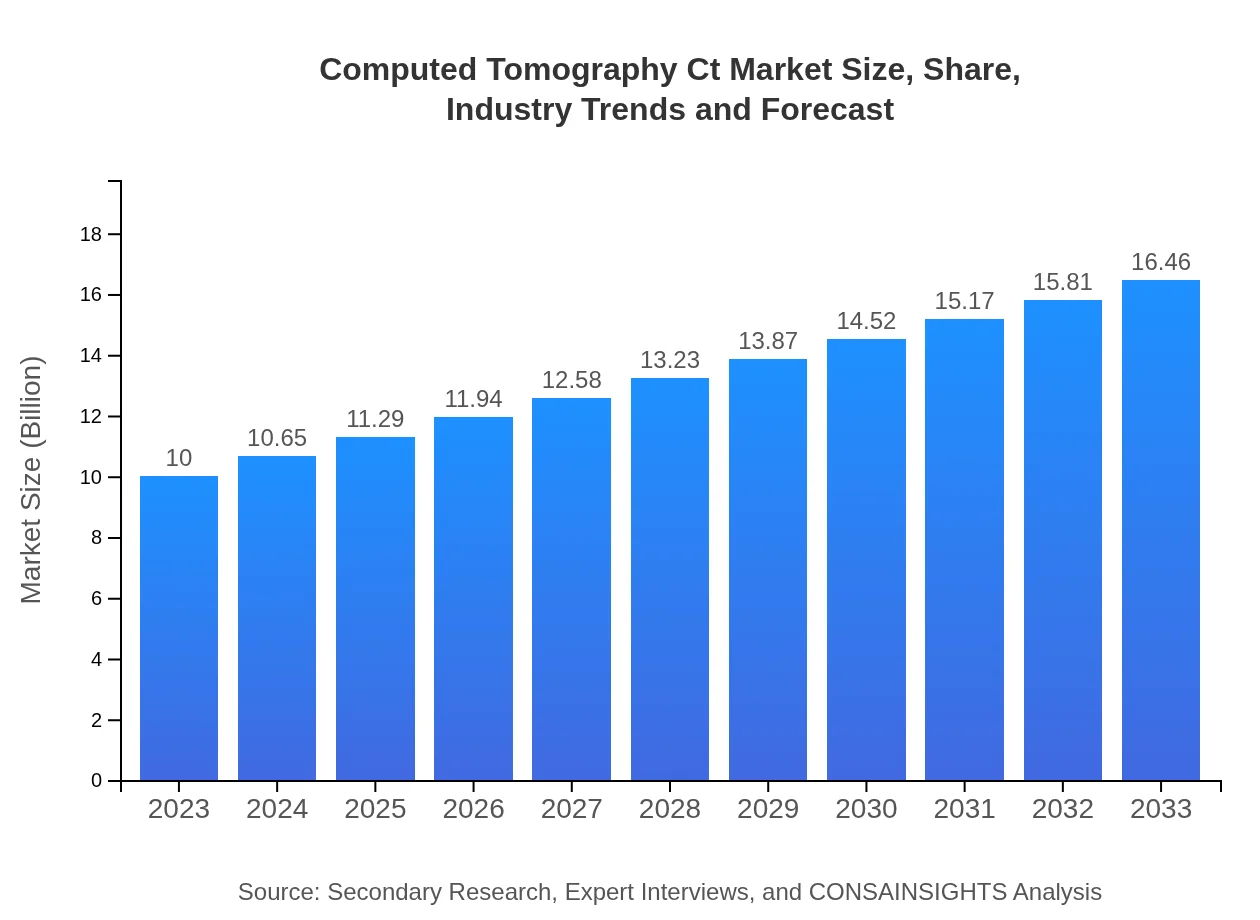

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Hitachi Medical Systems |

| Last Modified Date | 31 January 2026 |

Computed Tomography Ct Market Overview

Customize Computed Tomography Ct Market Report market research report

- ✔ Get in-depth analysis of Computed Tomography Ct market size, growth, and forecasts.

- ✔ Understand Computed Tomography Ct's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Computed Tomography Ct

What is the Market Size & CAGR of Computed Tomography Ct market in 2023?

Computed Tomography Ct Industry Analysis

Computed Tomography Ct Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Computed Tomography Ct Market Analysis Report by Region

Europe Computed Tomography Ct Market Report:

The CT market in Europe is valued at approximately $2.97 billion in 2023, growing to $4.89 billion by 2033. European nations emphasize advanced medical imaging solutions due to heightened disease detection rates and patient management preferences, resulting in robust market growth. The U.K., Germany, and France are the largest markets in Europe.Asia Pacific Computed Tomography Ct Market Report:

In 2023, the Computed Tomography market in the Asia Pacific is valued at approximately $1.88 billion, expected to grow to $3.09 billion by 2033. Factors such as the increasing prevalence of chronic diseases, investment in healthcare infrastructure, and improving economic conditions drive this growth. Countries like China and India are major contributors to this expanding market due to rising healthcare expenditure and a growing population.North America Computed Tomography Ct Market Report:

With an estimated market size of $3.68 billion in 2023, North America stands as the largest market, projected to reach $6.06 billion by 2033. The high adoption of advanced technologies and the presence of key players in the U.S. contribute to this significant market size. Furthermore, the biennial increase in health insurance coverage supports the demand for CT procedures.South America Computed Tomography Ct Market Report:

The South American CT market is currently valued at $0.55 billion in 2023 and predicted to reach $0.90 billion by 2033. This growth is facilitated by the rising awareness of advanced healthcare technologies and the prioritization of healthcare investments by governments in the region. Brazil and Argentina are the leading markets within this segment.Middle East & Africa Computed Tomography Ct Market Report:

Estimated at $0.92 billion in 2023 and $1.51 billion by 2033, the Middle East and Africa market shows promising growth owing to increased healthcare spending and the establishment of modern health facilities. Key nations such as the UAE and South Africa are pivotal in propelling this market expansion.Tell us your focus area and get a customized research report.

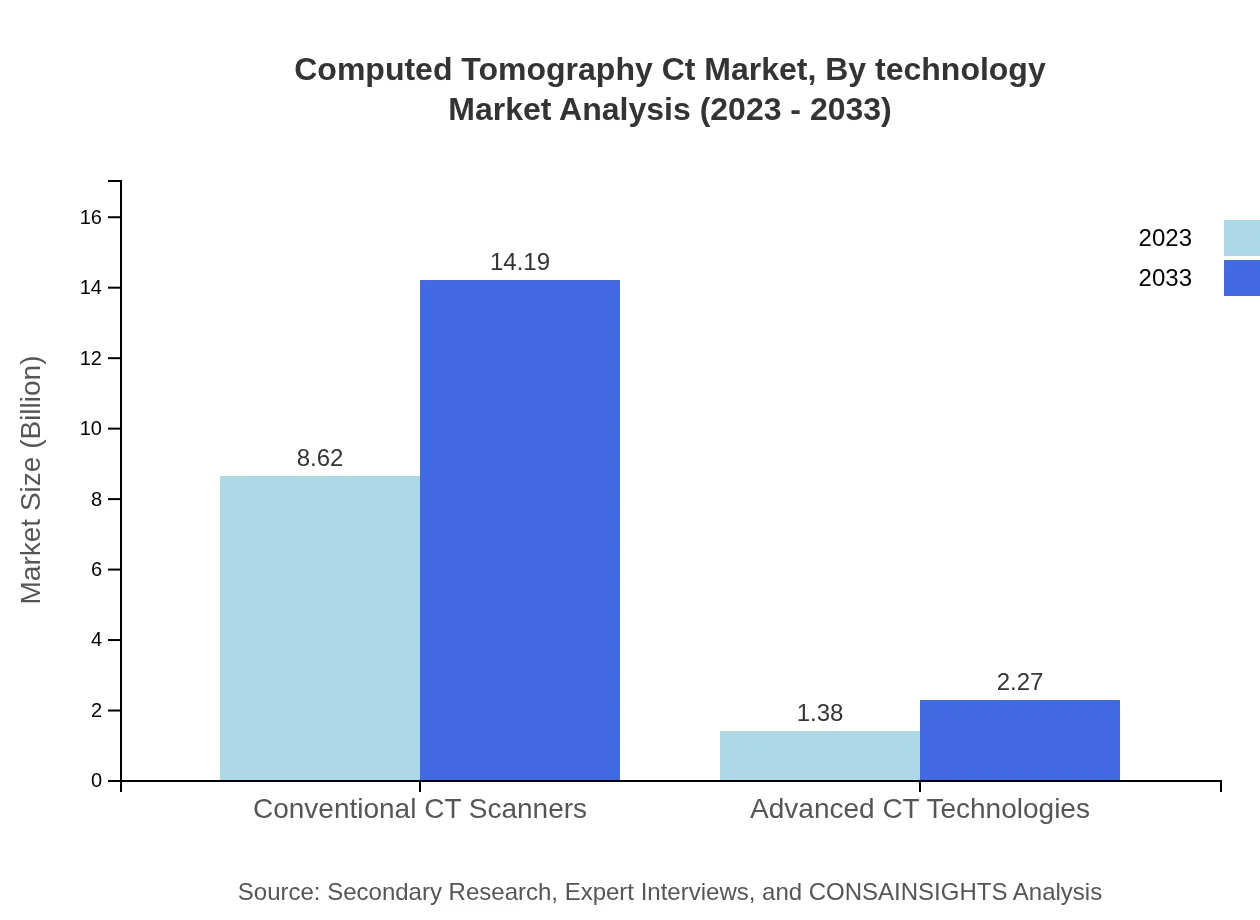

Computed Tomography Ct Market Analysis By Technology

The Computed Tomography market is divided into two main technology segments: Conventional CT Scanners and Advanced CT Technologies. In 2023, Conventional CT Scanners dominate the market, valued at approximately $8.62 billion, with a market share of 86.22%. In contrast, Advanced CT Technologies, valued at $1.38 billion, hold a 13.78% share. The adoption of advanced technologies is gradually increasing as healthcare providers aim to enhance image quality and patient safety through innovations such as dual-energy CT and low-dose protocols.

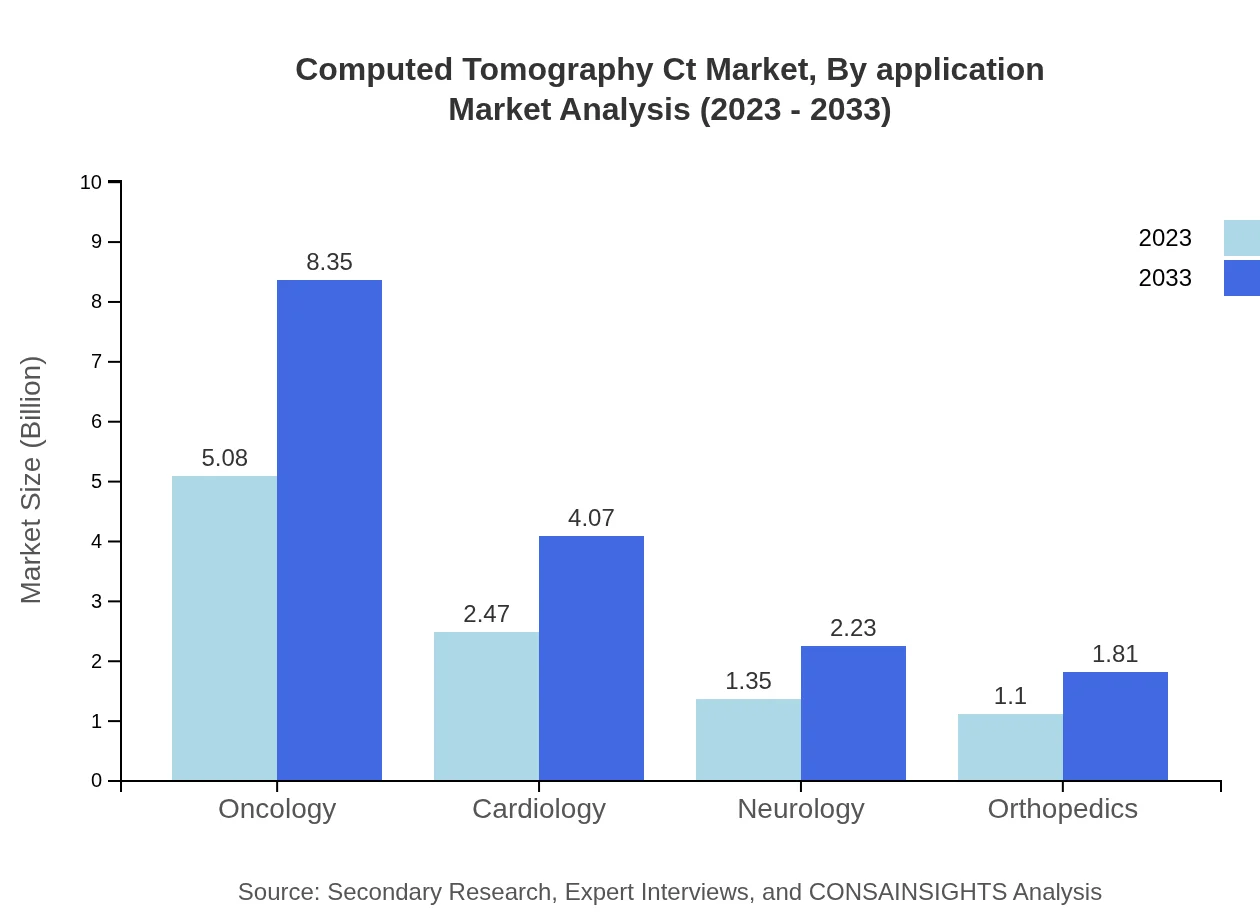

Computed Tomography Ct Market Analysis By Application

Market applications for CT predominantly include oncology, cardiology, neurology, and orthopedics. In 2023, oncology's market size is about $5.08 billion, capturing a 50.76% share, driven by cancer prevalence and the need for precise imaging in treatment planning. Cardiology follows, with a market size of $2.47 billion (24.73% share), as CT serves critical roles in diagnosing cardiovascular disorders. Neurology and orthopedics represent shares of 13.53% and 10.98%, reflecting their growing importance in patient diagnostics.

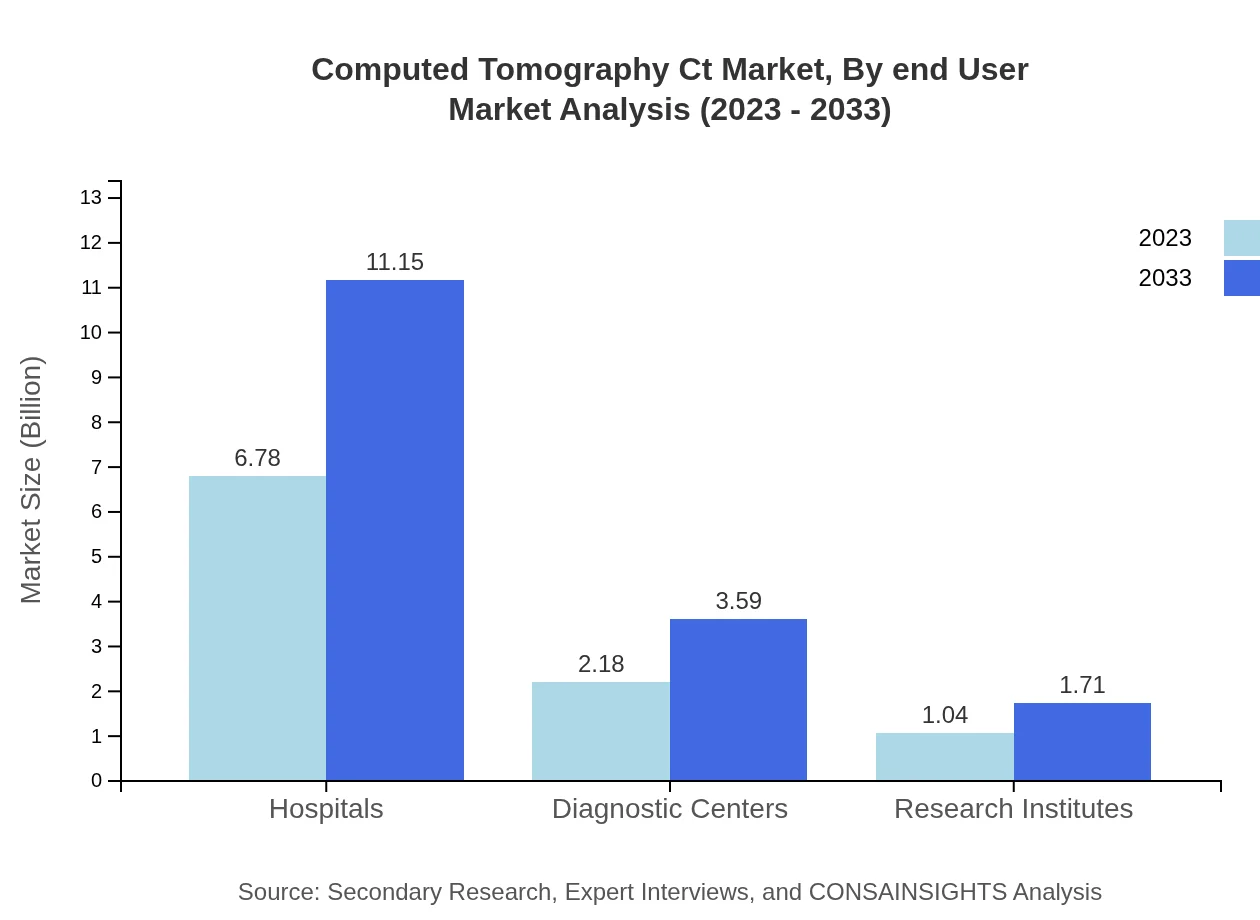

Computed Tomography Ct Market Analysis By End User

The primary end-users of the Computed Tomography market are hospitals, diagnostic centers, and research institutes. As of 2023, hospitals account for a considerable market size of $6.78 billion, representing 67.78% of the total market share, due to their extensive use of imaging for patient care. Diagnostic centers hold the next largest share with a market size of approximately $2.18 billion, while research institutes account for $1.04 billion, each facilitating major advancements in imaging techniques.

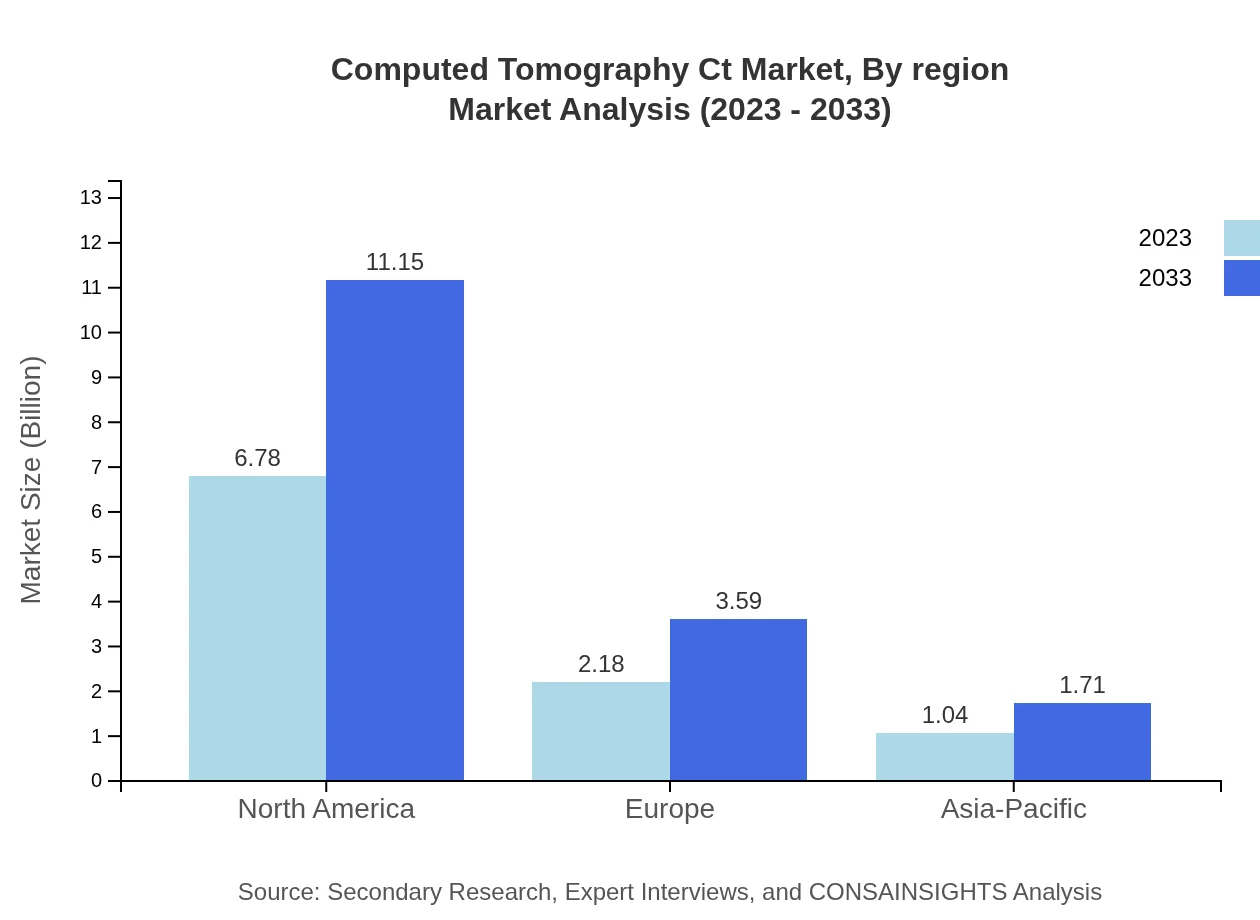

Computed Tomography Ct Market Analysis By Region

The Computed Tomography market analysis by region highlights substantial growth across all regions. North America remains the most significant market, followed by Europe, Asia Pacific, and emerging markets in South America and the Middle East. Each region presents unique growth opportunities linked to healthcare spending and technological advancements, setting the stage for ongoing innovation within the industry.

Computed Tomography Ct Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Computed Tomography Ct Industry

Siemens Healthineers:

Siemens Healthineers is a leading player in medical technology, known for its pioneering innovations in CT imaging systems that enhance diagnostic precision and patient care.GE Healthcare:

GE Healthcare is renowned for its advanced imaging technologies, offering a wide range of CT scanners that cater to diverse medical applications and facilitate advanced healthcare solutions.Philips Healthcare:

Philips Healthcare provides state-of-the-art imaging systems that leverage the latest CT technology to improve patient outcomes and streamline workflows in hospitals.Canon Medical Systems:

Canon Medical Systems specializes in providing comprehensive imaging solutions, focusing on high-quality CT systems that guarantee optimal performance in diagnosing complex medical conditions.Hitachi Medical Systems:

Hitachi Medical Systems is recognized for its innovative CT technologies that enhance diagnostic ability and operational efficiency within healthcare facilities.We're grateful to work with incredible clients.

FAQs

What is the market size of computed Tomography Ct?

The computed tomography (CT) market size is projected to reach approximately $10 billion by 2033, with a steady CAGR of 5%. This growth indicates a robust demand for CT technology within the healthcare sector, driven by advancements in imaging technology.

What are the key market players or companies in this computed Tomography Ct industry?

Key players in the computed tomography market include major companies such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, and Toshiba. These companies lead in technology advancements, product offerings, and global market reach.

What are the primary factors driving the growth in the computed Tomography Ct industry?

Growth in the CT market is primarily driven by technological advancements, increasing prevalence of chronic diseases, rising demand for early diagnosis, and expanding geriatric population. Enhanced application in oncology and cardiology further fuels market growth.

Which region is the fastest Growing in the computed Tomography Ct?

The Asia Pacific region is the fastest-growing market for computed tomography, projected to expand from $1.88 billion in 2023 to $3.09 billion by 2033, driven by increased healthcare investments and rising awareness about diagnostic imaging.

Does ConsaInsights provide customized market report data for the computed Tomography Ct industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the computed tomography industry. This includes comprehensive analyses of market trends, competitive landscapes, and forecasted growth by regions.

What deliverables can I expect from this computed Tomography Ct market research project?

Expect detailed market analysis reports including market size, growth forecasts, and key player insights. Additional deliverables may consist of segmented data analysis, regional growth trends, and strategic recommendations tailored to your objectives.

What are the market trends of computed Tomography Ct?

Current trends in the CT market include the adoption of advanced CT technologies and integration of AI for enhanced imaging accuracy. There is also a shift towards non-invasive diagnostic procedures and increased demand for portable CT scanners.