Computer Aided Manufacturing Market Report

Published Date: 31 January 2026 | Report Code: computer-aided-manufacturing

Computer Aided Manufacturing Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Computer Aided Manufacturing (CAM) market, highlighting key trends, projections, and insights from 2023 to 2033. It encompasses market size, growth rates, regional analyses, and segments within the industry, providing valuable data for stakeholders.

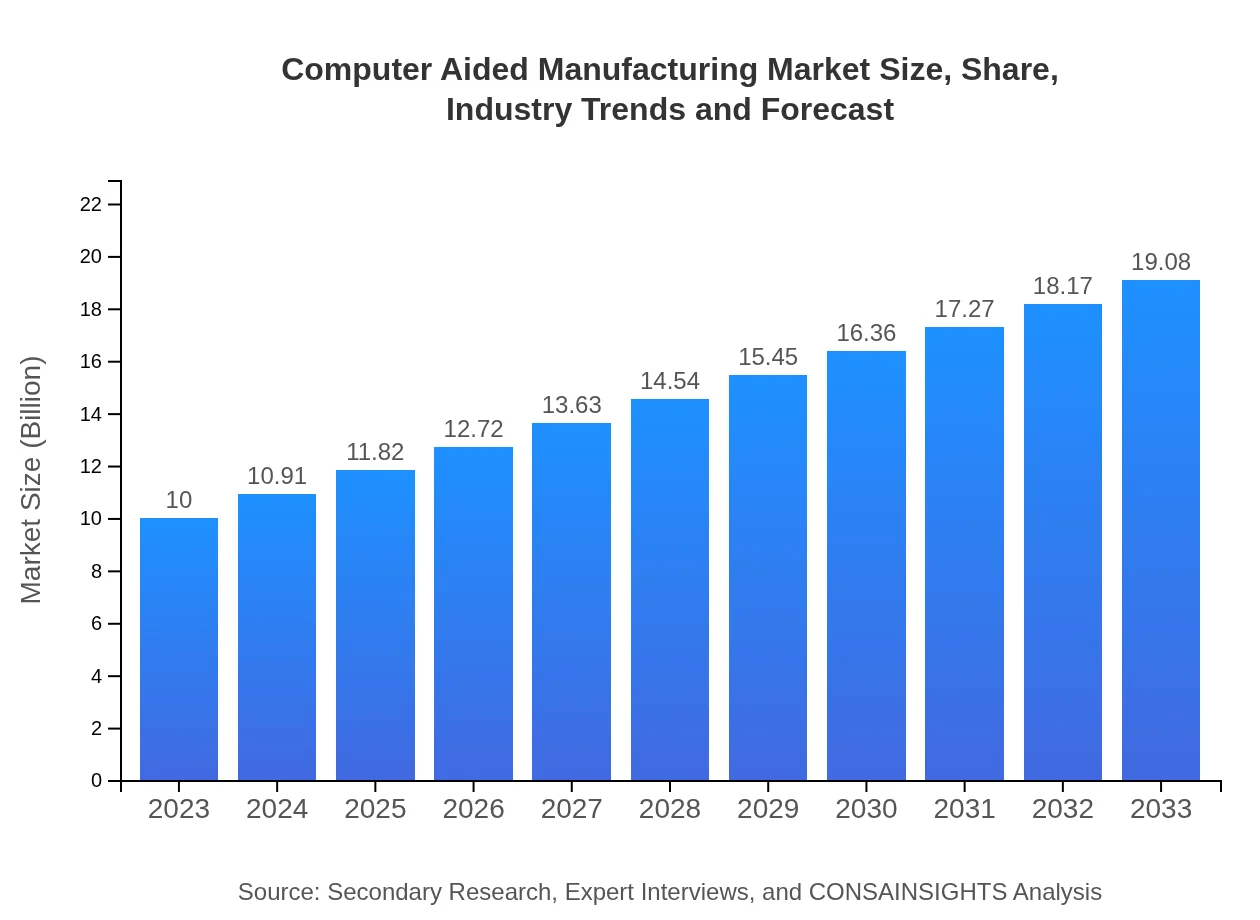

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Siemens AG, Hexagon AB, Dassault Systèmes, PTC Inc., Autodesk, Inc. |

| Last Modified Date | 31 January 2026 |

Computer Aided Manufacturing Market Overview

Customize Computer Aided Manufacturing Market Report market research report

- ✔ Get in-depth analysis of Computer Aided Manufacturing market size, growth, and forecasts.

- ✔ Understand Computer Aided Manufacturing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Computer Aided Manufacturing

What is the Market Size & CAGR of Computer Aided Manufacturing market in 2023?

Computer Aided Manufacturing Industry Analysis

Computer Aided Manufacturing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Computer Aided Manufacturing Market Analysis Report by Region

Europe Computer Aided Manufacturing Market Report:

Europe's Computer Aided Manufacturing market is set to grow from $2.74 billion in 2023 to $5.22 billion by 2033. The region focuses heavily on advanced manufacturing technologies, especially in Germany and Italy, where there’s significant investment in innovative manufacturing methodologies enhancing productivity.Asia Pacific Computer Aided Manufacturing Market Report:

In 2023, the Asia Pacific CAM market is valued at $1.95 billion, projected to grow to $3.72 billion by 2033. The growth in this region is driven by increasing investments in automation and manufacturing excellence, particularly in countries like China, Japan, and Korea, which are focusing on enhancing production capabilities in their manufacturing sectors.North America Computer Aided Manufacturing Market Report:

North America, with a market size of $3.62 billion in 2023, is anticipated to expand to $6.91 billion by 2033. This region leads in technological advancements and adoption, particularly in the automotive and aerospace sectors, thanks to strong research and development initiatives and supportive government policies encouraging automation.South America Computer Aided Manufacturing Market Report:

The South American market, valued at $0.88 billion in 2023 and expected to reach $1.68 billion by 2033, is witnessing growth mainly due to modernization in manufacturing facilities. Countries like Brazil and Argentina are investing in new technologies to boost their manufacturing efficiencies amidst competitive pressures.Middle East & Africa Computer Aided Manufacturing Market Report:

The Middle East and Africa market, valued at $0.82 billion in 2023, is projected to increase to $1.56 billion by 2033. The growth is more gradual, influenced by growing industries and the government’s initiative to diversify economies away from oil reliance.Tell us your focus area and get a customized research report.

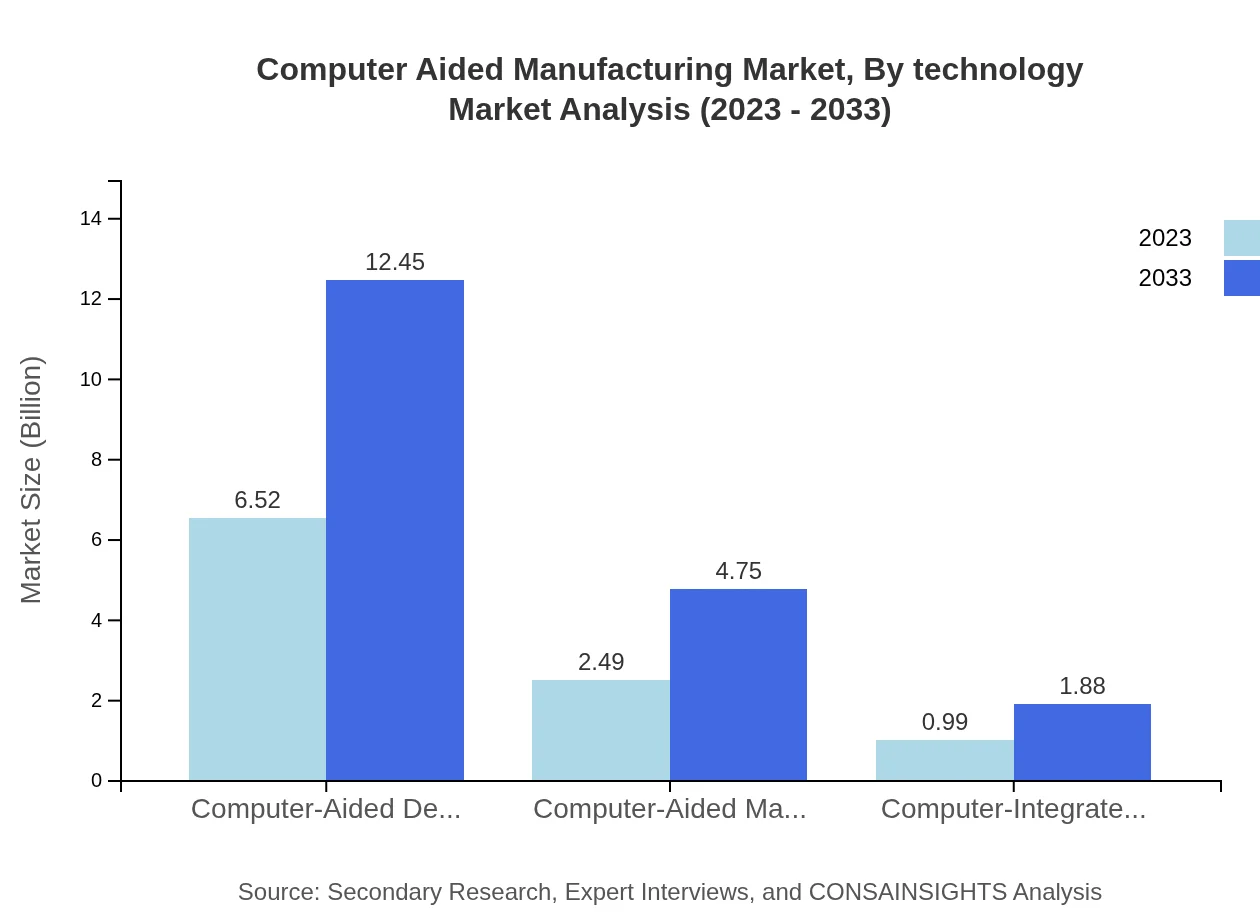

Computer Aided Manufacturing Market Analysis By Technology

The technology segment includes various solutions such as Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), and Computer-Integrated Manufacturing (CIM). CAD leads the market due to its widespread use in the design phase and has a share of 65.22% in 2023, while CAM holds 24.91% as manufacturers prioritize streamlined processes.

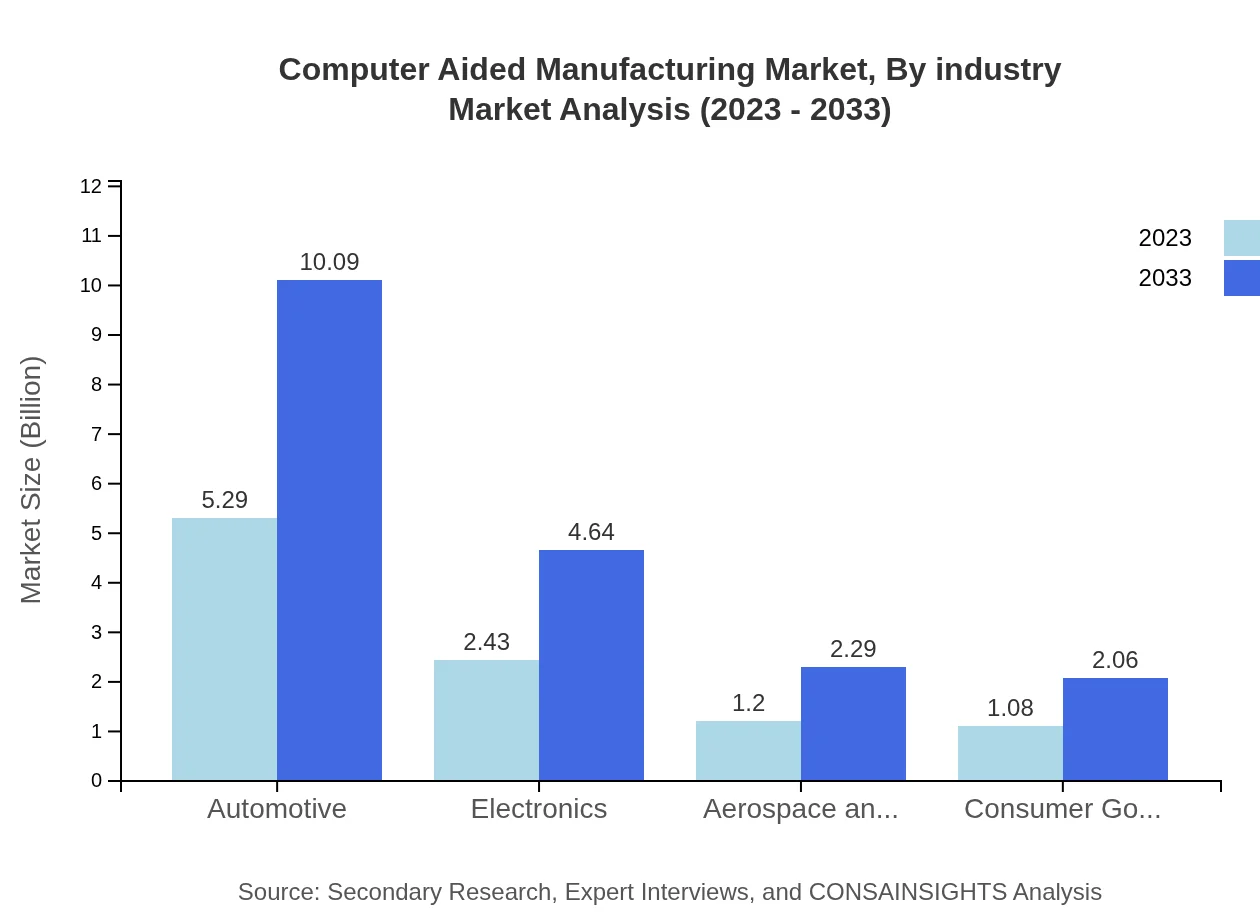

Computer Aided Manufacturing Market Analysis By Industry

In the industry segment, automotive is the largest contributor, holding a market size of $5.29 billion in 2023, expected to grow to $10.09 billion by 2033, ensuring a continuous push towards automation. Electronics and aerospace follow suit, highlighting critical advancements in these domains.

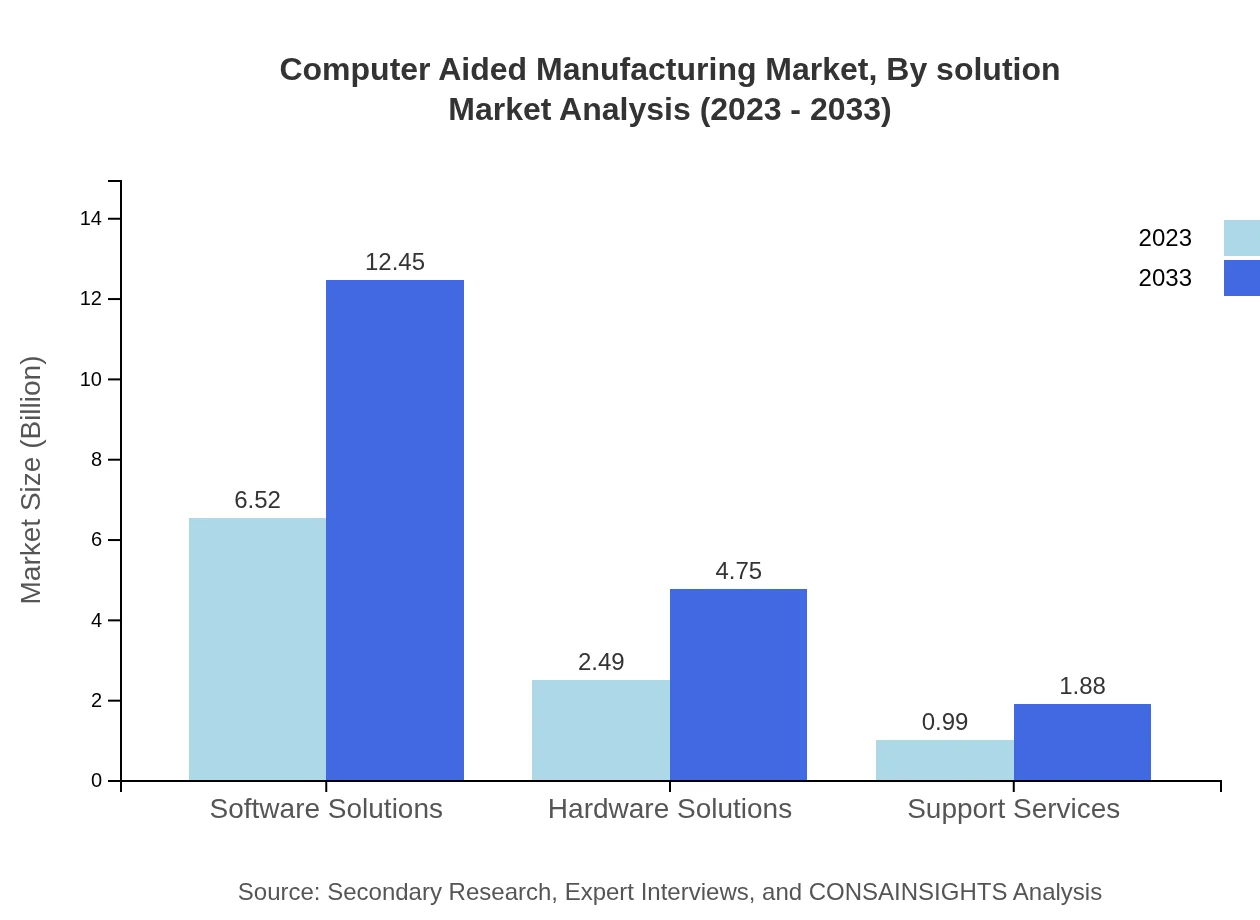

Computer Aided Manufacturing Market Analysis By Solution

The solutions segment indicates considerable growth for software solutions, which stand at $6.52 billion in 2023 and are expected to expand to $12.45 billion by 2033, reflecting the trend of integrating sophisticated software to drive efficiency alongside hardware advancements.

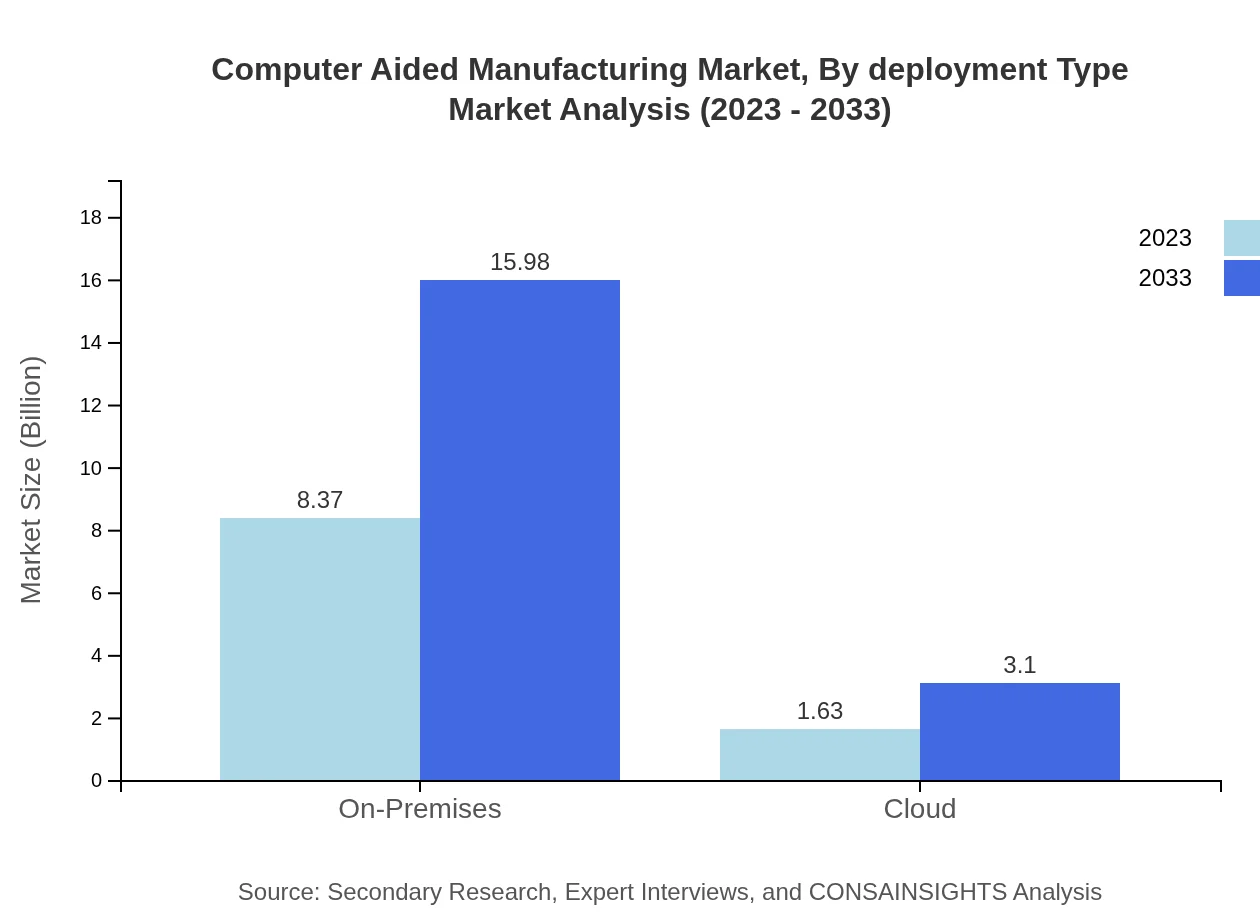

Computer Aided Manufacturing Market Analysis By Deployment Type

The deployment type shows a large preference for on-premises systems due to security and customization aspects, valued at $8.37 billion in 2023, with a forecasted growth to $15.98 billion by 2033, while cloud solutions, currently at $1.63 billion, are growing slowly as companies transition to more flexible operations.

Computer Aided Manufacturing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Computer Aided Manufacturing Industry

Siemens AG:

Siemens AG is a leading engineering and technology company specializing in automation and digitalization of the manufacturing sector, bringing innovative solutions like Teamcenter and Tecnomatix.Hexagon AB:

Hexagon AB provides advanced design, measurement, and visualization technologies that empower manufacturers to optimize their processes and achieve better quality and efficiency.Dassault Systèmes:

Known for its 3D design software, Dassault Systèmes creates solutions that are pivotal in various industries, streamlining the design to manufacturing to service process.PTC Inc.:

PTC provides cutting-edge solutions that incorporate IoT and augmented reality into industrial processes, enhancing the capabilities of designing and manufacturing.Autodesk, Inc.:

Autodesk is a pioneer in 3D design software and is known for its robust solutions that facilitate complex engineering processes across many verticals.We're grateful to work with incredible clients.

FAQs

What is the market size of computer Aided Manufacturing?

The computer-aided manufacturing market is valued at approximately $10 billion in 2023, with a projected growth at a CAGR of 6.5%, indicating robust demand for automated production technologies over the next decade.

What are the key market players or companies in this computer Aided Manufacturing industry?

Key players in the computer-aided manufacturing industry include Siemens AG, Autodesk Inc., 3D Systems Corporation, and Dassault Systèmes, contributing significantly with innovative solutions that enhance manufacturing efficiency and precision.

What are the primary factors driving the growth in the computer Aided Manufacturing industry?

Growth in computer-aided manufacturing is primarily driven by advancements in technology, increasing demand for automation in manufacturing, a rise in efficiency and productivity, and the need for reduced operational costs across industries.

Which region is the fastest Growing in the computer Aided Manufacturing?

The fastest-growing region in computer-aided manufacturing is North America, projected to grow from $3.62 billion in 2023 to $6.91 billion by 2033, fueled by technological innovation and investment in manufacturing automation.

Does ConsaInsights provide customized market report data for the computer Aided Manufacturing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the computer-aided manufacturing sector, allowing businesses to gain insights relevant to their operations and strategic planning.

What deliverables can I expect from this computer Aided Manufacturing market research project?

Deliverables from the computer-aided manufacturing market research project include comprehensive reports, trend analysis, competitor insights, forecast data, and actionable recommendations for strategic decision-making.

What are the market trends of computer Aided Manufacturing?

Key trends in the computer-aided manufacturing market include an increase in software solutions adoption, integration of AI and IoT technologies, rising demand for on-premises solutions, and a shift towards cloud-based systems.