Condiment Sauces Market Report

Published Date: 31 January 2026 | Report Code: condiment-sauces

Condiment Sauces Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the condiment sauces market, covering current trends, market size forecasts, and growth drivers from 2023 to 2033. Insights on segmentation, industry analysis, and key players will guide stakeholders in making informed decisions.

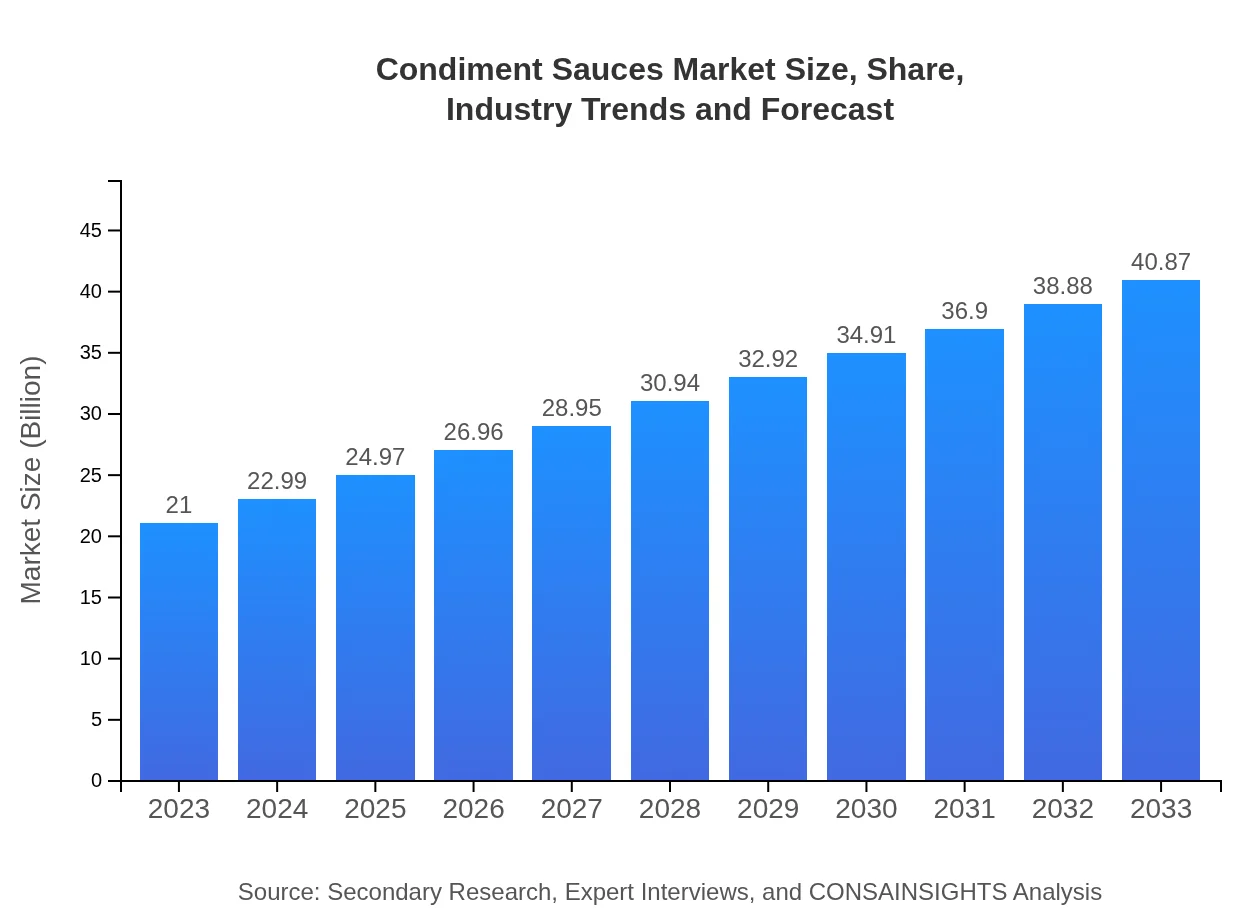

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.00 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $40.87 Billion |

| Top Companies | Kraft Heinz, Unilever, McCormick & Company, Nestlé |

| Last Modified Date | 31 January 2026 |

Condiment Sauces Market Overview

Customize Condiment Sauces Market Report market research report

- ✔ Get in-depth analysis of Condiment Sauces market size, growth, and forecasts.

- ✔ Understand Condiment Sauces's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Condiment Sauces

What is the Market Size & CAGR of Condiment Sauces market in 2023?

Condiment Sauces Industry Analysis

Condiment Sauces Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Condiment Sauces Market Analysis Report by Region

Europe Condiment Sauces Market Report:

In Europe, the market size is expected to increase from $5.34 billion in 2023 to $10.39 billion by 2033, with trends favoring organic and health-oriented condiment options among European consumers.Asia Pacific Condiment Sauces Market Report:

In the Asia Pacific region, the condiment sauces market is set to grow from $4.12 billion in 2023 to $8.01 billion by 2033, driven by culinary diversity and increasing adoption of condiments in household cooking.North America Condiment Sauces Market Report:

North America is projected to see significant growth from $8.19 billion in 2023 to $15.94 billion by 2033. The popularity of gourmet sauces and the growing food service industry are key drivers in this region.South America Condiment Sauces Market Report:

The South American condiment sauces market is estimated to expand from $1.06 billion in 2023 to $2.06 billion by 2033. Growth is fueled by rising disposable incomes and the influence of international cuisines.Middle East & Africa Condiment Sauces Market Report:

The Middle East and Africa market will grow from $2.30 billion in 2023 to $4.47 billion by 2033, driven by a growing interest in global flavors and sauces in local cuisines.Tell us your focus area and get a customized research report.

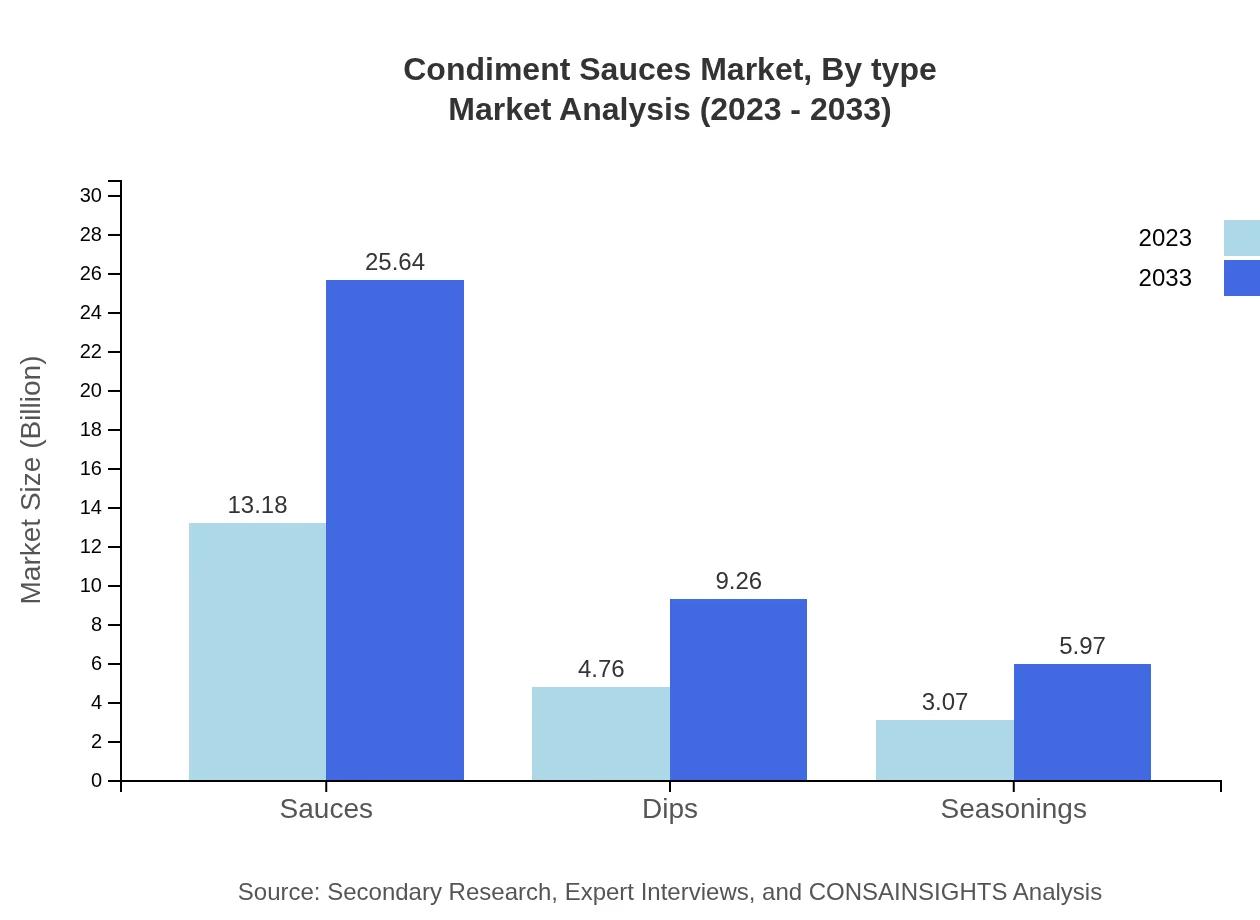

Condiment Sauces Market Analysis By Type

The segment of sauces dominates the market with a size of $13.18 billion in 2023, forecasted to reach $25.64 billion by 2033, accounting for 62.74% share. Dips and seasonings follow, with sizes of $4.76 billion and $3.07 billion, projected to grow significantly over the decade.

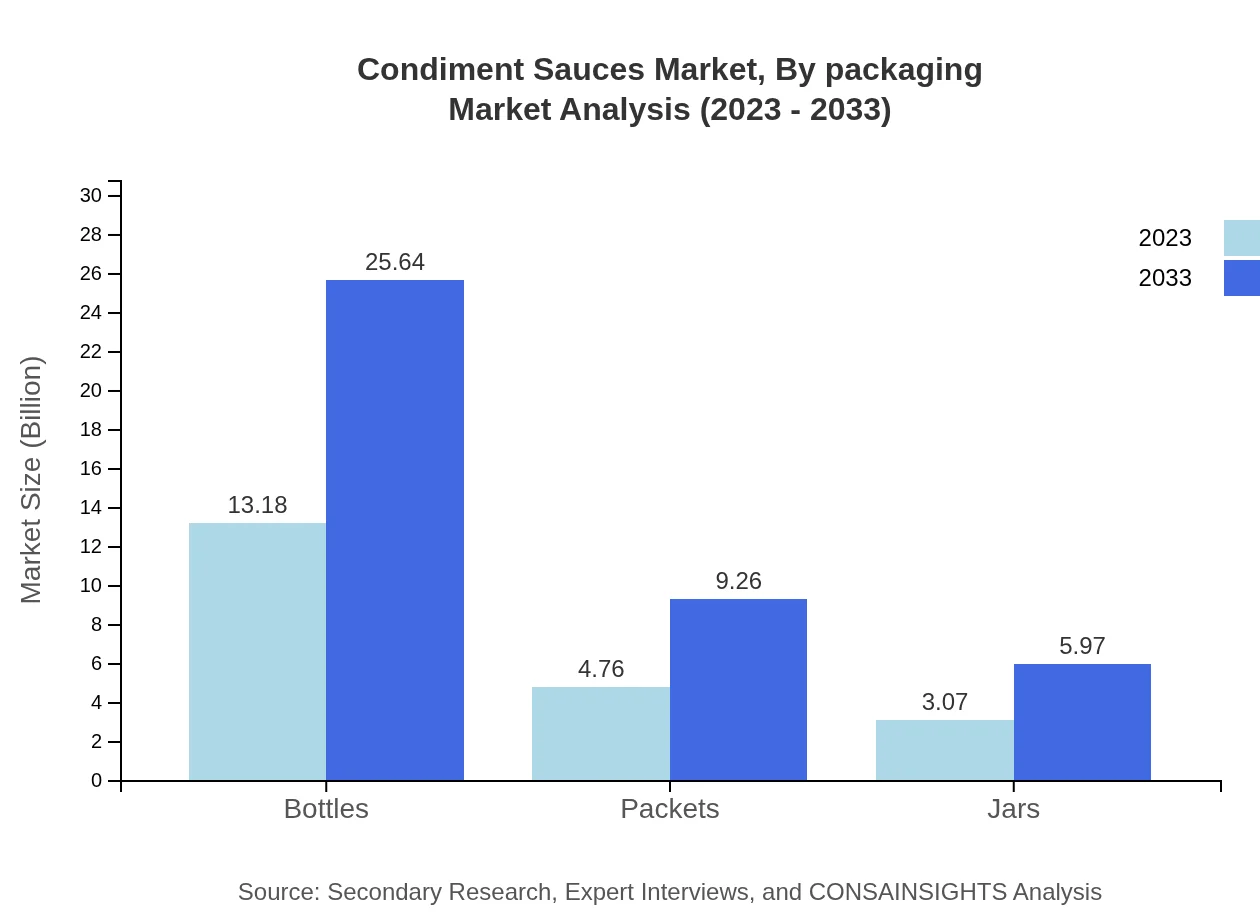

Condiment Sauces Market Analysis By Packaging

Packaging in bottles leads with a size of $13.18 billion in 2023, anticipated to expand to $25.64 billion by 2033. Packet and jar packaging types also represent significant segments, maintaining their importance in retail sales.

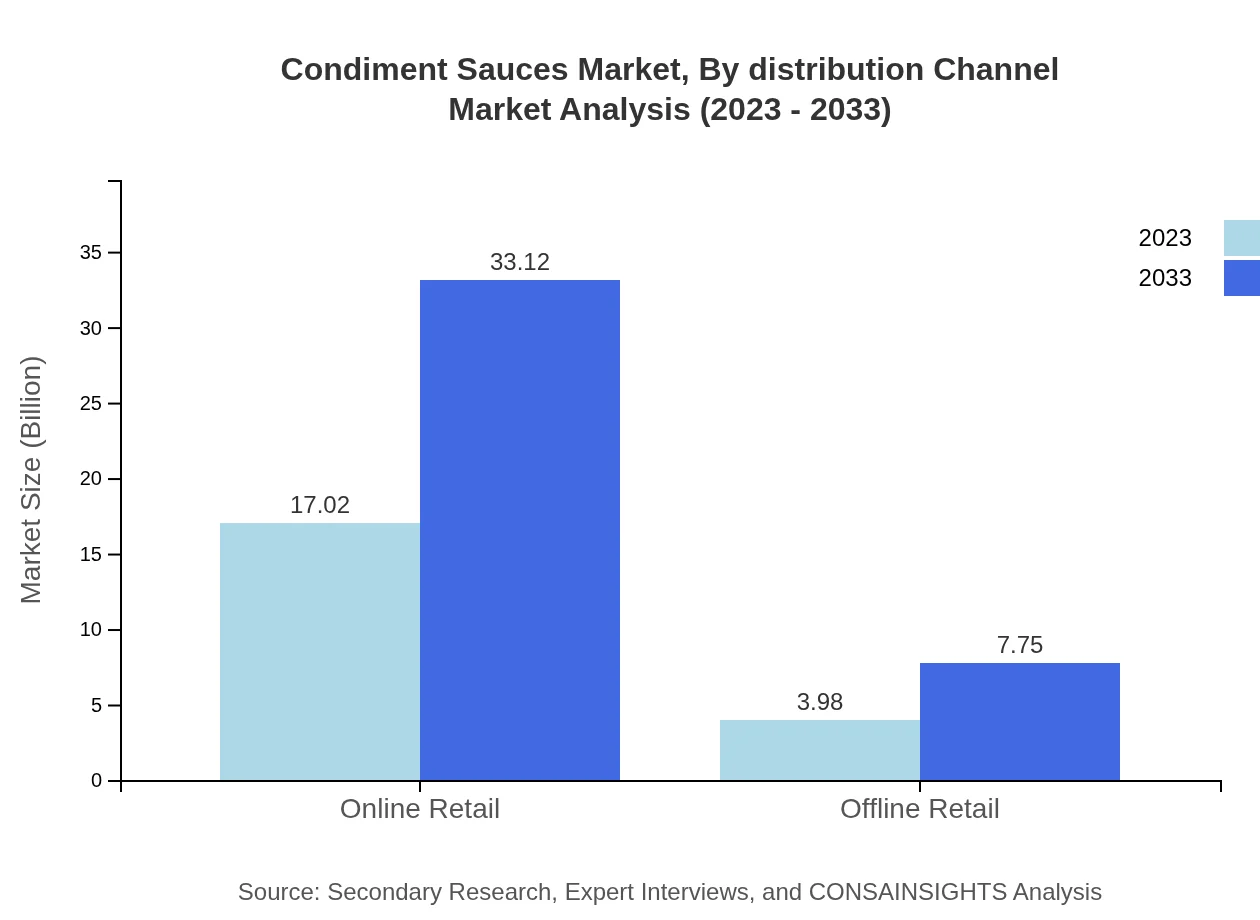

Condiment Sauces Market Analysis By Distribution Channel

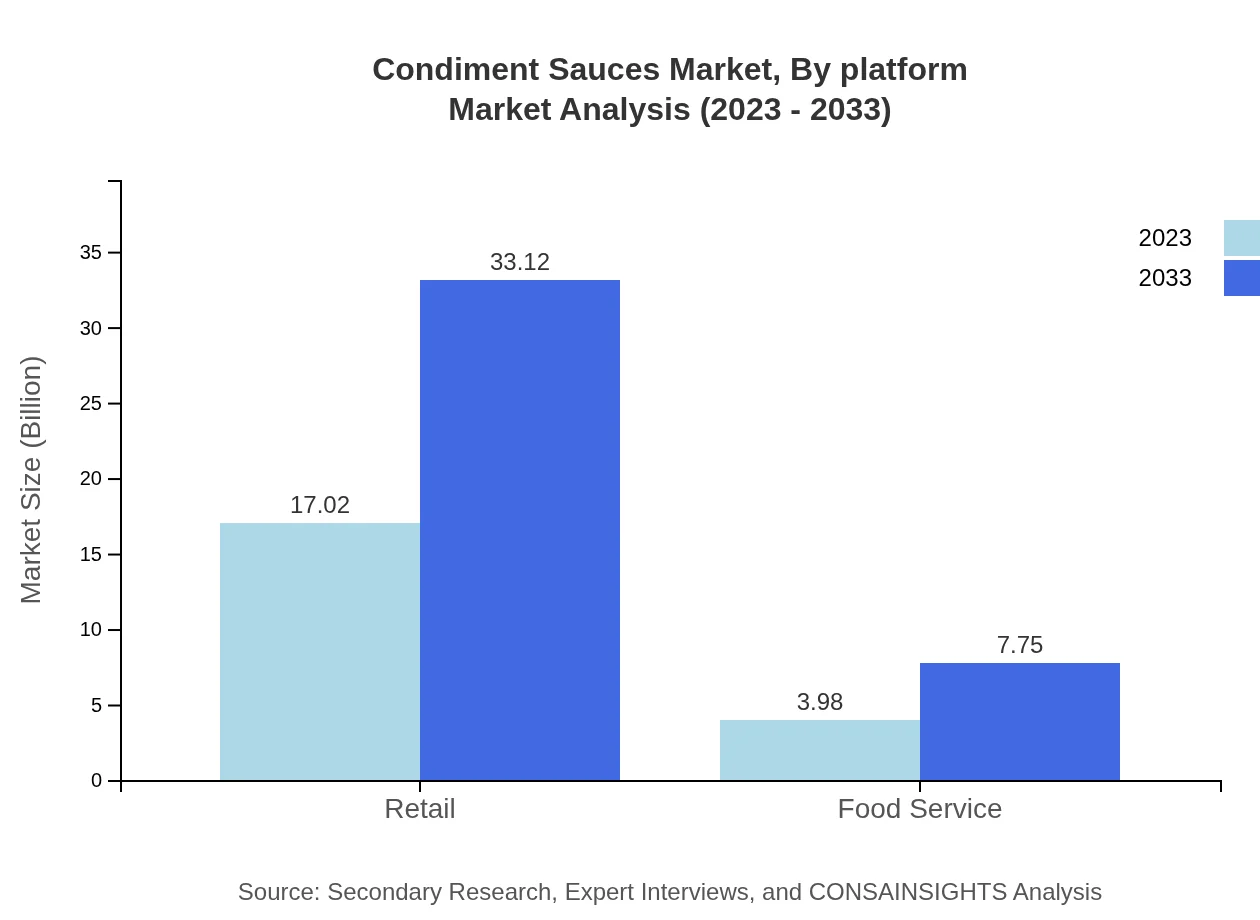

Retail remains the largest distribution channel with a share of 81.04%, comprising both online and offline sales. Online retail is projected to see substantial growth, reflecting changes in consumer buying habits towards convenience.

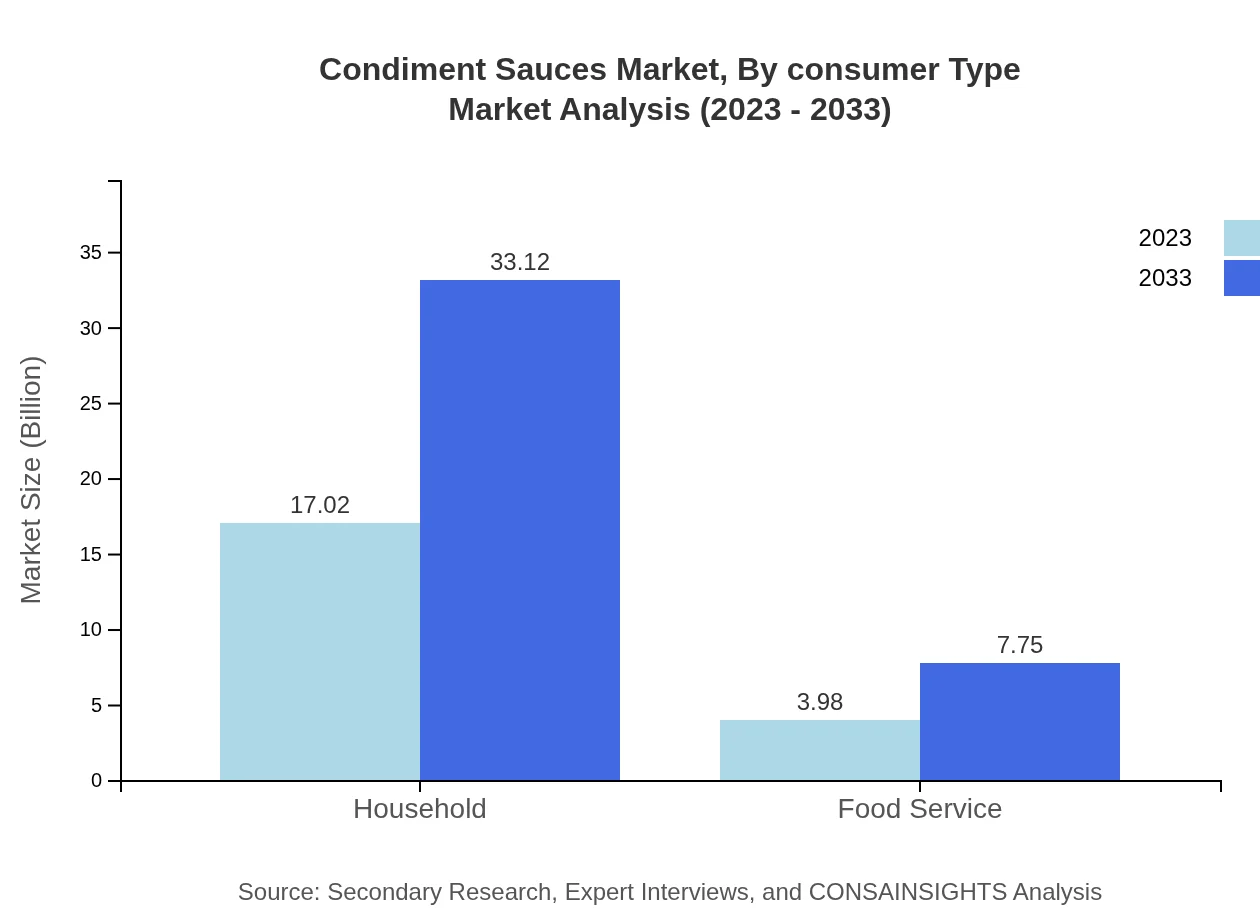

Condiment Sauces Market Analysis By Consumer Type

The household consumer type dominates, making up 81.04% of the market share in 2023. However, the food service segment is also growing steadily, reflecting increasing dining out trends.

Condiment Sauces Market Analysis By Platform

Online platforms are gaining market share, with a significant projection of growth as consumers shift towards digital purchasing, accounting for a notable portion of condiment sauce sales.

Condiment Sauces Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Condiment Sauces Industry

Kraft Heinz:

A leading global food company known for its extensive range of condiment sauces and dressings, Kraft Heinz is committed to innovation and quality in food production.Unilever:

Unilever offers a broad portfolio of condiment brands, focusing on sustainability and health, enhancing their global presence in the condiment market with numerous popular products.McCormick & Company:

Renowned for their spices and flavorings, McCormick also majorly participates in the condiment sauces market, contributing to flavor innovation and culinary enjoyment.Nestlé:

Nestlé's diverse food and beverage portfolio includes popular sauces and dressings, driving market reach through strong global distribution networks.We're grateful to work with incredible clients.

FAQs

What is the market size of condiment sauces?

The global condiment sauces market is valued at approximately $21 billion in 2023, with a projected CAGR of 6.7% through 2033. This growth is driven by increasing consumer demand for diverse flavors and convenience in food preparation.

What are the key market players or companies in this condiment sauces industry?

Key players in the condiment sauces market include major companies such as Heinz, Kraft Foods, Unilever, and McCormick. These companies dominate the market with a significant presence in both retail and food service sectors, continuously innovating their product offerings.

What are the primary factors driving the growth in the condiment sauces industry?

Primary growth factors include increasing globalization of cuisines, rising health awareness leading to the demand for organic options, and a growing preference for ready-to-eat meals. Additionally, the expansion of e-commerce has made sauces more accessible to consumers.

Which region is the fastest Growing in the condiment sauces industry?

The Asia Pacific region is the fastest-growing market for condiment sauces, projected to increase from $4.12 billion in 2023 to $8.01 billion by 2033. This growth is attributed to an expanding middle class and changing food consumption patterns.

Does ConsaInsights provide customized market report data for the condiment sauces industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the condiment sauces industry. This includes detailed insights into market trends, consumer preferences, and competitor analysis to aid strategic decision-making.

What deliverables can I expect from this condiment sauces market research project?

Deliverables include a comprehensive market analysis report, segmentation data, competitive landscape assessment, forecasts up to 2033, and recommendations based on market trends. Visual aids like charts and graphs will also be included for clearer insights.

What are the market trends of condiment sauces?

Current trends in the condiment sauces market include increased demand for gourmet and specialty sauces, an emphasis on plant-based ingredients, and the growing popularity of international flavors. Consumers are also leaning towards eco-friendly packaging and sustainability.