Conductive Compounds Market Report

Published Date: 31 January 2026 | Report Code: conductive-compounds

Conductive Compounds Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Conductive Compounds market, covering market size, segments, regional insights, and future trends from 2023 to 2033. It aims to equip stakeholders with valuable insights for informed decision-making.

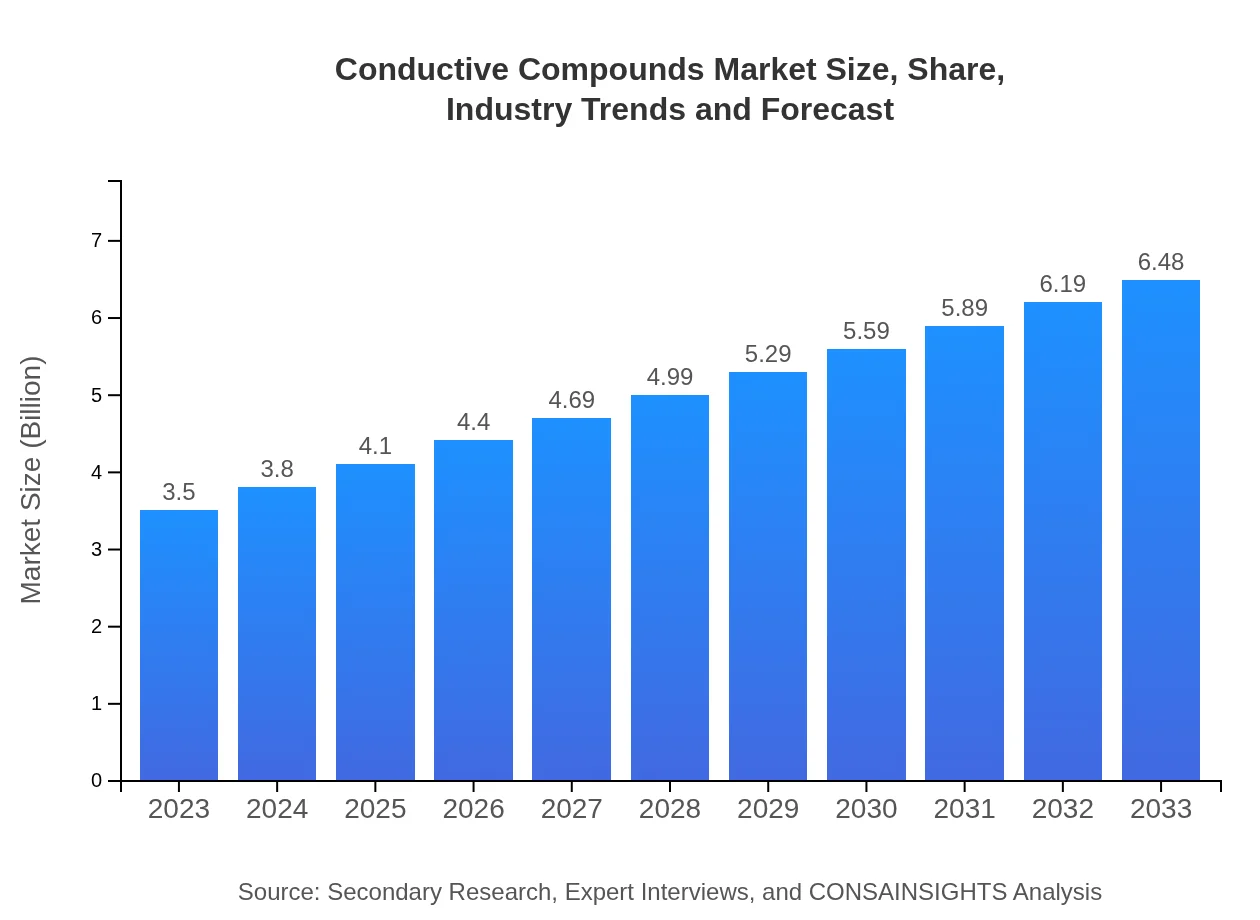

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | BASF SE, Henkel AG & Co. KGaA, E.I. du Pont de Nemours and Company, The Dow Chemical Company |

| Last Modified Date | 31 January 2026 |

Conductive Compounds Market Overview

Customize Conductive Compounds Market Report market research report

- ✔ Get in-depth analysis of Conductive Compounds market size, growth, and forecasts.

- ✔ Understand Conductive Compounds's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Conductive Compounds

What is the Market Size & CAGR of Conductive Compounds market in 2023?

Conductive Compounds Industry Analysis

Conductive Compounds Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Conductive Compounds Market Analysis Report by Region

Europe Conductive Compounds Market Report:

Europe's market for Conductive Compounds is expected to see substantial growth, moving from $0.84 billion in 2023 to $1.56 billion by 2033. Key factors driving this expansion include increasing regulatory pressures on industries to adopt more sustainable materials and the ongoing digital transformation in manufacturing processes. Countries such as Germany and the UK are at the forefront of these advancements.Asia Pacific Conductive Compounds Market Report:

The Asia-Pacific region is a significant contributor to the global Conductive Compounds market, with a market size of $0.70 billion in 2023, projected to grow to $1.29 billion by 2033. The rapid industrialization, burgeoning electronics sector, and investment in renewable energy solutions in countries like China and India are driving this growth. Furthermore, the demand for conductive materials in automotive manufacturing is expected to further bolster market prospects.North America Conductive Compounds Market Report:

North America, assessed at $1.18 billion in 2023, is expected to expand to $2.18 billion by 2033. This region is characterized by strong investment in research and development, particularly in electronic manufacturing and automotive technologies. The adoption of conductive compounds in high-performance applications, coupled with the technological advancements in materials science, positions North America as a leader in this market.South America Conductive Compounds Market Report:

South America currently holds a market size of $0.32 billion in 2023, with expectations to increase to $0.60 billion by 2033. The region's growth is attributed to rising demand in the automotive and renewable energy sectors, influenced by government initiatives promoting sustainable technologies. The expansion of the electronics industry is anticipated to further enhance market development over the forecast period.Middle East & Africa Conductive Compounds Market Report:

The Middle East and Africa market, currently at $0.46 billion in 2023, is forecasted to reach $0.86 billion by 2033. Growth in this region is largely due to investments in infrastructure development and renewable energy initiatives. The increasing focus on reducing carbon footprints and enhancing energy efficiency across various industries supports this upward trend.Tell us your focus area and get a customized research report.

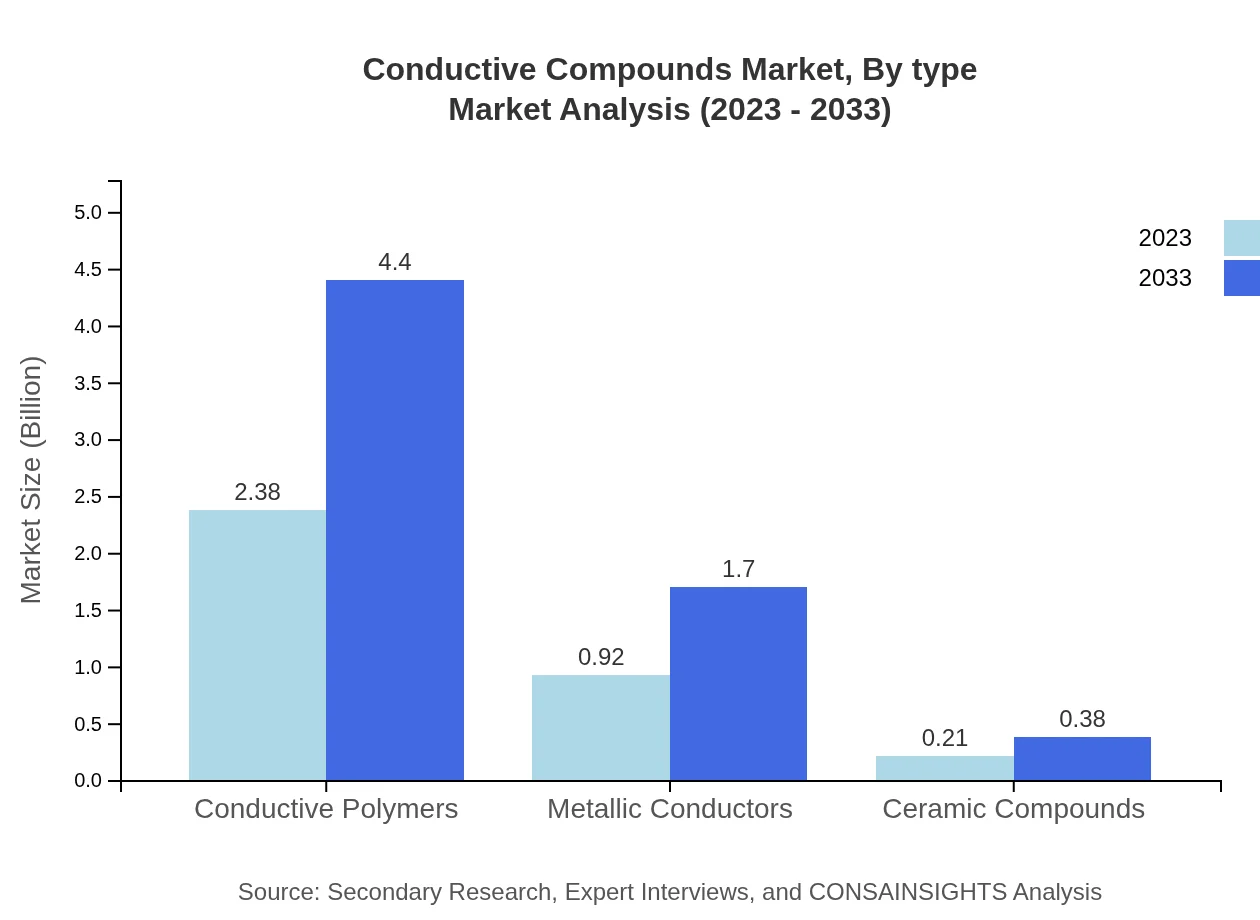

Conductive Compounds Market Analysis By Type

The Conductive Compounds market is primarily segmented into conductive polymers, metallic conductors, and ceramic compounds. Conductive polymers dominate the market size with $2.38 billion in 2023, expected to reach $4.40 billion by 2033, maintaining a market share of 67.9%. Metallic conductors follow, with a market size of $0.92 billion in 2023 to grow to $1.70 billion in 2033 (26.18% share). Ceramic compounds, although smaller, play a significant role in specialized applications with a projected growth to $0.38 billion by 2033, accounting for 5.92% of the market share overall.

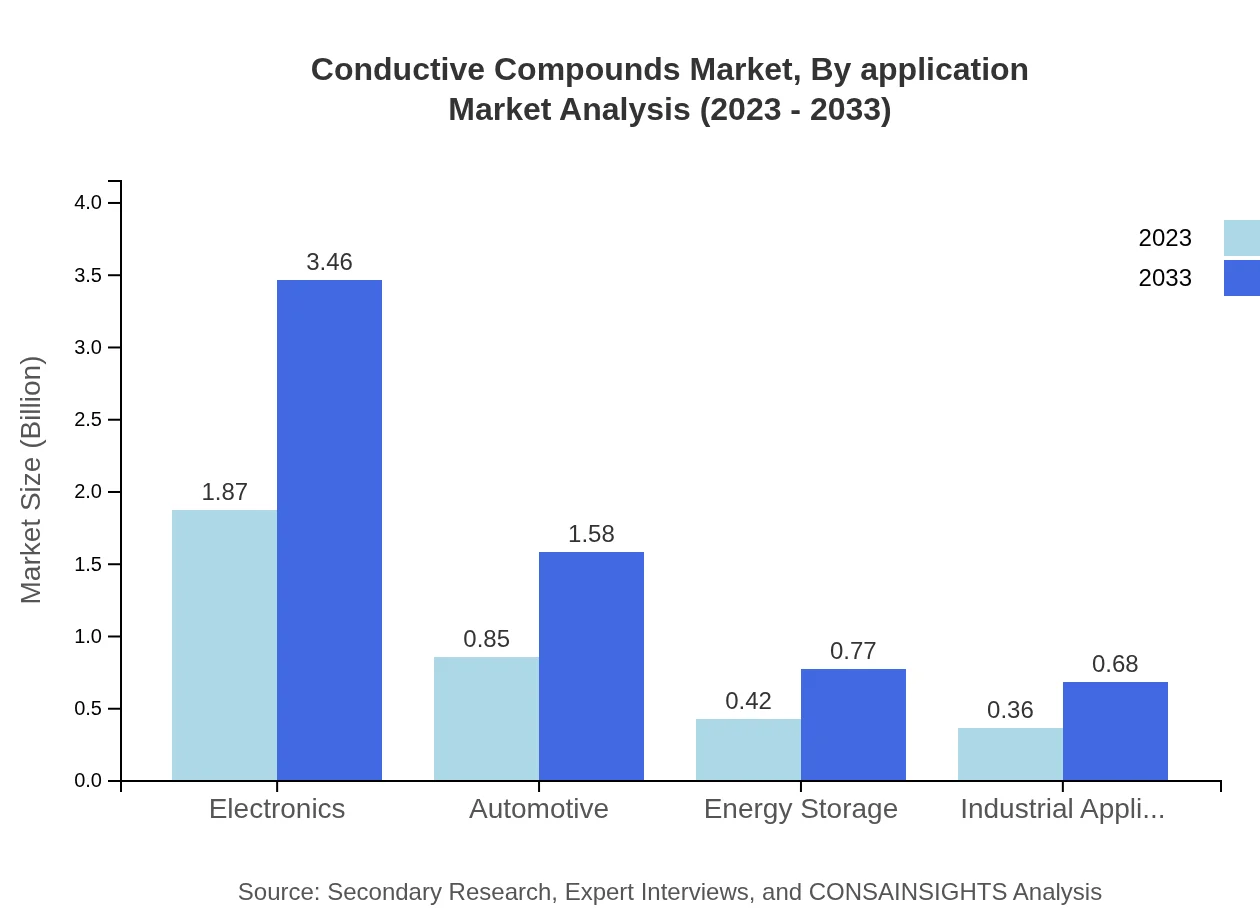

Conductive Compounds Market Analysis By Application

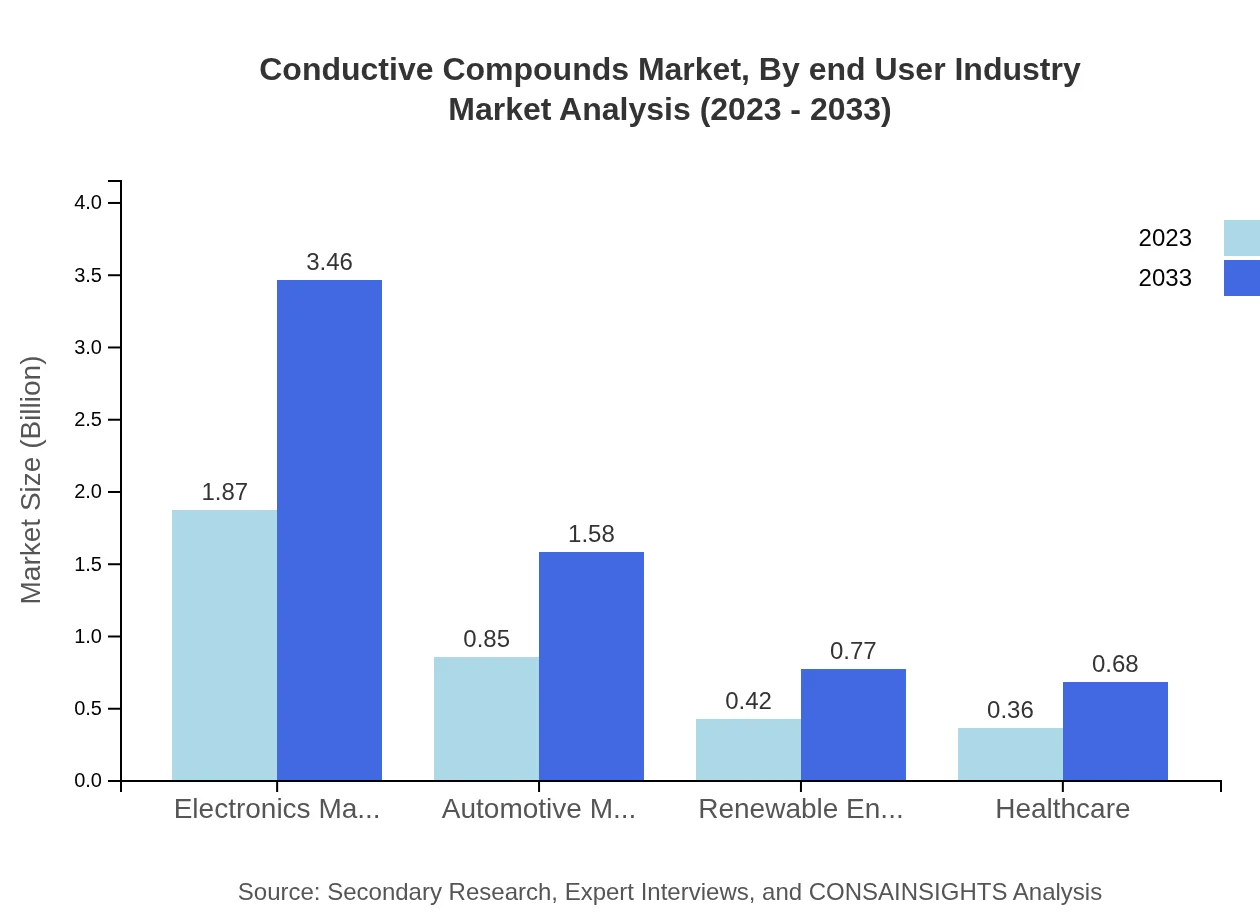

Notably, the electronics sector attempts to address the demand surge for conductive compounds, with market sizes expected to grow from $1.87 billion in 2023 to $3.46 billion by 2033, capturing a 53.39% market share. The automotive industry follows closely with a market expansion from $0.85 billion in 2023 to $1.58 billion by 2033, with a share of 24.29%. Energy storage and industrial applications also emerge as vital contributors with significant growth trajectories expected.

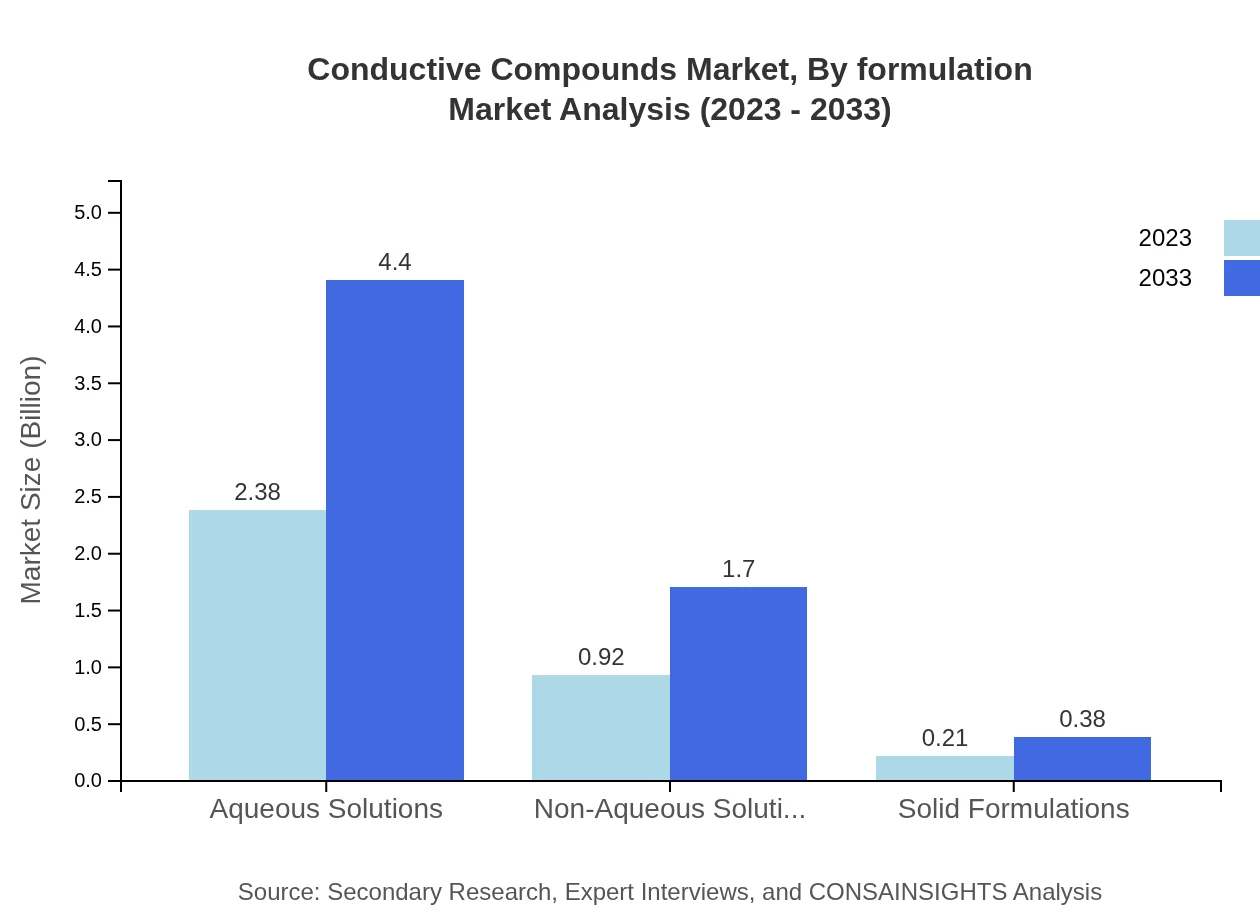

Conductive Compounds Market Analysis By Formulation

Conductive compounds are segmented into aqueous solutions, non-aqueous solutions, and solid formulations. Aqueous solutions lead in market size, accounted for $2.38 billion in 2023, projected to grow to $4.40 billion by 2033, holding a market share of 67.9%. Non-aqueous solutions and solid formulations represent 26.18% and 5.92% market shares respectively, with size trajectories indicating significant upward momentum as industries adopt versatile formulations to meet varying operational demands.

Conductive Compounds Market Analysis By End User Industry

The end-user segmentation demonstrates a dominant trend towards electronics manufacturing, commanding a market size of $1.87 billion in 2023, expected to rise to $3.46 billion by 2033 (53.39% market share). Automotive manufacturing and renewable energy sectors also hold considerable shares, with projected sizes of $0.85 billion and $0.42 billion in 2023 respectively, reflecting the growing integration of conductive compounds into high-performance applications.

Conductive Compounds Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Conductive Compounds Industry

BASF SE:

BASF SE is a global leader in chemical production, specializing in conducting materials that improve the efficiency of electronic components and automotive applications.Henkel AG & Co. KGaA:

Henkel is known for its adhesive and functional coatings, including advanced conductive adhesives that play a pivotal role in electronic manufacturing.E.I. du Pont de Nemours and Company:

DuPont is renowned for its innovative conductive polymers and materials, focusing on sustainability and high-performance applications.The Dow Chemical Company:

Dow Chemical excels in manufacturing conductive compounds intended for electronics and photovoltaic applications, emphasizing advanced technology.We're grateful to work with incredible clients.

FAQs

What is the market size of conductive compounds?

The global conductive compounds market is valued at approximately $3.5 billion in 2023 and is projected to witness a compound annual growth rate (CAGR) of 6.2%, reaching significant growth by 2033.

What are the key market players or companies in this conductive compounds industry?

The conductive compounds industry features key players such as EMERALD Performance Materials, 3M, DuPont, and Henkel. These companies drive innovation and market expansion through partnerships, product development, and strategic acquisitions.

What are the primary factors driving the growth in the conductive compounds industry?

Growth in the conductive compounds industry is driven by increasing demand in electronics manufacturing, advancements in automotive technologies, and the rising need for energy-efficient materials, alongside the ongoing expansion of renewable energy sectors.

Which region is the fastest Growing in the conductive compounds market?

The Asia Pacific region is anticipated to be the fastest-growing market for conductive compounds, with growth from $0.70 billion in 2023 to $1.29 billion by 2033, fueled by industrial expansion and rising consumer electronics demand.

Does ConsaInsights provide customized market report data for the conductive compounds industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the conductive compounds industry, ensuring insights are relevant to individual business objectives and market strategies.

What deliverables can I expect from this conductive compounds market research project?

Deliverables from the conductive compounds market research project typically include detailed reports on market size, growth forecasts, competitive analysis, trends, and insights pertaining to regional and segment data.

What are the market trends of conductive compounds?

Current market trends in conductive compounds include a shift towards sustainable materials, increasing use in advanced electronics, and growth in applications across automotive and renewable energy sectors, reflecting shifts in manufacturing and consumer preferences.