Cone Beam Computed Tomography Market Report

Published Date: 31 January 2026 | Report Code: cone-beam-computed-tomography

Cone Beam Computed Tomography Market Size, Share, Industry Trends and Forecast to 2033

This report provides an insightful analysis of the Cone Beam Computed Tomography market, covering trends, regional performance, and forecasts from 2023 to 2033. It aims to equip stakeholders with vital metrics and projections to support strategic decision-making.

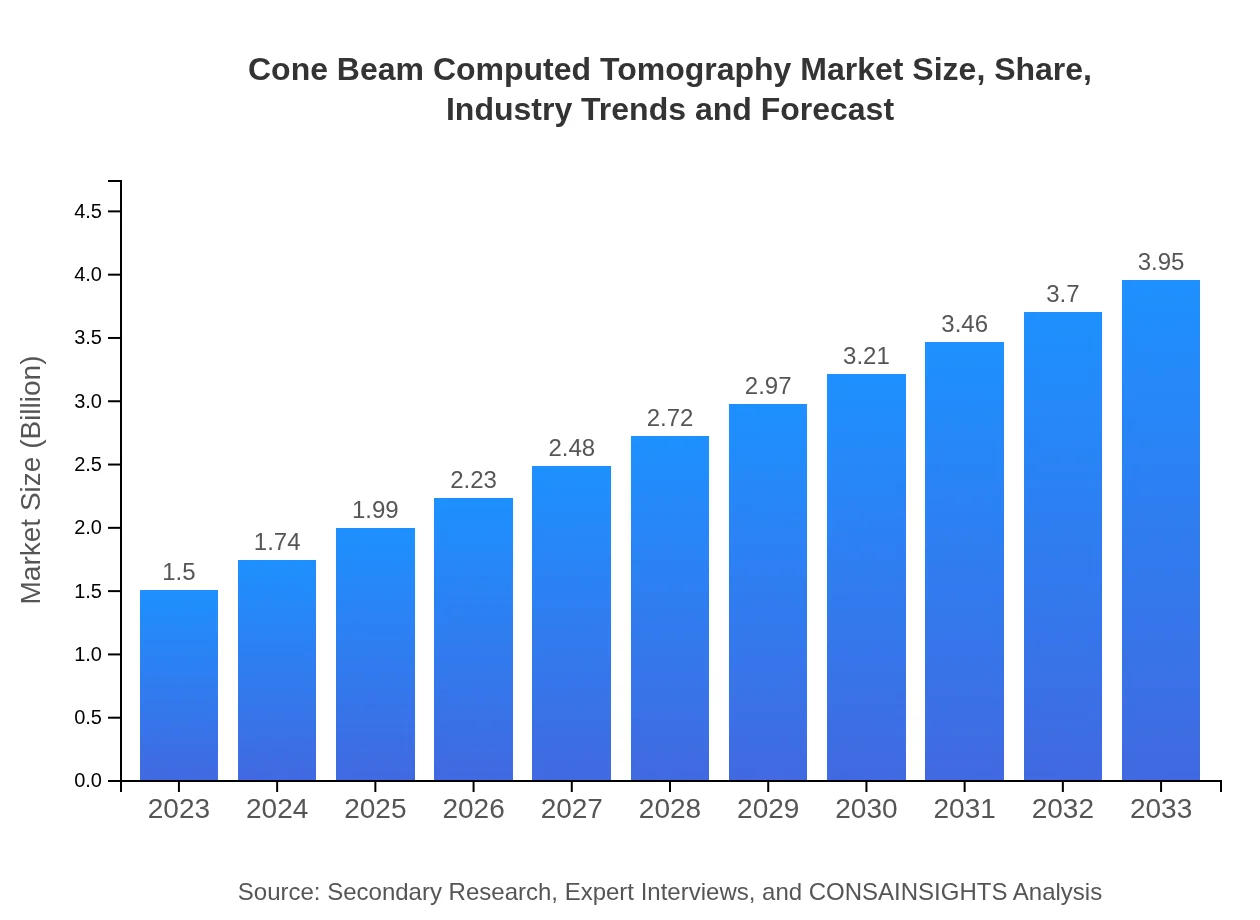

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $3.95 Billion |

| Top Companies | Carestream Health, Sirona Dental Systems, Planmeca Oy, Asahi Roentgen |

| Last Modified Date | 31 January 2026 |

Cone Beam Computed Tomography Market Overview

Customize Cone Beam Computed Tomography Market Report market research report

- ✔ Get in-depth analysis of Cone Beam Computed Tomography market size, growth, and forecasts.

- ✔ Understand Cone Beam Computed Tomography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cone Beam Computed Tomography

What is the Market Size & CAGR of Cone Beam Computed Tomography market in 2023?

Cone Beam Computed Tomography Industry Analysis

Cone Beam Computed Tomography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cone Beam Computed Tomography Market Analysis Report by Region

Europe Cone Beam Computed Tomography Market Report:

Europe's market size is forecasted to increase from $0.48 billion in 2023 to $1.28 billion by 2033. Countries such as Germany and the UK are leading the market due to high standards of healthcare services and increased focus on dental health initiatives. Technological advancements in diagnostic imaging tools further enhance the region’s growth prospects.Asia Pacific Cone Beam Computed Tomography Market Report:

The Asia Pacific region represented a market size of approximately $0.24 billion in 2023 and is projected to reach $0.64 billion by 2033. Rapid urbanization, increased health expenditure, and growing awareness around advanced imaging technologies contribute to market growth in this region. Countries like Japan and China are leading in adopting CBCT systems due to their advanced healthcare infrastructure and technological advancements.North America Cone Beam Computed Tomography Market Report:

In North America, the CBCT market is expected to grow from $0.56 billion in 2023 to approximately $1.47 billion by 2033. The presence of key industry players, high healthcare spending, and a rising number of dental procedures are major factors driving this growth. The region's advanced healthcare infrastructure supports the adoption of effective imaging technologies.South America Cone Beam Computed Tomography Market Report:

South America has a modest market size of around $0.01 billion in 2023, expected to escalate to $0.04 billion by 2033. The growth potential is driven by increasing disposable income and improvement in healthcare facilities. Investments in healthcare and dental services are likely to foster demand for CBCT systems as medical professionals seek advanced diagnostic tools.Middle East & Africa Cone Beam Computed Tomography Market Report:

The Middle East and Africa market is projected to grow from $0.20 billion in 2023 to $0.52 billion by 2033. This growth is driven by improvements in healthcare infrastructure and rising demand for advanced imaging technologies in diagnostic centers. Investments in healthcare modernization across the region are likely to support the uptake of CBCT systems.Tell us your focus area and get a customized research report.

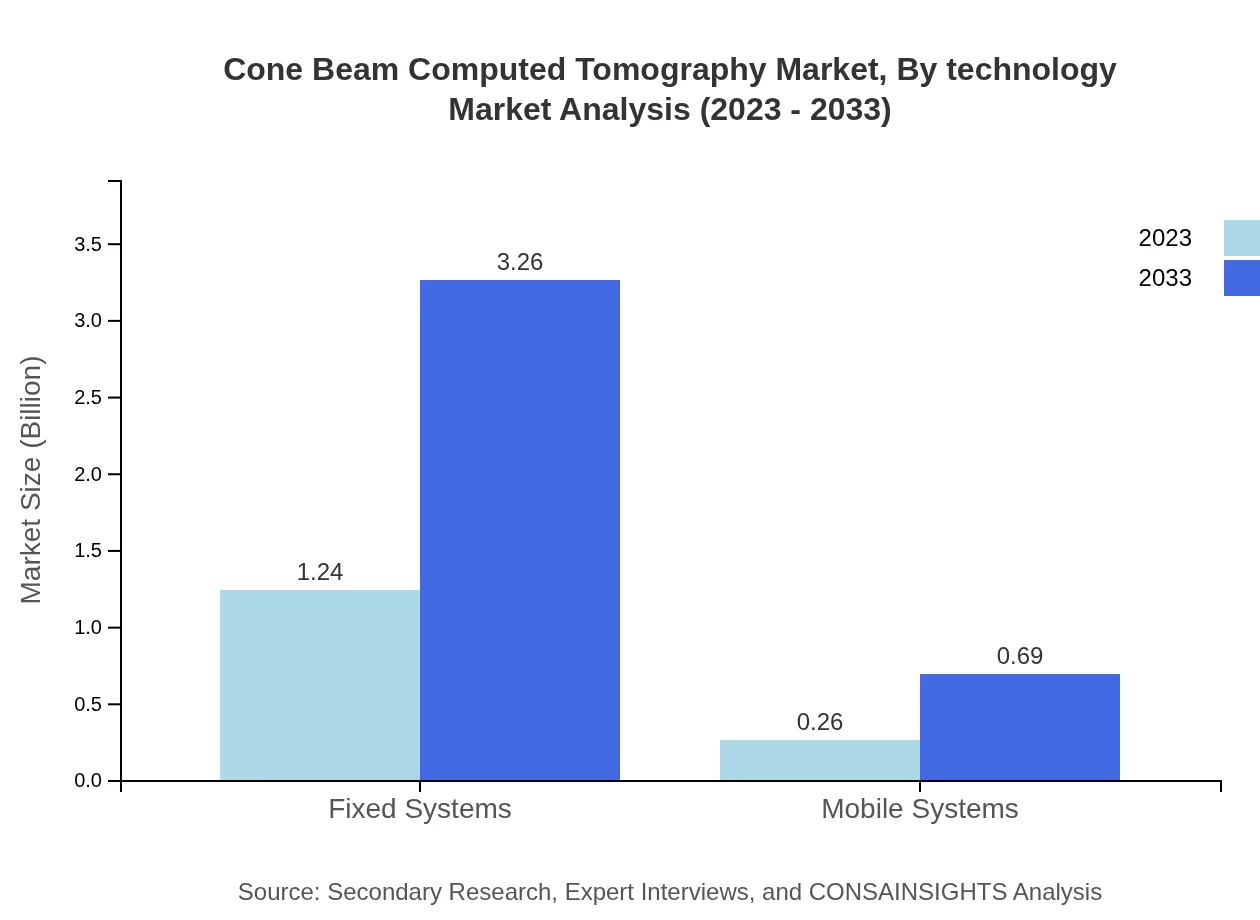

Cone Beam Computed Tomography Market Analysis By Technology

The technology segment is divided into Fixed Systems and Mobile Systems. Fixed Systems dominate the market, with a size of $1.24 billion in 2023, expected to grow to $3.26 billion by 2033 due to their accuracy and reliability in imaging. Mobile Systems, while smaller at $0.26 billion in 2023, are gaining traction due to their versatility and convenience.

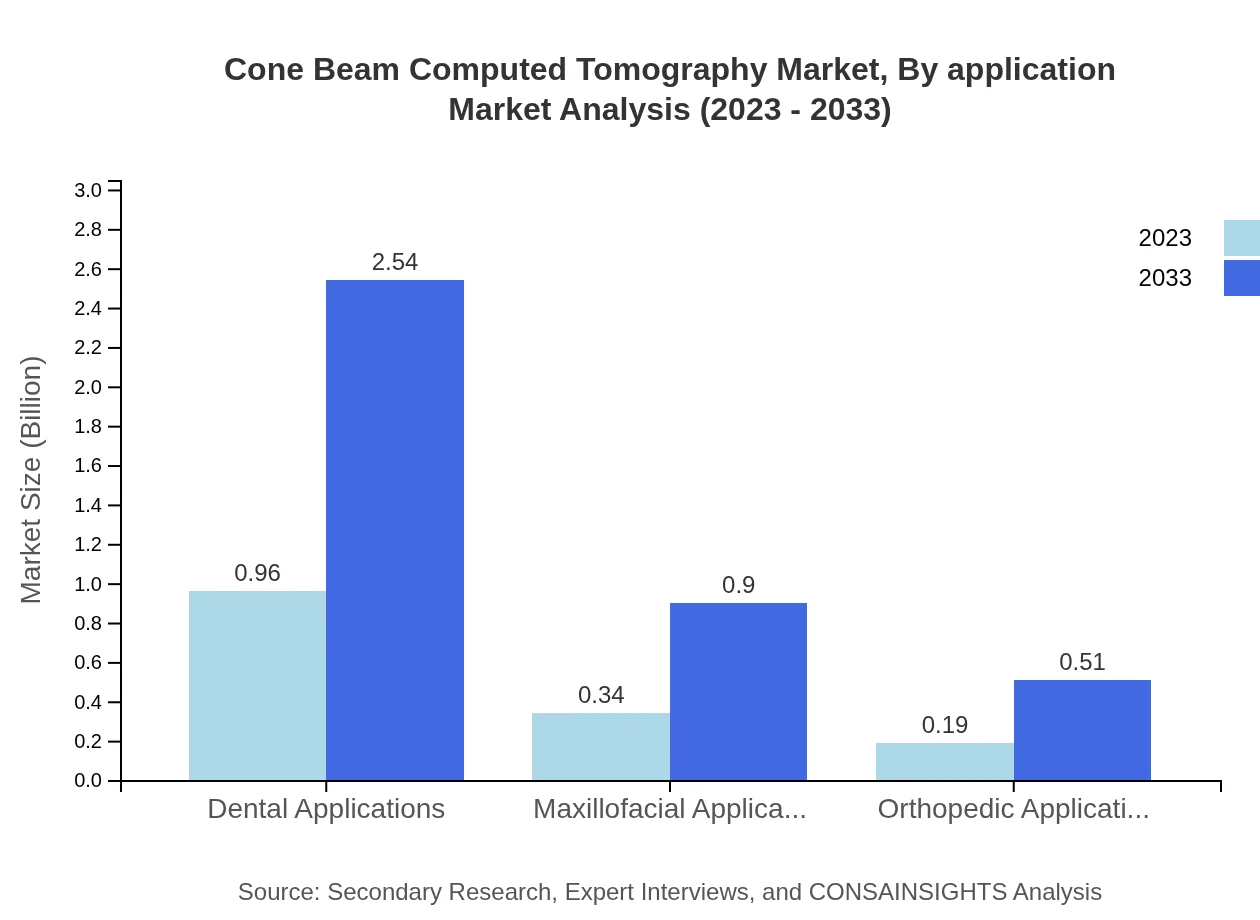

Cone Beam Computed Tomography Market Analysis By Application

Applications of CBCT include Dental Applications, Maxillofacial Applications, Orthopedic Applications. Dental Applications dominate the market with a size of $0.96 billion in 2023, projected to reach $2.54 billion by 2033. Maxillofacial Applications and Orthopedic Applications follow, with respective sizes of $0.34 billion and $0.19 billion in 2023, focusing on anatomical imaging and surgical planning.

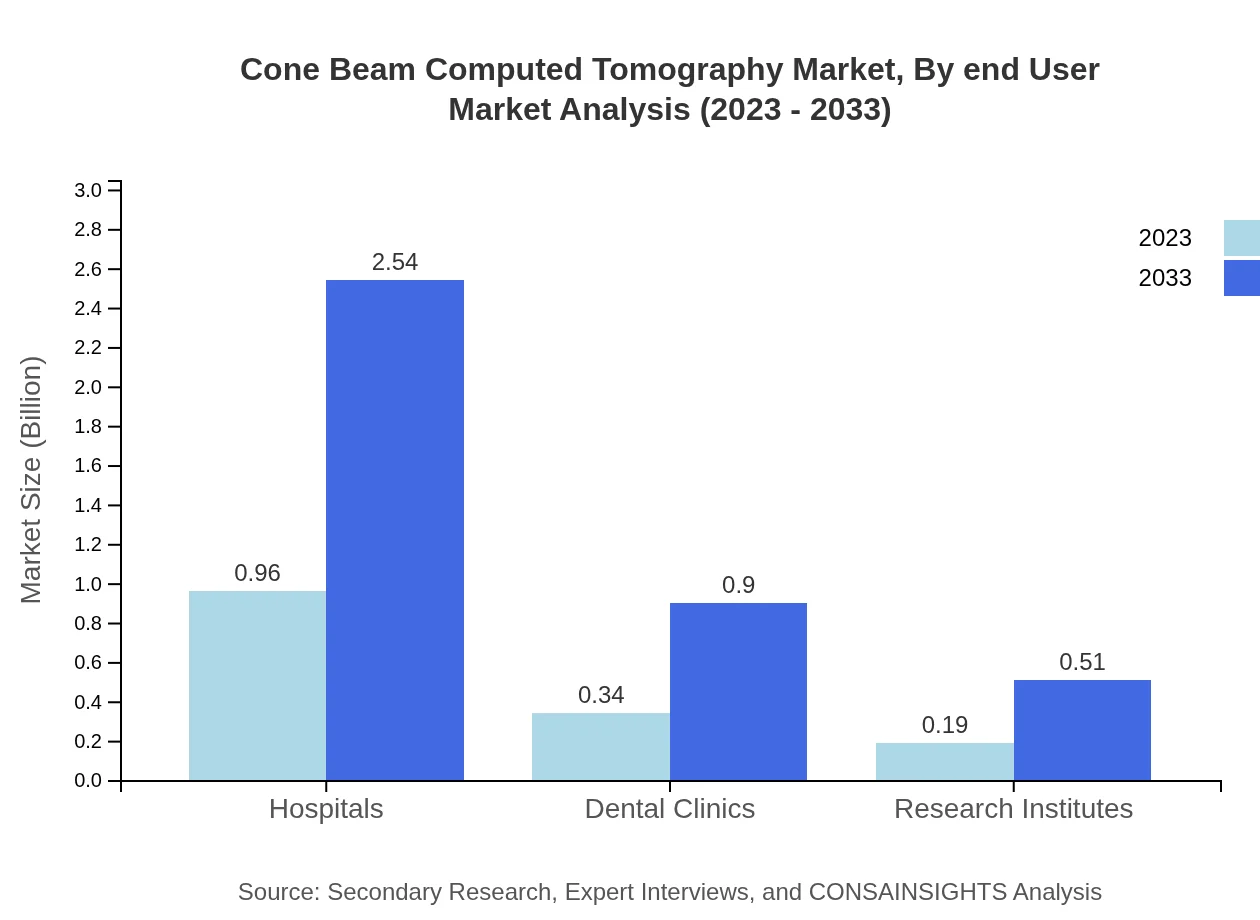

Cone Beam Computed Tomography Market Analysis By End User

Key end-users in the CBCT market are Hospitals and Dental Clinics. Hospitals lead with a market size of $0.96 billion in 2023, anticipated to grow to $2.54 billion by 2033, while Dental Clinics hold a significant share, valued at $0.34 billion in 2023 with a forecasted growth to $0.90 billion by 2033.

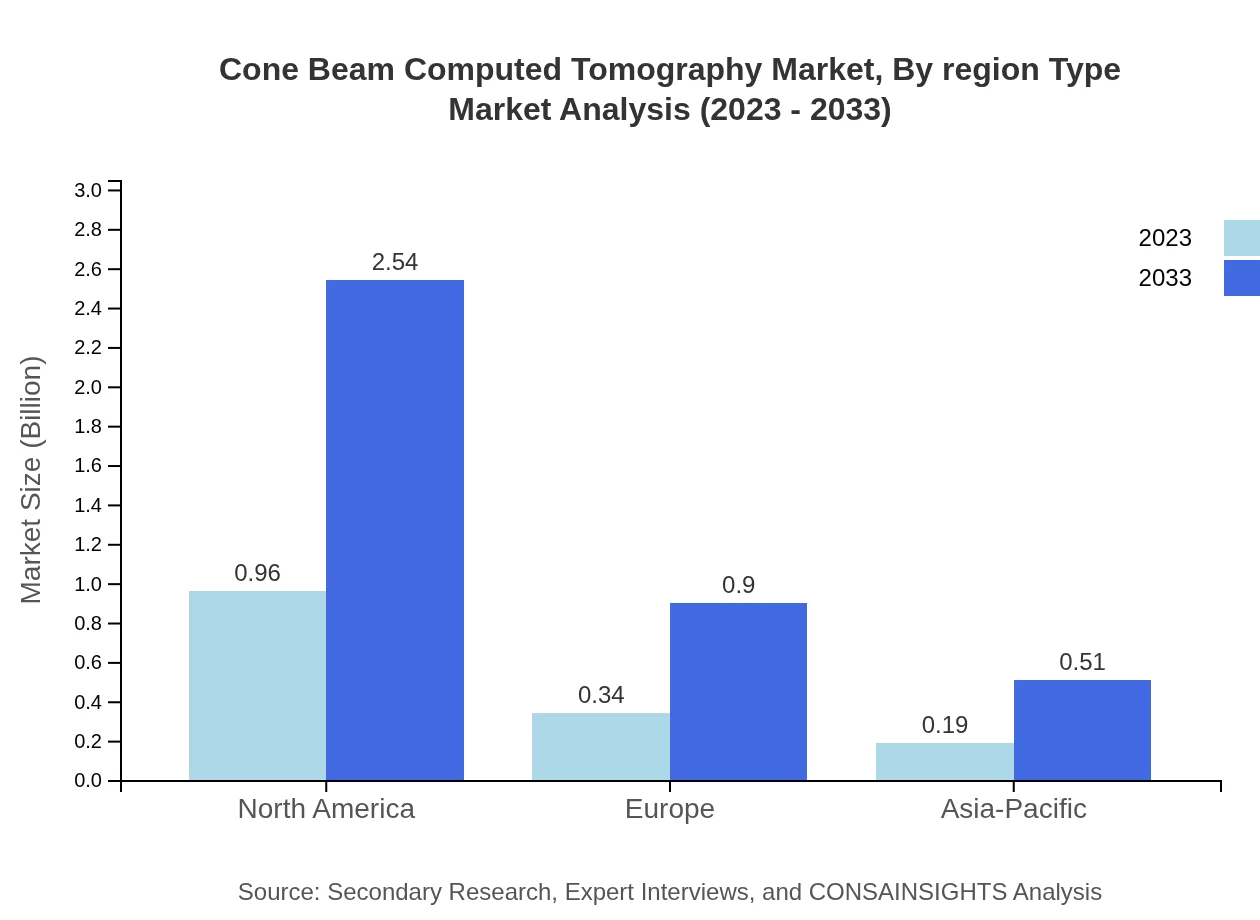

Cone Beam Computed Tomography Market Analysis By Region Type

Regional markets contribute diversely to the overall CBCT market, with North America leading, followed by Europe and the Asia Pacific. The regional analysis highlights different growth drivers and challenges each area faces, with significant emphasis on technological integration within healthcare systems for enhancing diagnostic outcomes.

Cone Beam Computed Tomography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cone Beam Computed Tomography Industry

Carestream Health:

Carestream is recognized for its innovative imaging technologies, offering advanced CBCT systems designed for dental, maxillofacial, and orthopedics applications, reinforcing its position as a market leader.Sirona Dental Systems:

Sirona specializes in digital dentistry solutions, with its CBCT offerings providing high-resolution imaging to enhance clinical outcomes in dental practices globally.Planmeca Oy:

Planmeca is a prominent player in the CBCT market, known for its cutting-edge imaging solutions and user-friendly design, catering to varied imaging needs across dental and healthcare settings.Asahi Roentgen:

Asahi Roentgen is a leading manufacturer focusing on high-performance imaging technology, specifically in the field of dental radiology, bolstering advancements in 3D imaging solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of cone Beam Computed Tomography?

The global cone-beam computed tomography market is projected to grow from $1.5 billion in 2023 to approximately $4 billion by 2033, with a compound annual growth rate (CAGR) of 9.8% during this period.

What are the key market players or companies in this cone Beam Computed Tomography industry?

Key players in the cone-beam computed tomography market include major medical imaging companies, manufacturers of specialized imaging devices, and emerging technologies firms focused on dental and orthopedic applications.

What are the primary factors driving the growth in the cone Beam Computed Tomography industry?

The growth in the cone-beam computed tomography market is driven by rising demand for accurate diagnostics, technological advancements in imaging systems, and an increasing number of healthcare facilities adopting these systems for dental and orthopedic applications.

Which region is the fastest Growing in the cone Beam Computed Tomography market?

North America is the fastest-growing region, expanding from a market size of $0.96 billion in 2023 to $2.54 billion by 2033, showcasing a strong demand for advanced imaging solutions in medical and dental practices.

Does ConsaInsights provide customized market report data for the cone Beam Computed Tomography industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the cone-beam computed tomography sector to ensure comprehensive insights into market dynamics.

What deliverables can I expect from this cone Beam Computed Tomography market research project?

From this market research project, you can expect detailed market analysis, segment-wise breakdown, competitive landscape assessments, and market forecasts alongside customized insights relevant to your specific business needs.

What are the market trends of cone Beam Computed Tomography?

Key market trends include increasing adoption of dental applications, emergence of mobile systems for flexibility, and advancements in fixed systems, all contributing to a rapid growth trajectory in the cone-beam computed tomography sector.