Confectionery Ingredients Market Report

Published Date: 31 January 2026 | Report Code: confectionery-ingredients

Confectionery Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Confectionery Ingredients market, detailing current trends, market size, and forecasts from 2023 to 2033. It aims to deliver insights on segmentation, technology impacts, regional analysis, and key players shaping the market landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

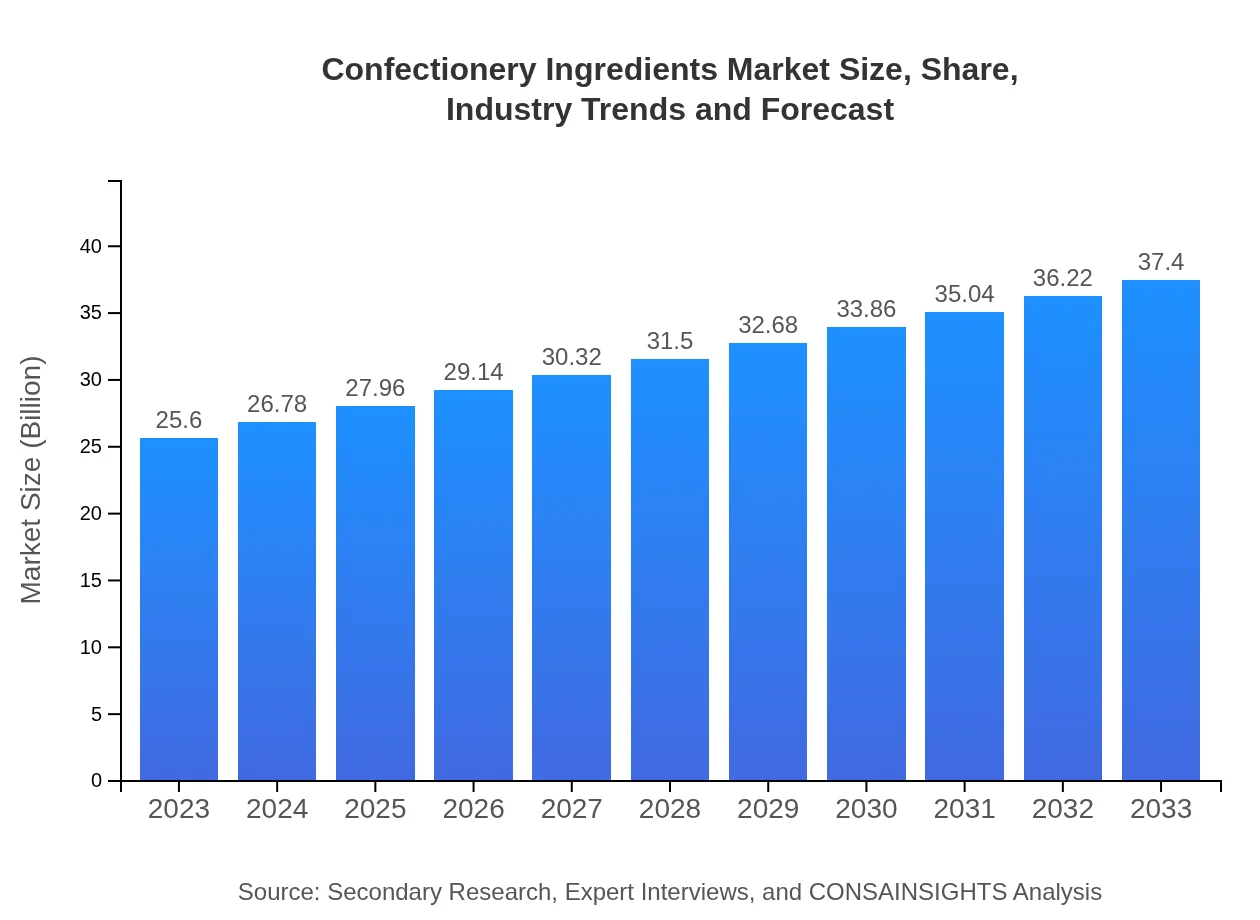

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 3.8% |

| 2033 Market Size | $37.40 Billion |

| Top Companies | Barry Callebaut, Cargill Inc., Ingredion Incorporated, Archer Daniels Midland Company (ADM), Tate & Lyle |

| Last Modified Date | 31 January 2026 |

Confectionery Ingredients Market Overview

Customize Confectionery Ingredients Market Report market research report

- ✔ Get in-depth analysis of Confectionery Ingredients market size, growth, and forecasts.

- ✔ Understand Confectionery Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Confectionery Ingredients

What is the Market Size & CAGR of Confectionery Ingredients market in 2023?

Confectionery Ingredients Industry Analysis

Confectionery Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Confectionery Ingredients Market Analysis Report by Region

Europe Confectionery Ingredients Market Report:

Europe’s market is projected to increase from $7.30 billion in 2023 to $10.67 billion in 2033. The region is recognized for its sophisticated taste profiles and strong demand for organic and health-focused ingredients, influencing market dynamics.Asia Pacific Confectionery Ingredients Market Report:

The Asia Pacific region is witnessing dynamic growth, with market size expected to rise from $4.73 billion in 2023 to $6.91 billion in 2033. Factors such as increased demand for sweets and a growing middle class are propelling market expansion, particularly in countries like China and India.North America Confectionery Ingredients Market Report:

North America remains a leading market with expected growth from $9.79 billion in 2023 to $14.30 billion in 2033. The U.S. and Canada are key contributors, driven by high per capita confectionery consumption, a trend towards premium products, and significant investments in product development.South America Confectionery Ingredients Market Report:

In South America, the market is projected to grow from $0.20 billion in 2023 to $0.30 billion in 2033. This growth is driven by a rising consumer base that increasingly favors confectionery products, indicating potential for expanding market share and product offerings.Middle East & Africa Confectionery Ingredients Market Report:

The Middle East and Africa market is poised for growth, reaching from $3.57 billion in 2023 to $5.22 billion in 2033, as changing lifestyles and evolving food norms contribute to increasing confectionery product consumption.Tell us your focus area and get a customized research report.

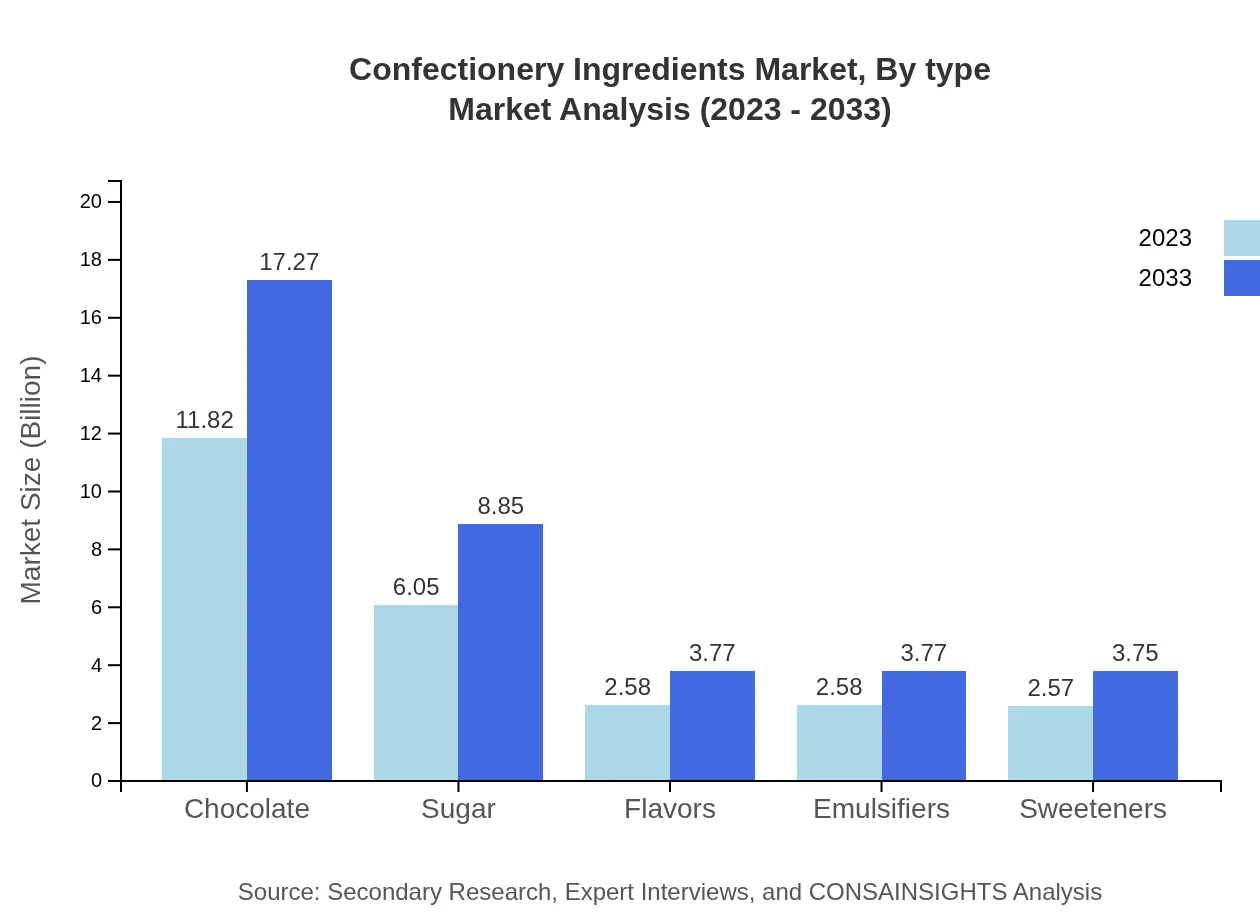

Confectionery Ingredients Market Analysis By Type

The market is highly fragmented by type, with Chocolate leading the segment with a market size of $11.82 billion in 2023, projected to reach $17.27 billion in 2033, maintaining a significant market share of 46.17%. Sugar is another major segment valued at $6.05 billion in 2023, with a projected growth to $8.85 billion by 2033. Flavors, emulsifiers, and sweeteners also contribute significantly to the market, with steady increases anticipated in the coming decade.

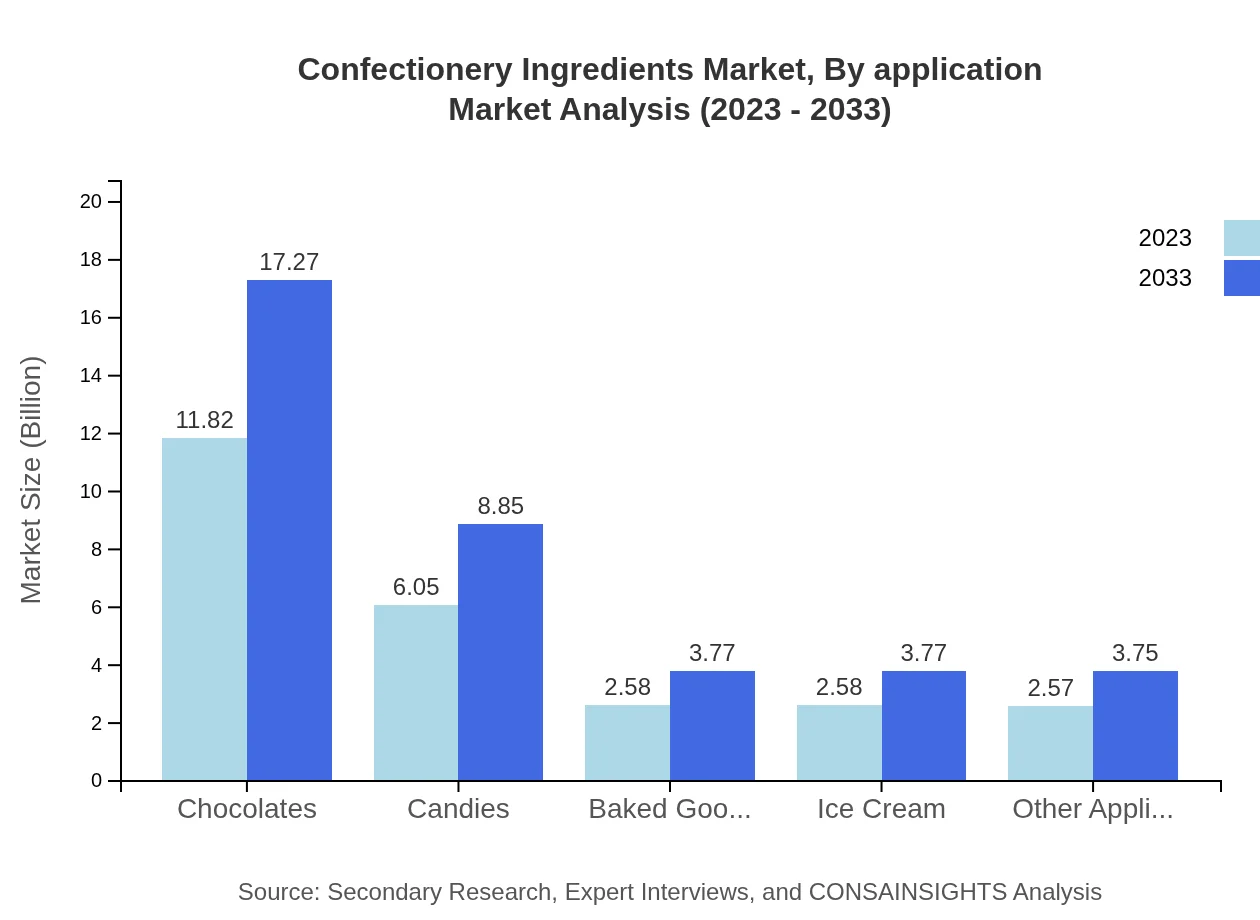

Confectionery Ingredients Market Analysis By Application

The applications cover a wide range of products, including candies, baked goods, ice cream, and other confectionery applications. Candies alone account for a sizable market segment valued at $6.05 billion in 2023, increasing to $8.85 billion by 2033, reflecting strong consumer demand. Baked goods and ice creams are also critical in the sector, driven by evolving consumer tastes for indulgence and convenience.

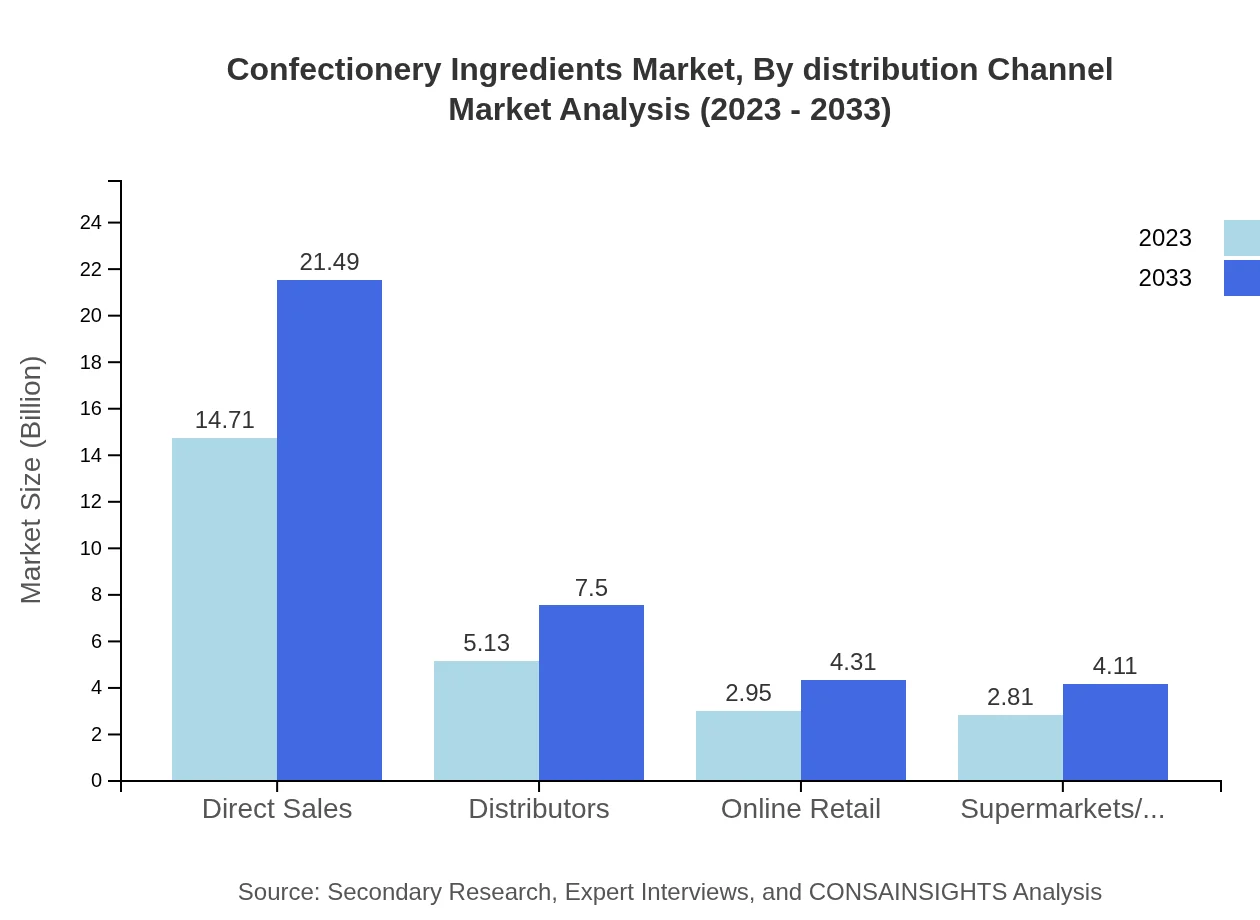

Confectionery Ingredients Market Analysis By Distribution Channel

Distribution channels play a crucial role in market dynamics, with direct sales holding the largest market share at $14.71 billion in 2023, forecasted to reach $21.49 billion by 2033. Distributors account for $5.13 billion, and online retail is gaining traction with a market size of $2.95 billion, highlighting the significance of e-commerce in reaching consumers more efficiently.

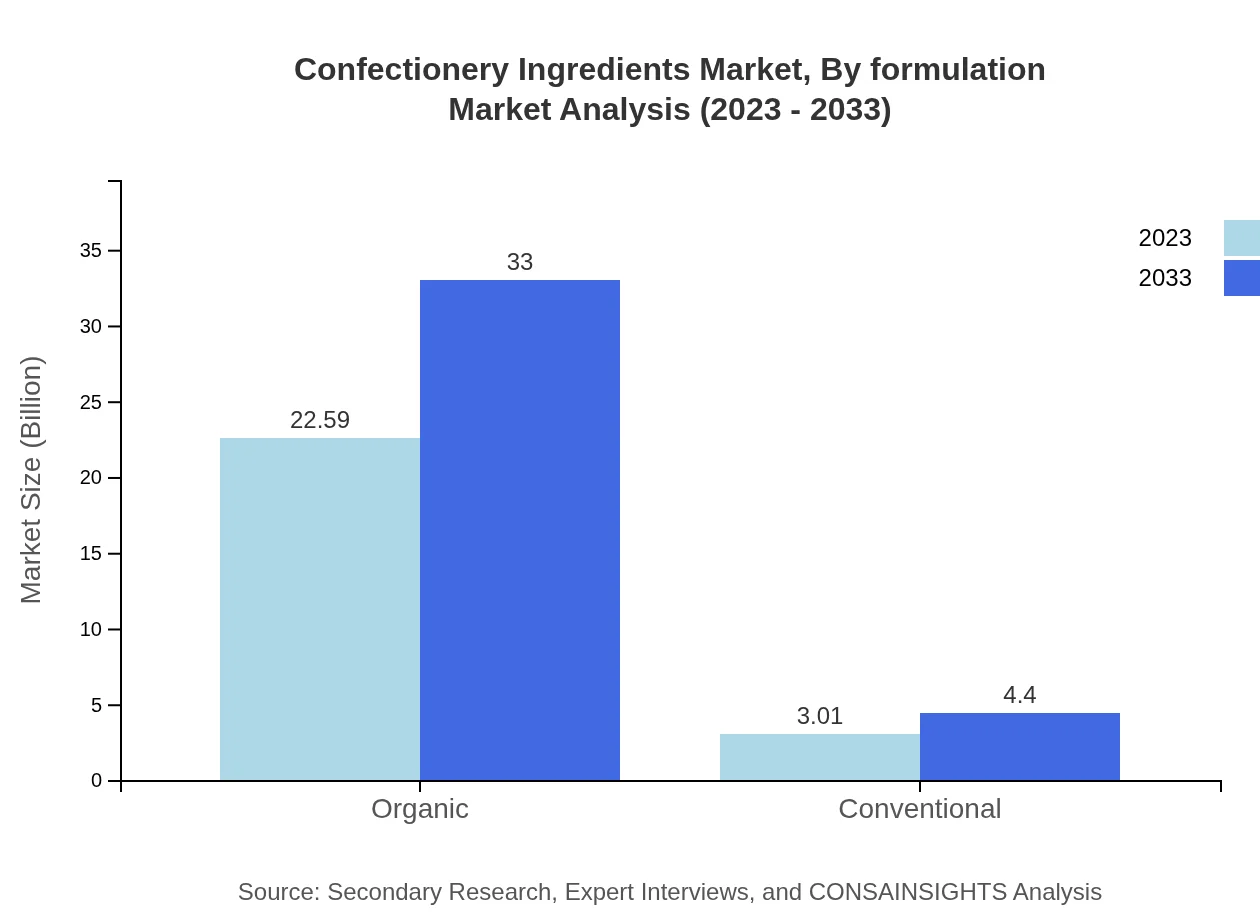

Confectionery Ingredients Market Analysis By Formulation

The formulation segment is segmented into organic and conventional products, where organic ingredients are increasingly favored, valued at $22.59 billion in 2023 and projected to grow to $33.00 billion by 2033. Conversely, conventional products are gaining steady demand but at a slower rate, indicating a shift towards health-oriented consumer choices.

Confectionery Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Confectionery Ingredients Industry

Barry Callebaut:

A global leader in chocolate and cocoa products, Barry Callebaut specializes in innovative solutions for the confectionery industry, providing high-quality ingredients to manufacturers worldwide.Cargill Inc.:

Cargill is a major player offering a variety of food ingredients, including sweeteners. Their focus on sustainable sourcing and product innovation helps shape the market.Ingredion Incorporated:

Ingredion provides a wide range of specialty ingredients for the confectionery sector, emphasizing natural and health-oriented solutions that respond to consumer trends.Archer Daniels Midland Company (ADM):

ADM is a key supplier of food ingredients, including sweeteners and flavorings, playing a crucial role in meeting the evolving demands of the confectionery market.Tate & Lyle:

This company specializes in sweeteners and texture solutions for confectionery and bakery industries, focusing on product development and customer collaboration.We're grateful to work with incredible clients.

FAQs

What is the market size of confectionery Ingredients?

The confectionery ingredients market is valued at approximately $25.6 billion in 2023, with a projected CAGR of 3.8% from 2023 to 2033. This growing market reflects increasing consumer demand for diverse confectionery products.

What are the key market players or companies in this confectionery Ingredients industry?

The key players in the confectionery ingredients industry include multinational companies such as Barry Callebaut, Cargill, Mondelez, and Olam. These companies lead with innovative product offerings and significant market share, contributing to overall sector growth.

What are the primary factors driving the growth in the confectionery ingredients industry?

Key drivers for growth in the confectionery ingredients market include rising disposable incomes, increasing demand for premium and specialty confectioneries, and a growing trend toward customization in flavors and ingredients appealing to diverse consumer preferences.

Which region is the fastest Growing in the confectionery ingredients?

The Asia Pacific region is the fastest-growing market for confectionery ingredients, expected to grow from $4.73 billion in 2023 to $6.91 billion by 2033. This growth is fueled by rising urbanization and changing consumer lifestyles.

Does ConsaInsights provide customized market report data for the confectionery Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the confectionery ingredients industry. This includes insights on market trends, competitive analysis, and in-depth regional studies to support strategic decision-making.

What deliverables can I expect from this confectionery Ingredients market research project?

Deliverables from the confectionery-ingredients market research project typically include comprehensive market reports, data on market size, growth forecasts, competitive landscapes, and insights into consumer trends and preferences across various regions.

What are the market trends of confectionery ingredients?

Current market trends in confectionery ingredients reveal a shift towards organic and healthier options, innovation in flavors and textures, and a rise in demand for sustainable sourcing practices among manufacturers and consumers alike.