Confectionery Market Report

Published Date: 31 January 2026 | Report Code: confectionery

Confectionery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Confectionery market from 2023 to 2033, encompassing insights on market size, growth trends, industry analysis, segmentation, regional performance, and key players in the market.

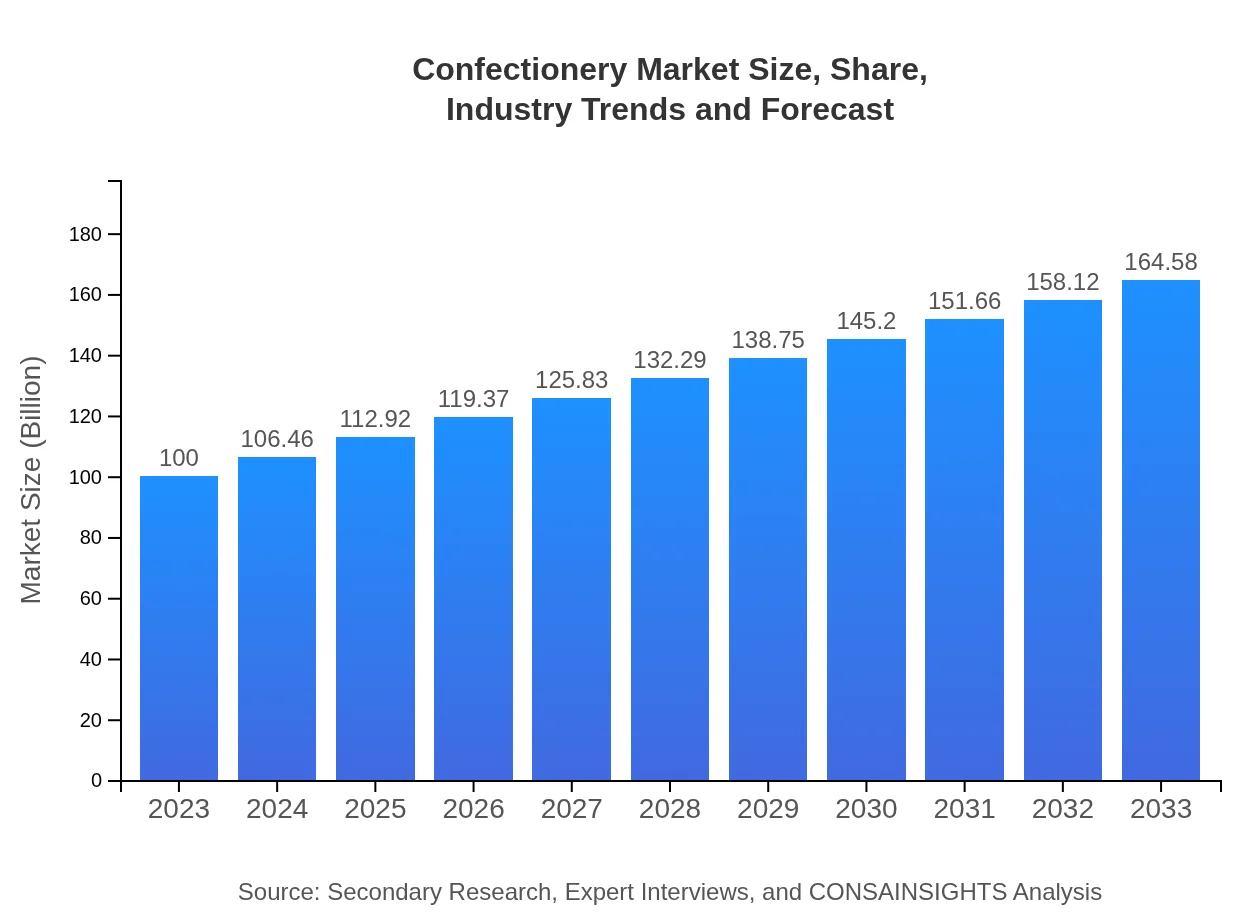

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Mars, Incorporated, Mondelez International, Nestlé S.A., Ferrero Group, Hershey's |

| Last Modified Date | 31 January 2026 |

Confectionery Market Overview

Customize Confectionery Market Report market research report

- ✔ Get in-depth analysis of Confectionery market size, growth, and forecasts.

- ✔ Understand Confectionery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Confectionery

What is the Market Size & CAGR of Confectionery market in 2023?

Confectionery Industry Analysis

Confectionery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Confectionery Market Analysis Report by Region

Europe Confectionery Market Report:

The European market, valued at 25.12 billion USD in 2023, is expected to reach 41.34 billion USD by 2033. The market is characterized by high demand for artisanal products and wellness-oriented confectionery items driven by stringent regulations on sugar content.Asia Pacific Confectionery Market Report:

The Asia Pacific region, with a market share of 20.47 billion USD in 2023, is projected to grow to 33.69 billion USD by 2033. The growth in this region is influenced by a young population, increasing urbanization, and a growing middle class, leading to higher discretionary spending on confectionery.North America Confectionery Market Report:

North America maps a significant market landscape, anticipated to grow from 34.40 billion USD in 2023 to 56.61 billion USD by 2033. The trend toward indulgent snacks and increased health awareness is leading to the introduction of innovative and premium confectionery products.South America Confectionery Market Report:

In South America, the confectionery market revenue is expected to rise from 9.14 billion USD in 2023 to 15.04 billion USD in 2033. The expanding e-commerce sector and a rising standard of living among consumers are key growth drivers in this region.Middle East & Africa Confectionery Market Report:

The Middle East and Africa region is estimated to grow from 10.87 billion USD in 2023 to 17.89 billion USD by 2033, influenced by increasing urbanization and a growing youth demographic that values convenience and indulgent consumption.Tell us your focus area and get a customized research report.

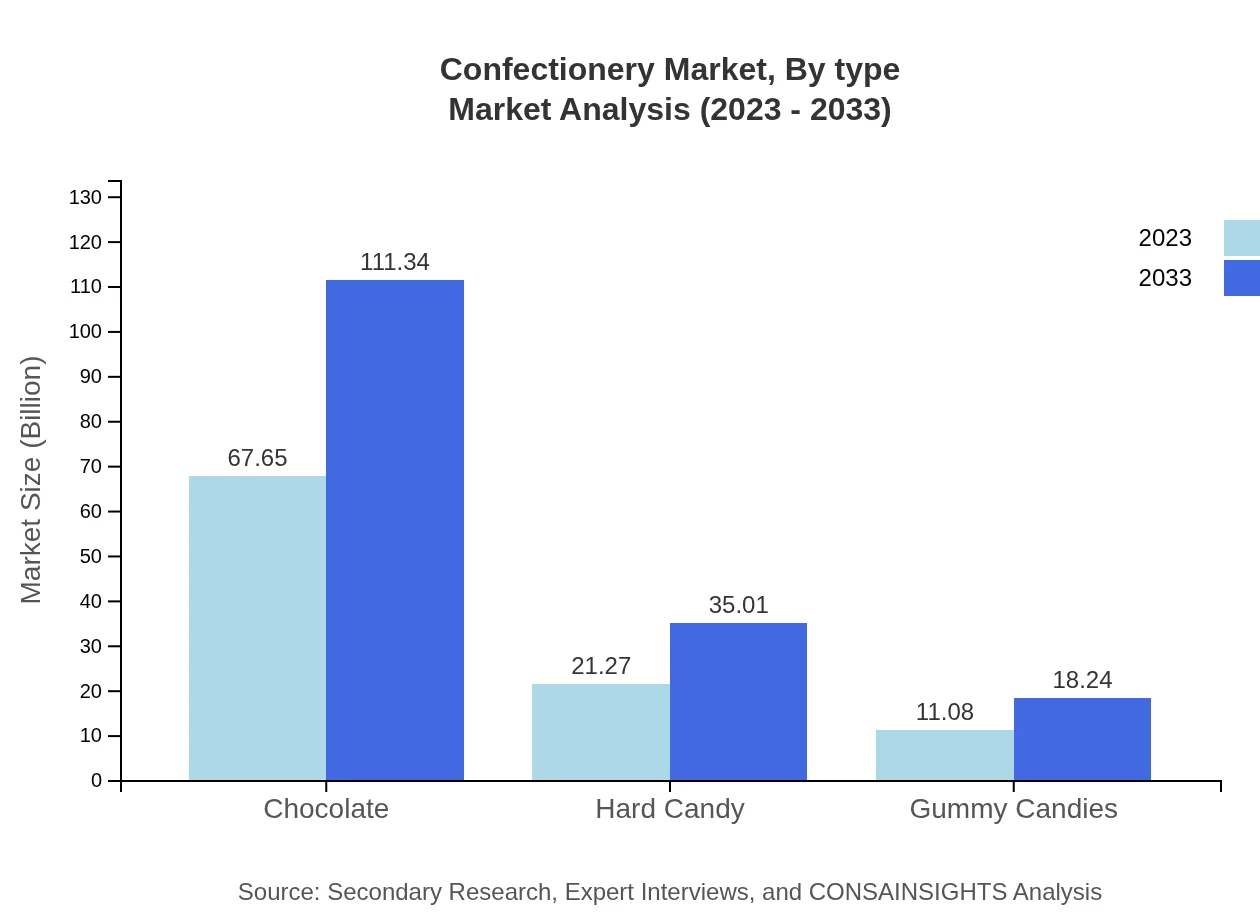

Confectionery Market Analysis By Type

The Confectionery market by type is dominated by chocolate, which accounts for a substantial share due to its universal appeal. In 2023, the chocolate segment is valued at approximately 67.65 billion USD, expected to grow to 111.34 billion USD by 2033. Other segments such as hard candy, gummy candies, and health-oriented products also show promising growth, with demographic shifts catering to varying tastes and preferences.

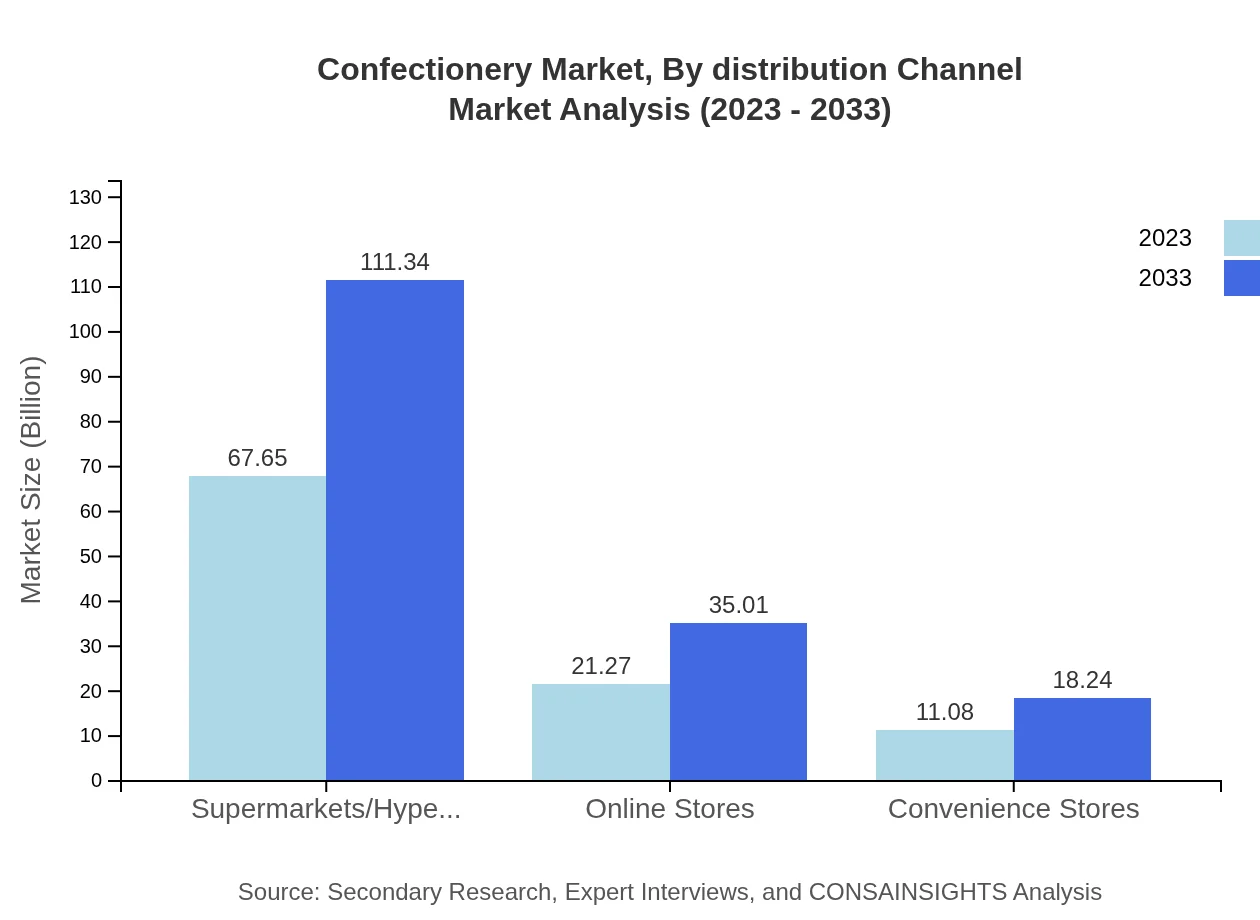

Confectionery Market Analysis By Distribution Channel

Distribution channels play a vital role in the Confectionery market. The majority of sales occur through supermarkets and hypermarkets, with a projected size of 67.65 billion USD in 2023. Online sales are also gaining traction, expected to grow from 21.27 billion USD to 35.01 billion USD by 2033, reflecting changing consumer shopping behaviors toward convenience.

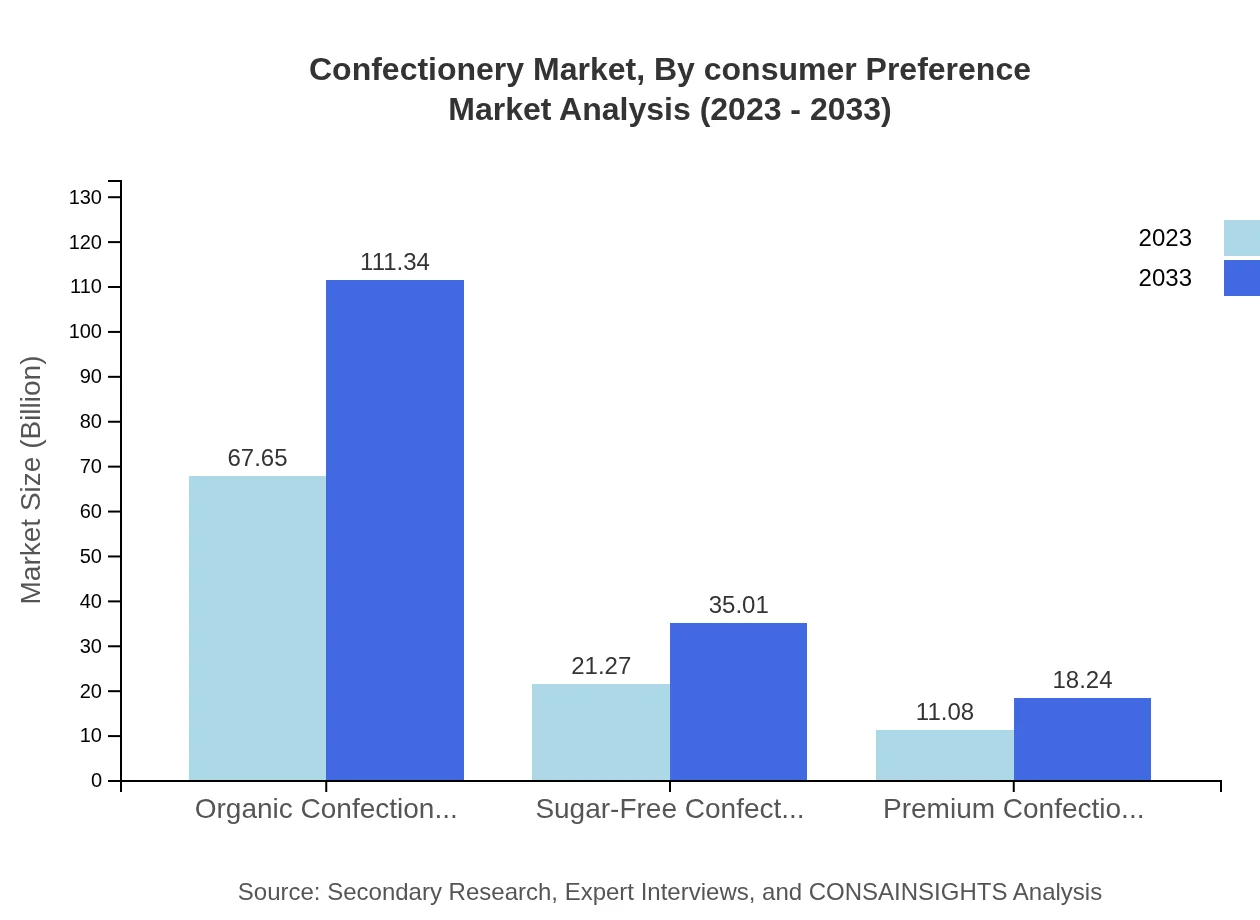

Confectionery Market Analysis By Consumer Preference

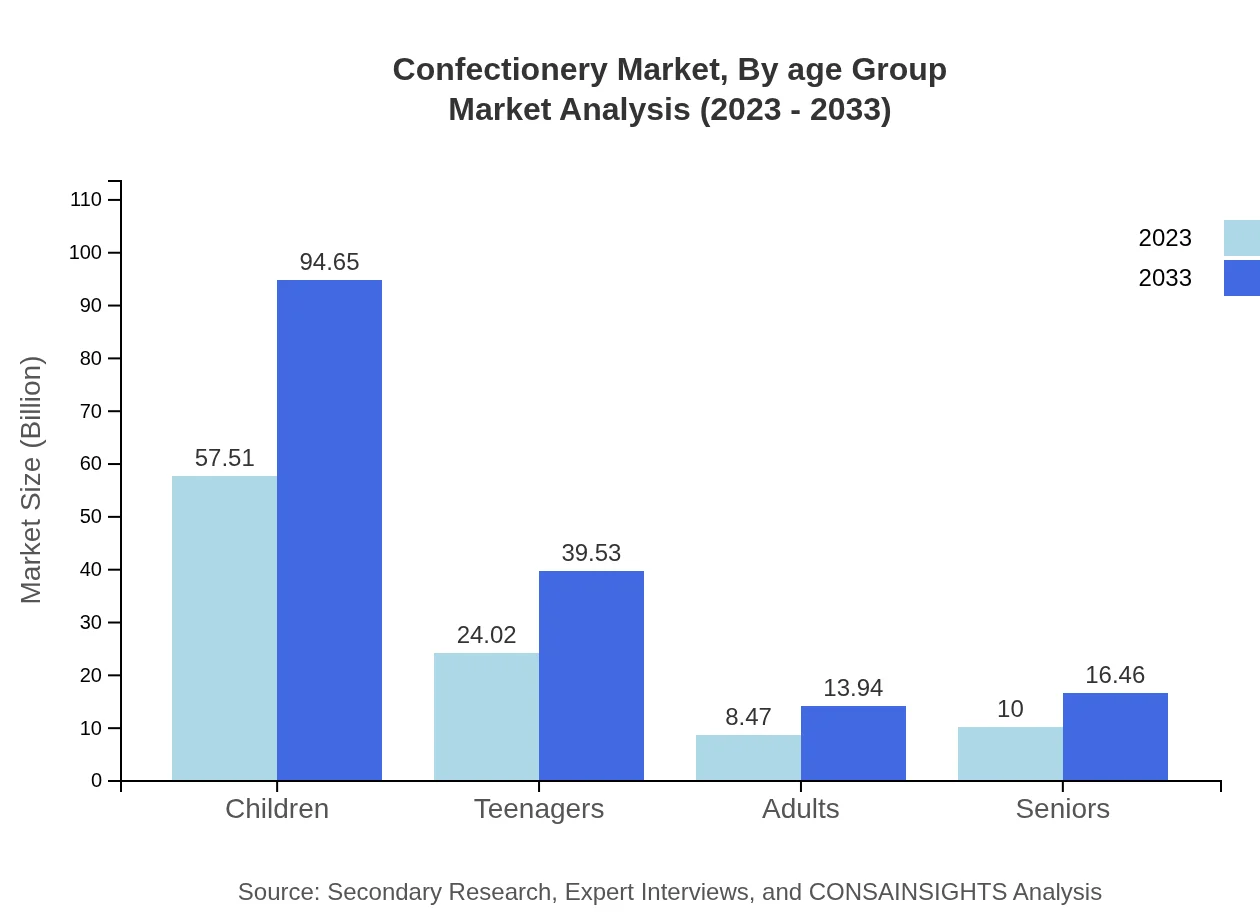

Consumer preferences in the confectionery market vary significantly by age and lifestyle. The largest segment by preference is children, generating significant revenue due to the availability of colorful and innovative product offerings. This segment will increase from 57.51 billion USD in 2023 to 94.65 billion USD by 2033, indicating a strong demand for confectionery targeted toward young consumers.

Confectionery Market Analysis By Age Group

The Confectionery market experiences varied consumption patterns across different age groups. Children and teenagers dominate the market share, while segments dedicated to adults and seniors are seeing considerable growth, especially in health-oriented products. Market performance for adults is expected to rise from 8.47 billion USD to 13.94 billion USD from 2023 to 2033.

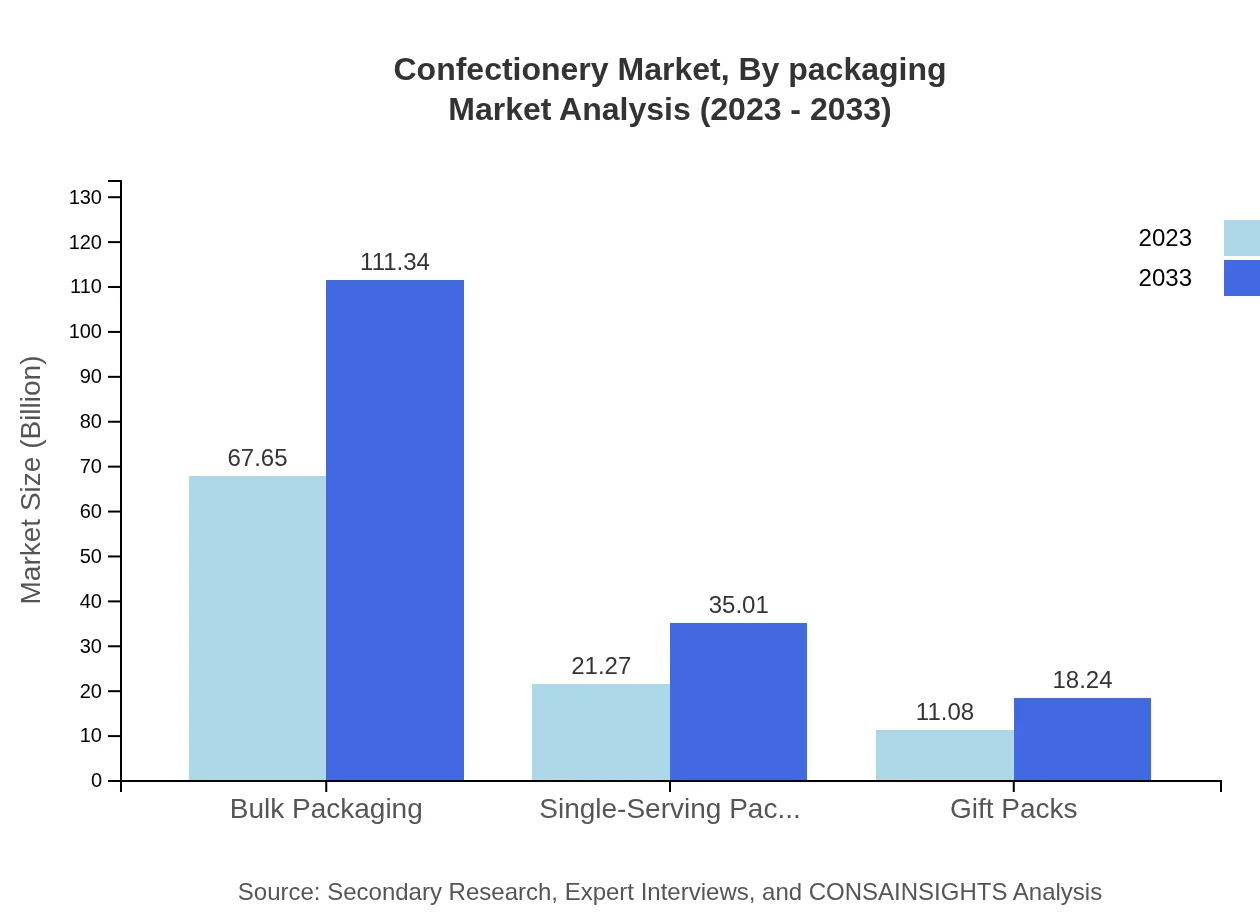

Confectionery Market Analysis By Packaging

Packaging innovations play a crucial role in appealing to consumers in the Confectionery market. Bulk packaging remains popular, accounting for 67.65 billion USD in 2023, while single-serving packages are gaining traction due to convenience, with anticipated growth from 21.27 billion USD in 2023 to 35.01 billion USD by 2033.

Confectionery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Confectionery Industry

Mars, Incorporated:

One of the largest confectionery manufacturers globally, known for popular brands such as M&M's, Snickers, and Twix.Mondelez International:

A leading global snacks company recognized for its iconic brands including Cadbury, Oreo, and Toblerone.Nestlé S.A.:

A multinational food and beverage company involved in the production of confectionery products including Kit Kat and Milky Bar.Ferrero Group:

Famous for its premium products such as Ferrero Rocher and Kinder chocolates, Ferrero focuses on quality and indulgence.Hershey's:

An iconic American confectionery company known for chocolate bars and products primarily sold in North America.We're grateful to work with incredible clients.

FAQs

What is the market size of confectionery?

The confectionery market is currently valued at approximately $100 million in 2023 and is projected to grow at a CAGR of 5% until 2033. This growth indicates a strong demand in the sector, making it a lucrative market for investors.

Who are the key market players in the confectionery industry?

The confectionery industry features major players such as Mars, Mondelēz International, Nestlé, Ferrero Group, and Haribo. These companies dominate the market, leveraging their extensive distribution networks and brand recognition to maintain a competitive edge.

What are the primary factors driving the growth in the confectionery industry?

Key factors driving growth include rising disposable incomes, evolving consumer preferences towards innovative and premium products, and increasing consumption, particularly among younger demographics who favor indulgent treats and convenience options.

Which region is the fastest Growing in the confectionery market?

The North American region is the fastest-growing for confectionery, projected to increase from $34.40 million in 2023 to $56.61 million by 2033. Europe and Asia Pacific also show significant growth, driven by various trends in taste and health.

Does ConsaInsights provide customized market report data for the confectionery industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements. Clients can request specific segments, geographical insights, and trend analyses that cater to their unique business needs and strategic goals.

What deliverables can I expect from this confectionery market research project?

Deliverables from the confectionery market research project include comprehensive reports featuring market size analysis, growth forecasts, competitive landscape assessments, consumer trend insights, and regional market performance.

What are the market trends of confectionery?

Current market trends in confectionery include the rise of health-conscious products like sugar-free options and organic lines, premiumization focus on high-quality ingredients, and the shift towards online sales channels that cater to convenience-seeking consumers.