Confectionery Processing Equipment Market Report

Published Date: 31 January 2026 | Report Code: confectionery-processing-equipment

Confectionery Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Confectionery Processing Equipment market from 2023 to 2033, highlighting market size, trends, segmentation, technological advancements, key players, and regional dynamics to present crucial insights for stakeholders.

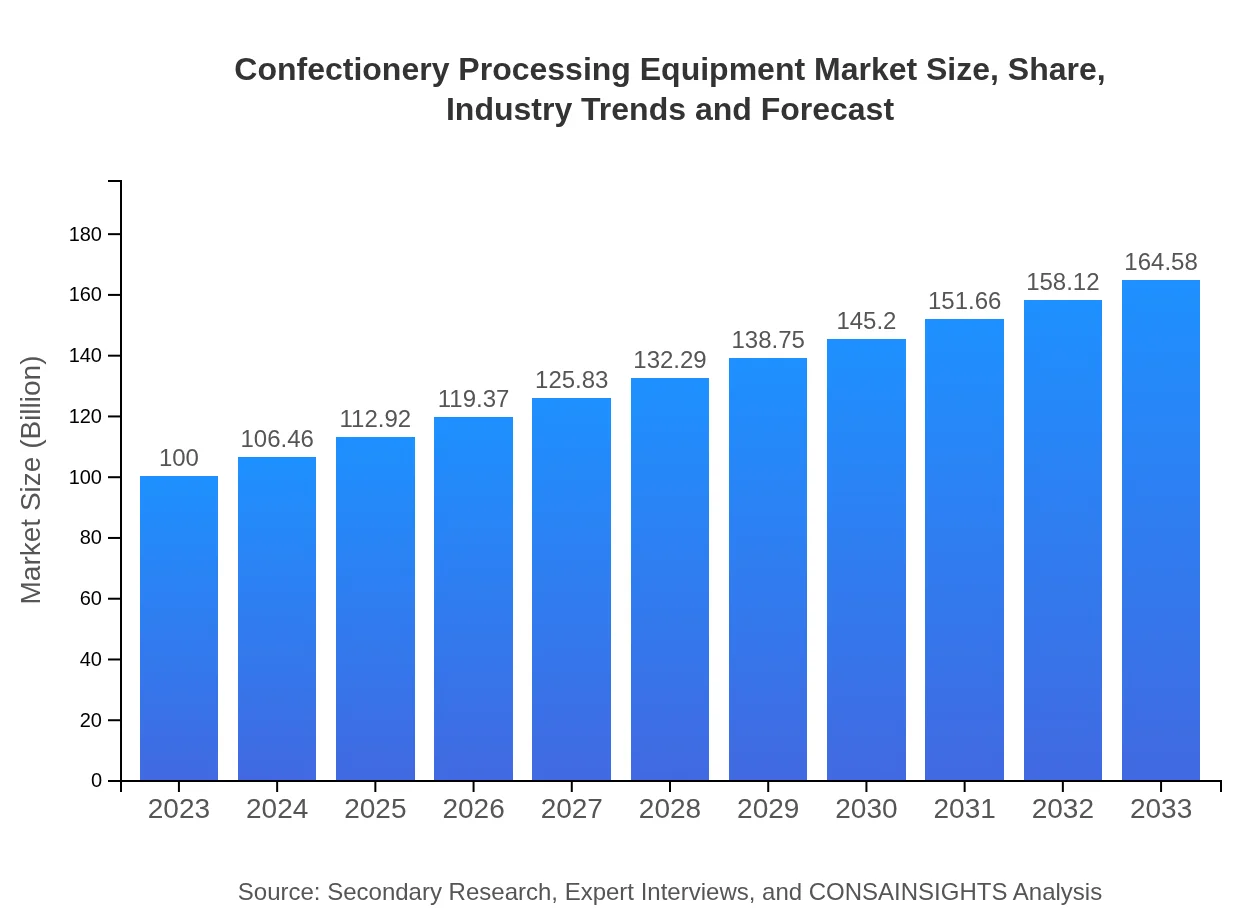

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Bühler Group, Baker Perkins Ltd, Clextral |

| Last Modified Date | 31 January 2026 |

Confectionery Processing Equipment Market Overview

Customize Confectionery Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Confectionery Processing Equipment market size, growth, and forecasts.

- ✔ Understand Confectionery Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Confectionery Processing Equipment

What is the Market Size & CAGR of Confectionery Processing Equipment market in 2023 and 2033?

Confectionery Processing Equipment Industry Analysis

Confectionery Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Confectionery Processing Equipment Market Analysis Report by Region

Europe Confectionery Processing Equipment Market Report:

Europe's market for confectionery processing equipment is expected to expand from $29.40 million in 2023 to $48.39 million by 2033. The region is known for its strong tradition in confectionery manufacturing, and increasing investments in automation and innovative technologies are further spurring market growth.Asia Pacific Confectionery Processing Equipment Market Report:

The Asia Pacific region is experiencing rapid growth in the confectionery processing equipment market, with a projected market size of $19.14 million in 2023 and expected to rise to $31.50 million by 2033. Factors driving this growth include increasing urbanization, rising disposable incomes, and the growing popularity of confectionery products among consumers in countries like China and India.North America Confectionery Processing Equipment Market Report:

North America is projected to have the largest share of the confectionery processing equipment market, with a size of $32.95 million in 2023, reaching $54.23 million by 2033. The growth in this region is primarily driven by high demand for chocolate and the presence of well-established manufacturers in the US.South America Confectionery Processing Equipment Market Report:

In South America, the market is anticipated to grow from $8.01 million in 2023 to approximately $13.18 million by 2033. The growth is attributed to rising production and consumption of sweets and snacks, along with the expansion of the food and beverage sector in countries like Brazil and Argentina.Middle East & Africa Confectionery Processing Equipment Market Report:

The market in the Middle East and Africa is forecasted to grow from $10.50 million in 2023 to $17.28 million by 2033. The rise in tourism, coupled with an evolving taste for diverse confectionery products, is driving growth in this region.Tell us your focus area and get a customized research report.

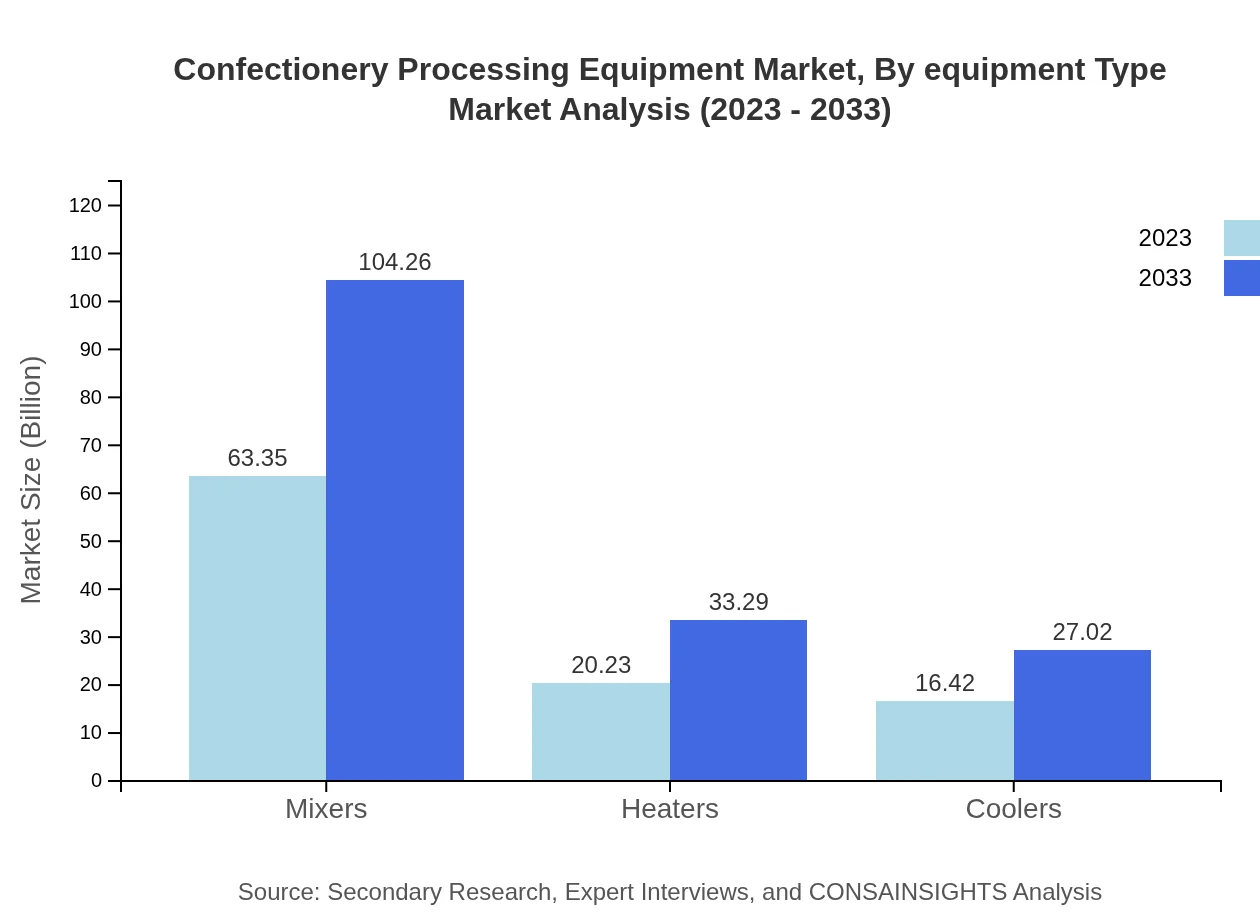

Confectionery Processing Equipment Market Analysis By Equipment Type

The segment for mixers, valued at $63.35 million in 2023, is expected to reach $104.26 million by 2033, highlighting its dominance in the market. Heaters and coolers are also significant, growing from $20.23 million and $16.42 million in 2023 to $33.29 million and $27.02 million by 2033, respectively.

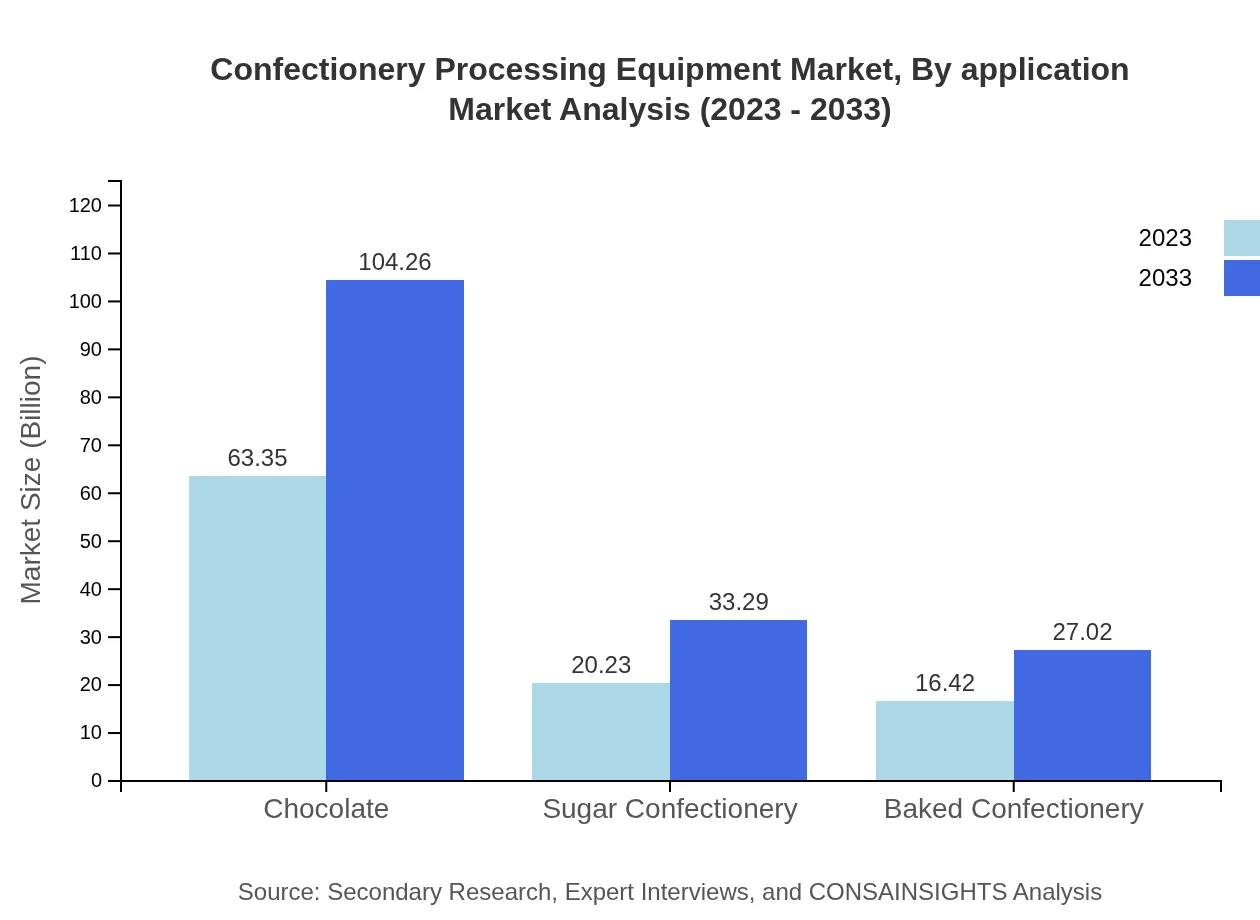

Confectionery Processing Equipment Market Analysis By Application

The chocolate segment remains the largest application area, accounting for $63.35 million in 2023, and is projected to grow to $104.26 million in 2033. The sugar confectionery and baked goods segments are also expanding, driven by consumer preferences for diverse and flavorful products.

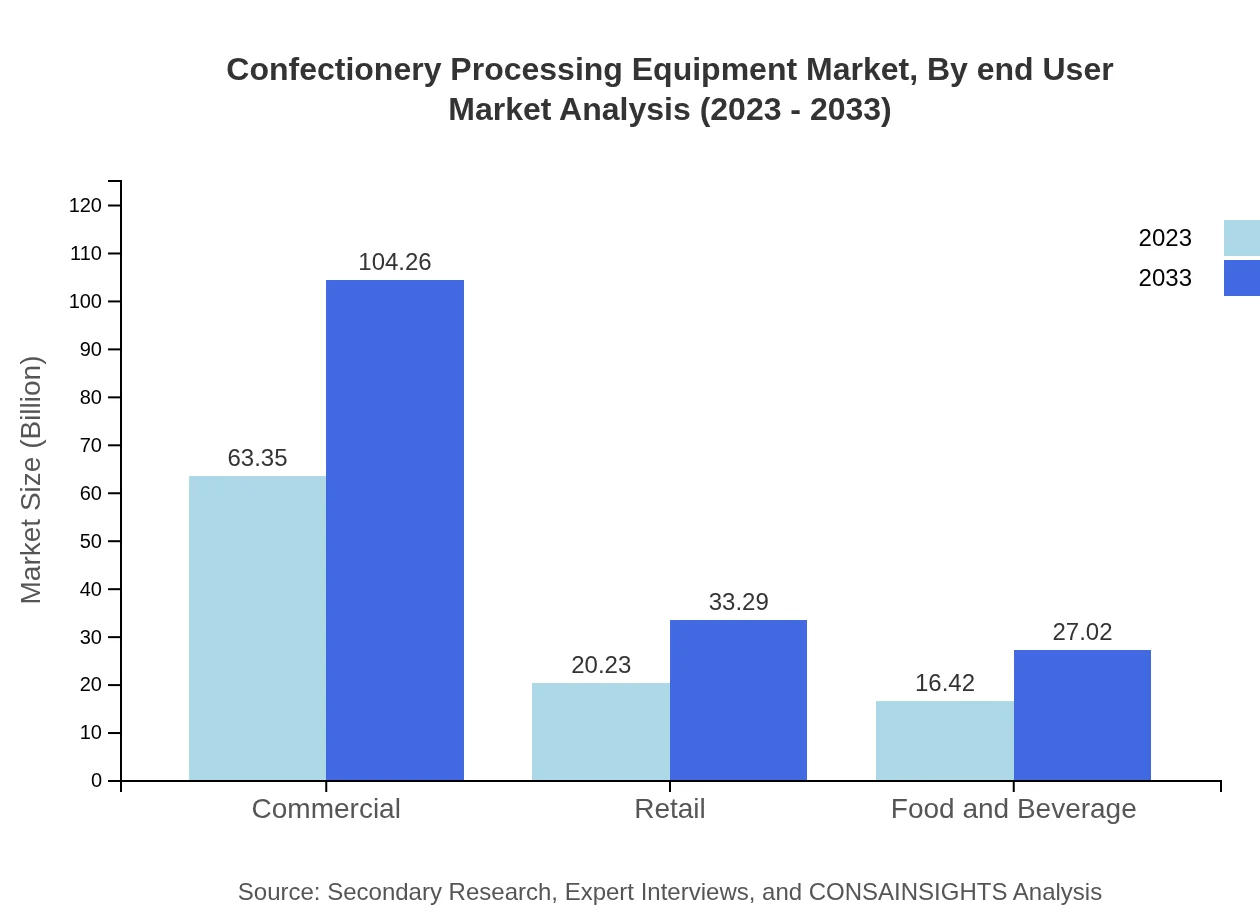

Confectionery Processing Equipment Market Analysis By End User

The commercial sector is the largest end-user, with a market size of $63.35 million in 2023 and an expected growth to $104.26 million by 2033. Retail and food and beverage sectors follow, with significant contributions to market growth.

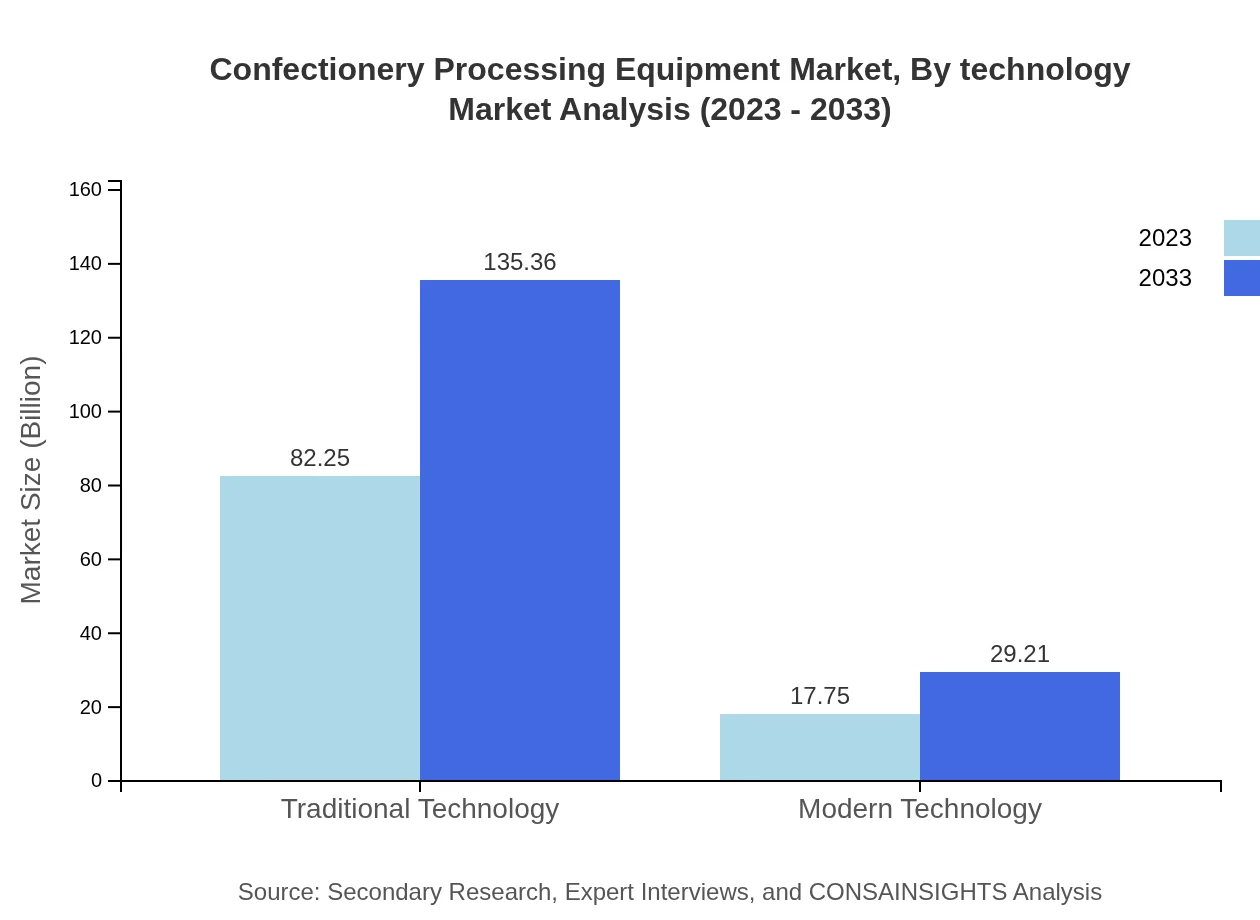

Confectionery Processing Equipment Market Analysis By Technology

Traditional technology continues to hold the majority share of the market, valued at $82.25 million in 2023 and expected to reach $135.36 million in 2033. However, modern technology is gaining traction, evolving from $17.75 million in 2023 to $29.21 million by 2033.

Confectionery Processing Equipment Market Analysis By Distribution Channel

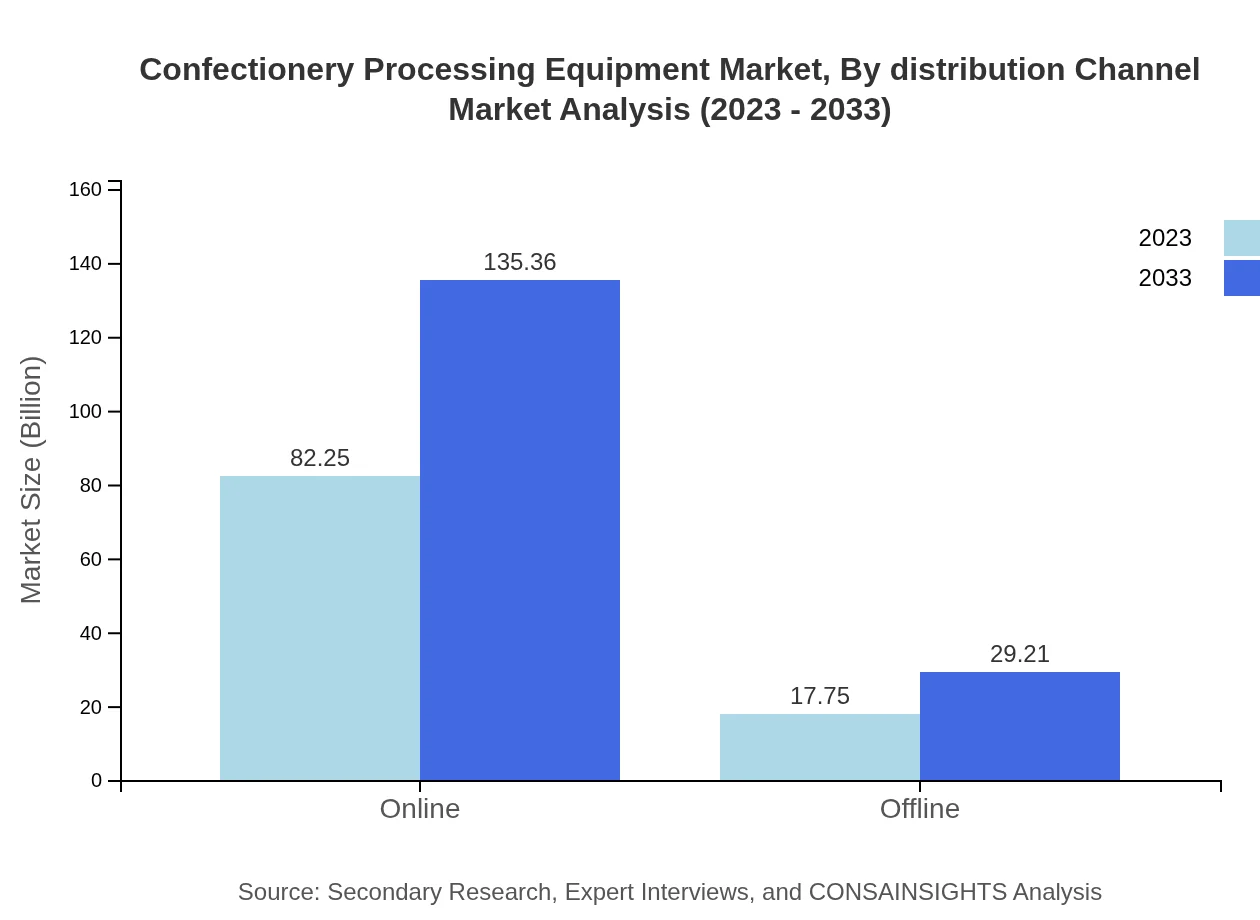

The online distribution channel dominates, with sales projected to rise from $82.25 million in 2023 to $135.36 million by 2033. Offline channels will also witness growth, moving from $17.75 million to $29.21 million within the same timeframe.

Confectionery Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Confectionery Processing Equipment Industry

Bühler Group:

A global leader in the supply of food processing equipment and services, Bühler Group specializes in processing grains and producing highly efficient chocolate and confectionery machinery.Baker Perkins Ltd:

Baker Perkins is known for its high-quality processing equipment and technology, focusing on baking and confectionery processes, offering innovative solutions for the production of candy and chocolate.Clextral:

Clextral provides advanced twin-screw extrusion technology for producing a wide variety of confectionery products, emphasizing efficiency and product quality.We're grateful to work with incredible clients.

FAQs

What is the market size of confectionery Processing Equipment?

The global market size of confectionery processing equipment is projected to reach approximately $100 million by 2033, growing at a CAGR of 5%. This growth is fueled by increasing consumer demand and innovative production techniques.

What are the key market players or companies in the confectionery processing equipment industry?

Key players in the confectionery processing equipment industry include large manufacturers and suppliers such as Bühler Group, Baker Perkins, and Schenck Process, which are known for their innovation and global reach, catering to various production needs.

What are the primary factors driving the growth in the confectionery processing equipment industry?

The growth in the confectionery processing equipment industry is driven by rising consumer demand for diverse confectionery products, advancements in technological capabilities, and a growing trend towards automation in manufacturing processes.

Which region is the fastest Growing in the confectionery processing equipment?

The fastest-growing region in the confectionery processing equipment market is projected to be Europe. The market in Europe is set to rise from $29.40 million in 2023 to $48.39 million by 2033, reflecting a robust growth trajectory.

Does ConsaInsights provide customized market report data for the confectionery processing equipment industry?

Yes, ConsaInsights offers customized market report data for the confectionery processing equipment industry tailored to specific client needs. This includes detailed data analysis, insights, and market trends to support strategic decision-making.

What deliverables can I expect from this confectionery processing equipment market research project?

From this confectionery processing equipment market research project, you can expect comprehensive reports detailing market size, segmentation data, competitive landscape analysis, and future growth trends across various regions and technologies.

What are the market trends of confectionery processing equipment?

Current market trends in confectionery processing equipment include a shift towards modern technology adoption, increasing focus on energy-efficient production methods, and growing popularity of online sales channels, along with innovations in product formulations.