Configuration Management Market Report

Published Date: 31 January 2026 | Report Code: configuration-management

Configuration Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Configuration Management market from 2023 to 2033, covering key insights, market size, growth forecasts, segmentation, and regional dynamics.

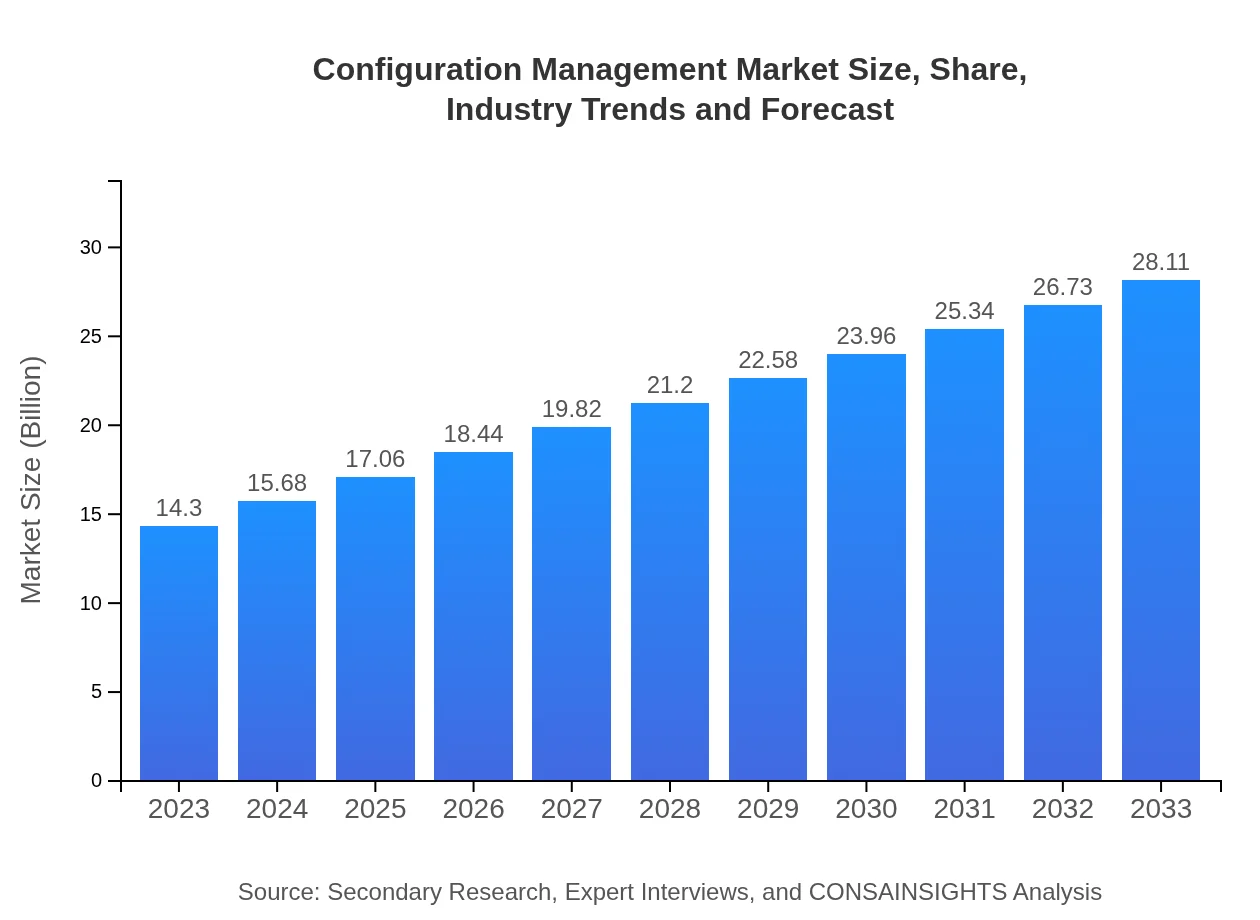

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $28.11 Billion |

| Top Companies | IBM, ServiceNow, Micro Focus, BMC Software |

| Last Modified Date | 31 January 2026 |

Configuration Management Market Overview

Customize Configuration Management Market Report market research report

- ✔ Get in-depth analysis of Configuration Management market size, growth, and forecasts.

- ✔ Understand Configuration Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Configuration Management

What is the Market Size & CAGR of Configuration Management market in 2033?

Configuration Management Industry Analysis

Configuration Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Configuration Management Market Analysis Report by Region

Europe Configuration Management Market Report:

In Europe, the Configuration Management market anticipates growth from $3.44 billion in 2023 to $6.76 billion by 2033, supported by stringent regulatory policies and an increasing focus on data security and compliance across sectors such as finance and healthcare.Asia Pacific Configuration Management Market Report:

The Asia Pacific region represents a burgeoning market for configuration management, with the market expected to grow from $3.09 billion in 2023 to $6.07 billion by 2033. Rapid digital transformation across major economies and a rising number of tech startups are driving this growth, complemented by increasing investments in IT infrastructure.North America Configuration Management Market Report:

North America is currently the largest market for Configuration Management, projected to grow from $4.93 billion in 2023 to $9.69 billion by 2033. This growth is attributed to the high concentration of tech giants, persistent innovation, and substantial investments in IT security and system efficiency.South America Configuration Management Market Report:

In South America, the Configuration Management market is poised to expand from $1.39 billion in 2023 to $2.74 billion by 2033 due to increasing adoption of IT service management processes in industries like healthcare and retail, along with growing awareness of compliance standards.Middle East & Africa Configuration Management Market Report:

The Middle East and Africa region's market is set to increase from $1.45 billion in 2023 to $2.85 billion by 2033. National initiatives promoting digitalization across various sectors and investments in infrastructure development contribute significantly to this growth.Tell us your focus area and get a customized research report.

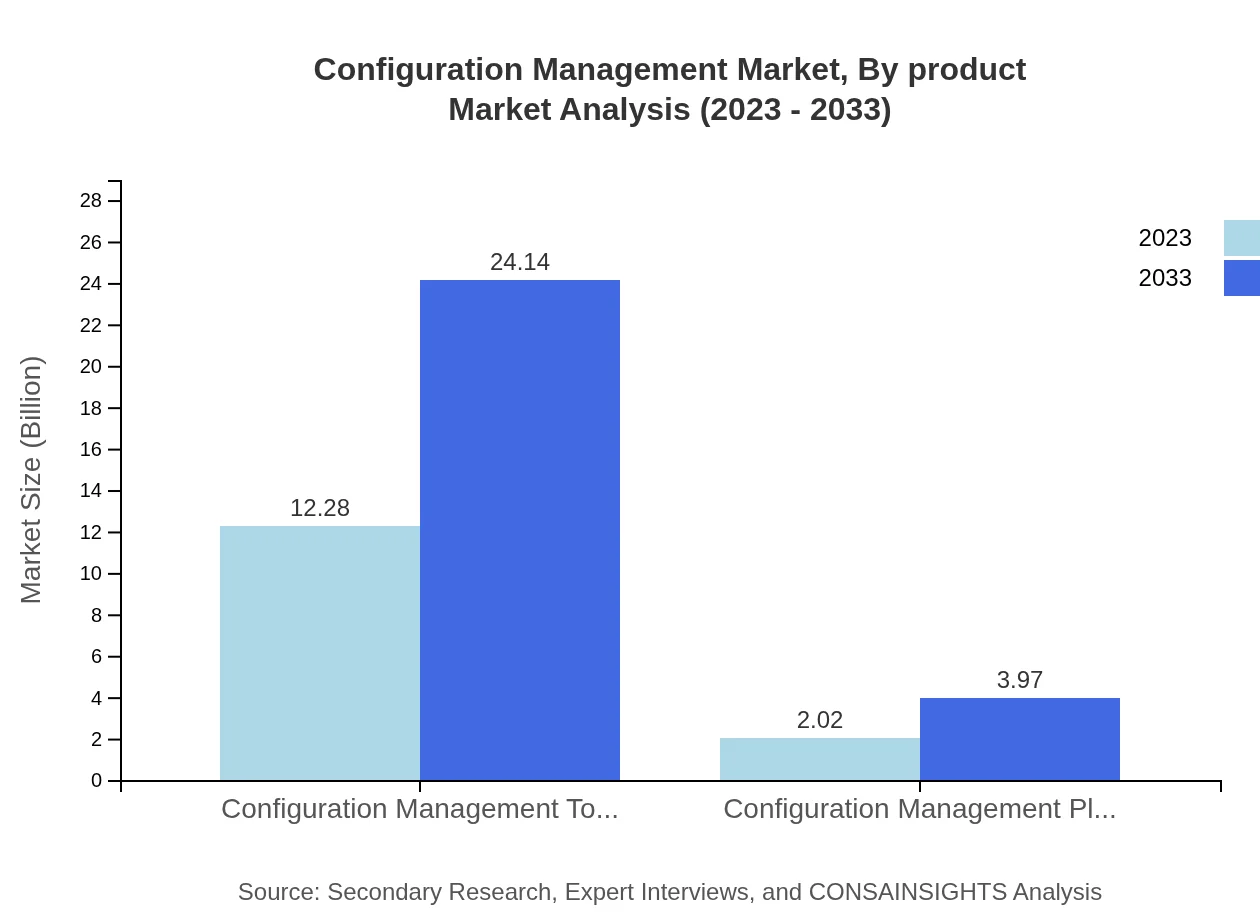

Configuration Management Market Analysis By Product

The Configuration Management market comprises various product types including Configuration Management Tools and Platforms. Configuration Management Tools are projected to grow from $12.28 billion in 2023 to $24.14 billion by 2033. Configuration Management Platforms also show robust growth, rising from $2.02 billion to $3.97 billion in the same period.

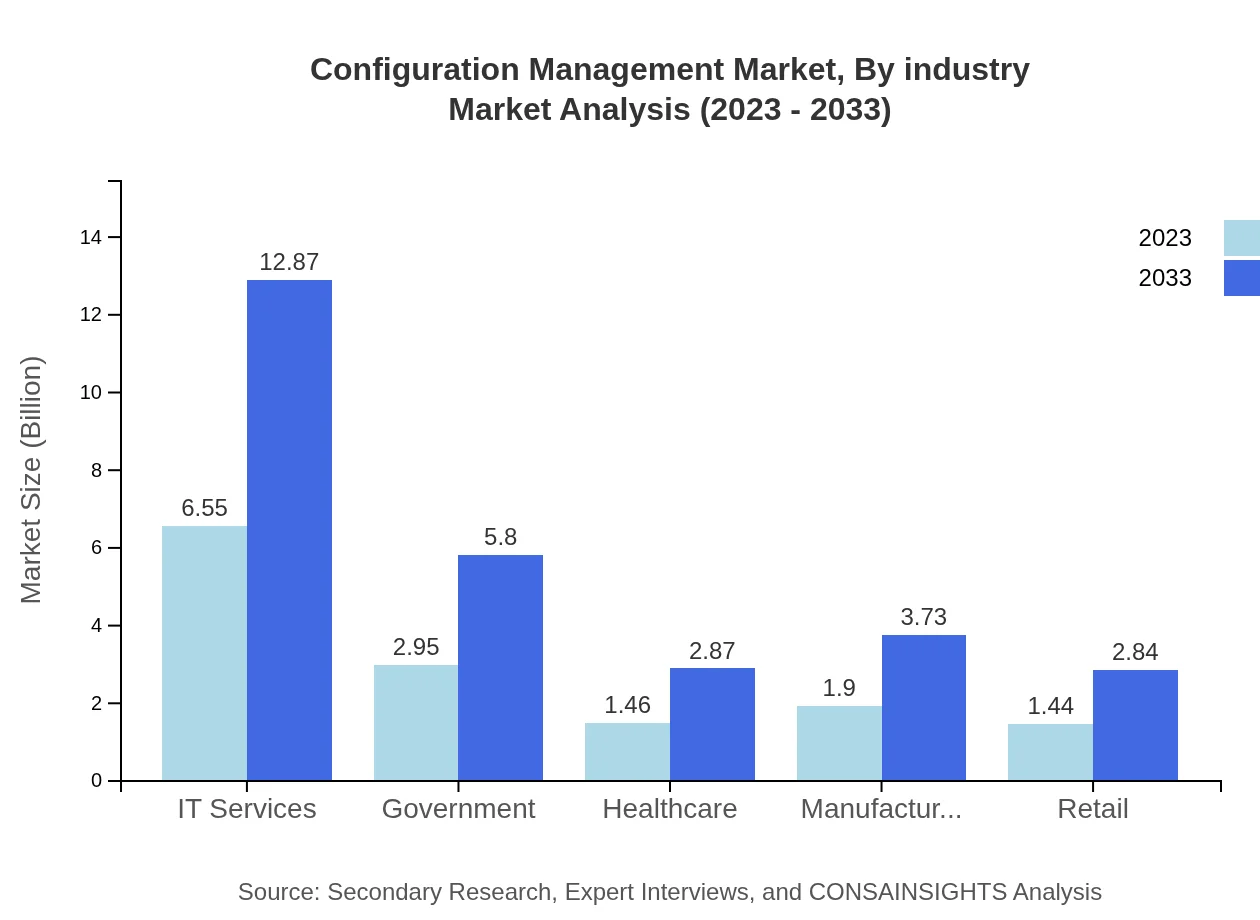

Configuration Management Market Analysis By Industry

Industry-wise segmentation highlights critical sectors such as IT Services, Government, Healthcare, Manufacturing, and Retail. For instance, IT Services will grow from $6.55 billion in 2023 to $12.87 billion in 2033, shedding light on the vital role of configuration management in optimizing IT operations.

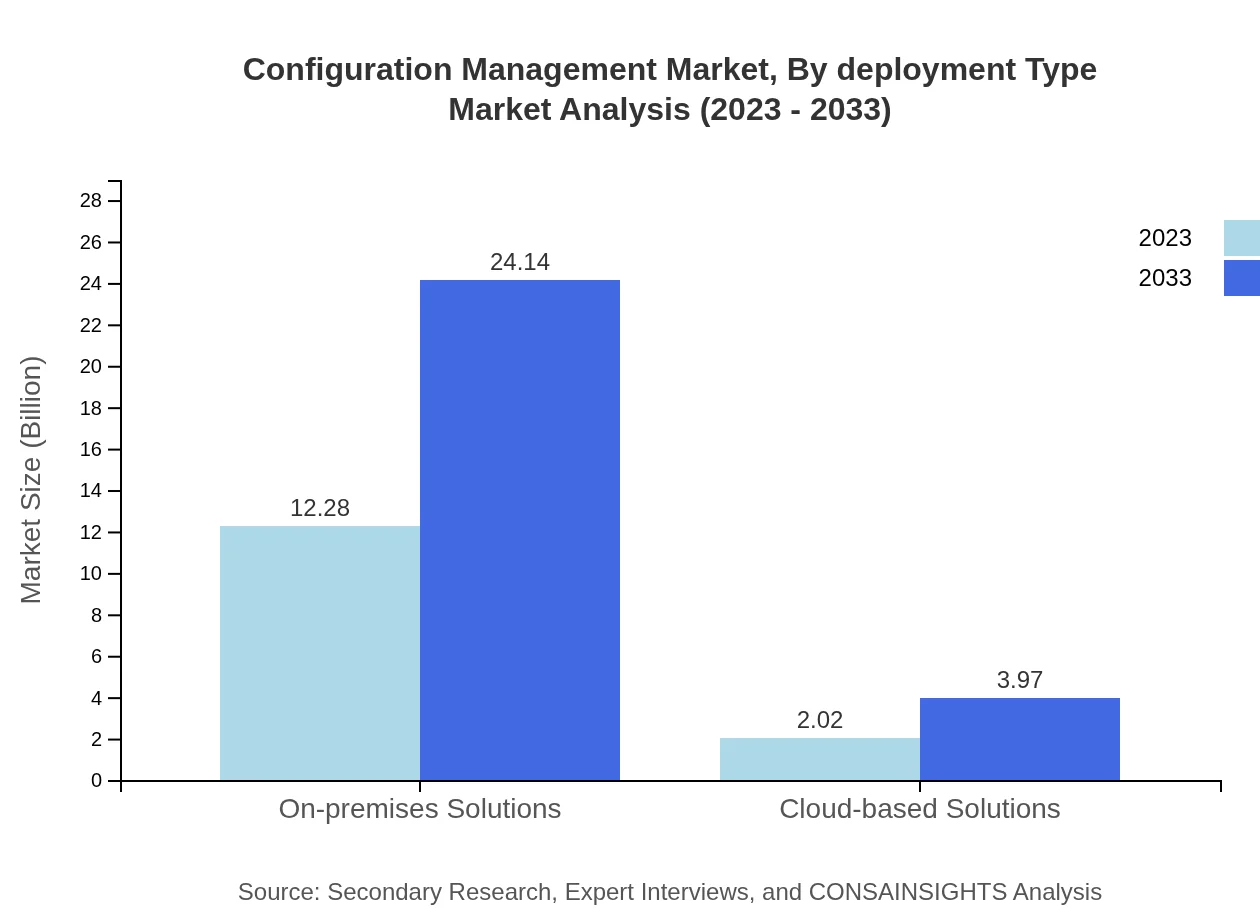

Configuration Management Market Analysis By Deployment Type

The market is segmented into On-premises Solutions and Cloud-based Solutions. The On-premises Solutions segment is set to see significant growth from $12.28 billion to $24.14 billion by 2033, while Cloud-based Solutions will progress from $2.02 billion to $3.97 billion during the same timeframe.

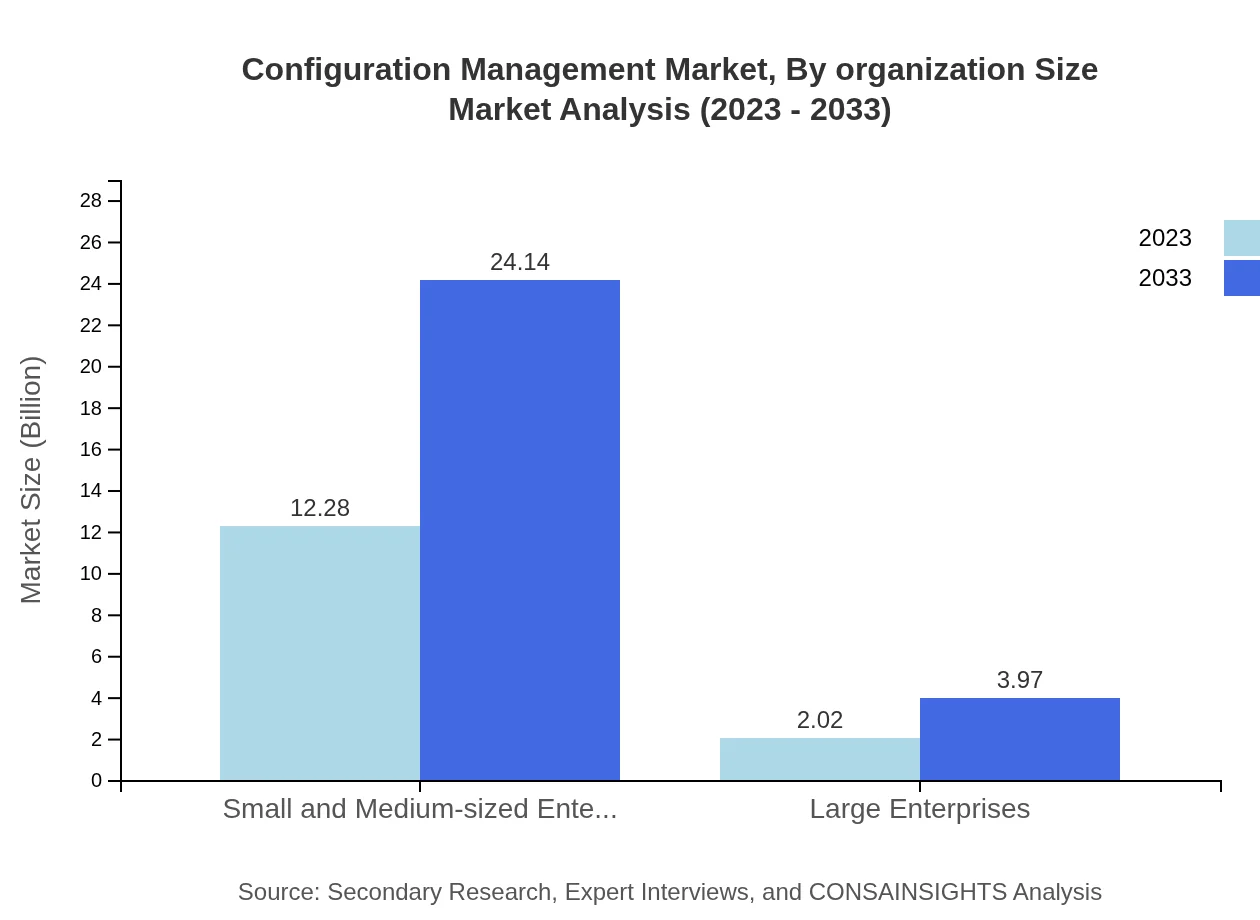

Configuration Management Market Analysis By Organization Size

In terms of organization size, the Configuration Management market is divided into SMEs and Large Enterprises. SMEs are likely to grow from $12.28 billion in 2023 to $24.14 billion by 2033, demonstrating their crucial role in leveraging configuration management solutions for efficiency.

Configuration Management Market Analysis By Service Type

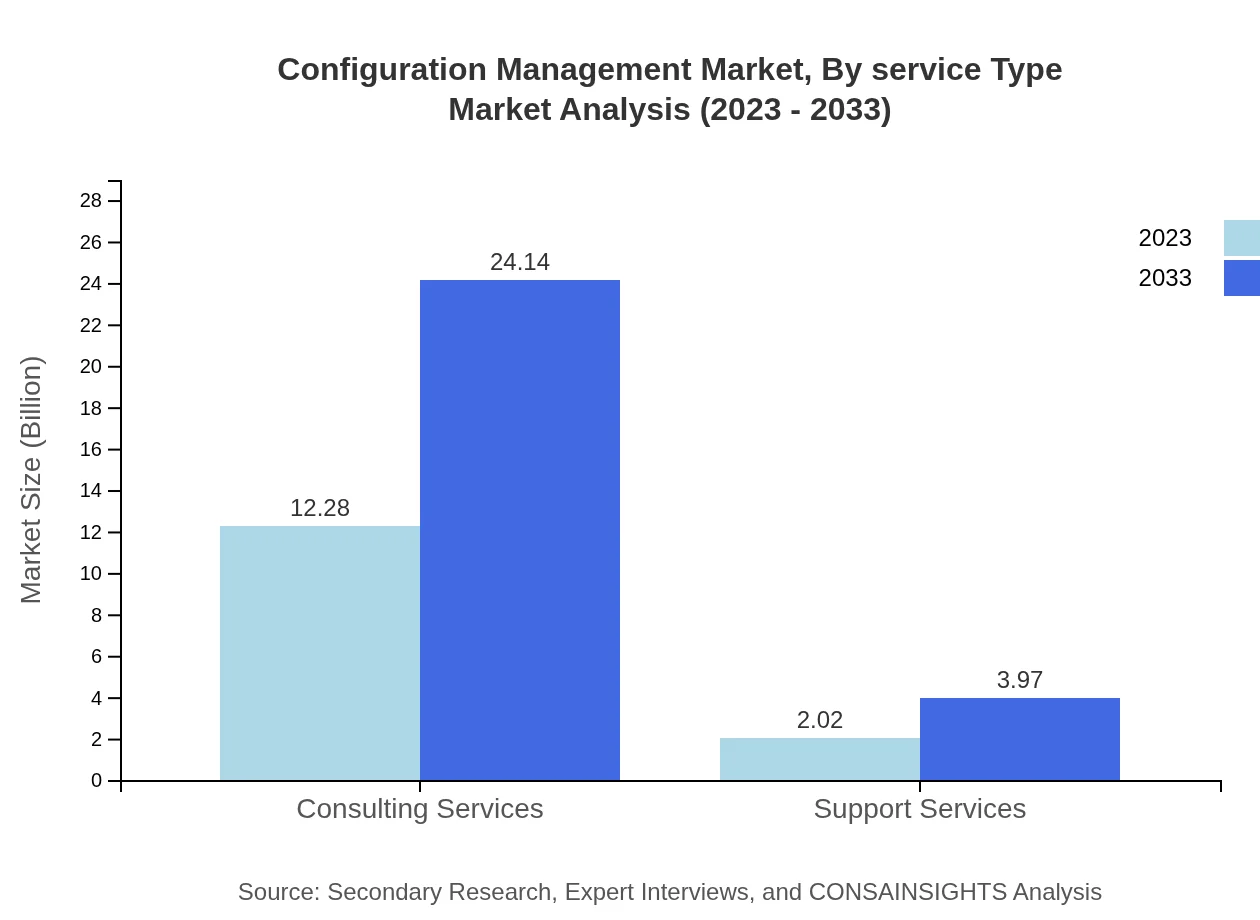

Service types include Consulting Services, Support Services, and more. Notably, Consulting Services are expected to expand from $12.28 billion to $24.14 billion by 2033, reflecting a trend towards strategic implementations in IT management.

Configuration Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Configuration Management Industry

IBM:

IBM provides advanced configuration management solutions integrated with AI to enhance automation, reducing operational risks.ServiceNow:

ServiceNow is renowned for its cloud-based IT service management tools that facilitate efficient configuration management and workflow automation.Micro Focus:

Micro Focus specializes in enterprise-grade configuration management tools, ensuring organizations can manage complex IT environments effectively.BMC Software:

BMC Software offers innovative solutions tailored to configuration management across various industries, enhancing operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of configuration Management?

The global configuration management market is projected to grow from $14.3 billion in 2023 to significantly higher by 2033, with a CAGR of 6.8%. This indicates robust future growth driven by increasing IT complexities.

What are the key market players or companies in this configuration Management industry?

Key players in the configuration management market include Software AG, CA Technologies, BMC Software, Red Hat, and Puppet. These companies drive innovation and service improvements, catering to diverse market needs.

What are the primary factors driving the growth in the configuration Management industry?

Growth in the configuration management industry is fueled by escalating cloud adoption, the increasing demand for automation in IT processes, and the rising necessity for compliance and security in configurations.

Which region is the fastest Growing in the configuration Management?

North America is currently the fastest-growing region in the configuration management market, with a market size of $4.93 billion in 2023 expected to reach $9.69 billion by 2033. Europe and Asia Pacific also show rapid growth.

Does ConsaInsights provide customized market report data for the configuration Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the configuration management industry, ensuring actionable insights based on client preferences and market dynamics.

What deliverables can I expect from this configuration Management market research project?

From the configuration management market research project, expect comprehensive reports including market size, growth forecasts, competitive analysis, segment data, and actionable recommendations tailored to guide strategic decision-making.

What are the market trends of configuration Management?

Current trends in the configuration management market include a shift towards cloud-based solutions, increased integration of AI and automation in tools, and growing importance of real-time configuration monitoring and compliance.