Configuration Management Software Market Report

Published Date: 31 January 2026 | Report Code: configuration-management-software

Configuration Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Configuration Management Software market, covering trends, growth, segmentation, and forecasts for the period 2023 to 2033. It offers valuable insights for stakeholders aiming to understand market dynamics and future opportunities.

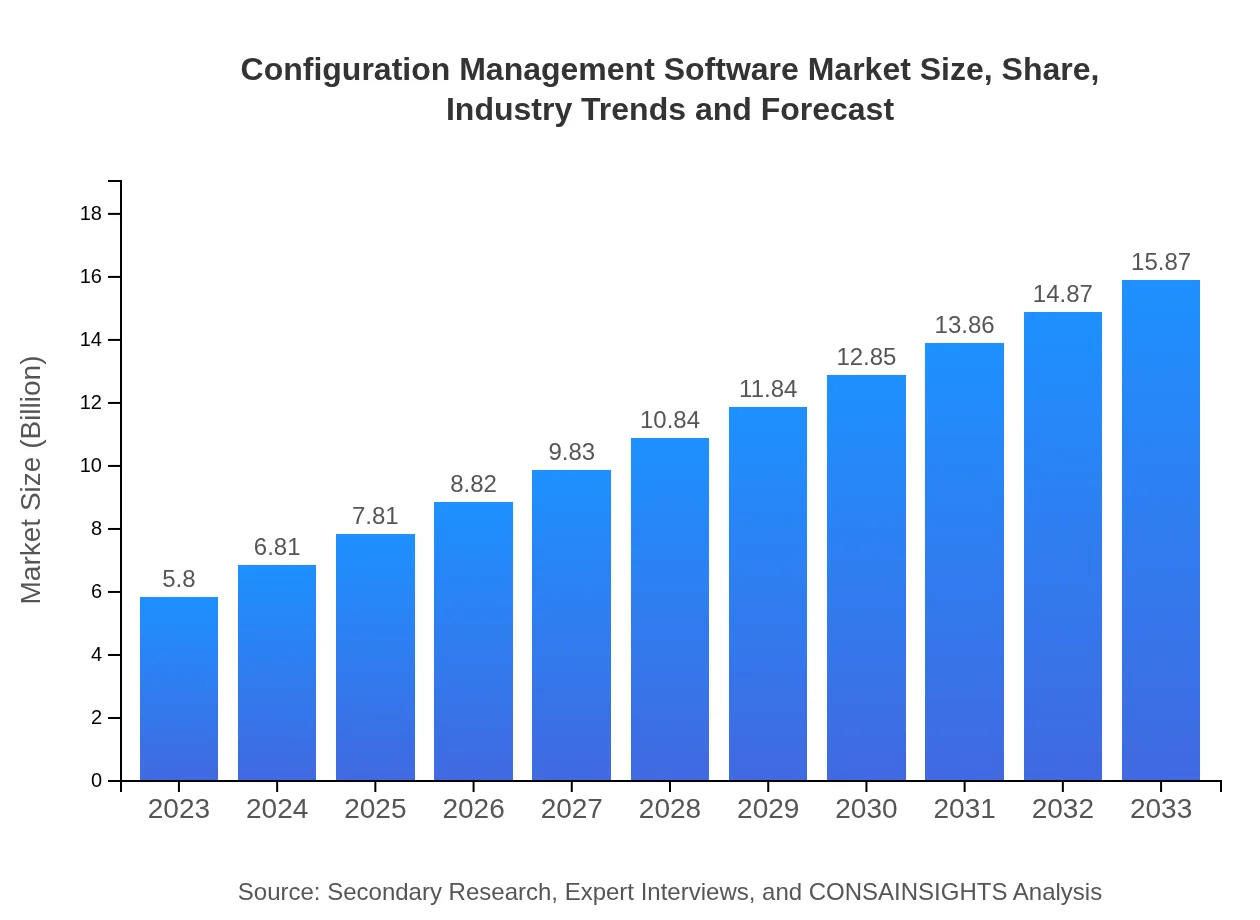

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.87 Billion |

| Top Companies | ServiceNow, BMC Software, Micro Focus, Cisco Systems, HashiCorp |

| Last Modified Date | 31 January 2026 |

Configuration Management Software Market Overview

Customize Configuration Management Software Market Report market research report

- ✔ Get in-depth analysis of Configuration Management Software market size, growth, and forecasts.

- ✔ Understand Configuration Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Configuration Management Software

What is the Market Size & CAGR of Configuration Management Software market in 2023?

Configuration Management Software Industry Analysis

Configuration Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Configuration Management Software Market Analysis Report by Region

Europe Configuration Management Software Market Report:

Europe's market is set to grow from $1.90 billion in 2023 to $5.19 billion by 2033, driven by stringent regulations concerning data protection and the growing emphasis on configuration management in compliance management strategies.Asia Pacific Configuration Management Software Market Report:

In the Asia-Pacific region, the Configuration Management Software market is expected to grow from $1.07 billion in 2023 to $2.93 billion by 2033. The increasing adoption of digital technologies and the rise of e-commerce are driving the demand for robust configuration management solutions, particularly in countries like India and China, where tech ecosystems are rapidly evolving.North America Configuration Management Software Market Report:

In North America, the market is forecasted to expand from $2.04 billion in 2023 to $5.57 billion in 2033. This region holds a significant market share due to the presence of numerous software vendors and the high level of investments in IT infrastructure and security.South America Configuration Management Software Market Report:

South America shows a smaller market size, projected to grow from $0.08 billion in 2023 to $0.23 billion by 2033. The growth in this region is largely influenced by the increasing digitization efforts and small to medium enterprises adopting automated solutions for better operational efficiency.Middle East & Africa Configuration Management Software Market Report:

The Middle East and Africa (MEA) region's market is expected to rise from $0.72 billion in 2023 to $1.96 billion by 2033, as regional organizations increasingly recognize the need for effective management of IT resources amidst growing digital threats.Tell us your focus area and get a customized research report.

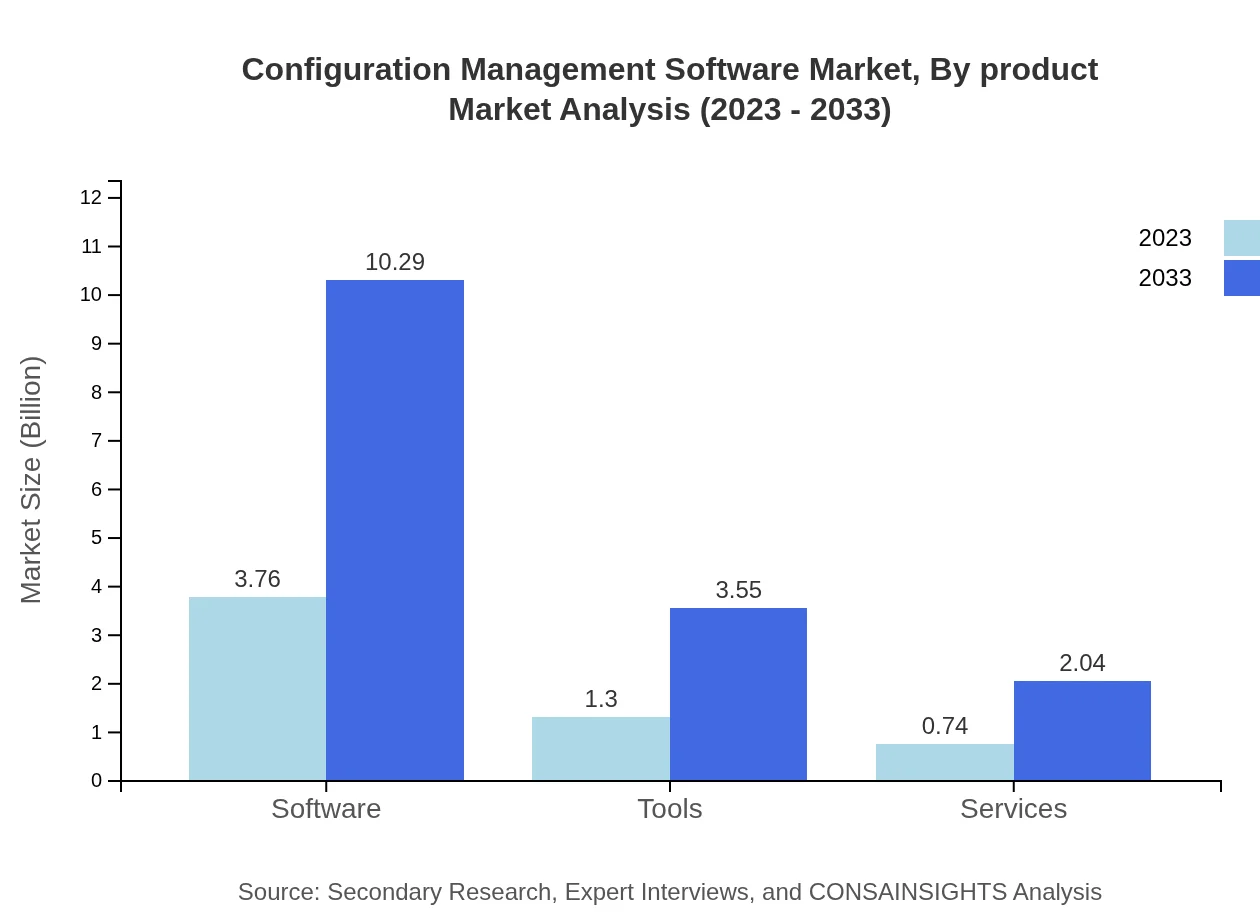

Configuration Management Software Market Analysis By Product

The product segmentation primarily features software, tools, and services. Software is projected to grow from $3.76 billion in 2023 to $10.29 billion by 2033, dominating the market share at 64.83%. Tools will expand from $1.30 billion to $3.55 billion, indicating its importance in supporting overall configuration management processes. Services are also expected to see growth from $0.74 billion to $2.04 billion, showcasing the demand for implementation support and consultancy.

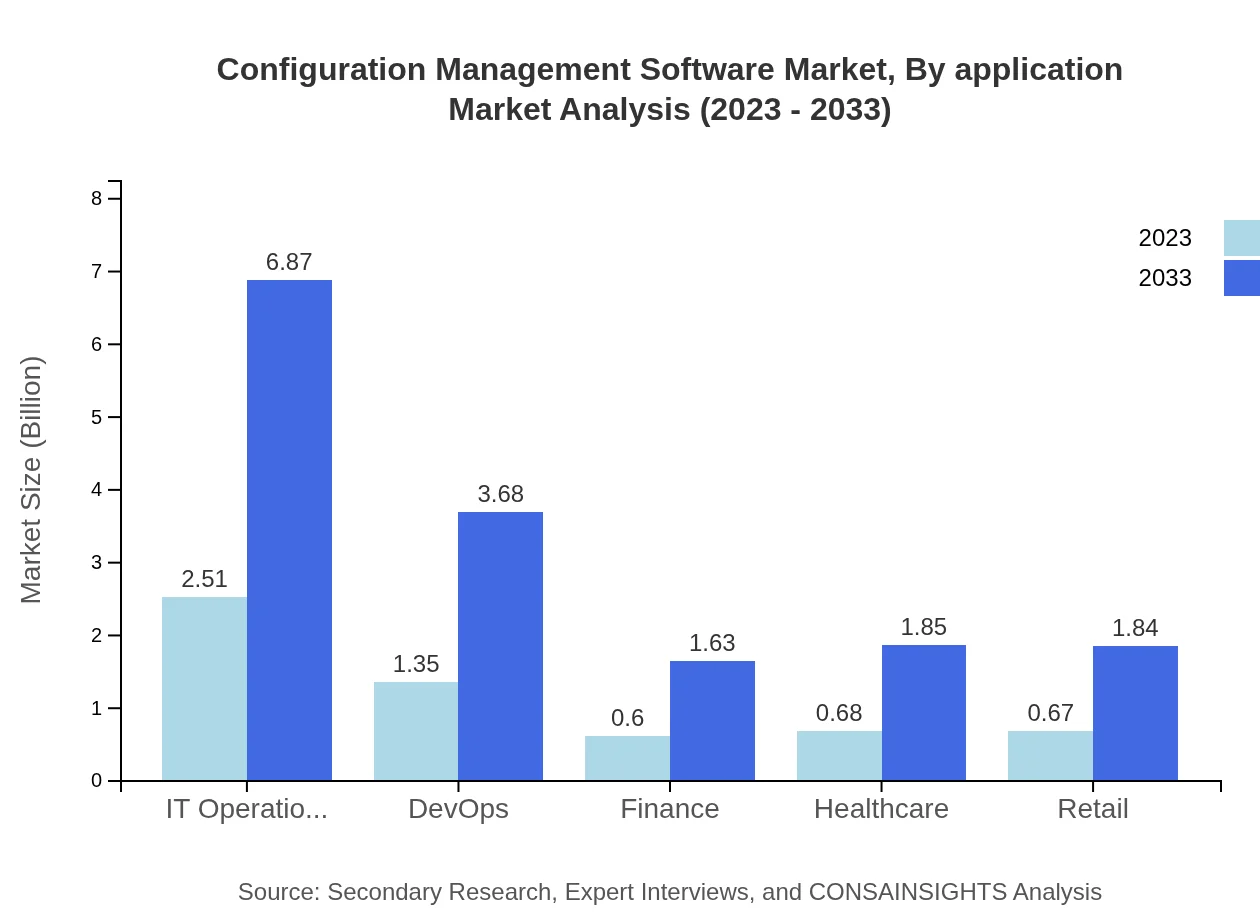

Configuration Management Software Market Analysis By Application

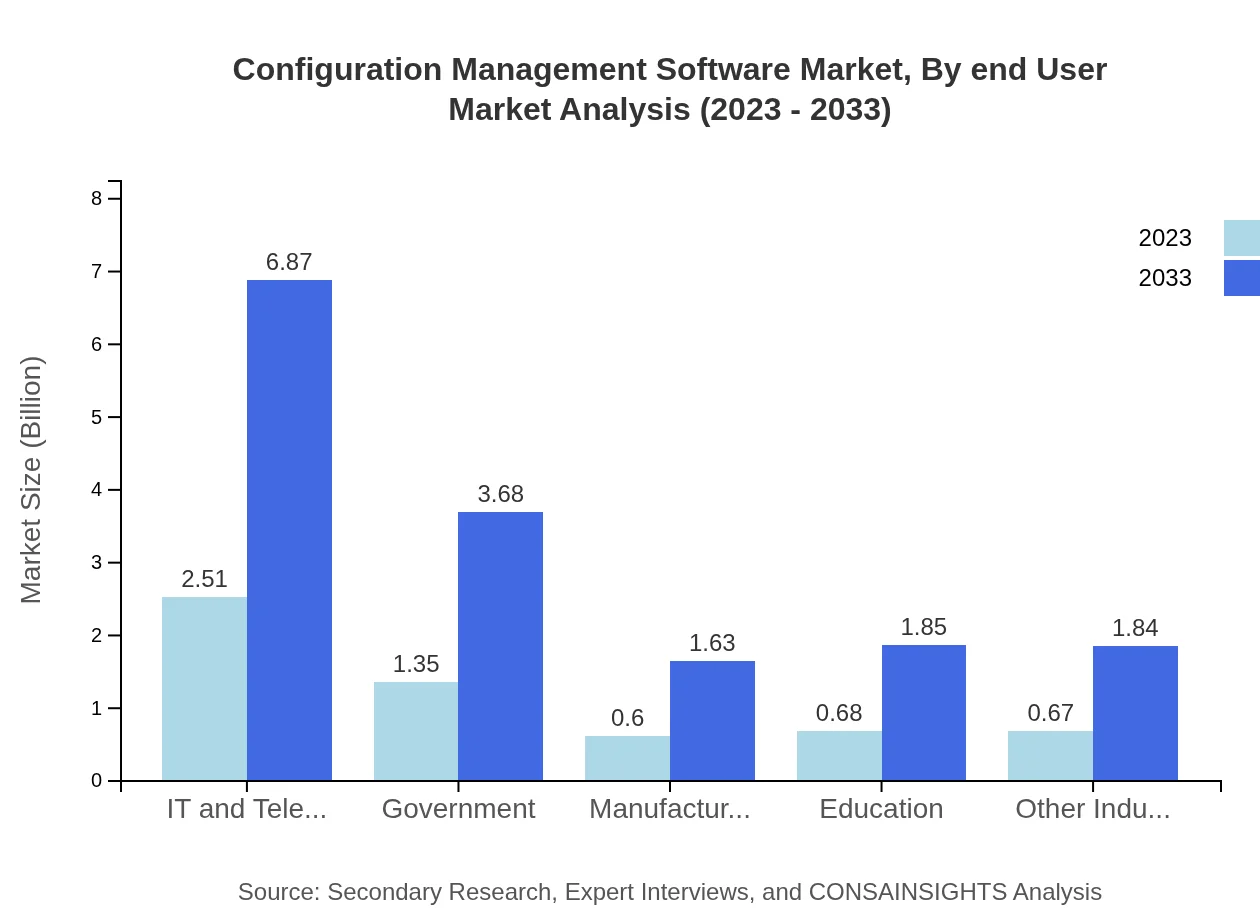

The application segment engages various sectors including IT and telecom, government, manufacturing, education, and healthcare. The IT and telecom sector leads with a market size of $2.51 billion in 2023, expanding to $6.87 billion by 2033. Other sectors, like government and finance, also present noteworthy contributions, with significant growth rates anticipated as more sectors lean into digital transformation efforts.

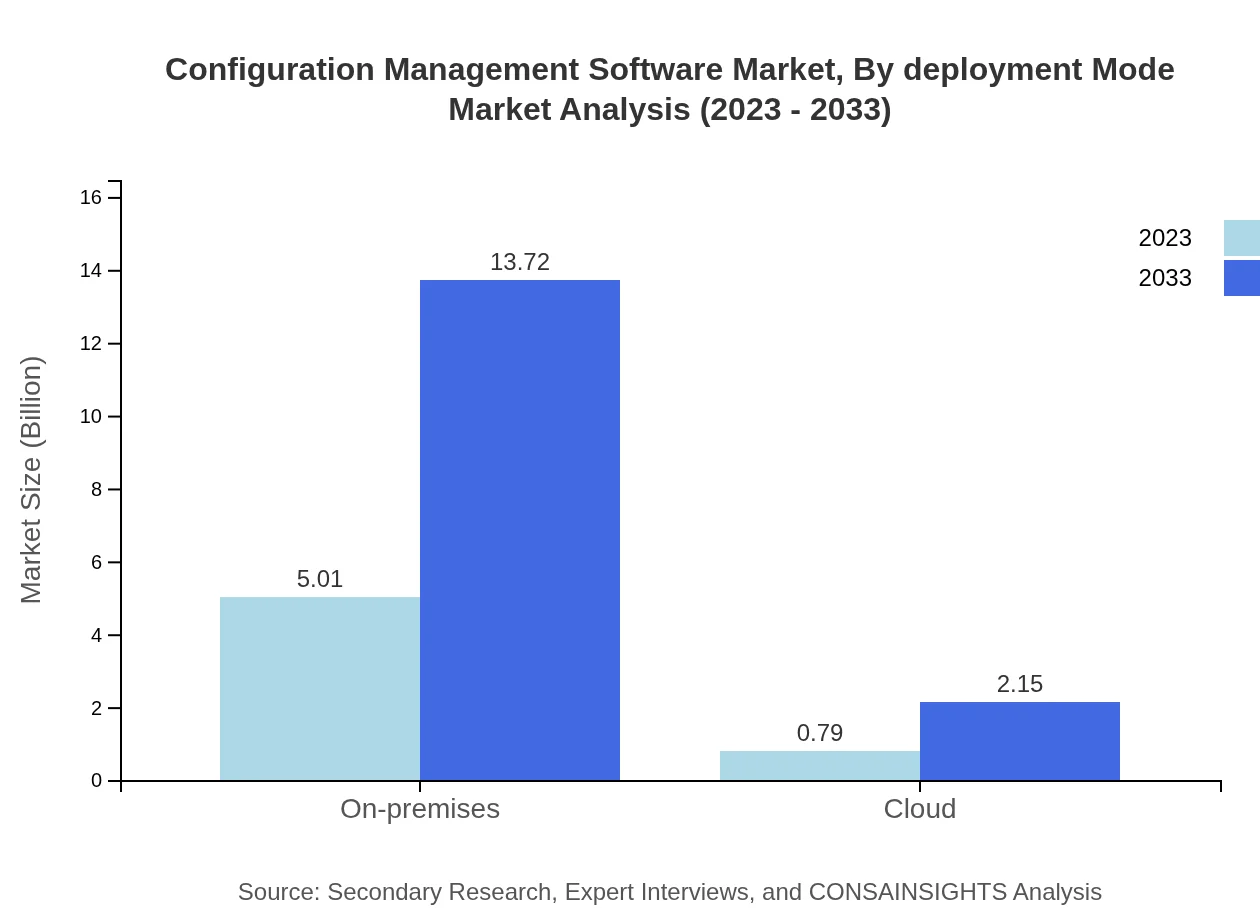

Configuration Management Software Market Analysis By Deployment Mode

The configuration management solutions are deployed in on-premises and cloud environments. The on-premise solution dominates the market with a size of $5.01 billion in 2023, showing reliability for sensitive data needs. However, the cloud segment is gaining traction, projected to grow from $0.79 billion to $2.15 billion, reflecting the global shift towards cloud adoption.

Configuration Management Software Market Analysis By End User

Key end-users include IT operations, finance, healthcare, and retail. IT operations is the largest end-user segment with $2.51 billion in 2023, set to increase to $6.87 billion by 2033, driven by the constant need for reliable configurations. The healthcare industry is also witnessing growth, with an increasing need for compliance and data protection measures.

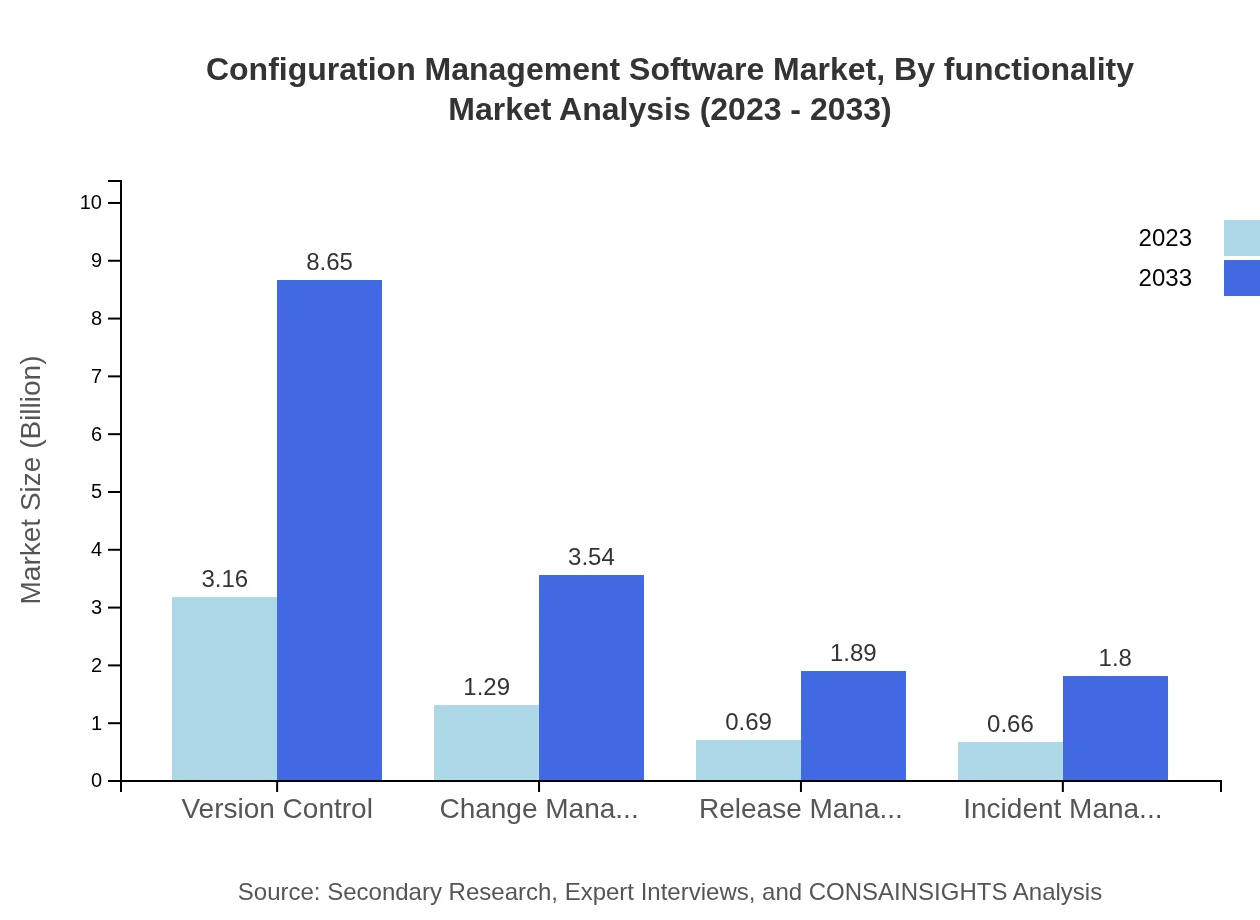

Configuration Management Software Market Analysis By Functionality

Different functionalities like version control, change management, and release management greatly impact the adoption of configuration management software. Version control is anticipated to hold the largest share, growing from $3.16 billion to $8.65 billion, as it significantly enhances collaboration among software teams.

Configuration Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Configuration Management Software Industry

ServiceNow:

ServiceNow offers dynamic IT service management and operations management software for enterprises, focusing heavily on automating workflows to improve efficiency.BMC Software:

BMC Software provides innovative IT solutions that help organizations enhance their service delivery and manage IT operations effectively.Micro Focus:

Micro Focus specializes in IT operations management solutions, delivering services that enhance organizational agility and operational efficiency.Cisco Systems:

Cisco Systems is a leader in networking solutions, offering powerful configuration management tools that help businesses streamline their IT environments.HashiCorp:

HashiCorp offers open-source software tools designed for building, changing, and versioning infrastructure safely and efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of configuration Management Software?

The global Configuration Management Software market is projected to reach $5.8 billion by 2033, growing at a CAGR of 10.2% from its current valuation. This significant growth reflects increasing demand for effective management solutions across various sectors.

What are the key market players or companies in this configuration Management Software industry?

The Configuration Management Software market features key players like Microsoft, BMC Software, Puppet, Chef Software, and IBM, among others. These companies lead through innovation and strategic partnerships, thus shaping market dynamics.

What are the primary factors driving the growth in the configuration Management Software industry?

Primary growth drivers include increasing cloud adoption, the need for data security, and the shift towards DevOps practices. Additionally, businesses are prioritizing agile IT operations, contributing to rising demand for configuration management solutions.

Which region is the fastest Growing in the configuration Management Software?

The fastest-growing region in the Configuration Management Software market is North America, with a projected market size of $5.57 billion by 2033, up from $2.04 billion in 2023, reflecting a robust CAGR alongside increasing IT investments.

Does ConsaInsights provide customized market report data for the configuration Management Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Configuration Management Software industry, allowing detailed insights into niche areas and market trends relevant to your organization.

What deliverables can I expect from this configuration Management Software market research project?

Deliverables typically include comprehensive reports, executive summaries, in-depth market analysis, segment details, trend identification, and competitive landscape insights tailored to guide strategic decision-making.

What are the market trends of configuration Management Software?

Current market trends include a growing shift towards cloud-based solutions, increasing integration of AI for automation, and enhanced focus on security features. Companies are emphasizing seamless deployment processes to improve operational efficiency.