Connected Aircraft Market Report

Published Date: 03 February 2026 | Report Code: connected-aircraft

Connected Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Connected Aircraft market, including insights on market dynamics, size, segmentation, regional performance, key players, and future forecasts from 2023 to 2033.

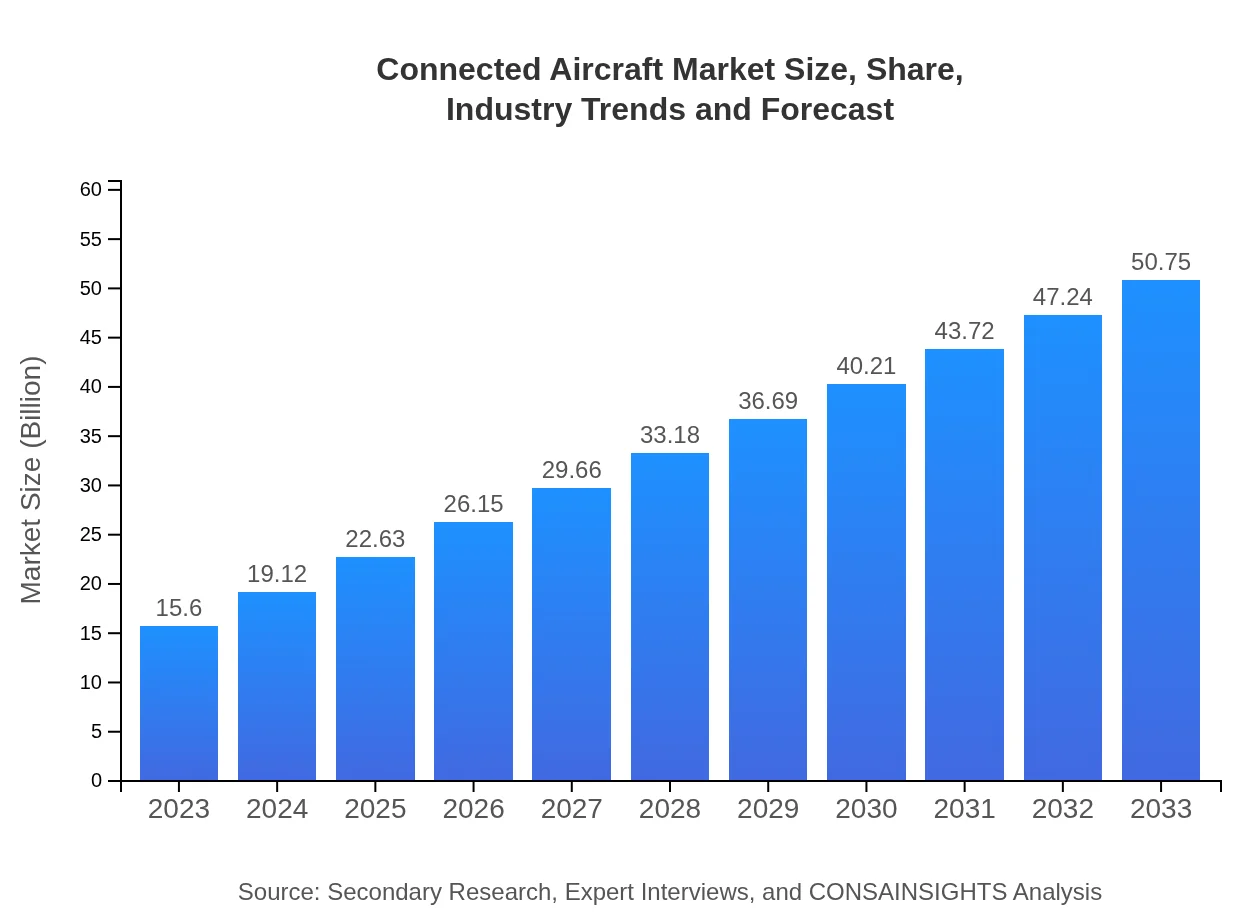

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $50.75 Billion |

| Top Companies | Honeywell International Inc., Gogo Inc., L3 Technologies, Inc., Thales Group, Vodafone Business |

| Last Modified Date | 03 February 2026 |

Connected Aircraft Market Overview

Customize Connected Aircraft Market Report market research report

- ✔ Get in-depth analysis of Connected Aircraft market size, growth, and forecasts.

- ✔ Understand Connected Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Connected Aircraft

What is the Market Size & CAGR of Connected Aircraft market in 2023?

Connected Aircraft Industry Analysis

Connected Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Connected Aircraft Market Analysis Report by Region

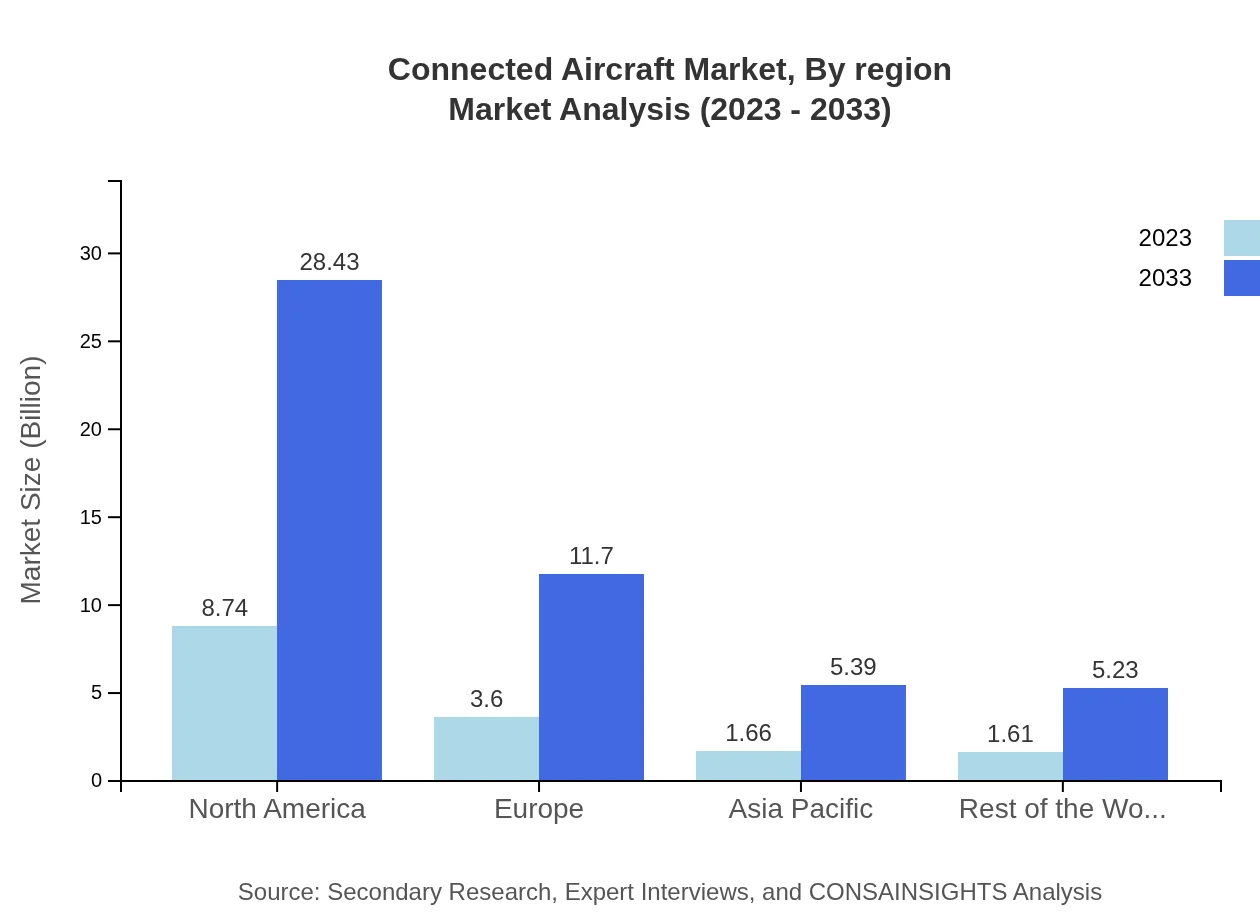

Europe Connected Aircraft Market Report:

The European market is also witnessing growth, with values reported at $3.93 billion in 2023 and anticipated to reach $12.77 billion by 2033, driven by stringent regulations on passenger safety and experience.Asia Pacific Connected Aircraft Market Report:

In the Asia Pacific region, the Connected Aircraft market was valued at $3.02 billion in 2023, projected to grow to $9.83 billion by 2033, exhibiting a significant CAGR as airlines integrate connectivity to enhance passenger services and operational efficiencies.North America Connected Aircraft Market Report:

North America is the largest market for Connected Aircraft, valued at $5.06 billion in 2023, expected to expand to $16.47 billion by 2033. The region's robust technological landscape and the presence of major airlines fuel this growth.South America Connected Aircraft Market Report:

South America shows a promising growth trajectory with a market estimate of $1.51 billion in 2023, reaching $4.93 billion by 2033. Key drivers include increasing passenger traffic and investments in infrastructure.Middle East & Africa Connected Aircraft Market Report:

In the Middle East and Africa, the market size was $2.07 billion in 2023 with a growth expectation to $6.74 billion by 2033, supported by increasing air travel and modernization of airline fleets.Tell us your focus area and get a customized research report.

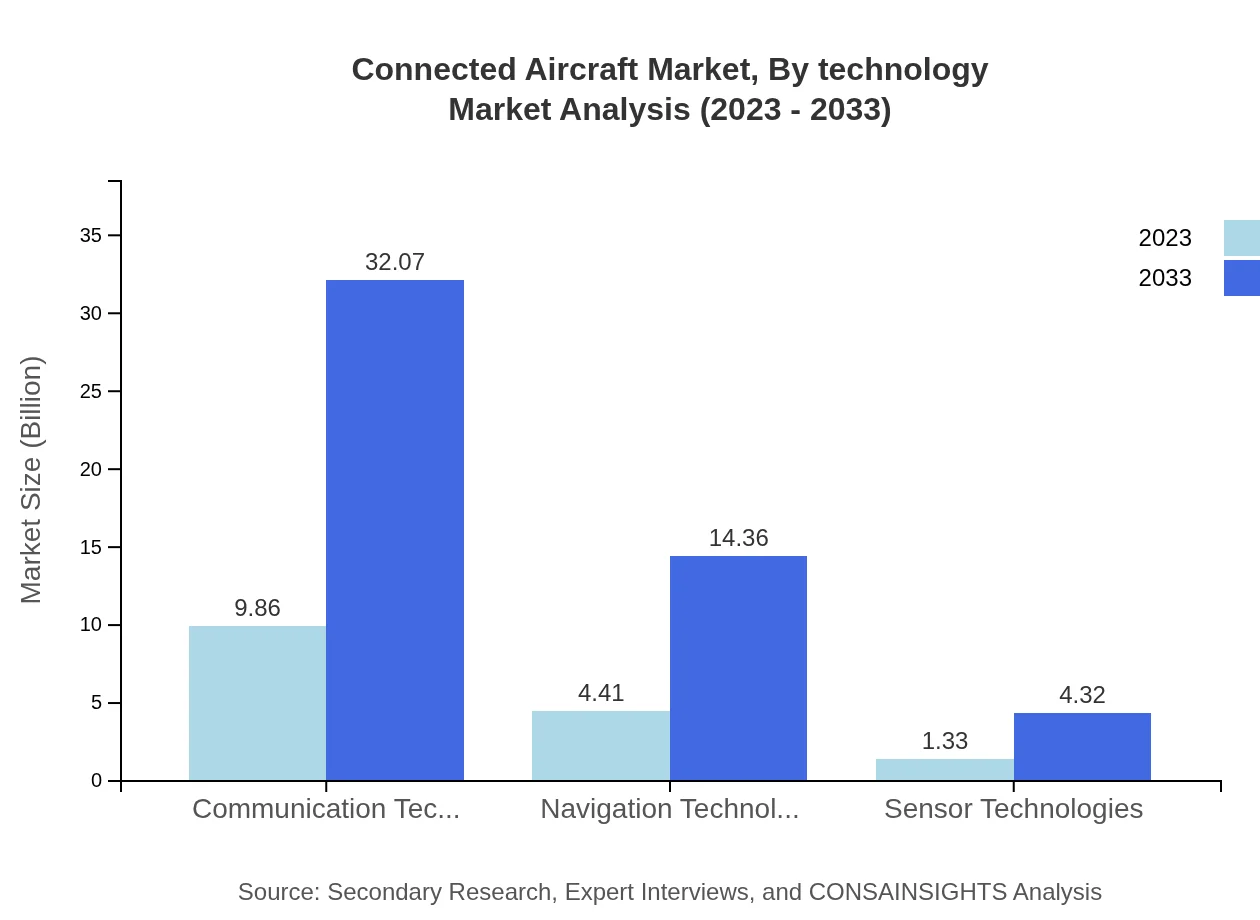

Connected Aircraft Market Analysis By Technology

The Connected Aircraft market, segmented by technology, includes communication technologies, navigation technologies, and sensor technologies. In 2023, communication technologies lead the market with a size of $9.86 billion, expected to increase to $32.07 billion by 2033. Navigation technologies and sensor technologies also show significant growth potential, with sizes of $4.41 billion and $1.33 billion in 2023, growing to $14.36 billion and $4.32 billion, respectively, by 2033.

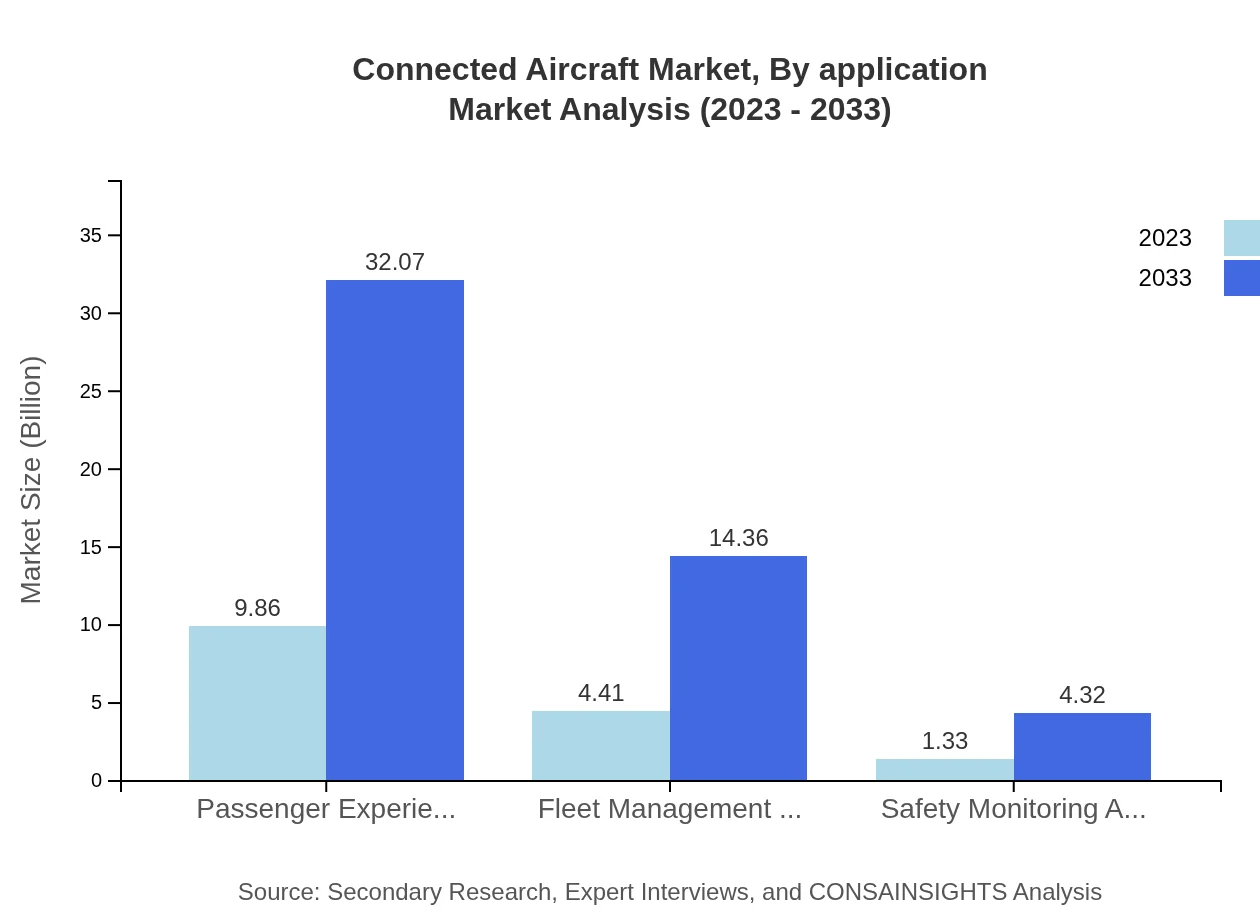

Connected Aircraft Market Analysis By Application

The application segment emphasizes passenger experience enhancements, fleet management solutions, and safety monitoring applications. Passenger experience enhancements dominate the market, estimated at $9.86 billion in 2023 and projected to reach $32.07 billion by 2033. Fleet management solutions and safety monitoring applications contribute $4.41 billion and $1.33 billion, respectively, in 2023, and are expected to grow substantially in the upcoming years.

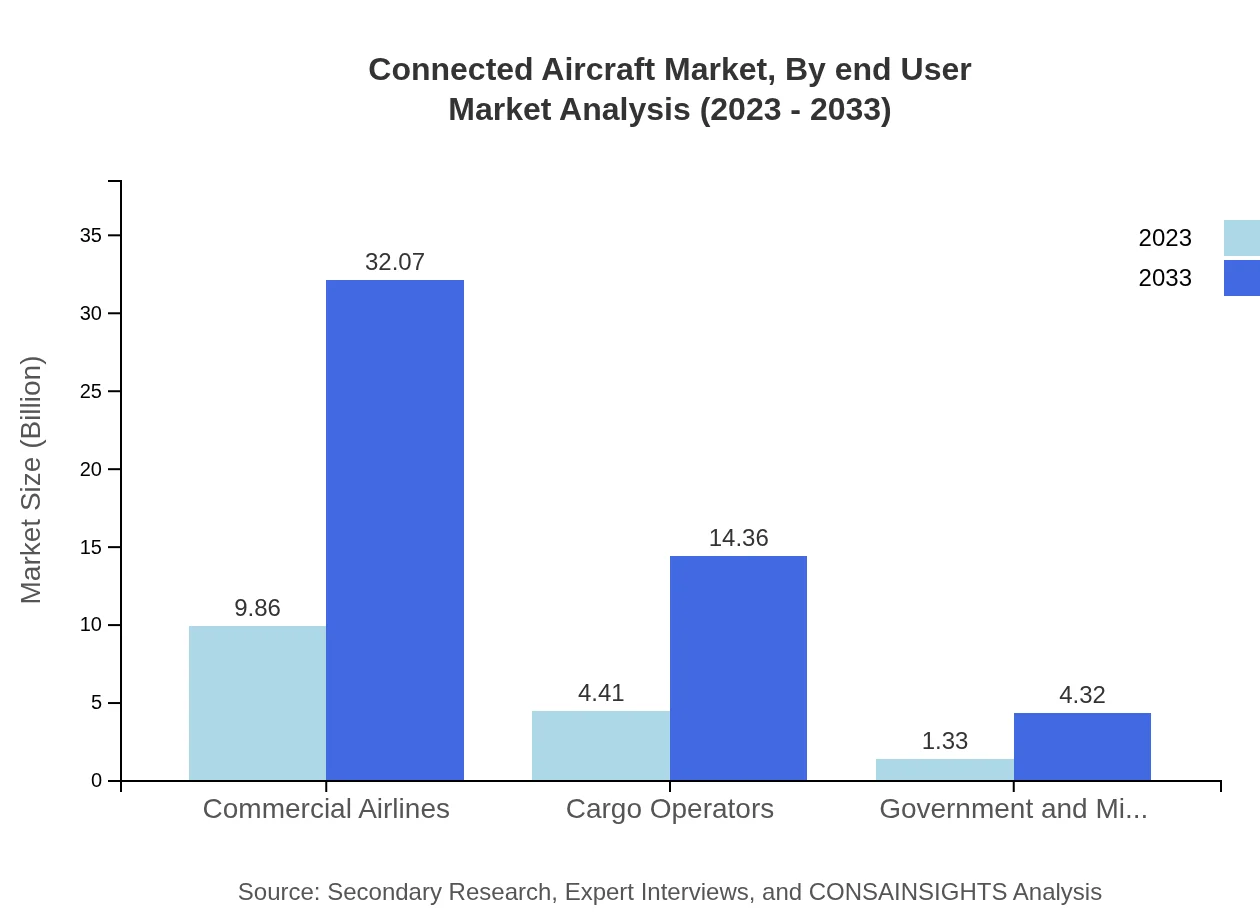

Connected Aircraft Market Analysis By End User

The end-user segmentation includes commercial airlines, cargo operators, and government/military users. Commercial airlines represent the largest segment, with a market size of $9.86 billion in 2023, expected to grow to $32.07 billion by 2033, while cargo operators and government/military use cases also reflect strong growth with estimated sizes of $4.41 billion and $1.33 billion, respectively, in 2023.

Connected Aircraft Market Analysis By Region

The regional analysis reiterates the varying dynamics of the market across geographical boundaries, with North America leading, followed by Europe and Asia Pacific. Each region showcases unique adoption patterns, influenced by local regulations, air travel trends, and technological advancements.

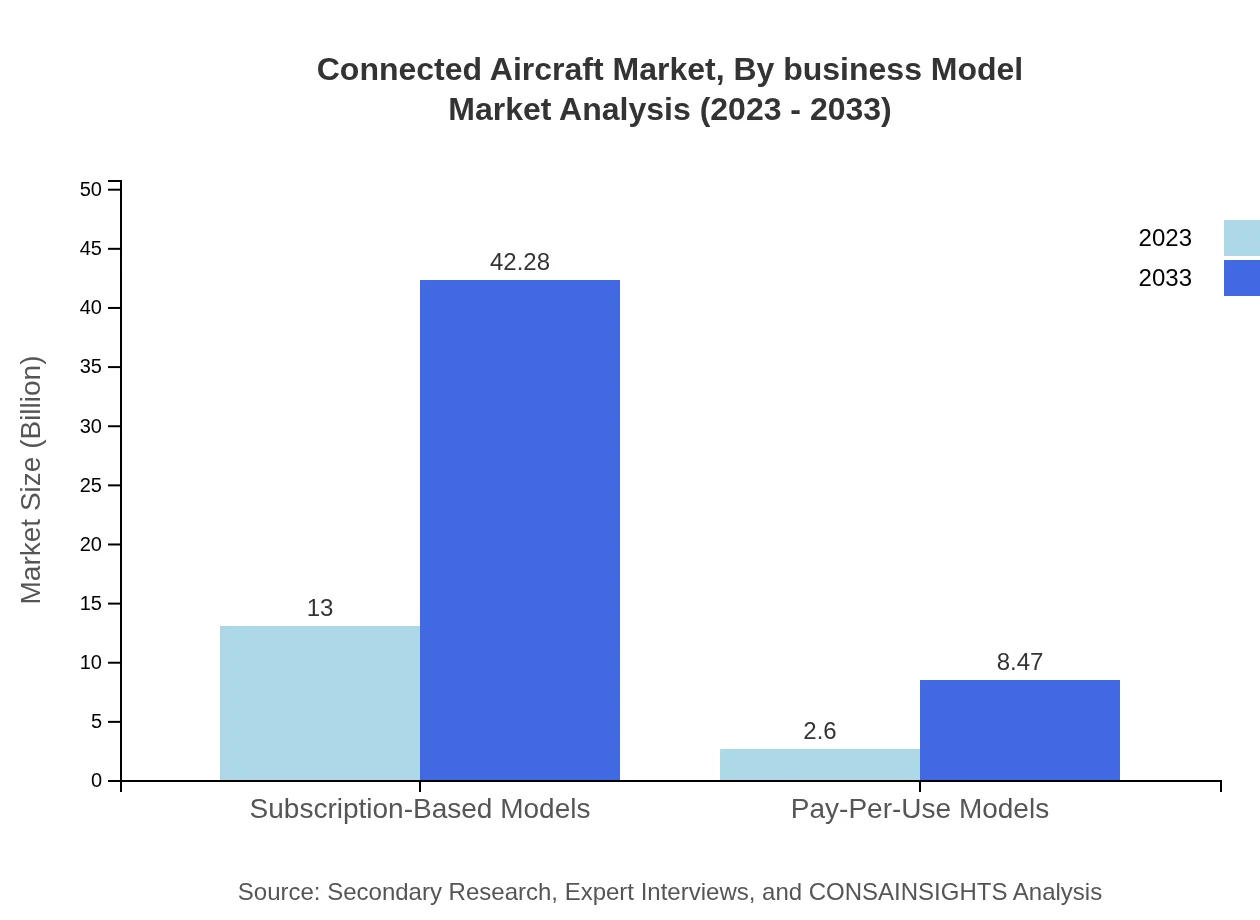

Connected Aircraft Market Analysis By Business Model

The business model segment illustrates the predominant use of subscription-based models which hold a market size of $13.00 billion in 2023, projected to expand to $42.28 billion by 2033. Pay-per-use models enjoy a smaller share yet are essential in providing flexible solutions for consumers, growing from $2.60 billion in 2023 to $8.47 billion by 2033.

Connected Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Connected Aircraft Industry

Honeywell International Inc.:

A leader in aerospace technology, Honeywell offers advanced connectivity solutions that enhance flight safety, real-time performance, and passenger experience.Gogo Inc.:

A prominent provider of in-flight internet access and connectivity solutions for commercial aviation, helping airlines improve passenger experience and operational efficiency.L3 Technologies, Inc.:

Known for providing critical communication and analytics services for the aviation sector, focusing on efficiency and safety enhancements in connected aircraft.Thales Group:

Thales specializes in high technology solutions for the aviation sector, including satellite communications and in-flight entertainment systems that enrich the passenger experience.Vodafone Business:

Provides innovative connectivity solutions specifically designed for aviation, enhancing data transmissions and operational insights for airlines.We're grateful to work with incredible clients.

FAQs

What is the market size of connected Aircraft?

The global connected aircraft market is projected to grow from $15.6 billion in 2023 to an estimated size in 2033, expanding at a robust CAGR of 12% over the decade.

What are the key market players or companies in this connected Aircraft industry?

Key players in the connected aircraft industry include major aerospace companies and technology firms leading innovation in communication, navigation, and passenger experience technologies. Leading companies are driving advancements to enhance operational efficiency and connectivity.

What are the primary factors driving the growth in the connected Aircraft industry?

Growth in the connected aircraft market is driven by increasing demand for enhanced passenger experiences, operational efficiency improvements, and advancements in communication technologies. The integration of IoT and real-time data systems is also pivotal to market expansion.

Which region is the fastest Growing in the connected Aircraft?

North America is identified as the fastest-growing region in the connected aircraft market. The market size is projected to escalate from $5.06 billion in 2023 to $16.47 billion by 2033, driven by technological innovations and robust aviation infrastructure.

Does ConsaInsights provide customized market report data for the connected Aircraft industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the connected aircraft industry, providing detailed insights into market dynamics, trends, and forecasts to support strategic decision-making.

What deliverables can I expect from this connected Aircraft market research project?

Deliverables from the connected aircraft market research project include comprehensive market reports, trend analyses, competitive landscape evaluations, and regional insights, designed to inform strategic planning and investment decisions.

What are the market trends of connected Aircraft?

Current trends in the connected aircraft market include a shift toward subscription-based models, increased use of sensor technologies for monitoring, and integration of advanced communication systems, indicating a significant transformation in aviation connectivity.