Connected Logistics Market Report

Published Date: 22 January 2026 | Report Code: connected-logistics

Connected Logistics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Connected Logistics market from 2023 to 2033, offering insights into market size, growth trends, segmentation, regional analysis, and technological advancements shaping the industry.

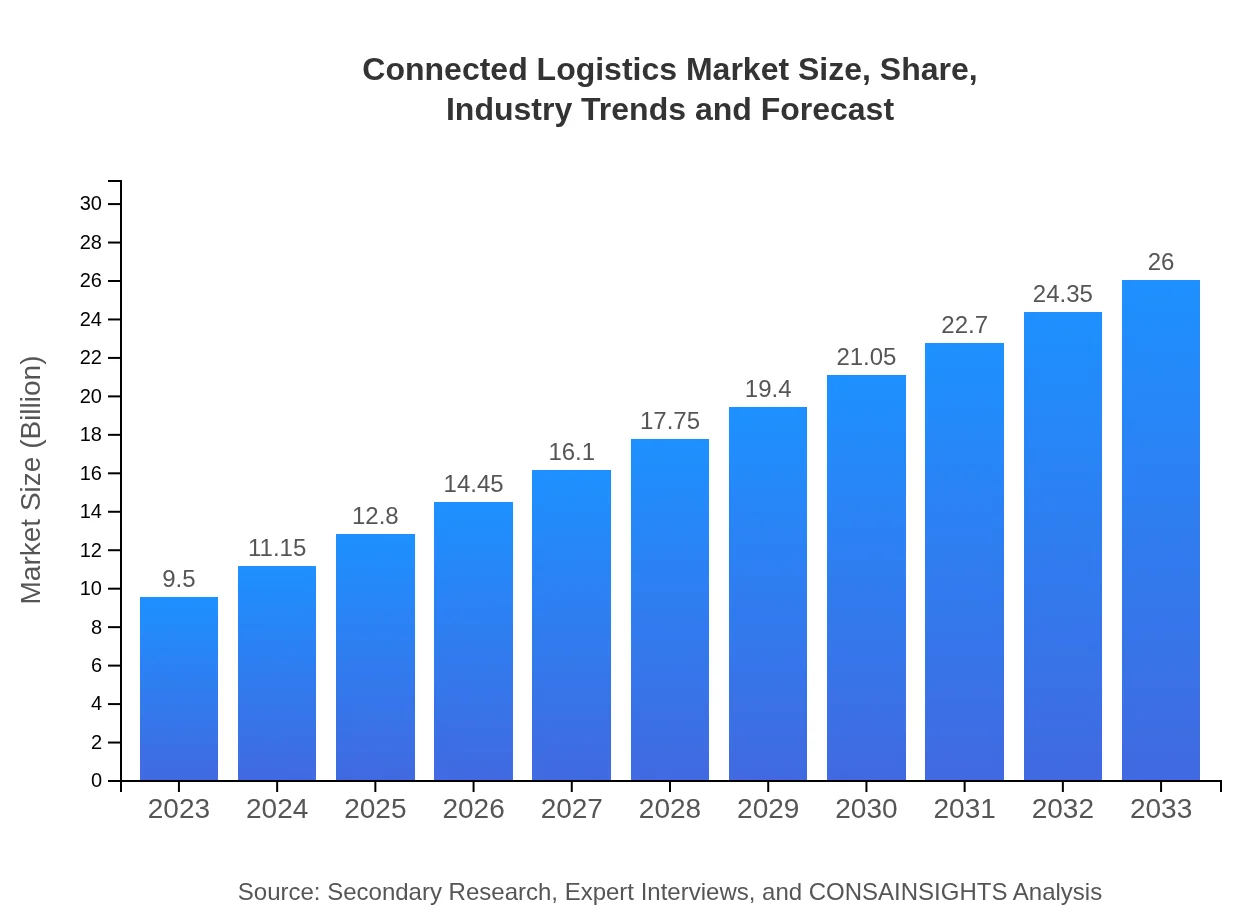

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $26.00 Billion |

| Top Companies | SAP SE, Oracle Corporation, IBM, Amazon Web Services |

| Last Modified Date | 22 January 2026 |

Connected Logistics Market Overview

Customize Connected Logistics Market Report market research report

- ✔ Get in-depth analysis of Connected Logistics market size, growth, and forecasts.

- ✔ Understand Connected Logistics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Connected Logistics

What is the Market Size & CAGR of Connected Logistics market in 2023?

Connected Logistics Industry Analysis

Connected Logistics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Connected Logistics Market Analysis Report by Region

Europe Connected Logistics Market Report:

Europe's Connected Logistics market is anticipated to grow from $2.57 billion in 2023 to $7.02 billion by 2033. The region is witnessing heightened demand for digitization in logistics operations, with sustainability and compliance driving technology investments.Asia Pacific Connected Logistics Market Report:

In 2023, the Asia Pacific market for Connected Logistics is valued at $1.83 billion, with expectations to grow to $5.01 billion by 2033 due to rising e-commerce activities and investments in smart warehouses across countries like China and India, which are leveraging technology to streamline supply chains.North America Connected Logistics Market Report:

North America represents the largest segment of the Connected Logistics market, with a valuation of $3.30 billion in 2023, forecasted to expand to $9.03 billion by 2033. The proliferation of advanced technologies and a strong focus on operational efficiency significantly contribute to this growth.South America Connected Logistics Market Report:

South America currently presents a Connected Logistics market size of $0.48 billion in 2023, projected to reach $1.32 billion by 2033. This growth is primarily driven by increasing globalization and the region's adoption of innovative logistics solutions to overcome infrastructural challenges.Middle East & Africa Connected Logistics Market Report:

The Connected Logistics market in the Middle East and Africa is valued at $1.33 billion in 2023 and is expected to grow to $3.63 billion by 2033. Countries in this region are increasingly adopting smart logistics solutions to enhance operational efficiency in light of growing economic diversification efforts.Tell us your focus area and get a customized research report.

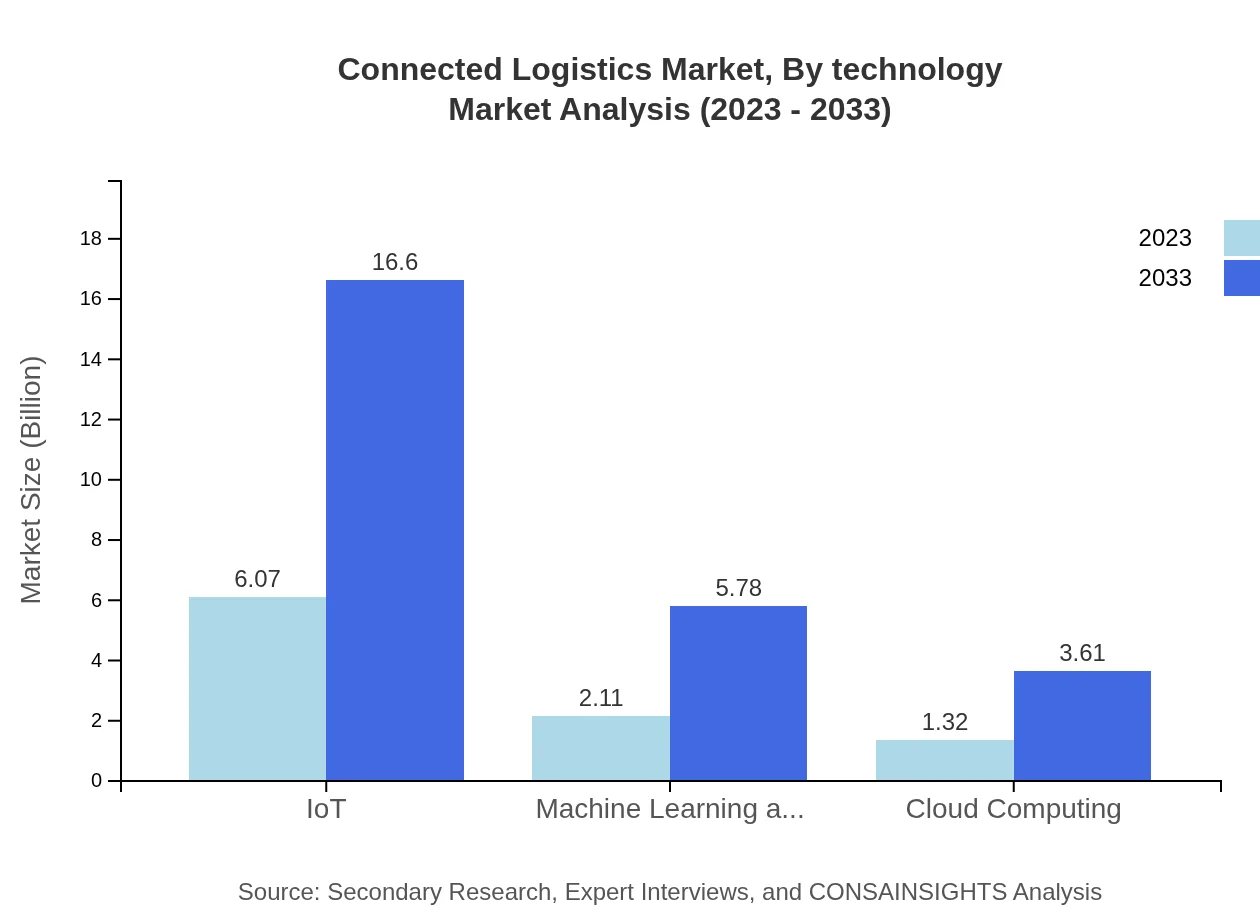

Connected Logistics Market Analysis By Technology

The Connected Logistics market exhibits a robust performance across various technologies. IoT holds a significant share of the market, valued at $6.07 billion in 2023 and projected to reach $16.60 billion by 2033, representing 63.86% market share. Similarly, Machine Learning and AI are pivotal, with a 2023 market size of $2.11 billion, expected to grow to $5.78 billion by 2033, maintaining a share of 22.24%.

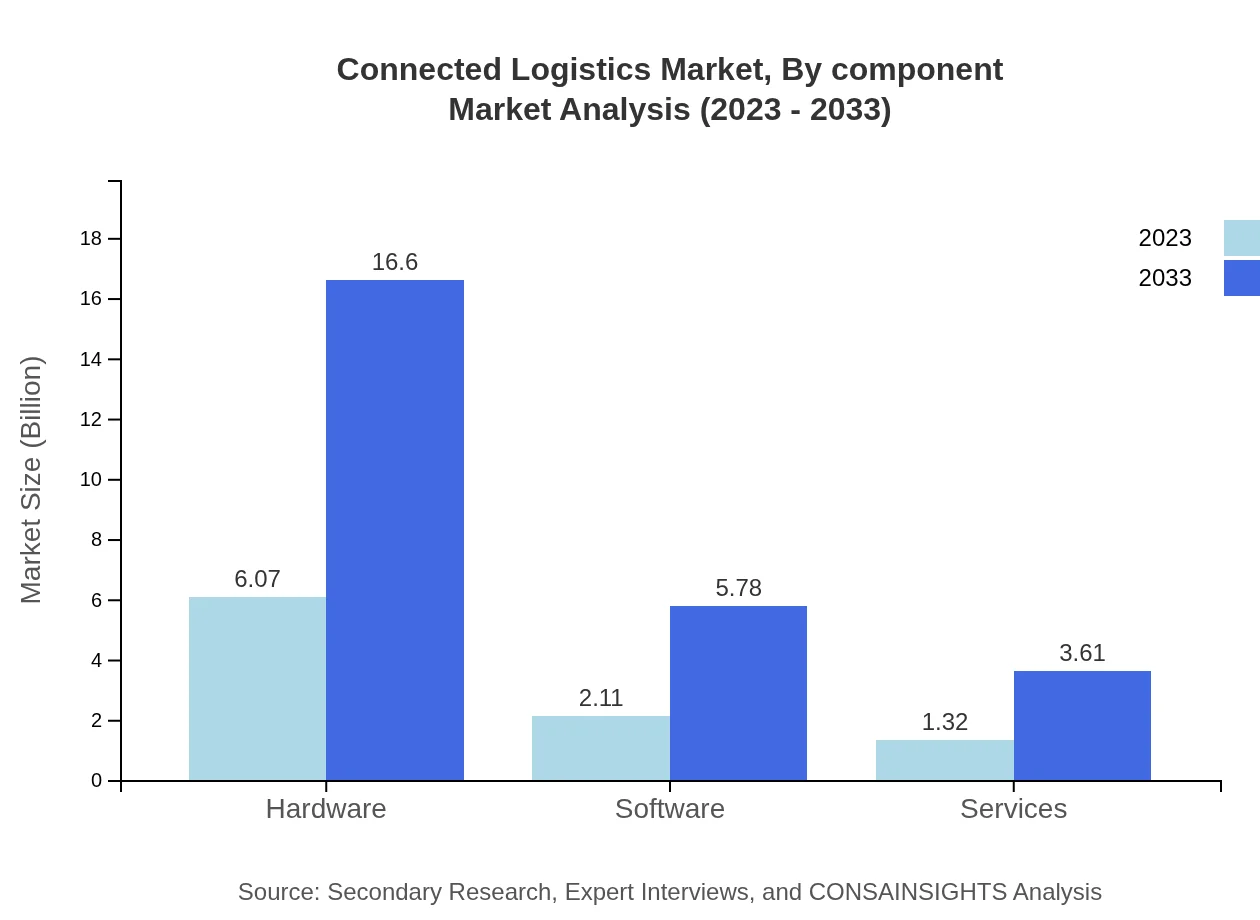

Connected Logistics Market Analysis By Component

Components of the Connected Logistics market are primarily hardware and software-driven. Hardware leads with a market size of $6.07 billion in 2023, expected to rise to $16.60 billion by 2033, retaining a 63.86% share. Services, while smaller, play a crucial role, with a size of $1.32 billion in 2023 projected to grow to $3.61 billion by 2033, accounting for 13.9% of the share.

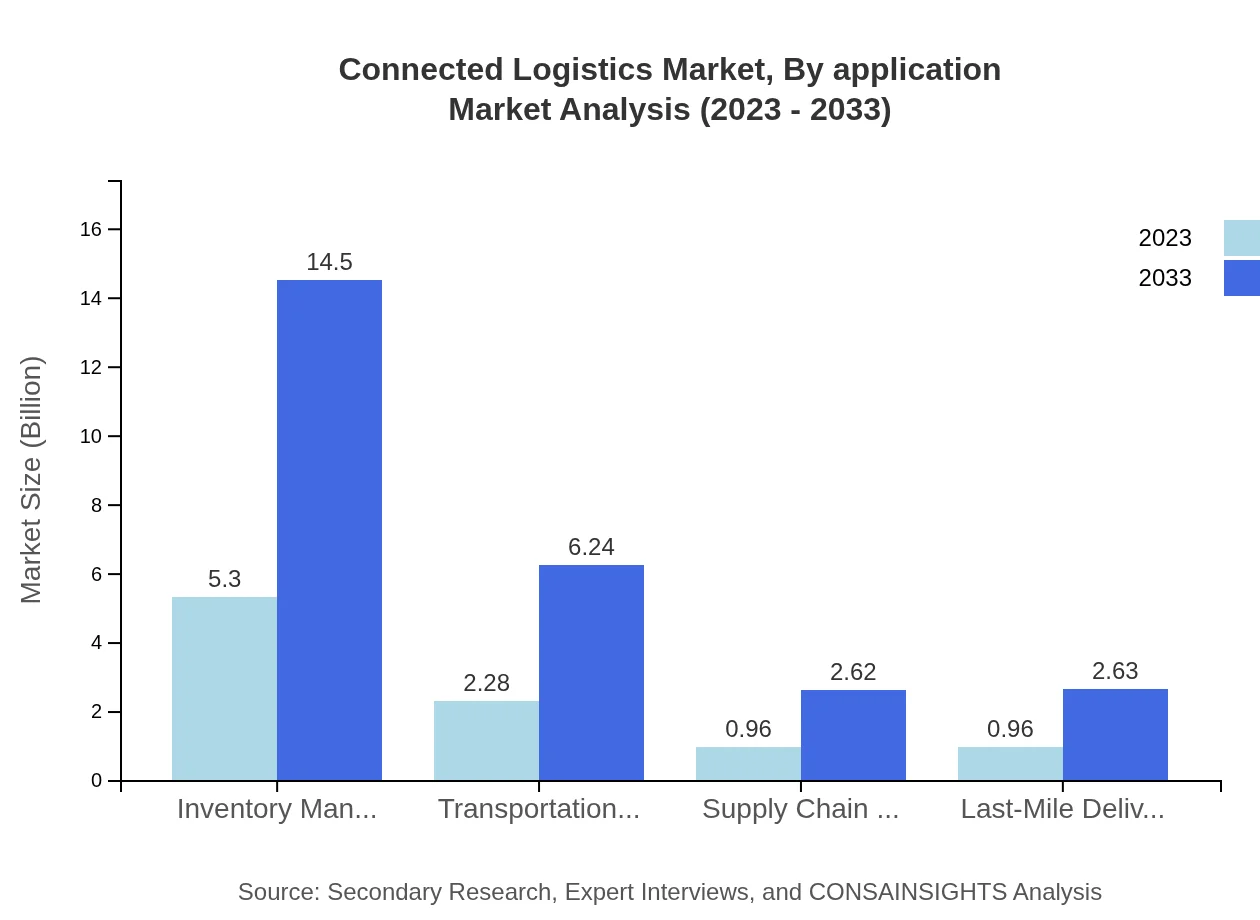

Connected Logistics Market Analysis By Application

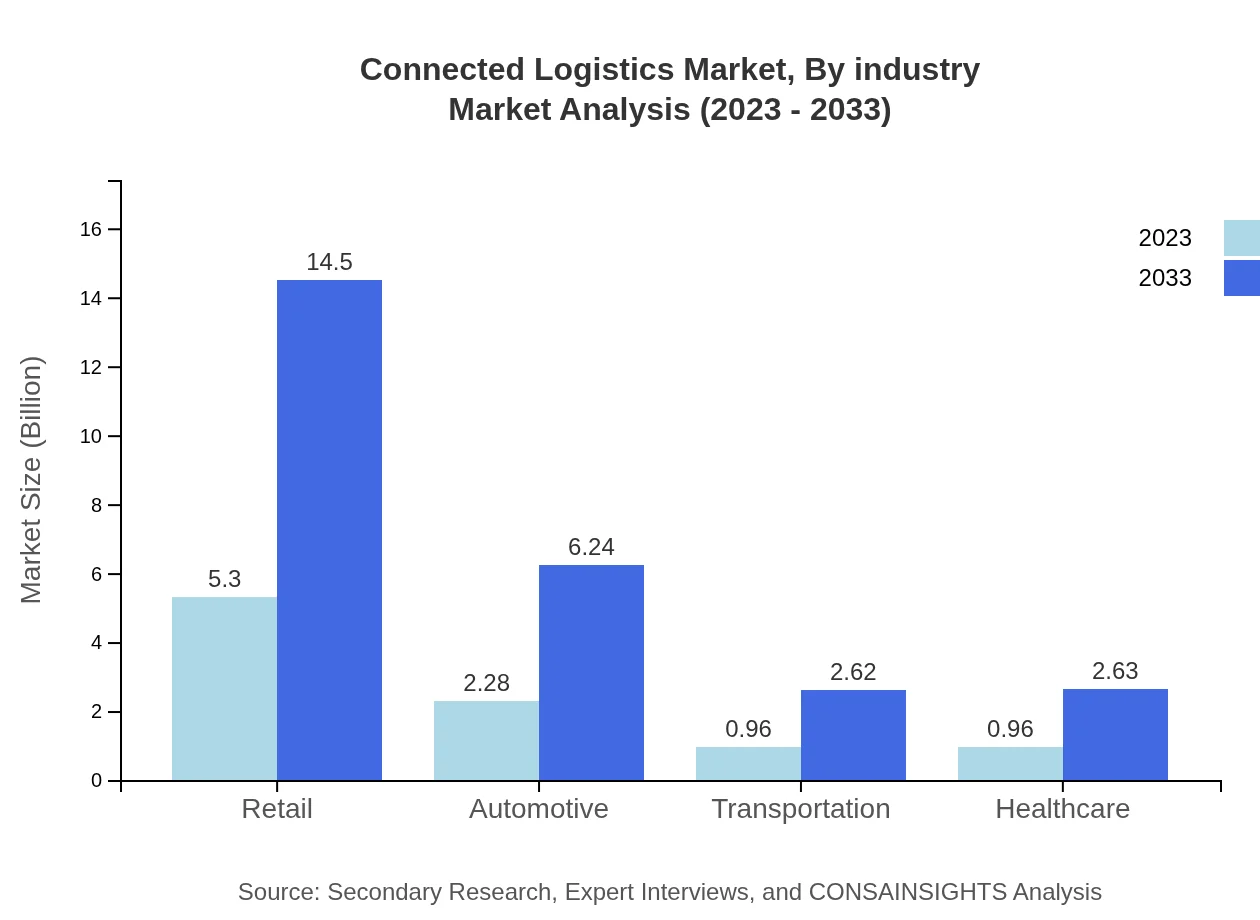

Retail is the leading application segment in the Connected Logistics market, valued at $5.30 billion in 2023 and projected to grow to $14.50 billion by 2033 with a consistent share of 55.78%. This is followed by the automotive and transportation sectors, with market sizes expected to reach $6.24 billion and $2.62 billion respectively by 2033.

Connected Logistics Market Analysis By Industry

The industry segmentation shows retail dominating the sector, while automotive and healthcare hold significant portions as well. In 2023, the automotive industry contributes $2.28 billion, projected to grow to $6.24 billion by 2033, reflecting a strong adoption of connected technologies that enhance supply chain efficiency.

Connected Logistics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Connected Logistics Industry

SAP SE:

SAP SE is a pioneer in enterprise software and solutions, offering innovative logistics management systems aimed at improving supply chain efficiency and visibility.Oracle Corporation:

Oracle offers robust cloud-based logistics solutions that facilitate connected logistics, improving data accuracy and operational insights for businesses globally.IBM:

IBM provides a range of AI and blockchain solutions to enhance transparency and efficiency in connected logistics ecosystems, enabling businesses to respond rapidly to changes in demand.Amazon Web Services:

AWS is at the forefront of providing scalable cloud solutions that facilitate real-time data tracking and management in logistics, driving innovation in supply chain operations.We're grateful to work with incredible clients.

FAQs

What is the market size of connected logistics?

The connected logistics market is projected to reach $9.5 billion in 2023, growing at a CAGR of 10.2%. By 2033, it is estimated to increase significantly, reflecting strong demand for integrated logistics solutions.

What are the key market players or companies in the connected logistics industry?

Key players in the connected logistics industry include major technology and logistics firms that provide innovative solutions in IoT, AI, and cloud computing. Companies like IBM, SAP, and Oracle are often highlighted for their contributions to this sector.

What are the primary factors driving the growth in the connected logistics industry?

Growth in the connected logistics industry is driven by rising demand for efficiency, technological advancements in IoT and cloud computing, and the need for real-time data analytics. Additionally, increasing consumer expectations for faster delivery play a vital role.

Which region is the fastest Growing in connected logistics?

North America is the fastest-growing region in the connected logistics market, with its market size projected to rise from $3.30 billion in 2023 to $9.03 billion in 2033. This growth is fueled by advanced technological adoption and infrastructure.

Does ConsaInsights provide customized market report data for the connected logistics industry?

Yes, ConsaInsights offers customized market report data for the connected logistics industry. Clients can request tailored insights and data specific to their market needs, ensuring relevant and actionable information.

What deliverables can I expect from this connected logistics market research project?

From the connected logistics market research project, you can expect detailed market analysis reports, segment-specific insights, trend analysis, growth forecasts, and actionable recommendations for strategic decision-making.

What are the market trends of connected logistics?

Current trends in the connected logistics market include increased integration of AI and machine learning, growing emphasis on supply chain visibility, and the evolution of last-mile delivery solutions driven by e-commerce demands.