Connected Truck Market Report

Published Date: 02 February 2026 | Report Code: connected-truck

Connected Truck Market Size, Share, Industry Trends and Forecast to 2033

This report presents an extensive analysis of the Connected Truck market from 2023 to 2033, including insights on market size, growth factors, segmentation, regional performance, and key players. It aims to provide stakeholders with actionable intelligence to navigate the evolving landscape of Connected Truck technology.

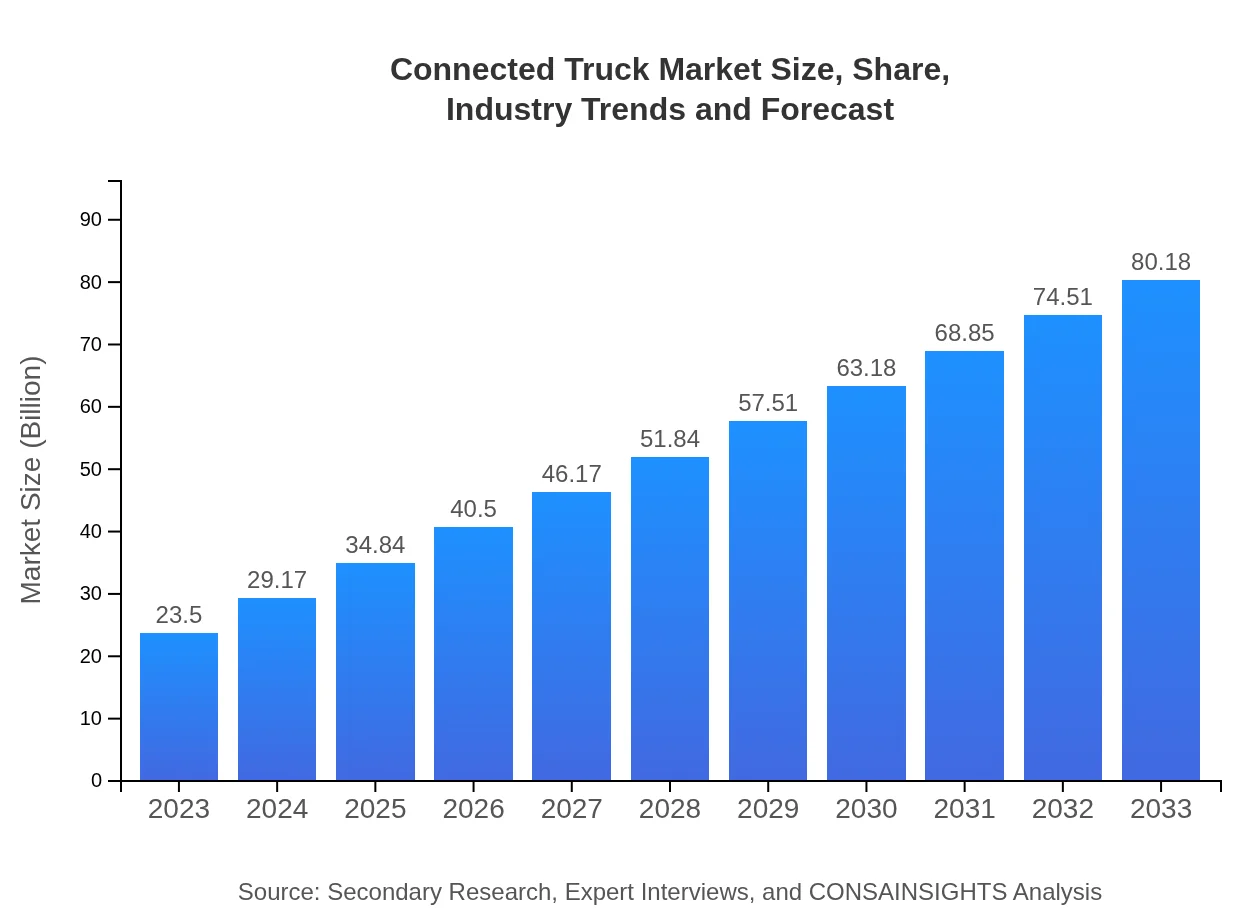

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $80.18 Billion |

| Top Companies | Teletrac Navman, Geotab, Omnicomm, Telematics Technologies |

| Last Modified Date | 02 February 2026 |

Connected Truck Market Overview

Customize Connected Truck Market Report market research report

- ✔ Get in-depth analysis of Connected Truck market size, growth, and forecasts.

- ✔ Understand Connected Truck's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Connected Truck

What is the Market Size & CAGR of Connected Truck market in 2023?

Connected Truck Industry Analysis

Connected Truck Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Connected Truck Market Analysis Report by Region

Europe Connected Truck Market Report:

The European market for Connected Trucks is projected to increase from $5.72 billion in 2023 to $19.50 billion by 2033. Factors such as robust adoption of connectivity technologies, environmental regulations, and government initiatives to foster autonomous vehicles are propelling growth.Asia Pacific Connected Truck Market Report:

In 2023, the Connected Truck market in the Asia Pacific region is valued at approximately $4.79 billion and is projected to grow to $16.34 billion by 2033. The growth can be attributed to rising urbanization, increased investments in connected infrastructure, and the incorporation of smart technologies in fleet operations.North America Connected Truck Market Report:

North America is a significant market for Connected Trucks, starting at $8.19 billion in 2023 and expected to soar to $27.95 billion by 2033. The increased focus on operational efficiency, stringent safety regulations, and the presence of major logistics companies are contributing to this growth.South America Connected Truck Market Report:

The South America Connected Truck market is expected to grow from $2.31 billion in 2023 to $7.88 billion by 2033. The surge in demand for logistics solutions and government initiatives aimed at improving road infrastructure are key drivers for market expansion in the region.Middle East & Africa Connected Truck Market Report:

In the Middle East and Africa, the Connected Truck market is anticipated to rise from $2.49 billion in 2023 to $8.51 billion by 2033. The growing logistics sector and investments in smart transport infrastructure are pivotal for the region's market development.Tell us your focus area and get a customized research report.

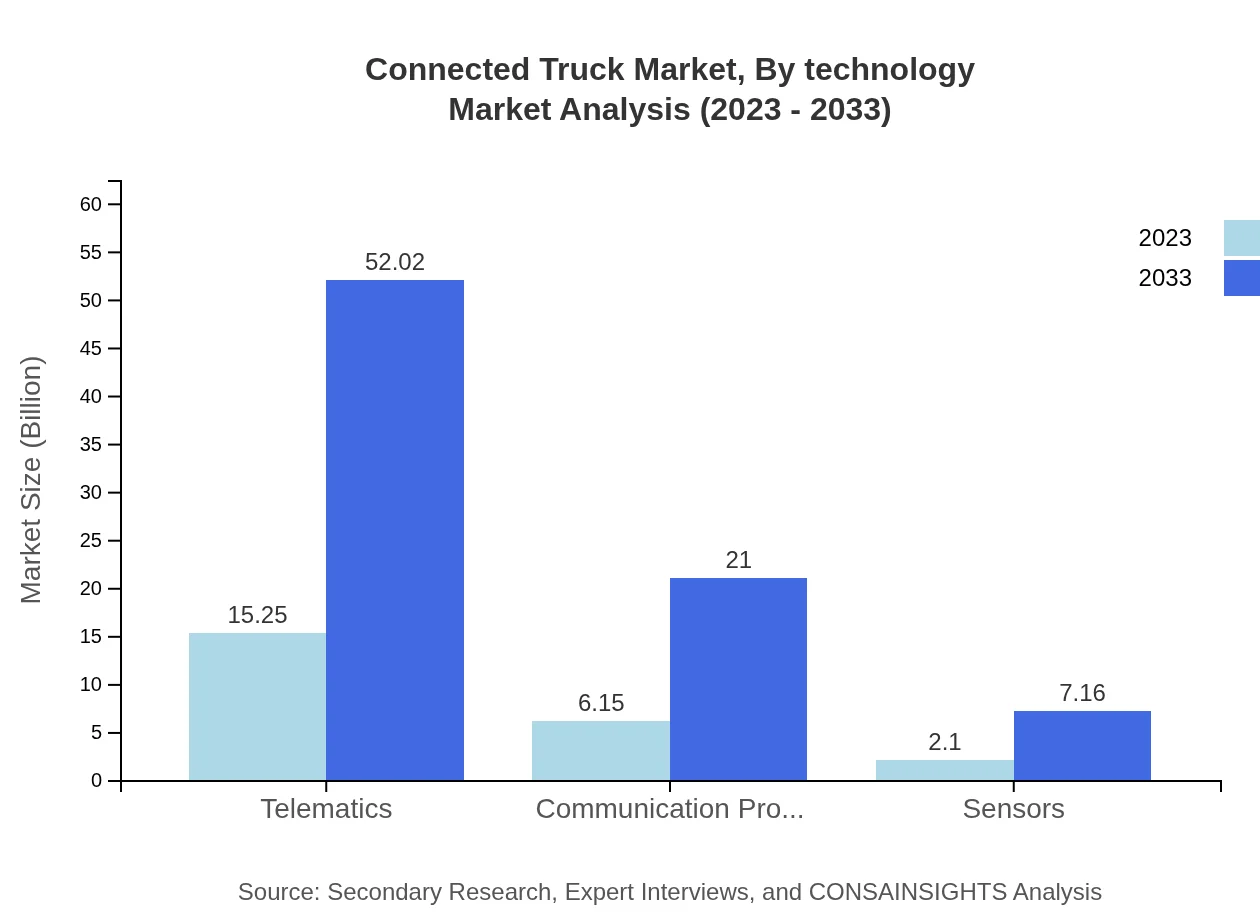

Connected Truck Market Analysis By Technology

The Connected Truck market's technology segment includes telematics, communication protocols, and sensors. Telecommunication solutions dominate the market, valued at $15.25 billion in 2023, with an expected growth to $52.02 billion by 2033, while communication protocols and sensors are also seeing significant advancements.

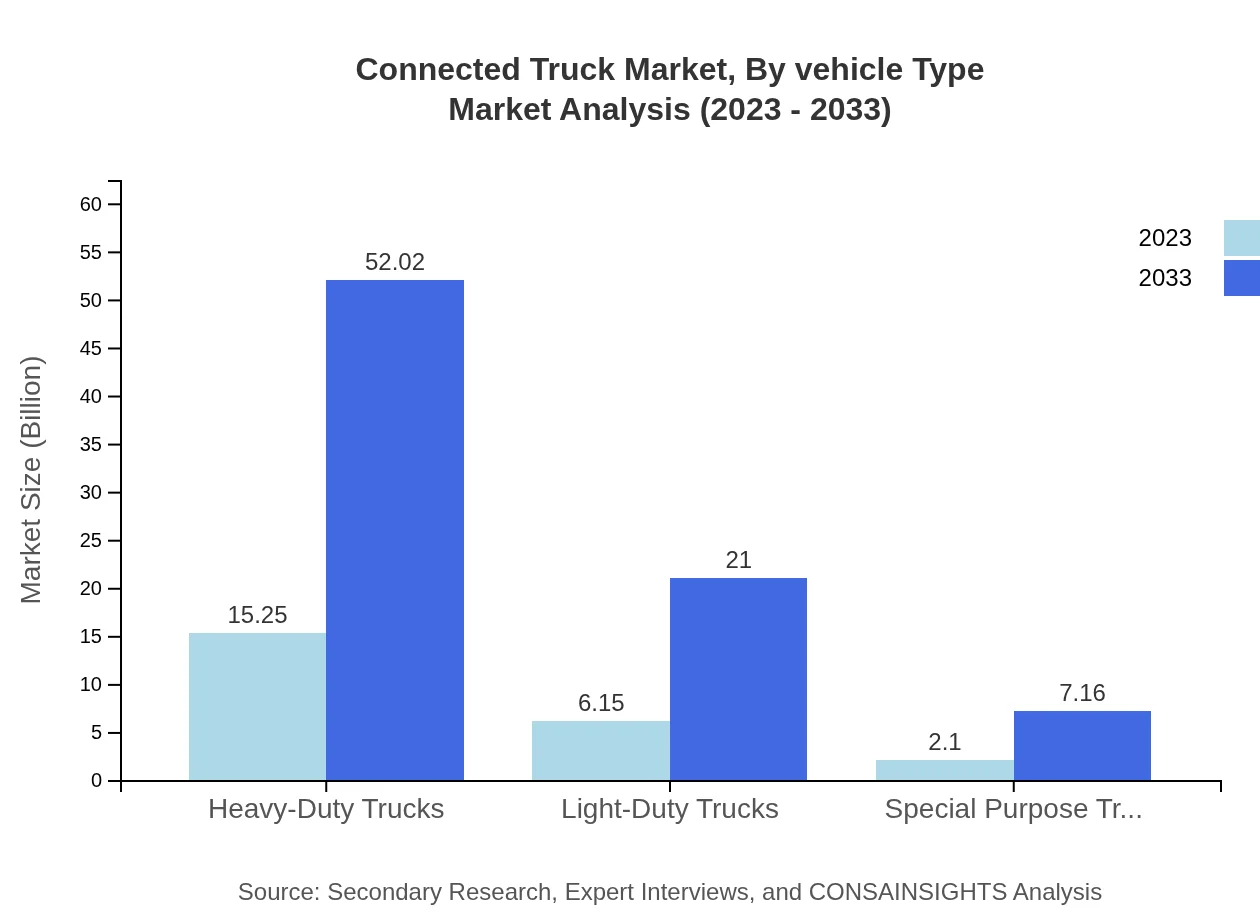

Connected Truck Market Analysis By Vehicle Type

The vehicle type segment divides the market into heavy-duty trucks, light-duty trucks, and special-purpose trucks. Heavy-duty trucks contribute the majority of the market share at $15.25 billion in 2023, and they are poised to expand to $52.02 billion by 2033, driven by logistics and freight transportation demand.

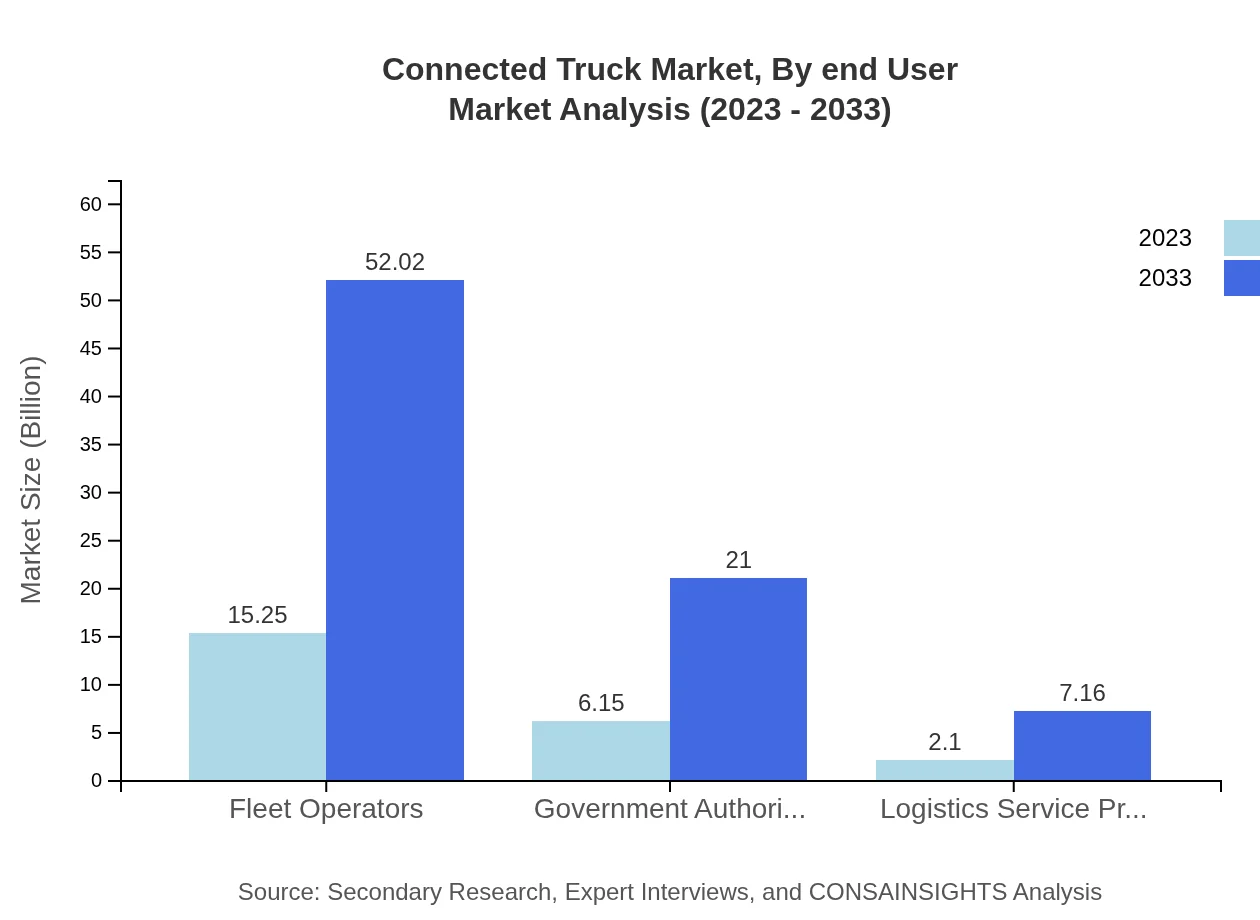

Connected Truck Market Analysis By End User

In terms of end-user segmentation, fleet operators lead the market at $15.25 billion for 2023, with forecasted growth to $52.02 billion by 2033. Government authorities and logistics service providers also play critical roles, focusing on improving safety and efficiency within their operations.

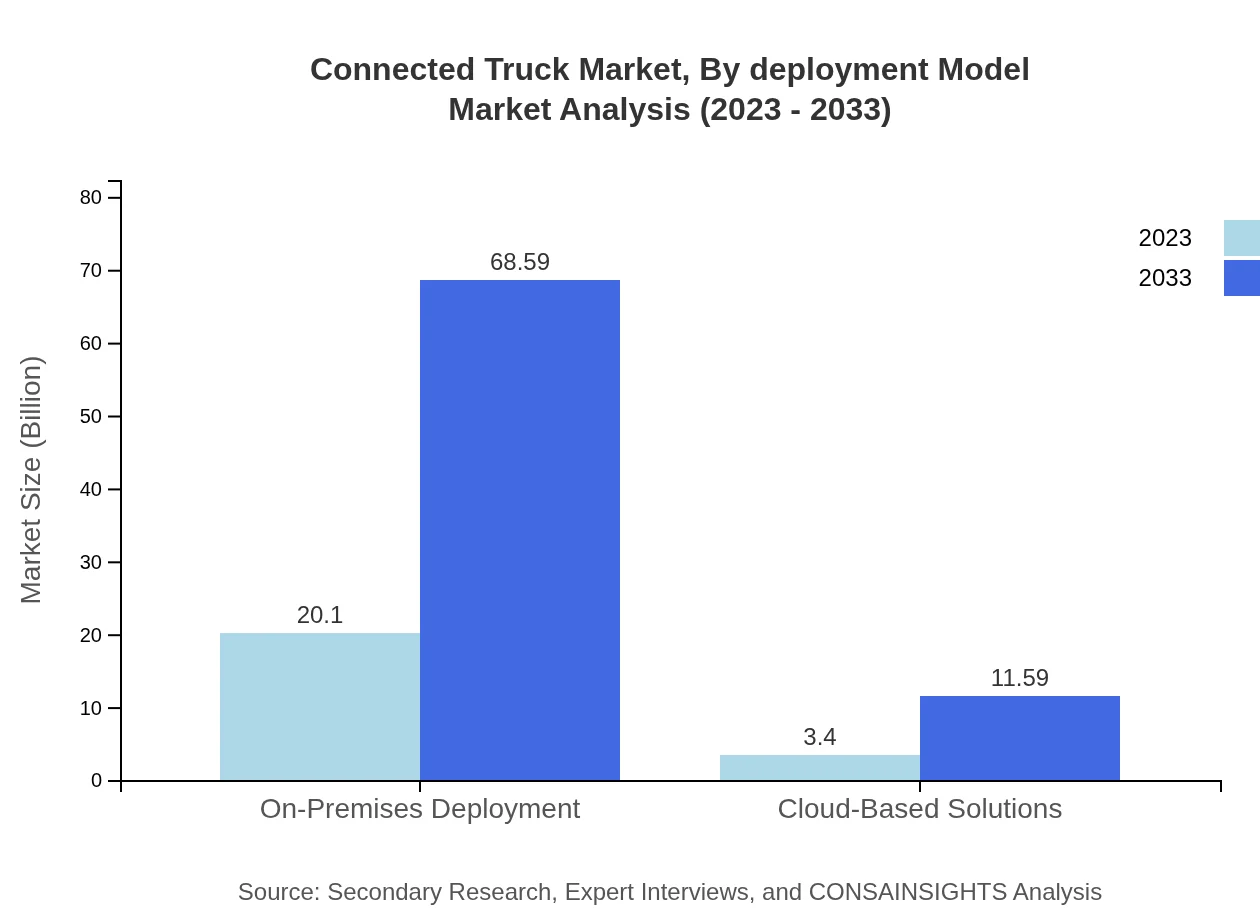

Connected Truck Market Analysis By Deployment Model

The deployment model segment encompasses both on-premises and cloud-based solutions. On-premises deployment is currently leading the segment with a market size of $20.10 billion in 2023, expanding to $68.59 billion by 2033, due to greater data control and security needs.

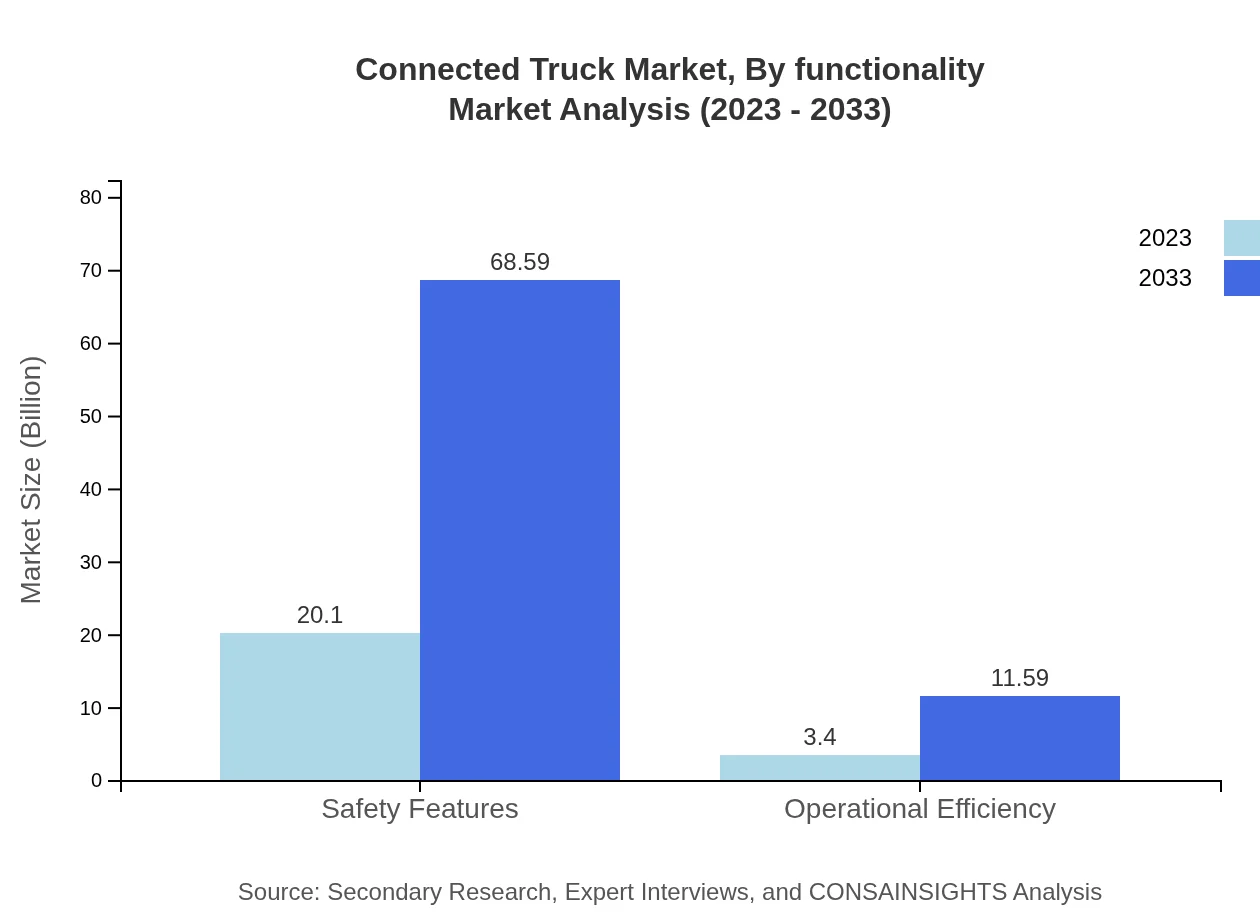

Connected Truck Market Analysis By Functionality

The functionality of Connected Trucks focuses on features such as safety, operational efficiency, and telematics. Safety features are projected to grow from $20.10 billion in 2023 to $68.59 billion by 2033, reflecting escalating concerns over road safety and regulatory compliance.

Connected Truck Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Connected Truck Industry

Teletrac Navman:

Teletrac Navman is a leader in fleet management technology, providing comprehensive telematics solutions that improve fleet visibility, efficiency, and safety.Geotab:

Geotab is a global leader in IoT and connected vehicles, providing advanced telematics solutions designed for optimizing vehicle fleets and enhancing operational performance.Omnicomm:

Omnicomm specializes in fuel management systems and telematics for heavy-duty trucks, enabling operators to track fuel consumption and operational costs effectively.Telematics Technologies:

Telematics Technologies provides integrated solutions for fleet management, emphasizing real-time tracking, driver behavior monitoring, and safety enhancements.We're grateful to work with incredible clients.

FAQs

What is the market size of the Connected Truck industry?

The Connected Truck market was valued at approximately $23.5 billion in 2023, and it is expected to grow at a CAGR of 12.5%, reaching significant milestones by 2033.

What are the key market players or companies in the Connected Truck industry?

Key players in the Connected Truck market include major automotive manufacturers and technology firms that provide telematics, vehicle safety systems, and connectivity solutions tailored to the trucking sector.

What are the primary factors driving the growth in the Connected Truck industry?

Key growth drivers for the Connected Truck industry include increased demand for fleet management solutions, advancements in IoT technology, and growing emphasis on safety and operational efficiency within logistics.

Which region is the fastest Growing in the Connected Truck industry?

The Connected Truck market is experiencing rapid growth in North America, forecasted to reach $27.95 billion by 2033, driven by advanced technological integration and robust logistics infrastructure.

Does ConsaInsights provide customized market report data for the Connected Truck industry?

Yes, ConsaInsights offers tailored market reports for the Connected Truck industry, allowing clients to access specific data and insights based on unique business needs and strategic objectives.

What deliverables can I expect from this Connected Truck market research project?

Deliverables typically include a comprehensive market analysis report, regional and segment insights, competitive landscape evaluation, and strategic recommendations to guide decision-making.

What are the market trends of the Connected Truck industry?

Current trends in the Connected Truck industry encompass the integration of AI and machine learning in fleet management, the rise of sustainability-focused solutions, and the increasing adoption of safety and operational efficiency technologies.