Construction Composites Market Report

Published Date: 22 January 2026 | Report Code: construction-composites

Construction Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Construction Composites market, covering key industry insights from 2023 to 2033. It delves into market size, growth projections, regional dynamics, and trends impacting this evolving sector.

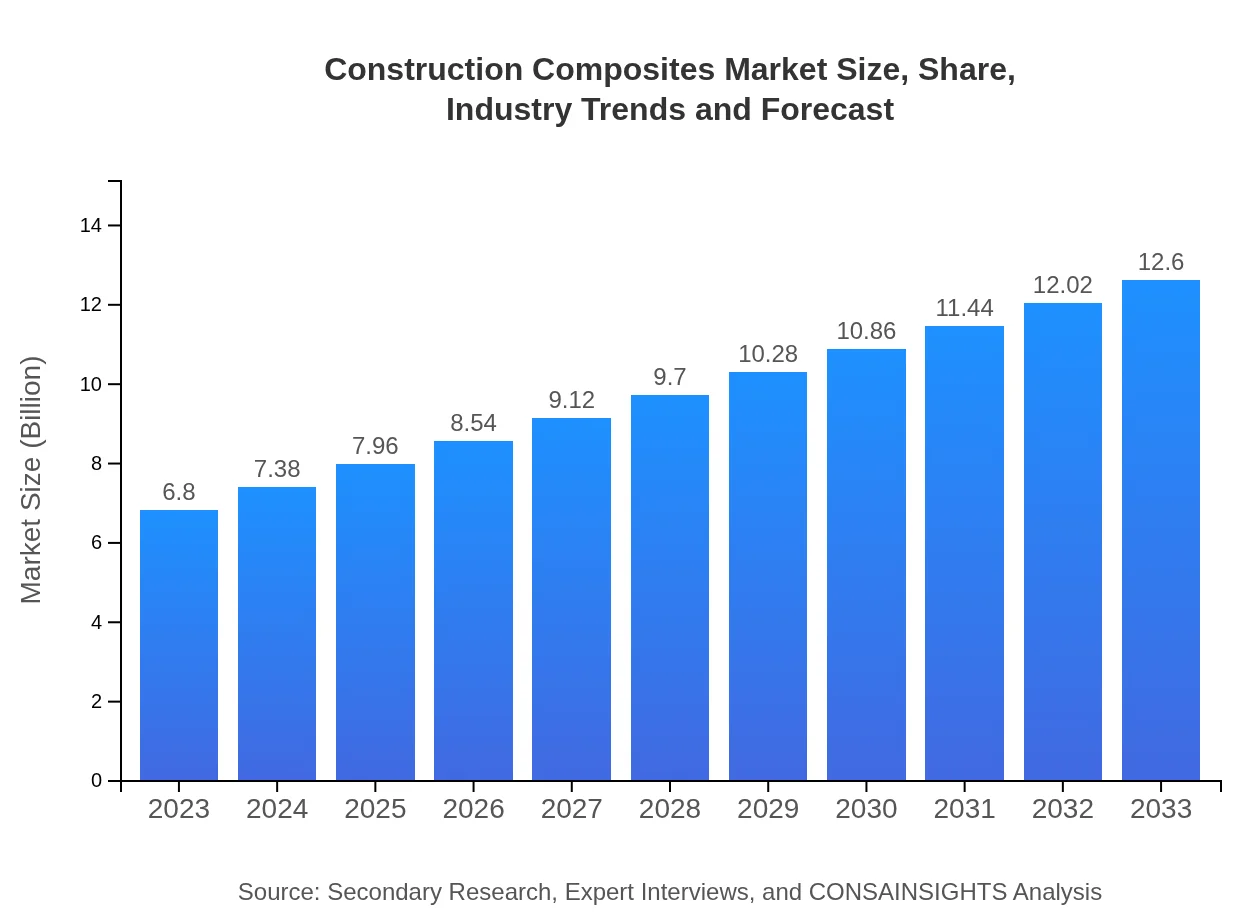

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $12.60 Billion |

| Top Companies | Hexcel Corporation, BASF SE, Gurit Holding AG, Toray Industries, Inc. |

| Last Modified Date | 22 January 2026 |

Construction Composites Market Overview

Customize Construction Composites Market Report market research report

- ✔ Get in-depth analysis of Construction Composites market size, growth, and forecasts.

- ✔ Understand Construction Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Composites

What is the Market Size & CAGR of Construction Composites market in 2023?

Construction Composites Industry Analysis

Construction Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Composites Market Analysis Report by Region

Europe Construction Composites Market Report:

In Europe, the market size is around $1.85 billion in 2023, with projections of reaching $3.42 billion by 2033. The region's demand for advanced composites is driven by stringent environmental regulations and growing investments in green building practices.Asia Pacific Construction Composites Market Report:

In 2023, the Construction Composites market in the Asia Pacific region is valued at approximately $1.31 billion and is expected to grow to $2.43 billion by 2033. This growth is driven by increased urbanization, government investments in infrastructure, and rising adoption of innovative construction technologies.North America Construction Composites Market Report:

North America holds a market value of $2.61 billion in 2023, expected to rise to $4.84 billion by 2033. The region is characterized by strong regulatory frameworks promoting sustainability, technological innovation in composite materials, and diversified applications across various construction sectors.South America Construction Composites Market Report:

The market in South America reached an estimated $0.16 billion in 2023 and is projected to grow to about $0.30 billion by 2033. Key growth factors include the expansion of construction activities and sustainability practices aimed at enhancing energy efficiency.Middle East & Africa Construction Composites Market Report:

The Middle East and Africa construction composites market is estimated at $0.87 billion in 2023, aiming for $1.61 billion by 2033. Factors influencing growth include rising construction activities amid urban expansion and an increasing focus on energy-efficient materials.Tell us your focus area and get a customized research report.

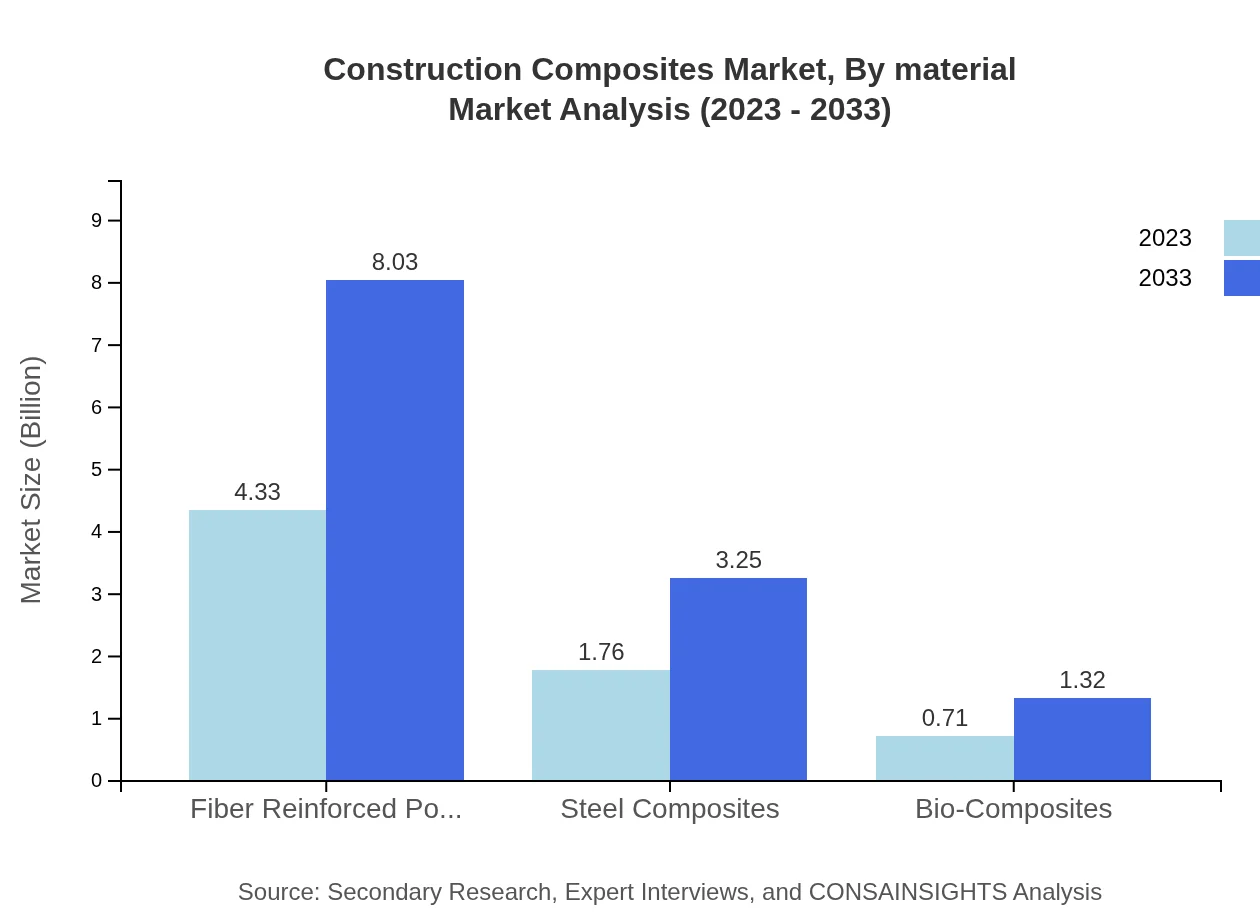

Construction Composites Market Analysis By Material

By 2023, the construction composites market, segmented by material, shows significant performance across various materials. Fiber Reinforced Polymer (FRP) holds the largest share, valued at approximately $4.33 billion and projected to reach $8.03 billion by 2033, accounting for about 63.71% of the market. Steel composites and bio-composites follow, contributing to diverse applications across infrastructure and building sectors.

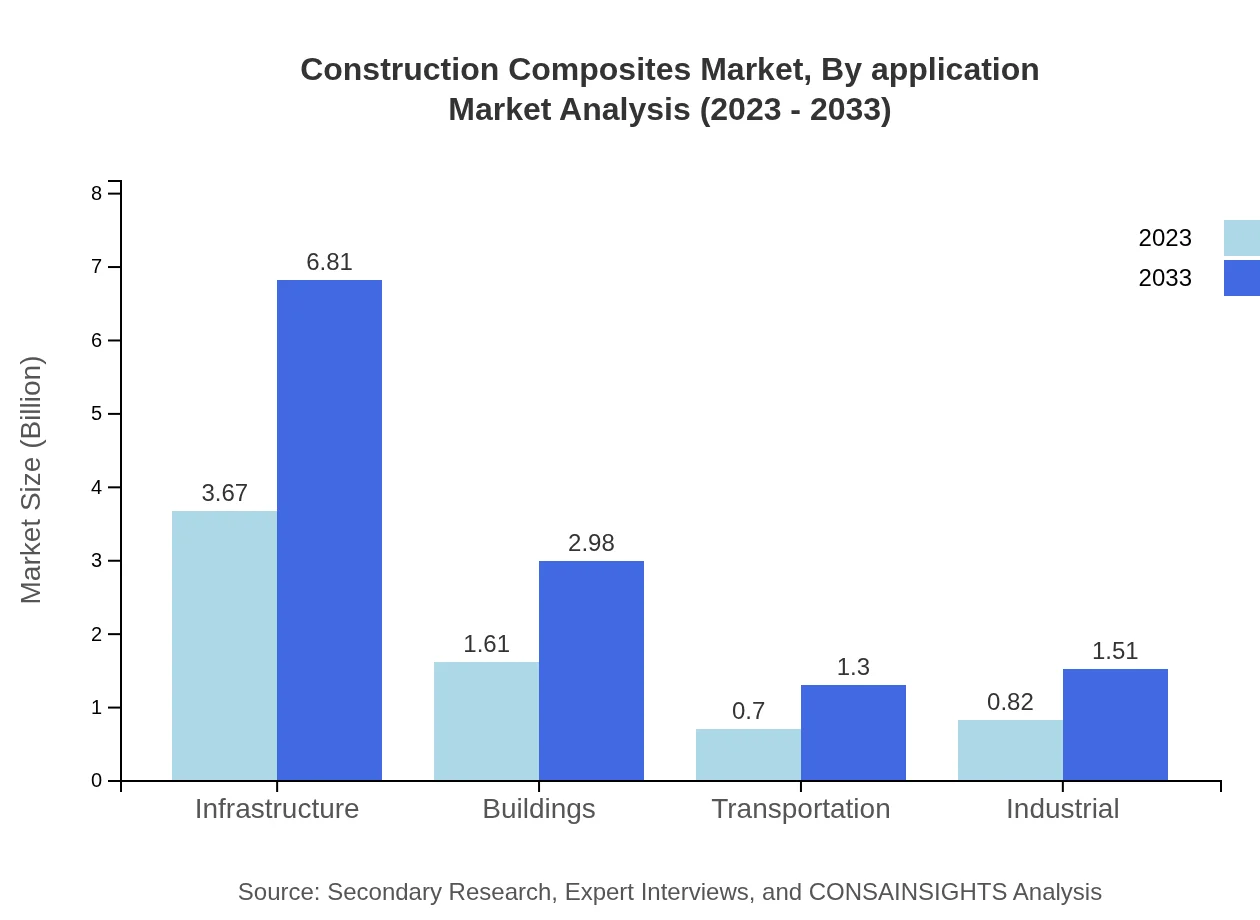

Construction Composites Market Analysis By Application

The market is primarily driven by applications in infrastructure, contributing approximately $3.67 billion in 2023 and expected to grow to $6.81 billion by 2033. Other significant applications include building constructions, which represent a considerable share at 23.69%, and transportation with a consistent market size aiming for $1.30 billion by 2033.

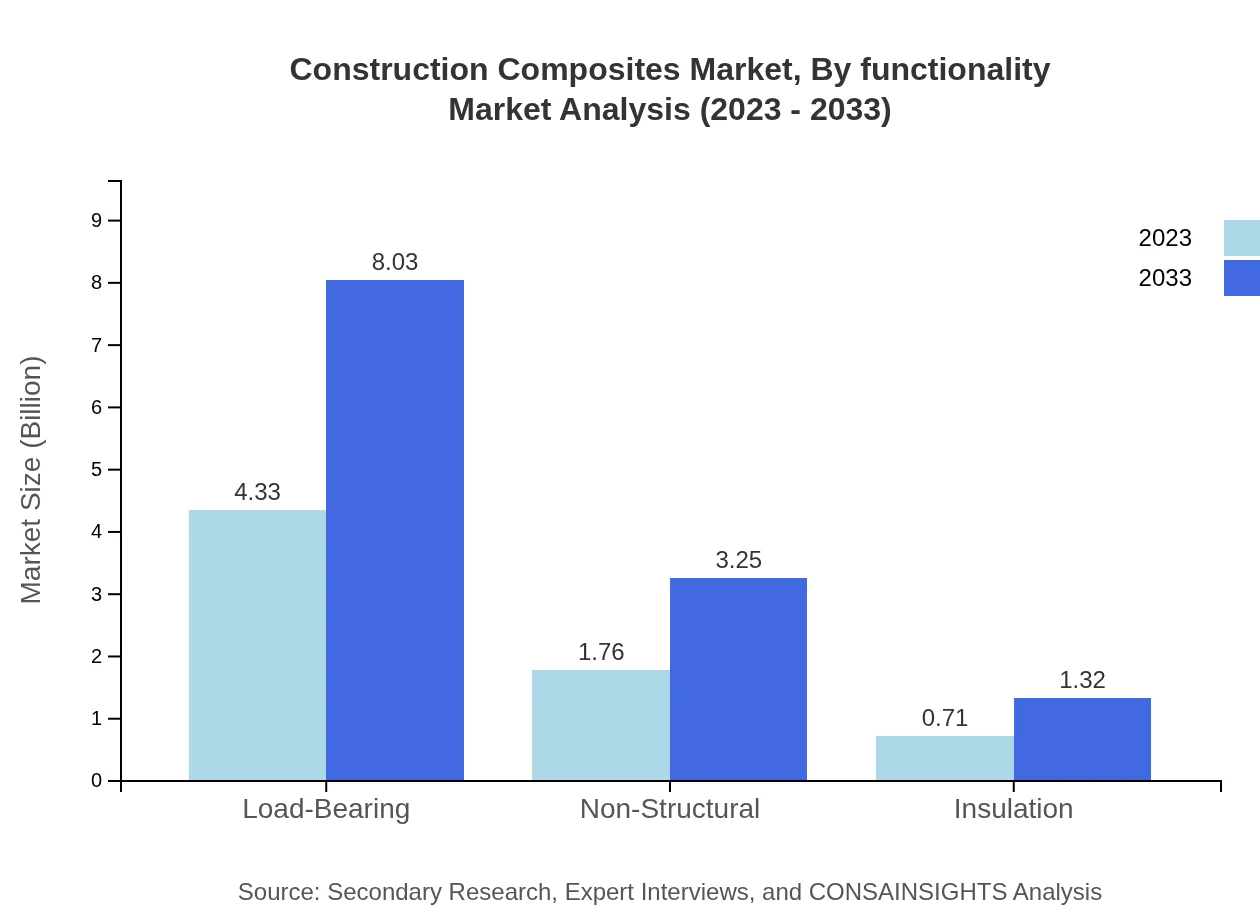

Construction Composites Market Analysis By Functionality

Load-bearing components dominate the construction composites sector, with a market size of $4.33 billion in 2023, reaching $8.03 billion by 2033. These components are crucial for infrastructure durability. Non-structural materials also play a vital role, holding about 25.82% of the market share, with a focus on versatility and aesthetic contributions to construction projects.

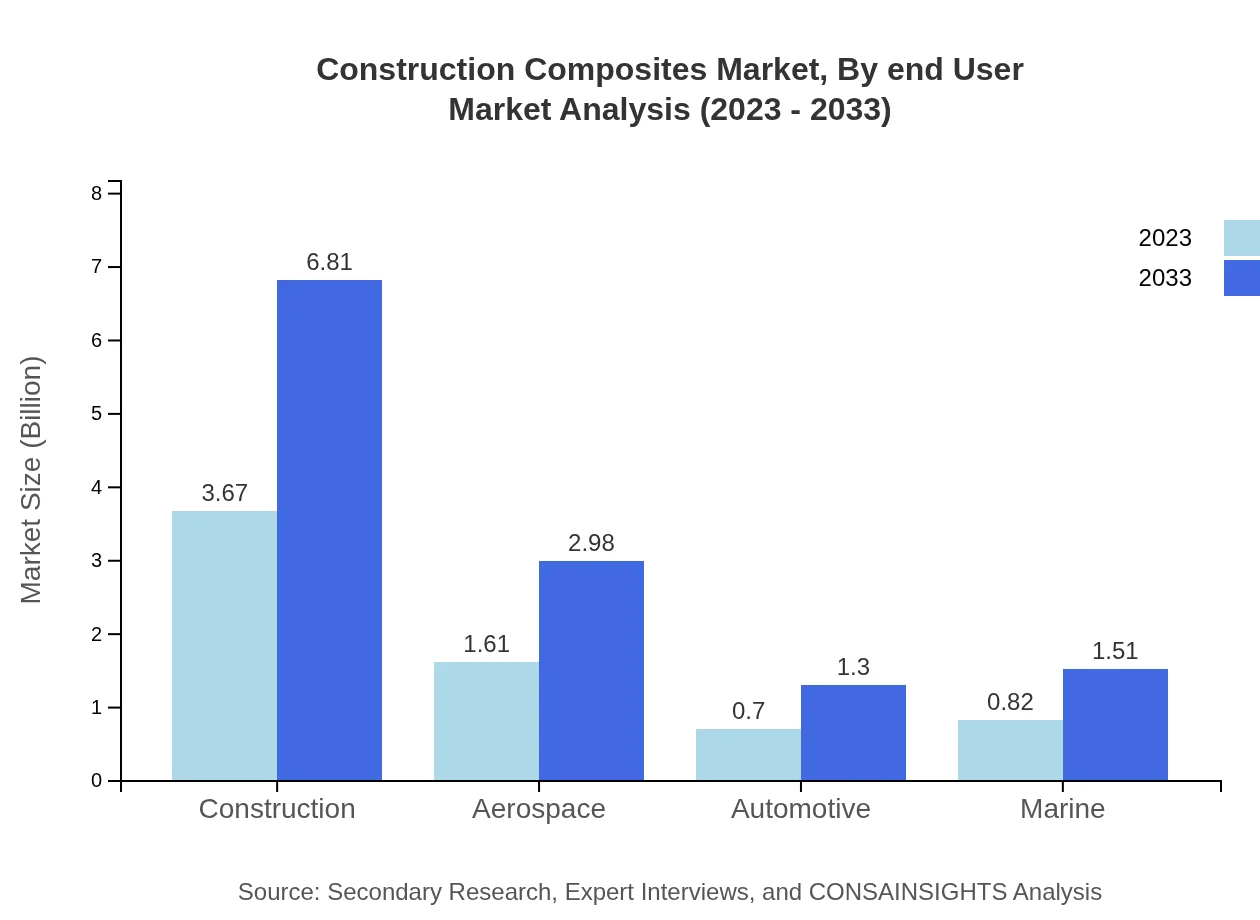

Construction Composites Market Analysis By End User

The construction sector is the major end-user of composites, with a market contribution of 54.02% and a size of $3.67 billion in 2023, expected to grow significantly by 2033. Industrial applications, aerospace, and automotive sectors are also notable contributors, reflecting the varied utility of construction composites across multiple industries.

Construction Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Composites Industry

Hexcel Corporation:

A leading manufacturer specializing in carbon fiber reinforced composites, Hexcel is pivotal in supplying innovative materials for the construction sector.BASF SE:

As a global supplier of chemical materials, BASF contributes significantly to the development of composite materials that enhance construction efficiency.Gurit Holding AG:

Gurit specializes in composite materials for various applications, including construction, enhancing structural performance and sustainability.Toray Industries, Inc.:

A major player in advanced composite materials, Toray provides solutions aimed at lightweight and high-strength applications in the construction industry.We're grateful to work with incredible clients.

FAQs

What is the market size of construction Composites?

The global construction composites market is valued at approximately $6.8 billion in 2023, projected to grow at a CAGR of 6.2% to reach significant expansions by 2033.

What are the key market players or companies in the construction Composites industry?

Key players in the construction composites market include major corporations focused on innovation, sustainability, and performance, significantly driving industry dynamics and competition.

What are the primary factors driving the growth in the construction Composites industry?

The growth in the construction composites sector is primarily driven by advancements in technology, rising demand for lightweight materials, sustainable practices, and increasing infrastructure investments globally.

Which region is the fastest Growing in the construction Composites?

The Asia Pacific region is the fastest-growing in the construction composites market, projected to grow from $1.31 billion in 2023 to $2.43 billion by 2033, indicating significant regional development.

Does ConsaInsights provide customized market report data for the construction Composites industry?

Yes, ConsaInsights offers tailored market report data for the construction-composites industry to meet specific client needs and provide in-depth insights.

What deliverables can I expect from this construction Composites market research project?

Deliverables from the construction-composites market research project include comprehensive reports, data analysis, market forecasts, and segmented insights across various demographics and regions.

What are the market trends of construction Composites?

Current trends in the construction-composites market include increasing use of Fiber Reinforced Polymers, rising emphasis on sustainable building materials, and innovations aimed at enhancing performance and durability.