Construction Equipment Market Report

Published Date: 22 January 2026 | Report Code: construction-equipment

Construction Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Construction Equipment market from 2023 to 2033, capturing market size, growth forecasts, technological advancements, and industry trends, supplemented with regional insights and competitive landscape information.

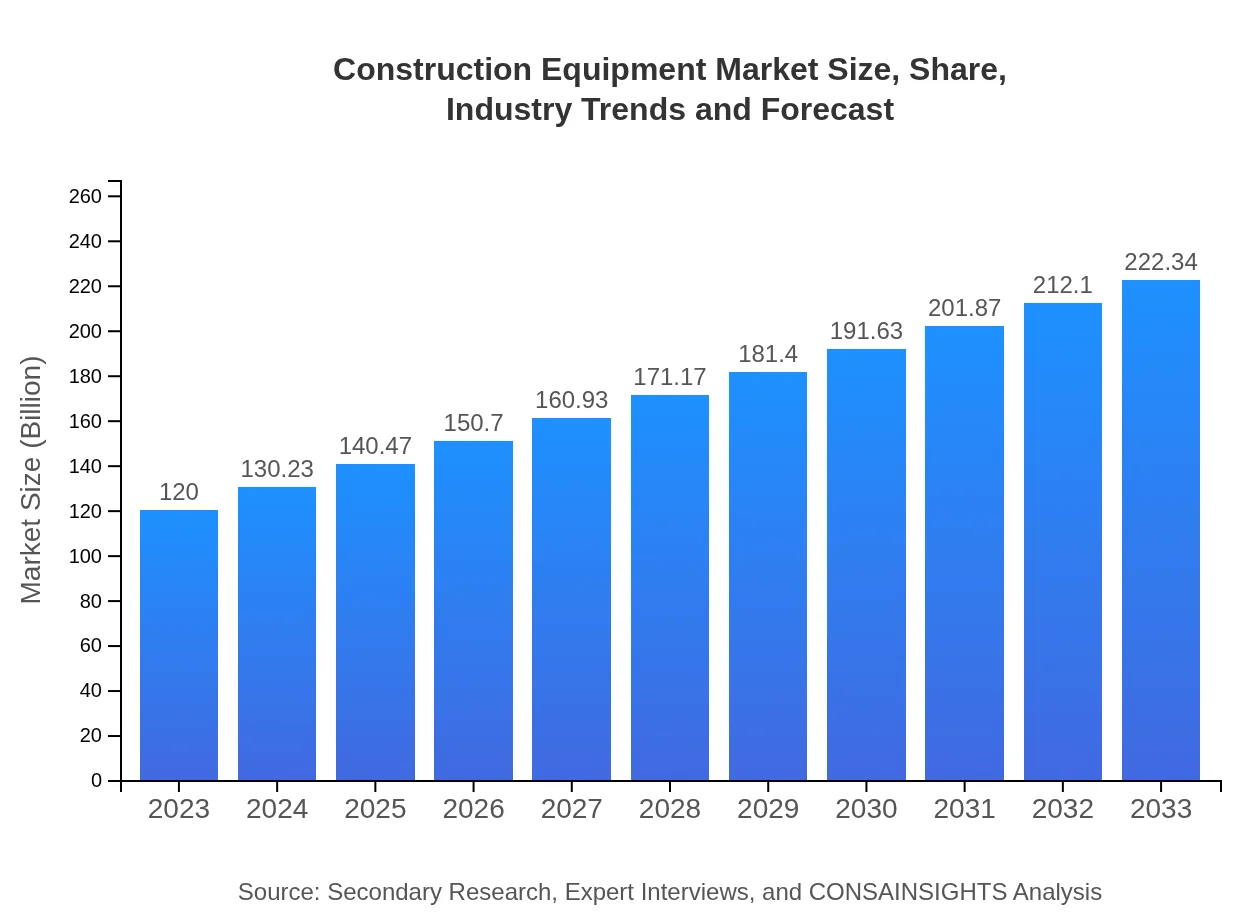

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $120.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $222.34 Billion |

| Top Companies | Caterpillar Inc., Komatsu Ltd., JCB, Hitachi Construction Machinery, Volvo Construction Equipment |

| Last Modified Date | 22 January 2026 |

Construction Equipment Market Overview

Customize Construction Equipment Market Report market research report

- ✔ Get in-depth analysis of Construction Equipment market size, growth, and forecasts.

- ✔ Understand Construction Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Equipment

What is the Market Size & CAGR of the Construction Equipment market in 2023?

Construction Equipment Industry Analysis

Construction Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Equipment Market Analysis Report by Region

Europe Construction Equipment Market Report:

The European Market is anticipated to grow from USD 28.96 billion in 2023 to USD 53.65 billion by 2033. The adoption of sustainable construction practices and increasing regulations on emissions are propelling the demand for eco-friendly construction equipment across major economies like Germany and France.Asia Pacific Construction Equipment Market Report:

The Asia Pacific region is a major contributor to the Construction Equipment market, with a market size of USD 23.72 billion in 2023 expected to grow to USD 43.96 billion by 2033. Rapid urbanization, government-infrastructure initiatives, and an increase in construction activities drive this growth. Countries like China and India are leading the charge with significant investments in infrastructure projects.North America Construction Equipment Market Report:

North America holds a substantial share of the market with a size of USD 45.49 billion projected to escalate to USD 84.29 billion by 2033. The region benefits from advanced construction techniques and heavy investments in residential and commercial construction, alongside a growing emphasis on renovating existing infrastructure.South America Construction Equipment Market Report:

In South America, the Construction Equipment market is expected to grow from USD 11.63 billion in 2023 to USD 21.54 billion in 2033. Demand is being fueled by infrastructure development in Brazil and Argentina, where governments are prioritizing construction projects to boost economic growth.Middle East & Africa Construction Equipment Market Report:

The Middle East and Africa market is projected to rise from USD 10.20 billion in 2023 to USD 18.90 billion in 2033. There is increasing investment in infrastructure, particularly in the Gulf Cooperation Council (GCC) nations, which are focusing on diversifying economies away from oil dependency, enhancing the construction sector.Tell us your focus area and get a customized research report.

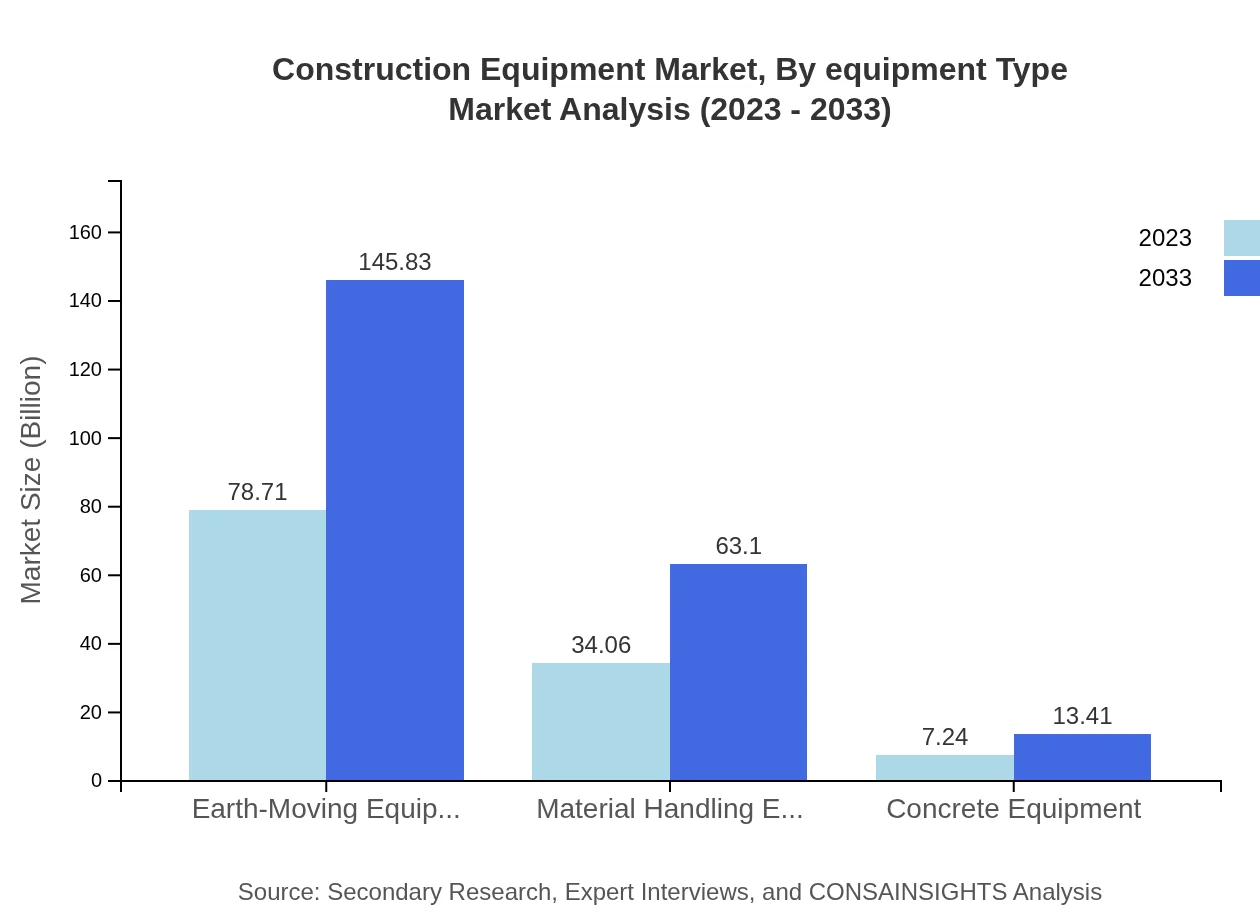

Construction Equipment Market Analysis By Equipment Type

The earth-moving equipment segment leads the market with a size of USD 78.71 billion in 2023, expected to grow to USD 145.83 billion by 2033, holding a significant share throughout the forecast period. This is followed by material handling equipment at USD 34.06 billion, rising to USD 63.10 billion, demonstrating the increasing complexity of construction tasks. Concrete equipment and demolition projects also show modest growth, highlighting the need for various specialized machinery in ongoing construction projects.

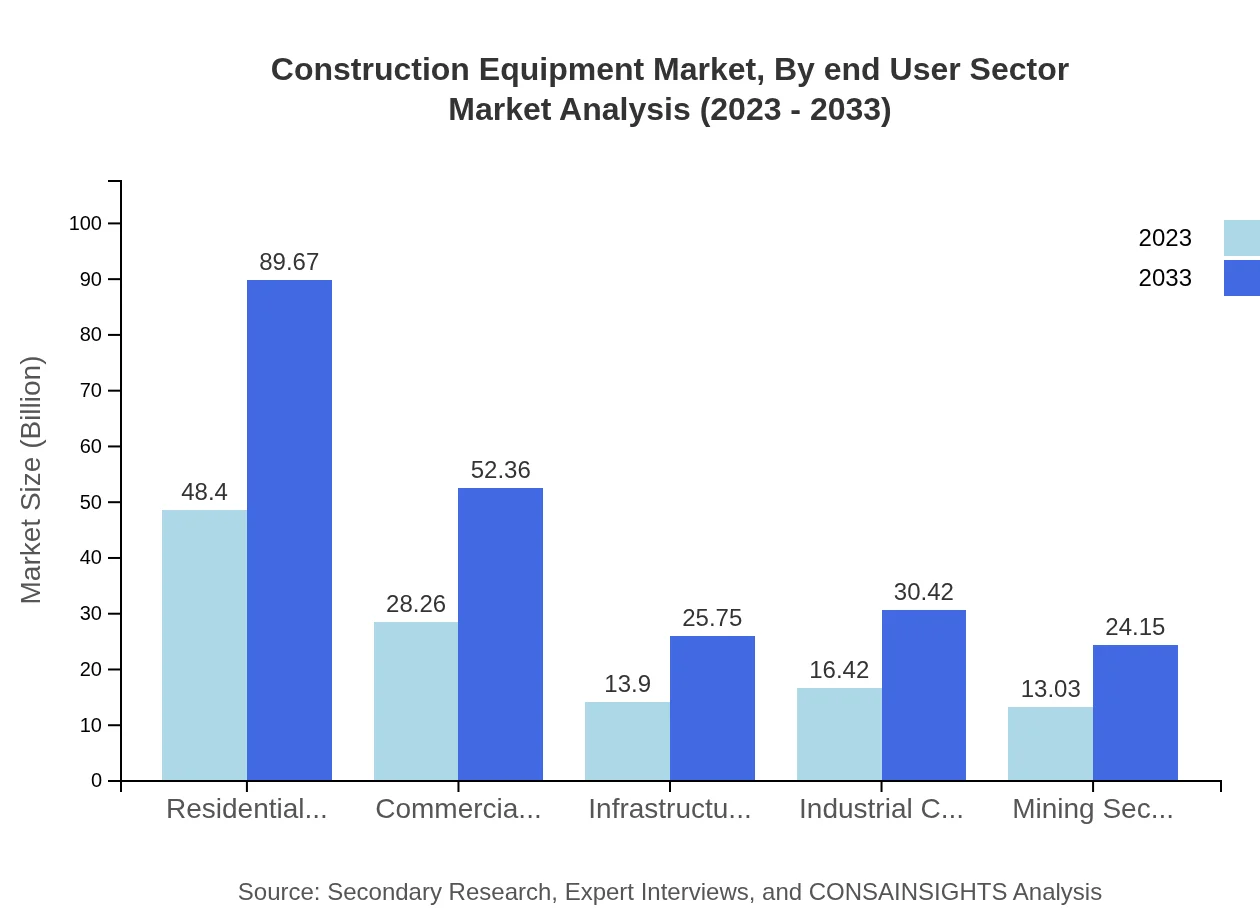

Construction Equipment Market Analysis By End User Sector

The residential construction sector accounts for a considerable portion of the market, sized at USD 48.40 billion in 2023 and forecasted to grow to USD 89.67 billion by 2033. Commercial construction follows closely, showing robust growth from USD 28.26 billion to USD 52.36 billion. The infrastructural segment is equally essential, driven by heightened investments in public works and urban development, a reflection of governmental economic stimulating measures.

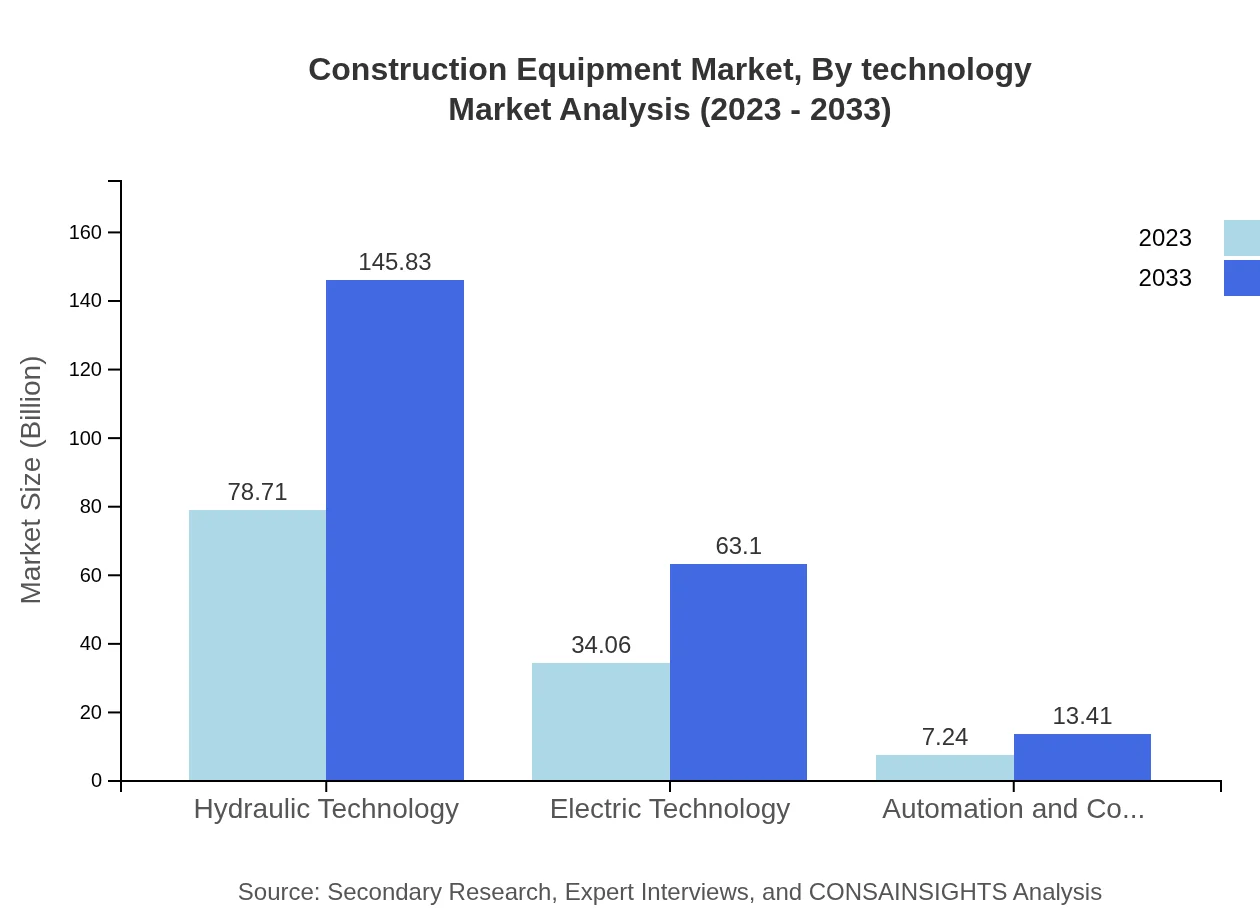

Construction Equipment Market Analysis By Technology

The hydraulic technology segment leads the market with a size of USD 78.71 billion in 2023, expanding to USD 145.83 billion by 2033. Electric technology is gaining traction, expected to grow from USD 34.06 billion to USD 63.10 billion, correlating with global pushes towards sustainability. Automation and control systems represent an emerging category reflecting significant interest in efficiency and smart capabilities on job sites.

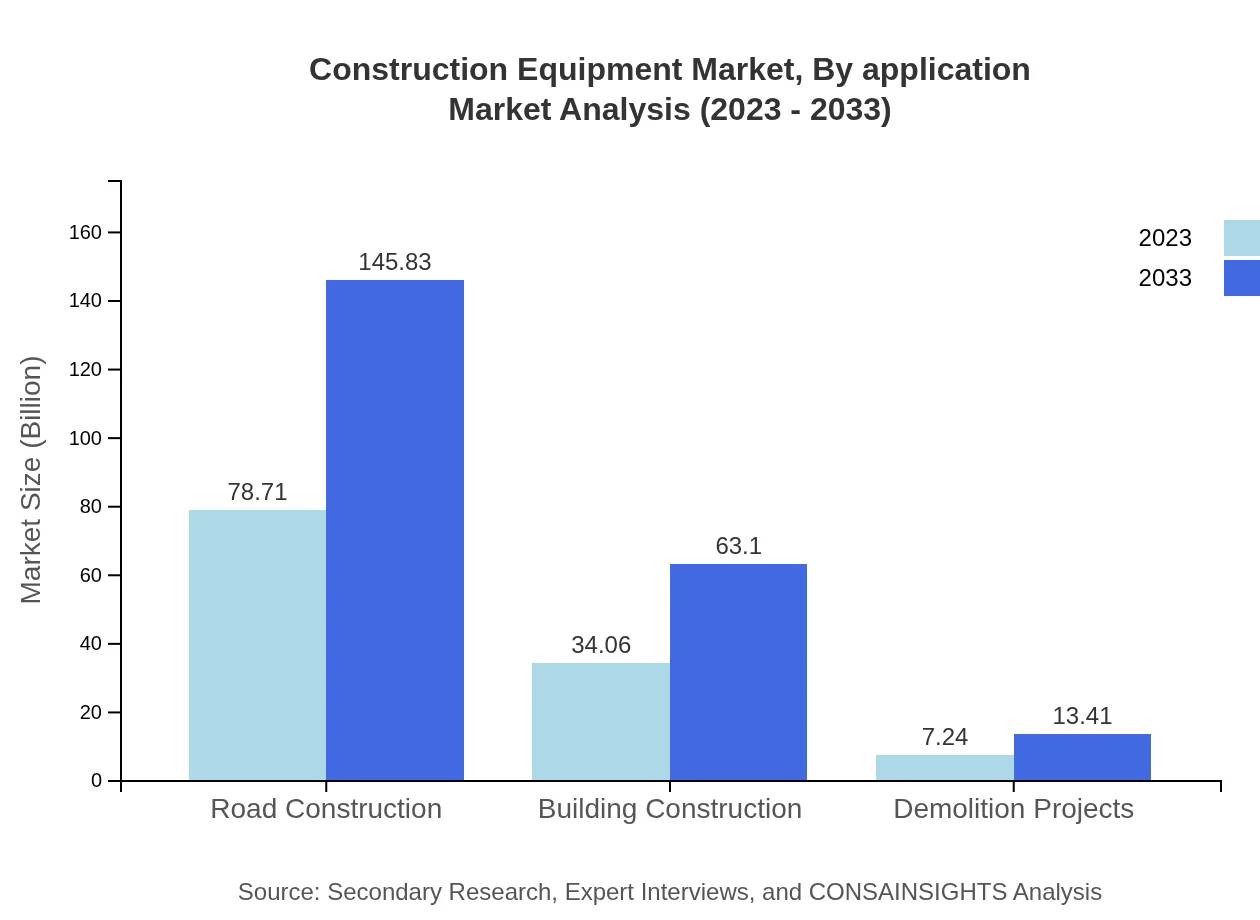

Construction Equipment Market Analysis By Application

The road construction application dominates, with expected growth from USD 78.71 billion in 2023 to USD 145.83 billion in 2033. Building construction shows a significant increase in demand as the urban residential requirements escalate, growing from USD 34.06 billion to USD 63.10 billion. Other applications such as infrastructure are expected to grow steadily as global construction outputs increase.

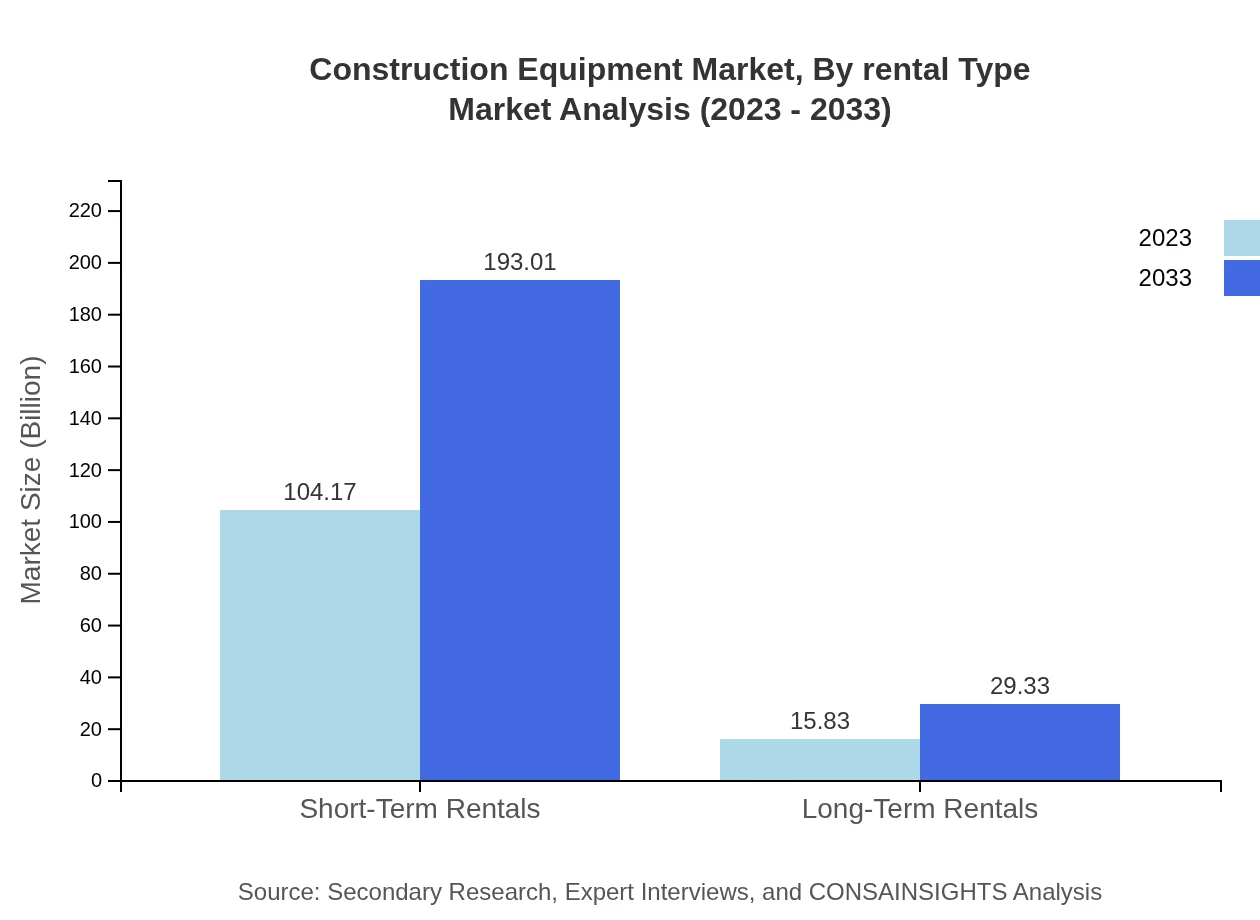

Construction Equipment Market Analysis By Rental Type

The short-term rental segment is forecasted to grow from USD 104.17 billion in 2023 to USD 193.01 billion by 2033. There is a growing trend of short-term rentals in the construction industry, providing flexibility and cost management for projects. Long-term rentals are also gaining traction, expected to increase from USD 15.83 billion to USD 29.33 billion, reflecting changing employer dynamics in workforce management and project financing.

Construction Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Construction Equipment Industry

Caterpillar Inc.:

Caterpillar is a global leader in manufacturing and supplying construction machinery and heavy equipment. With over 90 years in the industry, they provide high-performance products designed to enhance productivity and sustainability.Komatsu Ltd.:

Komatsu is one of the world’s foremost manufacturers of construction equipment and related products, recognized for their innovative technology and commitment to promoting sustainable practices within the construction industry.JCB:

JCB is a leading manufacturer of construction and agricultural machinery, renowned for its commitment to quality and advanced engineering practices, serving customers across various markets globally.Hitachi Construction Machinery:

Hitachi specializes in high-quality machines designed for construction and mining equipment, focusing heavily on technological development and user-friendly operation.Volvo Construction Equipment:

Volvo is well-known for their range of construction equipment and is committed to sustainability, leading the way in the development of electric and hybrid machines.We're grateful to work with incredible clients.

FAQs

What is the market size of construction Equipment?

The global market size for construction equipment is projected to reach approximately $120 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2% from 2023. This growth is driven by ongoing infrastructure development and increased construction activities worldwide.

What are the key market players or companies in the construction Equipment industry?

Key players in the construction equipment industry include Caterpillar, Volvo Construction Equipment, and Komatsu. These companies lead the market through innovation, strategic acquisitions, and continuous product development to address diverse construction needs.

What are the primary factors driving the growth in the construction equipment industry?

Major factors fueling growth in the construction equipment sector include rising urbanization, government initiatives to enhance infrastructure, technological advancements in machinery, and the growing demand for efficient construction processes.

Which region is the fastest Growing in the construction equipment market?

The fastest-growing region in the construction equipment market is forecasted to be North America, with significant growth from $45.49 billion in 2023 to $84.29 billion in 2033, largely due to extensive infrastructure investments and urban expansion.

Does ConsaInsights provide customized market report data for the construction equipment industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the construction equipment industry, allowing clients to gain insights that match their organizational goals and strategic initiatives.

What deliverables can I expect from this construction equipment market research project?

Clients can expect deliverables such as comprehensive market analysis reports, segment-based insights, competitive landscape evaluations, and tailored recommendations for strategic decision-making in the construction equipment industry.

What are the market trends of construction equipment?

Trends in the construction equipment market include increasing automation and the adoption of electric technologies. Market segments such as hydraulic and earth-moving equipment are growing significantly, emphasizing sustainability and operational efficiency.