Construction Equipment Rental Market Report

Published Date: 22 January 2026 | Report Code: construction-equipment-rental

Construction Equipment Rental Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Construction Equipment Rental market, highlighting market size, growth trends, and key drivers. Insights are offered on regional performance and industry segmentation, with a focus on forecasts from 2023 to 2033.

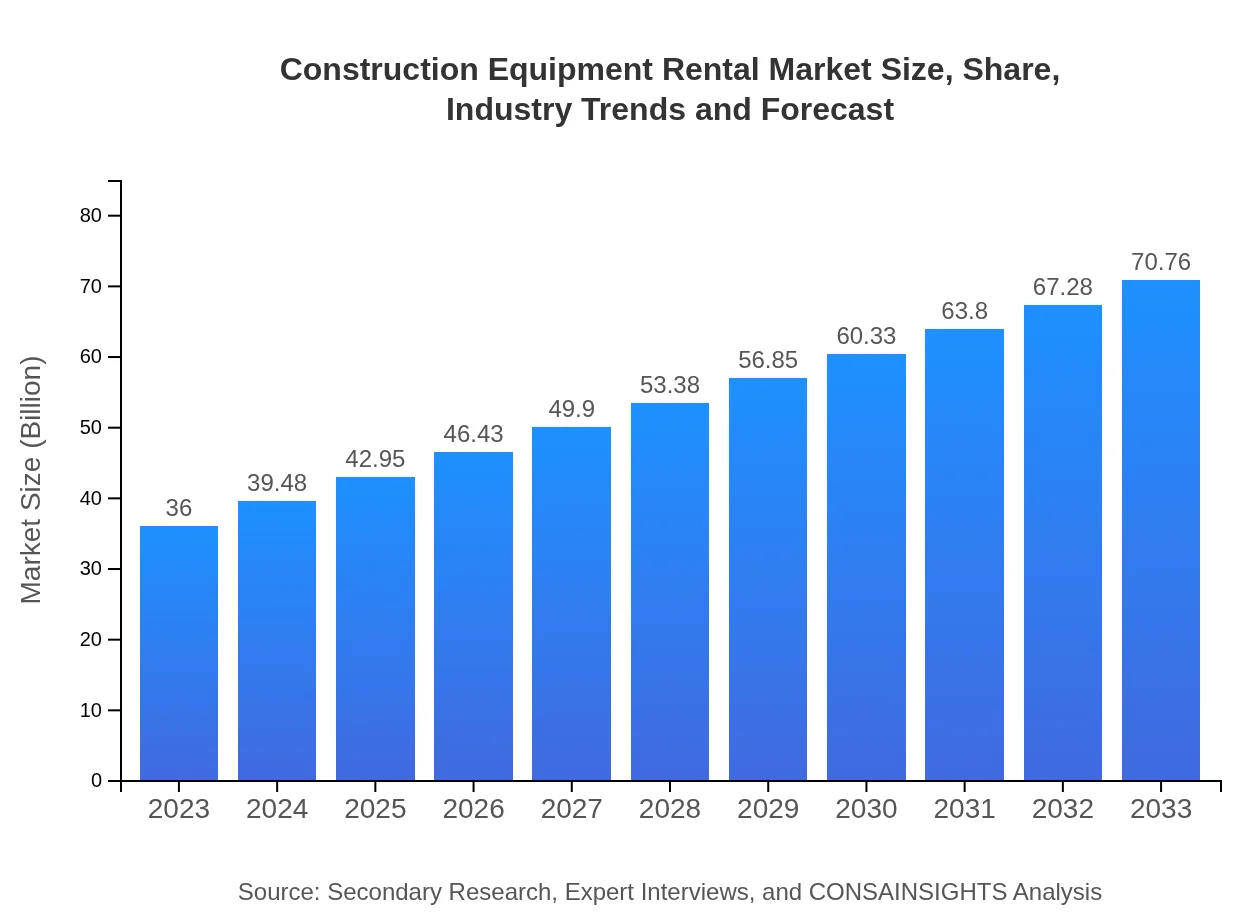

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $36.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $70.76 Billion |

| Top Companies | United Rentals, Inc., Ahern Rentals, Inc., Caterpillar Inc., Herc Rentals Inc., Sunbelt Rentals, Inc. |

| Last Modified Date | 22 January 2026 |

Construction Equipment Rental Market Overview

Customize Construction Equipment Rental Market Report market research report

- ✔ Get in-depth analysis of Construction Equipment Rental market size, growth, and forecasts.

- ✔ Understand Construction Equipment Rental's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Equipment Rental

What is the Market Size & CAGR of Construction Equipment Rental market in 2023?

Construction Equipment Rental Industry Analysis

Construction Equipment Rental Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Equipment Rental Market Analysis Report by Region

Europe Construction Equipment Rental Market Report:

In Europe, the market will expand from 9.85 billion USD in 2023 to 19.37 billion USD by 2033, supported by sustainable construction practices and a significant push toward innovation in rental offerings.Asia Pacific Construction Equipment Rental Market Report:

In Asia Pacific, the Construction Equipment Rental market is projected to grow from 6.91 billion USD in 2023 to an estimated 13.58 billion USD by 2033, driven by rapid urbanization and government-led infrastructure initiatives.North America Construction Equipment Rental Market Report:

North America, the largest segment, valued at 13.81 billion USD in 2023, is projected to grow to 27.13 billion USD by 2033, bolstered by robust construction activities and a shift towards rental methods to minimize costs.South America Construction Equipment Rental Market Report:

The South American segment, starting at 2.84 billion USD in 2023, is expected to reach 5.58 billion USD by 2033, with an increasing focus on infrastructure development enhancing market prospects.Middle East & Africa Construction Equipment Rental Market Report:

The Middle East and Africa's Construction Equipment Rental market is poised for growth, from 2.59 billion USD in 2023 to 5.09 billion USD in 2033, fueled by ongoing mega-projects and urban development.Tell us your focus area and get a customized research report.

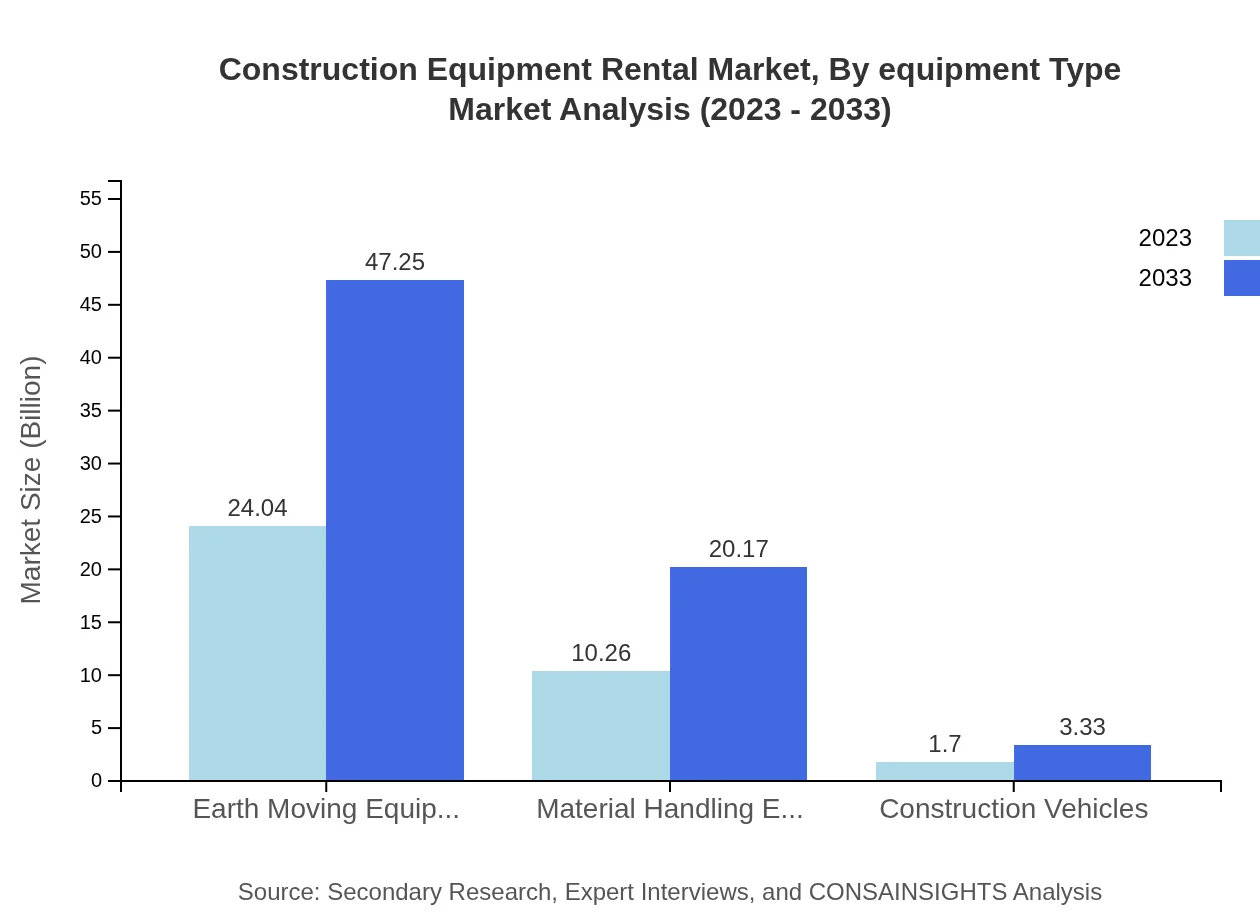

Construction Equipment Rental Market Analysis By Equipment Type

Earth Moving Equipment dominates the market, growing from 24.04 billion USD in 2023 to 47.25 billion USD in 2033, accounting for 66.78% of market share. Material Handling Equipment and Construction Vehicles also contribute significantly, with 10.26 billion USD to 20.17 billion USD and 1.70 billion USD to 3.33 billion USD, respectively. Traditional Equipment Rentals represent 87.65% share, against the gradual rise of Smart Equipment Rentals, forecasted from 4.45 billion USD in 2023 to 8.74 billion USD in 2033.

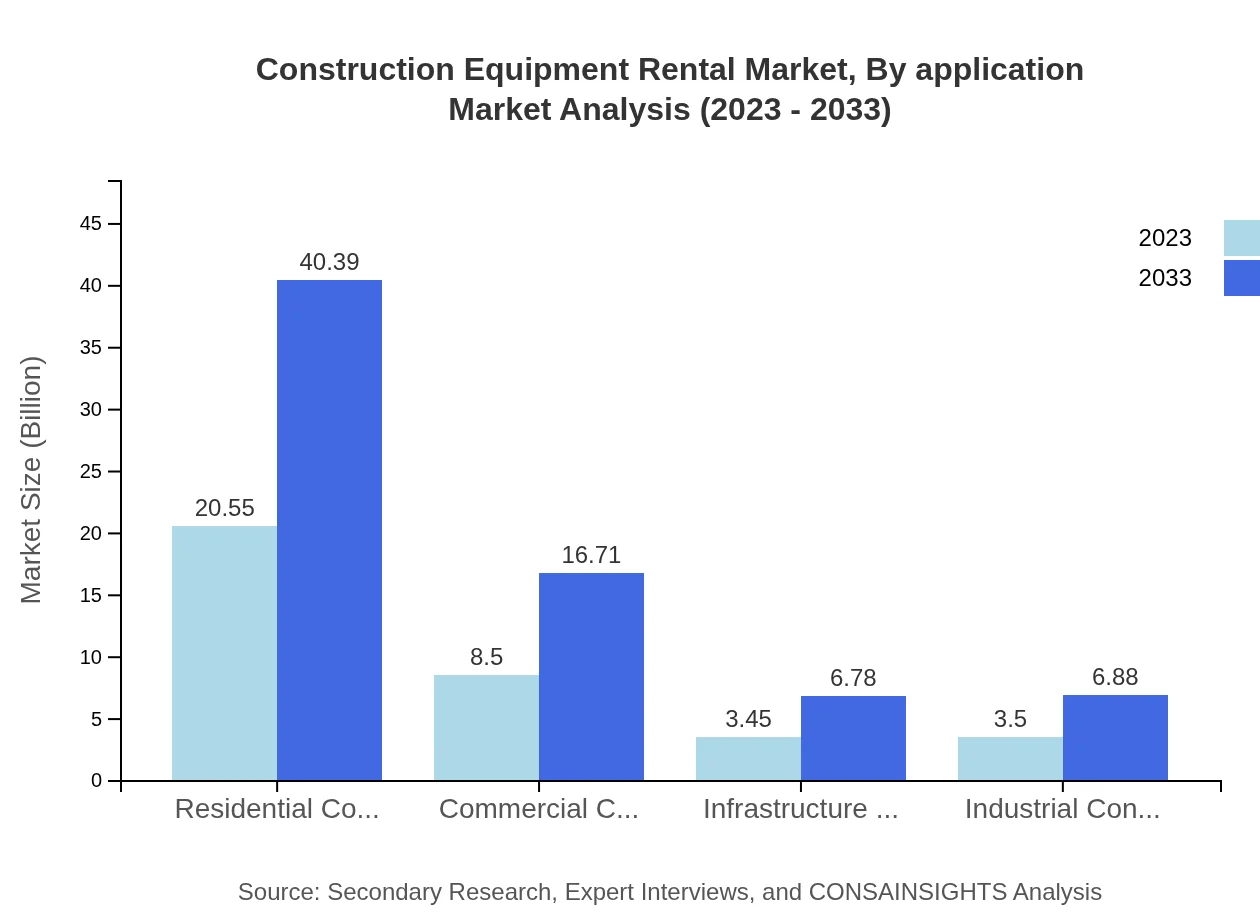

Construction Equipment Rental Market Analysis By Application

The Residential Construction segment leads the market, growing from 20.55 billion USD in 2023 to 40.39 billion USD in 2033, representing 57.09% share. The Commercial Construction segment and Infrastructure Development segment follow, with 8.50 billion USD to 16.71 billion USD and 3.45 billion USD to 6.78 billion USD growth respectively.

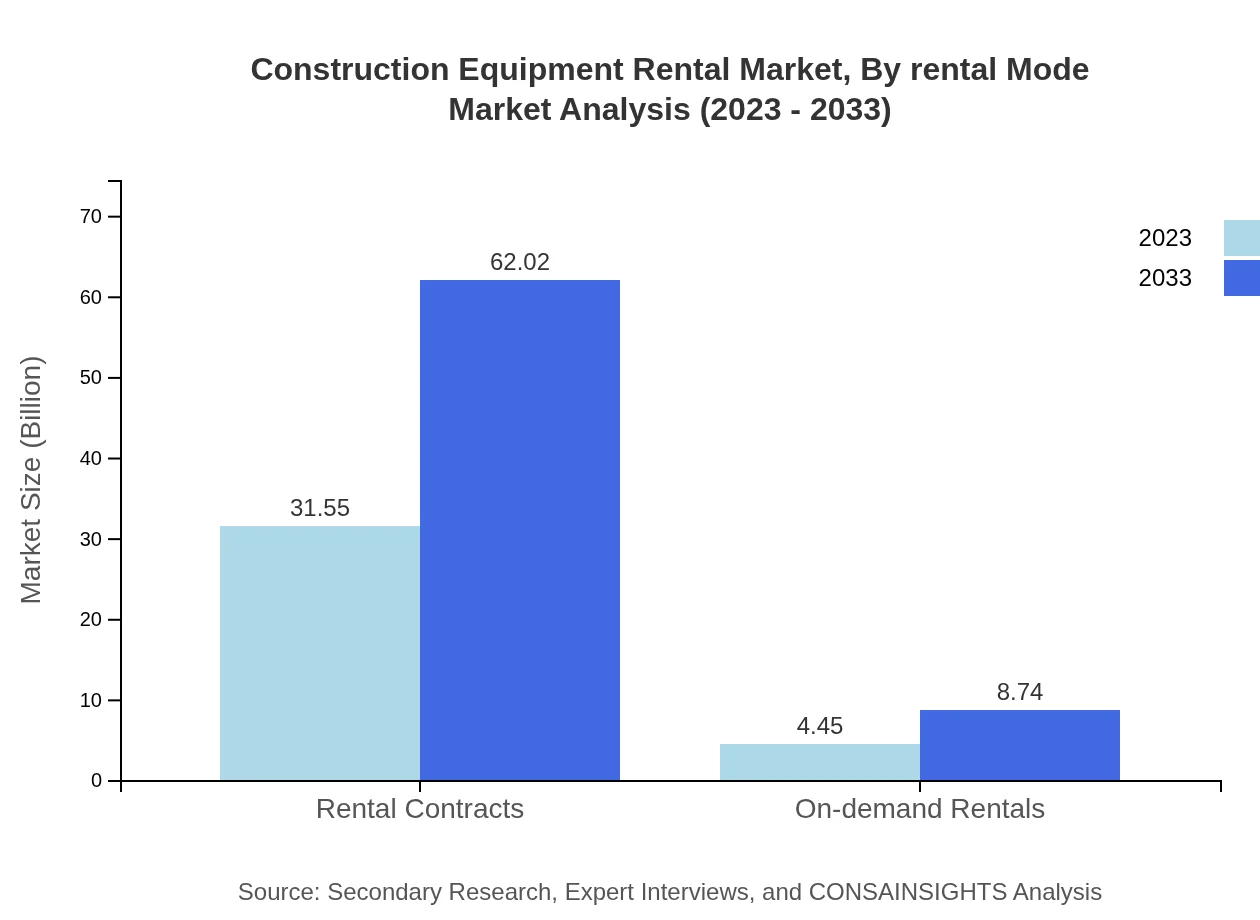

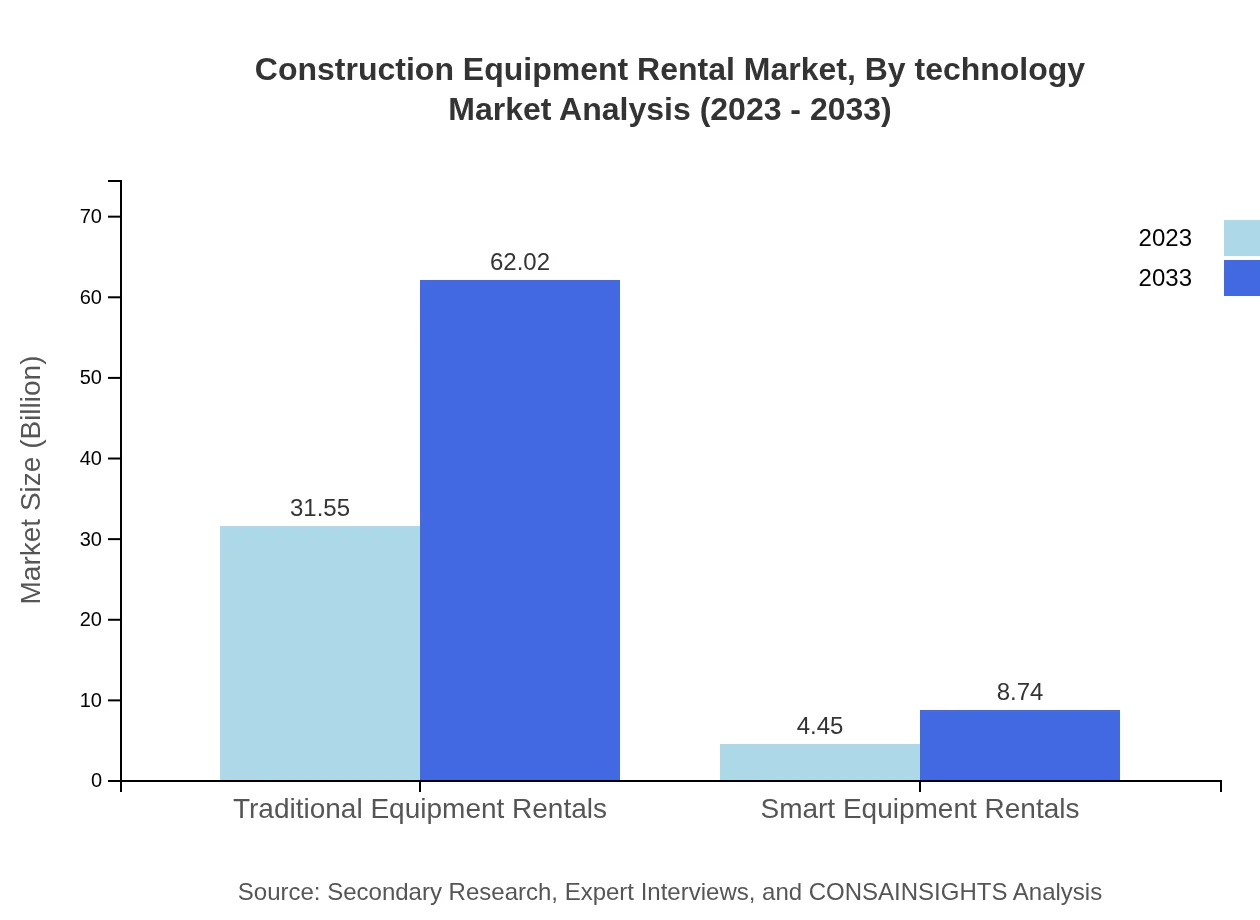

Construction Equipment Rental Market Analysis By Rental Mode

Rental Contracts, worth 31.55 billion USD in 2023 and expected to reach 62.02 billion USD by 2033, command the market with 87.65% share. The On-demand Rentals segment, while smaller, is rapidly evolving, progressing from 4.45 billion USD in 2023 to 8.74 billion USD by 2033, reflecting a market share of 12.35%.

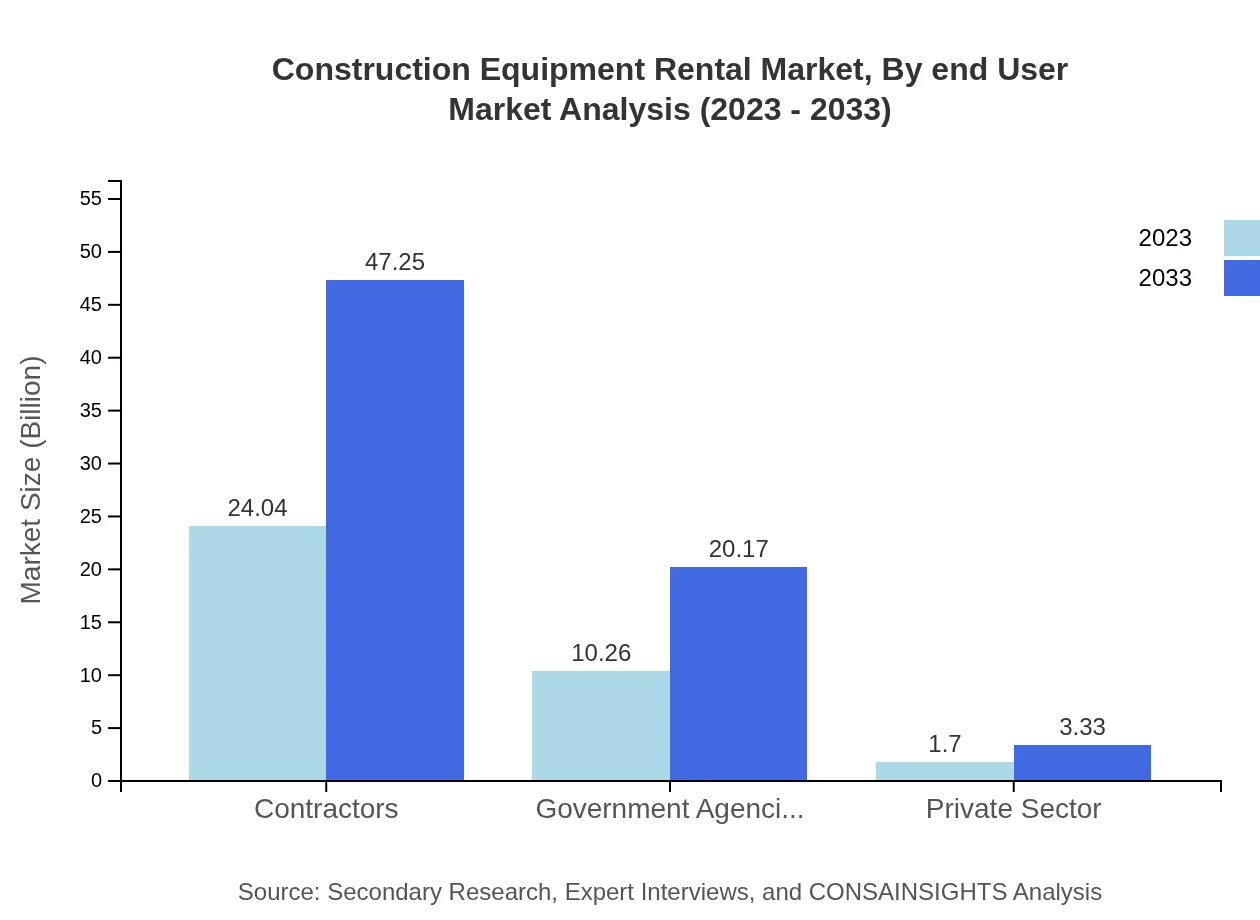

Construction Equipment Rental Market Analysis By End User

Contractors are the predominant end-user at 24.04 billion USD in 2023, expected to nearly double to 47.25 billion USD by 2033, capturing 66.78% share of the market. Government Agencies and the Private Sector are also vital contributors, with respective figures ranging from 10.26 billion to 20.17 billion USD and 1.70 billion to 3.33 billion USD by 2033.

Construction Equipment Rental Market Analysis By Technology

Advancements in telematics and remote management technology are crucial drivers in the sector, with a growing emphasis on Smart Equipment Rentals enhancing operational efficiency. Traditional Rentals still dominate but are experiencing competition from emerging tech-driven rental solutions that promise cost savings and increased project efficiency.

Construction Equipment Rental Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Equipment Rental Industry

United Rentals, Inc.:

The largest equipment rental company in the world, United Rentals, has a vast fleet of construction and industrial equipment and provides innovative solutions for various sectors.Ahern Rentals, Inc.:

Ahern Rentals specializes in renting out construction and industrial equipment, offering flexible rental solutions and strong customer service.Caterpillar Inc.:

Caterpillar is not only a leading manufacturer but also a key player in the rental sector, providing high-quality equipment and value-added rental services.Herc Rentals Inc.:

Herc Rentals offers a wide range of rental equipment across construction and industrial segments, focusing on safety and service excellence.Sunbelt Rentals, Inc.:

Sunbelt Rentals operates one of the largest rental fleets across North America, emphasizing equipment availability and customer satisfaction.We're grateful to work with incredible clients.

FAQs

What is the market size of construction Equipment Rental?

The construction equipment rental market is valued at approximately $36 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, indicating significant growth potential over the next decade.

What are the key market players or companies in the construction equipment rental industry?

Key players in the construction equipment rental market include United Rentals, Sunbelt Rentals, Herc Rentals, and Ahern Rentals. These companies dominate through expansive fleets and extensive service networks, positioning them as industry leaders.

What are the primary factors driving the growth in the construction equipment rental industry?

The growth in the construction equipment rental industry is driven by the increasing demand for industrial and infrastructure construction, urbanization, and cost-effective rental solutions that reduce capital expenditure for contractors and businesses.

Which region is the fastest Growing in the construction equipment rental market?

North America is the fastest-growing region in the construction equipment rental market, projected to reach approximately $27.13 billion by 2033. European and Asia Pacific markets also show significant growth potential in the same timeframe.

Does ConsaInsights provide customized market report data for the construction equipment rental industry?

Yes, ConsaInsights offers customized market report data for the construction equipment rental industry, allowing clients to receive tailored insights and analyses that meet their specific business needs and objectives.

What deliverables can I expect from this construction equipment rental market research project?

Deliverables from the construction equipment rental market research project include comprehensive market reports, trend analyses, competitive landscape evaluations, and actionable insights into regional and segment-specific opportunities.

What are the market trends of construction equipment rental?

Market trends in construction equipment rental include a shift towards smart equipment rentals, increased demand for eco-friendly solutions, and the rise of on-demand rental services catering to tighter project timelines and budget constraints.