Construction Films Market Report

Published Date: 22 January 2026 | Report Code: construction-films

Construction Films Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Construction Films market, detailing insights on market size, segmentation, and trends from 2023 to 2033. It covers regional analyses, technological advancements, and profiles of key market leaders to offer a comprehensive overview of the industry landscape.

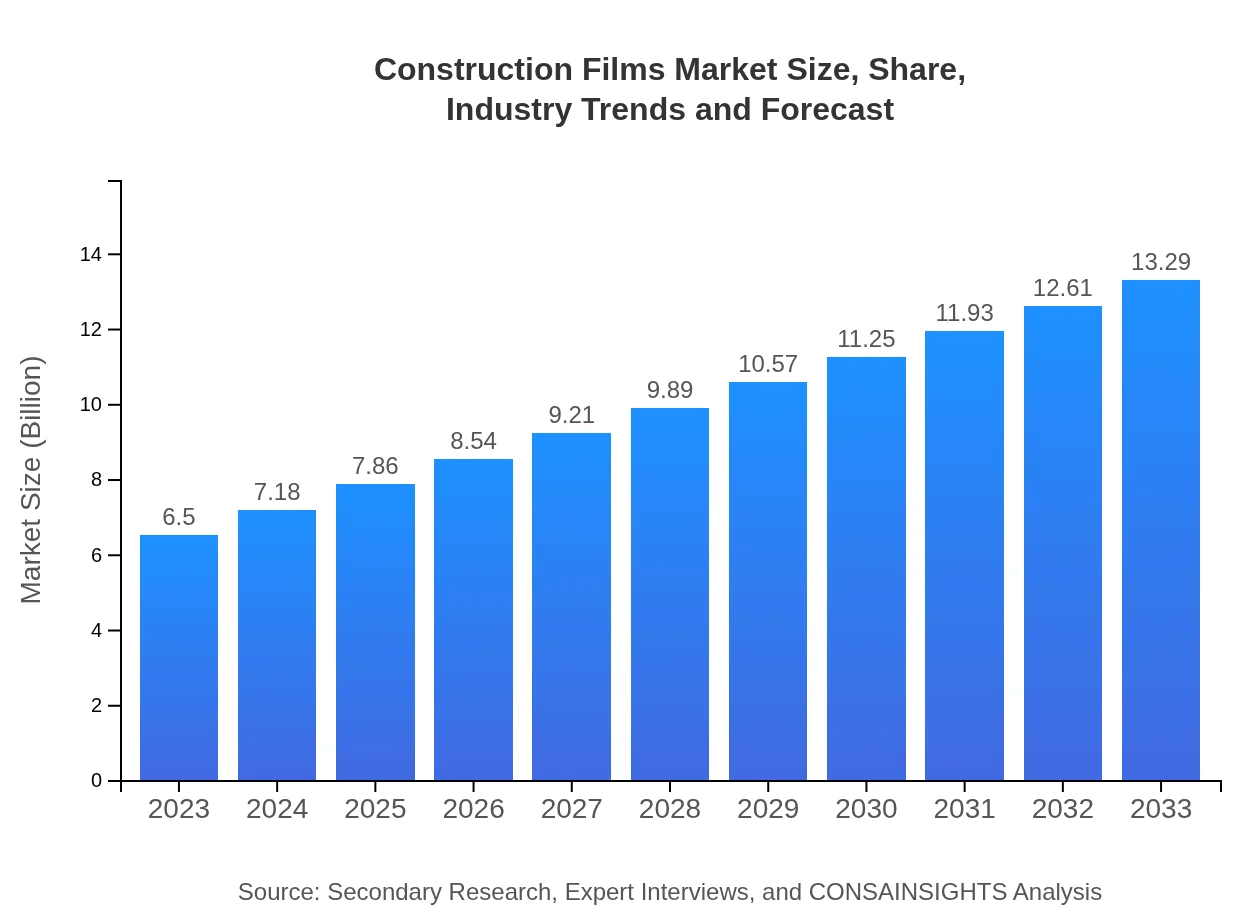

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $13.29 Billion |

| Top Companies | Berry Global, Inc., Gundle/SLT Environmental, Inc., Sealed Air Corporation, Amcor, DuPont |

| Last Modified Date | 22 January 2026 |

Construction Films Market Overview

Customize Construction Films Market Report market research report

- ✔ Get in-depth analysis of Construction Films market size, growth, and forecasts.

- ✔ Understand Construction Films's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Films

What is the Market Size & CAGR of Construction Films market in 2023?

Construction Films Industry Analysis

Construction Films Market Segmentation and Scope

Tell us your focus area and get a customized research report.

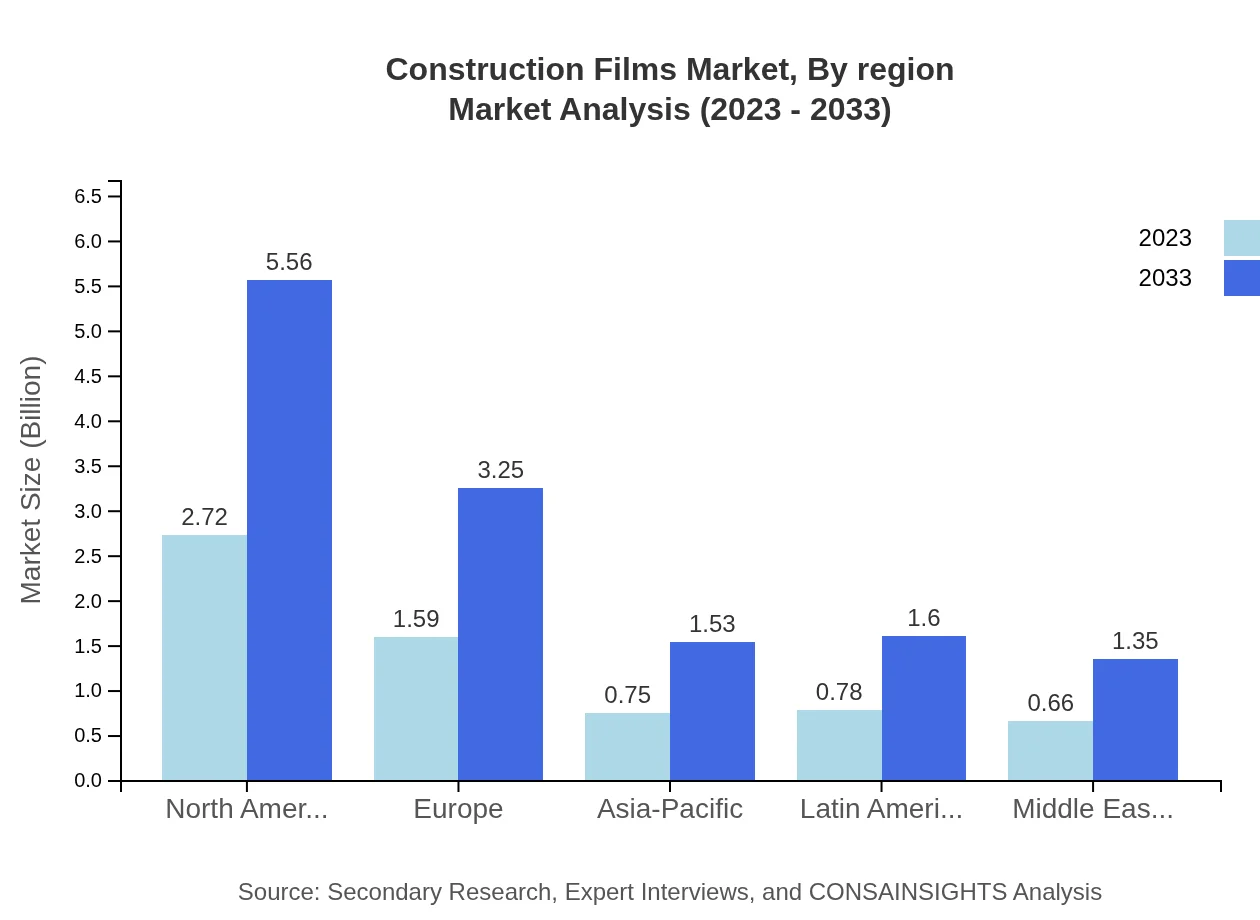

Construction Films Market Analysis Report by Region

Europe Construction Films Market Report:

The European Construction Films market is anticipated to grow from $1.66 billion in 2023 to $3.40 billion by 2033. Increased awareness regarding energy efficiency and the adoption of stringent building codes spur growth opportunities. Moreover, European countries are leading in adopting innovative construction practices, further enhancing the demand for high-performance construction films.Asia Pacific Construction Films Market Report:

The Asia Pacific region shows robust growth potential, with the market expected to expand from $1.28 billion in 2023 to $2.62 billion by 2033. Rapid urbanization, coupled with government initiatives to boost infrastructural development, plays a critical role in this growth. Additionally, the increasing adoption of construction films for sustainability and compliance with environmental norms drive market progression in this region.North America Construction Films Market Report:

North America is set to witness significant growth, with market size expected to soar from $2.43 billion in 2023 to $4.96 billion in 2033. The region benefits from advanced technological integration in construction and a strong shift toward sustainable building materials, aimed at reducing the carbon footprint. Stringent regulations regarding environmental sustainability enhance the application of specialized construction films.South America Construction Films Market Report:

In South America, the Construction Films market presents a gradual growth trend projected from $0.29 billion in 2023 to $0.59 billion in 2033. This growth can be attributed to rising investment in infrastructure projects and an increasing focus on innovative construction technologies, alongside a recovery in economic conditions post-pandemic.Middle East & Africa Construction Films Market Report:

The Middle East and Africa market will also see an upward trend, growing from $0.84 billion in 2023 to $1.71 billion by 2033. The growth is largely driven by significant investments in construction trends linked to urbanization and mega-projects in the region, coupled with demand for durable materials capable of withstanding the harsh climatic conditions.Tell us your focus area and get a customized research report.

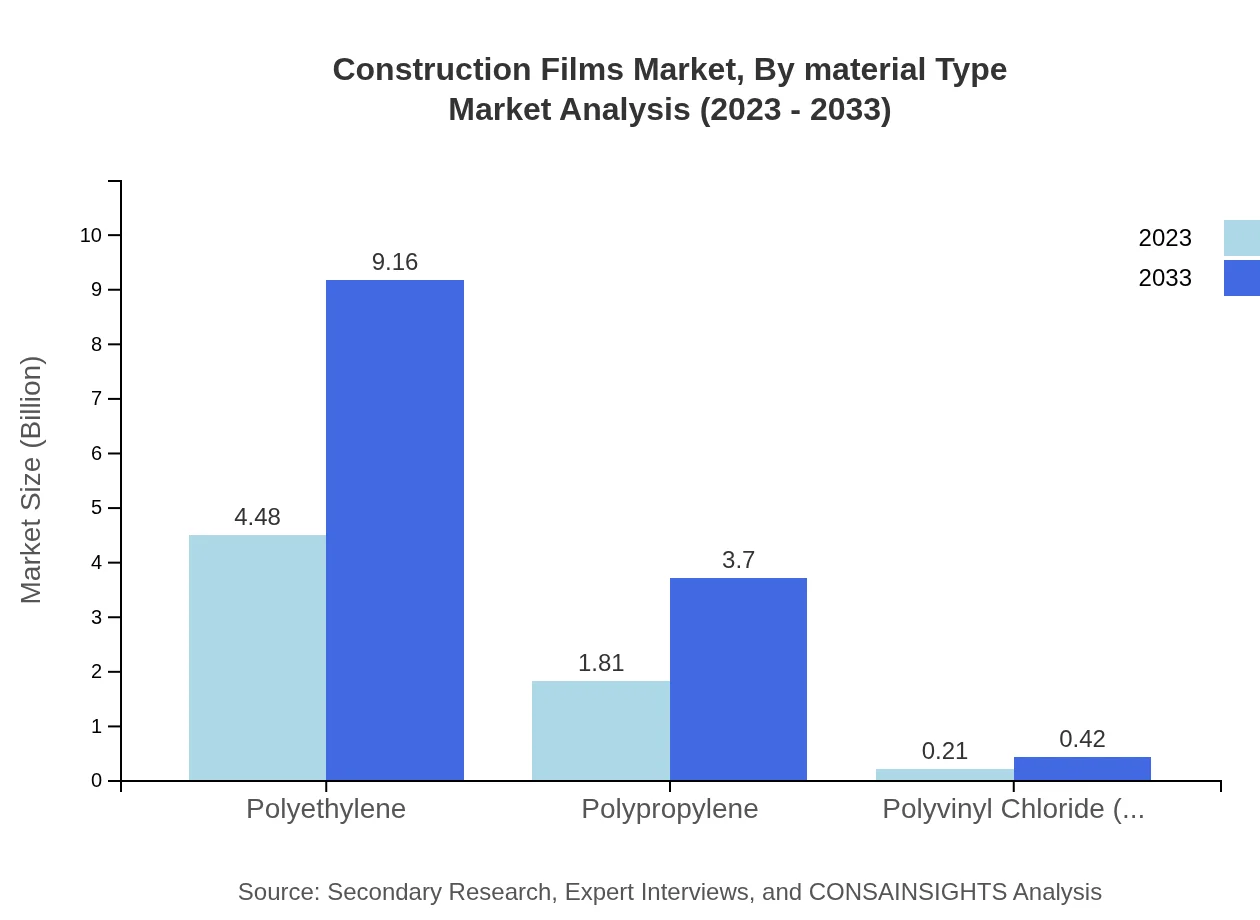

Construction Films Market Analysis By Material Type

The Construction Films market by material type includes Polyethylene, Polypropylene, and Polyvinyl Chloride (PVC). Polyethylene dominates the market with a share of 68.96% in 2023, attributed to its versatile application and economic viability. Polypropylene and PVC follow, holding shares of 27.85% and 3.19% respectively, driven by specific industry requirements and regional preferences.

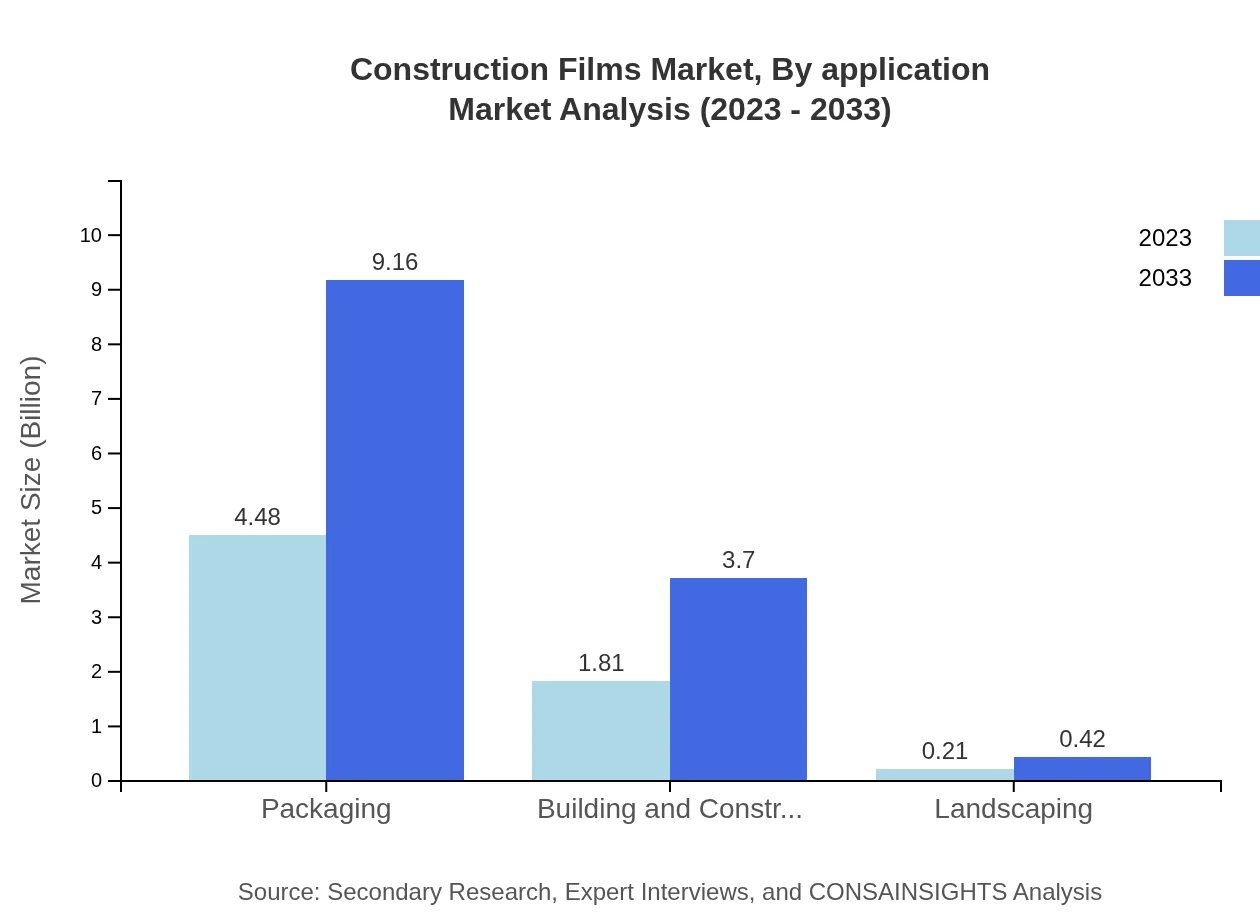

Construction Films Market Analysis By Application

Application analysis reveals that the construction segment is the largest contributor, accounting for 68.96% of the market in 2023. This is facilitated by the widespread use of films in various applications, such as ground coverings and protective barriers. Other applications, including agriculture and packaging, hold comparative shares, driven by their functionalities in insulation and protection.

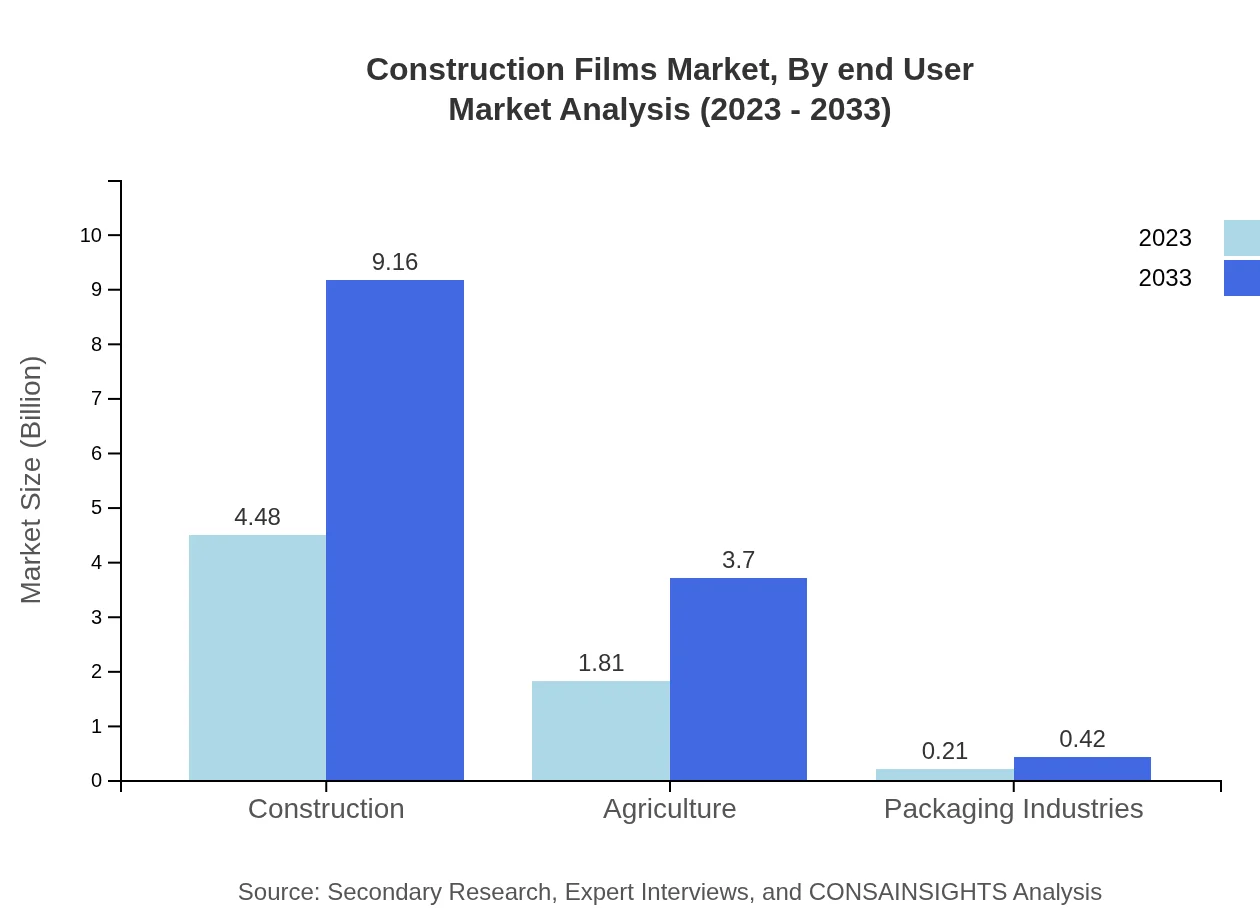

Construction Films Market Analysis By End User

The end-user analysis distinguishes between residential, commercial, and industrial sectors. The residential construction sector leads with a significant share, primarily due to heightened housing demand and renovation activities. Commercial markets closely follow, linked to rising office and retail space development, while industrial applications cater to specific construction needs.

Construction Films Market Analysis By Region

By region, the North American market holds a leading position in terms of both size and growth potential. Europe follows closely, benefiting from stringent building regulations and sustainability drives. The Asia Pacific region presents ample growth opportunities led by rapid urbanization. Conversely, the Middle East and Africa are observing consistent growth due to infrastructural investment and South America is gradually increasing due to infrastructural developments.

Construction Films Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Films Industry

Berry Global, Inc.:

A leader in manufacturing innovative plastic products, including construction films that focus on sustainability and high-performance features.Gundle/SLT Environmental, Inc.:

Specializes in providing engineered textiles and other construction films known for durability and effectiveness in environmental applications.Sealed Air Corporation:

Known for advanced protective packaging solutions, their construction films are extensively utilized for weatherproofing and vapor barriers.Amcor:

Global packaging company that offers a diverse range of films tailored for construction applications, emphasizing recyclable and eco-friendly materials.DuPont:

A strong focus on innovation in advanced materials, including construction films designed for energy efficiency and enhanced performance.We're grateful to work with incredible clients.

FAQs

What is the market size of construction Films?

The construction films market is valued at approximately $6.5 billion in 2023, with a projected growth rate of 7.2% CAGR until 2033. This growth reflects the increasing demand across various segments, including construction, agriculture, and packaging.

What are the key market players or companies in the construction Films industry?

Key players in the construction films market include established manufacturers and suppliers focusing on innovative materials and sustainable practices. These companies influence market trends through technological advancements and strategic partnerships aimed at enhancing product offerings.

What are the primary factors driving the growth in the construction Films industry?

Growth in the construction films industry is largely driven by increased construction activities, technological advancements in material production, and rising demand for eco-friendly construction solutions. Additionally, urbanization and infrastructure development projects further propel this market forward.

Which region is the fastest Growing in the construction Films?

The Asia-Pacific region is the fastest-growing market for construction films, projected to grow from $1.28 billion in 2023 to $2.62 billion by 2033. This growth is attributed to rapid industrialization and significant investments in construction projects.

Does ConsaInsights provide customized market report data for the construction Films industry?

Yes, ConsaInsights offers tailored market report data for the construction films industry. Clients can request specific insights based on their unique needs, ensuring relevant information that drives strategic decisions in their operations.

What deliverables can I expect from this construction Films market research project?

Deliverables from the construction films market research project include comprehensive reports featuring market size analysis, growth projections, segmentation data, competitive landscapes, and strategic recommendations to aid decision-making in this sector.

What are the market trends of construction Films?

Current trends in the construction films market include the increasing adoption of sustainable materials, technological advancements in film production, and a greater focus on energy-efficient solutions. These trends signify a shift towards eco-friendly practices within the industry.