Construction Machinery Tires Market Report

Published Date: 02 February 2026 | Report Code: construction-machinery-tires

Construction Machinery Tires Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Construction Machinery Tires market from 2023 to 2033. It includes market size, growth rates, regional insights, technology trends, key players, and forecasts to guide stakeholders' strategic decisions.

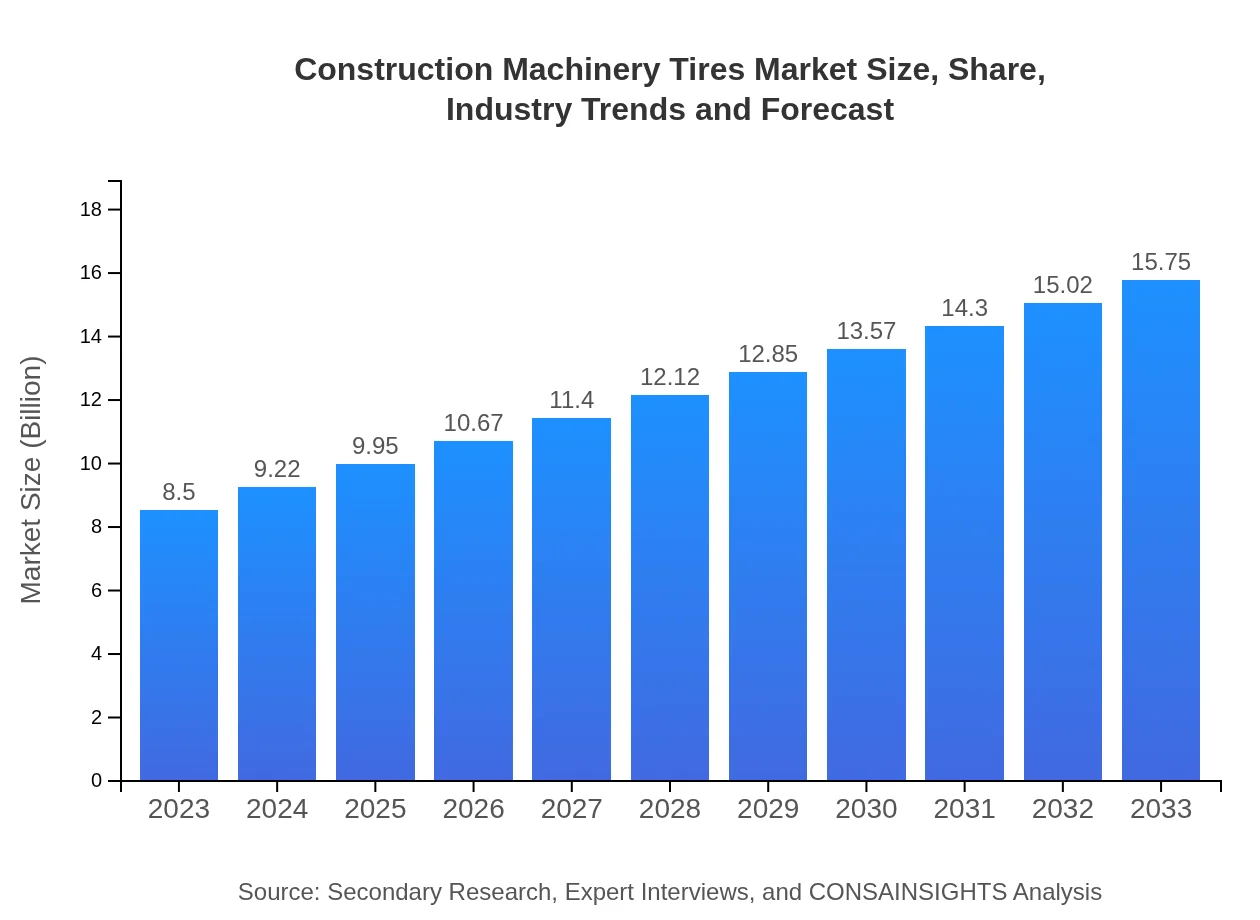

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.75 Billion |

| Top Companies | Michelin, Goodyear, Bridgestone, Continental, Pirelli |

| Last Modified Date | 02 February 2026 |

Construction Machinery Tires Market Overview

Customize Construction Machinery Tires Market Report market research report

- ✔ Get in-depth analysis of Construction Machinery Tires market size, growth, and forecasts.

- ✔ Understand Construction Machinery Tires's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Machinery Tires

What is the Market Size & CAGR of Construction Machinery Tires market in 2023?

Construction Machinery Tires Industry Analysis

Construction Machinery Tires Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Machinery Tires Market Analysis Report by Region

Europe Construction Machinery Tires Market Report:

The European market for Construction Machinery Tires is projected to grow from $2.78 billion in 2023 to $5.14 billion by 2033, fueled by ongoing construction projects and regulations promoting the use of efficient tire technologies.Asia Pacific Construction Machinery Tires Market Report:

The Asia Pacific region is projected to be one of the fastest-growing markets for Construction Machinery Tires, with a size expected to reach $2.86 billion by 2033, up from $1.54 billion in 2023. Rapid urbanization, infrastructural development, and government initiatives in countries like China and India significantly drive this growth.North America Construction Machinery Tires Market Report:

North America is expected to see its market size increase from $2.97 billion in 2023 to $5.50 billion by 2033. The region's sustained infrastructure investment and the increasing adoption of modern construction technologies are key growth drivers.South America Construction Machinery Tires Market Report:

In South America, the market for Construction Machinery Tires is estimated to grow from $0.57 billion in 2023 to $1.06 billion by 2033. This growth is propelled by increasing investment in mining and construction projects, especially in Brazil and Argentina.Middle East & Africa Construction Machinery Tires Market Report:

The Middle East and Africa market is expected to grow from $0.64 billion in 2023 to $1.19 billion by 2033, driven by ongoing infrastructure initiatives and the expansion of the construction and mining sectors.Tell us your focus area and get a customized research report.

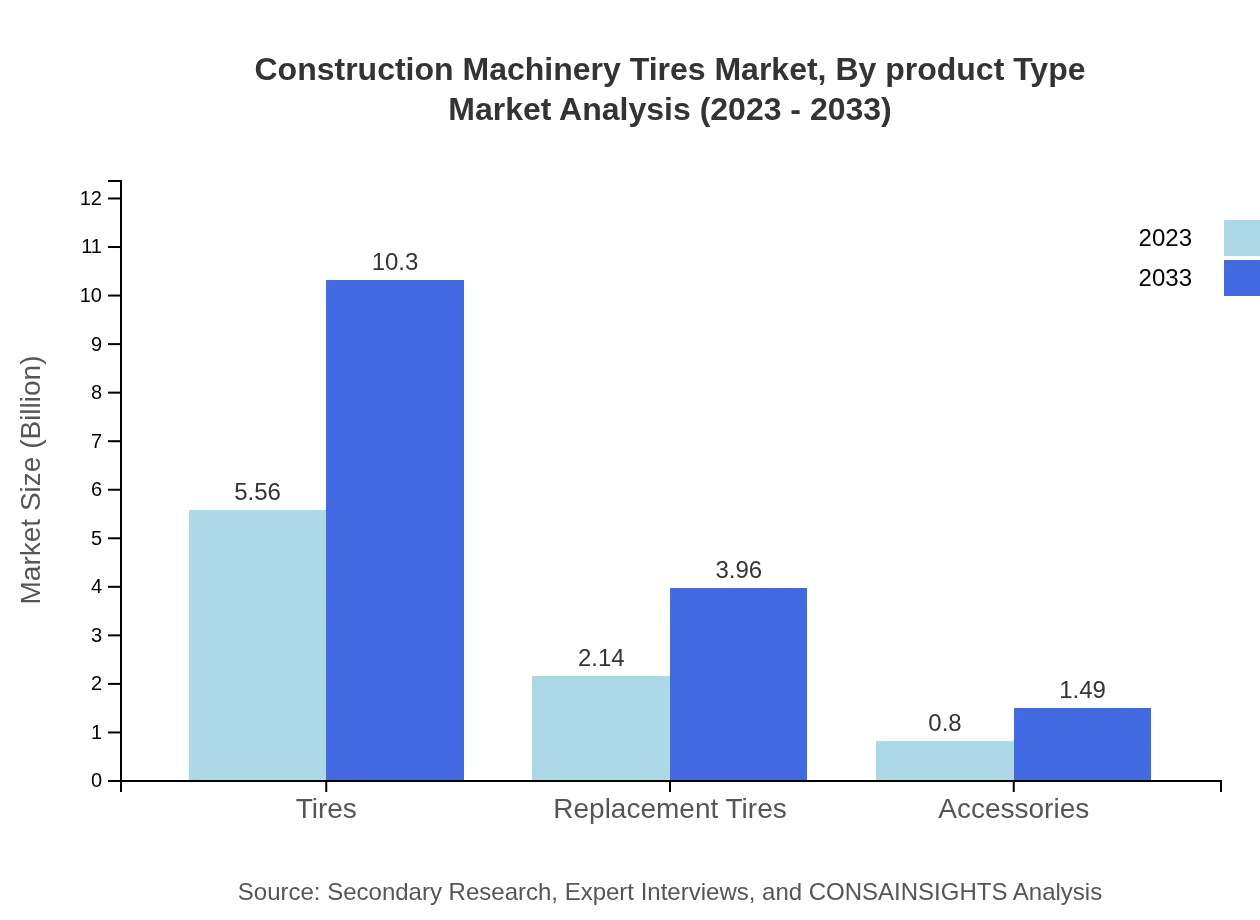

Construction Machinery Tires Market Analysis By Product Type

In the product type segment, ‘Tires’ lead the market with a size anticipated to increase from $5.56 billion in 2023 to $10.30 billion by 2033, holding a steady market share of 65.39%. Following closely, ‘Replacement Tires’ show growth from $2.14 billion to $3.96 billion with a share of 25.14%.

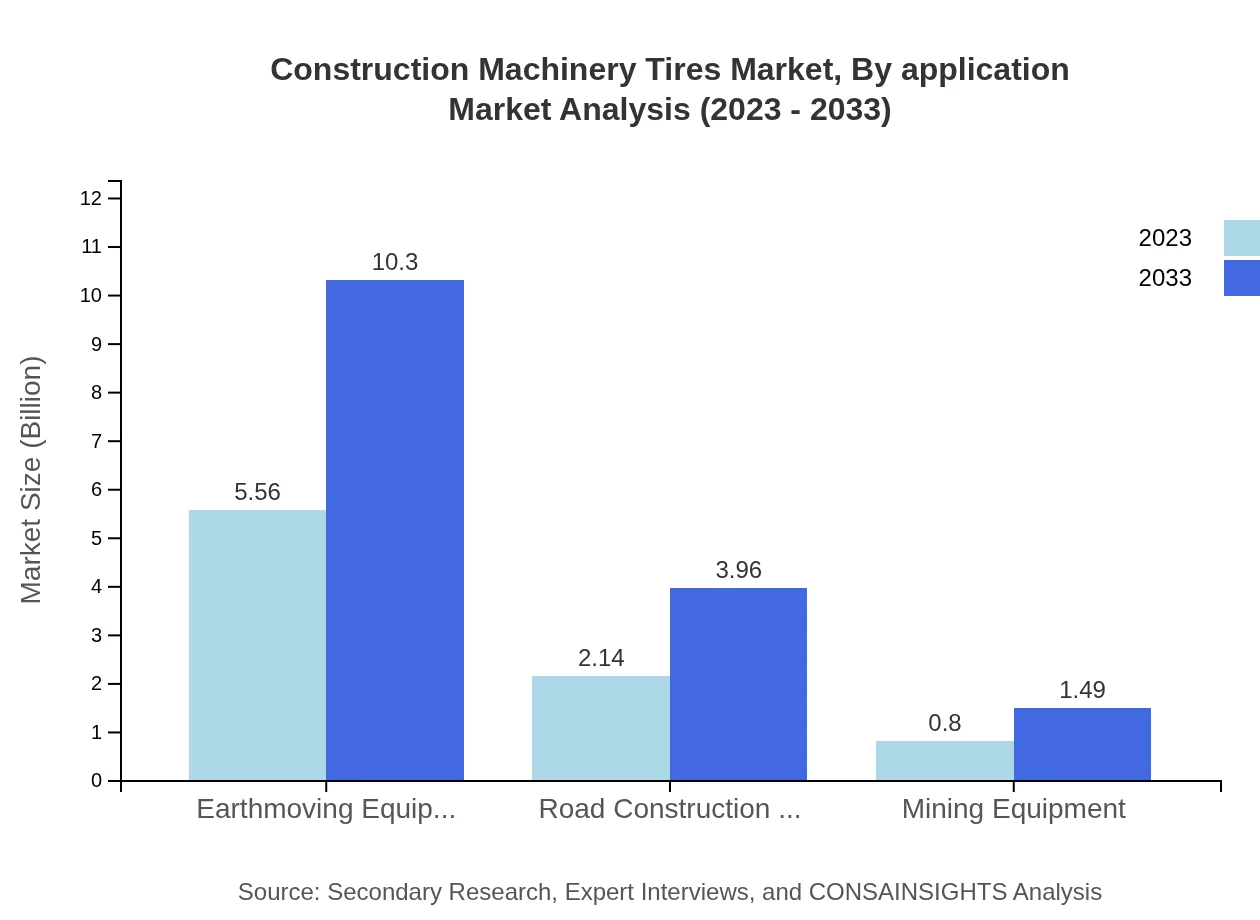

Construction Machinery Tires Market Analysis By Application

Construction companies dominate this segment, with a market size expected to rise from $5.56 billion in 2023 to $10.30 billion by 2033, maintaining a market share of 65.39%. Mining operations are also significant, expected to grow from $2.14 billion to $3.96 billion, preserving a share of 25.14%.

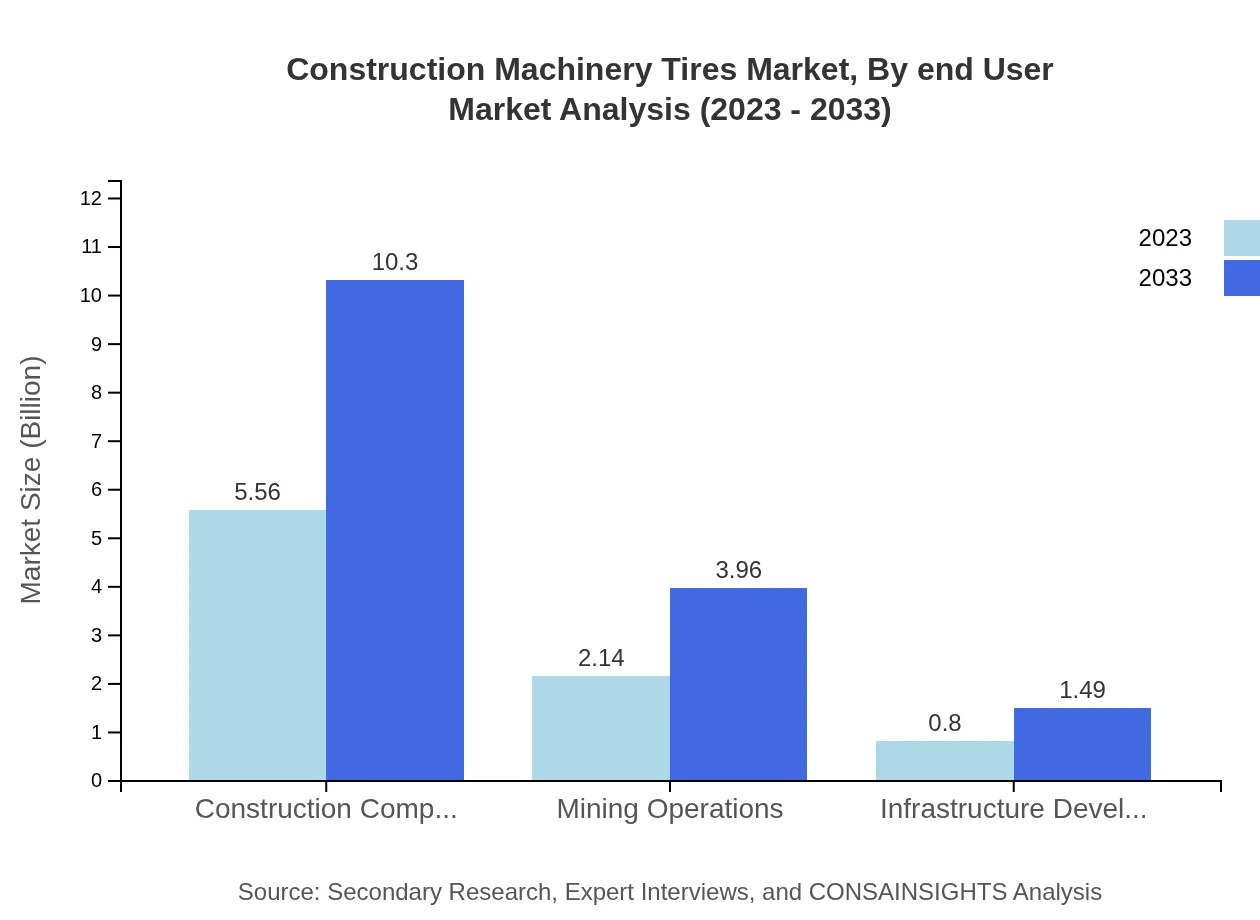

Construction Machinery Tires Market Analysis By End User

End-users comprise mainly Construction companies and Mining operations. The former expects an advancement from $5.56 billion to $10.30 billion, while Mining operations project a rise from $2.14 billion to $3.96 billion.

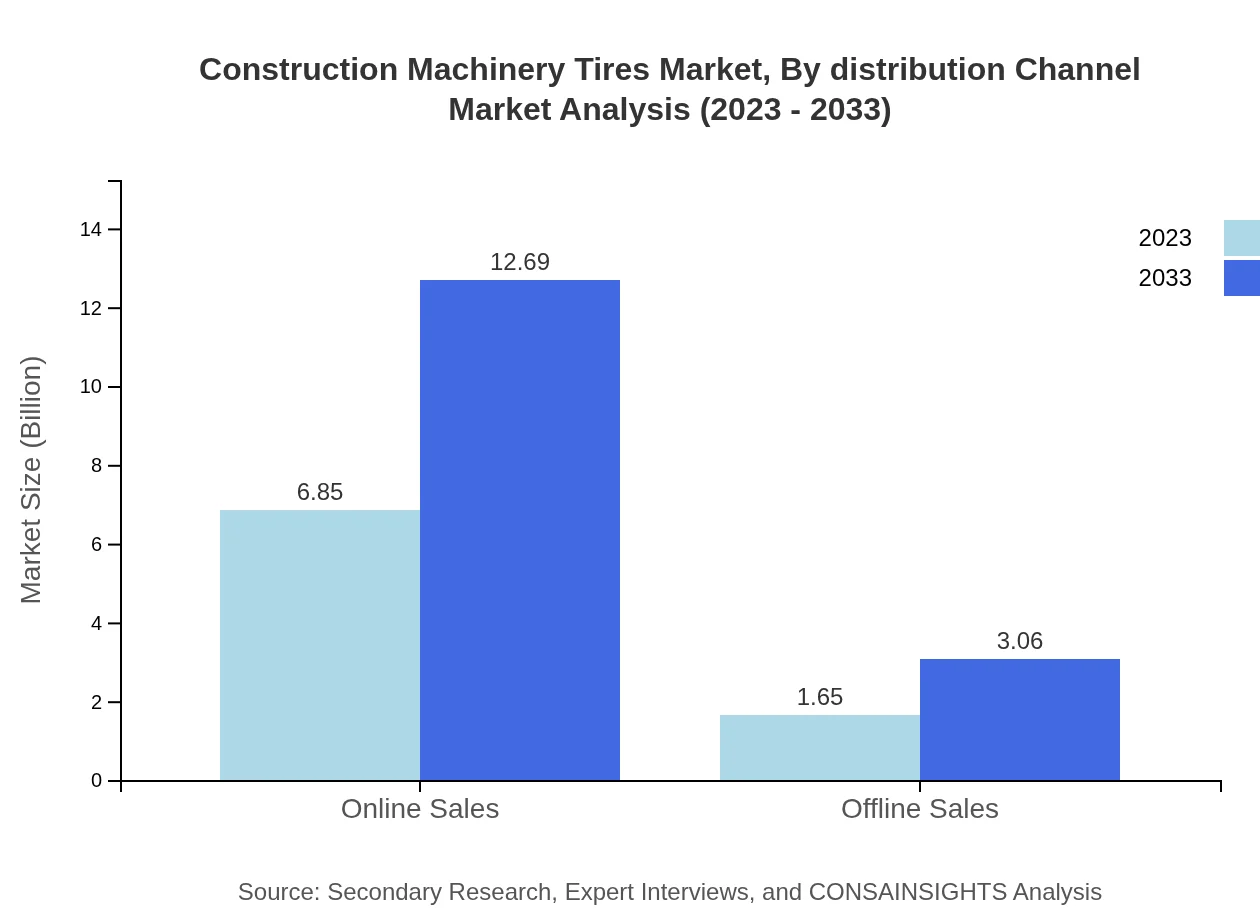

Construction Machinery Tires Market Analysis By Distribution Channel

The distribution channels are primarily characterized by online and offline sales. Online sales dominate the market with an expected growth from $6.85 billion to $12.69 billion, maintaining an 80.57% share, reflecting the rising trend of e-commerce in tire sales.

Construction Machinery Tires Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Machinery Tires Industry

Michelin:

A leading manufacturer known for its innovative tire technologies and extensive product range, Michelin plays a crucial role in advancing tire performance in the construction machinery sector.Goodyear:

Goodyear is a key player in this market, providing durable and high-resiliency tires that are in high demand among construction and mining companies.Bridgestone:

Recognized for its commitment to quality and sustainability, Bridgestone offers a range of superior construction machinery tires catering to various applications.Continental:

Continental is a prominent player known for its focus on safety and performance in modern construction tire technologies.Pirelli:

Pirelli specializes in high-performance tires and is expanding its portfolio to include more robust solutions for construction machinery.We're grateful to work with incredible clients.

FAQs

What is the market size of construction machinery tires?

The construction machinery tires market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 6.2% from 2023 to 2033. This growth underscores increasing demand in sectors such as construction, mining, and infrastructure.

What are the key market players or companies in the construction machinery tires industry?

Key players in the construction machinery tires market include leading tire manufacturers such as Michelin, Bridgestone, Goodyear, Continental, and Yokohama. These companies are known for innovation and quality, contributing significantly to market growth.

What are the primary factors driving the growth in the construction machinery tires industry?

Growth in the construction machinery tires market is driven by factors such as rising construction activities globally, increased demand for mining operations, infrastructure development, and advancements in tire technologies that improve durability and performance.

Which region is the fastest Growing in the construction machinery tires market?

The fastest-growing region in the construction machinery tires market is North America, which is expected to grow from $2.97 billion in 2023 to $5.50 billion by 2033, driven by ongoing infrastructure projects and robust construction activities.

Does ConsaInsights provide customized market report data for the construction machinery tires industry?

Yes, ConsaInsights offers customized market report data for the construction machinery tires industry, allowing clients to tailor insights based on specific needs, regional focus, or market segments to enhance decision-making and strategic planning.

What deliverables can I expect from this construction machinery tires market research project?

From the construction machinery tires market research project, expect comprehensive reports that detail market size, growth forecasts, competitive landscape, regional analysis, and key trends, along with actionable insights to assist in strategic planning.

What are the market trends of construction machinery tires?

Current trends in the construction machinery tires market include a shift towards eco-friendly materials, increased online sales channels, and the adoption of smart tire technologies that enhance monitoring and performance, reflecting the industry's response to evolving customer needs.