Construction Plastics Market Report

Published Date: 22 January 2026 | Report Code: construction-plastics

Construction Plastics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Construction Plastics market from 2023 to 2033, including insights on market size, trends, technology advancements, regional analysis, and key industry players.

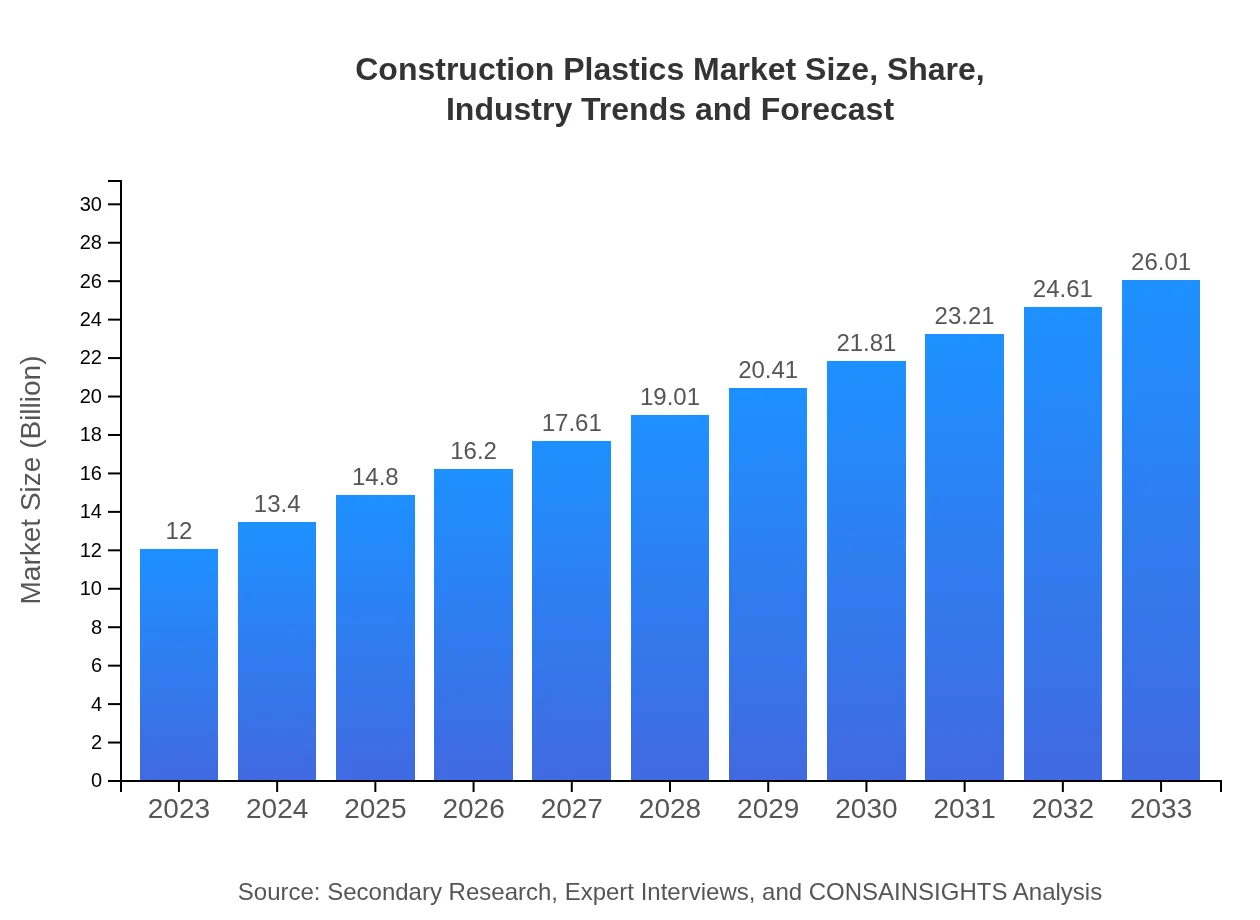

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $26.01 Billion |

| Top Companies | BASF, Dow Chemical, Saint-Gobain, SABIC |

| Last Modified Date | 22 January 2026 |

Construction Plastics Market Overview

Customize Construction Plastics Market Report market research report

- ✔ Get in-depth analysis of Construction Plastics market size, growth, and forecasts.

- ✔ Understand Construction Plastics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Plastics

What is the Market Size & CAGR of Construction Plastics market in 2023?

Construction Plastics Industry Analysis

Construction Plastics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Plastics Market Analysis Report by Region

Europe Construction Plastics Market Report:

The European market for construction plastics is set to grow from $3.48 billion in 2023 to $7.53 billion by 2033. The European Union’s stringent regulations on safety and environmental impacts are driving innovation and adoption of advanced plastic materials in construction applications.Asia Pacific Construction Plastics Market Report:

The Asia Pacific region is poised for significant market growth, projected to increase from $2.36 billion in 2023 to $5.12 billion by 2033, driven by rapid urbanization and infrastructure development across countries like India and China. The region’s focus on affordable housing solutions is further propelling the demand for construction plastics.North America Construction Plastics Market Report:

North America holds a substantial share of the market, with a size forecast to rise from $4.36 billion in 2023 to $9.44 billion by 2033. Strong regulatory support for sustainable construction coupled with high spending on renovations and new builds keeps the demand for construction plastics robust.South America Construction Plastics Market Report:

In South America, the market size is expected to grow from $0.46 billion in 2023 to $0.99 billion by 2033. Key drivers include improvements in construction technology and an increasing number of construction projects, especially in Brazil and Argentina.Middle East & Africa Construction Plastics Market Report:

The Middle East and Africa region is projected to grow from $1.35 billion in 2023 to $2.93 billion by 2033. The construction boom in the UAE, coupled with significant investments in infrastructure projects across various African nations, will likely enhance market prospects in this region.Tell us your focus area and get a customized research report.

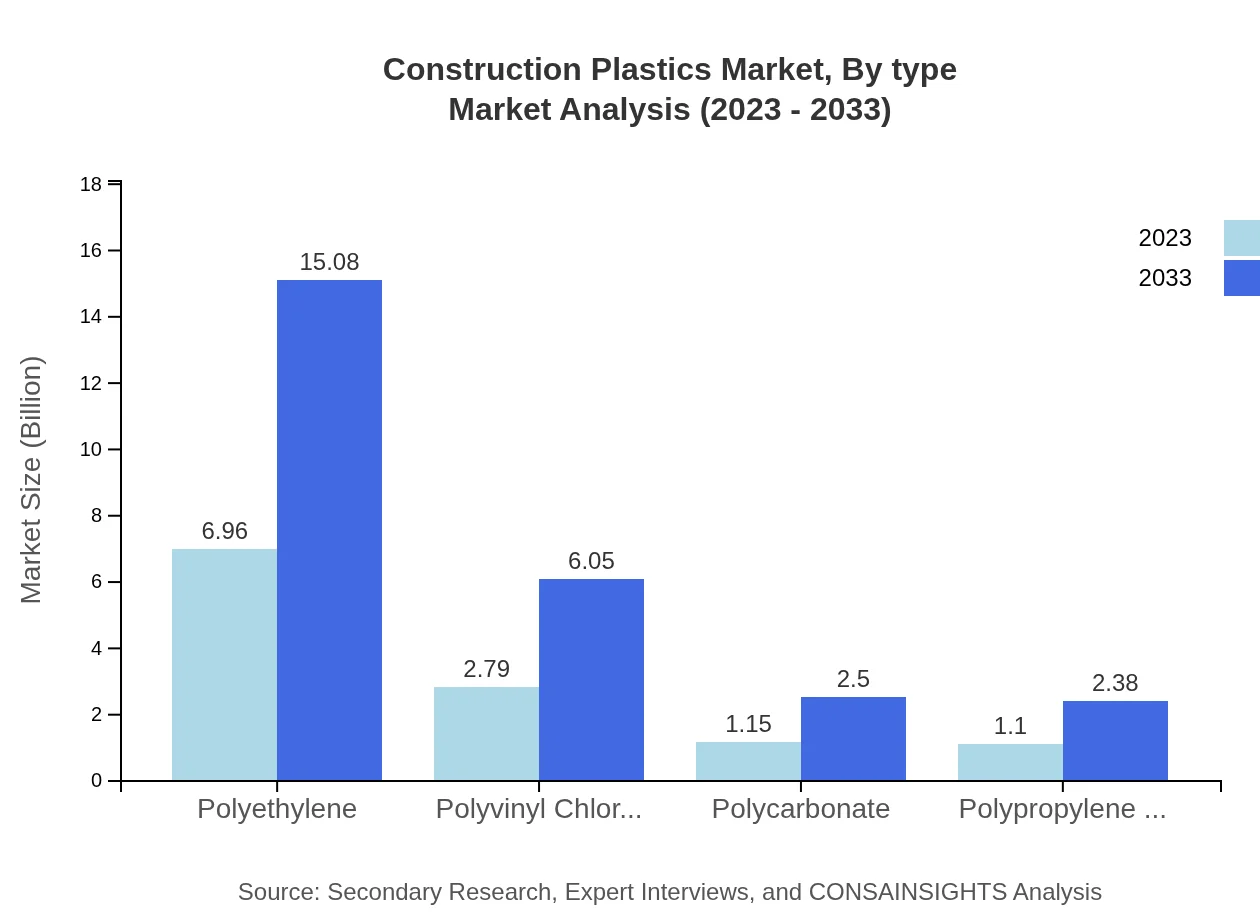

Construction Plastics Market Analysis By Type

The Construction Plastics market is dominated by Polyethylene, which constituted a market size of $6.96 billion in 2023, expected to reach $15.08 billion by 2033, maintaining a share of 57.98%. Polyvinyl Chloride (PVC) follows with a size of $2.79 billion in 2023, projected to rise to $6.05 billion, sustaining a similar share. Polycarbonate and Polypropylene are also significant players, together contributing to the diverse applications and functionalities of construction plastics.

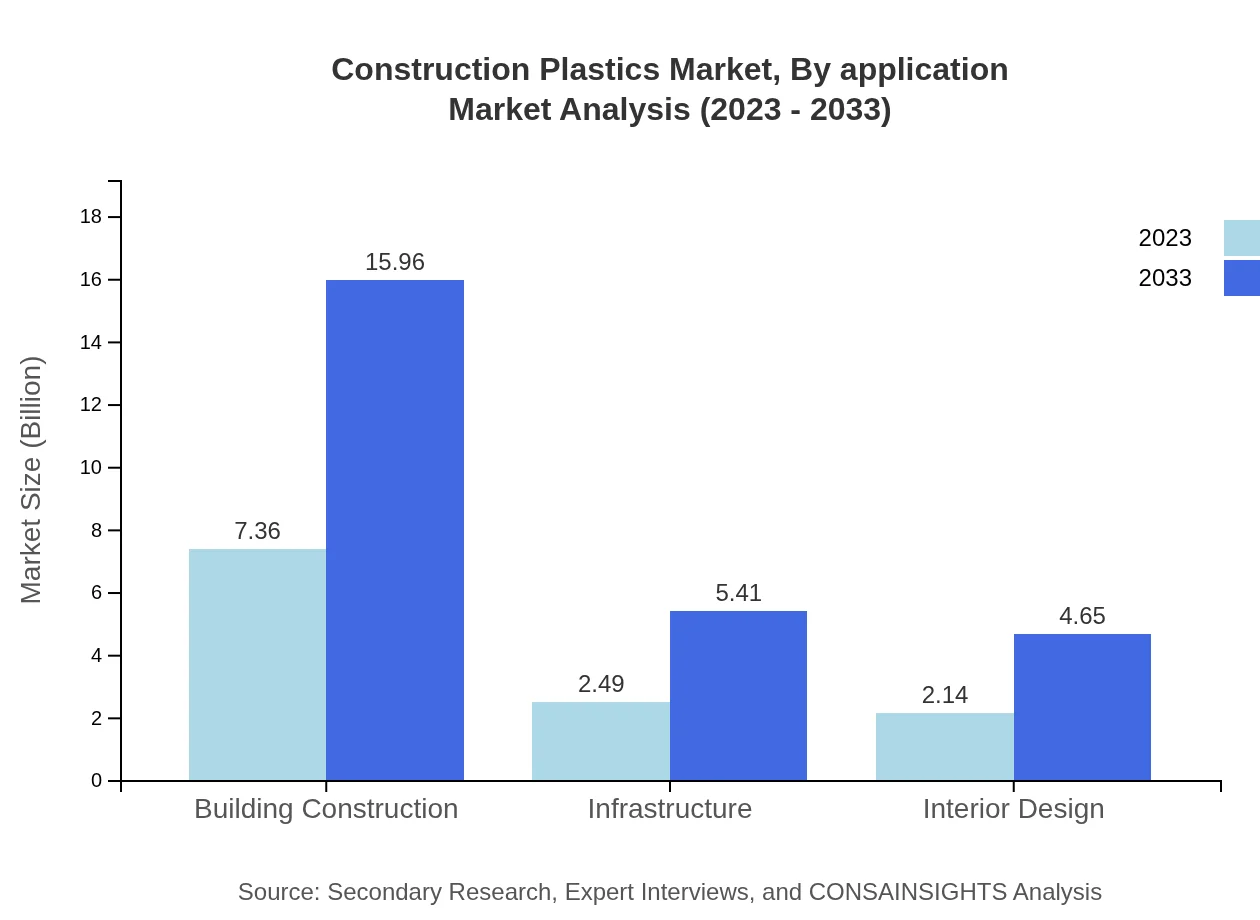

Construction Plastics Market Analysis By Application

In terms of application, residential construction is the leading segment, valued at $7.36 billion in 2023 and expected to grow to $15.96 billion by 2033, representing a consistent share. Commercial construction and industrial construction applications are also noteworthy, highlighting the versatile use of construction plastics in various builidng needs.

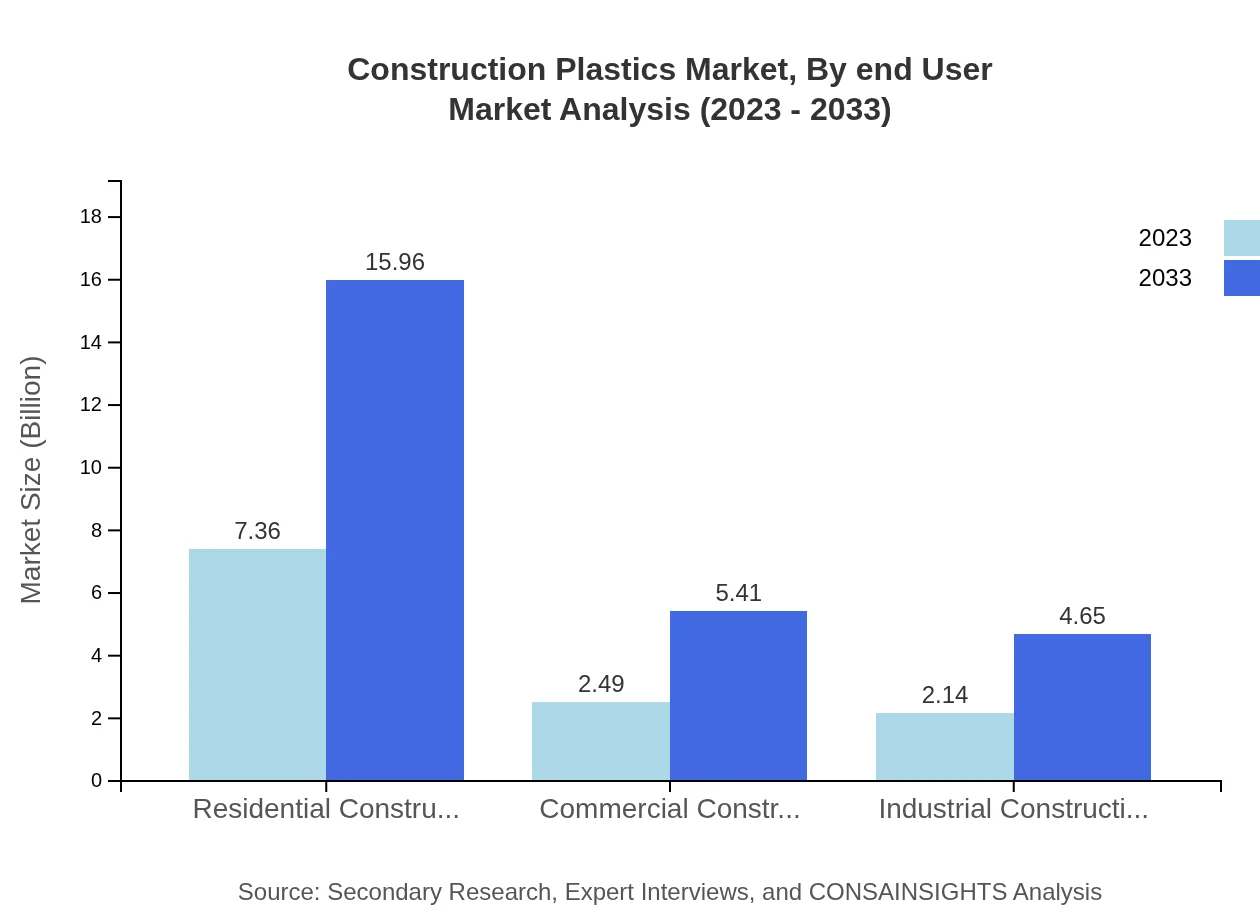

Construction Plastics Market Analysis By End User

The end-user segment shows strong demand from both individual consumers in residential settings and large organizations in the commercial sector. The latter is projected to account for $2.49 billion in 2023, increasing to $5.41 billion by 2033, reflecting the growing demand for efficient construction materials across various business sectors.

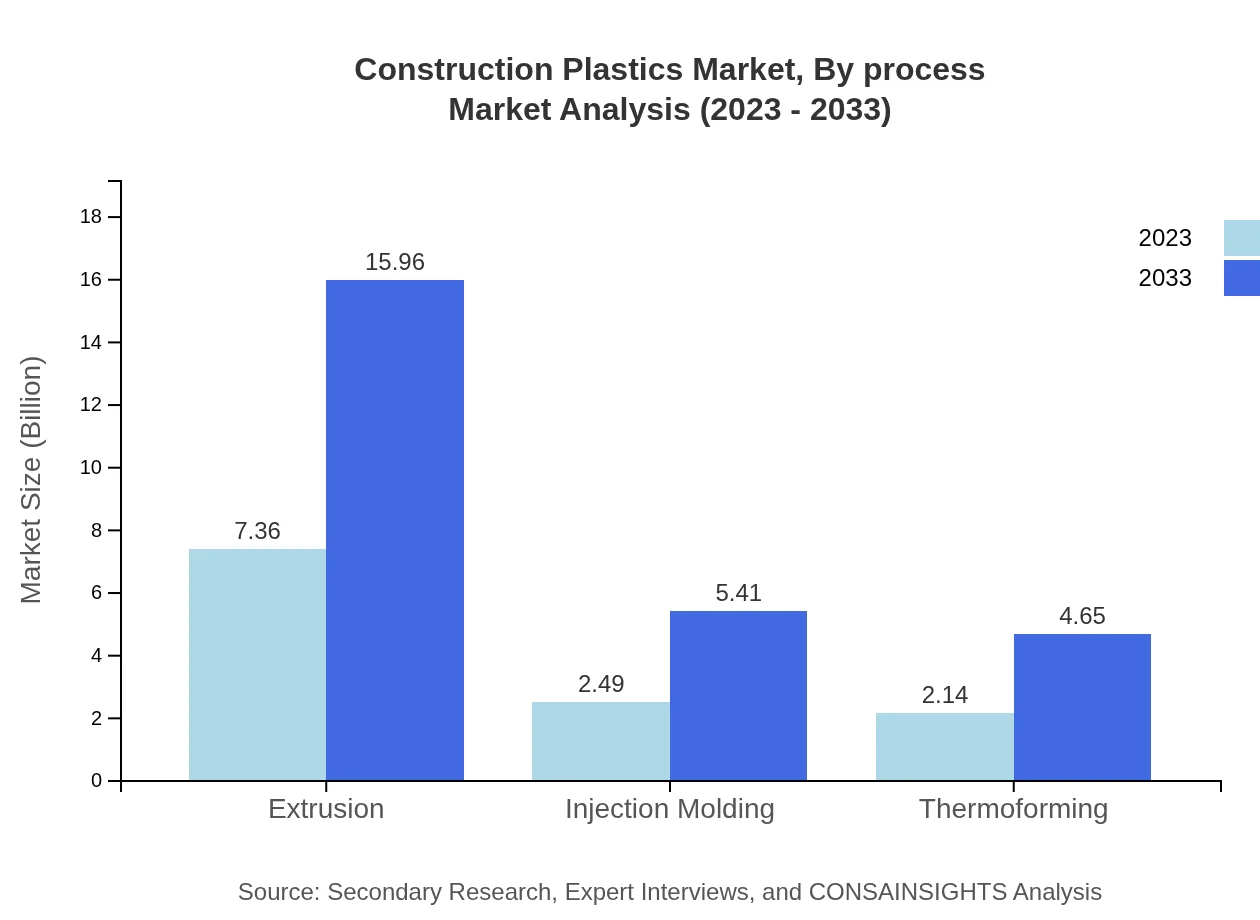

Construction Plastics Market Analysis By Process

Manufacturing processes such as extrusion dominate the market, valued at $7.36 billion in 2023 and expected to reach $15.96 billion in 2033, with the highest market share. Following this, injection molding and thermoforming are also critical, aiding in producing a wide range of plastic components necessary for construction projects.

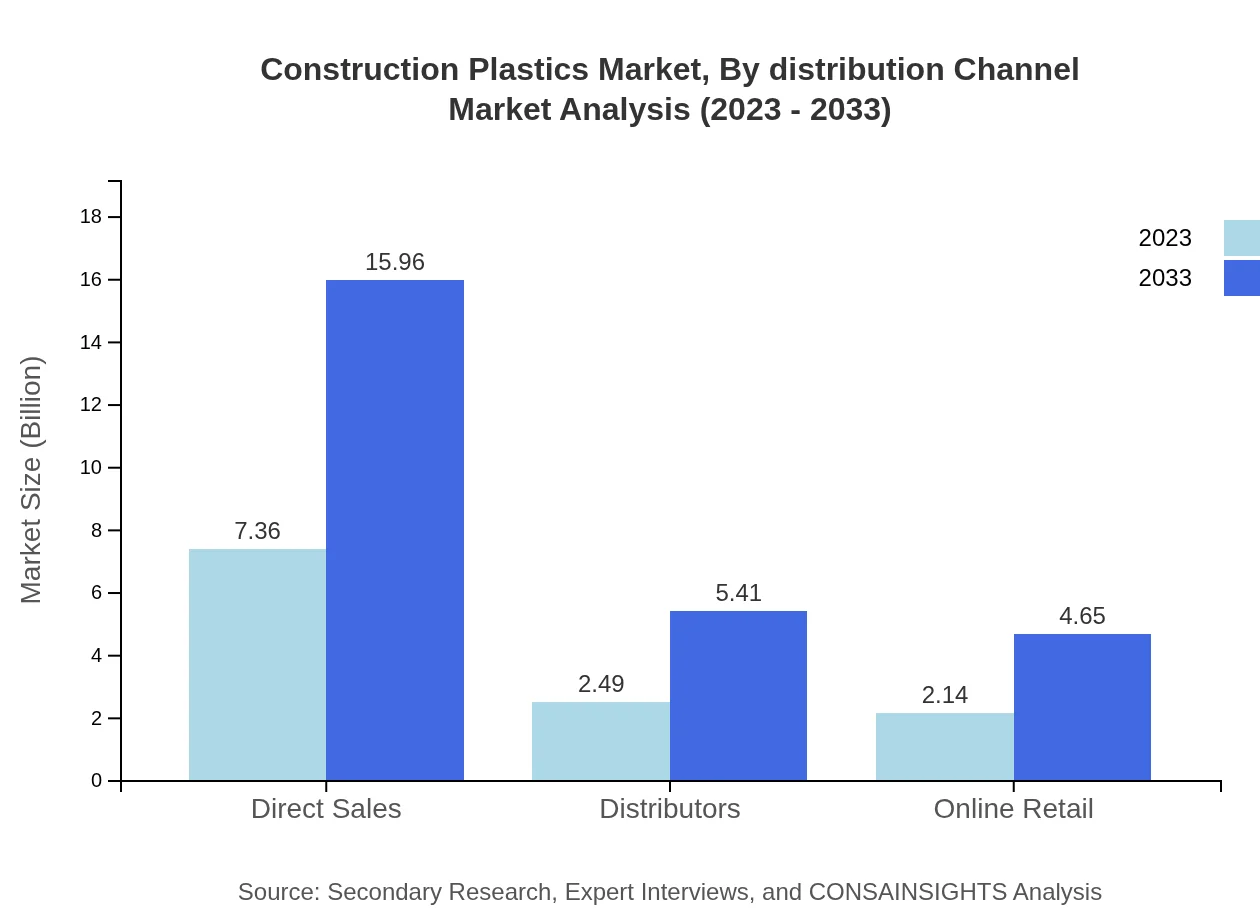

Construction Plastics Market Analysis By Distribution Channel

Distribution channels significantly impact market performance, with direct sales leading at $7.36 billion in 2023, set to grow to $15.96 billion by 2033. Other channels, including distributors and online retail, are also growing, driven by changing consumer purchasing behavior.

Construction Plastics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Plastics Industry

BASF:

A global leader in chemical production, BASF is known for its innovative and sustainable solutions in construction plastics, providing a wide range of products including insulation and protective coatings.Dow Chemical:

One of the largest chemical manufacturers, Dow Chemical produces a variety of construction plastics that are integral to building applications including energy-efficient solutions.Saint-Gobain:

A key player in the construction market, Saint-Gobain offers a diverse array of construction plastics and solutions aimed at enhancing building performance and sustainability.SABIC:

SABIC is recognized for its strong market presence in construction plastics offering high-performance materials that facilitate energy savings and environmental protection in construction projects.We're grateful to work with incredible clients.

FAQs

What is the market size of construction plastics?

The construction plastics market is valued at approximately $12 billion in 2023, with projections to grow significantly by 2033, supported by a compound annual growth rate (CAGR) of 7.8%. This growth reflects increased adoption across various segments.

What are the key market players or companies in the construction plastics industry?

Key players in the construction plastics industry include leading manufacturers and suppliers who specialize in producing materials like PVC, polyethylene, and polycarbonate, aiding in innovation and catering to diverse construction needs.

What are the primary factors driving the growth in the construction plastics industry?

The growth in the construction plastics market is driven by factors such as rising urbanization, increased demand for durable materials, the growing adoption of sustainable building practices, and technological advancements in plastic production.

Which region is the fastest Growing in the construction plastics market?

The Asia Pacific region is currently the fastest-growing in the construction plastics market, with an expected increase from $2.36 billion in 2023 to $5.12 billion by 2033, highlighting robust construction activities and rising infrastructure investments.

Does ConsaInsights provide customized market report data for the construction plastics industry?

Yes, ConsaInsights offers tailored market report data for the construction plastics industry, allowing clients to access specific insights and analyses that meet their unique industry-related requirements.

What deliverables can I expect from this construction plastics market research project?

From the construction plastics market research project, clients can expect comprehensive reports including market size, segment analysis, growth forecasts, competitive landscapes, and strategic recommendations tailored to their needs.

What are the market trends of construction plastics?

Current trends in the construction plastics market include increased focus on recycling efforts, advancements in polymer technologies, rising preferences for lightweight materials, and enhanced durability features to meet construction standards.