Construction Robots Market Report

Published Date: 22 January 2026 | Report Code: construction-robots

Construction Robots Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Construction Robots market from 2023 to 2033, detailing market size, growth rates, and industry trends while offering insights into market segmentation and regional performance.

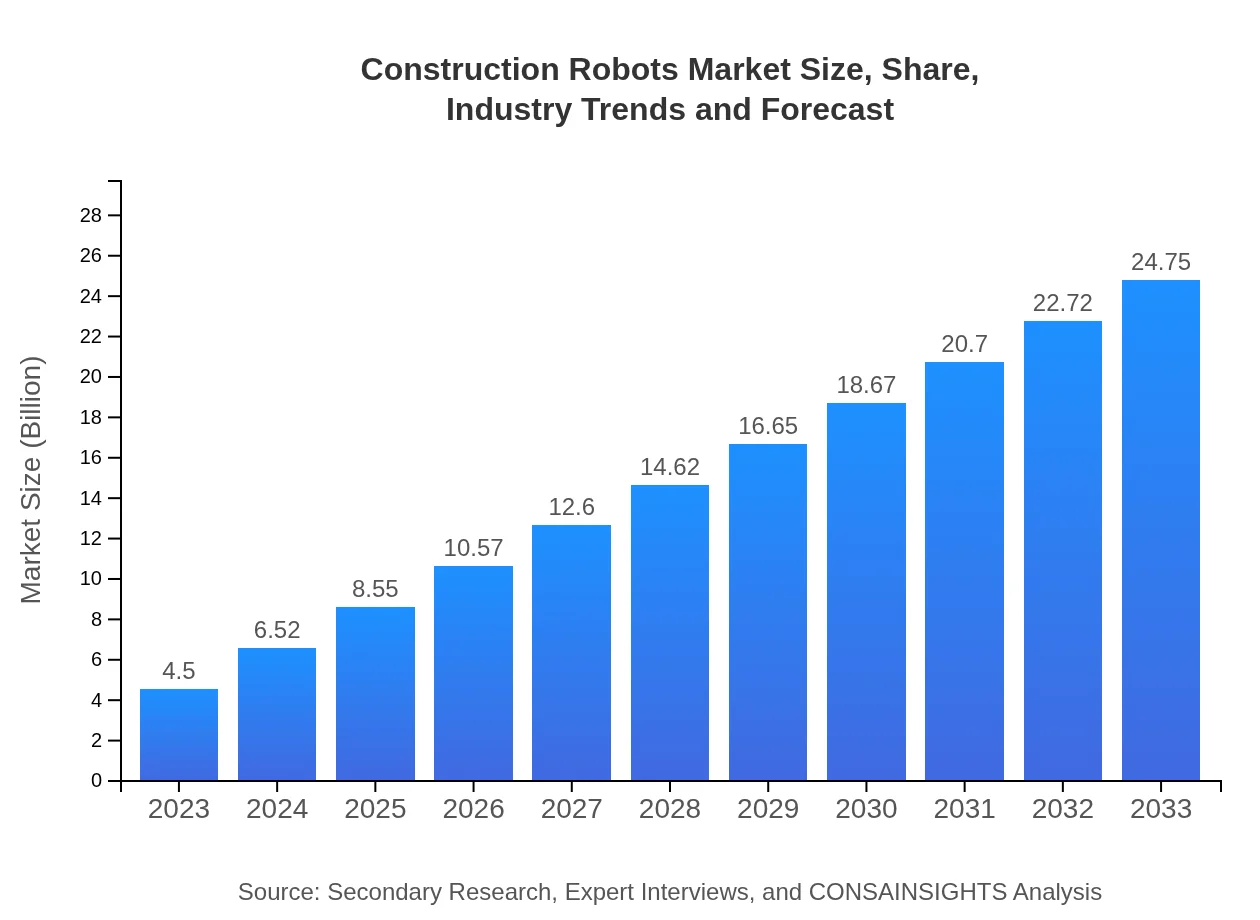

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 17.6% |

| 2033 Market Size | $24.75 Billion |

| Top Companies | Icon Robotics, Fastbrick Robotics, Boston Dynamics, Built Robotics, Excavator Robotics |

| Last Modified Date | 22 January 2026 |

Construction Robots Market Overview

Customize Construction Robots Market Report market research report

- ✔ Get in-depth analysis of Construction Robots market size, growth, and forecasts.

- ✔ Understand Construction Robots's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Robots

What is the Market Size & CAGR of Construction Robots market in 2023?

Construction Robots Industry Analysis

Construction Robots Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Robots Market Analysis Report by Region

Europe Construction Robots Market Report:

Europe's Construction Robots market is expected to amplify from $1.14 billion in 2023 to $6.29 billion by 2033, spurred by stringent regulations aimed at improving construction site safety and efficiency. Germany, the UK, and France lead the charge in robotics adoption supported by increasing public and private investments in smart construction technologies aimed at sustainability.Asia Pacific Construction Robots Market Report:

In the Asia Pacific region, the Construction Robots market is projected to expand significantly, from $0.90 billion in 2023 to approximately $4.93 billion by 2033. The upsurge is attributed to the booming construction industry in countries like China and India, where government investment in infrastructure is markedly increasing. Japan also plays a pivotal role due to its advanced robotics technology and aging workforce, encouraging the adoption of robots in construction tasks.North America Construction Robots Market Report:

North America remains a leader in the Construction Robots market, anticipated to rise from $1.58 billion in 2023 to about $8.67 billion by 2033. The region's robust investment in construction technology and ongoing adoption of automation solutions in response to a labor shortage strongly influence this growth. The U.S. is at the forefront of this trend, emphasizing safety and efficiency in construction processes through robotics.South America Construction Robots Market Report:

The South American Construction Robots market is expected to grow from $0.27 billion in 2023 to around $1.48 billion by 2033. This growth is fueled by a rise in construction activities, driven by urbanization and economic recovery post-COVID-19. Countries like Brazil and Argentina are concentrating on infrastructure investment, signaling opportunities for robotics uptake to enhance project efficiency and cost-effectiveness.Middle East & Africa Construction Robots Market Report:

In the Middle East and Africa, the market for Construction Robots is projected to grow from $0.61 billion in 2023 to approximately $3.36 billion by 2033, driven by ambitious construction projects linked to urbanization and economic diversification strategies. Notably, the UAE's emphasis on innovation and technology in construction illustrates significant potential for robotics integration.Tell us your focus area and get a customized research report.

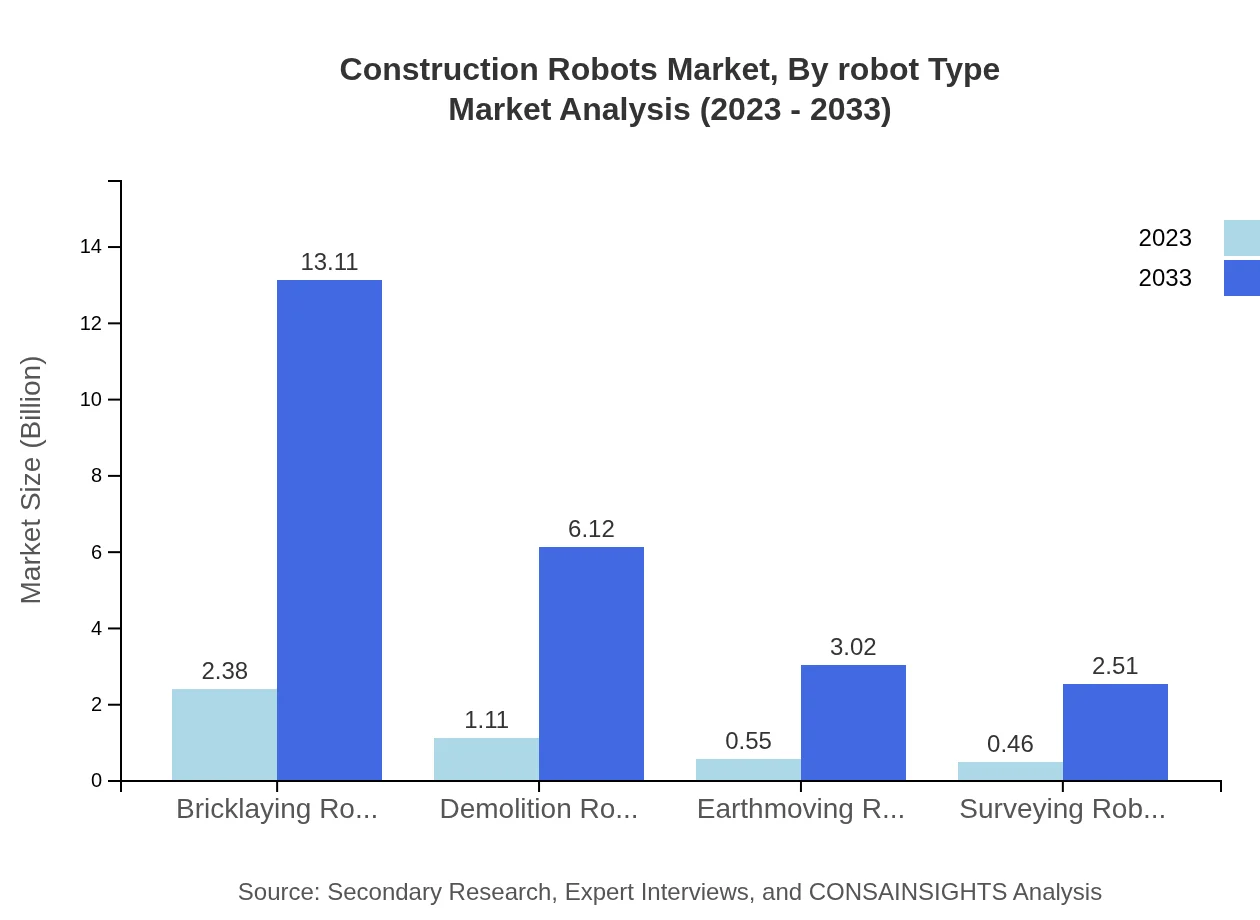

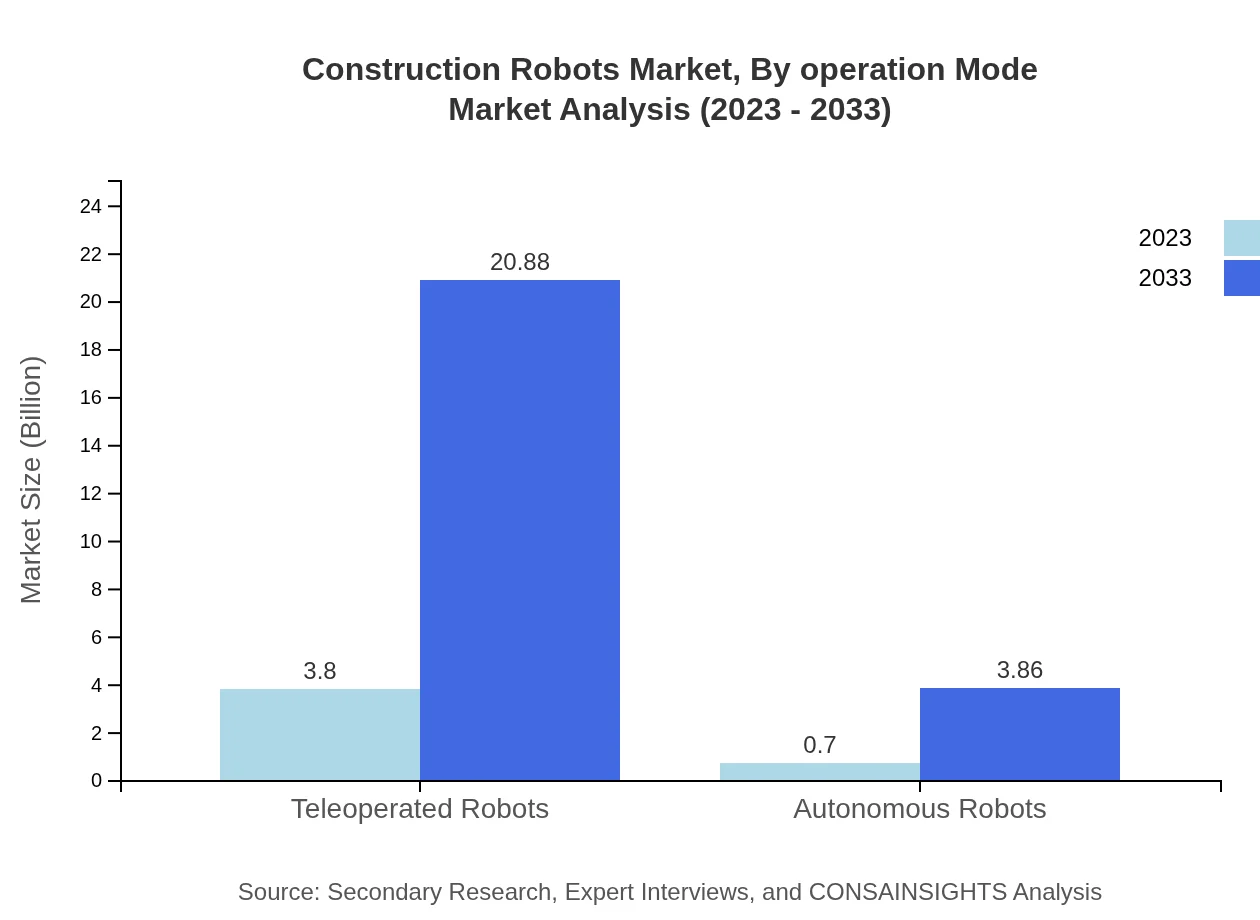

Construction Robots Market Analysis By Robot Type

The market analysis by robot type shows robust growth across various segments. Teleoperated robots lead the industry with a conversion from a market size of $3.80 billion in 2023 to an impressive $20.88 billion in 2033, holding an 84.39% market share. Meanwhile, autonomous robots, although smaller at $0.70 billion in 2023, are projected to substantially increase to $3.86 billion in 2033, targeting a 15.61% market share. Other types, such as bricklaying robots, also demonstrate promising growth, reflecting industry dynamics shifting toward increased automation.

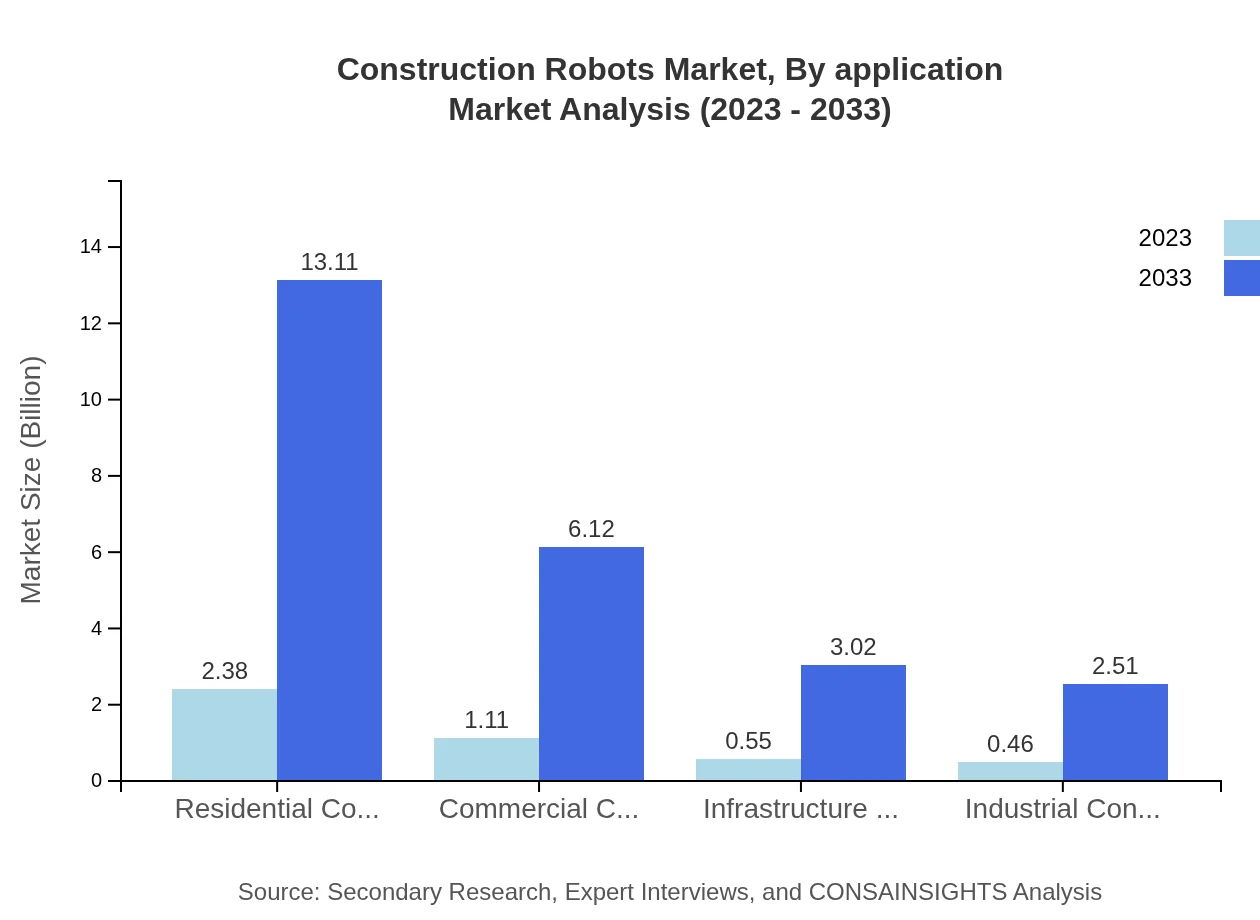

Construction Robots Market Analysis By Application

Segmentation by application reveals distinct market variations, with residential construction being the frontrunner. It is expected to expand from $2.38 billion in 2023 to $13.11 billion by 2033, capturing 52.97% of the market share. Commercial construction and infrastructure construction follow suit with anticipated sizes of $6.12 billion and $3.02 billion, respectively, hinting at a diversified application of robotic technologies across different building types.

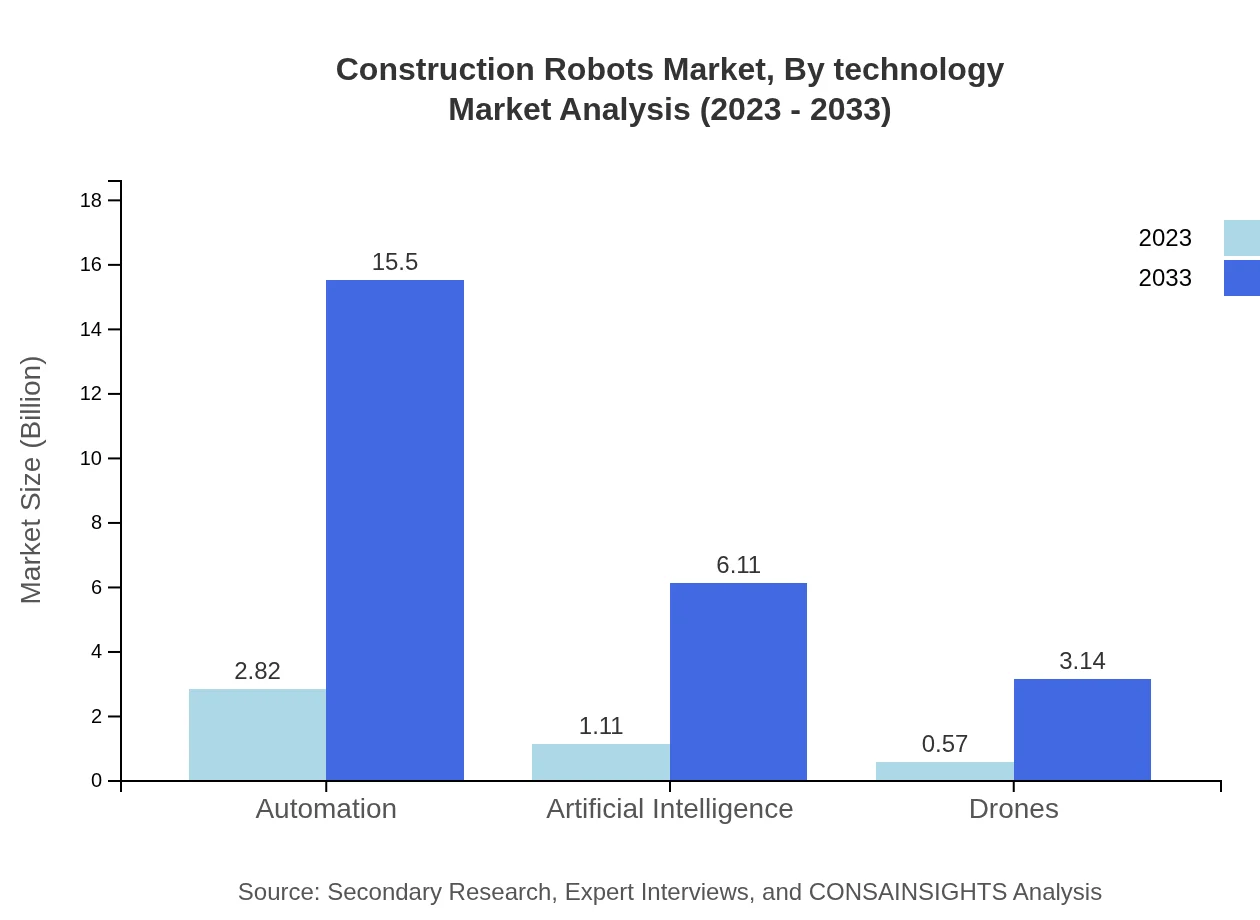

Construction Robots Market Analysis By Technology

An examination based on technology unveils significant adoption of automation and AI in construction robots. Automation leads the charge with a projected growth from $2.82 billion to $15.50 billion over the forecast period, yet AI-driven robots are also increasing in relevance, reflecting a trend towards more intelligent and adaptable construction processes.

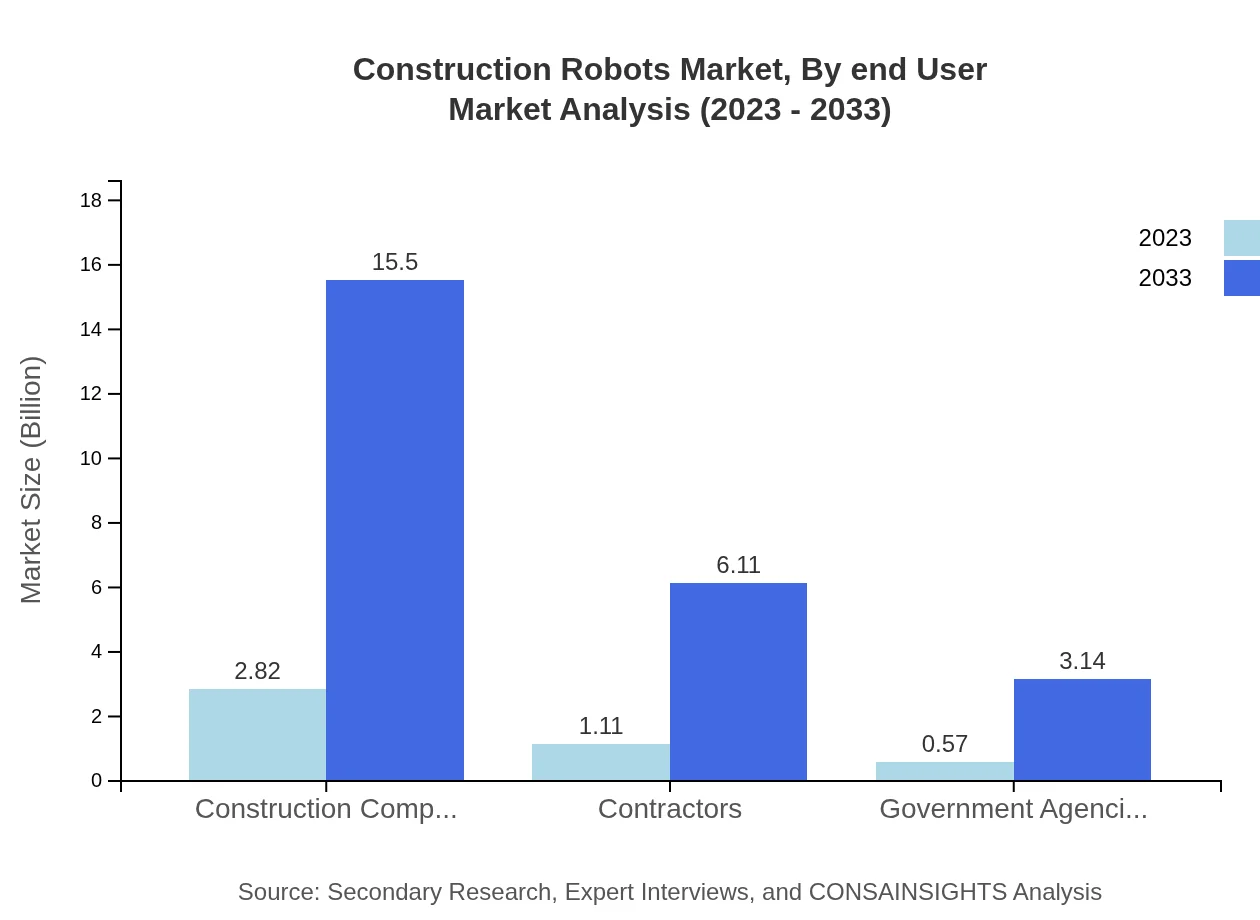

Construction Robots Market Analysis By End User

The end-user analysis points to construction companies dominating market share, with projected sizes of $2.82 billion in 2023 and $15.50 billion in 2033. Contractors also secure a substantial portion, with $1.11 billion increasing to $6.11 billion over the decade. Government agencies' role is growing, indicative of public sector experiments in robotics within urban development projects.

Construction Robots Market Analysis By Operation Mode

Analysis by operation mode highlights teleoperated robots as the most prevalent mode, expected to command market share throughout the period. Autonomous robots are increasingly recognized for their potential to transform operational efficiency, with market sizes showing definite growth, hinting at a pivot within operations toward less human intervention.

Construction Robots Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Robots Industry

Icon Robotics:

Icon Robotics is known for its innovative bricklaying technology, pioneering automation in the construction sector, and significantly reducing construction time and costs.Fastbrick Robotics:

Fastbrick employs advanced robotic arms specifically designed for bricklaying, emphasizing precision and speed, boosting labor efficiency on construction sites.Boston Dynamics:

Boston Dynamics integrates cutting-edge robotics into construction processes, focusing on mobility and adaptability with their robot fleet designed for varied construction tasks.Built Robotics:

Built Robotics specializes in transforming traditional construction equipment into automated machines, enhancing productivity with autonomous digging and grading systems.Excavator Robotics:

Focusing on earthmoving applications, Excavator Robotics develops autonomous and teleoperated excavators designed for applications in construction sites and quarries.We're grateful to work with incredible clients.

FAQs

What is the market size of construction robots?

The global construction robots market is estimated at $4.5 billion in 2023, with a projected CAGR of 17.6%. By 2033, this market is expected to realize significant growth, indicating a robust demand for robotic solutions in construction.

What are the key market players or companies in this construction robots industry?

Key players in the construction robots industry include leading technology companies and innovative start-ups, focusing on the development of automated solutions like bricklaying, demolition, and surveying robots that enhance productivity and safety.

What are the primary factors driving the growth in the construction robots industry?

Growth drivers include labor shortages, advancements in robotics technology, rising safety regulations, and the need for increased efficiency in construction processes, which encourage the adoption of automation across various projects.

Which region is the fastest Growing in the construction robots market?

The fastest-growing region for construction robots is expected to be North America, with the market projected to expand from $1.58 billion in 2023 to $8.67 billion by 2033, driven by significant investments in technology and infrastructure.

Does ConsaInsights provide customized market report data for the construction robots industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients, providing in-depth analysis and insights to support strategic decision-making in the construction robots industry.

What deliverables can I expect from this construction robots market research project?

Clients can expect comprehensive market analysis, trend reports, competitive landscape assessments, and segmented market data, including insights on key players, growth drivers, and regional market dynamics.

What are the market trends of construction robots?

Current market trends include increased integration of AI and automation in construction tasks, a rise in demand for teleoperated and autonomous robots, and a growing focus on sustainability and efficiency within the construction sector.