Construction Scaffolding Rental Market Report

Published Date: 22 January 2026 | Report Code: construction-scaffolding-rental

Construction Scaffolding Rental Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Construction Scaffolding Rental market, covering insights and data from 2023 to 2033. It includes market size estimations, segmentation, regional analysis, and trends, offering an in-depth look at future growth opportunities and challenges within the industry.

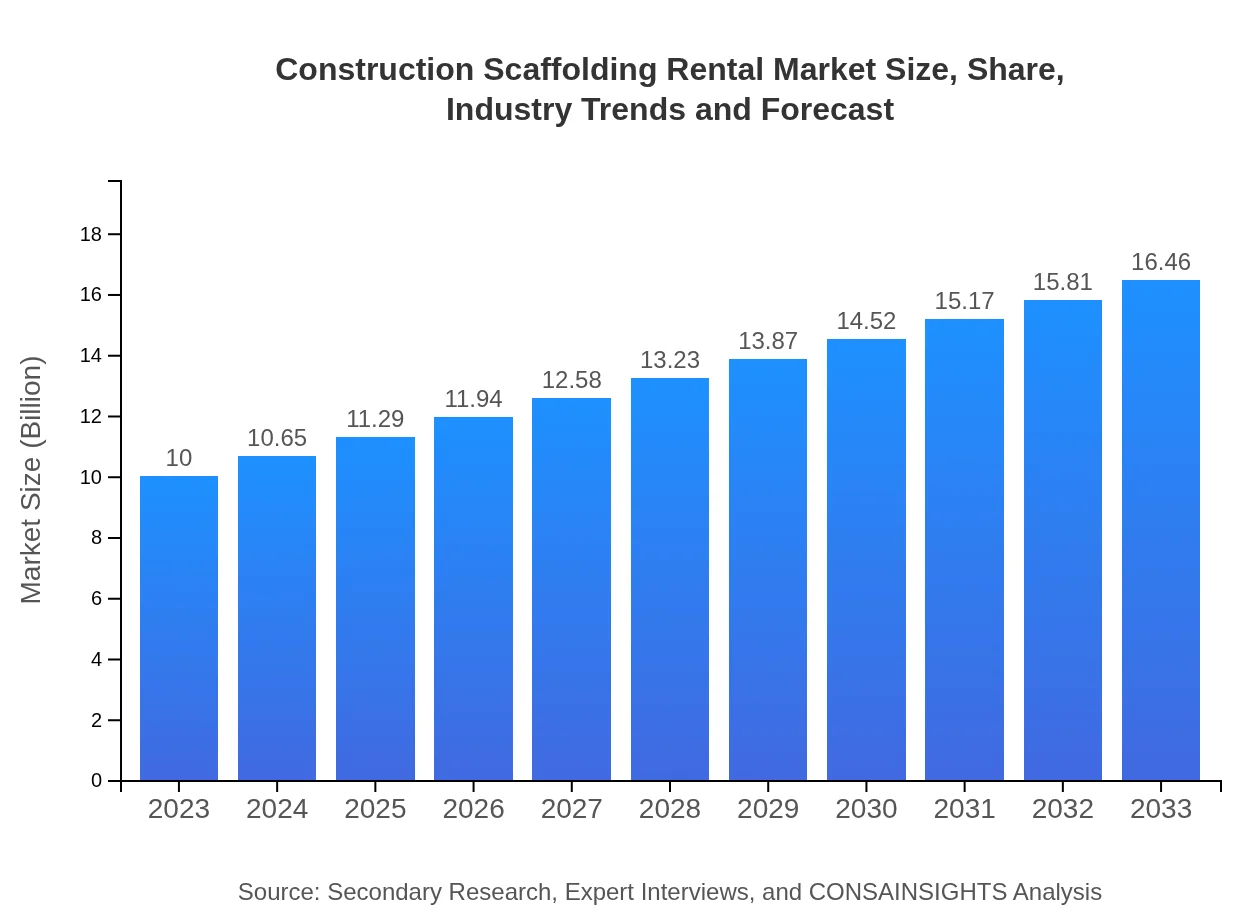

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Layher, PERI Group, BrandSafway, Altrad Group, Harsco Infrastructure |

| Last Modified Date | 22 January 2026 |

Construction Scaffolding Rental Market Overview

Customize Construction Scaffolding Rental Market Report market research report

- ✔ Get in-depth analysis of Construction Scaffolding Rental market size, growth, and forecasts.

- ✔ Understand Construction Scaffolding Rental's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Scaffolding Rental

What is the Market Size & CAGR of the Construction Scaffolding Rental market in 2023?

Construction Scaffolding Rental Industry Analysis

Construction Scaffolding Rental Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Scaffolding Rental Market Analysis Report by Region

Europe Construction Scaffolding Rental Market Report:

The European market for scaffolding rental is predicted to increase from $2.65 billion in 2023 to $4.37 billion by 2033, translating to a CAGR of 5.13%. The continuous demand for efficient scaffolding solutions in the construction and renovation of existing infrastructures drives this growth.Asia Pacific Construction Scaffolding Rental Market Report:

The Asia Pacific region is projected to grow from $2.15 billion in 2023 to $3.54 billion by 2033, reflecting a strong CAGR of 5.03%. Rapid urbanization, increased investment in infrastructure, and the expansion of the construction industry drive this growth. Countries such as China and India are significant contributors to the regional market due to their ongoing large-scale construction projects.North America Construction Scaffolding Rental Market Report:

North America is expected to witness growth from $3.47 billion in 2023 to $5.72 billion by 2033. Factors such as advanced construction practices, stringent safety regulations, and a robust focus on urban redevelopment projects are likely to sustain this market's expansion at a CAGR of 5.07%. The United States is the dominant market in this region.South America Construction Scaffolding Rental Market Report:

In South America, the market size will rise from $0.52 billion in 2023 to $0.86 billion by 2033, with a CAGR of 5.13%. Growth is fueled by increased government spending on infrastructure and an increase in housing projects. Key markets include Brazil and Argentina, where construction activity is on the rise.Middle East & Africa Construction Scaffolding Rental Market Report:

The Middle East and Africa market will grow from $1.20 billion in 2023 to $1.98 billion by 2033, demonstrating a CAGR of 5.12%. Increased investments in infrastructure projects, such as venues for sports events and urban development, are driving the demand for scaffolding rental services in this region.Tell us your focus area and get a customized research report.

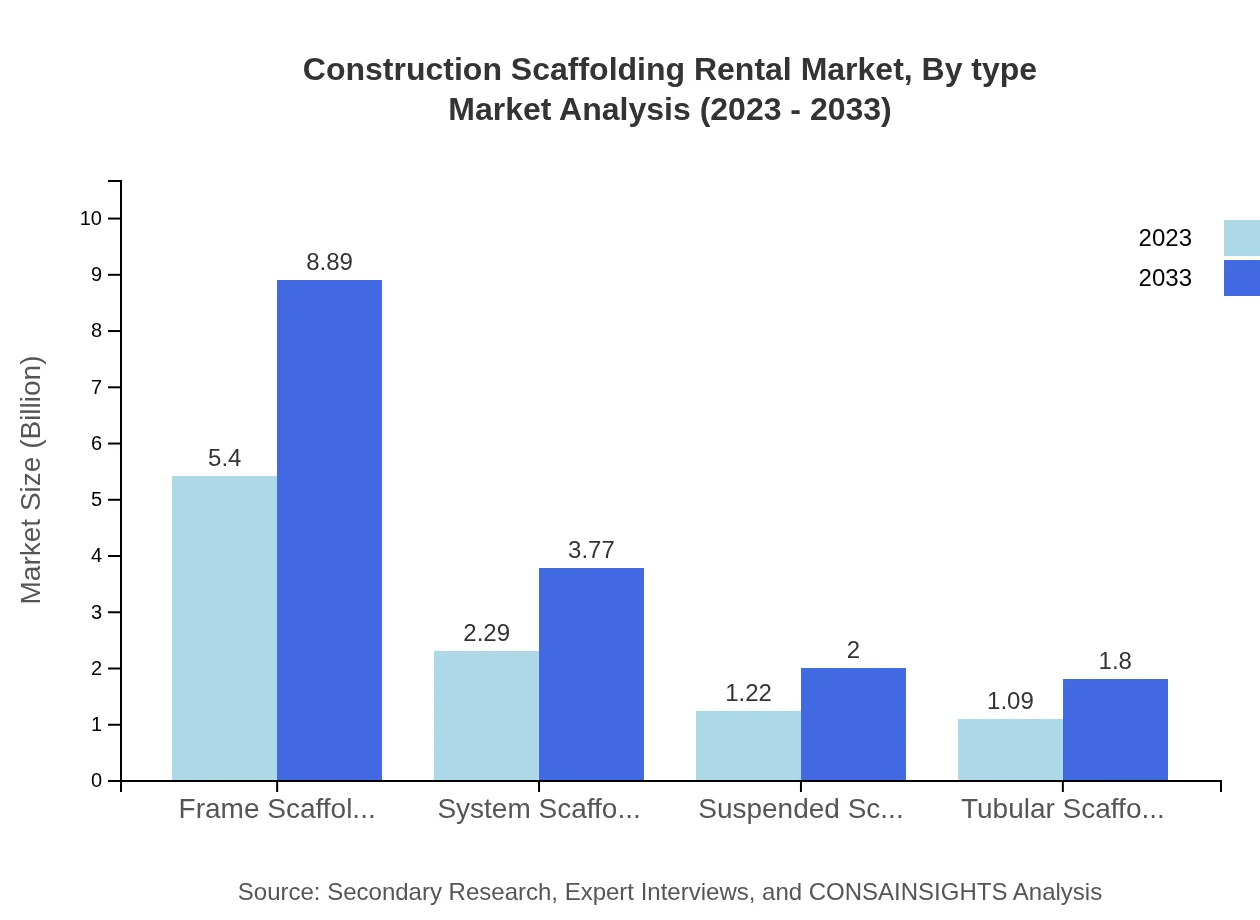

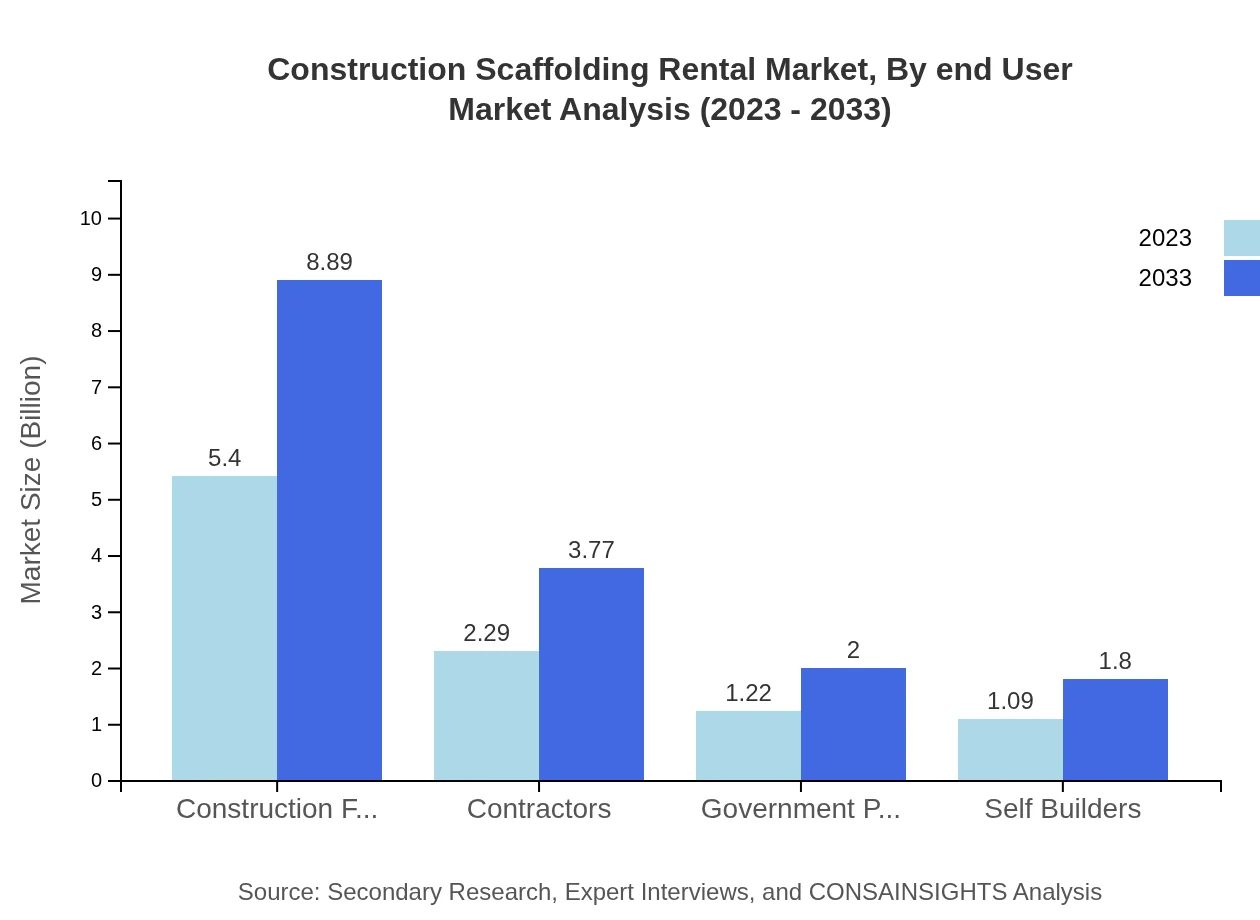

Construction Scaffolding Rental Market Analysis By Type

The major types of scaffolding in the construction rental market include Frame Scaffolding, System Scaffolding, Suspended Scaffolding, and Tubular Scaffolding. As of 2023, Frame Scaffolding leads the market with a size of $5.40 billion (54.02% market share), anticipated to grow to $8.89 billion by 2033. System Scaffolding accounts for $2.29 billion (22.89% share) in 2023, growing to $3.77 billion in 2033. Suspended and Tubular Scaffolding are also key players, with respective market sizes of $1.22 billion and $1.09 billion in 2023.

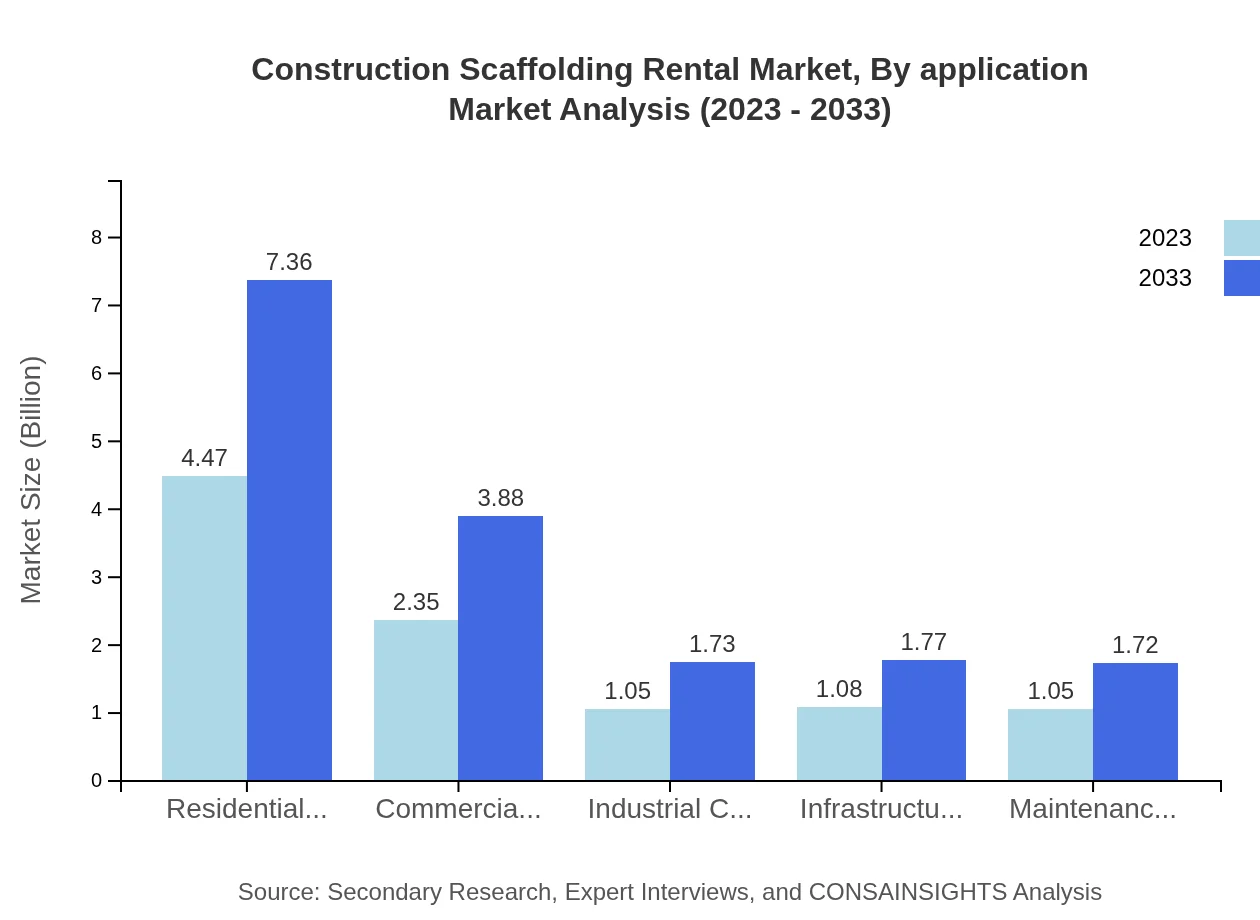

Construction Scaffolding Rental Market Analysis By Application

The main applications of scaffolding rental services encompass Residential Construction, Commercial Construction, Industrial Construction, and Infrastructure Projects. In 2023, Residential Construction took the largest share at $4.47 billion (44.71%), expected to rise to $7.36 billion by 2033. Infrastructure Projects hold a significant position, with their size growing from $1.08 billion in 2023 to $1.77 billion by 2033.

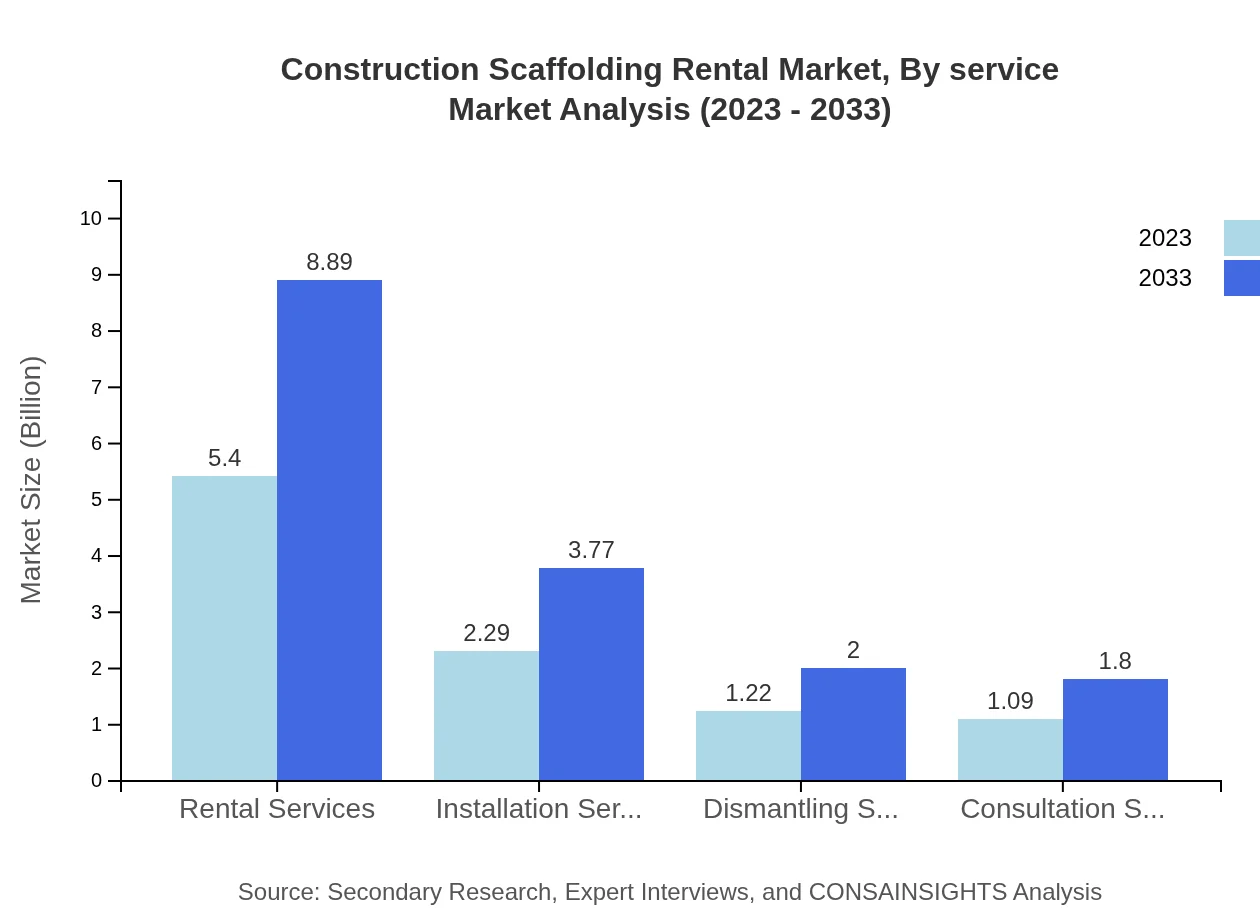

Construction Scaffolding Rental Market Analysis By Service

The Construction Scaffolding Rental market segment is divided into Rental Services, Installation Services, Dismantling Services, and Consultation Services. Rental services dominate this segment, holding a 54.02% share, with a market size projected from $5.40 billion in 2023 to $8.89 billion by 2033. Installation Services are critical, comprising a 22.89% market share in 2023, climbing to $3.77 billion by 2033.

Construction Scaffolding Rental Market Analysis By End User

End-users in the scaffolding rental market mainly include Construction Firms, Contractors, Government Projects, and Self Builders. The Construction Firms segment is the largest, sized at $5.40 billion in 2023 (54.02% share), forecasted to reach $8.89 billion by 2033. Government procurement for public works projects also contributes significantly, expected to grow from $1.22 billion to $2.00 billion by 2033.

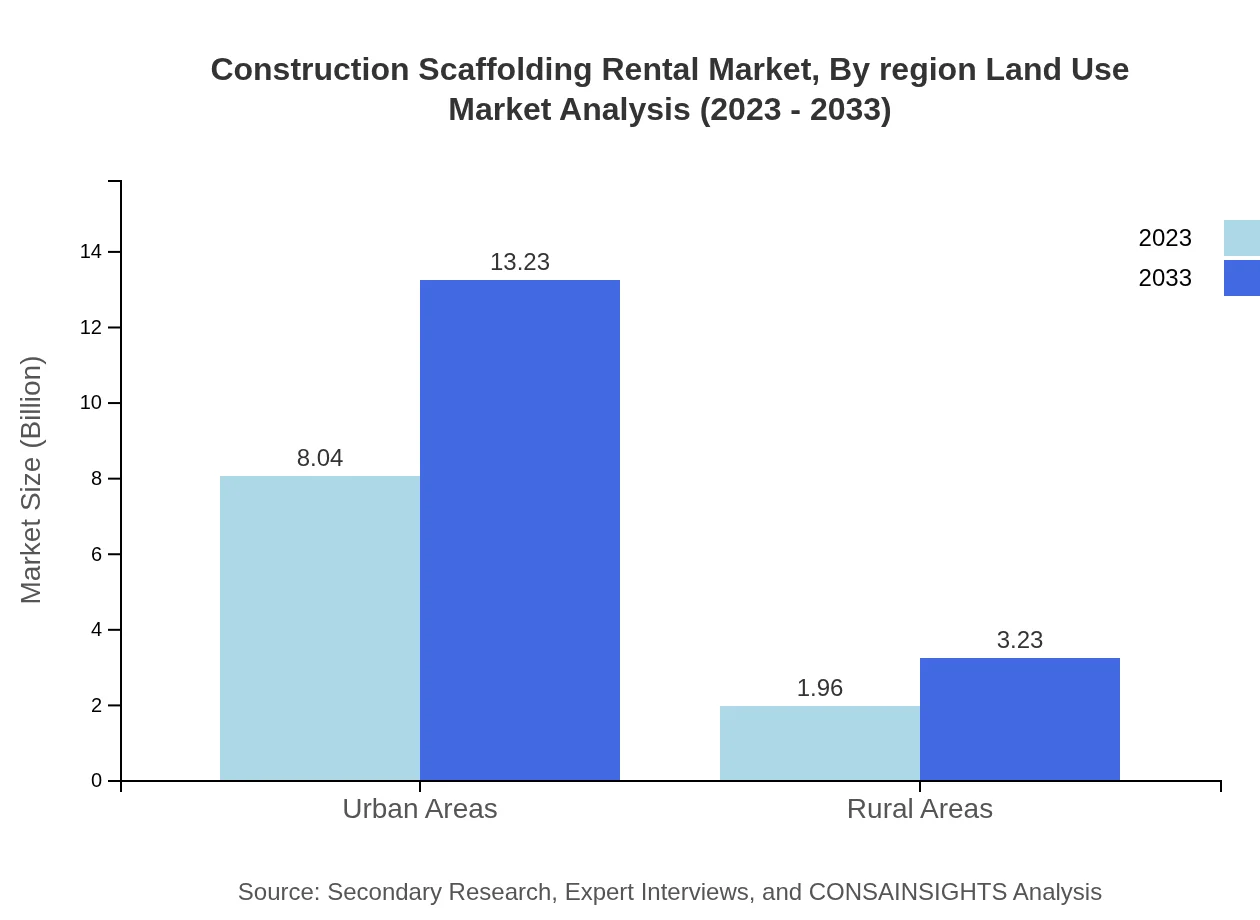

Construction Scaffolding Rental Market Analysis By Region Land Use

In terms of land use, Urban Areas account for a dominant $8.04 billion in 2023, with a share of 80.39%. Forecasted growth extends to $13.23 billion by 2033. Conversely, Rural Areas, while smaller, exhibit growth from $1.96 billion to $3.23 billion, maintaining a share of 19.61%.

Construction Scaffolding Rental Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Scaffolding Rental Industry

Layher:

A leading global manufacturer of scaffolding systems and accessories, renowned for its innovative scaffolding solutions and commitment to safety and efficiency.PERI Group:

A specialist in formwork and scaffolding systems, offering a range of services which includes production, rental, and planning support to optimize construction processes.BrandSafway:

A provider of scaffolding and access solutions across various industries, BrandSafway focuses on innovative solutions and operational excellence.Altrad Group:

A prominent player in infrastructure services, providing scaffolding solutions along with other services like maintenance and access solutions to enhance project efficiency.Harsco Infrastructure:

Part of Harsco Corporation, this company specializes in providing scaffolding, forming and shoring solutions, along with comprehensive services to meet client project needs.We're grateful to work with incredible clients.

FAQs

What is the market size of construction scaffolding rental?

The global construction scaffolding rental market is estimated to reach approximately $10 billion in 2033, growing at a CAGR of 5%. In 2023, the market is valued at $10 billion, reflecting significant growth across various regions and segments.

What are the key market players or companies in this construction scaffolding rental industry?

Key market players in the construction scaffolding rental industry include large firms specializing in scaffolding solutions. These companies typically dominate the market, influencing pricing, service delivery, and innovation within the industry.

What are the primary factors driving the growth in the construction scaffolding rental industry?

Growth drivers in the construction scaffolding rental industry include increased urbanization, infrastructure development projects, and rising demand from the residential and commercial sectors, along with advancements in safety regulations.

Which region is the fastest Growing in the construction scaffolding rental?

The North America region is anticipated to be the fastest-growing in the construction scaffolding rental market, projected to increase from $3.47 billion in 2023 to $5.72 billion by 2033, driven by booming construction activities and demand.

Does ConsaInsights provide customized market report data for the construction scaffolding rental industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the construction scaffolding rental industry, enabling clients to gain actionable insights and make informed decisions based on unique requirements.

What deliverables can I expect from this construction scaffolding rental market research project?

Key deliverables from the construction scaffolding rental market research include comprehensive reports, market trend analysis, growth forecasts, regional insights, competitor analysis, and strategic recommendations tailored to client needs.

What are the market trends of construction scaffolding rental?

Current market trends in the construction scaffolding rental industry include increasing adoption of advanced scaffolding technologies, heightened efficiency demands, and an emphasis on sustainability practices, shaping the future of construction projects.