Consumer Healthcare Market Report

Published Date: 31 January 2026 | Report Code: consumer-healthcare

Consumer Healthcare Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Consumer Healthcare market, offering insights into market size, growth trends, regional dynamics, and competitive landscape for the forecast period from 2023 to 2033.

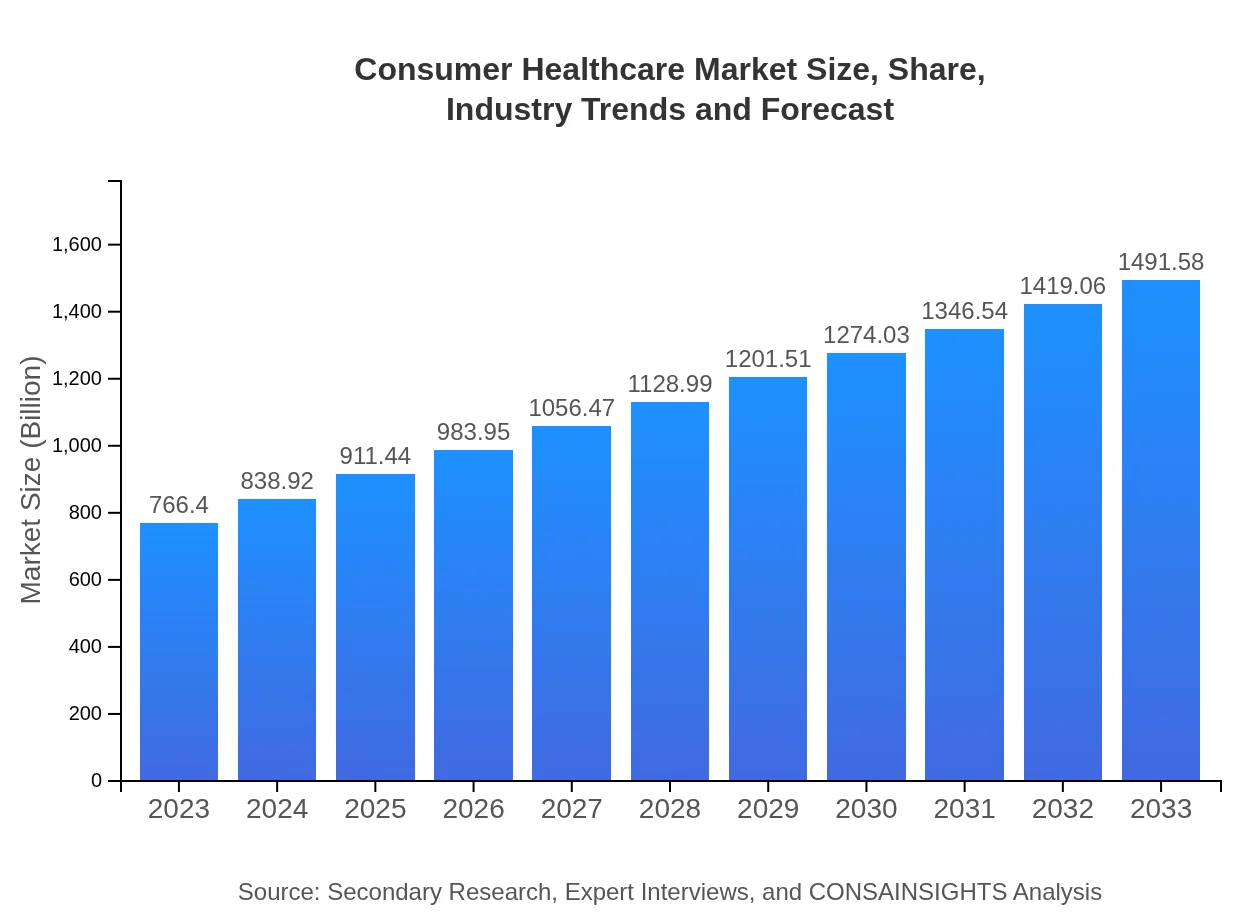

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $766.40 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $1491.58 Billion |

| Top Companies | Johnson & Johnson, Pfizer Consumer Healthcare, Procter & Gamble, GlaxoSmithKline, Bayer AG |

| Last Modified Date | 31 January 2026 |

Consumer Healthcare Market Overview

Customize Consumer Healthcare Market Report market research report

- ✔ Get in-depth analysis of Consumer Healthcare market size, growth, and forecasts.

- ✔ Understand Consumer Healthcare's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Consumer Healthcare

What is the Market Size & CAGR of Consumer Healthcare market in 2023?

Consumer Healthcare Industry Analysis

Consumer Healthcare Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Consumer Healthcare Market Analysis Report by Region

Europe Consumer Healthcare Market Report:

The European Consumer Healthcare market is set to grow from $192.67 billion in 2023 to $374.98 billion by 2033. With a high level of health consciousness among consumers and supportive regulatory frameworks, Europe provides a favorable environment for market growth. Increased emphasis on preventive care and an aging population are further contributing to this trend.Asia Pacific Consumer Healthcare Market Report:

The Asia Pacific region is projected to show robust growth in the Consumer Healthcare market, rising from $148.15 billion in 2023 to approximately $288.32 billion by 2033. Key drivers include increased disposable incomes, a growing preference for self-medication, and enhanced healthcare initiatives. The rise of e-commerce and digital health tools is also reshaping consumer behavior in this region, presenting opportunities for local and international firms.North America Consumer Healthcare Market Report:

North America remains a dominant force in the Consumer Healthcare market, projected to grow from $280.58 billion in 2023 to $546.07 billion by 2033. The region benefits from sophisticated healthcare infrastructure, high levels of consumer spending on health, and a well-established retail network. Innovations in product offerings, particularly in dietary supplements and wellness solutions, are fueling market expansion.South America Consumer Healthcare Market Report:

In South America, the Consumer Healthcare market is expected to expand from $62.54 billion in 2023 to $121.71 billion by 2033. Factors such as increasing health awareness and rising incidences of chronic diseases contribute to market growth. The region is seeing greater adoption of preventive healthcare and wellness products, aligning with global health trends.Middle East & Africa Consumer Healthcare Market Report:

The Middle East and Africa region's Consumer Healthcare market is anticipated to grow from $82.46 billion in 2023 to $160.49 billion by 2033. Rising healthcare expenditure, government initiatives to improve healthcare access, and a shift towards self-care solutions are driving growth. Moreover, increased awareness about health and wellness among consumers is shaping market dynamics.Tell us your focus area and get a customized research report.

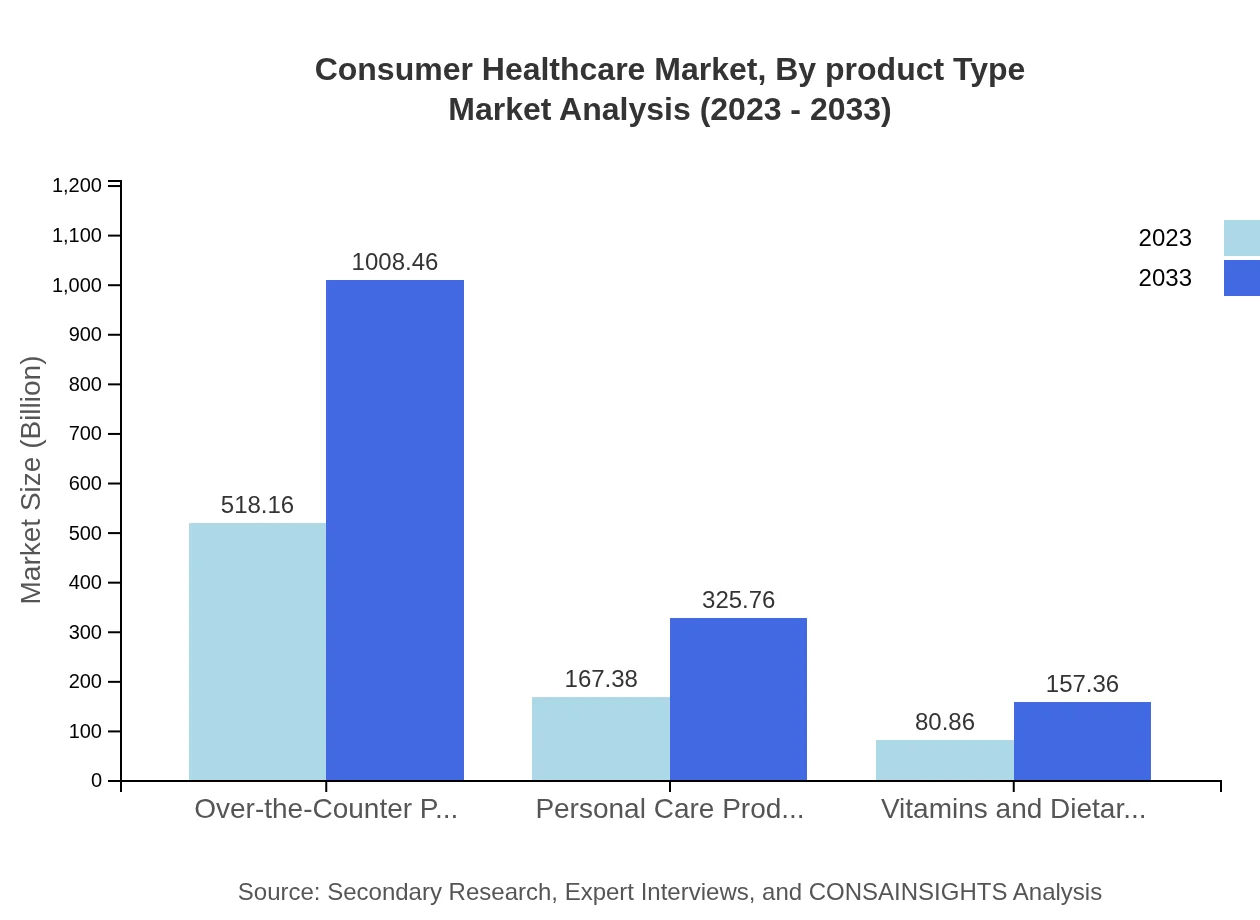

Consumer Healthcare Market Analysis By Product Type

The Consumer Healthcare market, when analyzed by product type, shows significant consumer preferences for Over-the-Counter (OTC) products, which accounted for a market size of $518.16 billion in 2023 and is anticipated to reach approximately $1008.46 billion by 2033. These products are popular among consumers due to their accessibility and ease of use. Vitamins and dietary supplements represent another key product segment, with a market size of $80.86 billion in 2023, projected to grow by 2033. This trend highlights the broad consumer shift towards preventive healthcare.

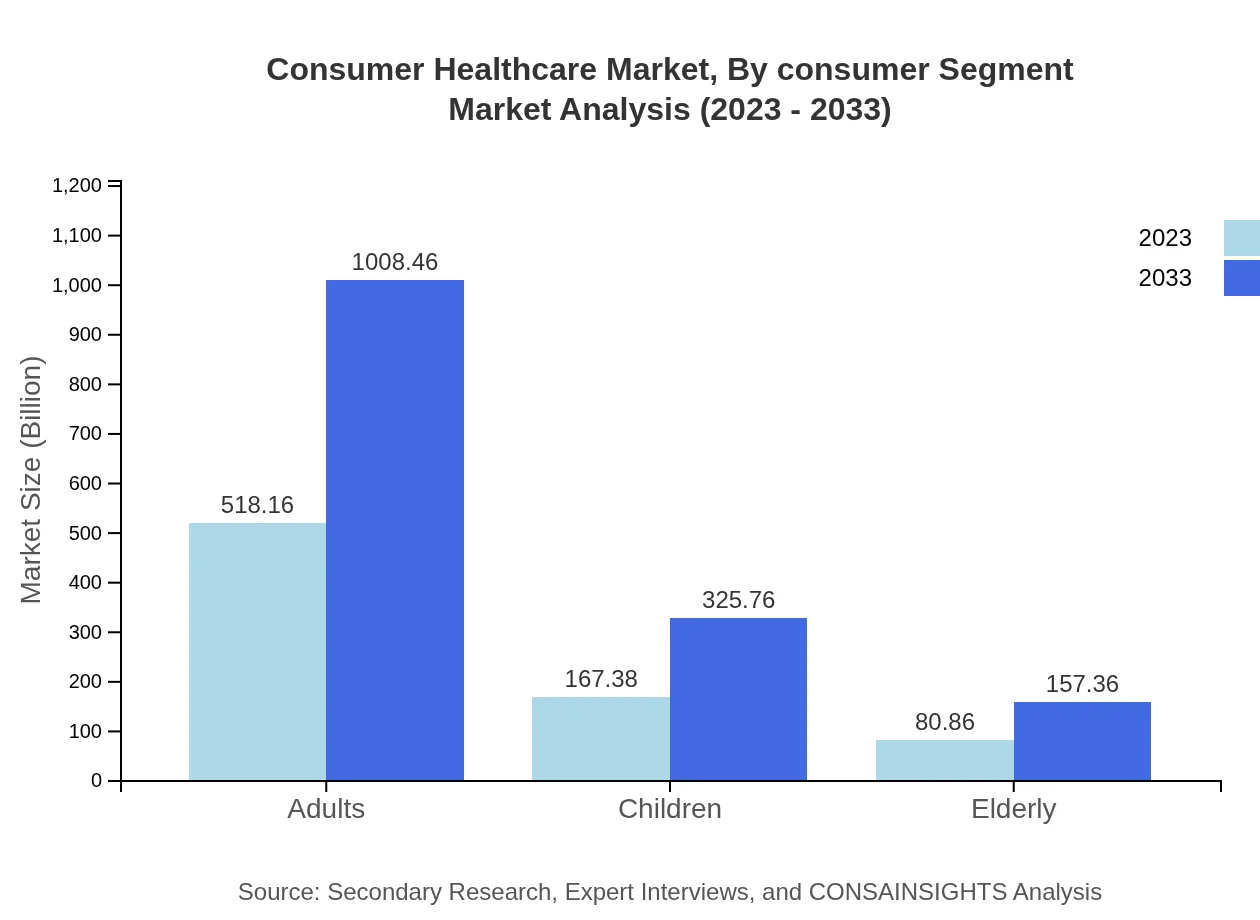

Consumer Healthcare Market Analysis By Consumer Segment

In terms of consumer segmentation, adults represented the largest market share in 2023 at $518.16 billion. This segment is expected to maintain its dominance, influenced by aging populations and a growing focus on health management. The children’s segment, growing from $167.38 billion in 2023 to $325.76 billion by 2033, emphasizes the increasing focus on pediatric health products. The elderly segment is also gaining traction, reflecting the health needs of an aging global demographic.

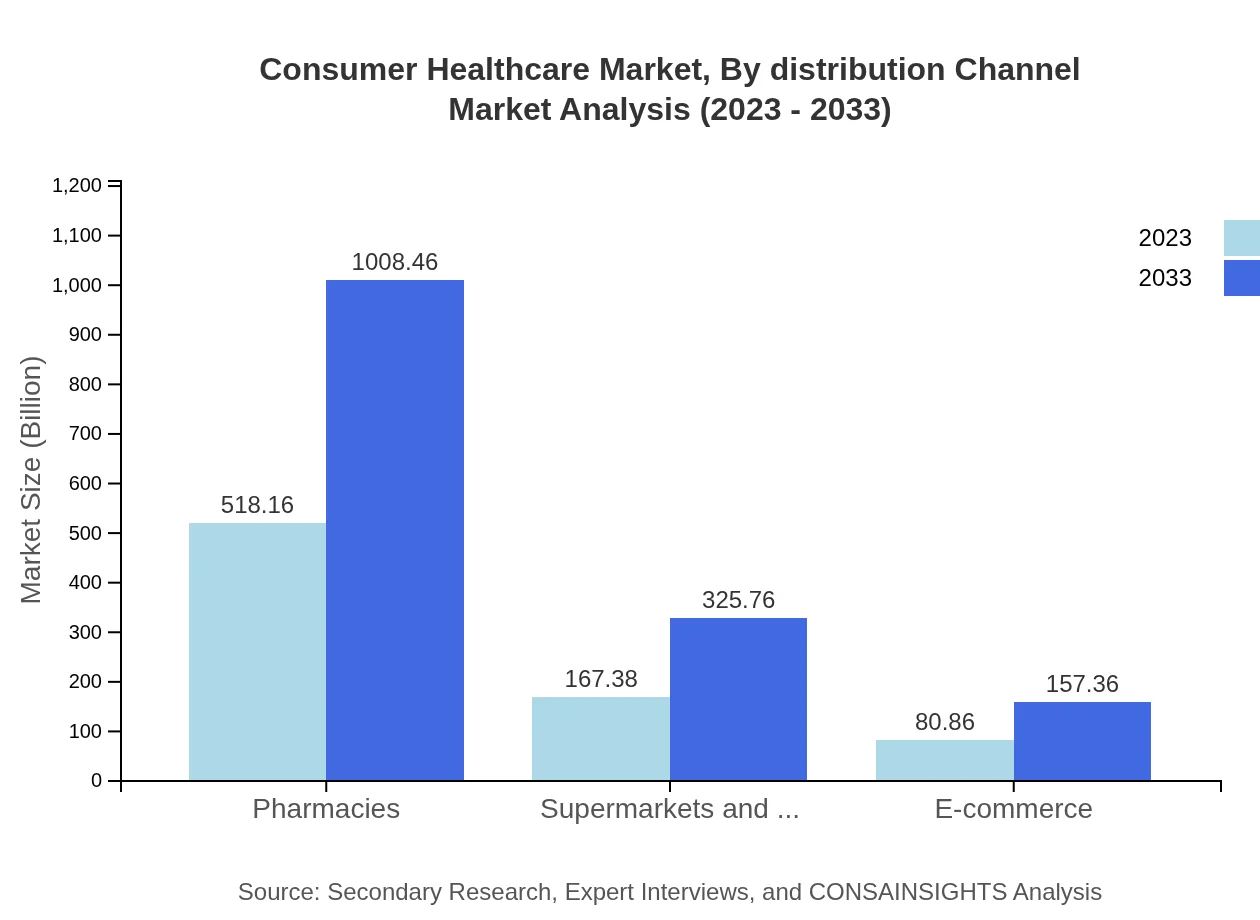

Consumer Healthcare Market Analysis By Distribution Channel

The analysis of distribution channels reveals that pharmacies continue to be the largest channel for Consumer Healthcare products, accounting for $518.16 billion in 2023 and projected to grow in the next decade. E-commerce is rapidly gaining ground, with a significant increase in sales driven by convenience, consumer preference for online shopping, and wider product availability. Supermarkets and hypermarkets also play a crucial role, capturing a considerable market segment due to their physical presence and product accessibility.

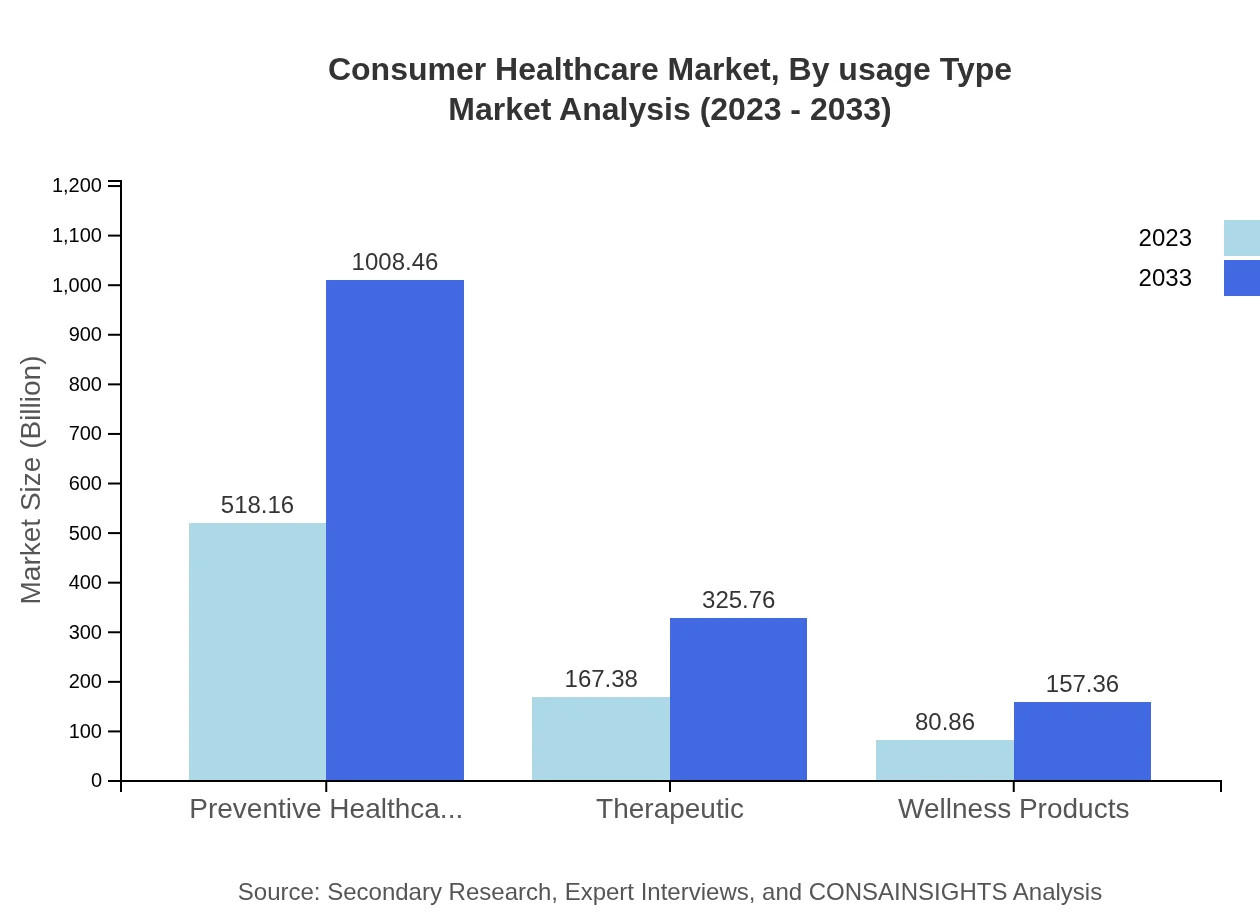

Consumer Healthcare Market Analysis By Usage Type

The usage type analysis indicates a growing demand for both preventive and therapeutic healthcare solutions. Preventive healthcare products accounted for a significant market size of $518.16 billion in 2023, projected to reach $1008.46 billion by 2033. These products are increasingly recognized for their role in improving overall health outcomes and decreasing the likelihood of chronic illness. Therapeutic products, although smaller in base volume, show promising growth trends as consumers seek effective treatments for specific health issues.

Consumer Healthcare Market Analysis By Formulation

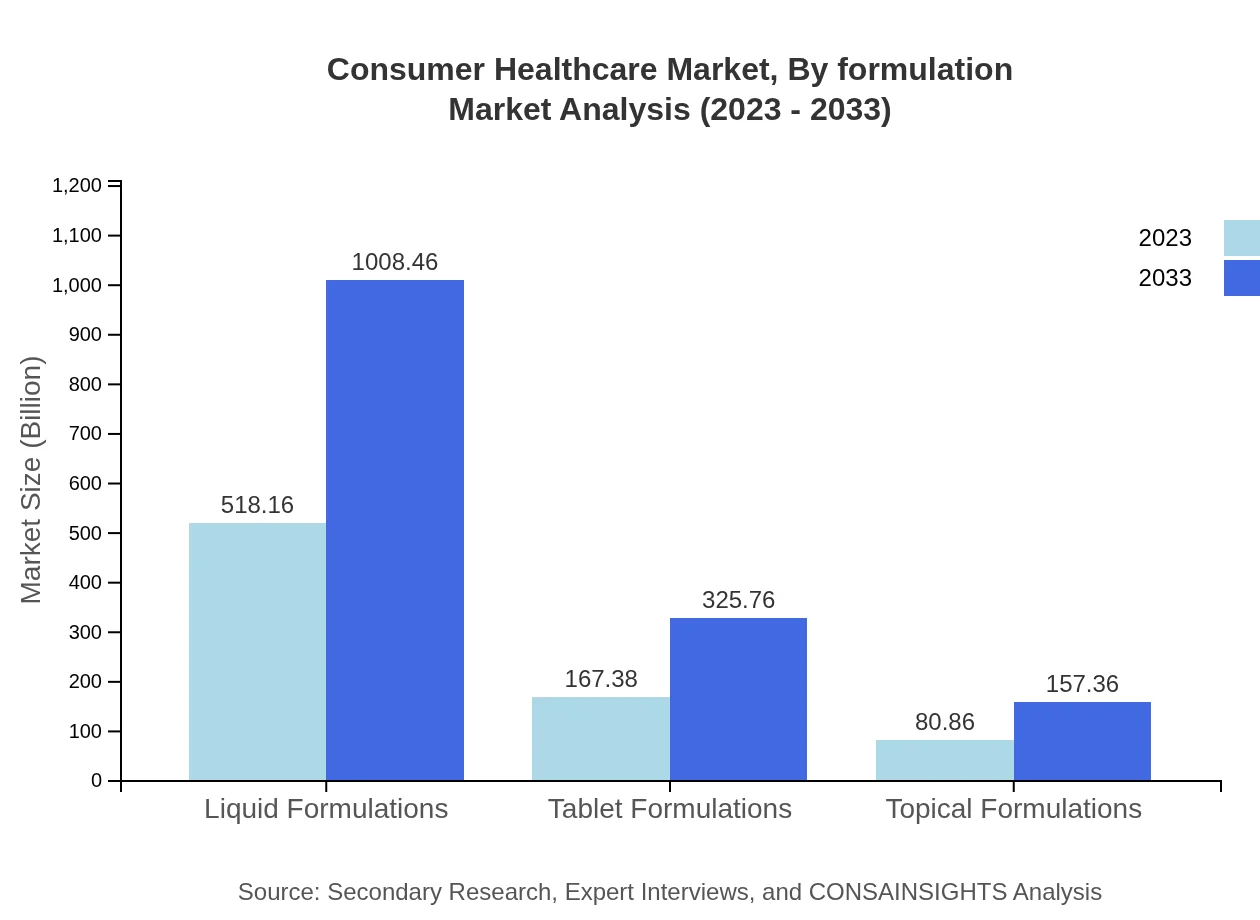

The Consumer Healthcare market's formulation segment includes various forms such as liquid, tablet, and topical preparations. Liquid formulations lead the segment, with a size of $518.16 billion in 2023, reflecting consumer preferences for easy-to-consume forms, especially among younger populations. Tablets account for a considerable market share at $167.38 billion, with steady growth expected as they remain the favored choice for many users. Topical preparations are also significant, valued at $80.86 billion, appealing to consumers for localized treatment options.

Consumer Healthcare Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Consumer Healthcare Industry

Johnson & Johnson:

A leading global healthcare company known for its innovative consumer health products, ranging from skincare and over-the-counter medications to baby care and wound care solutions.Pfizer Consumer Healthcare:

A division of Pfizer Inc. focused on consumer health products, including well-established OTC brands and innovative solutions for everyday health concerns.Procter & Gamble:

A consumer goods giant with a strong portfolio in personal care and health products, Procter & Gamble is committed to health and wellness via its diverse product offerings.GlaxoSmithKline:

An international pharmaceutical company with a significant presence in consumer healthcare, offering products that span pain relief, oral health, and respiratory health.Bayer AG:

A diversified global enterprise with core competencies in healthcare and agriculture, Bayer's consumer healthcare arm is well-known for its OTC and personal care products.We're grateful to work with incredible clients.

FAQs

What is the market size of consumer Healthcare?

The global consumer healthcare market is valued at approximately $766.4 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.7% through 2033.

What are the key market players or companies in the consumer Healthcare industry?

Key players in the consumer healthcare sector include major pharmaceutical and healthcare companies that dominate the market segments such as OTC medicines, supplements, and personal care products.

What are the primary factors driving the growth in the consumer Healthcare industry?

Drivers of growth include an increase in health awareness, aging populations, the rise of e-commerce, and the demand for preventive healthcare solutions among consumers globally.

Which region is the fastest Growing in consumer Healthcare?

The Asia Pacific region is the fastest-growing segment of the consumer healthcare market, expected to grow from $148.15 billion in 2023 to $288.32 billion by 2033.

Does ConsaInsights provide customized market report data for the consumer Healthcare industry?

Yes, ConsaInsights offers tailored market report data that addresses specific client needs in the consumer healthcare industry, ensuring relevant and actionable insights.

What deliverables can I expect from this consumer Healthcare market research project?

Deliverables may include comprehensive market analysis, segmentation data, competitive landscape, growth forecasts, trends, and strategic recommendations based on the consumer healthcare market.

What are the market trends of consumer Healthcare?

Current trends include increased digital engagement, personalization of health products, growth in preventive healthcare, and sustainable product offerings aimed at eco-conscious consumers.