Consumer Telematics Market Report

Published Date: 31 January 2026 | Report Code: consumer-telematics

Consumer Telematics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a thorough analysis of the consumer telematics market, covering market sizes, trends, competitive landscape, and regional insights for the forecast period from 2023 to 2033.

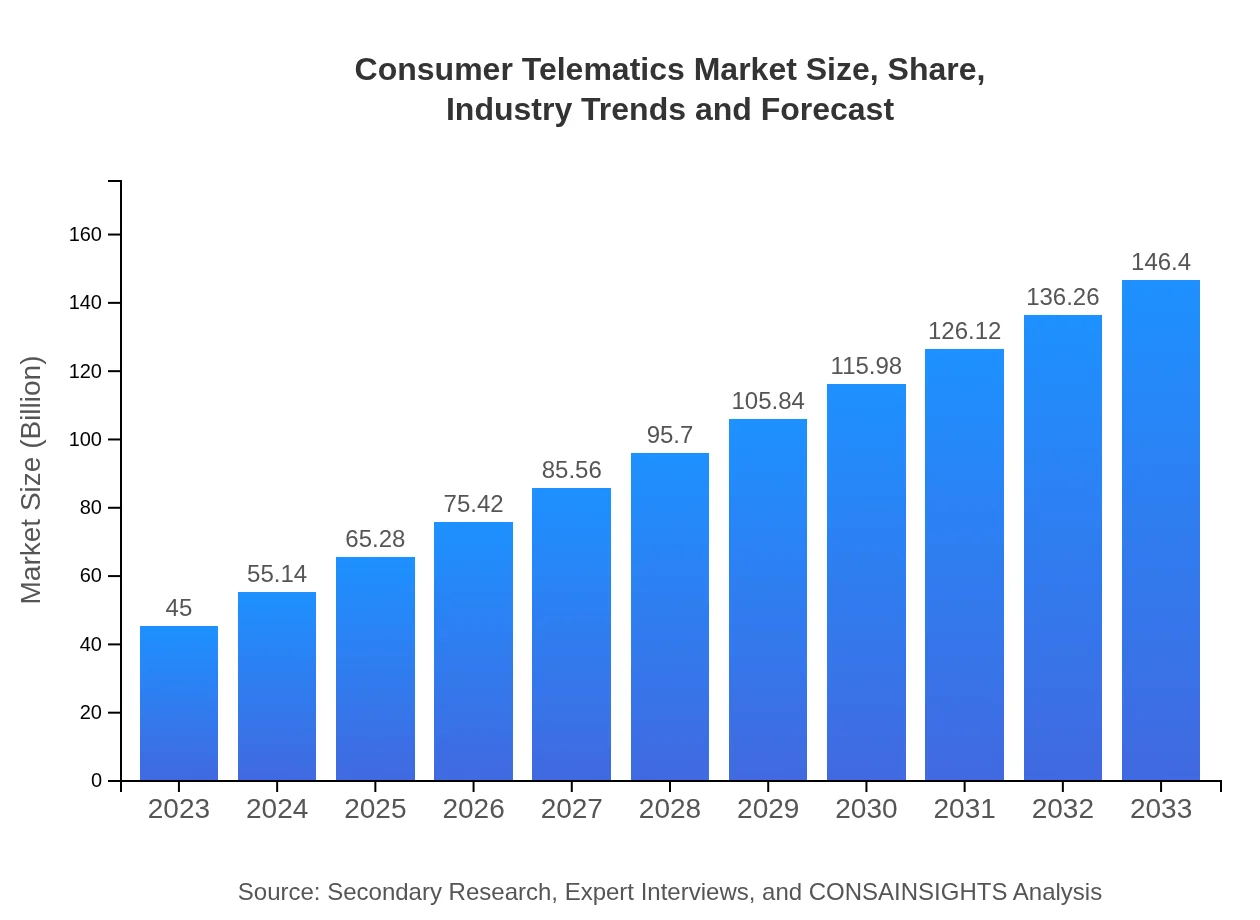

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $146.40 Billion |

| Top Companies | Verizon Connect, TomTom, Geotab, Continental AG, Bosch |

| Last Modified Date | 31 January 2026 |

Consumer Telematics Market Overview

Customize Consumer Telematics Market Report market research report

- ✔ Get in-depth analysis of Consumer Telematics market size, growth, and forecasts.

- ✔ Understand Consumer Telematics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Consumer Telematics

What is the Market Size & CAGR of Consumer Telematics market in 2023?

Consumer Telematics Industry Analysis

Consumer Telematics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Consumer Telematics Market Analysis Report by Region

Europe Consumer Telematics Market Report:

Europe's consumer telematics market is valued at $10.85 billion in 2023 and is expected to escalate to $35.30 billion by 2033. This growth is largely attributed to stringent government regulations on vehicle safety and emissions, which boost the adoption of telematics. Countries like Germany, France, and the UK are leading the charge with innovations aimed at reducing environmental impact while enhancing vehicle connectivity.Asia Pacific Consumer Telematics Market Report:

In the Asia Pacific region, the consumer telematics market is forecasted to grow significantly, with market size jumping from $9.58 billion in 2023 to $31.17 billion by 2033. The rapid adoption of connected vehicles, supportive government policies, and the growing middle-class population are fueling this growth. Major countries like China and Japan lead the regional market due to their advanced automotive sectors and technological capabilities.North America Consumer Telematics Market Report:

North America remains a dominant player in the consumer telematics market, with a size projected to grow from $15.24 billion in 2023 to $49.57 billion by 2033. The growth is driven by a high adoption rate of connected vehicles, robust infrastructure, and technological advancements in automotive industries. The U.S. automotive market is particularly vibrant due to many manufacturers integrating telematics systems in their models.South America Consumer Telematics Market Report:

The South American consumer telematics market is expected to rise from $3.67 billion in 2023 to $11.95 billion by 2033. Market growth will be supported by an increasing emphasis on road safety and vehicle efficiency. Emerging markets in Brazil and Argentina are likely to foster investments in telematics solutions, enhancing their transportation infrastructure.Middle East & Africa Consumer Telematics Market Report:

In the Middle East and Africa, the market is estimated at $5.66 billion in 2023 and projected to reach $18.42 billion by 2033. The growing automotive industry and the rise in consumer preference for enhanced in-car experiences are significant growth drivers. The increasing trend towards smart cities and improvements in road infrastructure are expected to further support the market's growth in this region.Tell us your focus area and get a customized research report.

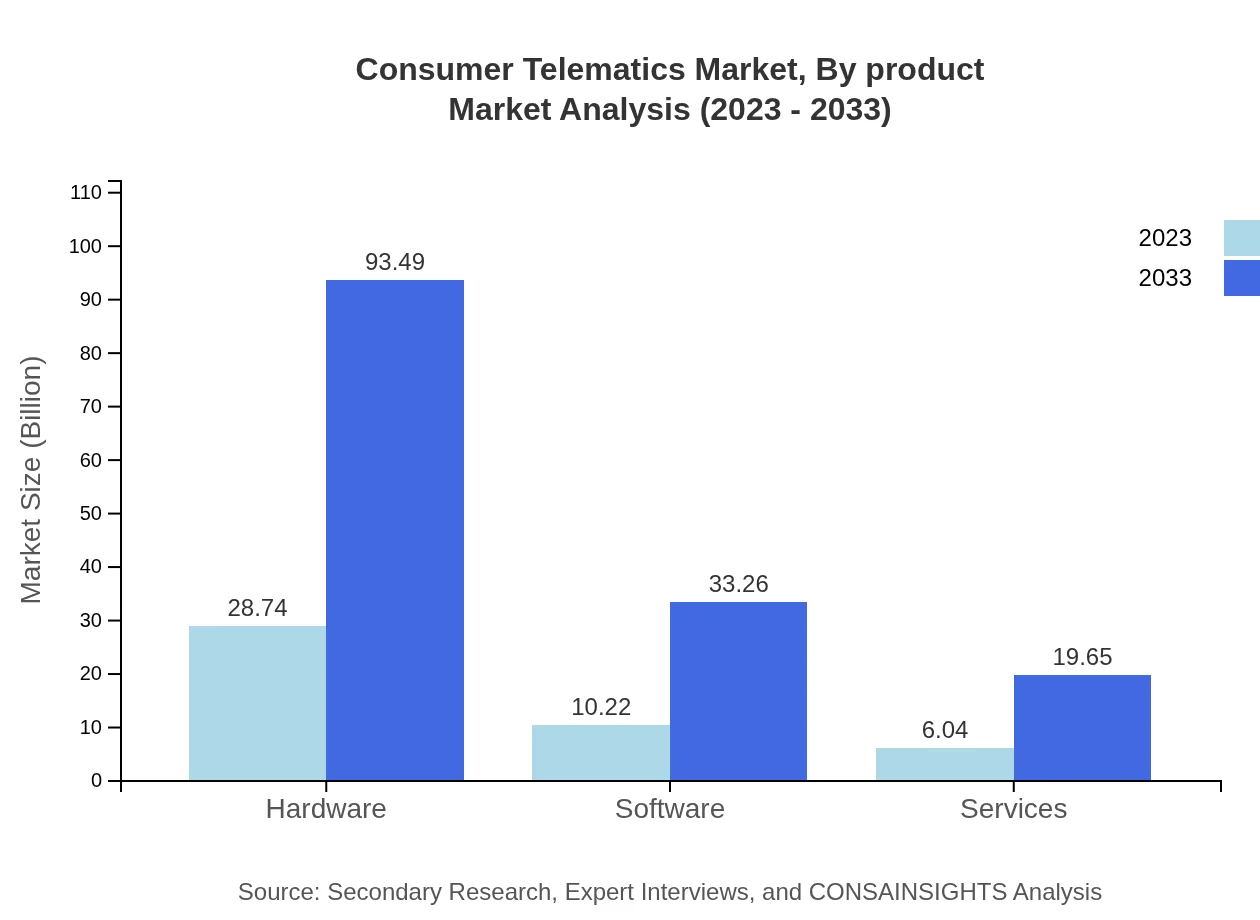

Consumer Telematics Market Analysis By Product

The product segment analysis reveals that hardware is expected to dominate the market, accounting for approximately $28.74 billion in 2023 and projected to grow to $93.49 billion by 2033. Software and services are also significant, with forecasted growth from $10.22 billion to $33.26 billion and $6.04 billion to $19.65 billion, respectively. This pattern reflects the increasing sophistication of telematics solutions and the need for continuous updates in software to enhance service offerings.

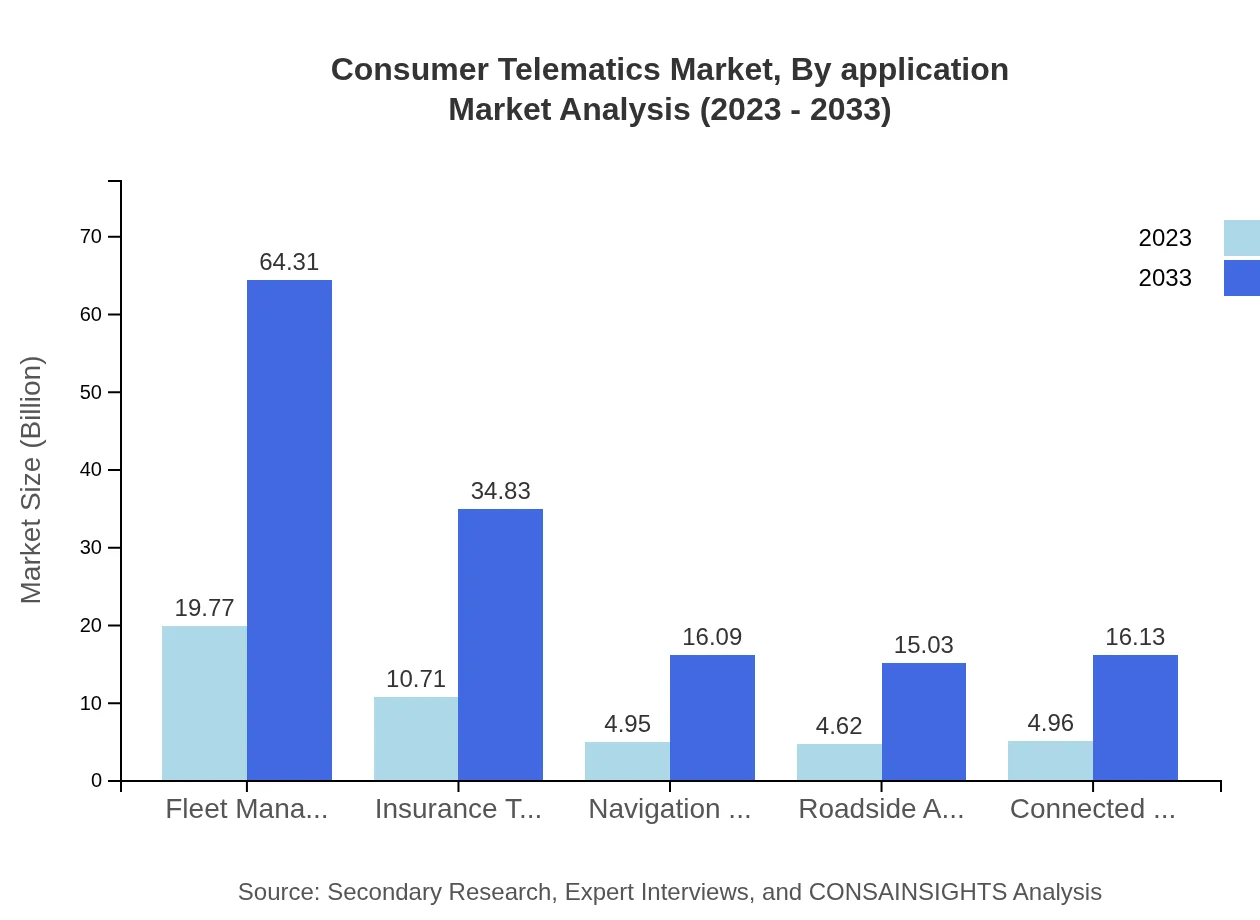

Consumer Telematics Market Analysis By Application

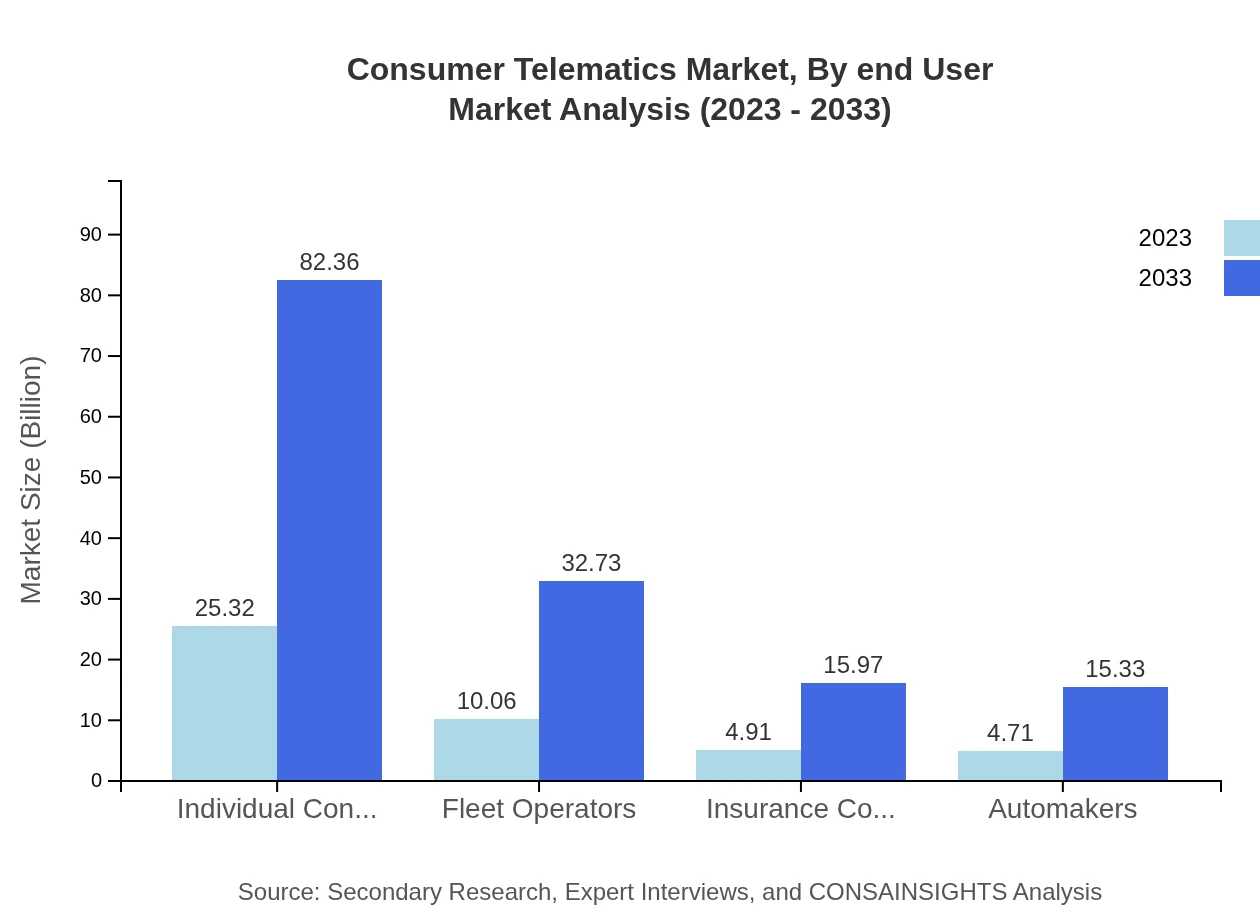

By application, individual consumers represent the largest segment with a market size of $25.32 billion in 2023, expected to grow to $82.36 billion by 2033, driven by the need for personalized driving experiences. Fleet operators and insurance companies are also crucial segments, with projected market sizes of $10.06 billion to $32.73 billion for fleet management applications and $4.91 billion to $15.97 billion for insurance telematics by 2033.

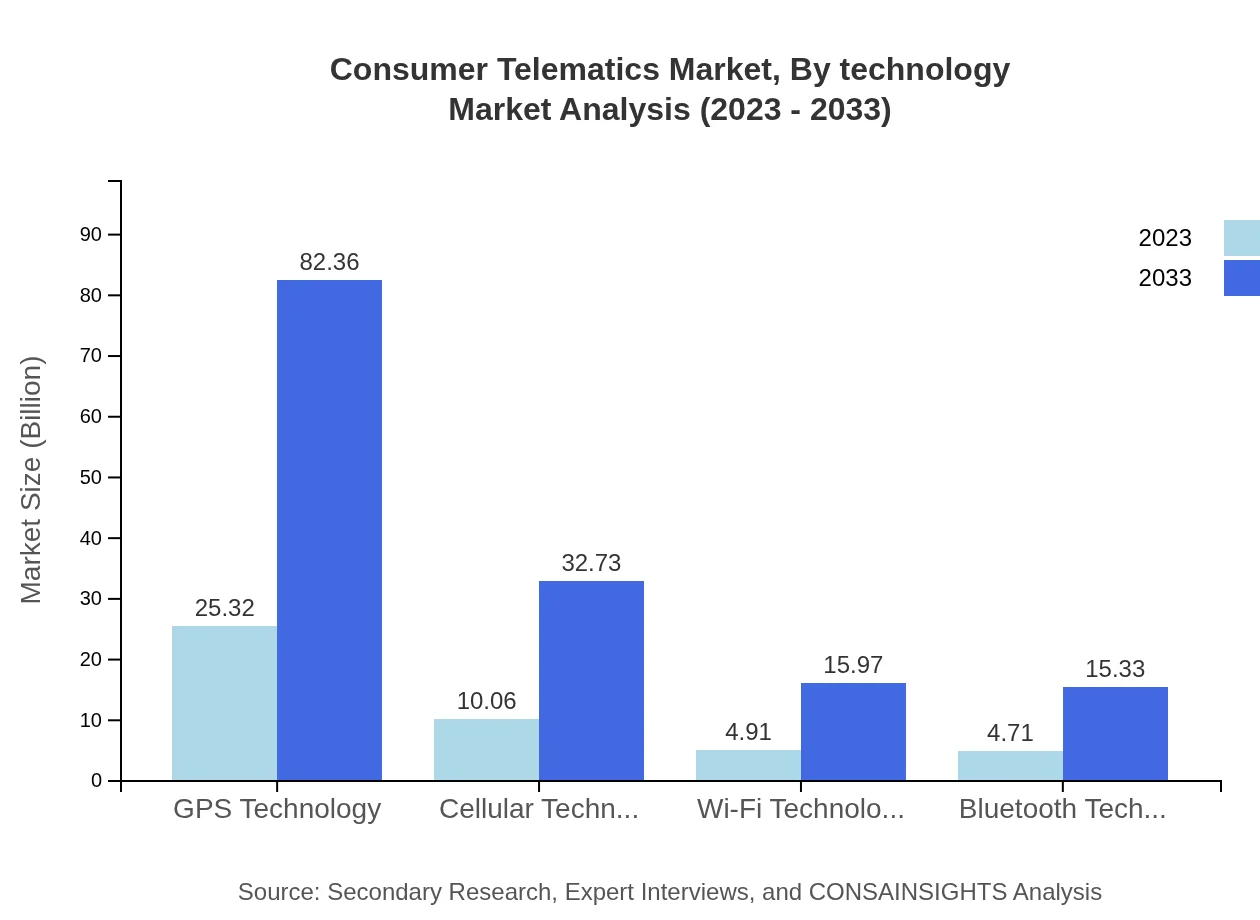

Consumer Telematics Market Analysis By Technology

The technology segment highlights the growth of GPS technology, which is anticipated to maintain a significant share at $25.32 billion in 2023, growing to $82.36 billion by 2033. Cellular and Wi-Fi technologies are also important with expected increases from $10.06 billion to $32.73 billion and from $4.91 billion to $15.97 billion, respectively. The advancement of connectivity solutions facilitates enhanced user engagement in telematics.

Consumer Telematics Market Analysis By End User

The end-user analysis shows that individual consumers dominate the market, accounting for a significant share of 56.26% in 2023, forecasted to remain steady through 2033. Fleet operators hold a 22.36% share with growth potential linked to the rise of logistics and on-demand service industries. Meanwhile, insurers and automakers represent smaller, yet critical segments driving overall market dynamics.

Consumer Telematics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Consumer Telematics Industry

Verizon Connect:

A leading provider of telematics solutions, focusing on fleet management, vehicle tracking, and performance analytics, helping customers enhance operational efficiency.TomTom:

Known for its GPS technology and navigation services, TomTom offers consumers and businesses telematics solutions that improve driving accuracy and route optimization.Geotab:

A globally recognized leader in telematics technology, Geotab specializes in tracking systems, fleet management solutions, and performance reports aimed at enhancing operational efficiencies.Continental AG:

An automotive manufacturing giant, Continental AG provides innovative telematics and connectivity solutions that enhance vehicle safety and user experience.Bosch:

A significant player in automotive telematics, Bosch produces various telematics solutions that integrate vehicle safety, navigation, and connectivity technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of consumer Telematics?

The consumer telematics market is currently valued at approximately $45 billion in 2023, with a compound annual growth rate (CAGR) of 12%. This indicates robust growth potential, projected to significantly increase in the coming years.

What are the key market players or companies in this consumer Telematics industry?

Major players in the consumer telematics market include companies like Bosch, Verizon Telematics, and AT&T. These companies drive innovation and competition, ensuring advancements in technology and services within the industry.

What are the primary factors driving the growth in the consumer telematics industry?

Key growth factors include advancements in GPS technology, increasing demand for connected vehicles, and heightened awareness of vehicle safety. Additionally, a growing emphasis on fleet management efficiency underscores this industry's expansion.

Which region is the fastest Growing in the consumer telematics market?

North America is the fastest-growing region in the consumer telematics market, with a projected market size increasing from $15.24 billion in 2023 to $49.57 billion by 2033, largely driven by technological innovations and high consumer adoption.

Does ConsaInsights provide customized market report data for the consumer telematics industry?

Yes, ConsaInsights offers tailored market report data for the consumer telematics industry. Our custom solutions can cater to specific client needs, focusing on various segments, geographies, and market trends to enhance your strategic decisions.

What deliverables can I expect from this consumer telematics market research project?

From the consumer telematics market research project, you can expect comprehensive reports featuring market analysis, segment breakdowns, competitive landscapes, and future projections, along with visual data representations for better insights.

What are the market trends of consumer telematics?

Current trends in the consumer telematics market include increasing integration of IoT and AI technologies, emphasis on data analytics for targeted marketing, and a shift towards subscription-based services, enhancing customer experience and engagement.