Contact Center Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: contact-center-outsourcing

Contact Center Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Contact Center Outsourcing market from 2023 to 2033. It includes insights into market size, industry trends, regional performance, product segmentation, and forecasts for future growth.

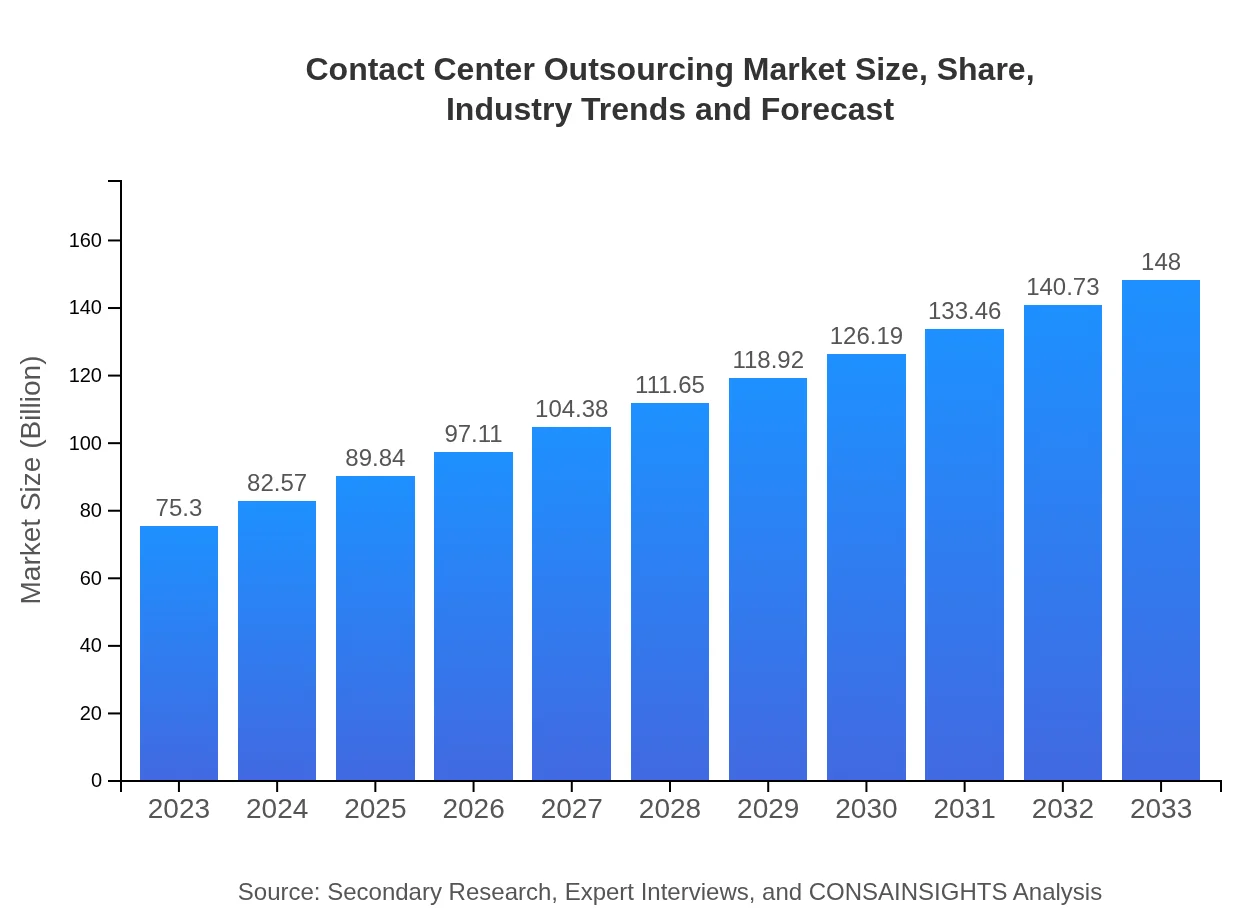

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $75.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $148.00 Billion |

| Top Companies | Teleperformance, Concentrix, Alorica, Sitel Group |

| Last Modified Date | 31 January 2026 |

Contact Center Outsourcing Market Overview

Customize Contact Center Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Contact Center Outsourcing market size, growth, and forecasts.

- ✔ Understand Contact Center Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Contact Center Outsourcing

What is the Market Size & CAGR of Contact Center Outsourcing market in 2023?

Contact Center Outsourcing Industry Analysis

Contact Center Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Contact Center Outsourcing Market Analysis Report by Region

Europe Contact Center Outsourcing Market Report:

Europe is experiencing significant growth, with the market expanding from $23.98 billion in 2023 to $47.14 billion by 2033. The emphasis on customer experience and digital transformation initiatives is enhancing the appeal of outsourced contact center services.Asia Pacific Contact Center Outsourcing Market Report:

The Asia Pacific region is anticipated to be a significant contributor to the Contact Center Outsourcing market, growing from $13.26 billion in 2023 to $26.06 billion by 2033. The rise in outsourcing by global companies to this region, owing to lower labor costs and a skilled workforce, is a prominent factor driving this growth.North America Contact Center Outsourcing Market Report:

North America remains one of the largest markets for Contact Center Outsourcing, projected to expand from $27.15 billion in 2023 to $53.35 billion by 2033. The region's focus on high-quality customer engagement services, combined with technological advancements, is a driving force behind this market's growth.South America Contact Center Outsourcing Market Report:

In South America, the market is expected to grow from $1.46 billion in 2023 to $2.87 billion by 2033. The increasing focus on outsourcing as a means to enhance customer service and efficiency is propelling the adoption of outsourced contact center solutions in this region.Middle East & Africa Contact Center Outsourcing Market Report:

The Middle East and Africa are anticipated to see growth from $9.45 billion in 2023 to $18.57 billion by 2033, driven by increasing investments in customer service solutions and a shift towards outsourcing as a strategic business approach.Tell us your focus area and get a customized research report.

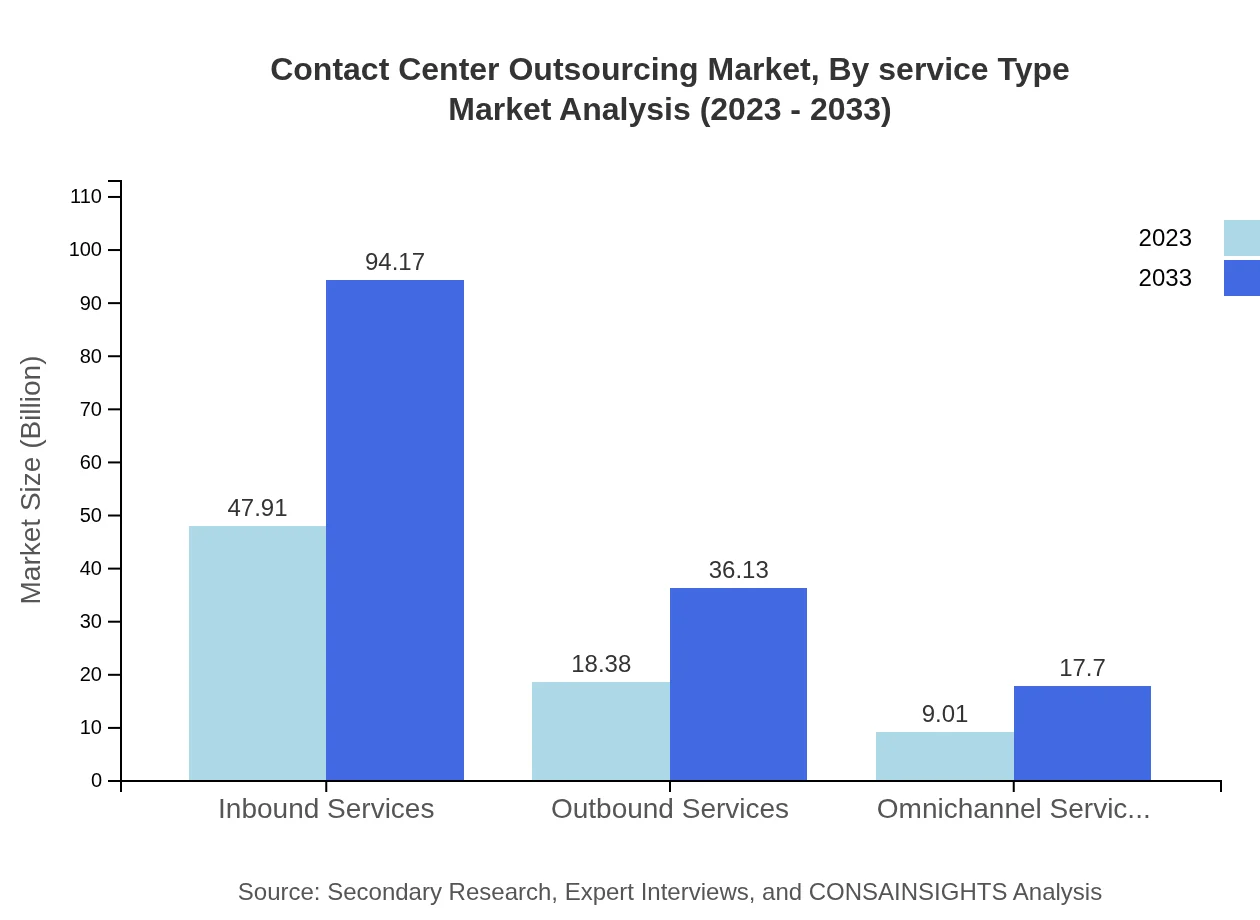

Contact Center Outsourcing Market Analysis By Service Type

Inbound services lead the market size with $47.91 billion in 2023, expected to double to $94.17 billion by 2033, followed by outbound services at $18.38 billion increasing to $36.13 billion. Omnichannel services will also exhibit significant growth, reflecting a robust consumer preference for integrated communication. Each service type plays a vital role in enhancing customer engagement and optimizing business outcomes.

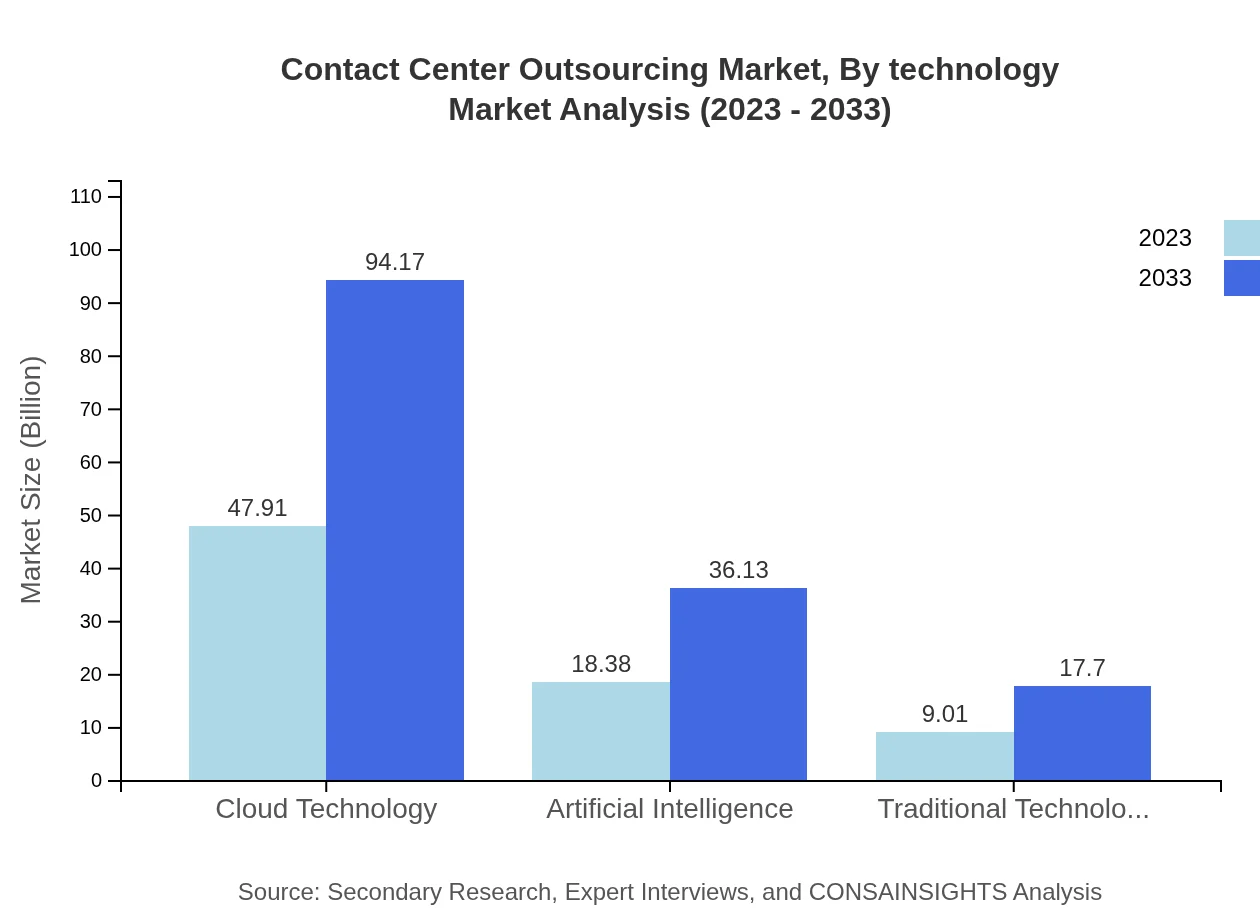

Contact Center Outsourcing Market Analysis By Technology

Cloud technology is dominating the Contact Center Outsourcing market, with a size of $47.91 billion in 2023 expected to reach $94.17 billion by 2033. Artificial Intelligence applications are also growing, reflecting the increasing integration of intelligent systems to improve customer interactions. Traditional technology is seeing a slower growth trajectory, evidencing the trend towards modern, scalable solutions.

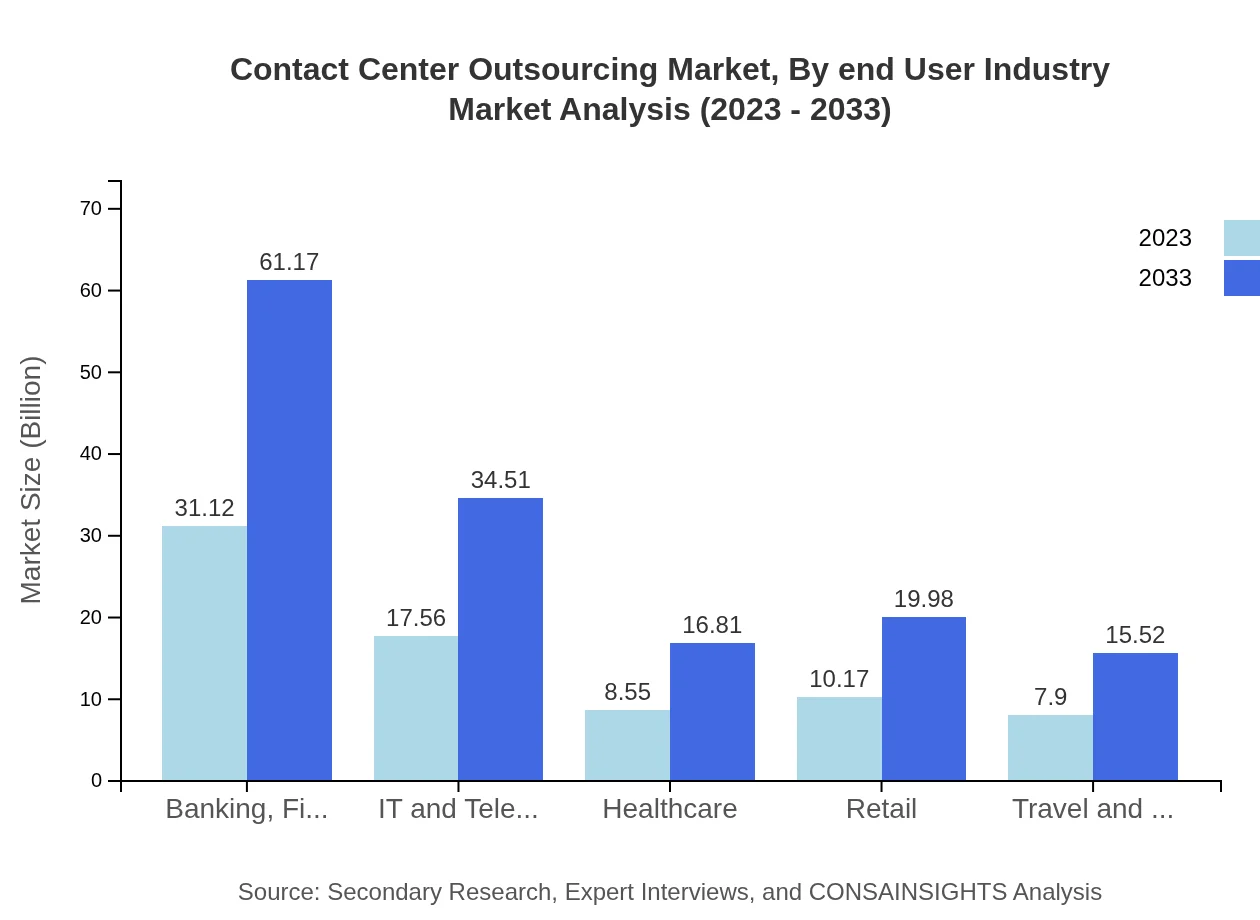

Contact Center Outsourcing Market Analysis By End User Industry

The Banking, Financial Services, and Insurance (BFSI) sector is the largest user of contact center services, expanding from $31.12 billion in 2023 to $61.17 billion by 2033. IT and Telecom, Healthcare, and Retail are also significant contributors, with demand driven by the need for responsive and effective customer service.

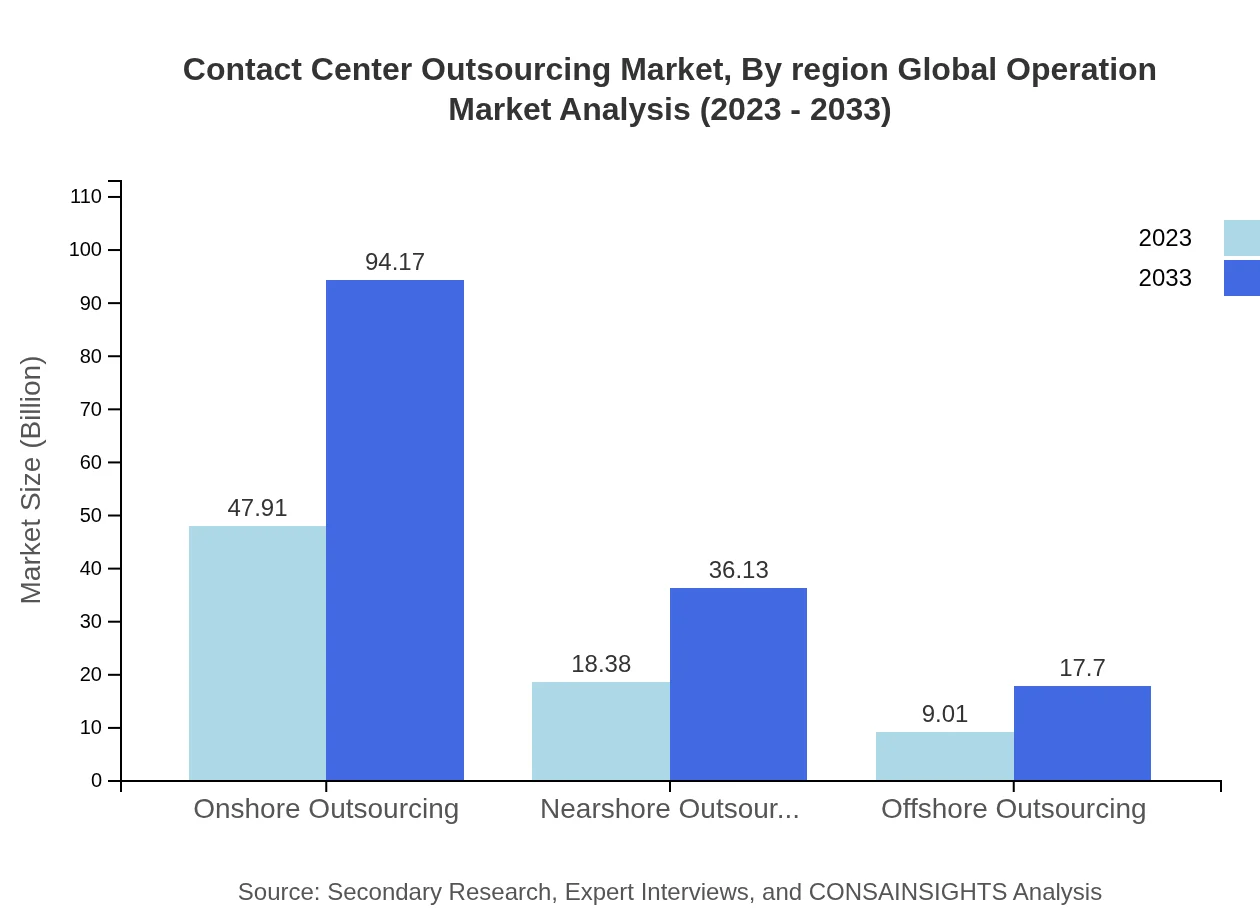

Contact Center Outsourcing Market Analysis By Region Global Operation

Onshore outsourcing, with a market share of $47.91 billion in 2023, will see steady growth, while nearshore and offshore outsourcing are also gaining traction, especially as businesses seek more flexible and responsive service models that adapt to customer needs.

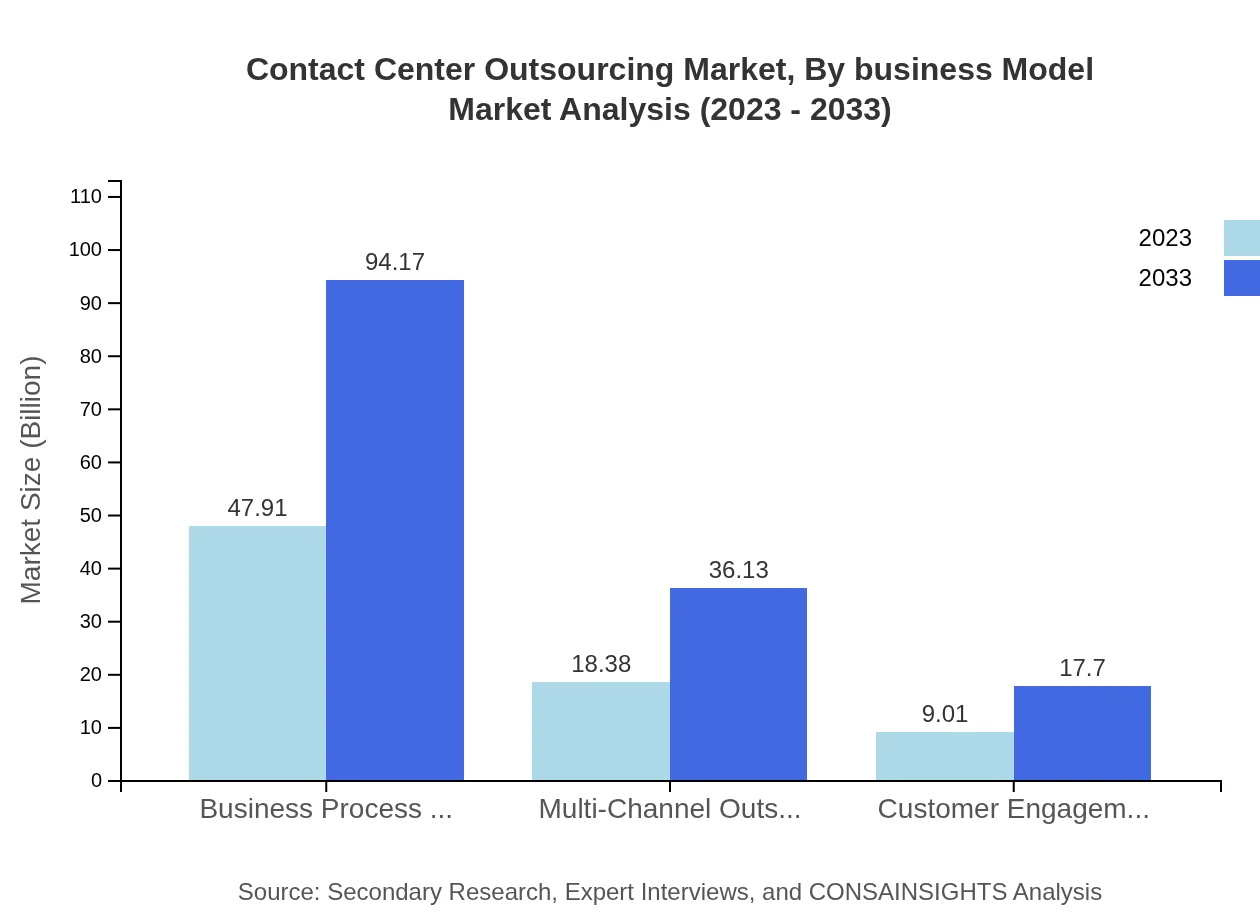

Contact Center Outsourcing Market Analysis By Business Model

The market is primarily driven by Business Process Outsourcing (BPO) with expectations of profitability increasing substantially. Other models, like multi-channel and customer engagement outsourcing, are also vital, reflecting diverse business strategies aimed at enhancing customer experience.

Contact Center Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Contact Center Outsourcing Industry

Teleperformance:

A global leader in customer experience management, Teleperformance offers a broad range of outsourcing solutions, with a strong focus on digital transformation and customer engagement.Concentrix:

With over 400 clients globally, Concentrix is renowned for its innovative approaches to improving customer experiences through technology-driven outsourcing.Alorica:

Alorica provides customer experience solutions tailored to a spectrum of industries, emphasizing a personalized approach to client service.Sitel Group:

Sitel Group specializes in custom outsourcing solutions, creating compelling customer experiences through a mix of traditional and digital service delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of Contact Center Outsourcing?

The Contact Center Outsourcing market is projected to reach $75.3 billion by 2033, with a compound annual growth rate (CAGR) of 6.8%. This growth reflects an increasing reliance on outsourced communication solutions across various industries.

What are the key market players or companies in the Contact Center Outsourcing industry?

Key players in the Contact Center Outsourcing industry include major firms recognized for their comprehensive service offerings and technological advancements. Prominent companies often lead through innovation, partnership, and investments in customer experience technology.

What are the primary factors driving the growth in the Contact Center Outsourcing industry?

Growth in the Contact Center Outsourcing industry is primarily driven by increased demand for enhanced customer service, cost efficiencies, and the integration of advanced technologies like AI and cloud services, fostering a competitive edge for businesses.

Which region is the fastest Growing in the Contact Center Outsourcing?

The North America region is the fastest-growing, with the market expected to grow from $27.15 billion in 2023 to $53.35 billion by 2033. Europe follows closely, demonstrating significant expansion due to rising demand for outsourcing services.

Does ConsaInsights provide customized market report data for the Contact Center Outsourcing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Contact Center Outsourcing industry. This allows businesses to gain insights that are directly relevant to their operational contexts and strategic planning.

What deliverables can I expect from this Contact Center Outsourcing market research project?

From this market research project, expect comprehensive reports detailing market size, growth forecasts, key players, trends, and segment analyses. Additional visual data representations and strategic recommendations will also be included for actionable insights.

What are the market trends of Contact Center Outsourcing?

Current trends in Contact Center Outsourcing include increased automation through AI, a shift towards cloud-based solutions, and greater emphasis on omnichannel customer experiences. These trends reflect evolving consumer expectations and technological advancements driving industry transformation.