Contact Center Software Market Report

Published Date: 31 January 2026 | Report Code: contact-center-software

Contact Center Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Contact Center Software market from 2023 to 2033, highlighting key market insights, industry trends, technological advancements, and regional dynamics, offering valuable data for stakeholders.

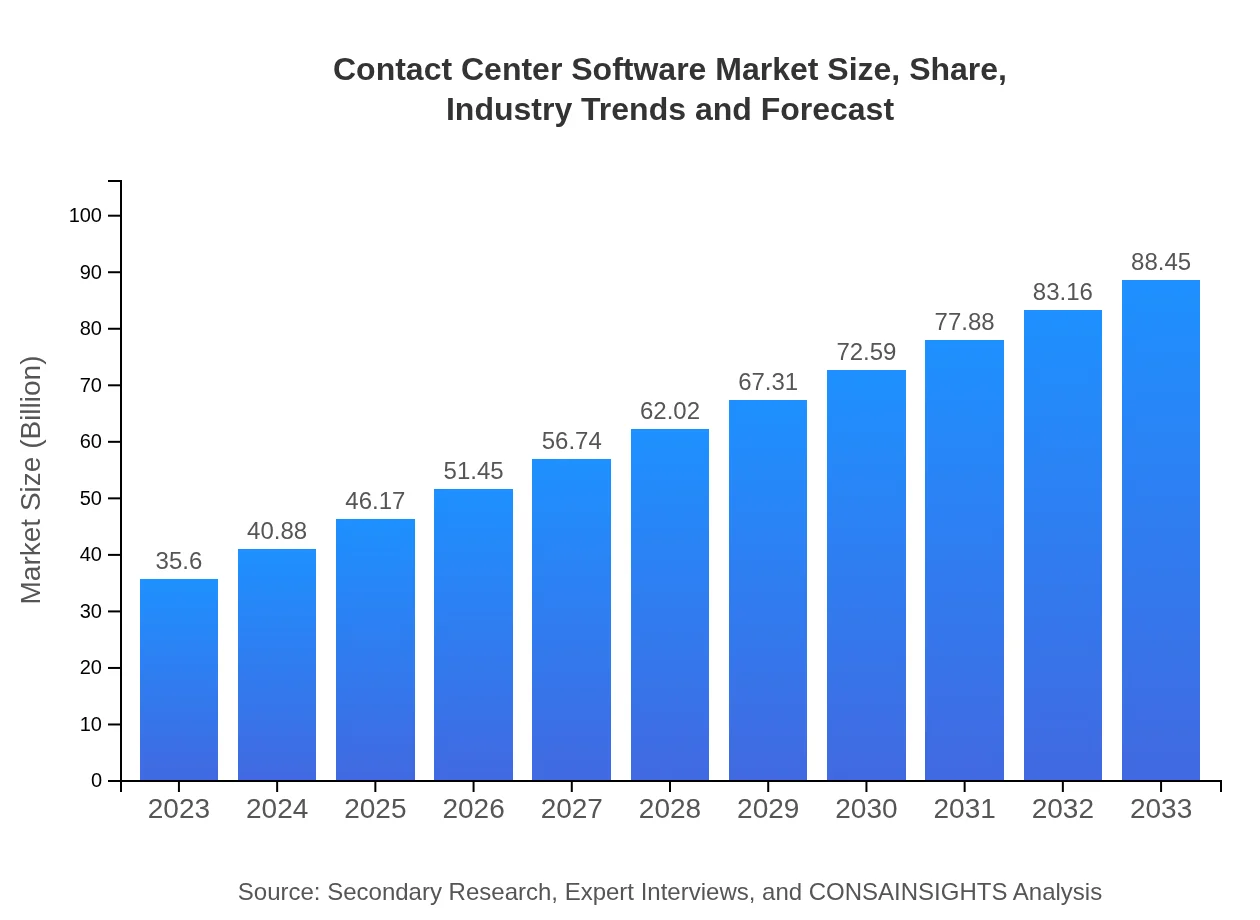

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $88.45 Billion |

| Top Companies | Salesforce, Zendesk, Genesys, Avaya, NICE inContact |

| Last Modified Date | 31 January 2026 |

Contact Center Software Market Overview

Customize Contact Center Software Market Report market research report

- ✔ Get in-depth analysis of Contact Center Software market size, growth, and forecasts.

- ✔ Understand Contact Center Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Contact Center Software

What is the Market Size & CAGR of Contact Center Software market in 2023 and 2033?

Contact Center Software Industry Analysis

Contact Center Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Contact Center Software Market Analysis Report by Region

Europe Contact Center Software Market Report:

The Contact Center Software market in Europe is estimated to expand from $10.85 billion in 2023 to $26.95 billion by 2033. The demand for multilingual customer support and compliance with local regulations like GDPR are encouraging companies to adopt comprehensive contact center solutions. Additionally, innovations in cloud computing are shaping the European market, making it more robust.Asia Pacific Contact Center Software Market Report:

The Asia Pacific region is rapidly emerging as a significant market for Contact Center Software, anticipated to grow from $6.80 billion in 2023 to $16.89 billion by 2033. The increasing adoption of digital transformation initiatives and a burgeoning middle class are driving enterprise investments in contact center solutions. Countries like India and China are focusing on enhancing customer experience, thereby amplifying demand for innovative contact center technologies.North America Contact Center Software Market Report:

North America is projected to grow from $12.57 billion in 2023 to $31.22 billion by 2033. The region's well-established businesses are at the forefront of adopting advanced contact center solutions, largely due to the heightened focus on improving customer satisfaction and retention. Technological innovations and the integration of AI and automation in contact center operations are key drivers in this market.South America Contact Center Software Market Report:

In South America, the Contact Center Software market is set to expand from $1.60 billion in 2023 to $3.98 billion by 2033. Factors such as improved telecommunications infrastructure and increasing internet penetration, particularly in Brazil and Argentina, are fostering market growth. Businesses in this region are increasingly looking for cost-effective solutions to manage customer relations effectively.Middle East & Africa Contact Center Software Market Report:

The Middle East and Africa market is also witnessing an uptick, with expectations to rise from $3.79 billion in 2023 to $9.41 billion by 2033. Rapid digitalization across various sectors, combined with an increasing emphasis on customer service, is driving demand for sophisticated contact center solutions. Countries like the UAE and South Africa are leading this trend, emphasizing technological integration.Tell us your focus area and get a customized research report.

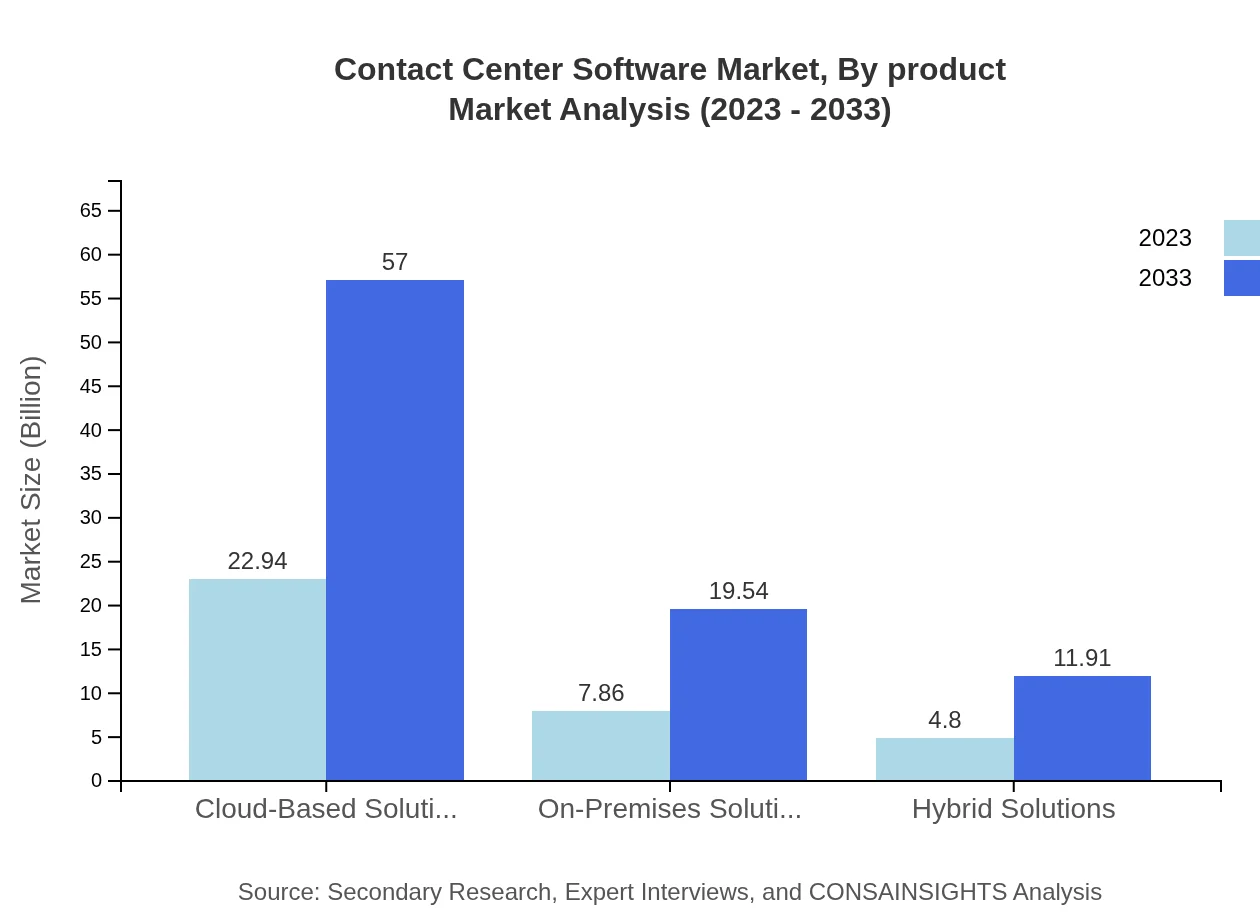

Contact Center Software Market Analysis By Product

The product segments within the Contact Center Software market include Cloud-Based Solutions, On-Premises Solutions, and Hybrid Solutions. Cloud-Based Solutions dominate the market, with a size of $22.94 billion in 2023 expected to reach $57.00 billion by 2033 due to their scalability and ease of implementation. On-Premises Solutions, while facing competition from cloud technologies, hold a market size of $7.86 billion in 2023, projected to grow to $19.54 billion by 2033. Hybrid Solutions are also gaining traction, anticipated to increase from $4.80 billion in 2023 to $11.91 billion by 2033.

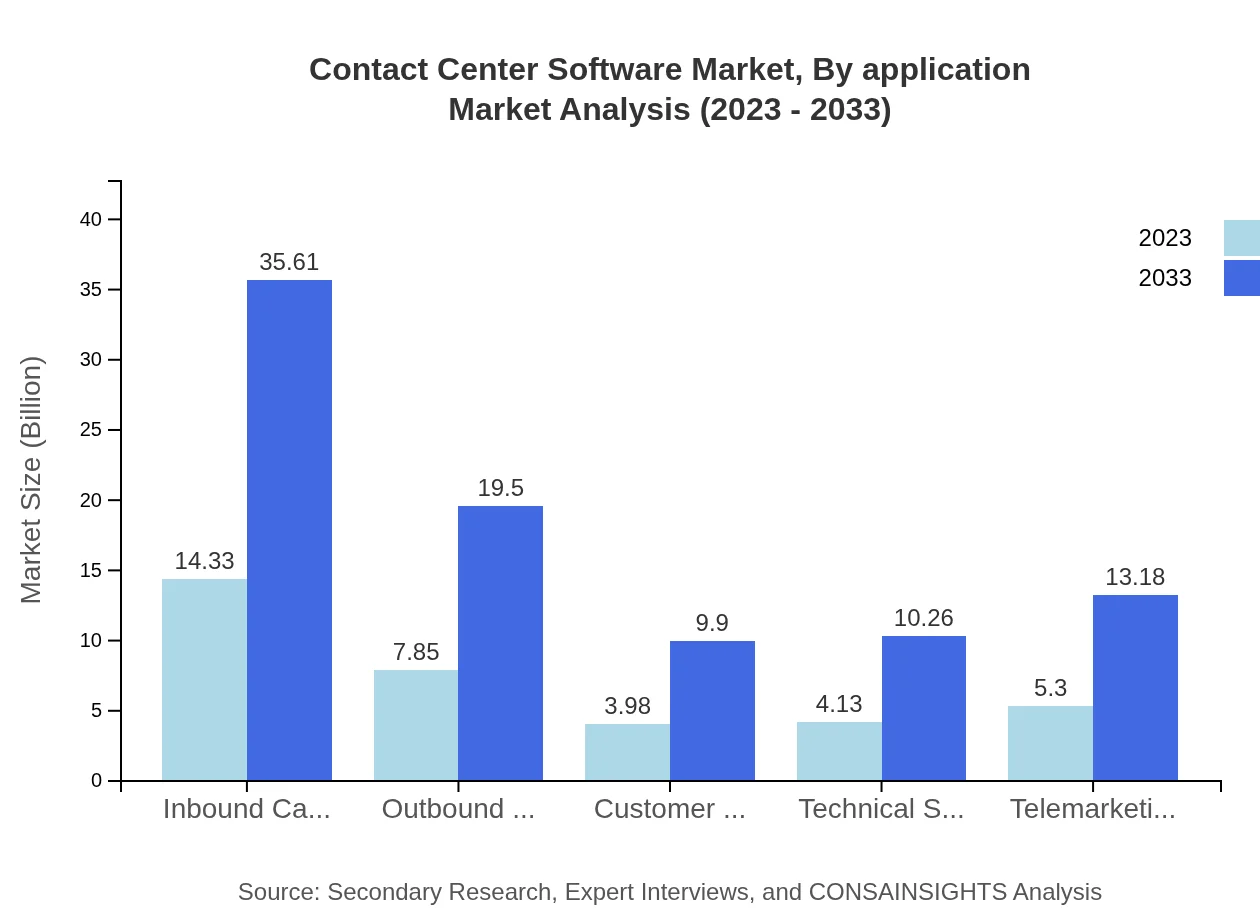

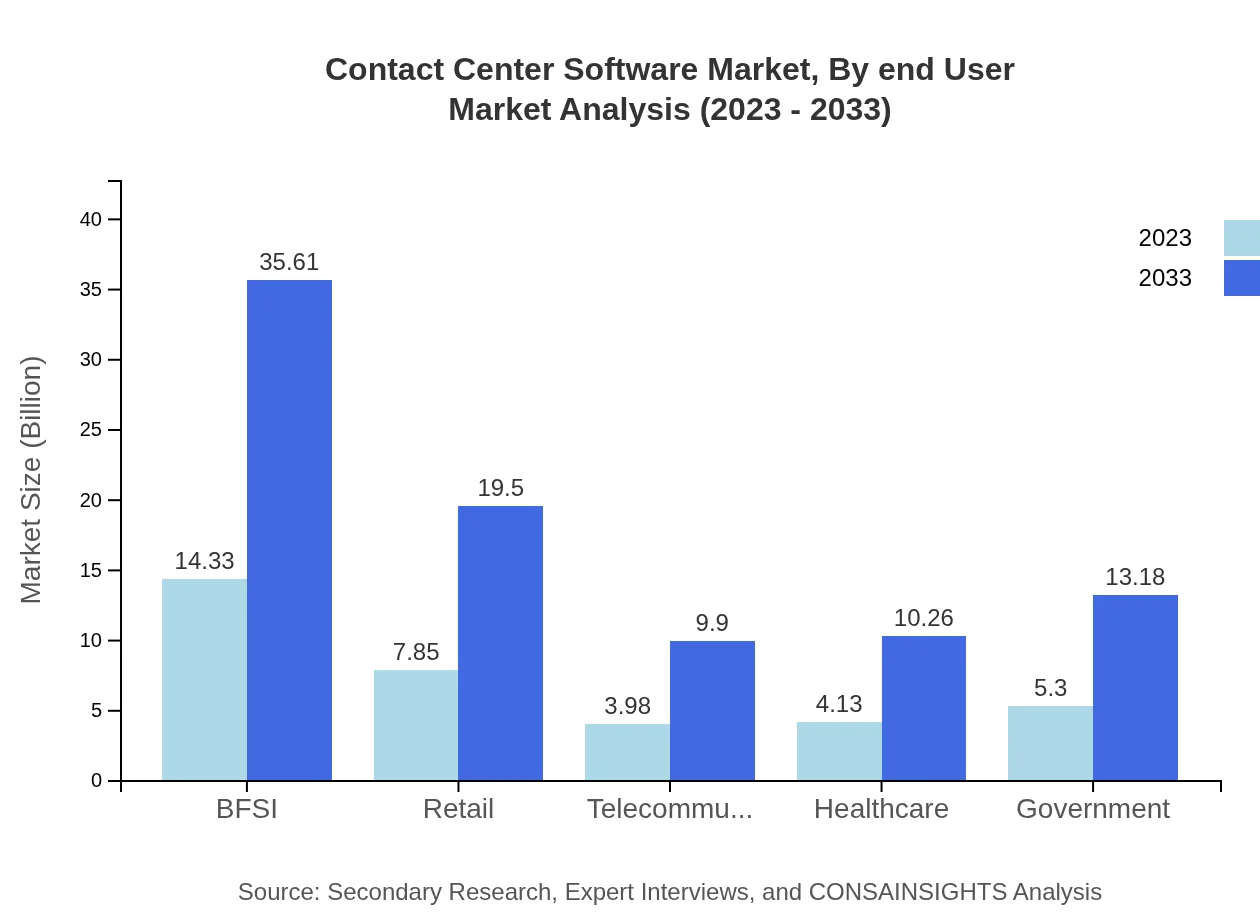

Contact Center Software Market Analysis By Application

The application segments include BFSI, retail, telecommunications, healthcare, government, and others. BFSI leads the segment with a market size of $14.33 billion in 2023, projected to achieve $35.61 billion by 2033, highlighting the industry's demand for effective customer service solutions. The retail sector is witnessing a significant uptick with projections of $7.85 billion in 2023 expanding to $19.50 billion by 2033. Telecommunications and healthcare also represent considerable segments, focusing on enhancing customer engagement and loyalty.

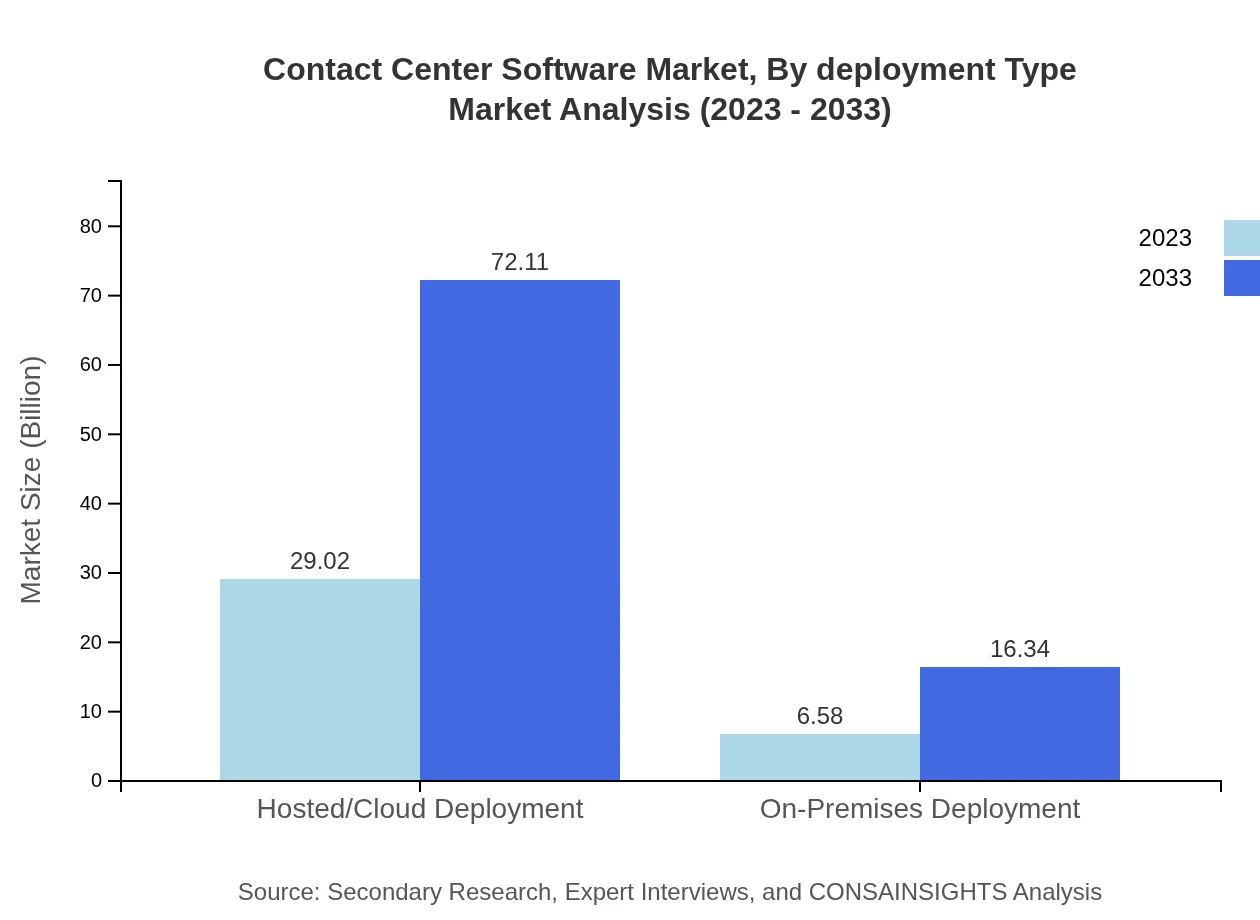

Contact Center Software Market Analysis By Deployment Type

Deployment type analysis reveals that Hosted/Cloud Deployment is the largest segment, with a market size of $29.02 billion in 2023, projected to reach $72.11 billion by 2033. On-Premises Deployment is anticipated to maintain its presence, growing from $6.58 billion in 2023 to $16.34 billion in 2033, whereas Hybrid Deployment will also see significant growth with increasing demand for flexible solutions.

Contact Center Software Market Analysis By End User

End-user segmentation is diversified, encompassing fields such as BFSI, retail, telecommunications, healthcare, and government. The BFSI sector continues to lead due to stringent customer engagement needs, while sectors like healthcare are increasingly focusing on patient experience management through contact center solutions. This trend indicates growing investments across various sectors looking to leverage these technologies for improved customer relationship management.

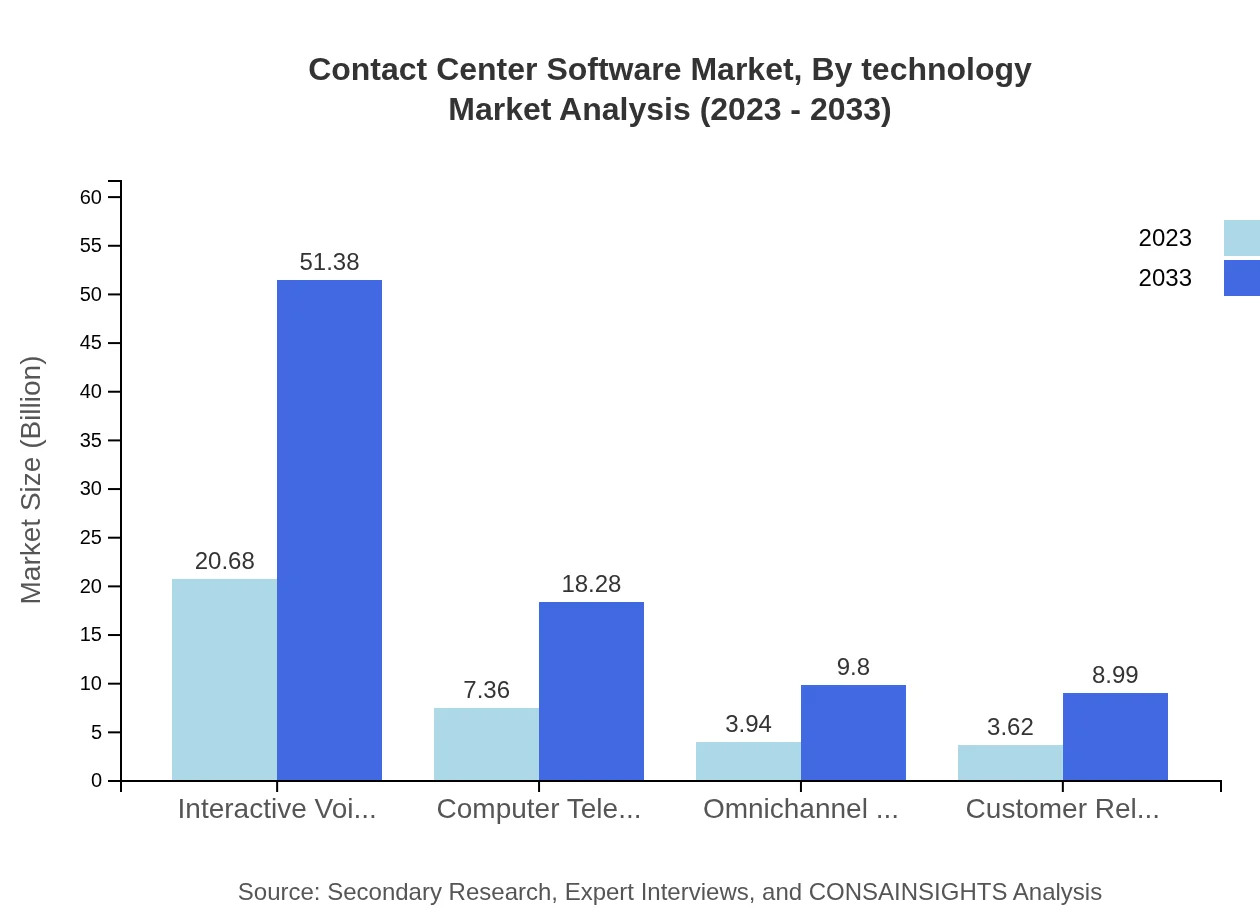

Contact Center Software Market Analysis By Technology

Technology segmentation includes solutions like Interactive Voice Response (IVR), Computer Telephony Integration (CTI), Omnichannel Communication, and CRM Integration. IVR technology leads the segment with a size of $20.68 billion in 2023, expected to grow to $51.38 billion by 2033. Omnichannel communication solutions continue to gain traction, projected to grow alongside consumer demands for seamless interaction across multiple platforms.

Contact Center Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Contact Center Software Industry

Salesforce:

Salesforce provides a comprehensive suite of CRM and customer service solutions that streamline operations, enhance customer interactions, and drive business growth.Zendesk:

Zendesk offers a versatile customer service platform designed for various businesses, focusing on improving customer experience with omnichannel support and AI-enhanced workflows.Genesys:

Genesys specializes in omnichannel customer engagement software and cloud-based contact center solutions, focusing on personalized customer experiences across multiple channels.Avaya:

Avaya is a global leader in business communications, providing solutions that enhance customer engagement through innovative contact center technologies.NICE inContact:

NICE inContact offers cloud-based contact center solutions known for their scalability, advanced analytics, and capability to enhance customer service quality.We're grateful to work with incredible clients.

FAQs

What is the market size of contact Center Software?

The contact center software market is projected to reach $35.6 billion by 2033, growing at a CAGR of 9.2% from 2023 to 2033, reflecting significant demand in various sectors.

What are the key market players or companies in this contact Center Software industry?

Key players in the contact center software industry include Salesforce, Cisco Systems, Avaya, Genesys, and 8x8, among others, providing diverse solutions for customer engagement and service.

What are the primary factors driving the growth in the contact Center Software industry?

Growth in the contact center software industry is driven by digital transformation, increased demand for omnichannel solutions, advancements in AI technology, and growing customer expectations for service.

Which region is the fastest Growing in the contact Center Software?

The Asia Pacific region is projected to be the fastest-growing market, rising from $6.80 billion in 2023 to $16.89 billion by 2033, with a heightened focus on technological adoption and customer service improvements.

Does ConsaInsights provide customized market report data for the contact Center Software industry?

Yes, ConsaInsights offers tailored market report data for the contact center software industry, allowing clients to obtain specific insights and trends that match their business needs.

What deliverables can I expect from this contact Center Software market research project?

Deliverables from this market research project typically include comprehensive reports, data analysis, market insights, trend forecasting, and recommendations tailored to strategic planning in the contact center sector.

What are the market trends of contact Center Software?

Current trends include a shift towards cloud-based solutions, integration of AI for better customer interactions, growth in automated services, and increasing emphasis on data security and customer privacy.