Contactless Payment Market Report

Published Date: 31 January 2026 | Report Code: contactless-payment

Contactless Payment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Contactless Payment market, highlighting key insights, trends, and forecasts from 2023 to 2033. It encompasses market size, segments, regional analysis, and leading players contributing to this rapidly evolving industry.

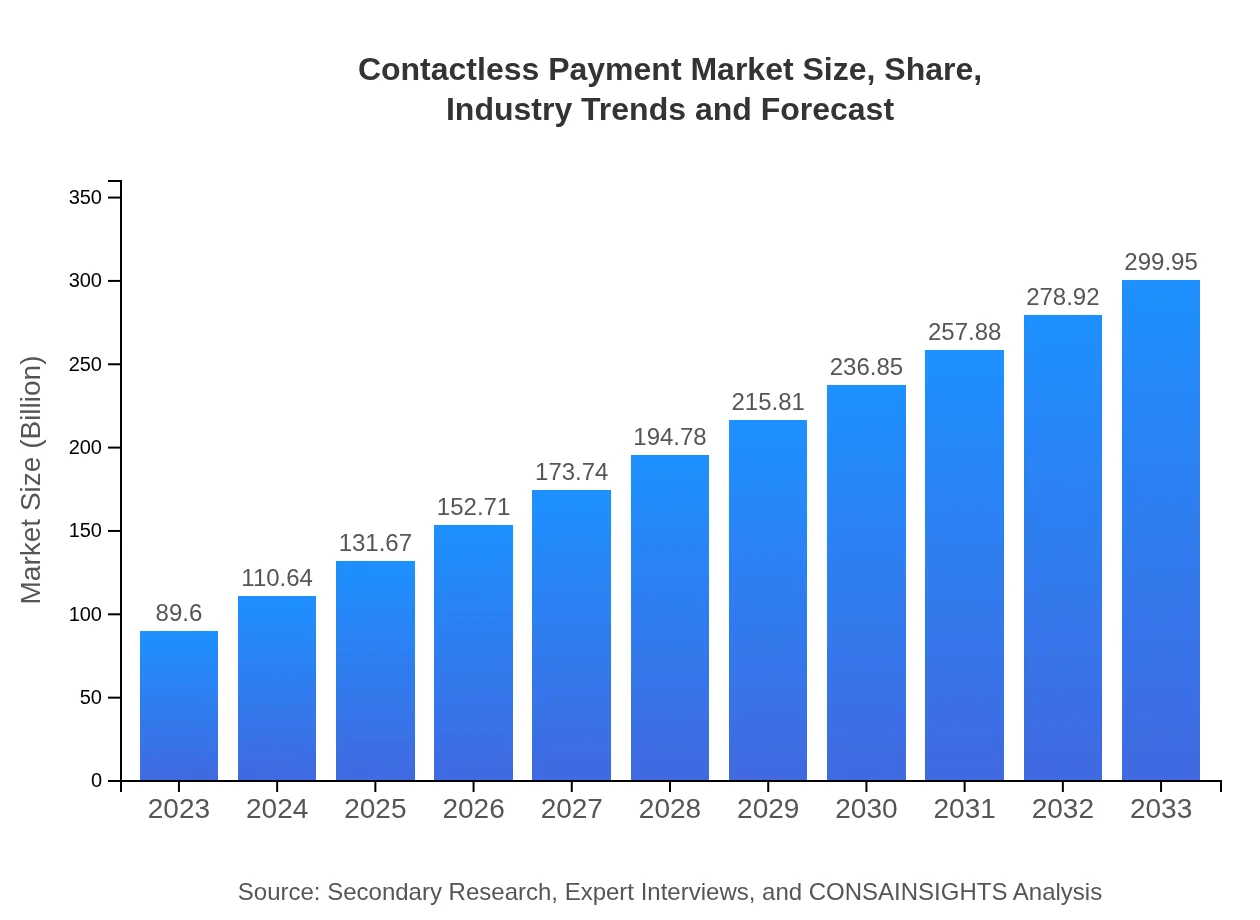

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $89.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $299.95 Billion |

| Top Companies | Visa Inc., Mastercard Inc., PayPal Holdings, Inc., American Express Company |

| Last Modified Date | 31 January 2026 |

Contactless Payment Market Overview

Customize Contactless Payment Market Report market research report

- ✔ Get in-depth analysis of Contactless Payment market size, growth, and forecasts.

- ✔ Understand Contactless Payment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Contactless Payment

What is the Market Size & CAGR of Contactless Payment market in 2023?

Contactless Payment Industry Analysis

Contactless Payment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Contactless Payment Market Analysis Report by Region

Europe Contactless Payment Market Report:

In Europe, the market is progressing remarkably from $23.04 billion in 2023 to $77.12 billion by 2033. This growth is fueled by strict regulatory frameworks promoting payment security, increasing consumer awareness of contactless technologies, and a substantial rise in mobile wallet use among European consumers.Asia Pacific Contactless Payment Market Report:

In the Asia Pacific region, the Contactless Payment market is expanding rapidly, valued at $19.20 billion in 2023 and expected to reach $64.28 billion by 2033. The growth is attributed to a young and tech-savvy population, alongside increased investment in digital payment infrastructure and e-commerce. Countries like China and India are leading this trend with their robust adoption of mobile payment applications.North America Contactless Payment Market Report:

North America remains a leading market for Contactless Payment, with a valuation of $31.85 billion in 2023 and forecasted growth to $106.63 billion by 2033. The region is characterized by high credit card penetration, widespread adoption of new payment technologies, and established infrastructure for digital transactions.South America Contactless Payment Market Report:

The South American market, though smaller, has shown promising growth from $6.30 billion in 2023 to $21.09 billion by 2033. Factors contributing to this growth include increasing smartphone penetration and a shift towards cashless transactions in urban areas. Additionally, governments are actively promoting digital payment strategies to enhance economic inclusivity.Middle East & Africa Contactless Payment Market Report:

The Middle East and Africa region is anticipating growth from $9.21 billion in 2023 to $30.83 billion by 2033. Enhanced internet connectivity, rapid urbanization, and increased investment in fintech solutions contribute to the growing adoption of contactless payment methods in this diverse region.Tell us your focus area and get a customized research report.

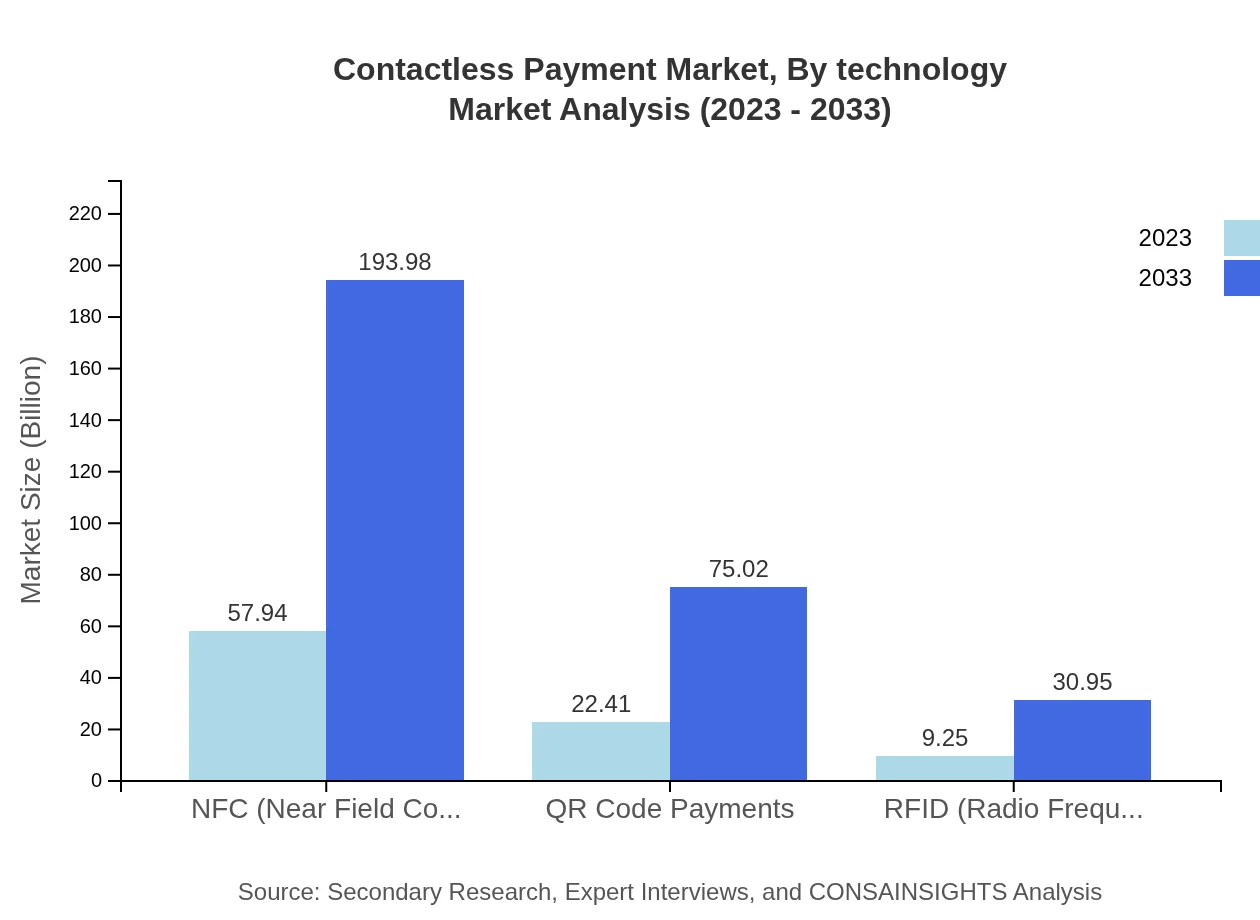

Contactless Payment Market Analysis By Technology

In terms of technology, the NFC segment is projected to grow from $57.94 billion in 2023 to $193.98 billion by 2033. QR code payments will also see significant expansion, increasing from $22.41 billion to $75.02 billion in the same period. RFID technology is expected to rise from $9.25 billion to $30.95 billion. These figures underscore the technological shift toward more streamlined, efficient, and secure payment solutions.

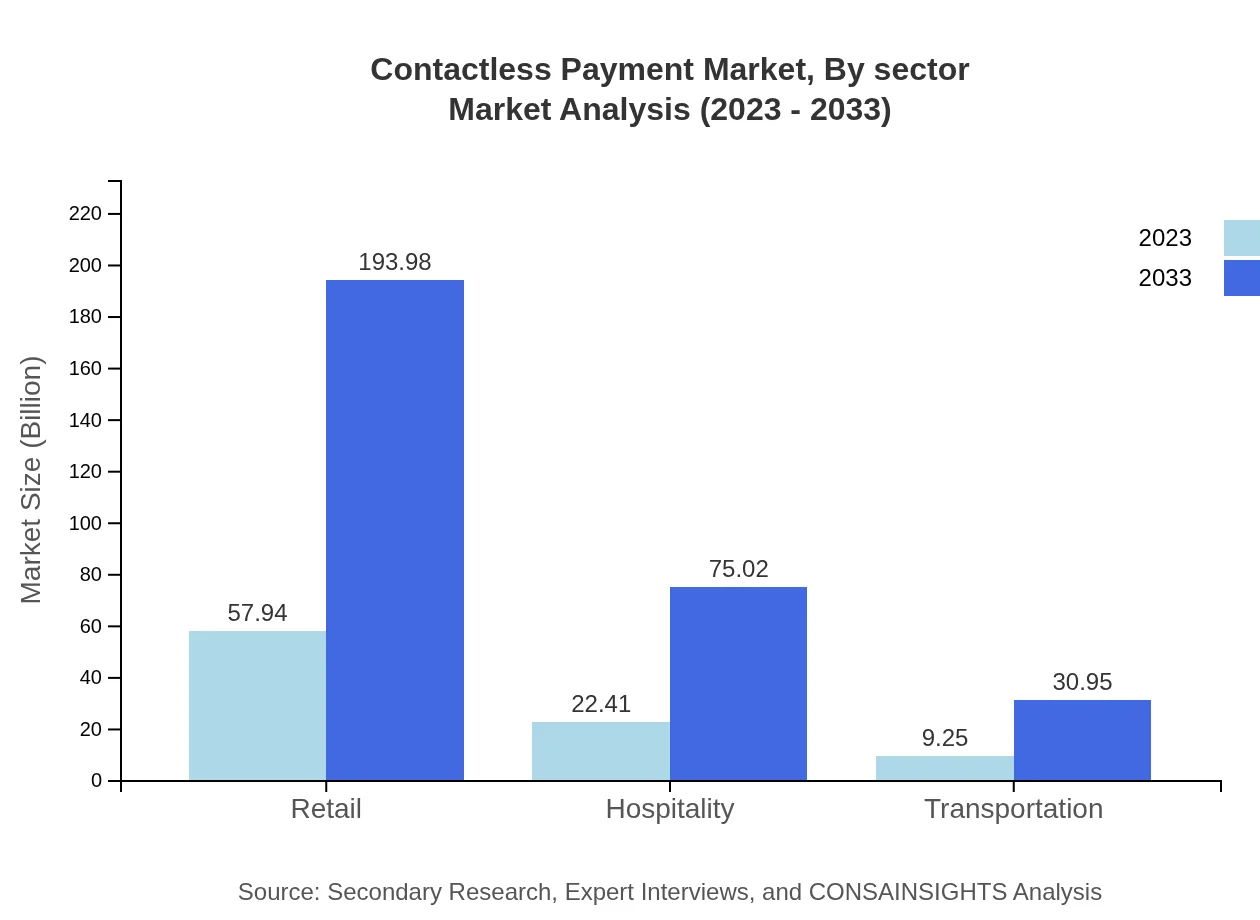

Contactless Payment Market Analysis By Sector

The retail sector leads contactless payment adoption, projected to rise from $57.94 billion in 2023 to $193.98 billion by 2033. The hospitality sector follows closely, growing from $22.41 billion to $75.02 billion, driven by improvements in customer service and speed of checkout processes.

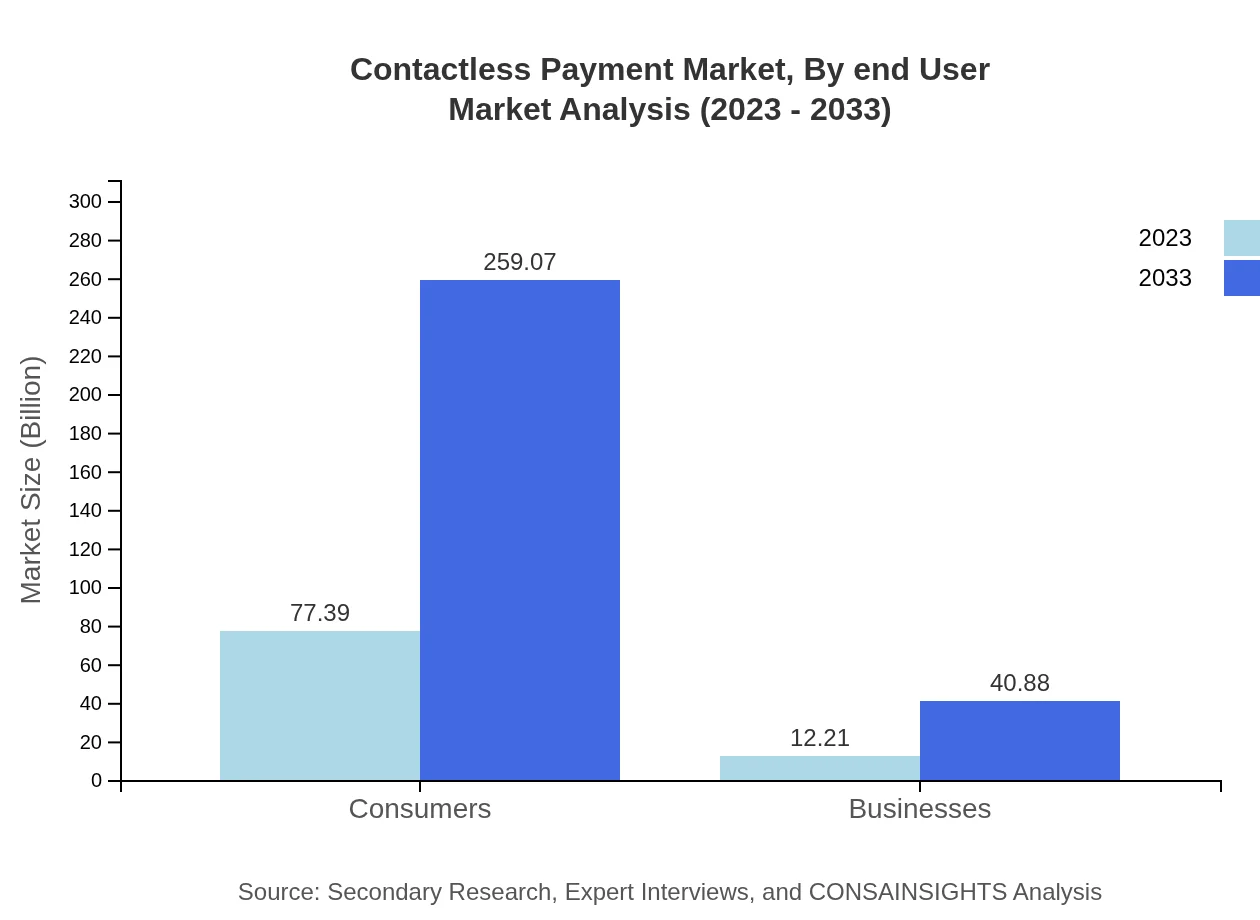

Contactless Payment Market Analysis By End User

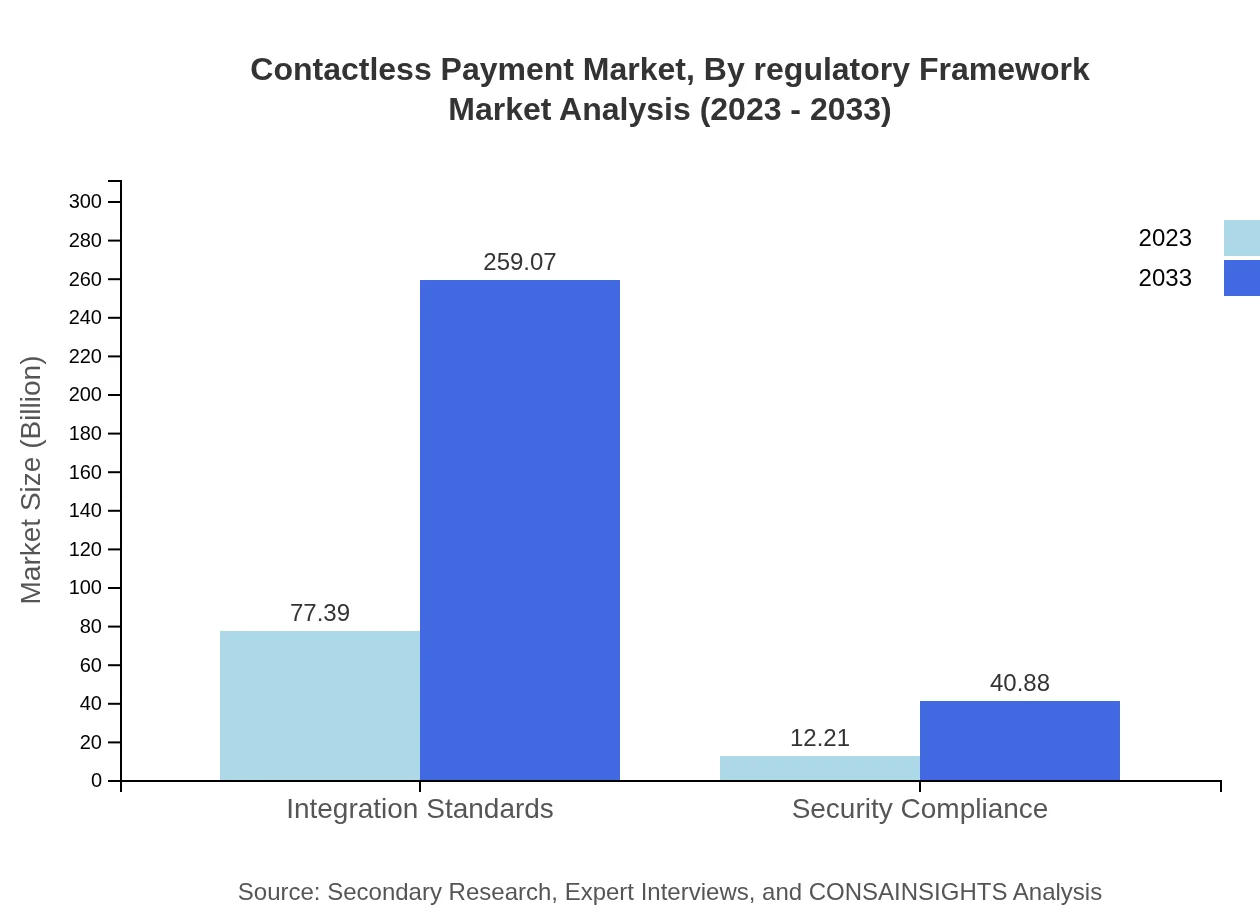

Consumers dominate the end-user segment, with the market expanding from $77.39 billion in 2023 to $259.07 billion by 2033. Businesses are also increasing their reliance on contactless payments, with expectations for growth from $12.21 billion to $40.88 billion as they adopt modern payment solutions for efficiency.

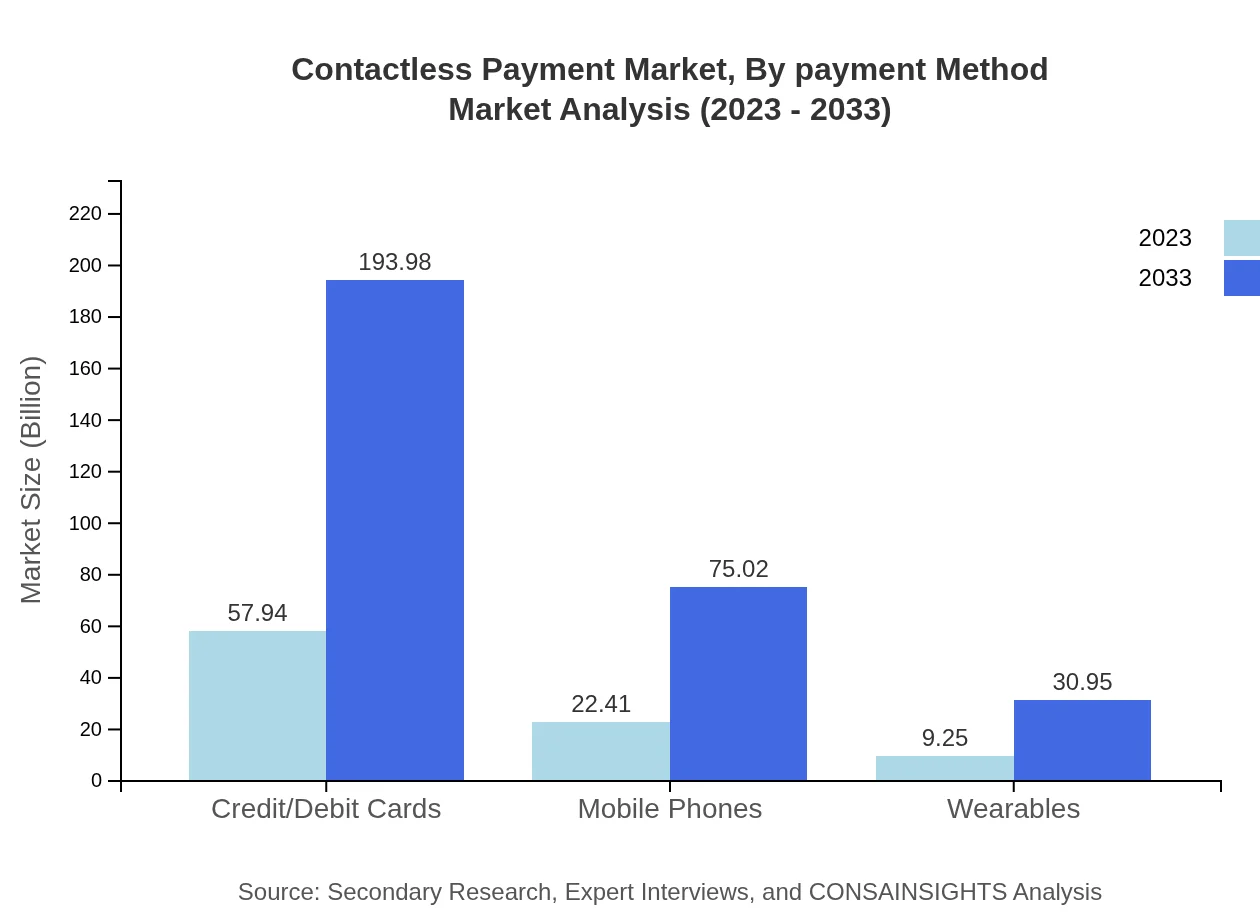

Contactless Payment Market Analysis By Payment Method

The analysis indicates that credit/debit card payments dominate, projected to grow from $57.94 billion to $193.98 billion. Mobile phones are also gaining traction, with growth anticipated from $22.41 billion to $75.02 billion, reflecting shifting consumer preferences towards mobile wallets.

Contactless Payment Market Analysis By Regulatory Framework

Significant regulatory frameworks surrounding data protection and payment security standards are influencing the market's growth. As these regulations evolve, compliance will drive many participants toward adopting and integrating advanced contactless payment systems, fostering substantial growth in a secure environment.

Contactless Payment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Contactless Payment Industry

Visa Inc.:

Visa is a global leader in digital payments, offering innovative contactless payment solutions and services. The company continually invests in upgrading its technology infrastructure to enhance payment security and consumer convenience.Mastercard Inc.:

Mastercard is renowned for its contactless payment card technology and its commitment to advancing secure digital payments. The company focuses on enabling faster transactions through cutting-edge technology and strategic partnerships.PayPal Holdings, Inc.:

PayPal has emerged as a significant player in the contactless payment space, with its mobile wallet solutions enhancing the consumer payment experience across various retail platforms, contributing extensively to market growth.American Express Company:

American Express offers a wide range of contactless card products and has been involved in numerous initiatives to promote contactless technology in retail environments, enhancing user experiences.We're grateful to work with incredible clients.

FAQs

What is the market size of contactless payment?

The contactless payment market is projected to reach a size of $89.6 billion by 2033, growing from its current value, with a compound annual growth rate (CAGR) of 12.3% over the next decade.

What are the key market players or companies in this contactless payment industry?

Key players in the contactless payment industry include major financial institutions, technology providers, and payment platforms such as Visa, Mastercard, PayPal, Square, and various fintech startups that innovate within the transaction space.

What are the primary factors driving the growth in the contactless payment industry?

The growth in the contactless payment industry is driven by technological advancements, increasing consumer preference for convenience, heightened security concerns leading to increased focus on cashless transactions, and the rapid expansion of digital transaction infrastructures.

Which region is the fastest Growing in the contactless payment?

The North American region is the fastest-growing for contactless payments, expected to rise from $31.85 billion in 2023 to $106.63 billion by 2033, supported by widespread adoption among consumers and businesses.

Does Consainsights provide customized market report data for the contactless payment industry?

Yes, Consainsights offers tailored market report data for the contactless payment industry, allowing clients to obtain insights specific to their business needs and market challenges.

What deliverables can I expect from this contactless payment market research project?

From the contactless payment market research project, expect comprehensive reports including market analysis, competitive landscape, segmentation data, regional performance insights, and forecasts for future growth.

What are the market trends of contactless payment?

Current trends in the contactless payment market include increased adoption of mobile wallets, rising use of NFC technology, consumer shift towards QR code payments, and a focus on enhanced security protocols.