Contactless Payment Terminals Market Report

Published Date: 31 January 2026 | Report Code: contactless-payment-terminals

Contactless Payment Terminals Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Contactless Payment Terminals market, offering insights on market size, growth forecasts through 2033, competitive landscape, technology advancements, and regional analyses among others.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

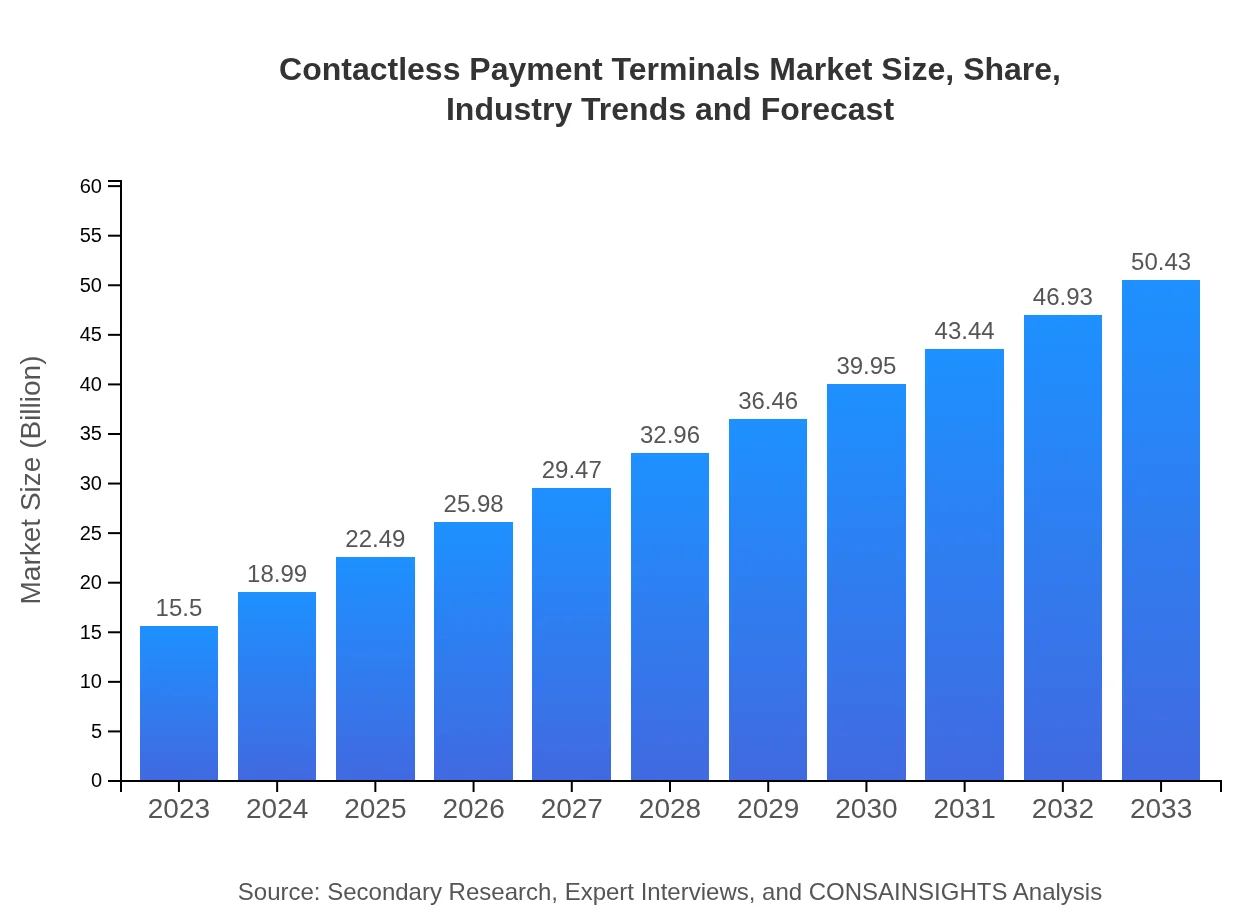

| 2023 Market Size | $15.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $50.43 Billion |

| Top Companies | Ingenico Group, Verifone Systems, Inc., NCR Corporation, PAX Technology Limited |

| Last Modified Date | 31 January 2026 |

Contactless Payment Terminals Market Overview

Customize Contactless Payment Terminals Market Report market research report

- ✔ Get in-depth analysis of Contactless Payment Terminals market size, growth, and forecasts.

- ✔ Understand Contactless Payment Terminals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Contactless Payment Terminals

What is the Market Size & CAGR of Contactless Payment Terminals market in 2023?

Contactless Payment Terminals Industry Analysis

Contactless Payment Terminals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

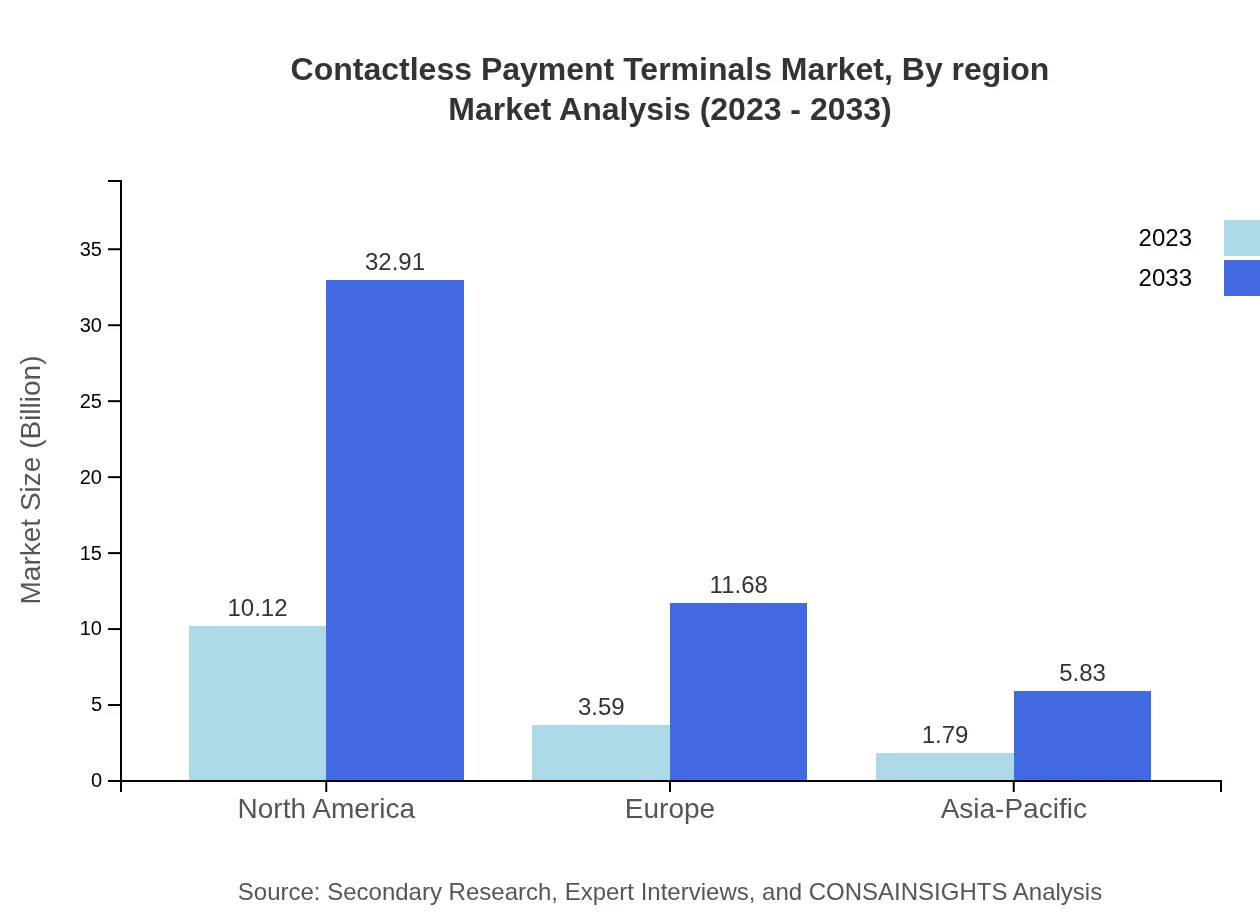

Contactless Payment Terminals Market Analysis Report by Region

Europe Contactless Payment Terminals Market Report:

Europe's Contactless Payment Terminals market will expand from USD 4.11 billion in 2023 to USD 13.36 billion by 2033, bolstered by the growth of e-commerce and the widespread adaptation of contactless technology in retail and transportation.Asia Pacific Contactless Payment Terminals Market Report:

In the Asia-Pacific region, the Contactless Payment Terminals market is set to grow from USD 3.22 billion in 2023 to USD 10.49 billion by 2033. Factors contributing to this growth include rapid urbanization, high mobile penetration, and increasing investments in payment technologies by governments and private enterprises.North America Contactless Payment Terminals Market Report:

North America stands as a significant market in the Contactless Payment Terminals sector, with an estimated growth from USD 5.59 billion in 2023 to USD 18.19 billion by 2033. The market is driven by high consumer acceptance of contactless payments and technological advancements in payment systems.South America Contactless Payment Terminals Market Report:

The South American market is expected to see a rise from USD 1.24 billion in 2023 to USD 4.05 billion in 2033, spurred by the increasing inclination towards digital payment solutions and supportive regulatory frameworks aimed at financial inclusion.Middle East & Africa Contactless Payment Terminals Market Report:

The Middle East and Africa market is projected to increase from USD 1.33 billion in 2023 to USD 4.34 billion by 2033, driven by the rising population, increasing smartphone usage, and a growing demand for innovative payment solutions.Tell us your focus area and get a customized research report.

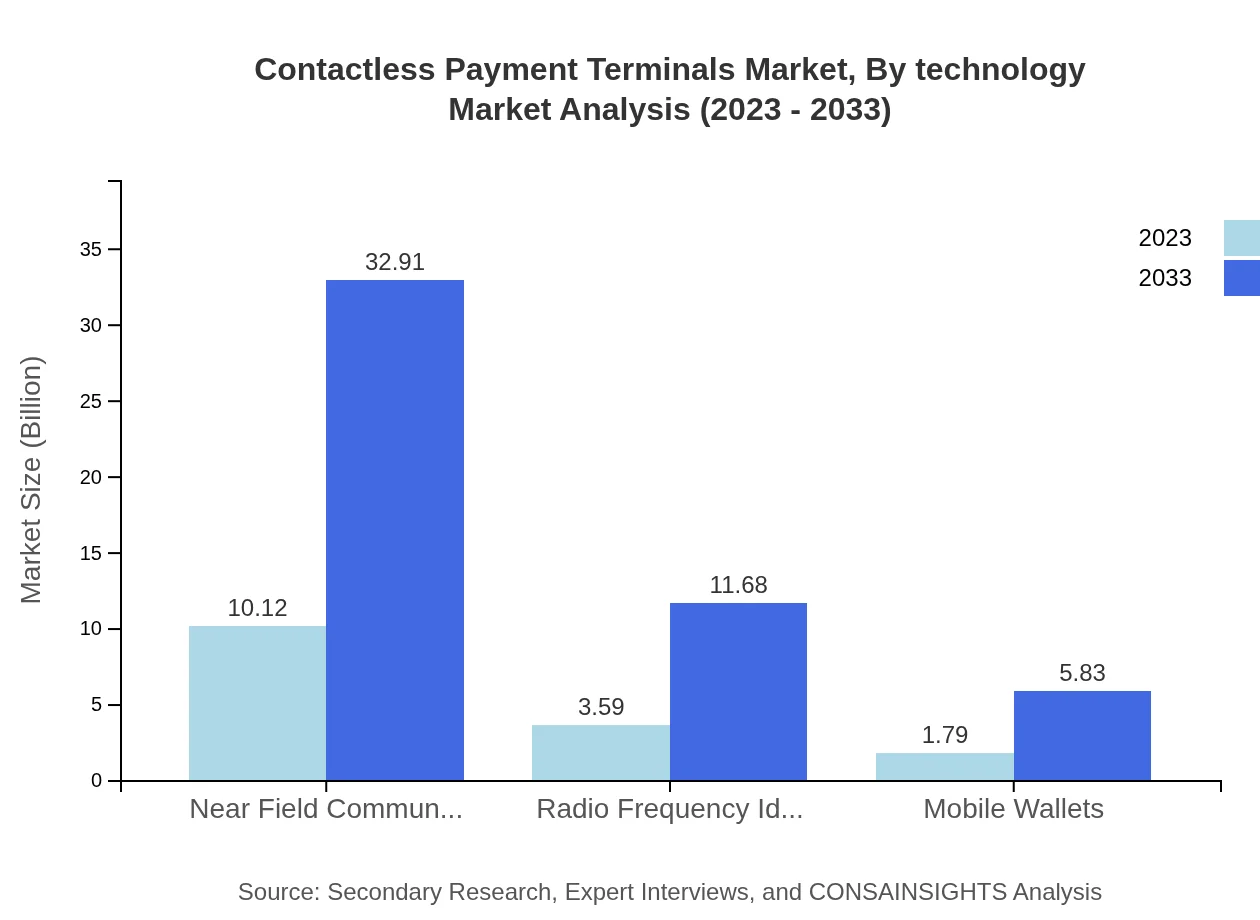

Contactless Payment Terminals Market Analysis By Technology

The analysis of Contactless Payment Terminals by technology reveals that Near Field Communication (NFC) dominates the market with significant growth projections. NFC technology represents a dominant share due to its ease of use and compatibility with existing mobile devices, enhancing consumer adoption. Radio Frequency Identification (RFID) also demonstrates substantial growth, particularly in retail environments to streamline operations and improve customer experience.

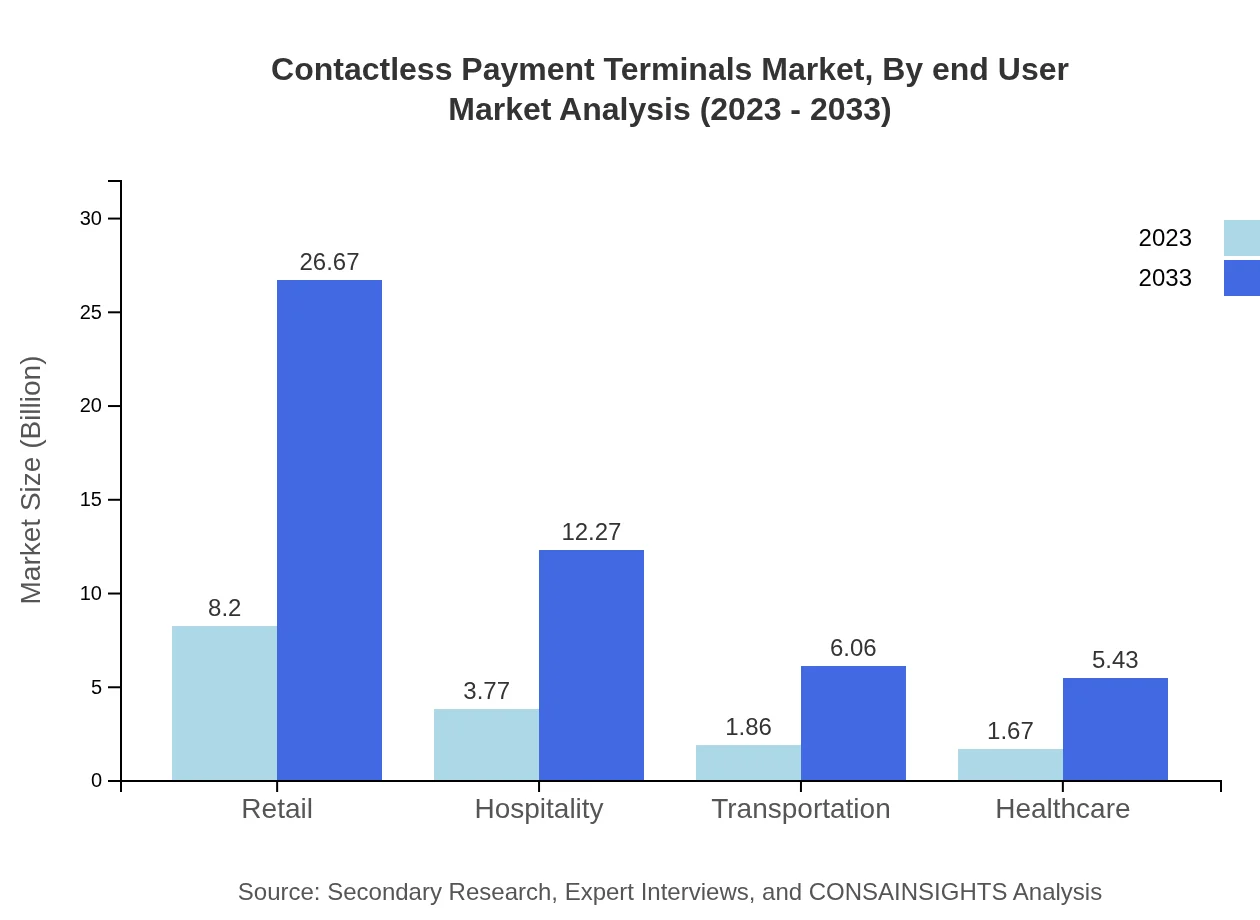

Contactless Payment Terminals Market Analysis By End User

The end-user segmentation indicates retail as the largest market for Contactless Payment Terminals, reflecting an increasing need for speed and convenience in transactions. The hospitality sector follows closely, adopting these terminals to enhance guest experiences. The transportation sector is also significant, utilizing contactless solutions to speed up fare collections and improve passenger convenience.

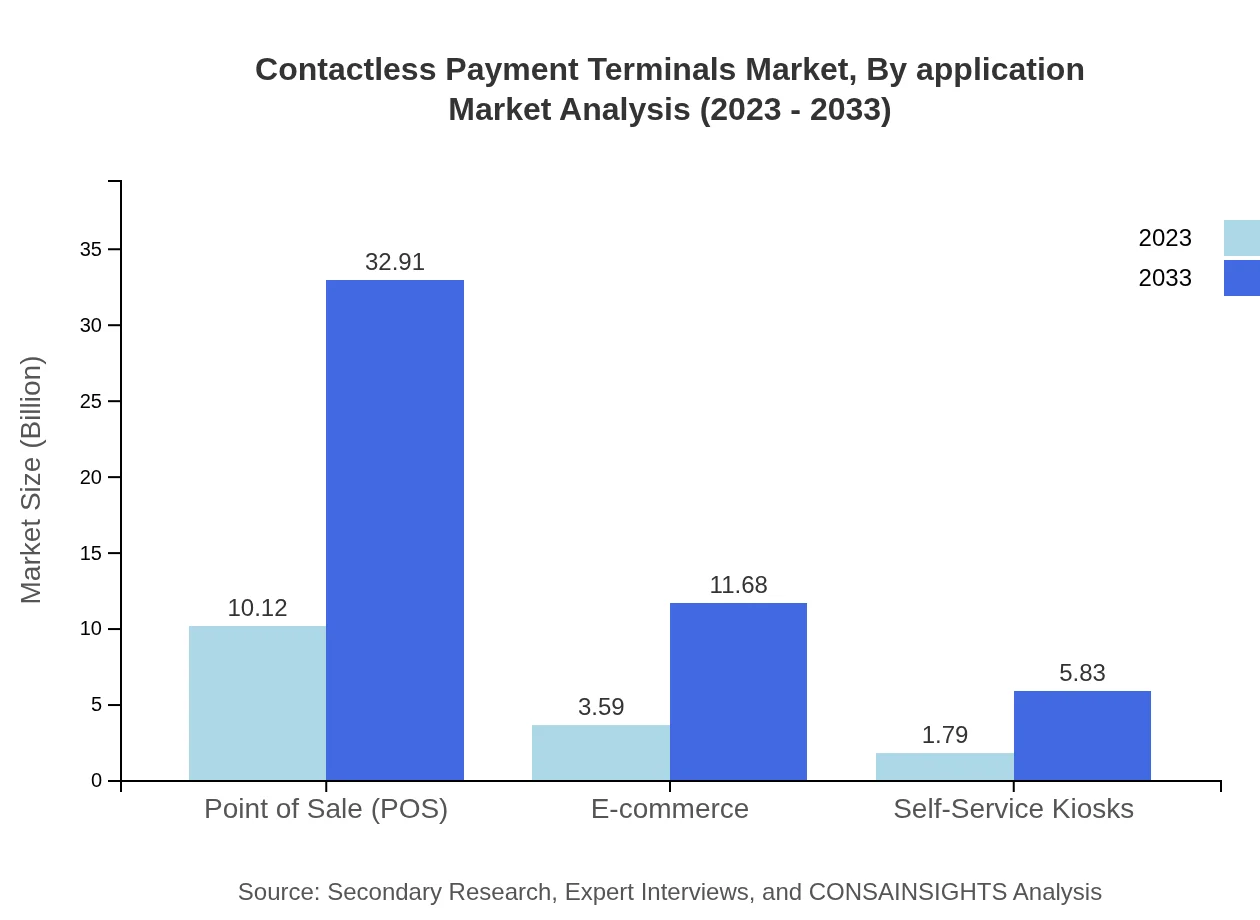

Contactless Payment Terminals Market Analysis By Application

Contactless Payment Terminals are seeing versatile applications, prominently in retail and e-commerce. Retail captures a substantial share due to the quick transaction speeds and enhanced customer experience. E-commerce is growing as businesses adapt omnichannel strategies, integrating contactless payments into their digital platforms, thus increasing transaction efficiency.

Contactless Payment Terminals Market Analysis By Region

The regional analysis reaffirms that North America leads the market due to high disposable incomes and consumer readiness to adopt new technologies. Europe follows, with stringent regulations promoting digital payments. The Asia-Pacific region is rapidly emerging, with vast potential driven by its large population and increasing smartphone penetration.

Contactless Payment Terminals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Contactless Payment Terminals Industry

Ingenico Group:

A leading provider of payment solutions known for its innovative contactless payment terminals, Ingenico offers devices known for performance and security in transactions.Verifone Systems, Inc.:

Verifone is a prominent player in the electronic payment industry, providing advanced payment terminals and infrastructure supporting contactless technology.NCR Corporation:

NCR specializes in technology solutions, including contactless payment terminals aimed at various sectors such as retail, hospitality, and banking.PAX Technology Limited:

PAX Technology leads in providing reliable contactless POS terminals and payment solutions, enhancing transaction efficiency across numerous sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of contactless Payment Terminals?

The global contactless payment terminals market is projected to grow from approximately $15.5 billion in 2023 to an estimated value by 2033, driven by an impressive CAGR of 12%. This growth reflects the increasing adoption of cashless transactions among consumers and businesses.

What are the key market players or companies in the contactless Payment Terminals industry?

The contactless payment terminals industry is led by several key players, including major companies such as PayPal, VeriFone, Ingenico, and Square. These companies are recognized for their innovative solutions and contributions towards enhancing payment technologies in both retail and e-commerce.

What are the primary factors driving the growth in the contactless Payment Terminals industry?

Key factors driving growth in the contactless payment terminals industry include consumer preference for secure and fast transactions, the rise of e-commerce, and increased adoption of mobile payment solutions. Enhanced convenience and initiatives pushing for cashless economies also contribute significantly to this growth.

Which region is the fastest Growing in the contactless Payment Terminals?

The fastest-growing region in the contactless payment terminals market is North America, with market size expected to grow from $5.59 billion in 2023 to $18.19 billion by 2033. Other significant regions include Europe and Asia-Pacific, which also show promising growth rates.

Does ConsaInsights provide customized market report data for the contactless Payment Terminals industry?

Yes, Consainsights offers tailored market reports for the contactless payment terminals industry, allowing clients to access detailed insights and data that fit specific business needs. Custom reports may include segmented market analysis and forecasts to aid strategic decision-making.

What deliverables can I expect from this contactless Payment Terminals market research project?

Deliverables from the contactless payment terminals market research include comprehensive reports, market forecasts, regional analyses, and breakdowns by segments such as type, application, and region. These insights facilitate strategic planning and market entry strategies.

What are the market trends of contactless Payment Terminals?

Market trends in the contactless payment terminals sector include a shift towards Near Field Communication (NFC) technology, increased reliance on mobile wallets, and expansion in sectors like retail and transportation. These trends reflect the evolving payment landscape focused on convenience and security.