Container As A Service Market Report

Published Date: 31 January 2026 | Report Code: container-as-a-service

Container As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Container As A Service (CaaS) market, covering market size, growth forecasts from 2023 to 2033, regional insights, and industry trends. It aims to equip stakeholders with critical insights and data needed for strategic planning and decision-making.

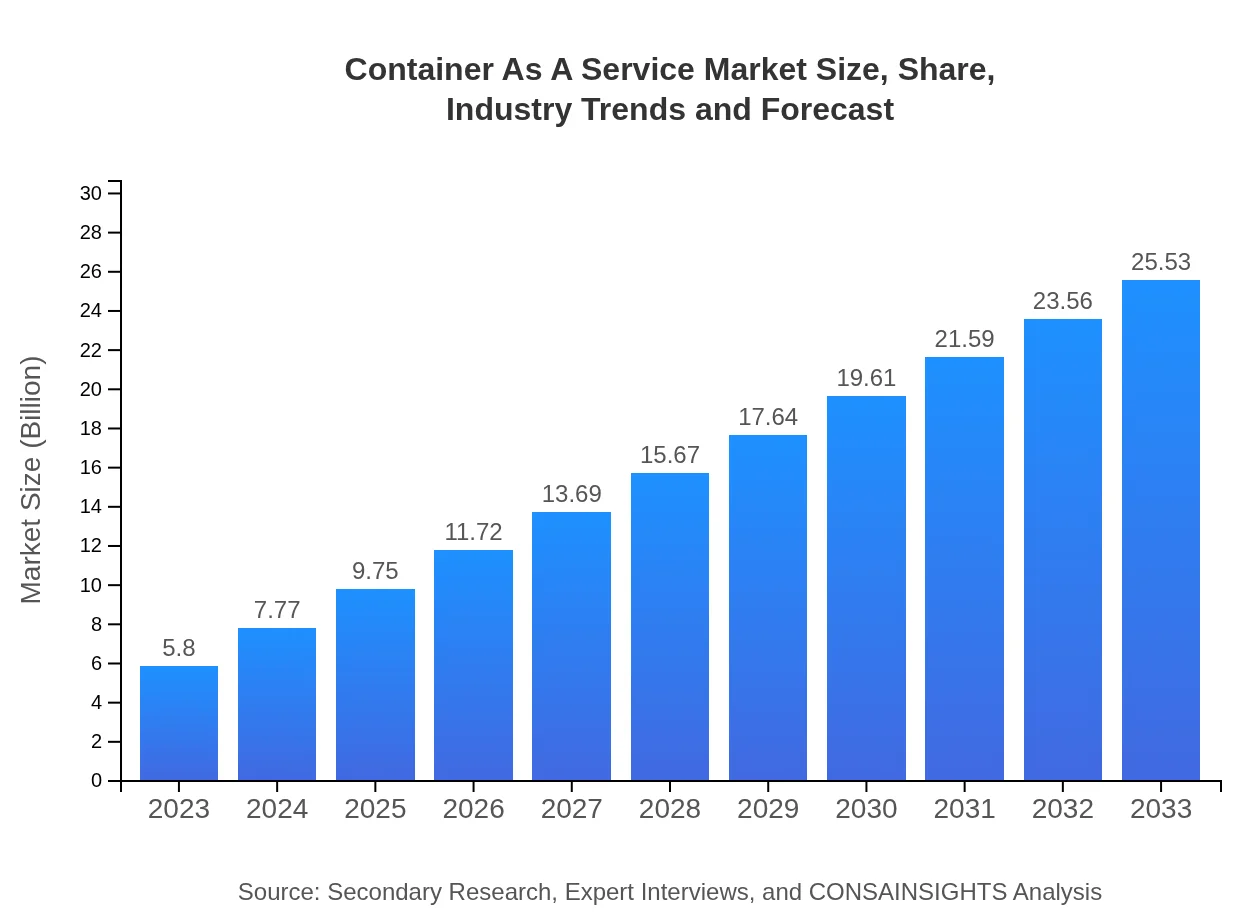

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $25.53 Billion |

| Top Companies | Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM |

| Last Modified Date | 31 January 2026 |

Container As A Service Market Overview

Customize Container As A Service Market Report market research report

- ✔ Get in-depth analysis of Container As A Service market size, growth, and forecasts.

- ✔ Understand Container As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Container As A Service

What is the Market Size & CAGR of Container As A Service market in 2023?

Container As A Service Industry Analysis

Container As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Container As A Service Market Analysis Report by Region

Europe Container As A Service Market Report:

The European market for CaaS was valued at $1.79 billion in 2023, projected to grow to $7.89 billion by 2033. The regulatory environment in Europe fosters a significant emphasis on data security and privacy, driving the demand for managed container solutions.Asia Pacific Container As A Service Market Report:

The Asia Pacific region has emerged as a key market for CaaS, with a market size of $1.15 billion in 2023, projected to grow to $5.07 billion by 2033. Countries like China, India, and Australia are driving adoption due to rapid industrialization and the need for scalable IT solutions.North America Container As A Service Market Report:

North America leads the CaaS market with a valuation of $1.94 billion in 2023, expected to reach $8.55 billion by 2033. The region is characterized by advanced technological infrastructure, a large number of established tech giants, and fast-paced innovation in cloud services.South America Container As A Service Market Report:

In South America, the CaaS market stood at approximately $0.46 billion in 2023, expanding to $2.01 billion by 2033. Growth is driven by increasing digital transformation initiatives and the adoption of cloud technologies among small and medium enterprises.Middle East & Africa Container As A Service Market Report:

The Middle East and Africa region shows a market size of $0.46 billion in 2023, with projections to reach $2.02 billion by 2033. Increased investment in IT infrastructure and smart technologies in this region is, however, expected to boost CaaS adoption.Tell us your focus area and get a customized research report.

Container As A Service Market Analysis By Service Model

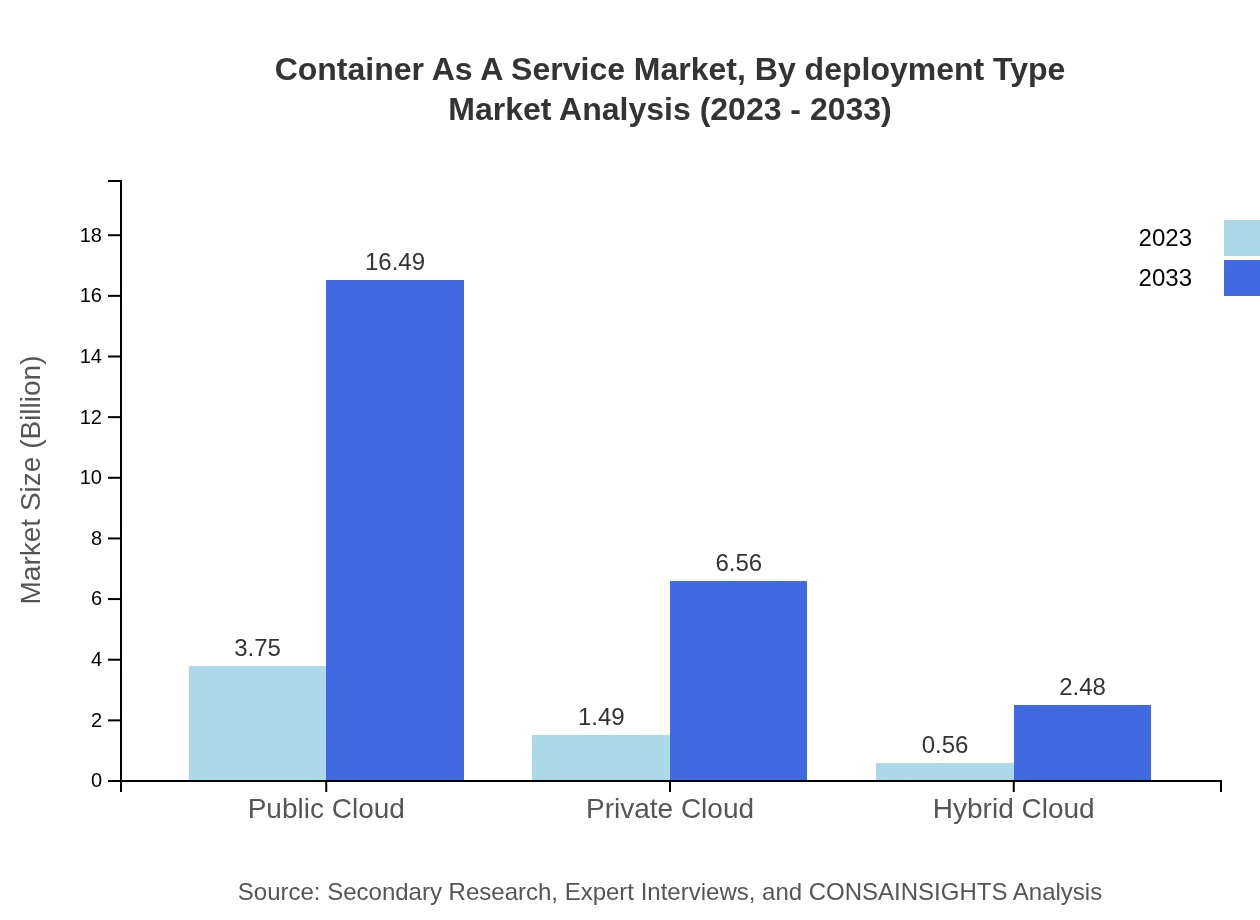

The service model segment underlines the various deployment strategies for CaaS, namely public, private, and hybrid cloud. In 2023, the public cloud segment held substantial market share as organizations favored the cost-effectiveness and scalability of this model.

Container As A Service Market Analysis By Deployment Type

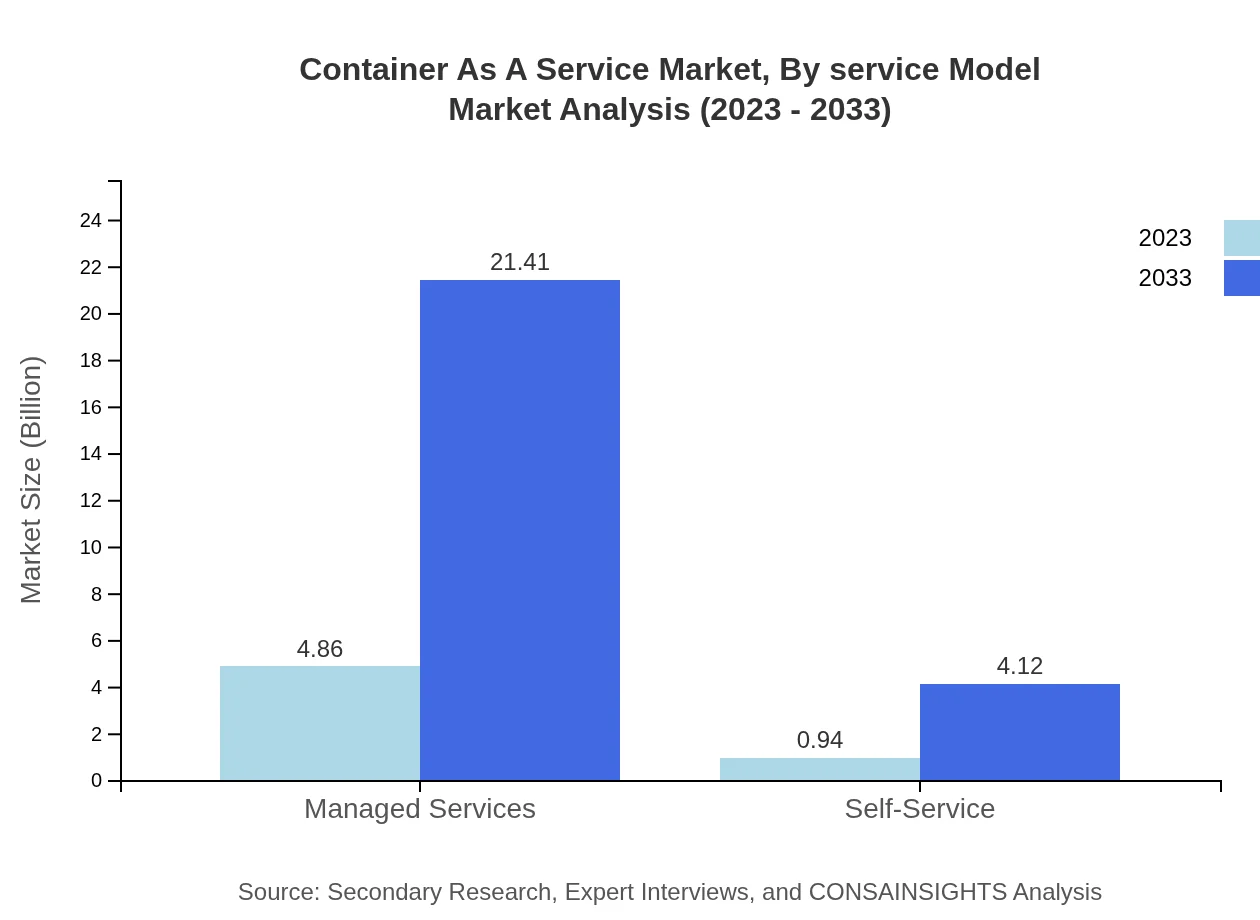

CaaS deployment is primarily categorized into managed and self-service models. Managed services accounted for a significant share due to their advantages in reducing the complexities involved in container management.

Container As A Service Market Analysis By Industry

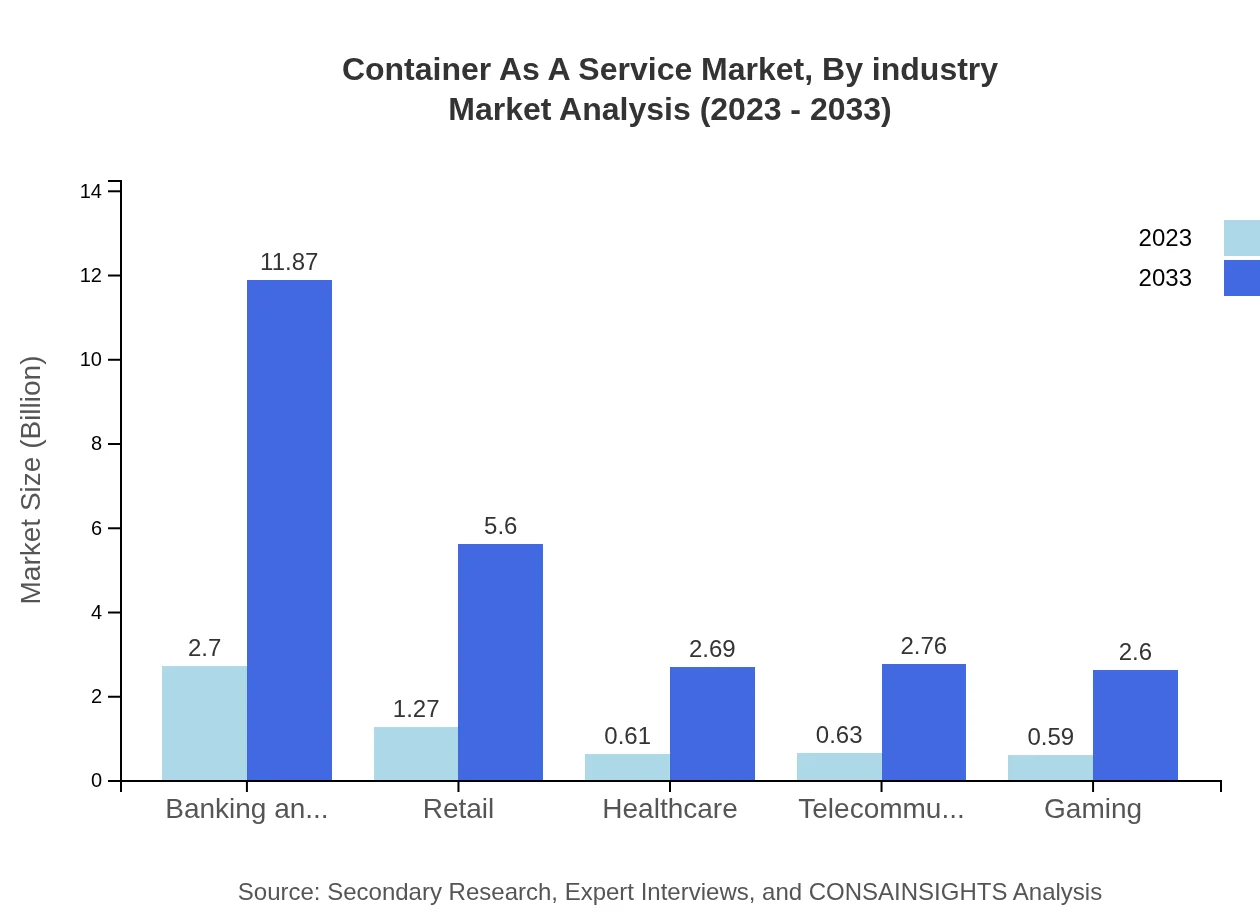

The banking and financial services sector is the largest contributor to the CaaS market, with a market size of $2.70 billion in 2023, evolving to $11.87 billion by 2033, driven by the demand for secure and compliant container solutions.

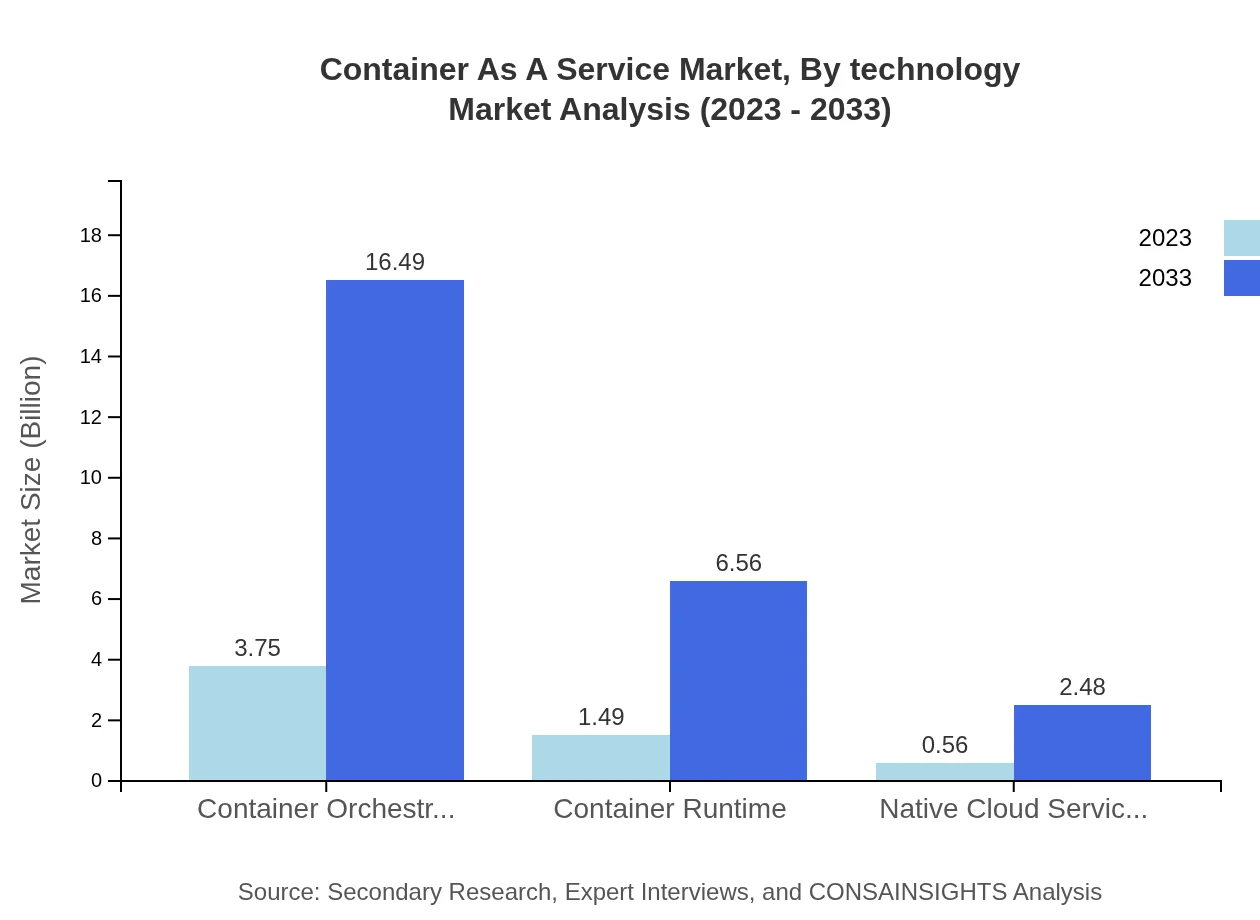

Container As A Service Market Analysis By Technology

Technologies like Kubernetes, Docker Swarm, and Apache Mesos dominate the CaaS sector, facilitating robust orchestration capabilities and resource management for containerized applications.

Container As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Container As A Service Industry

Amazon Web Services (AWS):

AWS offers a comprehensive suite of cloud solutions including Amazon ECS and EKS, which dominate the CaaS landscape through their ease of integration and scalability.Microsoft Azure:

Azure provides a robust set of services for CaaS, leveraging its established cloud infrastructure to offer seamless container management solutions.Google Cloud:

Google Cloud’s Kubernetes Engine is a key player in the CaaS market, enabling efficient orchestration of containerized applications.IBM:

IBM offers a strong CaaS platform focused on enterprise-grade solutions, integrating AI-driven insights for enhanced operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Container As A-Service?

The Container-as-a-Service market is currently valued at approximately $5.8 billion, with an impressive projected CAGR of 15.2%. This rapid growth is indicative of increasing adoption of containerization technologies among businesses.

What are the key market players or companies in the Container As A-Service industry?

Leading players in the Container-as-a-Service market include major cloud service providers like Amazon Web Services, Microsoft Azure, Google Cloud Platform, and IBM. These companies offer comprehensive container solutions and drive innovation within the industry.

What are the primary factors driving the growth in the Container As A-Service industry?

Key growth factors include increased demand for scalable application deployment, the rise of microservices architecture, and the necessity for efficient resource utilization in cloud environments. These trends enhance the attractiveness of CaaS offerings.

Which region is the fastest Growing in the Container As A-Service market?

The fastest-growing region is Europe, projecting a market size growth from $1.79 billion in 2023 to $7.89 billion by 2033. Asia Pacific is also significant, expanding from $1.15 billion to $5.07 billion over the same period.

Does ConsaInsights provide customized market report data for the Container As A-Service industry?

Yes, ConsaInsights offers tailored market reports for the Container-as-a-Service industry, catering to specific business needs. Customization ensures that companies receive relevant insights to facilitate informed strategic decisions.

What deliverables can I expect from this Container As A-Service market research project?

From this market research project, expect comprehensive analysis reports, market size assessments, competitive landscape evaluations, and growth forecasts. Additionally, we provide insights on regional trends and consumer behavior.

What are the market trends of Container As A-Service?

Notable trends include increasing adoption of hybrid and multi-cloud environments, the rising emphasis on DevOps practices, and growing security concerns driving enhancements in container management solutions.