Container Handling Equipment Market Report

Published Date: 22 January 2026 | Report Code: container-handling-equipment

Container Handling Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Container Handling Equipment market from 2023 to 2033, providing insights into market size, growth trends, and key player dynamics, as well as regional market assessments and technological advancements.

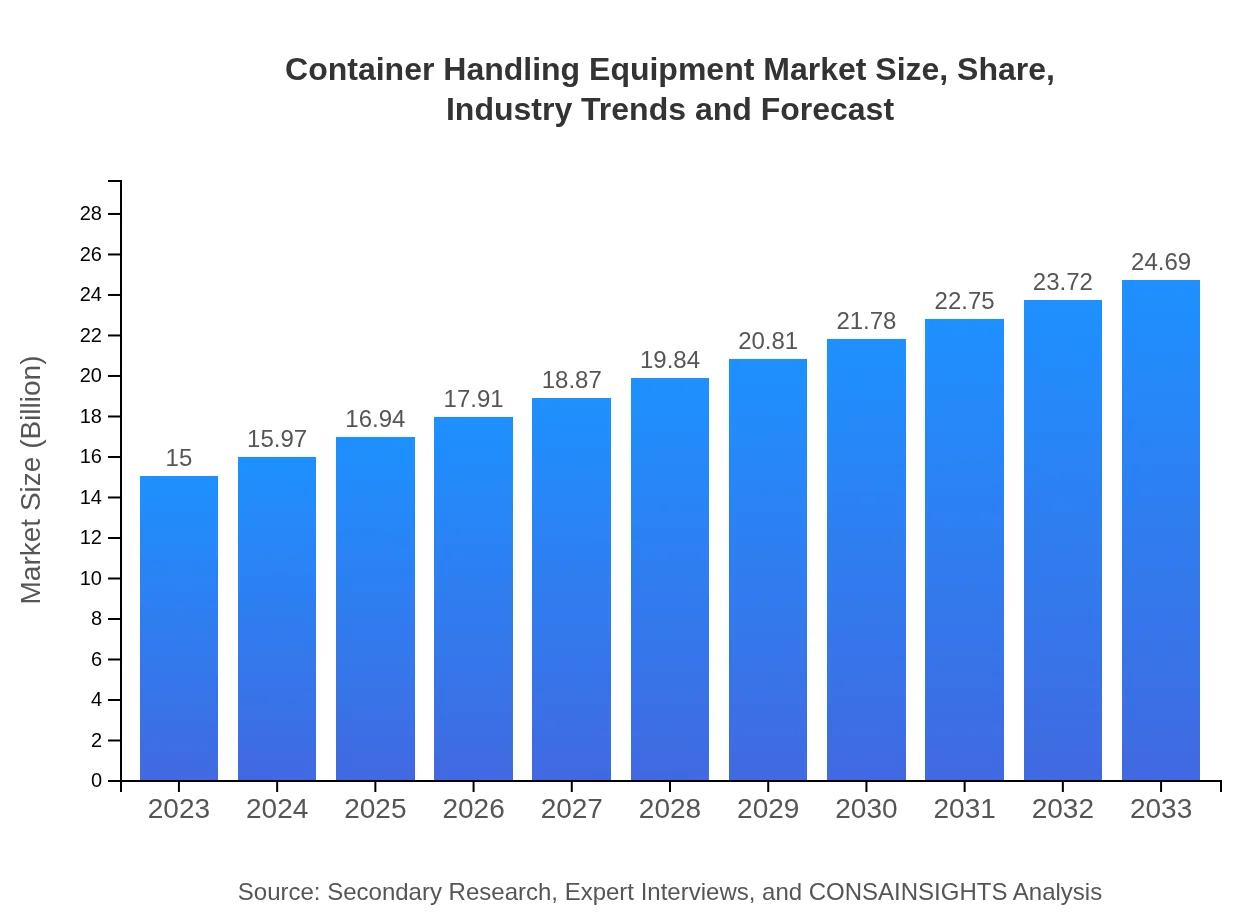

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $24.69 Billion |

| Top Companies | Konecranes, Cargotec, Hyster-Yale Materials Handling, Inc., Terex Corporation |

| Last Modified Date | 22 January 2026 |

Container Handling Equipment Market Overview

Customize Container Handling Equipment Market Report market research report

- ✔ Get in-depth analysis of Container Handling Equipment market size, growth, and forecasts.

- ✔ Understand Container Handling Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Container Handling Equipment

What is the Market Size & CAGR of Container Handling Equipment market in 2023?

Container Handling Equipment Industry Analysis

Container Handling Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Container Handling Equipment Market Analysis Report by Region

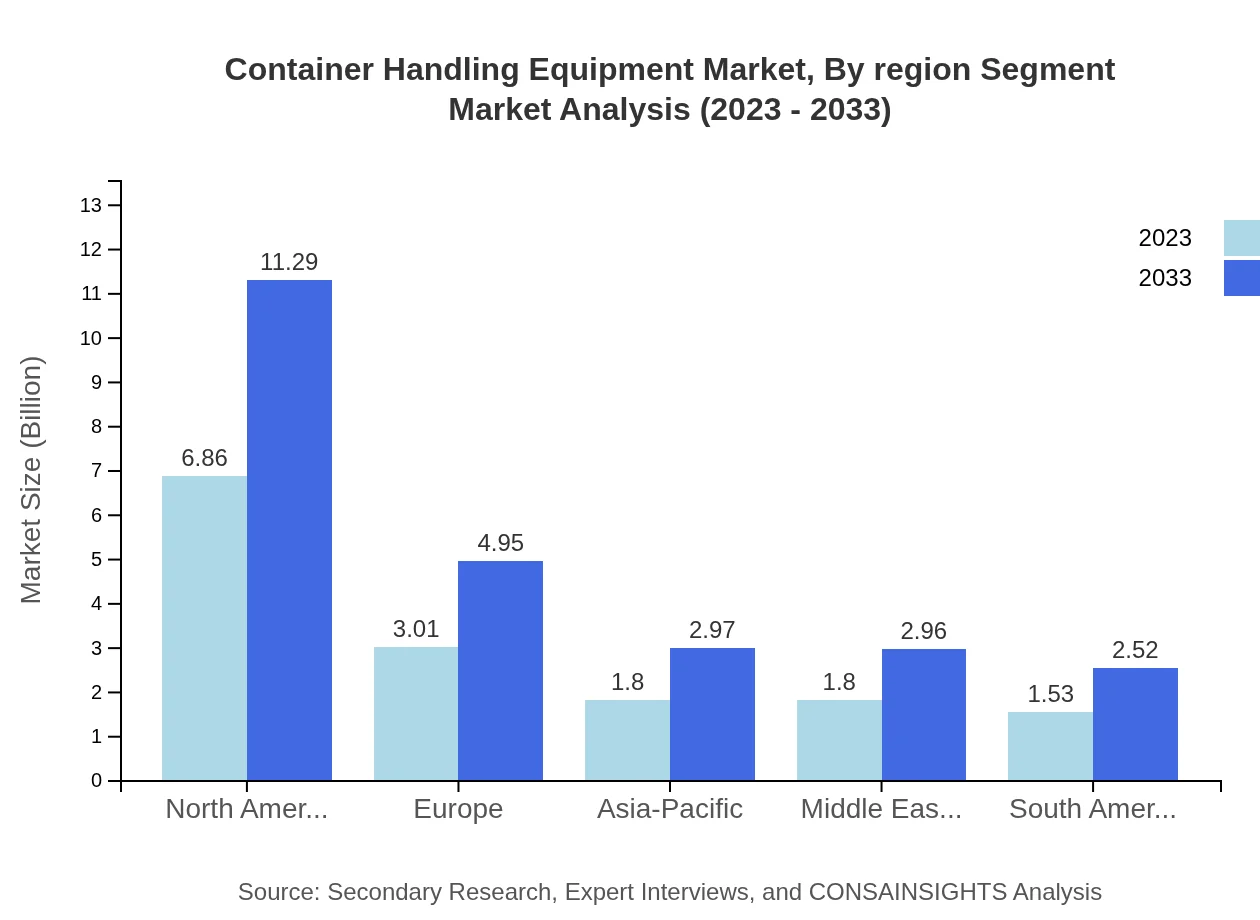

Europe Container Handling Equipment Market Report:

Europe's market, currently at $3.76 billion in 2023, is projected to grow to $6.19 billion by 2033. The region is focusing on sustainability trends, with many companies investing in greener technologies for equipment and seeking to improve operational efficiencies.Asia Pacific Container Handling Equipment Market Report:

The Asia Pacific region, valued at $3.01 billion in 2023 and projected to grow to $4.96 billion by 2033, is experiencing rapid infrastructure development and increased container traffic. Countries like China and India are enhancing port capabilities, fueling demand for advanced container handling solutions.North America Container Handling Equipment Market Report:

North America holds a significant market share with a valuation of $5.70 billion in 2023, forecasted to reach $9.38 billion by 2033. The U.S. and Canada are leading in adopting automated solutions, which enhance efficiency and reduce operational costs in busy ports.South America Container Handling Equipment Market Report:

In South America, the market is expected to expand from $0.63 billion in 2023 to $1.04 billion in 2033. Investments in port modernization and the need for efficient logistics services are driving growth in this region, supported by increasing trade volume.Middle East & Africa Container Handling Equipment Market Report:

With a market size of $1.90 billion in 2023 expected to rise to $3.12 billion by 2033, the Middle East and Africa region is also seeing growth in container handling capabilities, driven by increasing trade and investments in infrastructure development.Tell us your focus area and get a customized research report.

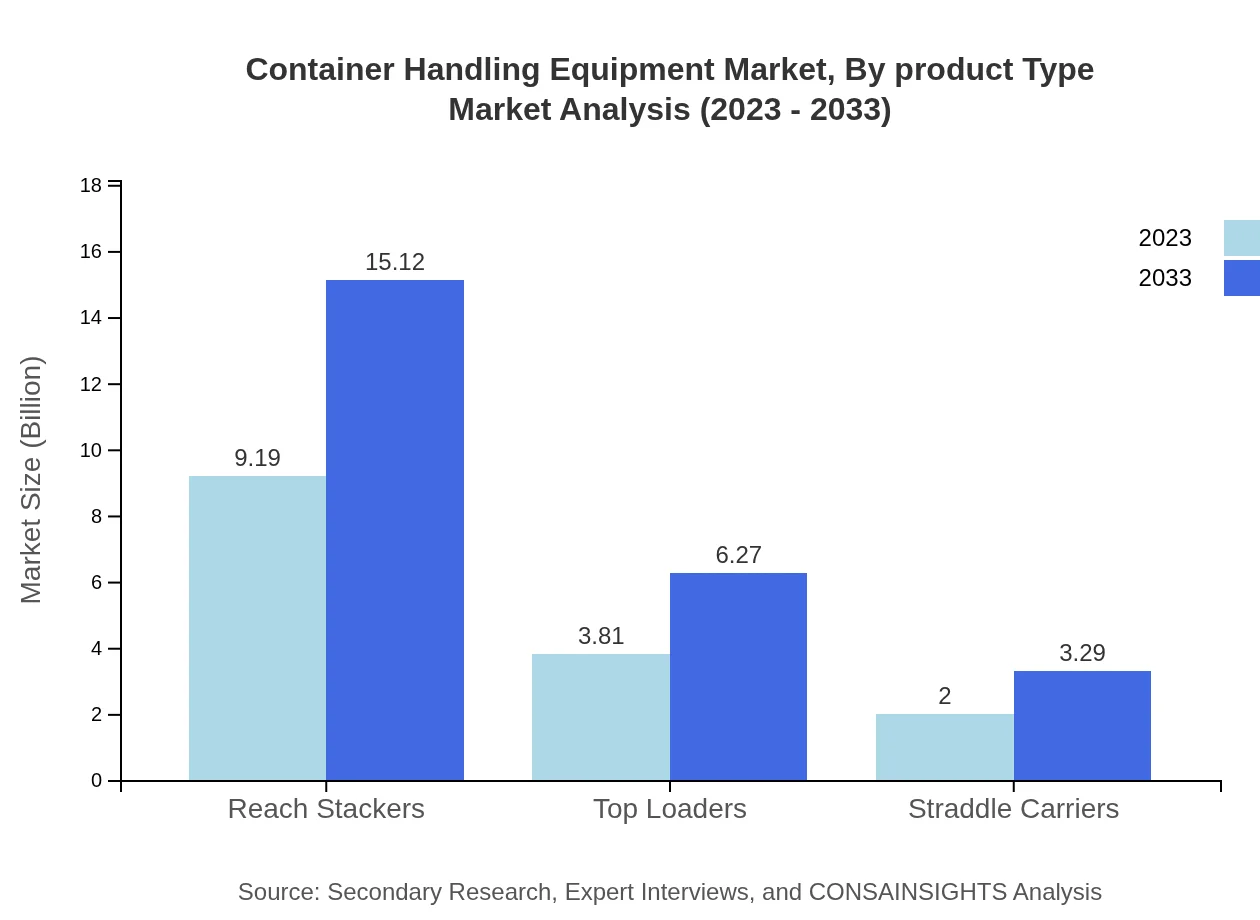

Container Handling Equipment Market Analysis By Product Type

The container handling equipment market shows robust performance across various product types. Key products include reach stackers, manual, semi-automated, and automated handling technologies. For instance, reach stackers dominate the market with a market size of $9.19 billion in 2023 and are expected to reach $15.12 billion by 2033, capturing a market share of 61.26%.

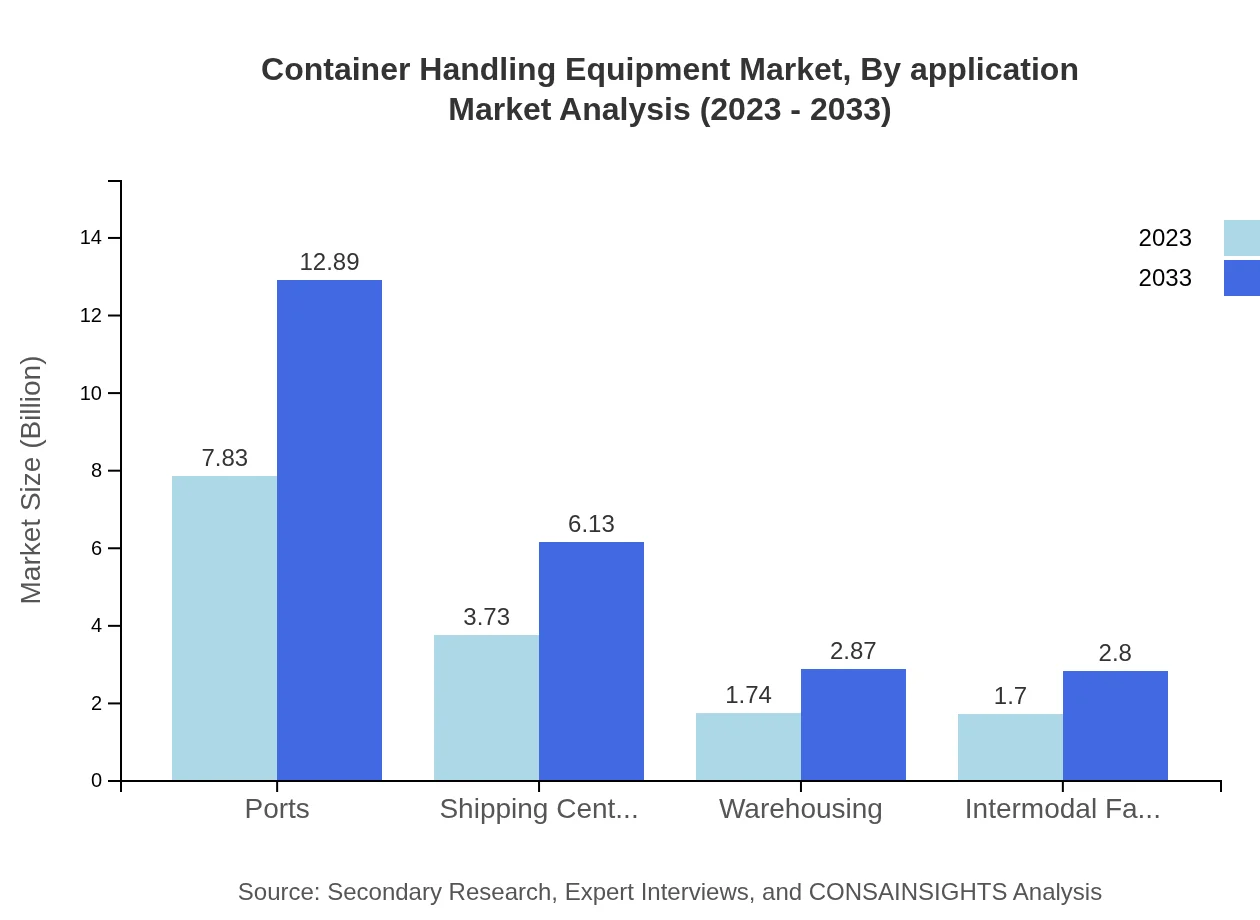

Container Handling Equipment Market Analysis By Application

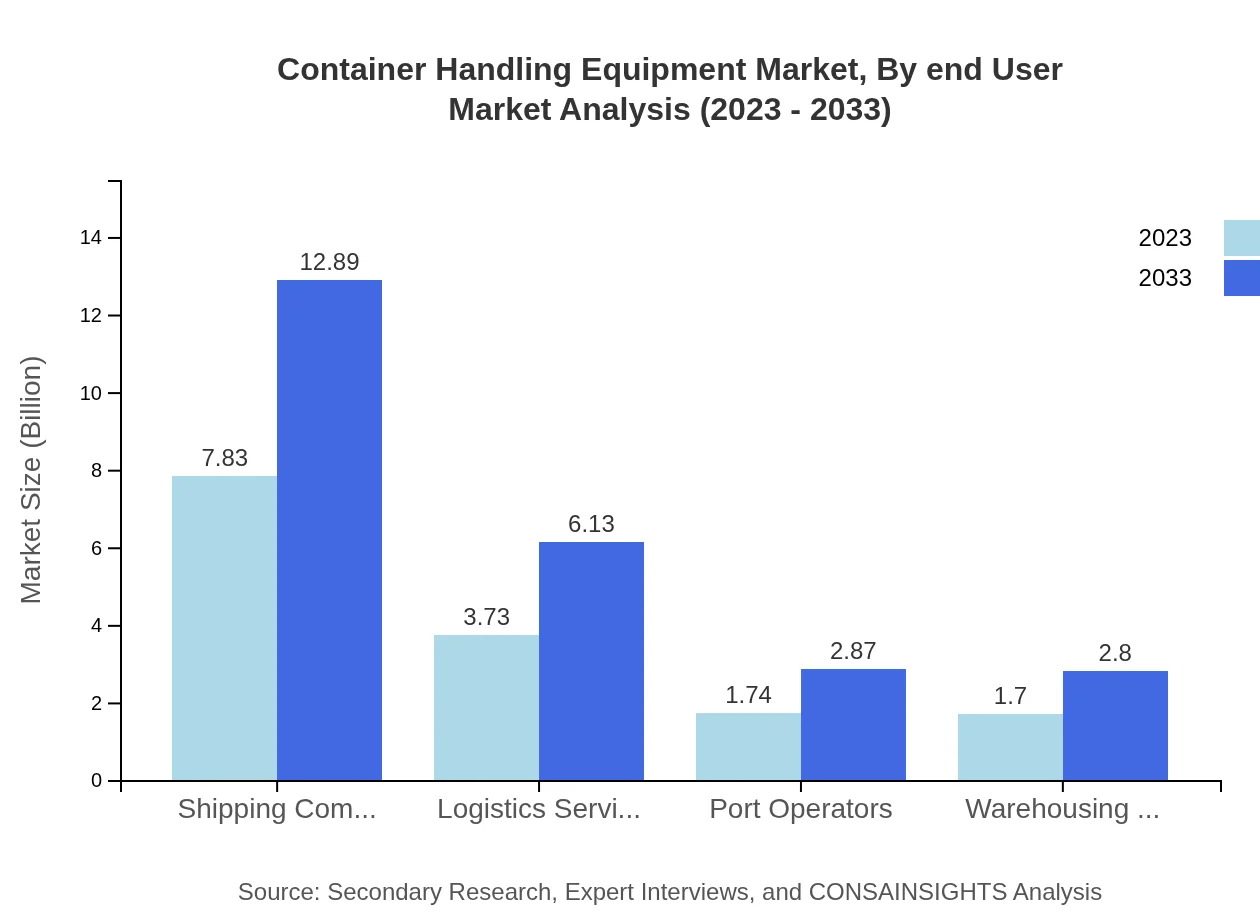

Applications of container handling equipment span shipping, logistics services, and port operations. Shipping companies lead the market, with a size of $7.83 billion in 2023, expanding to $12.89 billion by 2033. In addition, logistics service providers and port operators play pivotal roles, indicating diverse usage and demand across different sectors.

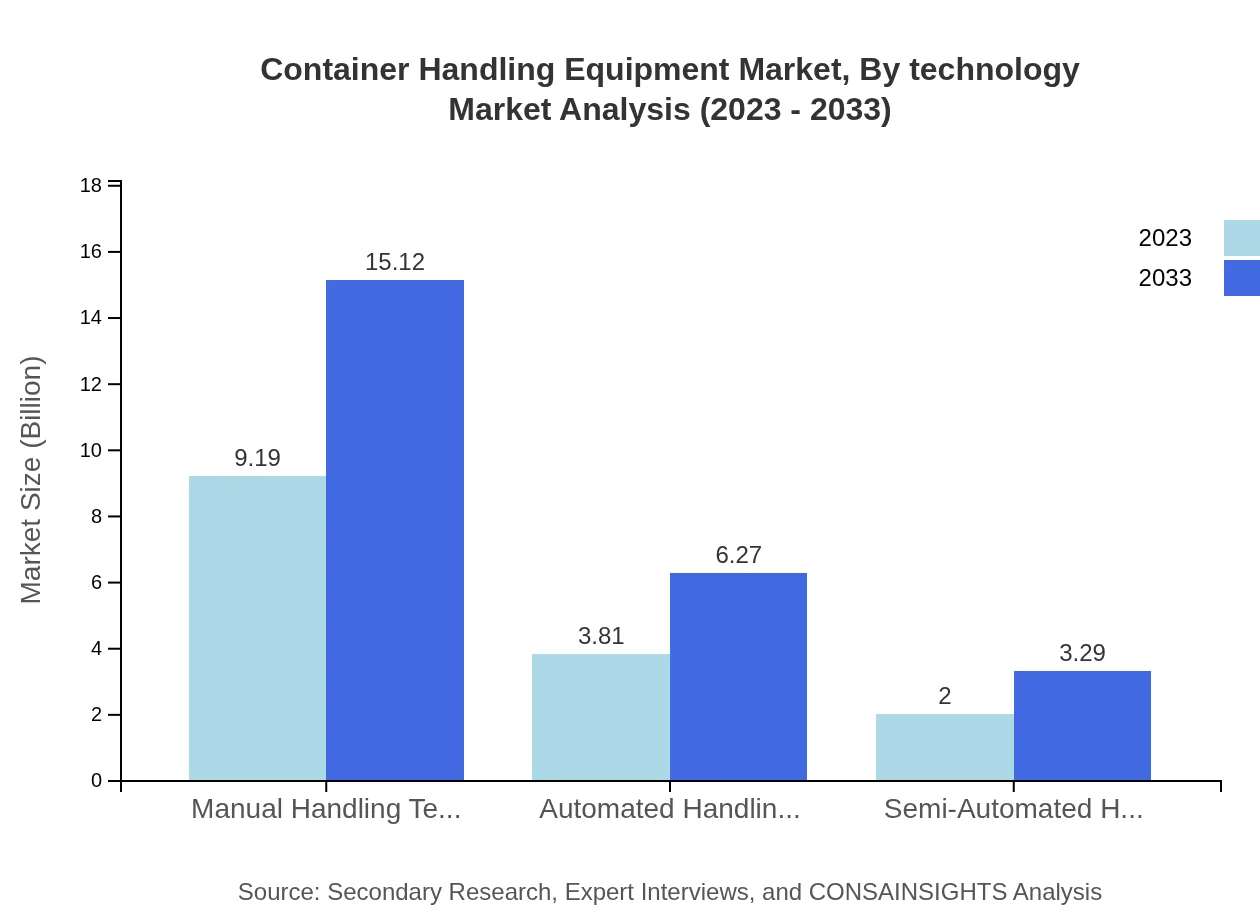

Container Handling Equipment Market Analysis By Technology

The market is evolving with several technological advancements. Manual handling technology holds a significant share of 61.26%, with a market size of $9.19 billion expected to reach $15.12 billion by 2033. Automated handling emerges with a growing market share at 25.41% and is projected to continue capturing more as operational efficiencies become crucial.

Container Handling Equipment Market Analysis By End User

End-users of container handling equipment include shipping companies, logistics providers, and port authorities. Shipping centers have a substantial market size of $3.73 billion in 2023, growing to $6.13 billion by 2033. Port authorities increasingly focus on automated solutions, reflecting the industry's shift towards more efficient operations.

Container Handling Equipment Market Analysis By Region Segment

Geographically, the region analysis underscores North America and Europe as the leading markets, driven by technological adoption and operational efficiency. Noteworthy growth is observed in the Asia Pacific region due to expanding infrastructure projects and trade volumes, suggesting a shift towards a more integrated global supply chain.

Container Handling Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Container Handling Equipment Industry

Konecranes:

A leading global provider of engineered lifting solutions, Konecranes specializes in manufacturing materials handling equipment such as cranes and automated solutions for ports.Cargotec:

Cargotec offers cargo and load handling solutions with innovative technologies, including automated systems and port logistics that enhance efficiency in container handling.Hyster-Yale Materials Handling, Inc.:

Hyster-Yale provides a diverse range of container handling equipment and is known for innovation and technology in material handling solutions.Terex Corporation:

Terex manufactures a wide variety of lifting and material handling equipment, focusing on critical areas like efficiency and sustainability within the container handling industry.We're grateful to work with incredible clients.

FAQs

What is the market size of container Handling Equipment?

The global container-handling equipment market is valued at approximately $15 billion in 2023, with an expected compound annual growth rate (CAGR) of 5%, indicating significant growth potential over the next decade.

What are the key market players or companies in this container Handling Equipment industry?

Key players in the container-handling equipment industry include major manufacturers such as CAT Lift Trucks, Kalmar, Liebherr, and Konecranes, which dominate the market with innovative and efficient handling solutions, ensuring operational effectiveness in logistics.

What are the primary factors driving the growth in the container Handling Equipment industry?

The growth in the container-handling equipment industry is primarily driven by increased global trade, the expansion of ports, and the demand for automation technologies to enhance operational efficiency, ultimately reducing costs associated with labor and manual handling.

Which region is the fastest Growing in the container Handling Equipment market?

The Asia-Pacific region is currently the fastest-growing market for container-handling equipment, projected to increase from $3.01 billion in 2023 to $4.96 billion by 2033, owing to rapid industrialization and increasing trade activities.

Does ConsaInsights provide customized market report data for the container Handling Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the container-handling equipment sector, enabling clients to access detailed insights and analysis pertinent to their operational requirements.

What deliverables can I expect from this container Handling Equipment market research project?

Clients can expect comprehensive deliverables including detailed market analysis reports, forecasts, competitive landscape assessments, and strategic recommendations to enhance decision-making within the container-handling equipment industry.

What are the market trends of container Handling Equipment?

Market trends for container-handling equipment indicate a shift towards automation and smart technologies, with notable growth in demand for automated handling solutions, reflecting the evolution of logistics and supply chain operations.