Container Weighing Systems Market Report

Published Date: 22 January 2026 | Report Code: container-weighing-systems

Container Weighing Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Container Weighing Systems market, covering trends, size, and forecasts from 2023 to 2033. It encompasses industry insights, segmentation, and regional analyses to inform stakeholders and decision-makers.

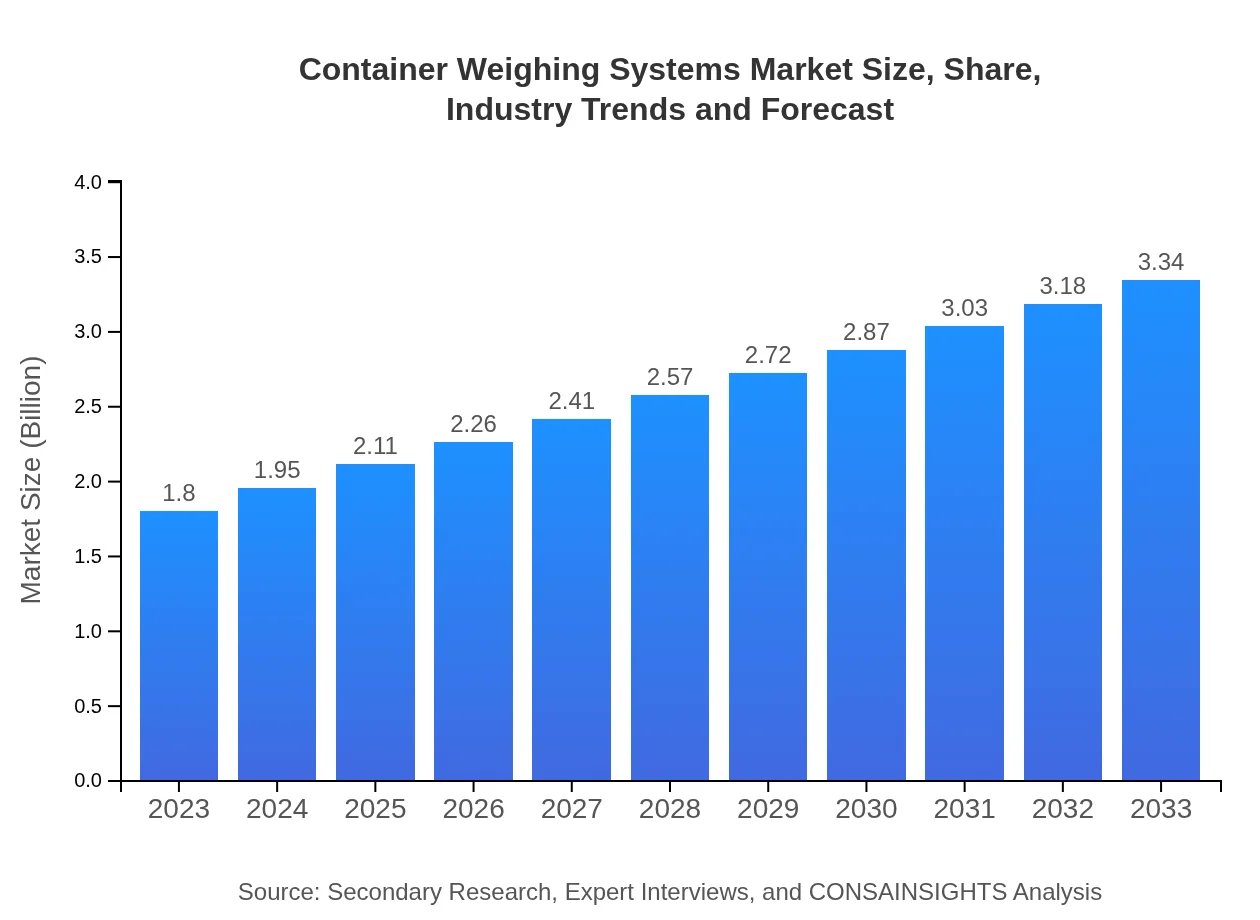

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Vishay Precision Group (VPG), Mettler Toledo, KUKA Robotics, Siemens AG, Palmer Instruments |

| Last Modified Date | 22 January 2026 |

Container Weighing Systems Market Overview

Customize Container Weighing Systems Market Report market research report

- ✔ Get in-depth analysis of Container Weighing Systems market size, growth, and forecasts.

- ✔ Understand Container Weighing Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Container Weighing Systems

What is the Market Size & CAGR of Container Weighing Systems market in 2023?

Container Weighing Systems Industry Analysis

Container Weighing Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

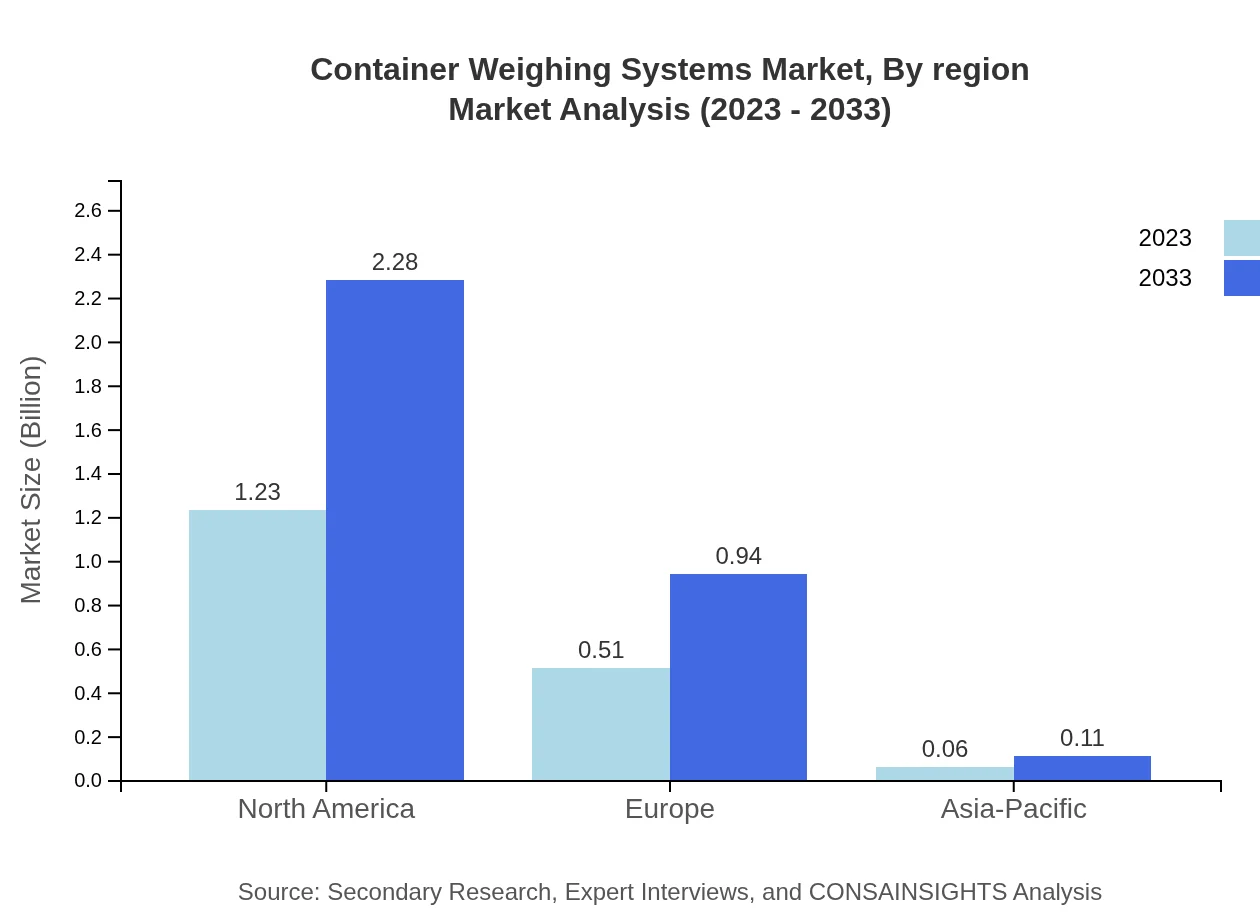

Container Weighing Systems Market Analysis Report by Region

Europe Container Weighing Systems Market Report:

Europe's Container Weighing Systems market is establishing itself with a size of $0.63 billion in 2023, expected to reach $1.16 billion by 2033. Strong regulations regarding cargo weight and the increase in automation within logistics operations are primary growth drivers.Asia Pacific Container Weighing Systems Market Report:

The Asia Pacific region is projected to witness considerable growth due to expanding manufacturing and shipping industries in countries like China and India. In 2023, the market size stands at $0.33 billion, anticipated to rise to $0.61 billion by 2033. The increasing emphasis on compliance with international regulations is driving adoption in this region.North America Container Weighing Systems Market Report:

In North America, the market is robust, valued at $0.59 billion in 2023, likely increasing to $1.10 billion by 2033. The presence of advanced technological solutions and stringent regulatory requirements fuel this growth, making it one of the largest markets globally.South America Container Weighing Systems Market Report:

The South American market for Container Weighing Systems is relatively nascent, starting at $0.00 billion in 2023 and expected to grow to $0.01 billion by 2033. Growth is mainly driven by improvements in infrastructure and logistics capabilities regionally.Middle East & Africa Container Weighing Systems Market Report:

The Middle East and Africa show significant potential, starting with a market size of $0.25 billion in 2023 and projecting growth to $0.46 billion by 2033. Regulatory compliance and expansions in shipping facilities are contributing to this traction.Tell us your focus area and get a customized research report.

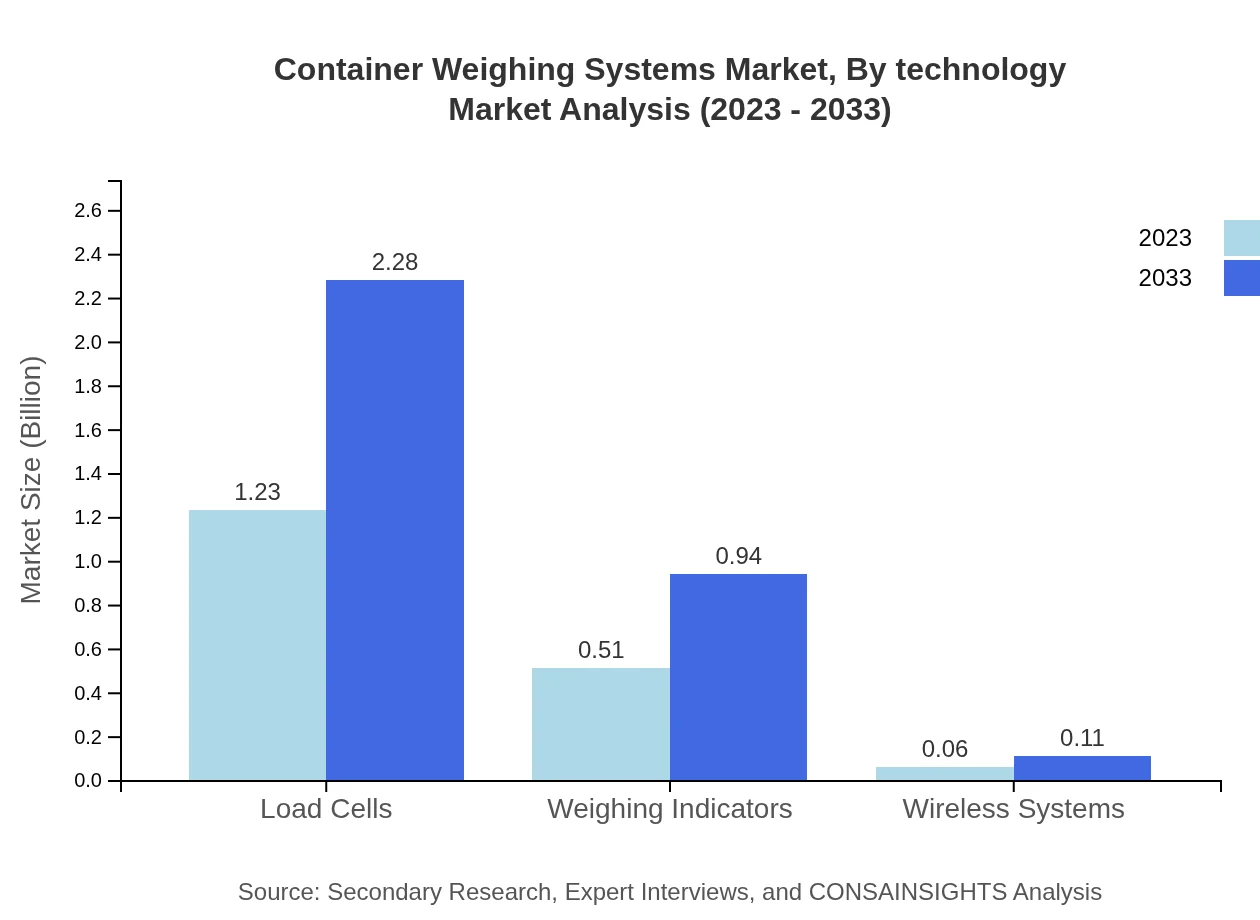

Container Weighing Systems Market Analysis By Technology

The technology segment is classified into load cells, weighing indicators, and wireless systems. Load cells dominate the market due to their precision and reliability, comprising a significant market share of 68.29% in 2023 and projected to remain stable through 2033. Weighing indicators represent 28.28% of the market, while wireless systems are gaining traction, accounting for 3.43%.

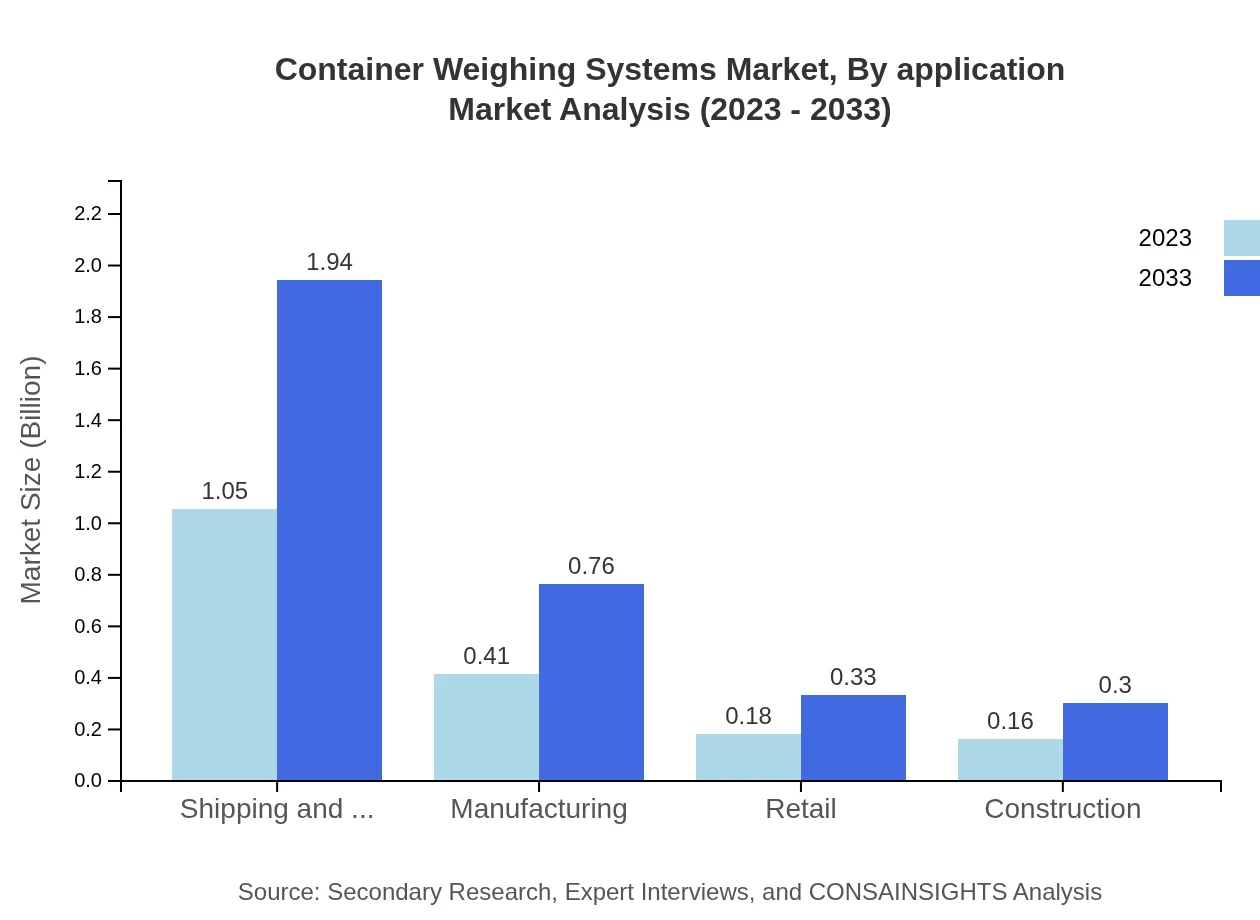

Container Weighing Systems Market Analysis By Application

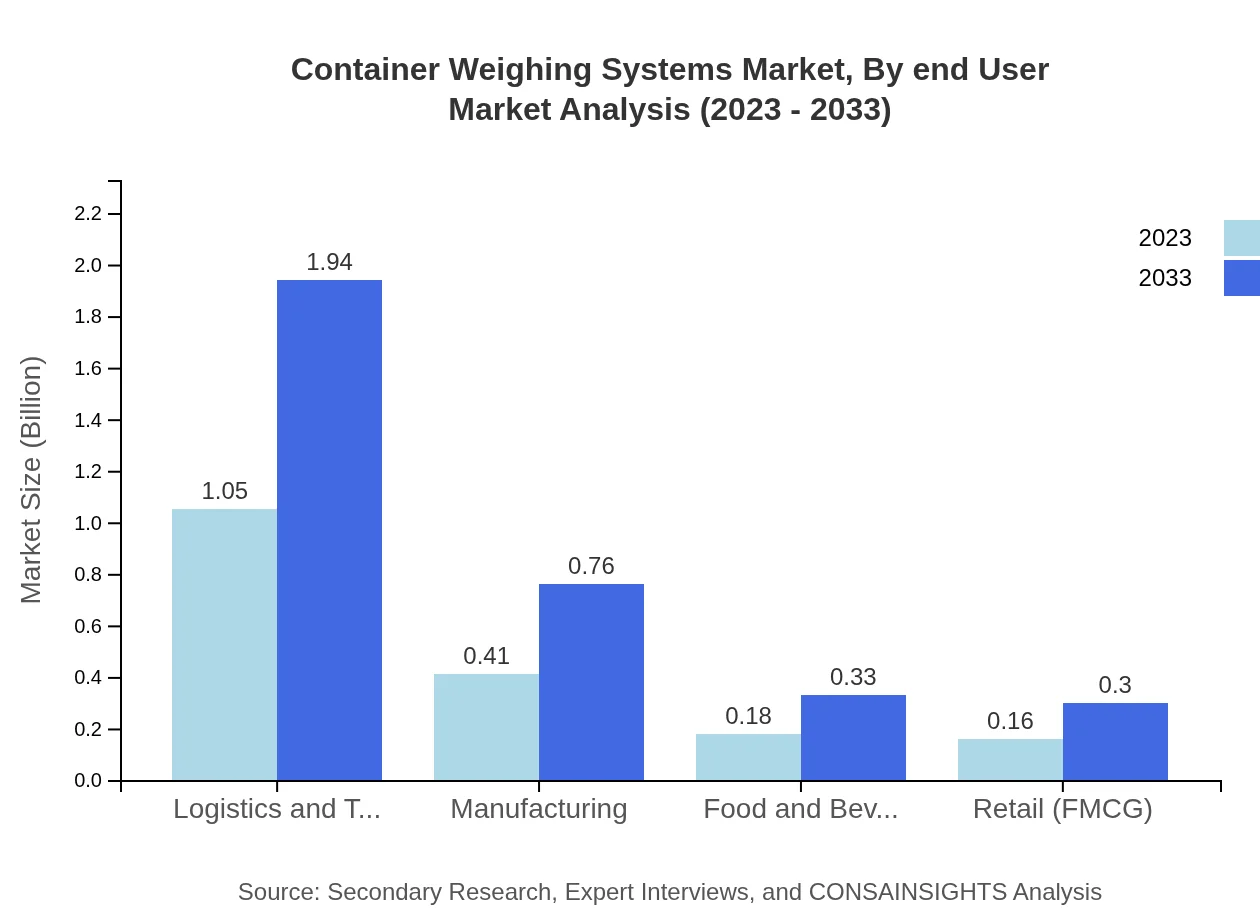

Container weighing systems are applicable in various sectors, with logistics and transportation taking the largest share of 58.16% in 2023 and expected to hold steady until 2033. Manufacturing follows at 22.84%, and food and beverage as well as retail sectors contribute to about 19% collectively.

Container Weighing Systems Market Analysis By End User

End-user industries such as shipping, manufacturing, and retail are the key drivers. Specifically, the shipping and logistics sector accounts for the largest market share of around 58.16%, indicative of the pressing need for accurate container weight assessments in this area.

Container Weighing Systems Market Analysis By Region

Analysis of Container Weighing Systems by region indicates varying levels of adoption and regulatory influences. North America leads with robust compliance and technology investments, while Europe showcases strong market growth fueled by regulations. The Asia Pacific region is rapidly expanding due to industrialization, while Middle East and Africa continue to develop their logistics frameworks.

Container Weighing Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Container Weighing Systems Industry

Vishay Precision Group (VPG):

VPG is renowned for its high-quality load cells and weighing technologies that cater to diverse industries, enhancing measurement accuracy and operational efficiency.Mettler Toledo:

A leading provider of weighing solutions, Mettler Toledo focuses on innovation and precision, serving industries from pharmaceuticals to logistics.KUKA Robotics:

KUKA specializes in automated solutions, integrating container weighing systems with advanced robotics to improve efficiency in logistics operations.Siemens AG:

Siemens offers comprehensive solutions for digitalization in manufacturing and logistics sectors, including container weighing systems that enhance operational performance.Palmer Instruments:

Palmer Instruments focuses on high-end load cell technology, providing advanced solutions for the logistics sector with a strong emphasis on custom applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Container Weighing Systems?

The global Container Weighing Systems market is valued at approximately $1.8 billion in 2023 with an expected compound annual growth rate (CAGR) of 6.2%, indicating strong growth throughout the decade.

What are the key market players or companies in the Container Weighing Systems industry?

Key players in the Container Weighing Systems industry include established firms specializing in logistics and transportation technology, weighing equipment manufacturing, and automation solutions, driving competitive advancements and innovations.

What are the primary factors driving the growth in the Container Weighing Systems industry?

The growth in the Container Weighing Systems industry is driven by increasing demand for accurate weight measurements in shipping and logistics, regulatory compliance, efficiency in operations, and advancements in technology enhancing system functionalities.

Which region is the fastest Growing in the Container Weighing Systems market?

The fastest-growing region for Container Weighing Systems from 2023 to 2033 is anticipated to be Europe, increasing from $0.63 billion to $1.16 billion, reflecting a significant market expansion.

Does Consainsights provide customized market report data for the Container Weighing Systems industry?

Yes, Consainsights offers customized market report data tailored to the specific needs of clients in the Container Weighing Systems industry, providing insights based on unique market conditions and requirements.

What deliverables can I expect from this Container Weighing Systems market research project?

Deliverables from the Container Weighing Systems market research project include comprehensive market reports, segment analysis, forecasts, competitive landscape assessments, and insights on regional performance.

What are the market trends of Container Weighing Systems?

Current market trends in Container Weighing Systems include a focus on automation, integration of advanced technologies like IoT, rising demand for wireless systems, and an emphasis on sustainability and regulatory compliance.