Continuous Delivery Market Report

Published Date: 31 January 2026 | Report Code: continuous-delivery

Continuous Delivery Market Size, Share, Industry Trends and Forecast to 2033

This market report explores the Continuous Delivery industry, providing insights from 2023 to 2033. It covers market size, growth forecasts, industry trends, segmentation, and a regional analysis, equipping stakeholders with necessary data for strategic planning.

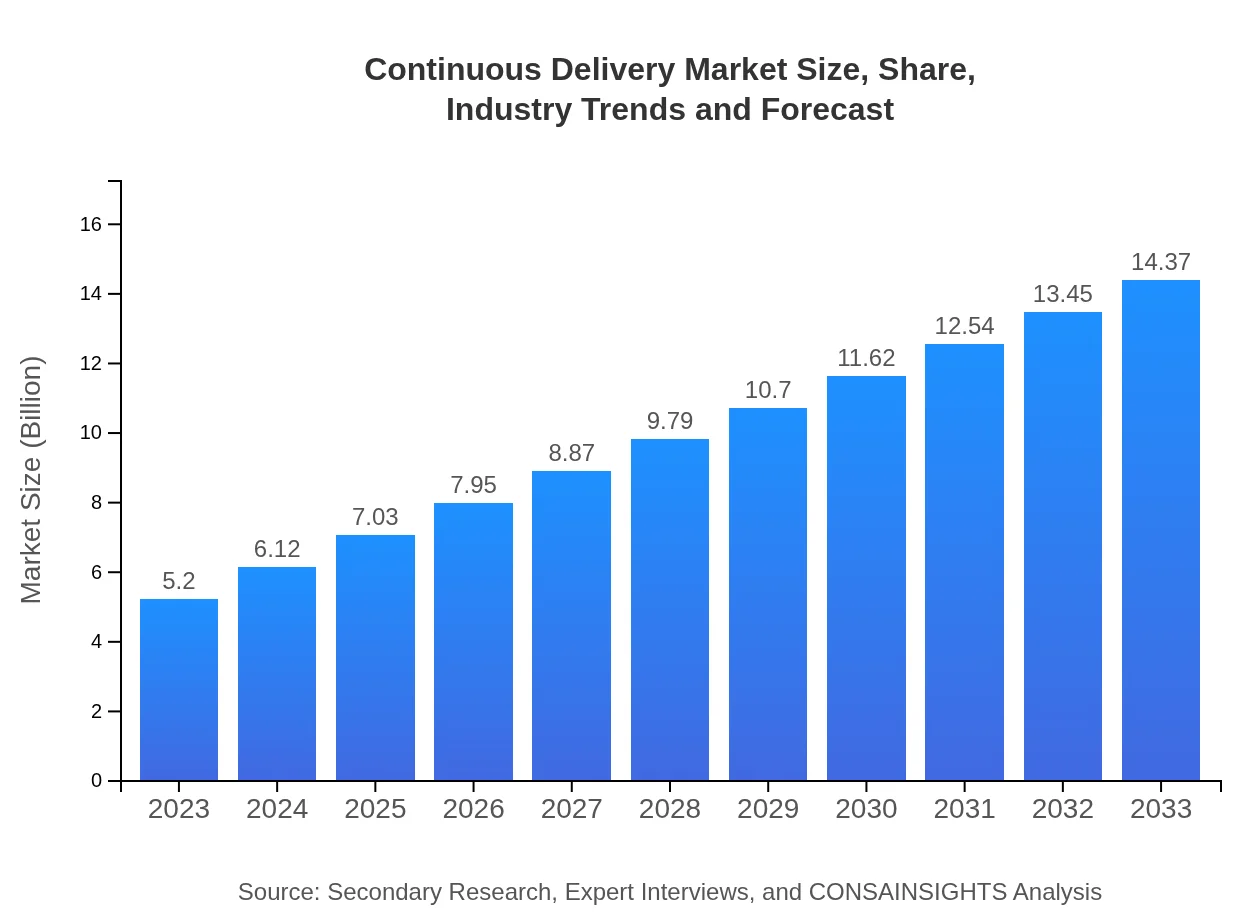

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 10.3% |

| 2033 Market Size | $14.37 Billion |

| Top Companies | GitLab, Jenkins, CircleCI, Travis CI, AWS CodeDeploy |

| Last Modified Date | 31 January 2026 |

Continuous Delivery Market Overview

Customize Continuous Delivery Market Report market research report

- ✔ Get in-depth analysis of Continuous Delivery market size, growth, and forecasts.

- ✔ Understand Continuous Delivery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Continuous Delivery

What is the Market Size & CAGR of Continuous Delivery market in 2023?

Continuous Delivery Industry Analysis

Continuous Delivery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Continuous Delivery Market Analysis Report by Region

Europe Continuous Delivery Market Report:

The European Continuous Delivery market stood at around $1.36 billion in 2023 and is projected to reach $3.77 billion by 2033. Factors such as stringent regulatory requirements and the emphasis on enhancing software quality drive the adoption of Continuous Delivery tools across various industries.Asia Pacific Continuous Delivery Market Report:

In 2023, the market for Continuous Delivery in the Asia Pacific region stands at approximately $1.01 billion and is expected to grow to $2.79 billion by 2033. The growing number of startups and the digital transformation initiatives across countries like China and India heavily contribute to this growth. Additionally, increasing adoption of cloud technologies in enterprises is driving demand.North America Continuous Delivery Market Report:

With a valuation of approximately $1.87 billion in 2023, the North American Continuous Delivery market is expected to surge to $5.16 billion by 2033. The presence of leading technology companies and ongoing investments in cloud infrastructure and DevOps practices fuel strong growth trajectories in this region.South America Continuous Delivery Market Report:

The South American market for Continuous Delivery is valued at around $0.50 billion in 2023, projected to reach $1.37 billion by 2033. With enhancements in IT infrastructure and a focus on improving business processes, the demand for automation and Continuous Delivery practices is rising across Brazil, Argentina, and other key markets.Middle East & Africa Continuous Delivery Market Report:

In 2023, the Continuous Delivery market in the Middle East and Africa is estimated at $0.46 billion, with projections of reaching $1.28 billion by 2033. Companies are increasingly prioritizing digital transformation initiatives and the adoption of cloud services to enhance operational efficiencies, driving the market's growth.Tell us your focus area and get a customized research report.

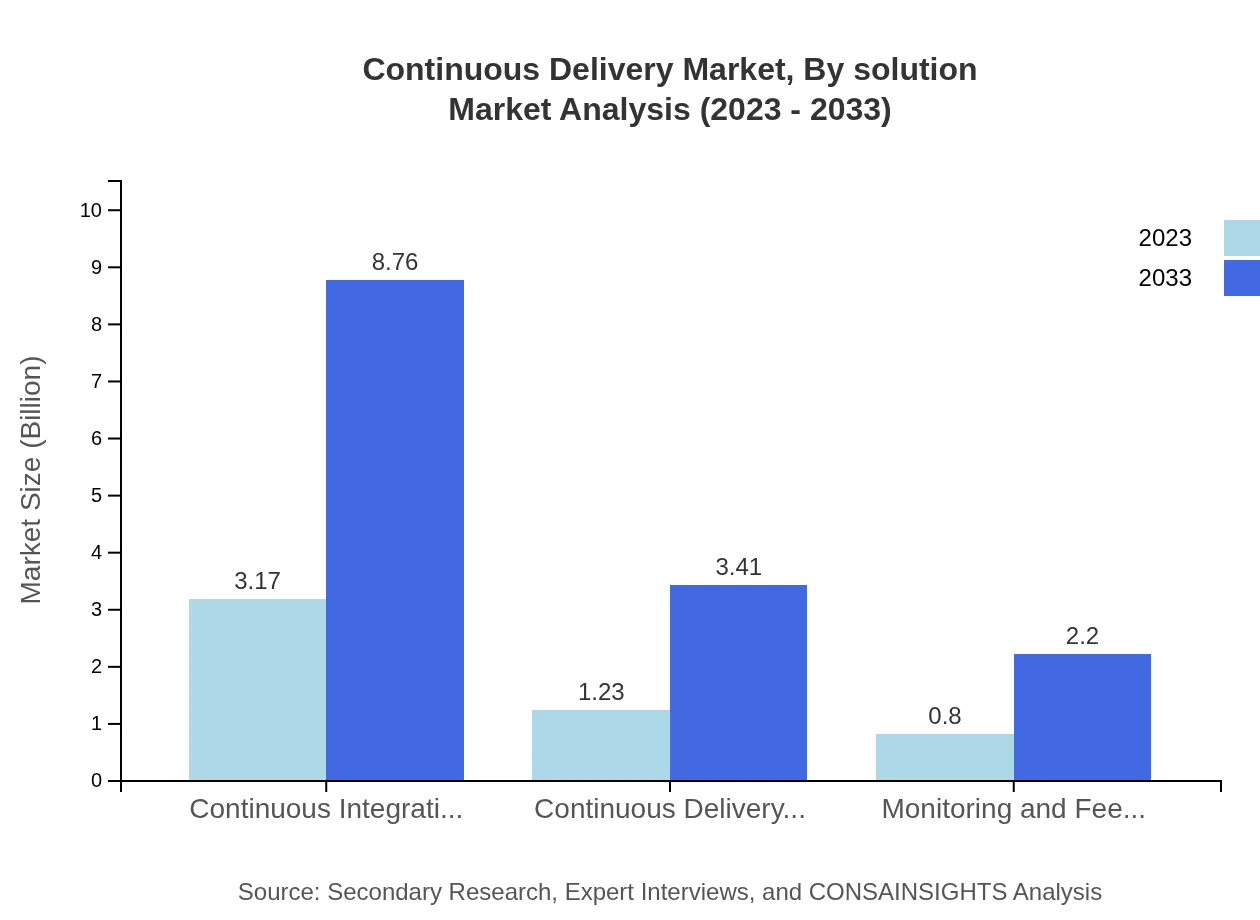

Continuous Delivery Market Analysis By Solution

The Continuous Delivery market is primarily divided into various solution segments, including Continuous Delivery Tools, Continuous Integration Tools, and Monitoring and Feedback Tools. Continuous Integration tools dominate the market, valued at $3.17 billion in 2023 and expected to increase to $8.76 billion by 2033 due to their critical role in streamlining software development processes. Continuous Delivery Tools hold a market size of $1.23 billion in 2023, anticipated to reach $3.41 billion by 2033, while Monitoring and Feedback Tools are projected to grow from $0.80 billion to $2.20 billion during the same period.

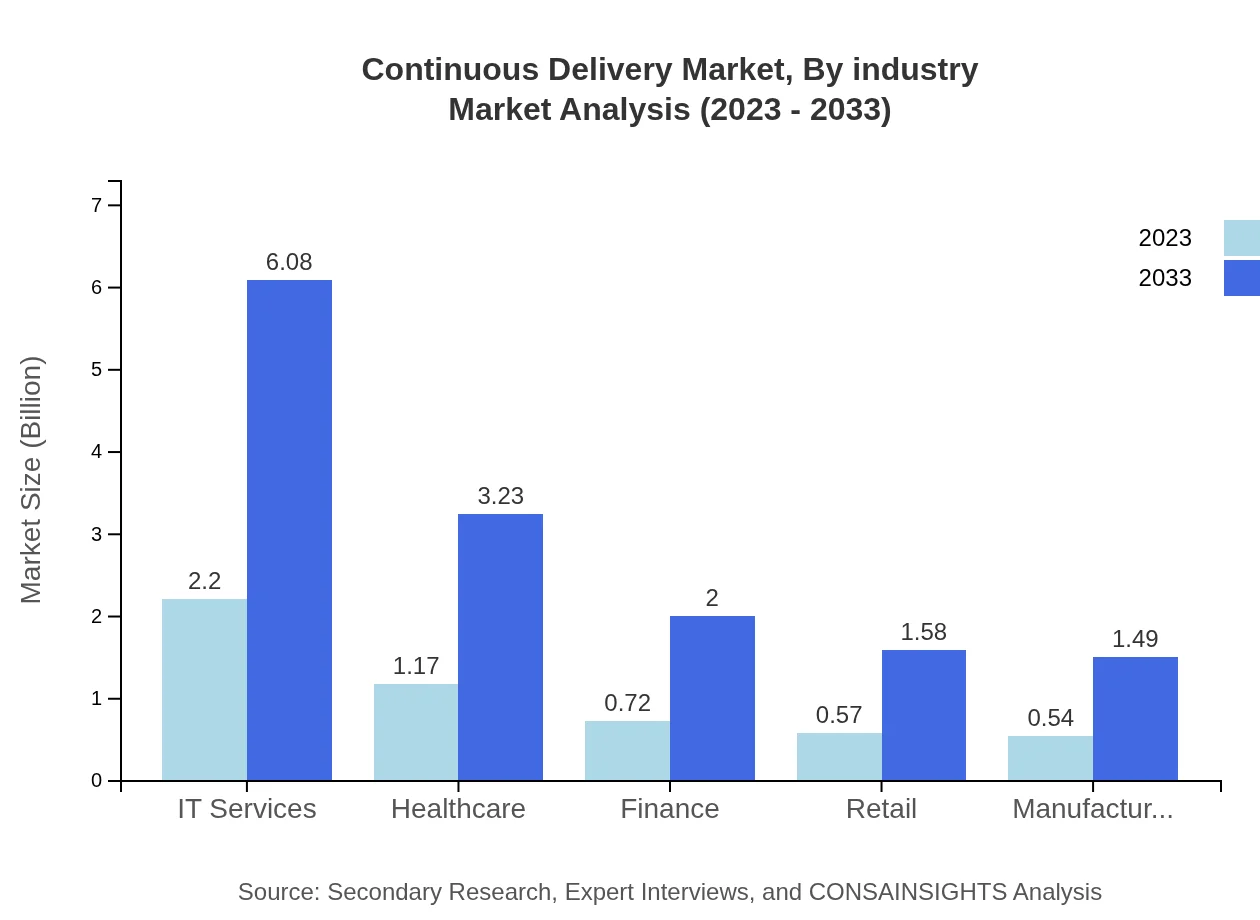

Continuous Delivery Market Analysis By Industry

The market segmentation by industry reveals the significance of Continuous Delivery in varied sectors, including IT Services, Healthcare, Finance, Retail, and Manufacturing. The IT services segment is the largest, estimated at $2.20 billion in 2023 and expected to reach $6.08 billion by 2033. Healthcare follows with a market size of $1.17 billion in 2023, set to grow to $3.23 billion. The finance and retail sectors also display considerable growth potential due to their increasing reliance on software solutions, with estimated values of $0.72 billion and $0.57 billion in 2023, respectively.

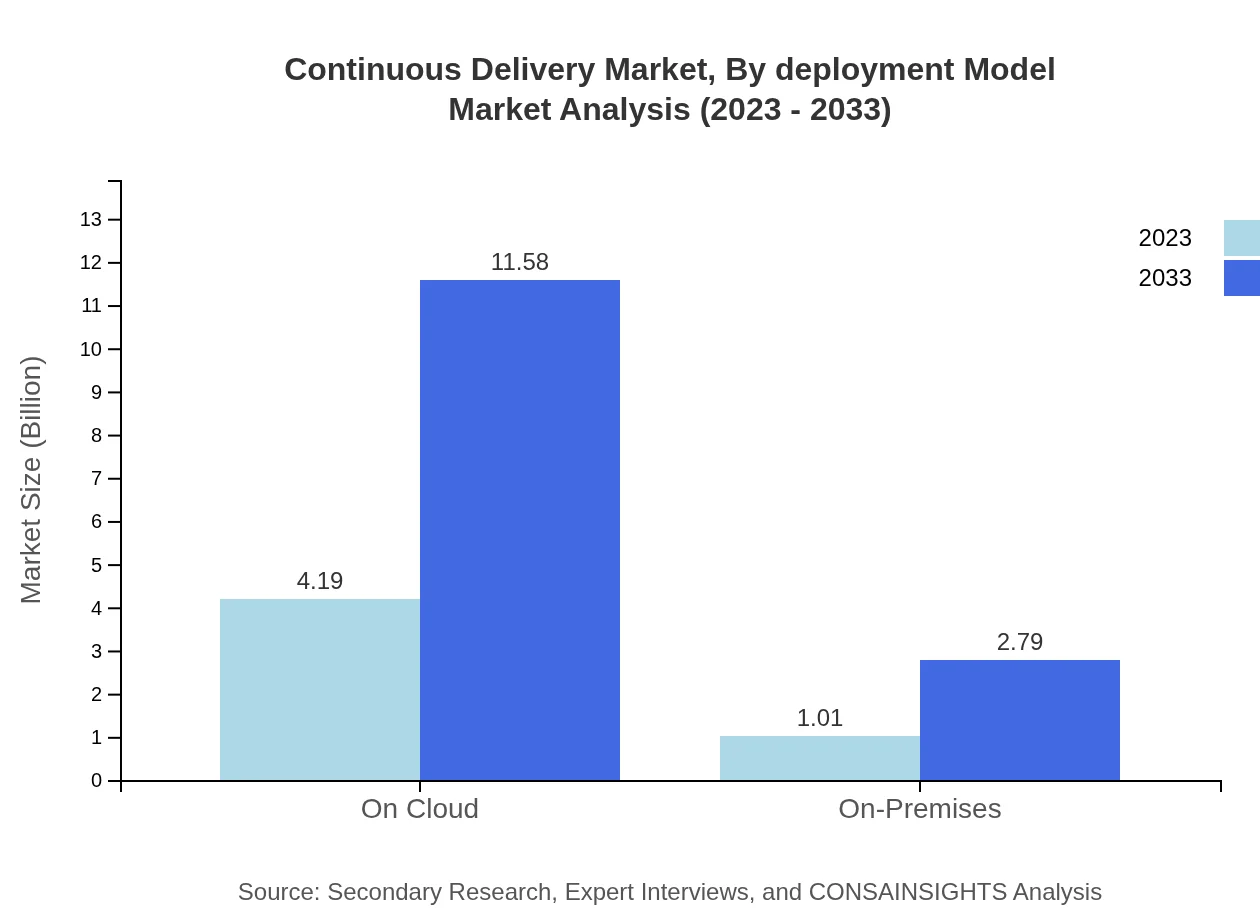

Continuous Delivery Market Analysis By Deployment Model

Continuous Delivery is deployed using Cloud and On-Premises models, with the Cloud-based solutions commanding s significant share of the market. The Cloud solutions segment is valued at $4.19 billion in 2023, expected to grow to $11.58 billion by 2033, driven by the ongoing shift to cloud technology. Conversely, the On-Premises deployment is projected to expand from $1.01 billion to $2.79 billion during the same period as organizations invest in maintaining data security and regulatory compliance.

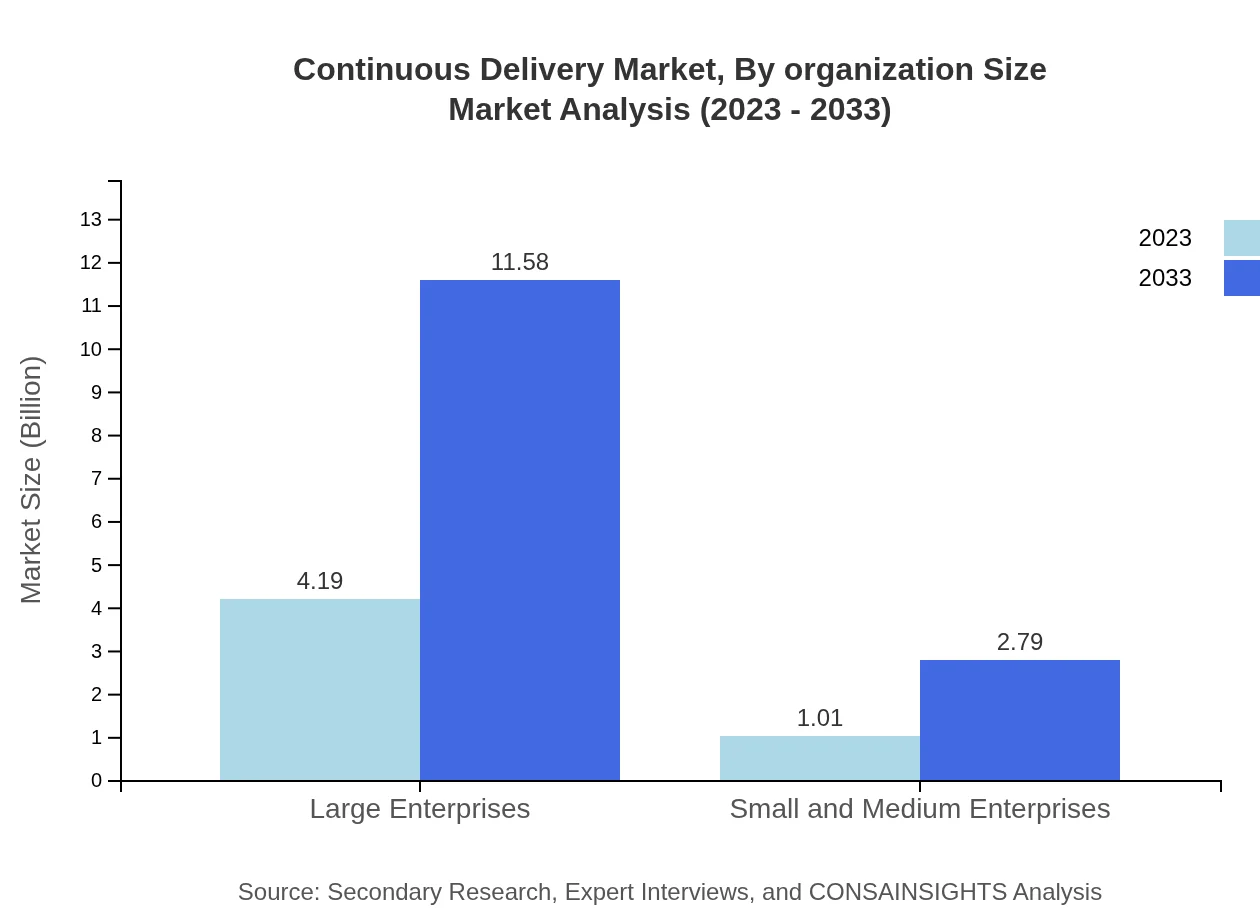

Continuous Delivery Market Analysis By Organization Size

Market segmentation by organization size shows that Large Enterprises dominate the Continuous Delivery market, valued at $4.19 billion in 2023 and projected to reach $11.58 billion by 2033. Small and Medium Enterprises, with a market size of $1.01 billion in 2023, are set to grow to $2.79 billion by 2033, reflecting the increasing adoption of Continuous Delivery practices in smaller organizations seeking to enhance operational efficiency.

Continuous Delivery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Continuous Delivery Industry

GitLab:

GitLab is a leading DevOps platform that provides integrated solutions for Continuous Integration, Continuous Deployment, and other essential software development processes. Their products empower teams to enhance collaboration and improve deployment efficiency.Jenkins:

Jenkins is one of the most widely used open-source automation servers. It enables Continuous Integration and Continuous Delivery, facilitating software development and deployment through automation, thus enhancing project deliverability and efficiency.CircleCI:

CircleCI provides a cloud-based Continuous Integration and Continuous Delivery platform, enabling developers to automate the software development process. CircleCI focuses on optimizing build performance and enhancing user experience, making it a favorite among development teams.Travis CI:

Travis CI is a Continuous Integration service used to build and test software projects hosted on GitHub. Its ease of integration and support for multiple programming languages has made it a popular choice for many developers.AWS CodeDeploy:

AWS CodeDeploy automates software deployments to various compute services. Being a part of the Amazon Web Services (AWS) ecosystem, it significantly simplifies deployment processes within cloud environments and supports scalable applications.We're grateful to work with incredible clients.

FAQs

What is the market size of continuous Delivery?

The global Continuous Delivery market is valued at $5.2 billion in 2023, with a projected compound annual growth rate (CAGR) of 10.3% from 2023 to 2033, indicating robust growth opportunities and rising adoption across industries.

What are the key market players or companies in this continuous Delivery industry?

Key players in the Continuous Delivery industry include major technology firms and software providers who specialize in automation, integration, and delivery tools, significantly influencing the market with their innovative solutions and services.

What are the primary factors driving the growth in the continuous delivery industry?

The growth in the Continuous Delivery industry is primarily driven by the increasing demand for faster software delivery, the adoption of DevOps practices, and the need for enhanced operational efficiency among enterprises globally.

Which region is the fastest Growing in the continuous delivery?

North America is expected to be the fastest-growing region in the Continuous Delivery market, projected to grow from $1.87 billion in 2023 to $5.16 billion in 2033, stimulated by technological advancements and enterprise innovation.

Does ConsaInsights provide customized market report data for the continuous delivery industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Continuous Delivery industry, allowing clients to gain insights that align with their strategic objectives and market focus.

What deliverables can I expect from this continuous delivery market research project?

Expect a comprehensive report including market analysis, growth forecasts, competitive landscape details, regional insights, and segment-wise breakdowns, ensuring thorough understanding of the Continuous Delivery landscape.

What are the market trends of continuous delivery?

Market trends in Continuous Delivery include increased adoption of cloud-based solutions, a shift towards containerization, enhanced automation tools, and the growing importance of feedback mechanisms in software development processes.