Continuous Glucose Monitoring Market Report

Published Date: 31 January 2026 | Report Code: continuous-glucose-monitoring

Continuous Glucose Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Continuous Glucose Monitoring market, presenting insights into market size, segmentation, and trends. It forecasts market developments from 2023 to 2033, covering key players, technological advancements, and regional dynamics critical for stakeholders in the health technology landscape.

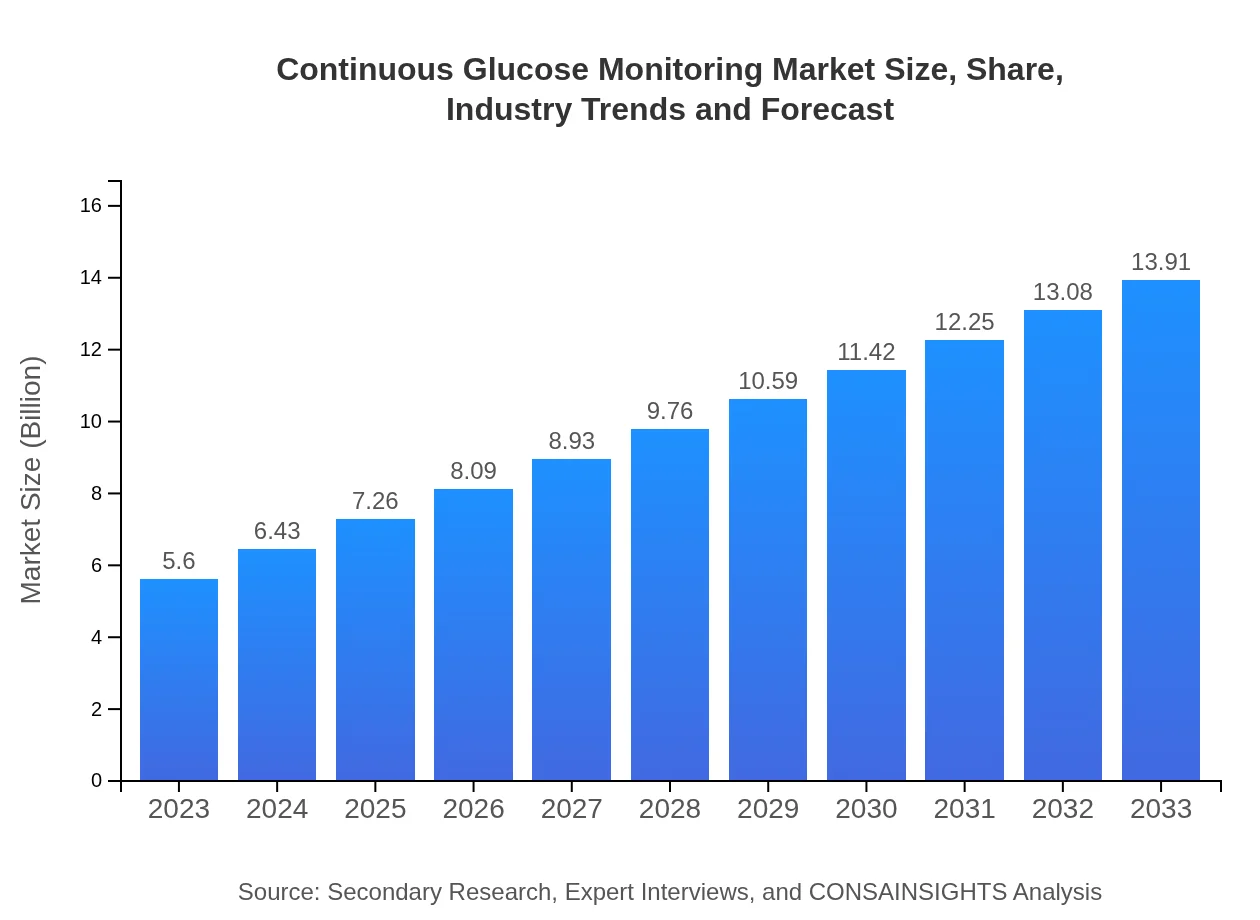

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Dexcom, Inc., Abbott Laboratories, Medtronic plc, Senseonics Holdings, Inc. |

| Last Modified Date | 31 January 2026 |

Continuous Glucose Monitoring Market Overview

Customize Continuous Glucose Monitoring Market Report market research report

- ✔ Get in-depth analysis of Continuous Glucose Monitoring market size, growth, and forecasts.

- ✔ Understand Continuous Glucose Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Continuous Glucose Monitoring

What is the Market Size & CAGR of Continuous Glucose Monitoring market in 2023?

Continuous Glucose Monitoring Industry Analysis

Continuous Glucose Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Continuous Glucose Monitoring Market Analysis Report by Region

Europe Continuous Glucose Monitoring Market Report:

The European CGM market is projected to increase significantly from USD 1.90 billion in 2023 to USD 4.72 billion by 2033. Favorable regulatory frameworks and increasing diabetes awareness among the population are pivotal in driving this growth.Asia Pacific Continuous Glucose Monitoring Market Report:

In the Asia Pacific region, the Continuous Glucose Monitoring market is expected to grow from USD 1.06 billion in 2023 to USD 2.62 billion by 2033. This growth is attributed to increasing healthcare awareness, rise in disposable income, and greater access to advanced healthcare technologies in emerging economies like India and China.North America Continuous Glucose Monitoring Market Report:

North America is poised to maintain its lead in the CGM market, growing from USD 1.84 billion in 2023 to USD 4.58 billion by 2033. This market expansion is bolstered by high healthcare expenditure, increasing adoption of advanced diabetes management technologies, and strong presence of key players.South America Continuous Glucose Monitoring Market Report:

The South American CGM market, albeit smaller, is anticipated to increase from USD 0.02 billion in 2023 to USD 0.05 billion by 2033. Factors driving growth include rising diabetes prevalence and enhancements in healthcare infrastructure, although challenges remain in terms of affordability and access.Middle East & Africa Continuous Glucose Monitoring Market Report:

The Middle East and Africa CGM market is forecasted to grow from USD 0.78 billion in 2023 to USD 1.95 billion by 2033. Stagnant healthcare systems in certain areas may hinder growth, but increasing investments in health infrastructure and the rising burden of diabetes are expected to drive demand.Tell us your focus area and get a customized research report.

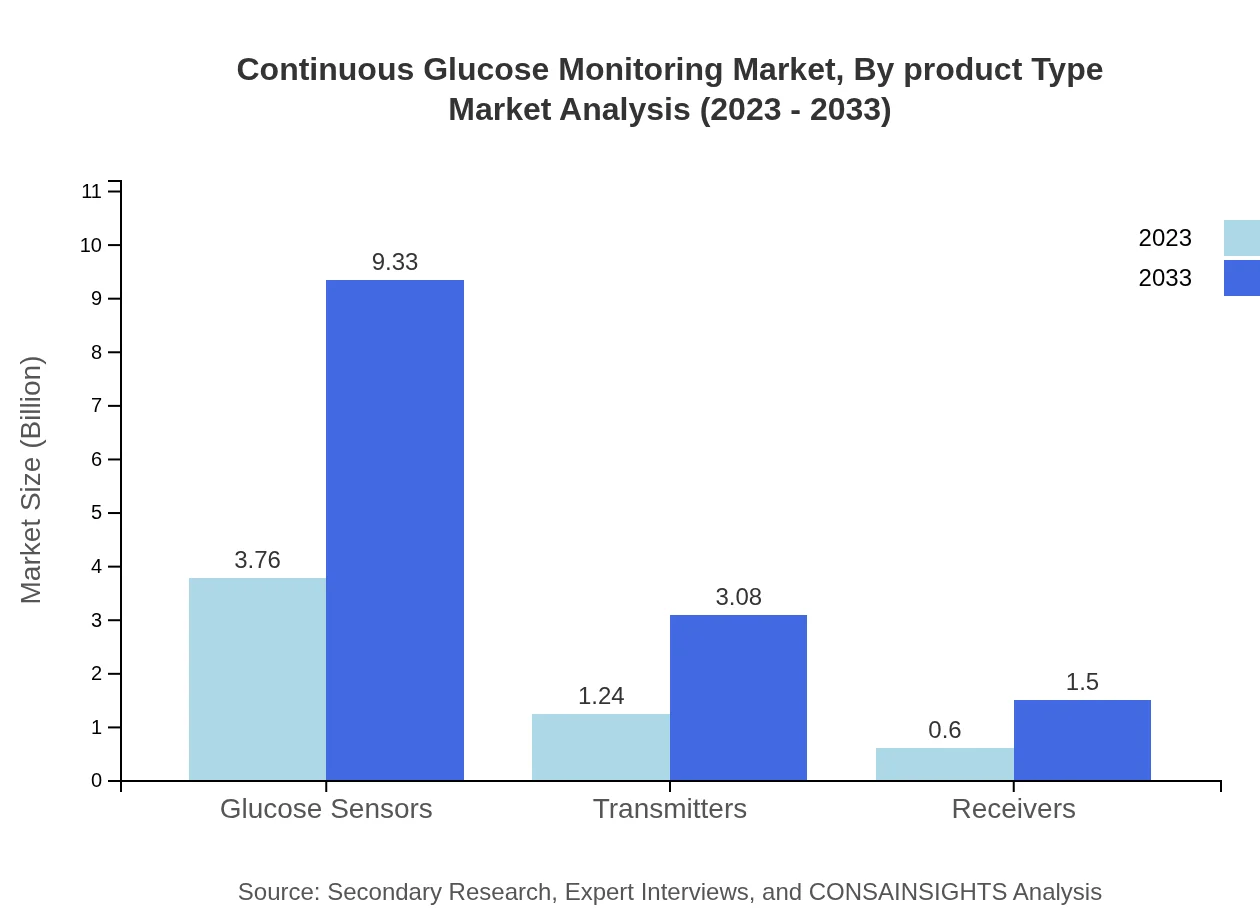

Continuous Glucose Monitoring Market Analysis By Product Type

The product type segment includes key components such as glucose sensors (market value growing from USD 3.76 billion to USD 9.33 billion by 2033), transmitters (increasing from USD 1.24 billion to USD 3.08 billion), and receivers (rising from USD 0.60 billion to USD 1.50 billion). The dominance of glucose sensors highlights their vital role in accurate glucose monitoring, while transmitters and receivers facilitate essential data communication.

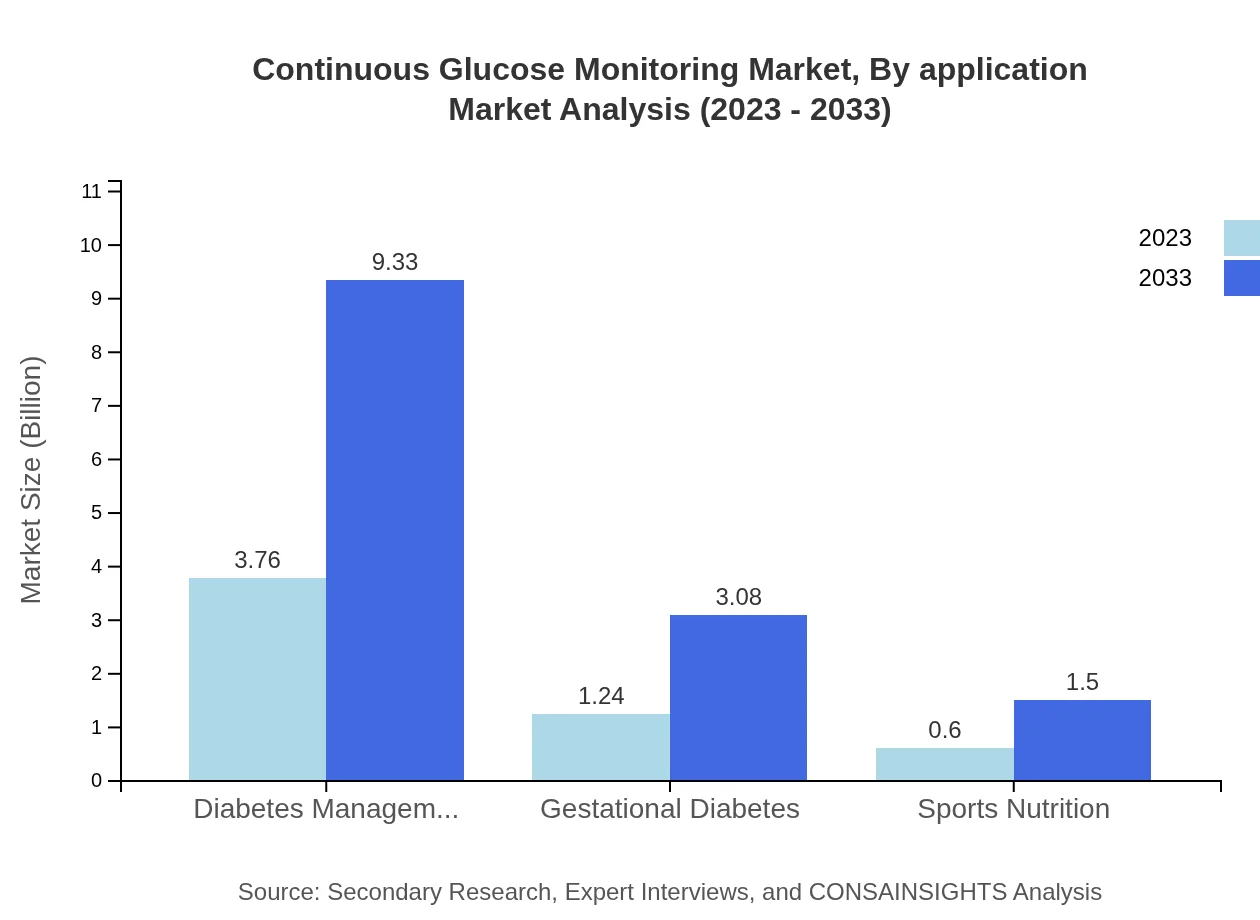

Continuous Glucose Monitoring Market Analysis By Application

The application segment encompasses diabetes management, gestational diabetes, and sports nutrition, with diabetes management expected to grow from USD 3.76 billion in 2023 to USD 9.33 billion by 2033, capturing around 67.08% market share. This segment will continue to drive innovation and demand for CGMs as healthcare focuses on chronic disease management.

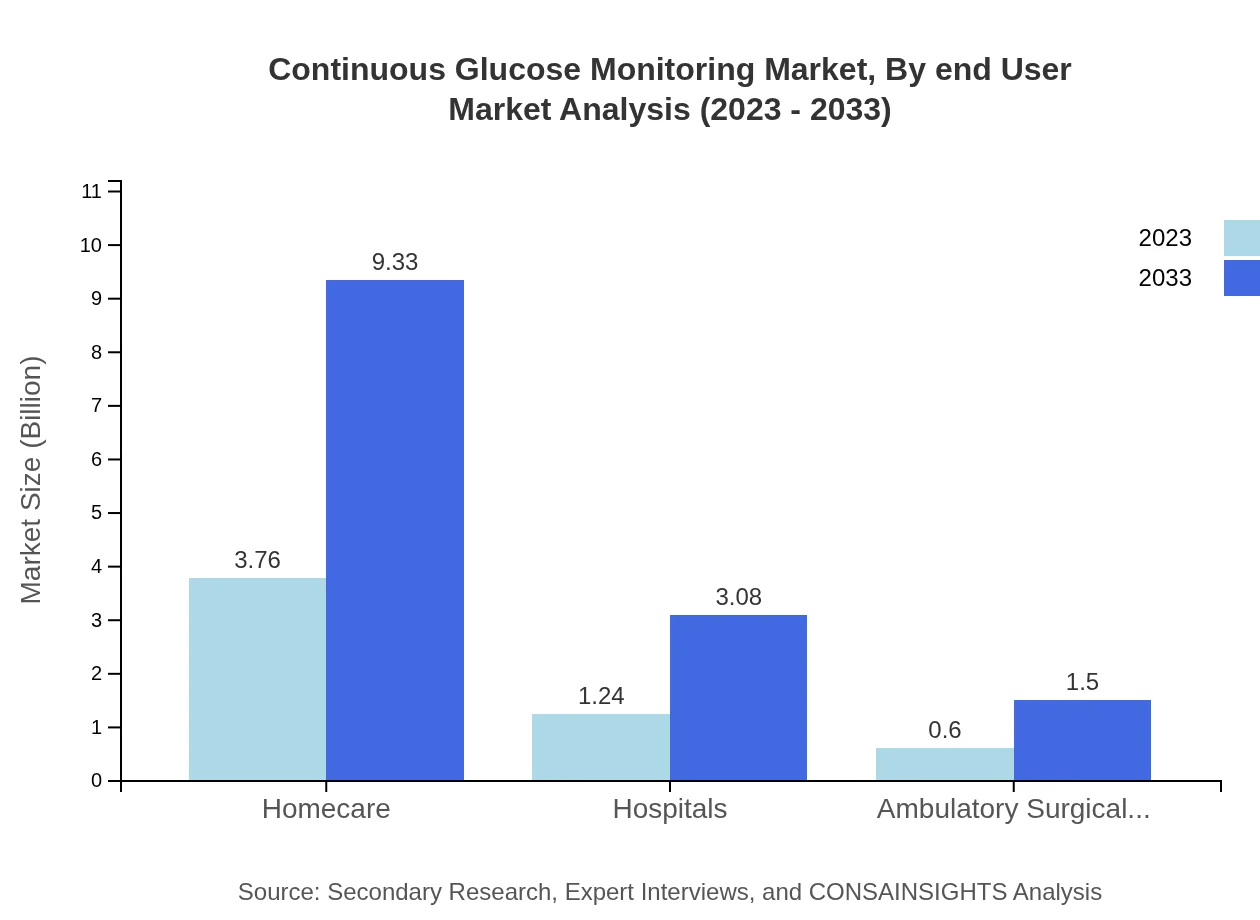

Continuous Glucose Monitoring Market Analysis By End User

Homecare settings are projected to maintain their significant lead, with market values moving from USD 3.76 billion in 2023 to USD 9.33 billion by 2033. Hospitals are also notable, growing from USD 1.24 billion to USD 3.08 billion. Growth in hospitals often reflects advancements in acute care facilities and emergency response capabilities.

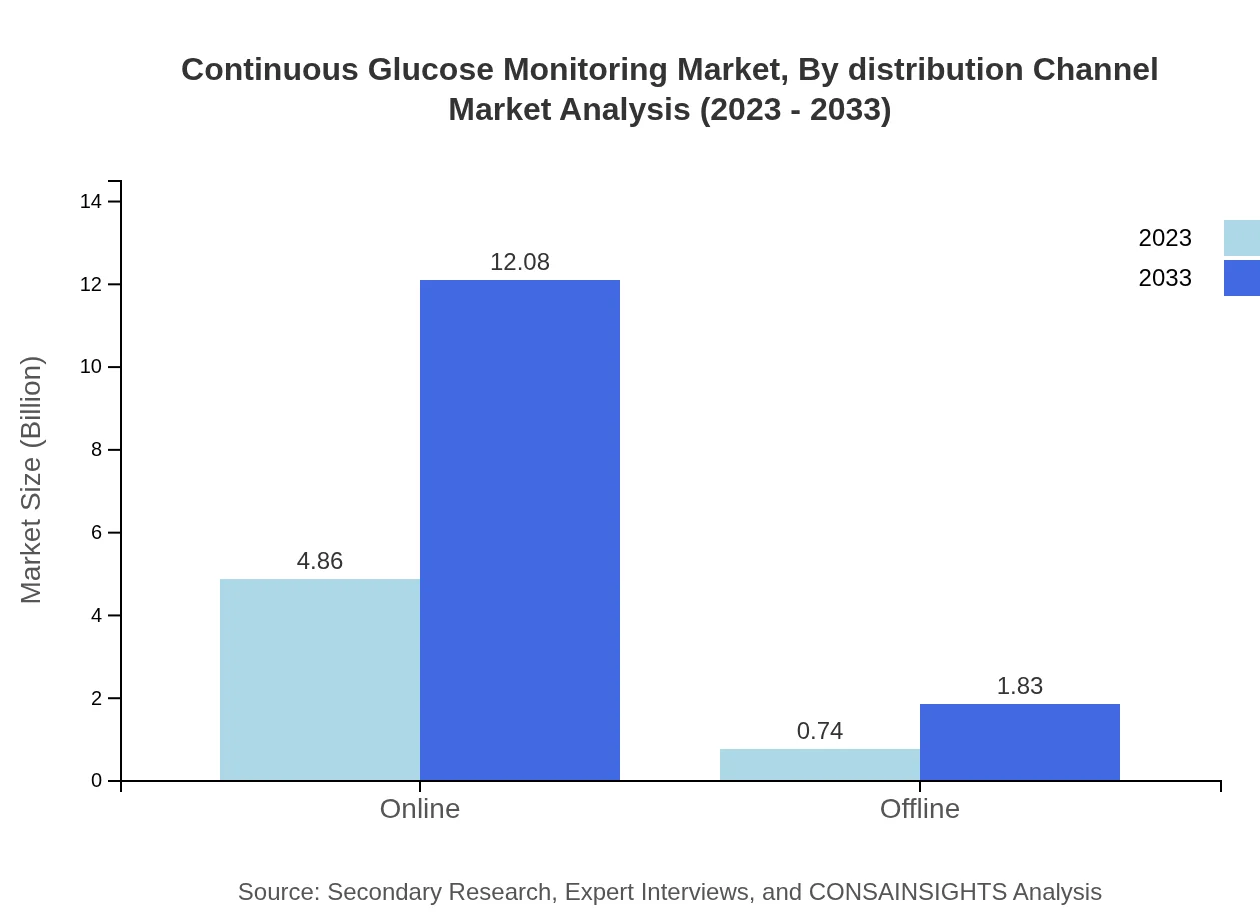

Continuous Glucose Monitoring Market Analysis By Distribution Channel

The distribution channels for CGMs include online and offline sales. Online sales are anticipated to grow significantly, increasing from USD 4.86 billion to USD 12.08 billion, indicating a shift toward consumer-direct purchasing models. Offline channels remain relevant, particularly for immediate product need and consultation.

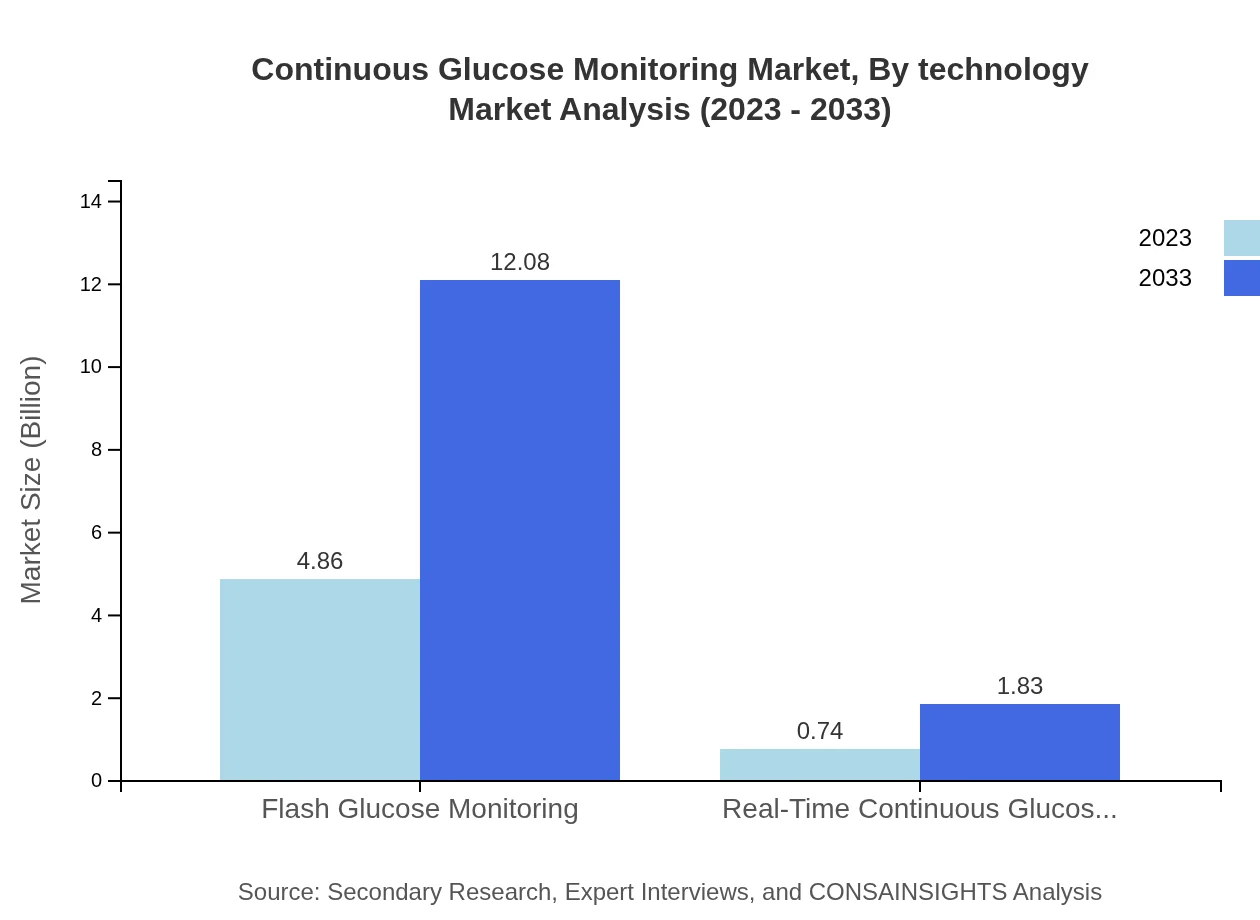

Continuous Glucose Monitoring Market Analysis By Technology

Technological advancements play a critical role, with innovations such as real-time continuous monitoring systems emerging. Real-time CGMs are projected to increase from USD 0.74 billion in 2023 to USD 1.83 billion by 2033, reflecting a growing consumer preference for immediate feedback on glucose levels.

Continuous Glucose Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Continuous Glucose Monitoring Industry

Dexcom, Inc.:

Dexcom is a leading developer of continuous glucose monitoring systems, known for innovative solutions like the Dexcom G6, which streamline diabetes management with real-time data and alerts.Abbott Laboratories:

Abbott, with its Freestyle Libre system, revolutionized glucose monitoring by providing an accessible and user-friendly alternative, leading to a significant increase in CGM adoption among diabetes patients.Medtronic plc:

Medtronic is a prominent player in the CGM market, integrating advanced technology into their MiniMed systems, which combine insulin delivery and glucose monitoring for comprehensive diabetes management.Senseonics Holdings, Inc.:

Senseonics specializes in long-term implantable CGM systems, pushing boundaries in the technology with the Eversense product, designed for patients requiring prolonged monitoring solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of Continuous Glucose Monitoring?

The global Continuous Glucose Monitoring market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 9.2% leading to significant growth by 2033.

What are the key market players or companies in the Continuous Glucose Monitoring industry?

Key players in the Continuous Glucose Monitoring market include Abbott Laboratories, Dexcom, Medtronic, and others, focusing on innovation and technology to enhance diabetes management solutions.

What are the primary factors driving the growth in the Continuous Glucose Monitoring industry?

Growth in the Continuous Glucose Monitoring industry is driven by increasing diabetes prevalence, technological advancements in monitoring devices, and rising health awareness among patients and healthcare professionals.

Which region is the fastest Growing in the Continuous Glucose Monitoring?

The fastest-growing region in the Continuous Glucose Monitoring market is Europe, projected to grow from $1.90 billion in 2023 to $4.72 billion by 2033, driven by rising healthcare expenditures and advancements.

Does ConsaInsights provide customized market report data for the Continuous Glucose Monitoring industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, enabling businesses to gain insights based on unique research requirements in the Continuous Glucose Monitoring field.

What deliverables can I expect from this Continuous Glucose Monitoring market research project?

Expect comprehensive reports including market size, segmentation analysis, competitive landscape, regional insights, and trend analysis to support strategic decision-making.

What are the market trends of Continuous Glucose Monitoring?

Market trends in the Continuous Glucose Monitoring sector show a growing shift towards home-based monitoring systems, enhanced real-time tracking technologies, and increasing consumer demand for easy-to-use glucose management solutions.