Contract Management Software Market Report

Published Date: 31 January 2026 | Report Code: contract-management-software

Contract Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Contract Management Software market from 2023 to 2033, covering market size, growth forecasts, regional insights, and key trends impacting the industry.

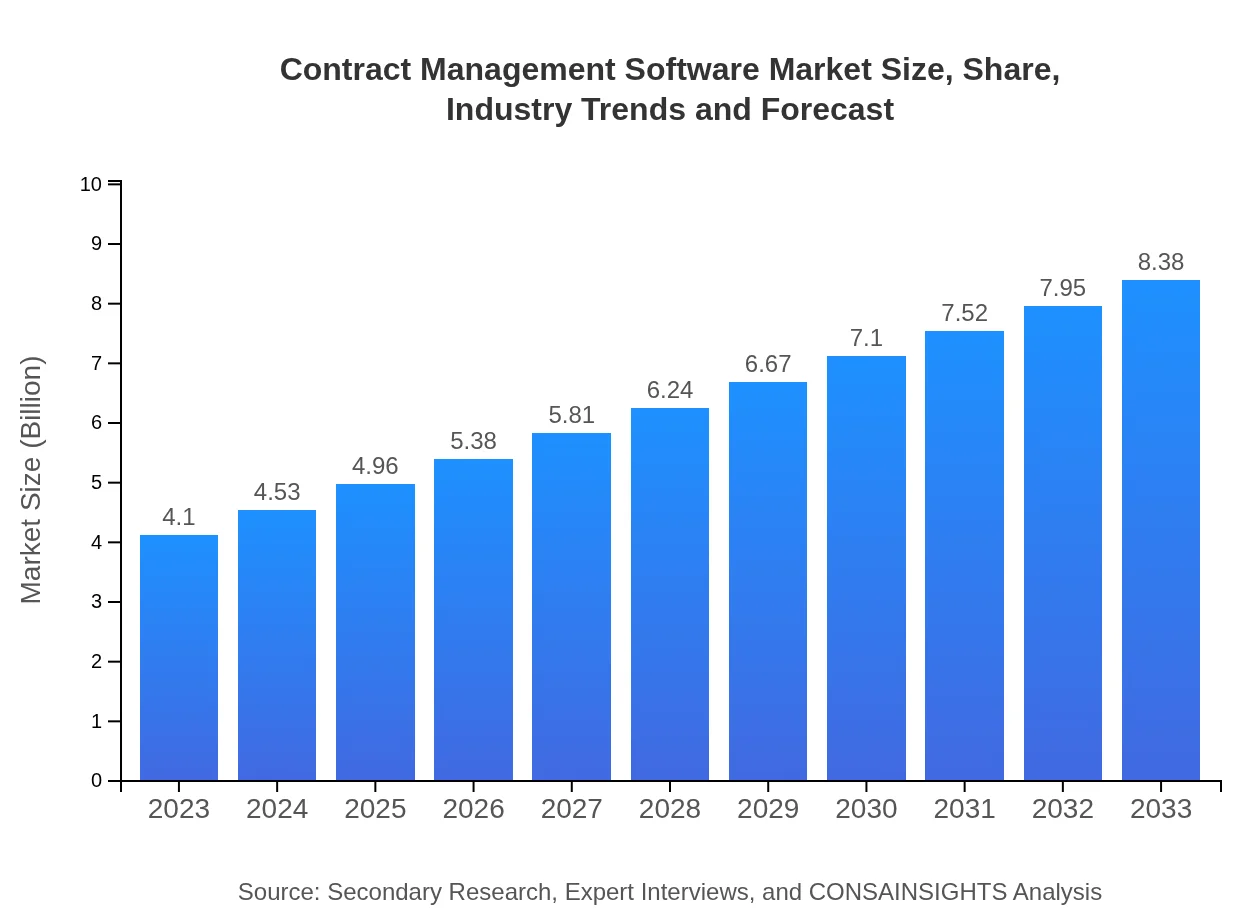

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.10 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $8.38 Billion |

| Top Companies | DocuSign, SAP Ariba, Icertis, Coupa, ContractWorks |

| Last Modified Date | 31 January 2026 |

Contract Management Software Market Overview

Customize Contract Management Software Market Report market research report

- ✔ Get in-depth analysis of Contract Management Software market size, growth, and forecasts.

- ✔ Understand Contract Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Contract Management Software

What is the Market Size & CAGR of Contract Management Software market in 2023?

Contract Management Software Industry Analysis

Contract Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Contract Management Software Market Analysis Report by Region

Europe Contract Management Software Market Report:

The European market is anticipated to grow from $1.25 billion in 2023 to $2.56 billion by 2033. The increasing emphasis on regulatory compliance and contract risk management, alongside rising investments in automation, are key drivers for this growth. The European Union's various directives and compliance frameworks further support the demand for contract management solutions.Asia Pacific Contract Management Software Market Report:

In the Asia Pacific region, the contract management software market is expected to grow from $0.77 billion in 2023 to $1.58 billion in 2033, driven by increasing digital transformation initiatives, government reforms, and the rise of SMEs. The adoption of cloud-based solutions and demand for automation in contract processes are significant factors contributing to this growth.North America Contract Management Software Market Report:

North America stands as a leader in the contract management software market, with an estimated value of $1.51 billion in 2023, expected to reach $3.09 billion by 2033. The region's growth is propelled by the presence of established players, high adoption rates of advanced technologies, and strict regulations necessitating robust contract management solutions.South America Contract Management Software Market Report:

The South American market for contract management software is projected to grow from $0.26 billion in 2023 to $0.53 billion by 2033. Factors influencing this growth include a rising focus on compliance and the need for efficient contract management solutions among companies in emerging economies, coupled with a growing digital landscape.Middle East & Africa Contract Management Software Market Report:

In the Middle East and Africa, the market is projected to expand from $0.31 billion in 2023 to $0.63 billion by 2033. Growth is influenced by increasing investments in digital infrastructure and the necessity for organizations to manage contracts more effectively amid a complex regulatory landscape.Tell us your focus area and get a customized research report.

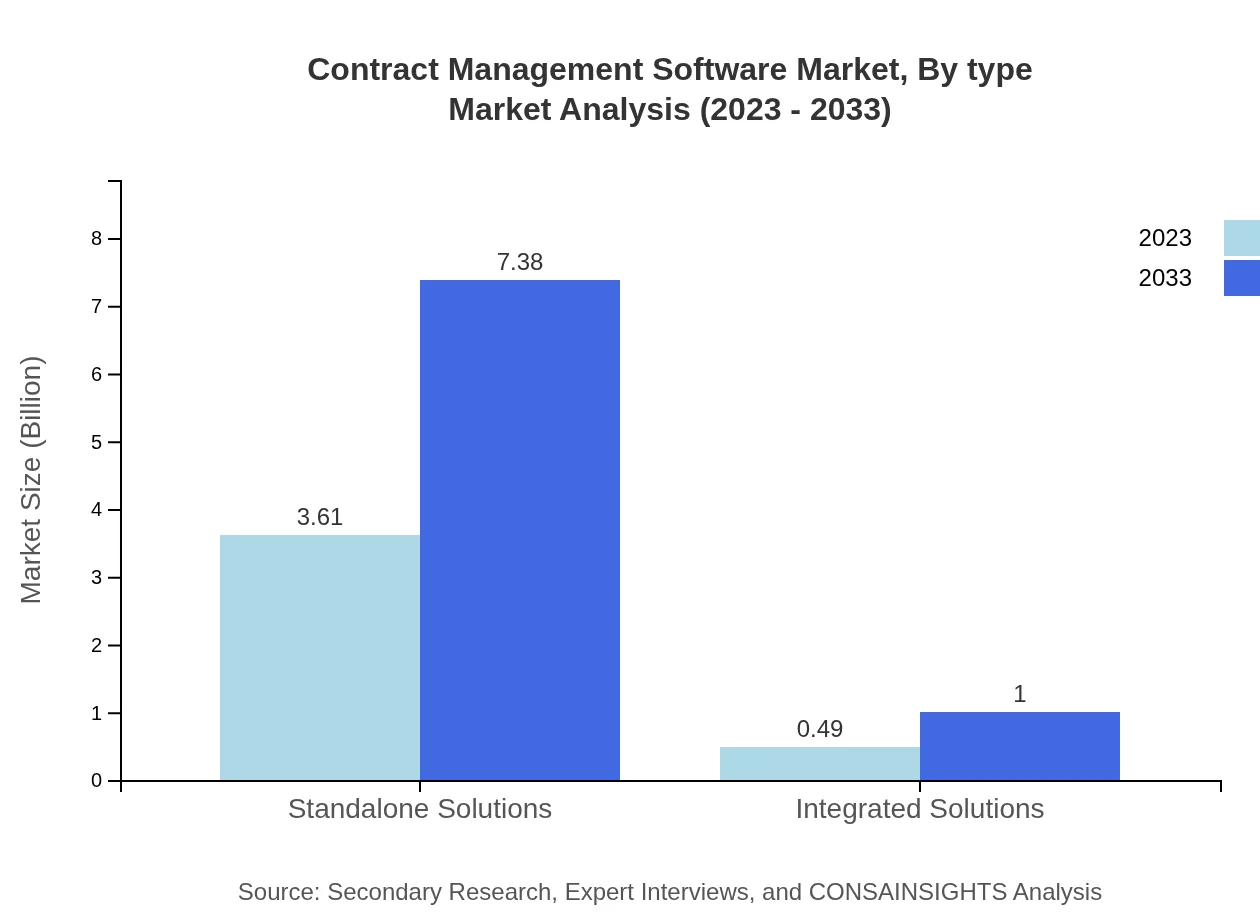

Contract Management Software Market Analysis By Type

The market is primarily driven by standalone solutions, which held a valued market size of $3.61 billion in 2023, projected to reach $7.38 billion by 2033, contributing to 88.09% of market share. Integrated solutions represent a smaller segment with a market size of $0.49 billion in 2023, expected to grow to $1.00 billion by 2033, making up 11.91% share.

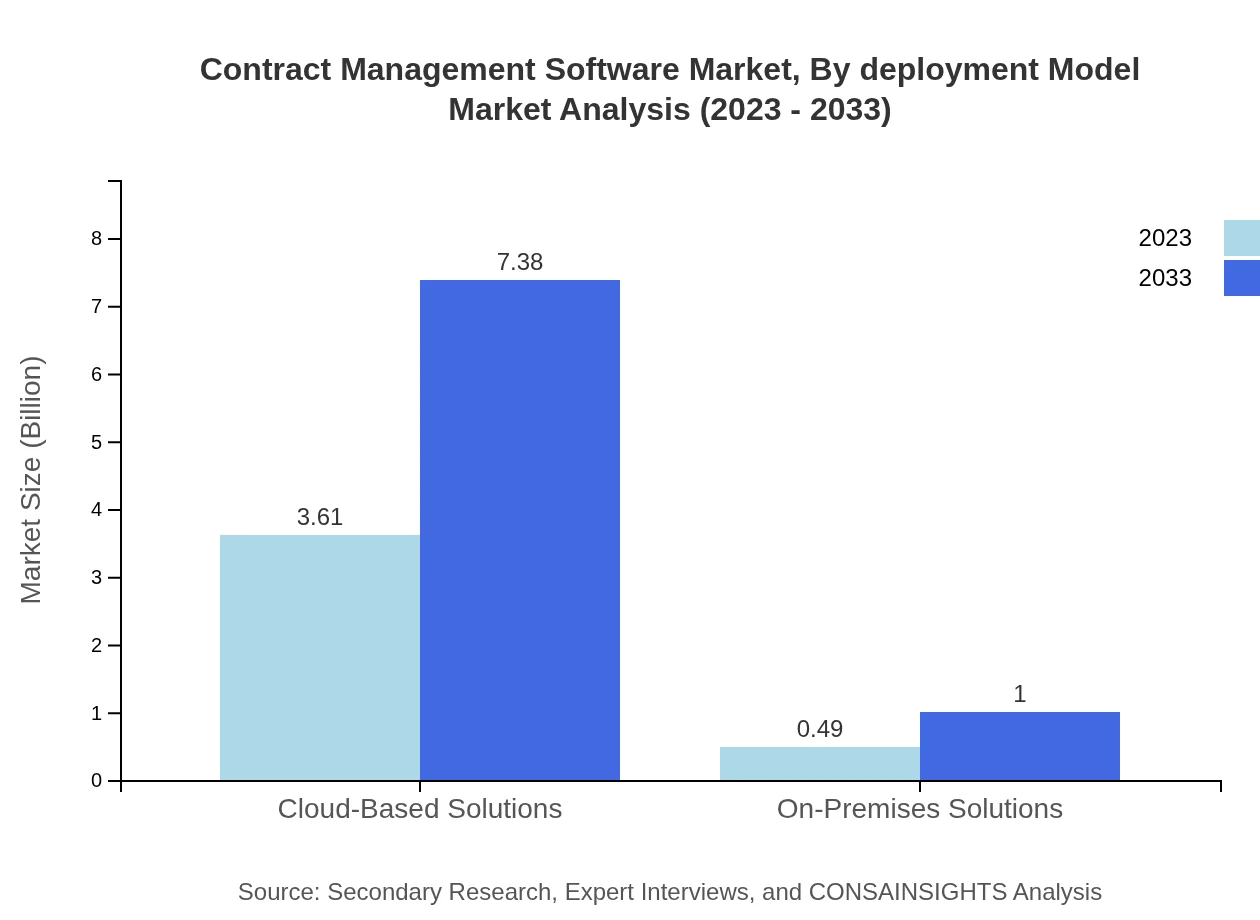

Contract Management Software Market Analysis By Deployment Model

The deployment model segment reveals a preference for cloud-based solutions, valued at $3.61 billion in 2023, with growth expected to reach $7.38 billion by 2033, maintaining an 88.09% share. On-premises solutions, while less favored, are projected to grow from $0.49 billion in 2023 to $1.00 billion by 2033, holding an 11.91% market share.

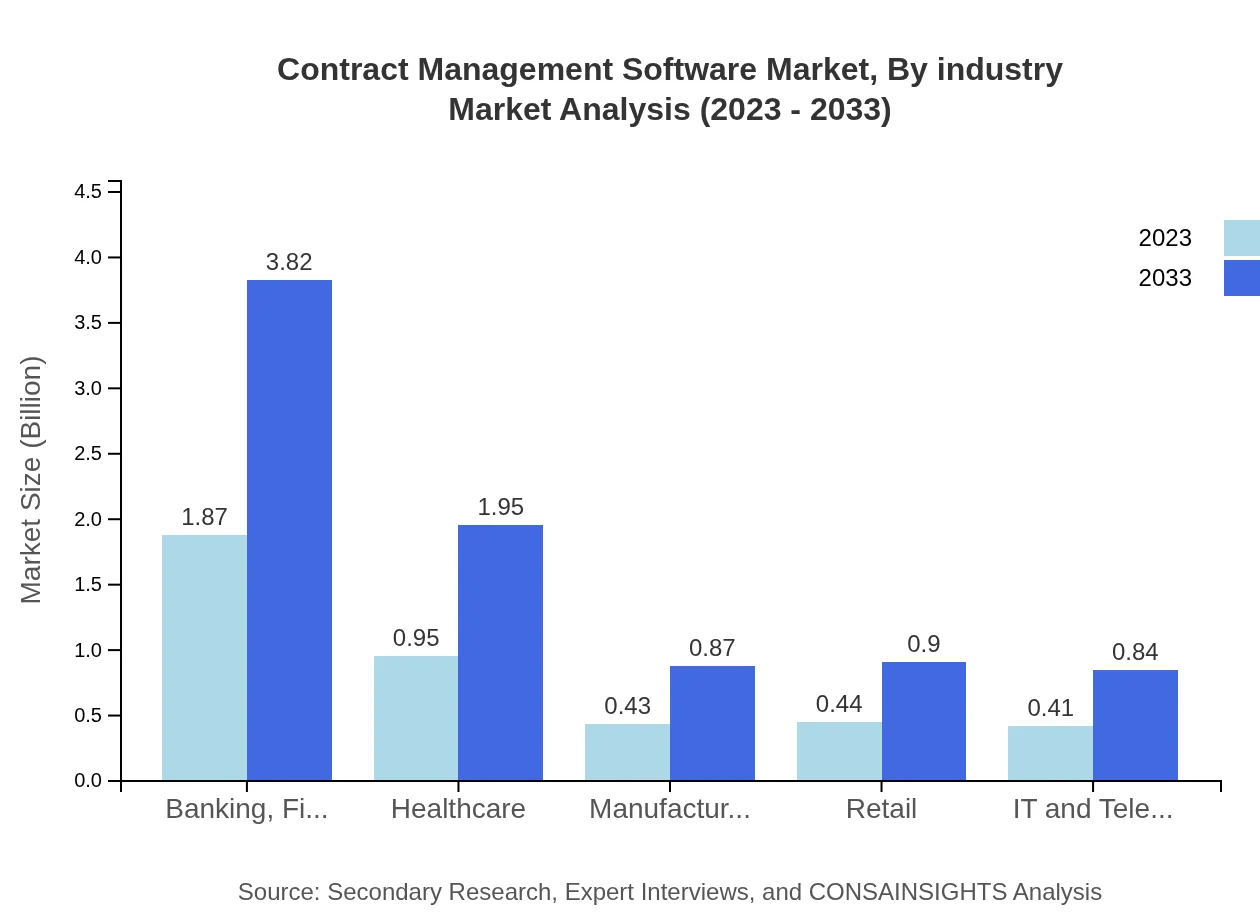

Contract Management Software Market Analysis By Industry

Various industries contribute distinctly to the market, with the banking, financial services, and insurance sector valued at $1.87 billion in 2023, projected to grow to $3.82 billion by 2033. The healthcare sector has a market size of $0.95 billion in 2023, expected to expand to $1.95 billion by 2033, followed by manufacturing and retail, which are also key sectors enhancing the market.

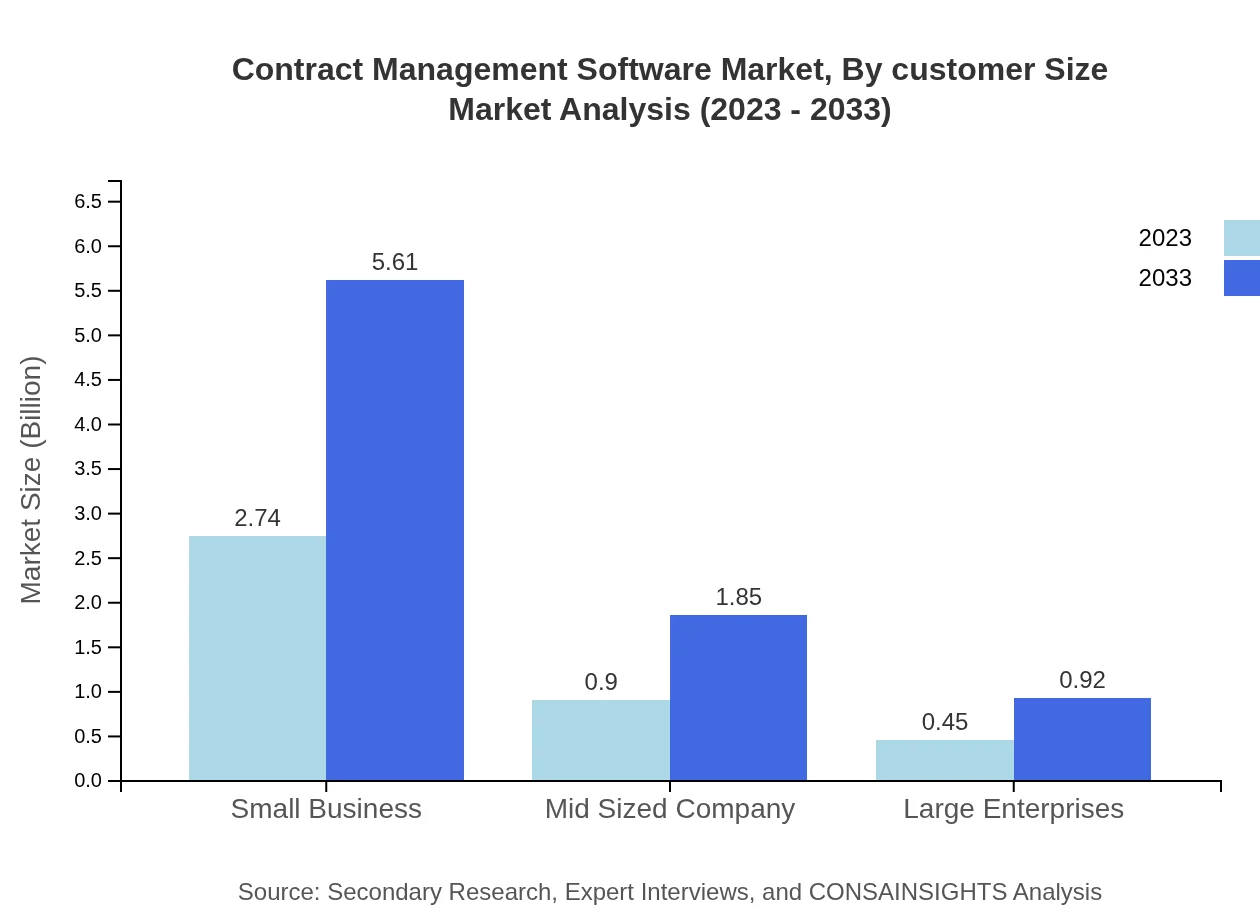

Contract Management Software Market Analysis By Customer Size

Customer size segmentation showcases small businesses leading the market with a size of $2.74 billion in 2023, growing to $5.61 billion by 2033 and holding a 66.9% share. Mid-sized companies are valued at $0.90 billion, expected to rise to $1.85 billion, and large enterprises at $0.45 billion, projected for $0.92 billion by 2033.

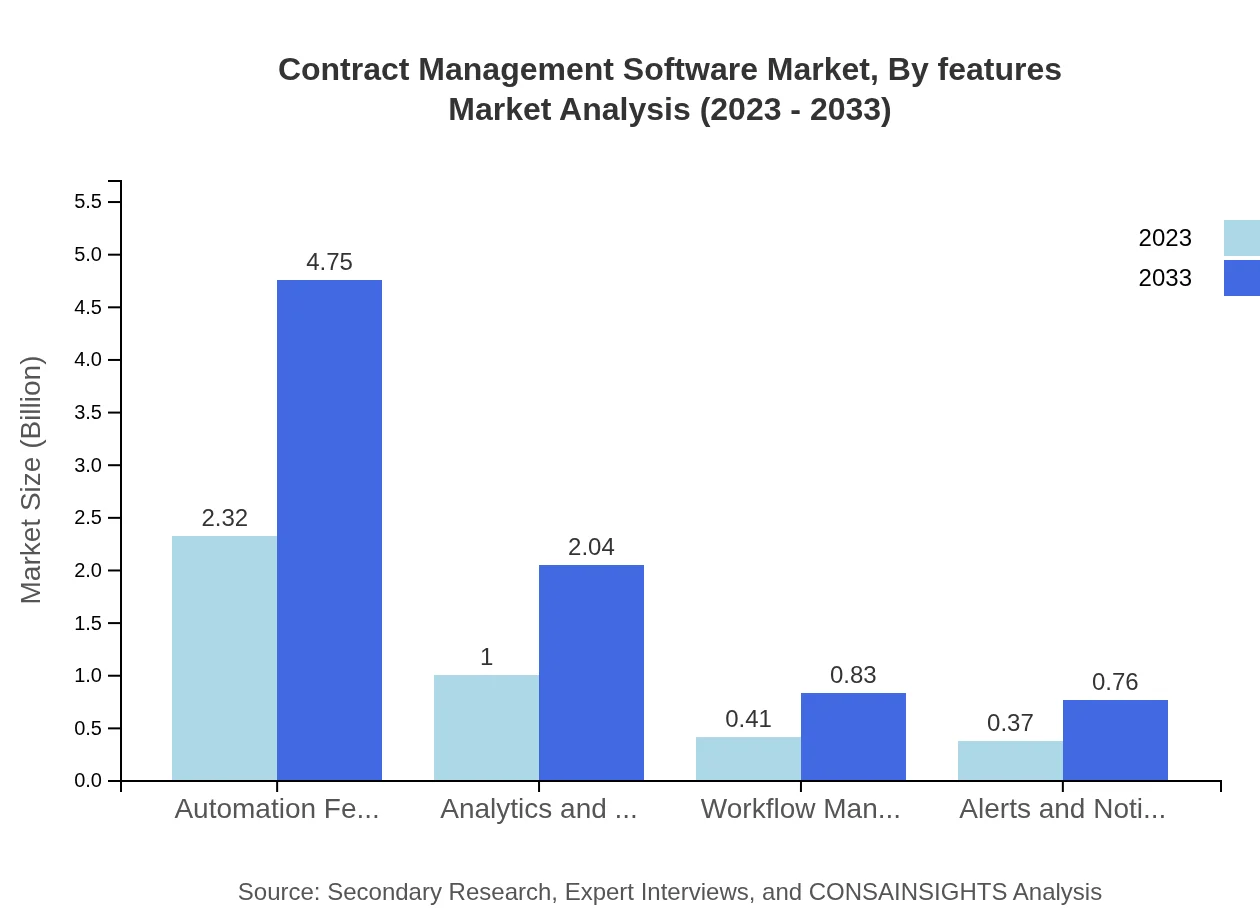

Contract Management Software Market Analysis By Features

Key features driving the market include automation features valued at $2.32 billion in 2023, projected to expand to $4.75 billion by 2033, making up 56.7% of market share. Other significant components include analytics and reporting, workflow management, and alerts & notifications, each growing steadily over the forecast period.

Contract Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Contract Management Software Industry

DocuSign:

Leading provider of electronic signature technology and digital transaction management, offering contract lifecycle management solutions.SAP Ariba:

Specializes in procurement and supply chain solutions, providing contract management as part of its cloud-based platforms.Icertis:

Offers a comprehensive contract lifecycle management platform empowering organizations to manage their contracts effectively.Coupa:

Delivers comprehensive procurement and spend management solutions, including contract management functionalities.ContractWorks:

Provides easy-to-use contract management software specifically designed for small and mid-sized businesses.We're grateful to work with incredible clients.

FAQs

What is the market size of contract Management Software?

The contract management software market is valued at approximately $4.1 billion in 2023, with a projected CAGR of 7.2%. This growth indicates robust sector expansion driven by demand for streamlined contract processes and legal compliance.

What are the key market players or companies in this contract Management Software industry?

Key players in the contract management software industry include DocuSign, SAP Ariba, Coupa Software, Icertis, Oracle, and Zycus. These companies are leading innovation and contributing significantly to market growth through diverse product offerings.

What are the primary factors driving the growth in the contract Management Software industry?

The growth in the contract management software market is driven by increasing digital transformation, demand for compliance management, globalization of business operations, and the need for enhanced efficiency in contract-related processes.

Which region is the fastest Growing in the contract Management Software market?

North America represents the fastest-growing region in the contract management software market, with a projected growth from $1.51 billion in 2023 to $3.09 billion by 2033. This growth is fueled by technological advancements and a strong demand for streamlined operations.

Does ConsaInsights provide customized market report data for the contract Management Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the contract management software industry. This includes detailed analysis, forecast data, and insights into market trends and specific company performance.

What deliverables can I expect from this contract Management Software market research project?

Expect comprehensive reports featuring market size estimates, segmentation analysis, competitive landscape insights, regional breakdowns, and growth forecasts. Each deliverable aims to provide actionable insights for strategic decision-making.

What are the market trends of contract Management Software?

Current trends in the contract management software space include the rise of cloud-based solutions, increasing automation of contract processes, and a growing emphasis on analytics and reporting capabilities to enhance business intelligence.