Contract Research Organization Market Report

Published Date: 31 January 2026 | Report Code: contract-research-organization

Contract Research Organization Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Contract Research Organization (CRO) industry, including market size, trends, and regional insights from 2023 to 2033. It offers valuable data for stakeholders looking to comprehend the dynamics of the CRO market.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $55.60 Billion |

| CAGR (2023-2033) | 7.9% |

| 2033 Market Size | $121.71 Billion |

| Top Companies | IQVIA , Covance, Paraxel, Charles River Laboratories, PPD |

| Last Modified Date | 31 January 2026 |

Contract Research Organization Market Overview

Customize Contract Research Organization Market Report market research report

- ✔ Get in-depth analysis of Contract Research Organization market size, growth, and forecasts.

- ✔ Understand Contract Research Organization's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Contract Research Organization

What is the Market Size & CAGR of Contract Research Organization market in 2023?

Contract Research Organization Industry Analysis

Contract Research Organization Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Contract Research Organization Market Analysis Report by Region

Europe Contract Research Organization Market Report:

Europe's CRO market is forecasted to grow substantially from $16.80 billion in 2023 to $36.77 billion by 2033. The region benefits from a well-established regulatory framework, a diverse patient pool for clinical trials, and rising collaborations among pharmaceutical firms.Asia Pacific Contract Research Organization Market Report:

The Asia Pacific region is expected to witness significant growth in the CRO market, with expected revenues increasing from $9.77 billion in 2023 to $21.39 billion by 2033. The rise in healthcare investments, coupled with favorable regulatory frameworks and a burgeoning patient population, bolsters the outsourcing trend in this region.North America Contract Research Organization Market Report:

North America holds a significant market share, projected to expand from $21.14 billion in 2023 to $46.29 billion by 2033. The strong presence of major pharmaceutical companies, high R&D spending, and advanced healthcare systems all contribute to the region's leadership in the CRO market.South America Contract Research Organization Market Report:

In South America, the market size remains smaller, moving from $0.40 billion in 2023 to $0.88 billion by 2033. Factors such as increasing investments in healthcare infrastructure and a rise in clinical trial activities for local drug development are driving this growth.Middle East & Africa Contract Research Organization Market Report:

The Middle East and Africa are expected to see a rise in CRO market dynamics from $7.49 billion in 2023 to $16.39 billion by 2033, driven by an increase in healthcare spending and the expansion of clinical trial activities aimed at establishing new treatment options.Tell us your focus area and get a customized research report.

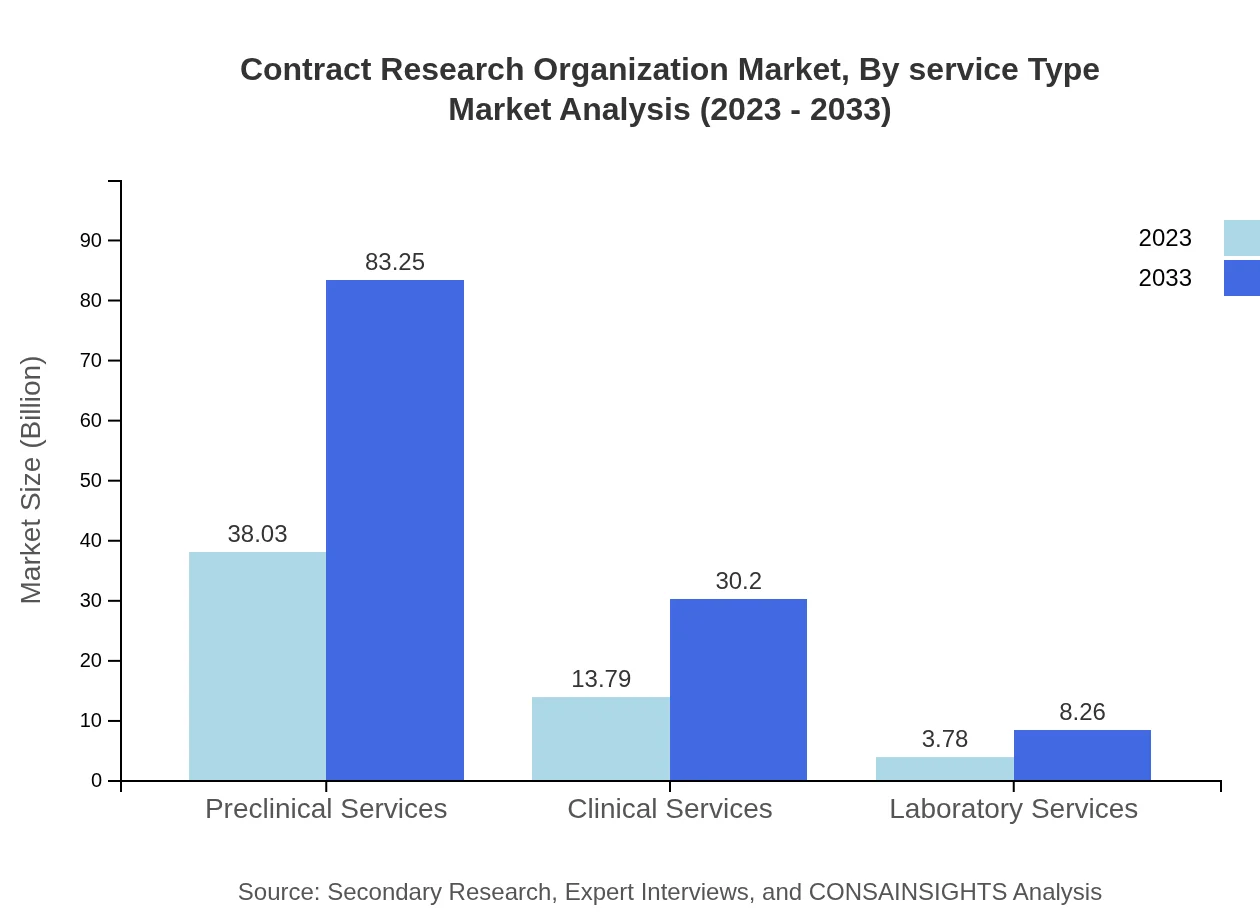

Contract Research Organization Market Analysis By Service Type

The market by service type reflects the significant traction in full-service CROs, expected to grow from $38.03 billion in 2023 to $83.25 billion by 2033, commanding a market share of 68.4%. Project-based CROs are also seeing growth from $13.79 billion to $30.20 billion driven by specific project demands. Functional Service Providers (FSP) show moderate growth from $3.78 billion to $8.26 billion.

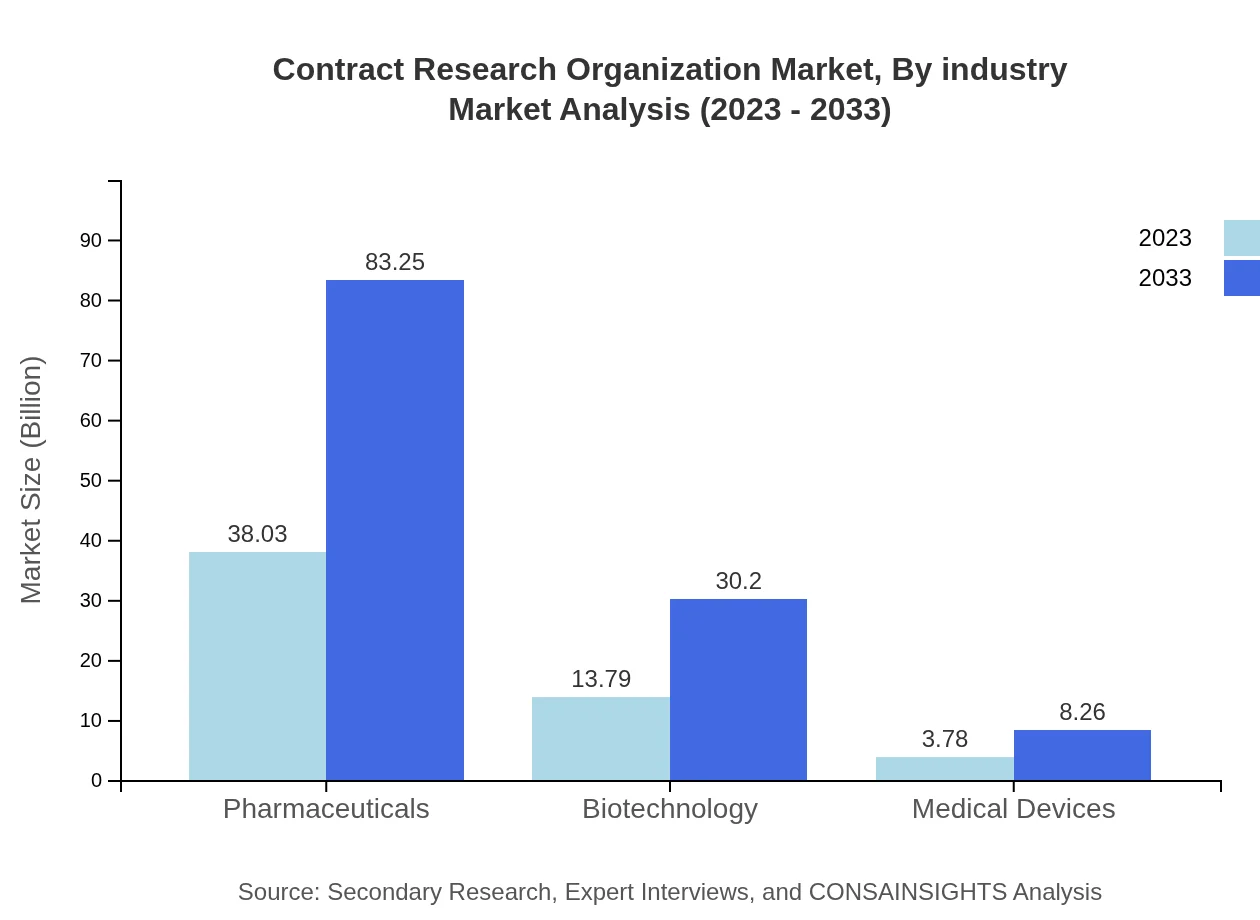

Contract Research Organization Market Analysis By Industry

Pharmaceuticals lead this segment, representing a fair share of the market from $38.03 billion in 2023 to $83.25 billion by 2033. Biotechnology is another growing segment, increasing from $13.79 billion to $30.20 billion in the same period. Medical devices, although smaller, show a potential rise from $3.78 billion to $8.26 billion.

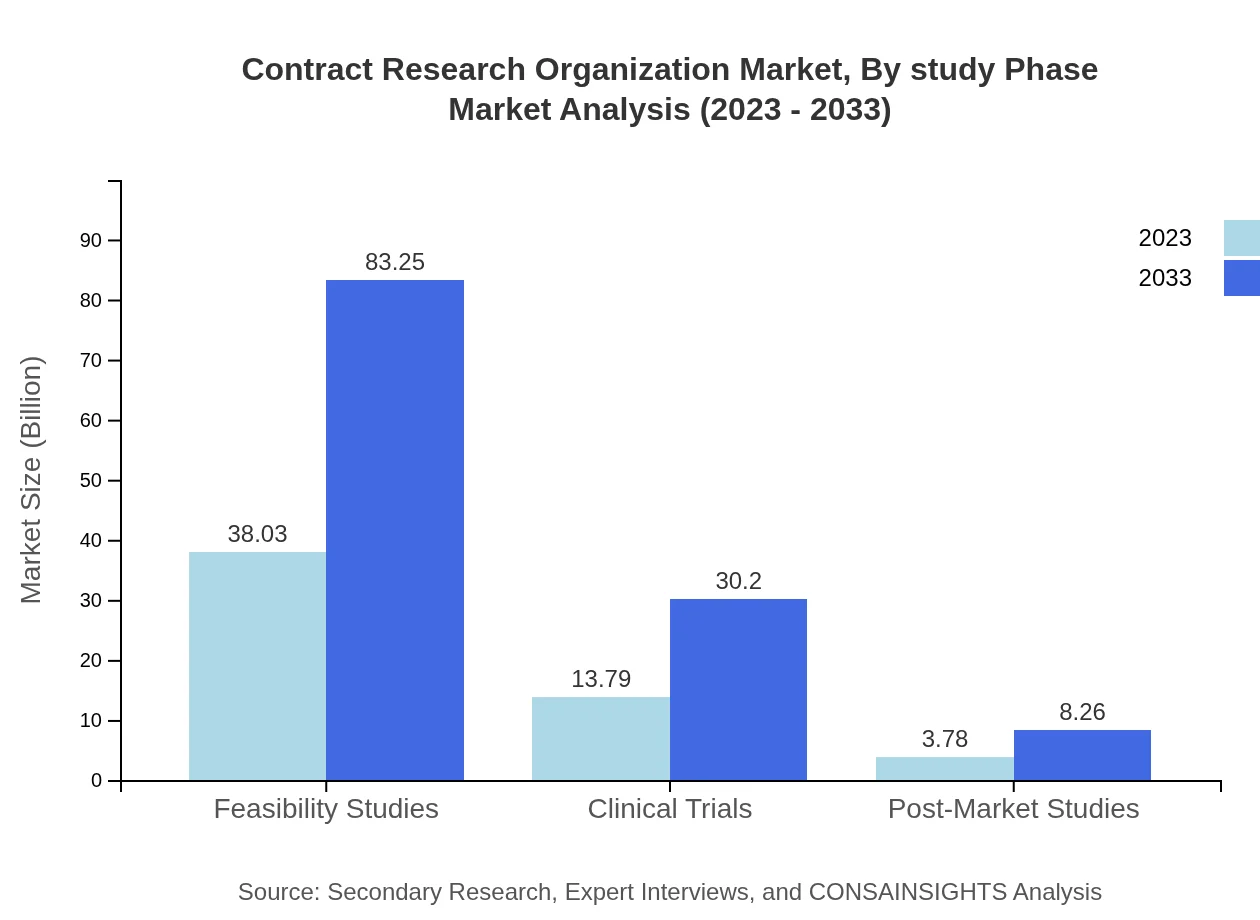

Contract Research Organization Market Analysis By Study Phase

In terms of study phases, preclinical services dominate, growing from $38.03 billion to $83.25 billion. Clinical trials follow, projected to increase from $13.79 billion to $30.20 billion, confirming the strong R&D efforts in drug development. Post-market studies are smaller but are anticipated to rise from $3.78 billion to $8.26 billion.

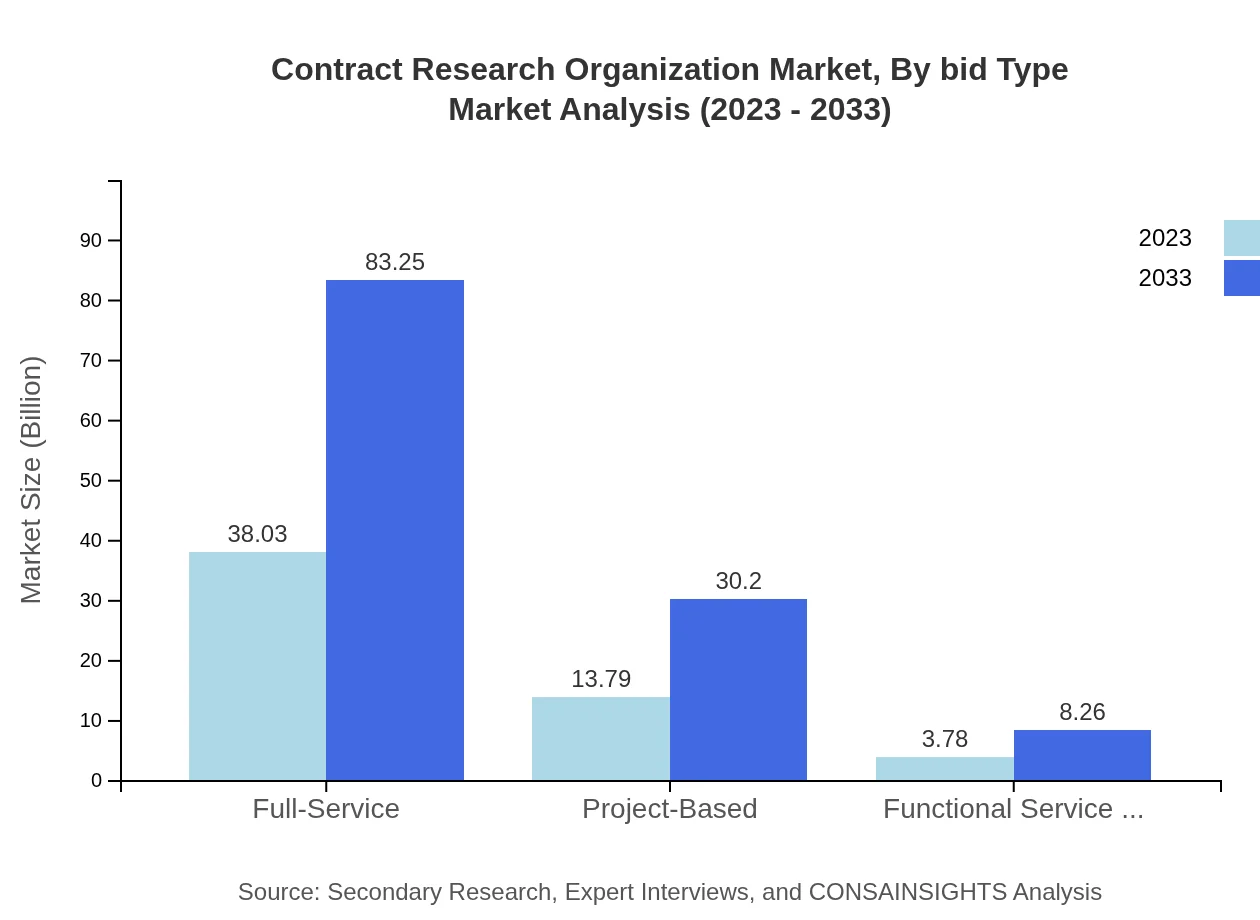

Contract Research Organization Market Analysis By Bid Type

The bid types examined confirm that full-service bids and project-based contracts take precedence, reflecting the preference for comprehensive service offerings as drug development strategies become more complex.

Contract Research Organization Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Contract Research Organization Industry

IQVIA :

A leading global CRO providing advanced analytics, technology solutions, and contract research services.Covance:

A subsidiary of LabCorp, Covance offers comprehensive drug development services to pharmaceutical and biotechnology companies.Paraxel:

An industry-leading business offering a wide range of services including clinical research, regulatory consulting, and commercialization services.Charles River Laboratories:

Known for its extensive portfolio of services in preclinical research and development and one of the pioneers in the CRO market.PPD:

Pharmaceutical Product Development, LLC, provides comprehensive, integrated drug development, laboratory, and lifecycle management services.We're grateful to work with incredible clients.

FAQs

What is the market size of Contract Research Organization?

The global market size for Contract Research Organizations (CROs) is projected to reach $55.6 billion by 2033, growing at a CAGR of 7.9%. This growth is driven by increasing demand for outsourcing in clinical trials and development activities.

What are the key market players or companies in this Contract Research Organization industry?

Key players in the CRO industry include Quintiles IMS Holdings, Covance Inc., Charles River Laboratories, Parexel International Corporation, and ICON plc, among others. These companies dominate due to their extensive service offerings and global reach.

What are the primary factors driving the growth in the Contract Research Organization industry?

Growth in the CRO industry is driven by factors such as the rising need for efficient clinical trials, the increasing prevalence of chronic diseases, and the surge in pharmaceutical research and development. Moreover, regulatory complexities boost demand for specialized CRO services.

Which region is the fastest Growing in the Contract Research Organization?

Asia-Pacific is the fastest-growing region in the CRO market, with projected growth from $9.77 billion in 2023 to $21.39 billion by 2033. This rapid expansion is fueled by a robust increase in clinical trials and substantial health expenditure in the region.

Does ConsaInsights provide customized market report data for the Contract Research Organization industry?

Yes, ConsaInsights offers customized market report data tailored to specific stakeholder needs in the CRO industry, covering various parameters such as regional insights, market trends, and competitive landscapes to facilitate informed decision-making.

What deliverables can I expect from this Contract Research Organization market research project?

Deliverables from the CRO market research project include comprehensive market reports, analysis of growth drivers, competitive analysis, and segmented market data, specific to the client's requirements for strategic planning and investment guidance.

What are the market trends of Contract Research Organization?

Key trends in the CRO market include increasing adoption of digital technologies, the shift towards patient-centric research, and growth in partnerships between CROs and biotech companies. Additionally, there is a rising emphasis on personalized medicine and adaptive trial designs.