Cooking Oils And Fats Market Report

Published Date: 31 January 2026 | Report Code: cooking-oils-and-fats

Cooking Oils And Fats Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cooking Oils And Fats market, covering market size, trends, segmentation, regional insights, and future forecasts from 2023 to 2033.

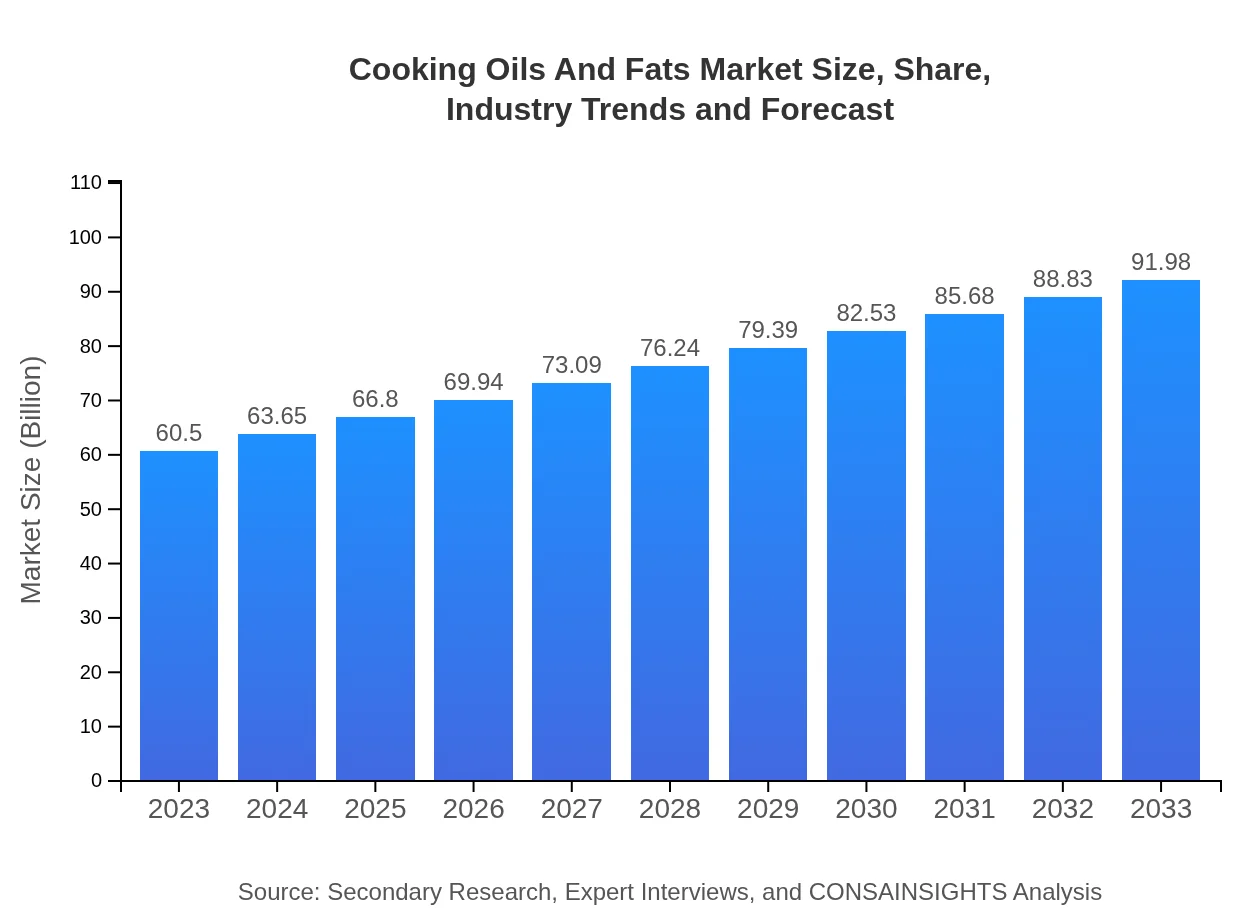

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $60.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $91.98 Billion |

| Top Companies | Cargill, Inc., Bunge Limited, Unilever, Archer Daniels Midland Company (ADM), Kraft Heinz Company |

| Last Modified Date | 31 January 2026 |

Cooking Oils And Fats Market Overview

Customize Cooking Oils And Fats Market Report market research report

- ✔ Get in-depth analysis of Cooking Oils And Fats market size, growth, and forecasts.

- ✔ Understand Cooking Oils And Fats's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cooking Oils And Fats

What is the Market Size & CAGR of Cooking Oils And Fats market in 2023?

Cooking Oils And Fats Industry Analysis

Cooking Oils And Fats Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cooking Oils And Fats Market Analysis Report by Region

Europe Cooking Oils And Fats Market Report:

Europe's Cooking Oils and Fats market is estimated at USD 16.41 billion in 2023, with expectations to reach USD 24.95 billion by 2033. The European market is marked by high awareness of health and wellness trends, leading to a strong preference for organic and non-GMO certified oils, particularly in Western Europe.Asia Pacific Cooking Oils And Fats Market Report:

In 2023, the Asia Pacific region's Cooking Oils and Fats market is valued at USD 12.15 billion, projected to grow to USD 18.48 billion by 2033. This growth is driven by an increasing population, urbanization, and a rising middle-income demographic seeking diverse cooking options. Countries like India and China are notable consumers of various oils due to their culinary traditions.North America Cooking Oils And Fats Market Report:

In North America, the market was valued at USD 20.99 billion in 2023, anticipated to expand to USD 31.91 billion by 2033. The U.S. is the primary driver of this market, with consumers increasingly gravitating towards healthier options and organic products, boosting the demand for innovative cooking oils.South America Cooking Oils And Fats Market Report:

The South American market for Cooking Oils and Fats stood at USD 4.79 billion in 2023, expected to reach USD 7.28 billion by 2033. This region is experiencing growth due to an increase in food processing industries and rising demand for plant-based cooking oils, particularly in Brazil and Argentina.Middle East & Africa Cooking Oils And Fats Market Report:

The Middle East and Africa's market is projected to grow from USD 6.15 billion in 2023 to USD 9.35 billion by 2033. The growth in this region is bolstered by increasing health awareness and a growing preference for non-traditional fats, alongside traditional olive oil consumption.Tell us your focus area and get a customized research report.

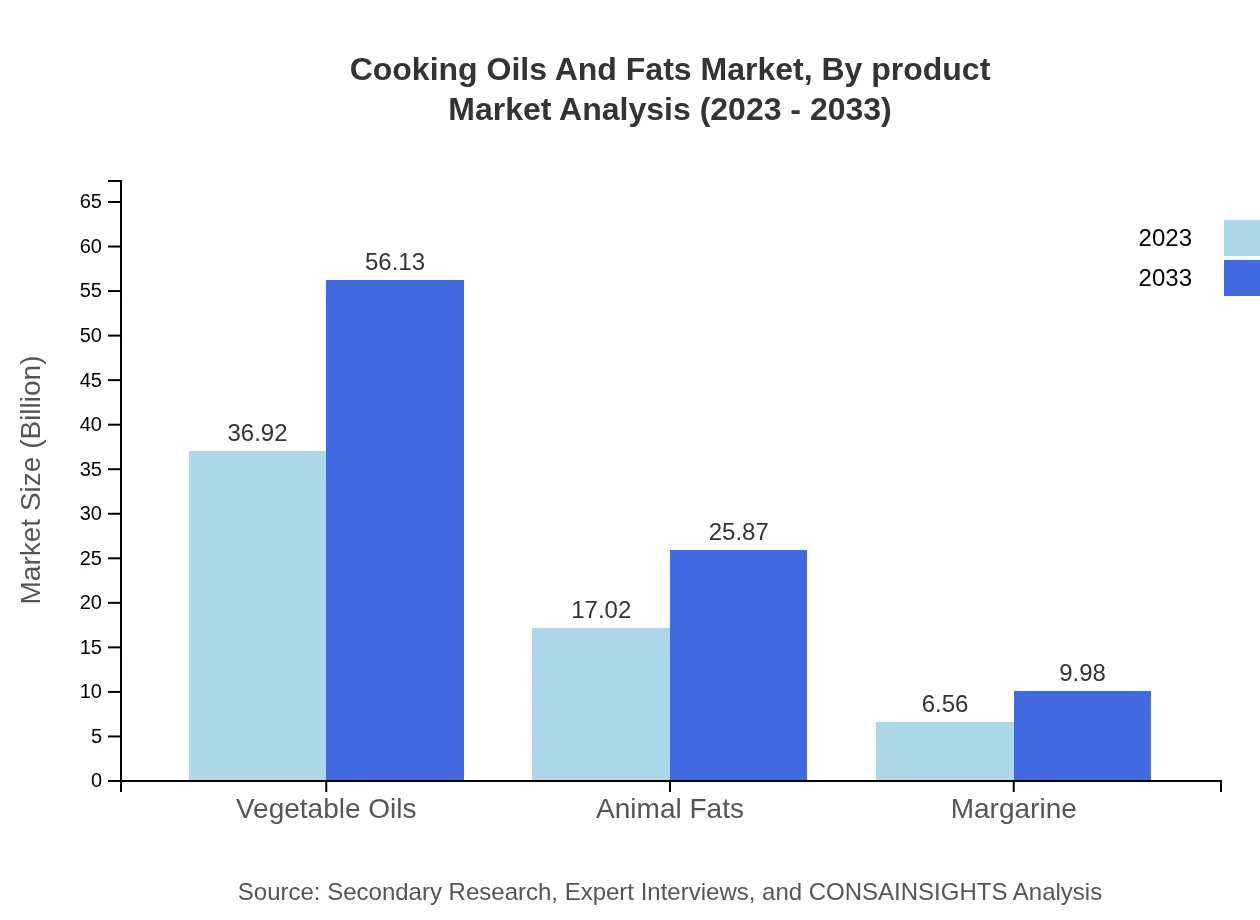

Cooking Oils And Fats Market Analysis By Product

The Cooking Oils and Fats market is primarily divided into Liquid Oils, Solid Fats, and Semi-Solid Fats. Liquid Oils dominated the market in 2023 with a valued size of USD 36.92 billion, expected to rise to USD 56.13 billion by 2033. Solid Fats also maintain a significant segment, growing from USD 17.02 billion in 2023 to USD 25.87 billion in 2033. Semi-Solid Fats, while smaller, are projected to increase from USD 6.56 billion to USD 9.98 billion over the same period.

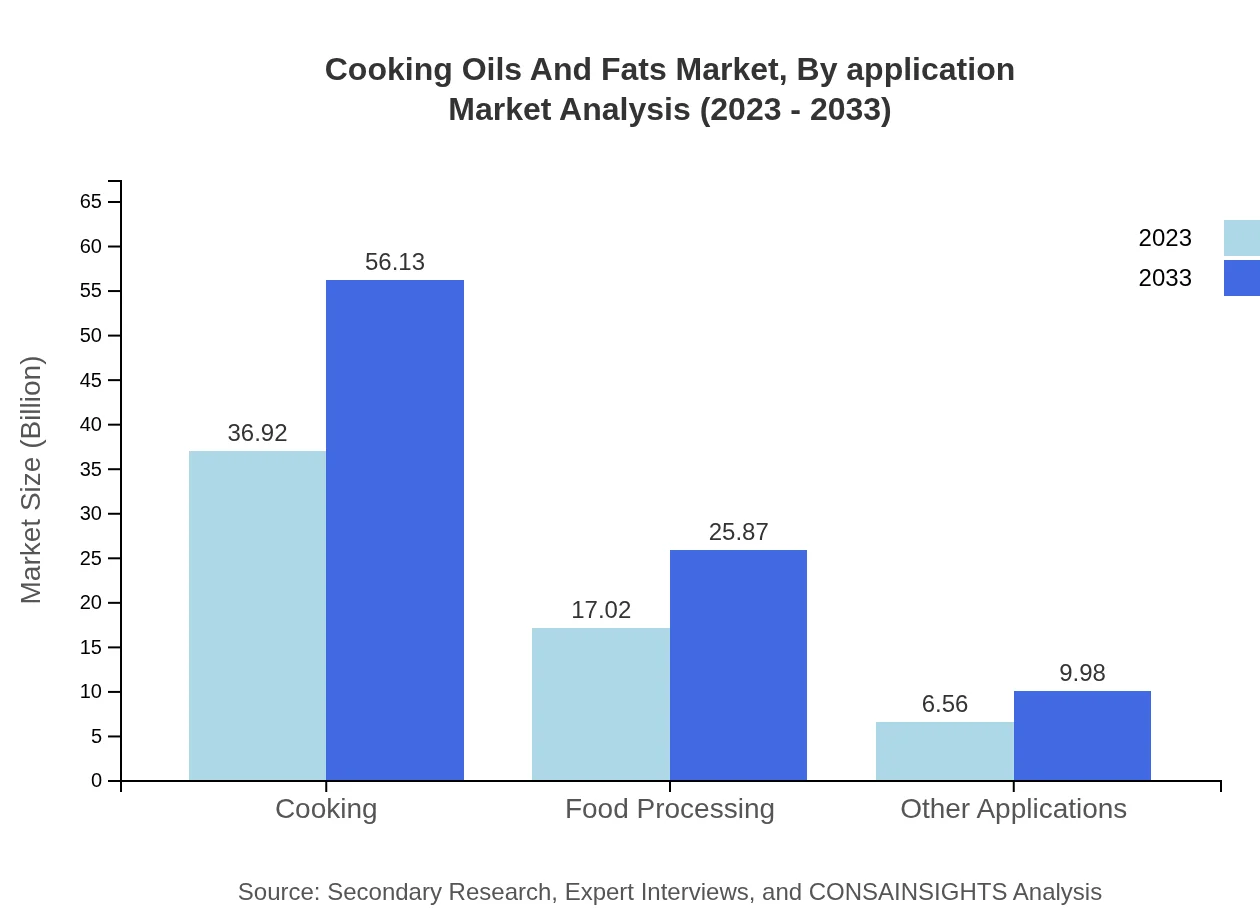

Cooking Oils And Fats Market Analysis By Application

Applications of cooking oils include Cooking, Food Processing, and Other Applications. Cooking remains the largest application segment, valued at USD 36.92 billion in 2023 and projected to grow towards USD 56.13 billion by 2033. Food Processing accounts for USD 17.02 billion, with expected growth to USD 25.87 billion. Other Applications also hold a notable share, growing from USD 6.56 billion to USD 9.98 billion.

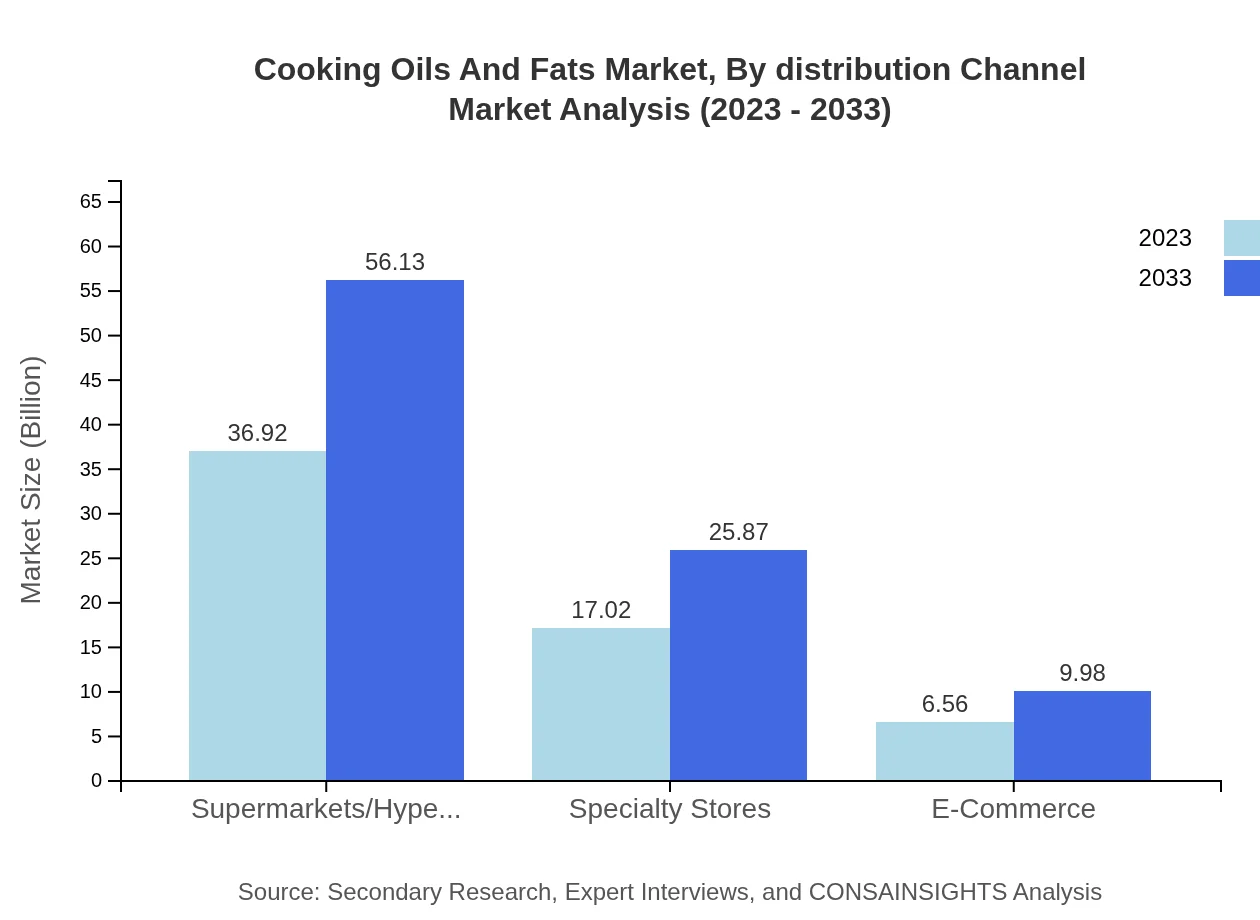

Cooking Oils And Fats Market Analysis By Distribution Channel

Distribution channels include Supermarkets/Hypermarkets, Specialty Stores, and E-Commerce. Supermarkets/Hypermarkets lead the distribution segment, valued at USD 36.92 billion, projected to grow to USD 56.13 billion. Specialty Stores follow with USD 17.02 billion, while E-Commerce, although smaller, is expected to experience significant growth from USD 6.56 billion to USD 9.98 billion as consumer trends shift towards online shopping.

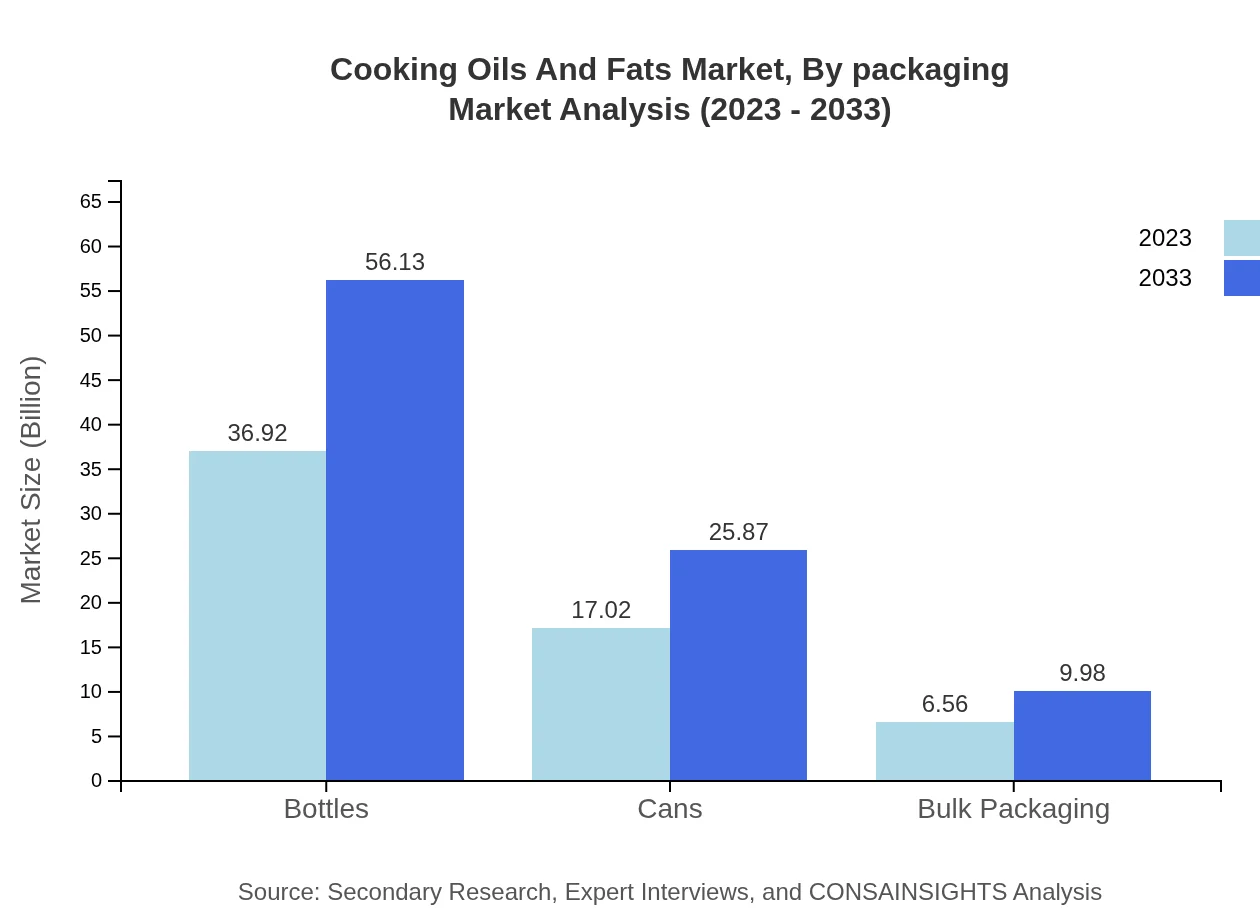

Cooking Oils And Fats Market Analysis By Packaging

The packaging of cooking oils includes Bottles, Cans, and Bulk Packaging. Bottles hold the largest market share at USD 36.92 billion, expected to reach USD 56.13 billion in 2033. Cans follow with a size of USD 17.02 billion, while Bulk Packaging accounts for USD 6.56 billion, indicating a robust market dynamics extending to larger-scale food processing operations.

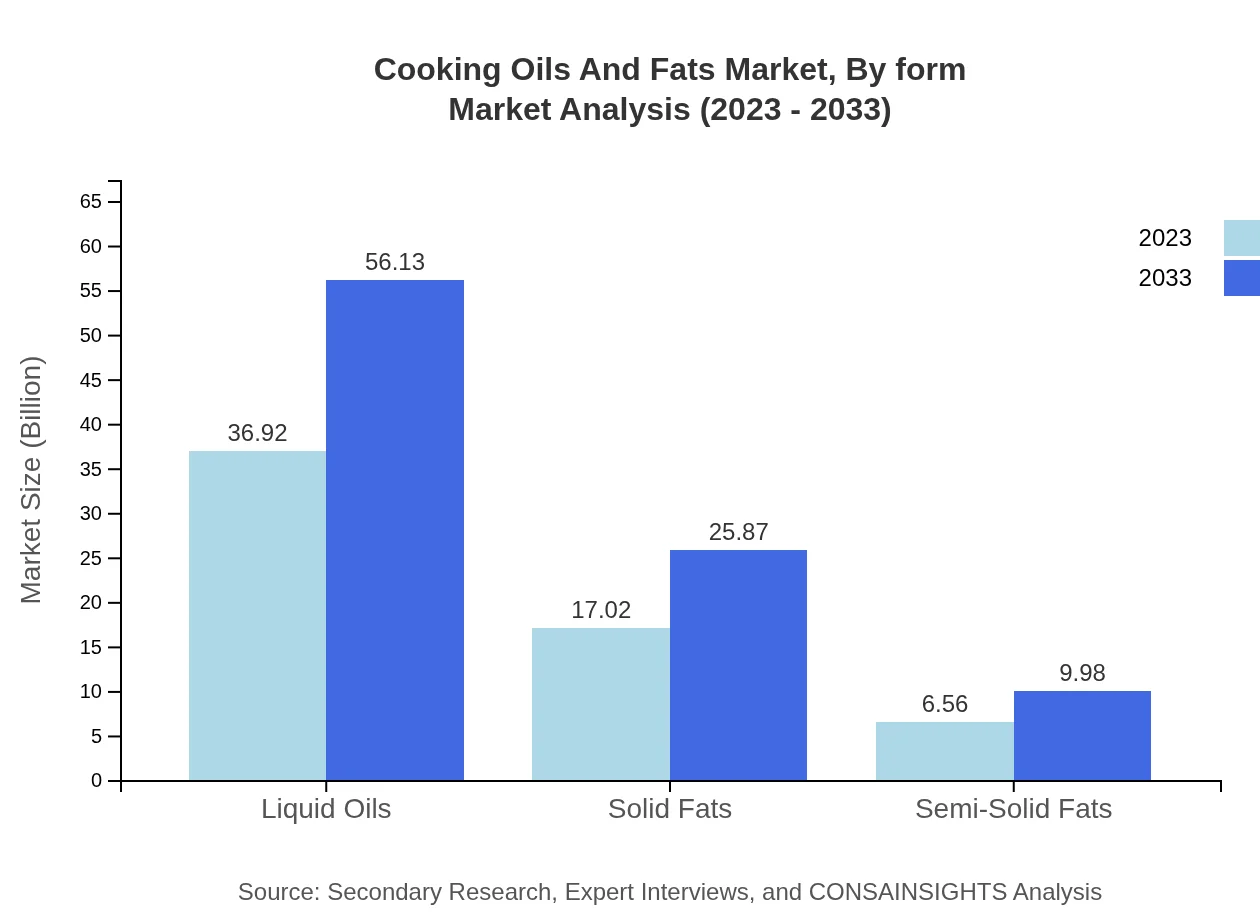

Cooking Oils And Fats Market Analysis By Form

Various forms of cooking oils include Liquid, Semi-Solid, and Solid variations. Liquid forms dominate the market, projected at USD 36.92 billion and expected to progress to USD 56.13 billion. Semi-Solid and Solid forms are also essential, with sizes of USD 6.56 billion and USD 17.02 billion respectively, reflecting diverse consumer culinary preferences.

Cooking Oils And Fats Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cooking Oils And Fats Industry

Cargill, Inc.:

Cargill is a global leader in food and agriculture, producing a wide array of oil products and providing agricultural services, ensuring sustainability throughout its supply chain.Bunge Limited:

Bunge is a leading global agribusiness and food company, specializing in the sourcing, processing, and sale of various cooking oils and fats, committed to innovation and quality.Unilever:

Unilever is a key player in the FMCG sector, producing an extensive range of cooking oils and fats, with a strong emphasis on health and sustainability in brand development.Archer Daniels Midland Company (ADM):

ADM is renowned for its role in agricultural processing, providing quality oils and fats while focusing on environmental stewardship and efficient production practices.Kraft Heinz Company:

Kraft Heinz offers a diverse portfolio of food and condiment brands, including popular cooking oil products, catering to consumers' varying preferences.We're grateful to work with incredible clients.

FAQs

What is the market size of cooking oils and fats?

The cooking oils and fats market is valued at approximately $60.5 billion in 2023, with a projected CAGR of 4.2% over the next decade, indicating substantial growth potential.

What are the key market players or companies in the cooking oils and fats industry?

Key players in the cooking oils and fats market include major manufacturers such as Unilever, Cargill, Archer Daniels Midland, Bunge Limited, and Olam International, which contribute significantly to market dynamics and innovation.

What are the primary factors driving the growth in the cooking oils and fats industry?

The growth in the cooking oils and fats industry is driven by increasing consumer preferences for healthy cooking options, rise in disposable income, expansion of the food processing sector, and growing demand for convenient food products.

Which region is the fastest Growing in the cooking oils and fats market?

The North American region is the fastest-growing in the cooking oils and fats market, expected to increase from $20.99 billion in 2023 to $31.91 billion in 2033, driven by health trends and food production.

Does ConsaInsights provide customized market report data for the cooking oils and fats industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the cooking oils and fats industry, allowing clients to access relevant insights for strategic decision-making.

What deliverables can I expect from this cooking oils and fats market research project?

From this research project, you can expect comprehensive deliverables including market analysis, growth forecasts, competitive landscape, regional insights, and segmentation analysis for cooking oils and fats.

What are the market trends of cooking oils and fats?

Current trends in the cooking oils and fats market include a shift towards organic and non-GMO products, increasing popularity of plant-based oils, and innovative packaging solutions aimed at sustainability.