Cooking Wine Market Report

Published Date: 31 January 2026 | Report Code: cooking-wine

Cooking Wine Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the cooking wine market, covering key insights, trends, and data from 2023 to 2033. It includes a thorough market overview, size and growth forecasts, industry analysis, segmentation, regional insights, leading players, technology advancements, and future trends.

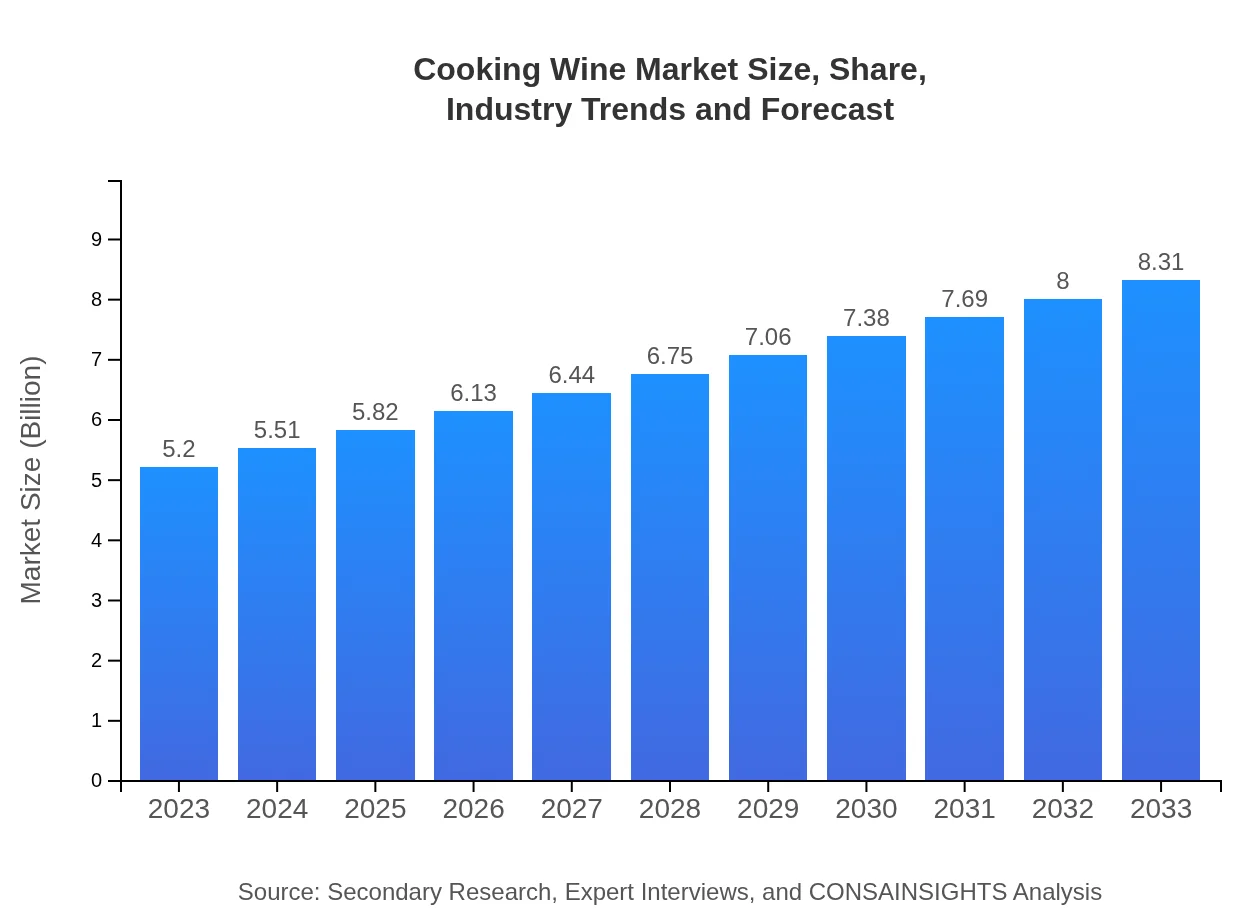

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $8.31 Billion |

| Top Companies | E&J Gallo Winery, Constellation Brands, Pernod Ricard, Kraft Heinz, Carojevic Winery |

| Last Modified Date | 31 January 2026 |

Cooking Wine Market Overview

Customize Cooking Wine Market Report market research report

- ✔ Get in-depth analysis of Cooking Wine market size, growth, and forecasts.

- ✔ Understand Cooking Wine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cooking Wine

What is the Market Size & CAGR of Cooking Wine market in 2023?

Cooking Wine Industry Analysis

Cooking Wine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cooking Wine Market Analysis Report by Region

Europe Cooking Wine Market Report:

Europe's cooking wine market is estimated at $1.71 billion in 2023, anticipated to grow to $2.73 billion by 2033. The region's rich culinary heritage and tradition of incorporating wine into dishes facilitate sustained demand.Asia Pacific Cooking Wine Market Report:

In 2023, the Asia Pacific region's cooking wine market is valued at $0.87 billion, projected to grow to $1.40 billion by 2033. This growth is driven by the increasing popularity of Western culinary practices in countries like China and India, alongside a growing appreciation for gourmet cooking.North America Cooking Wine Market Report:

North America holds a significant portion of the market, with a value of $1.84 billion in 2023, projected to reach $2.94 billion by 2033. The growing trend of home cooking and the expansion of online retail channels contribute to robust market growth.South America Cooking Wine Market Report:

The South American cooking wine market is valued at $0.51 billion in 2023, expected to reach $0.82 billion by 2033. The region exhibits a burgeoning interest in culinary arts, particularly in Argentina and Brazil, stimulating demand for cooking wines.Middle East & Africa Cooking Wine Market Report:

The Middle East and Africa market is valued at $0.27 billion in 2023, expected to grow to $0.42 billion by 2033. The rising middle class and growing interest in culinary experiences drive market expansion in this diverse region.Tell us your focus area and get a customized research report.

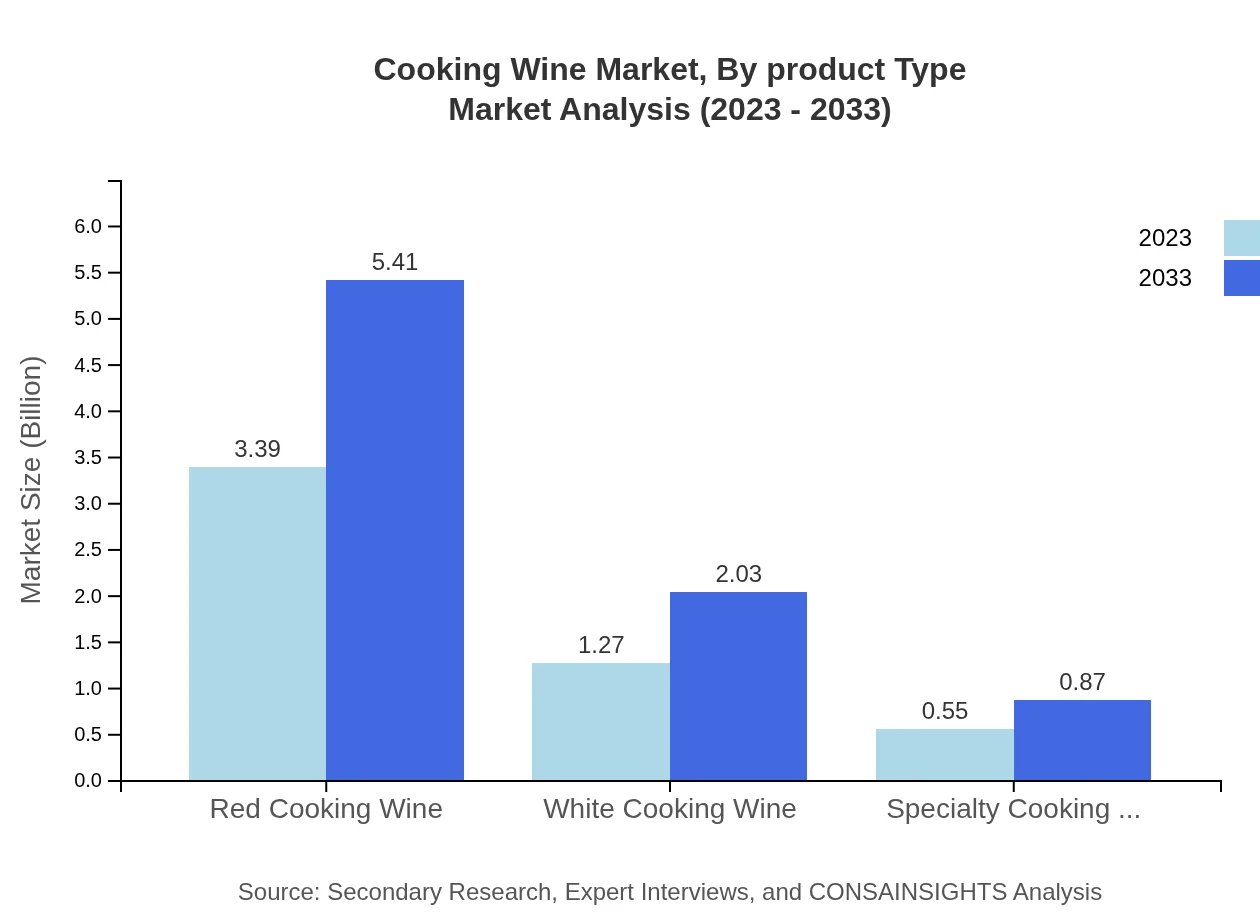

Cooking Wine Market Analysis By Product Type

The cooking wine market showcases distinct segments based on product types: Red cooking wine generates significant revenue, valued at $3.39 billion in 2023 with growth to $5.41 billion by 2033, representing 65.12% market share. White cooking wine also commands attention with a projected growth from $1.27 billion to $2.03 billion, holding 24.39% share, while specialty cooking wines are anticipated to rise from $0.55 billion to $0.87 billion, representing 10.49% market share.

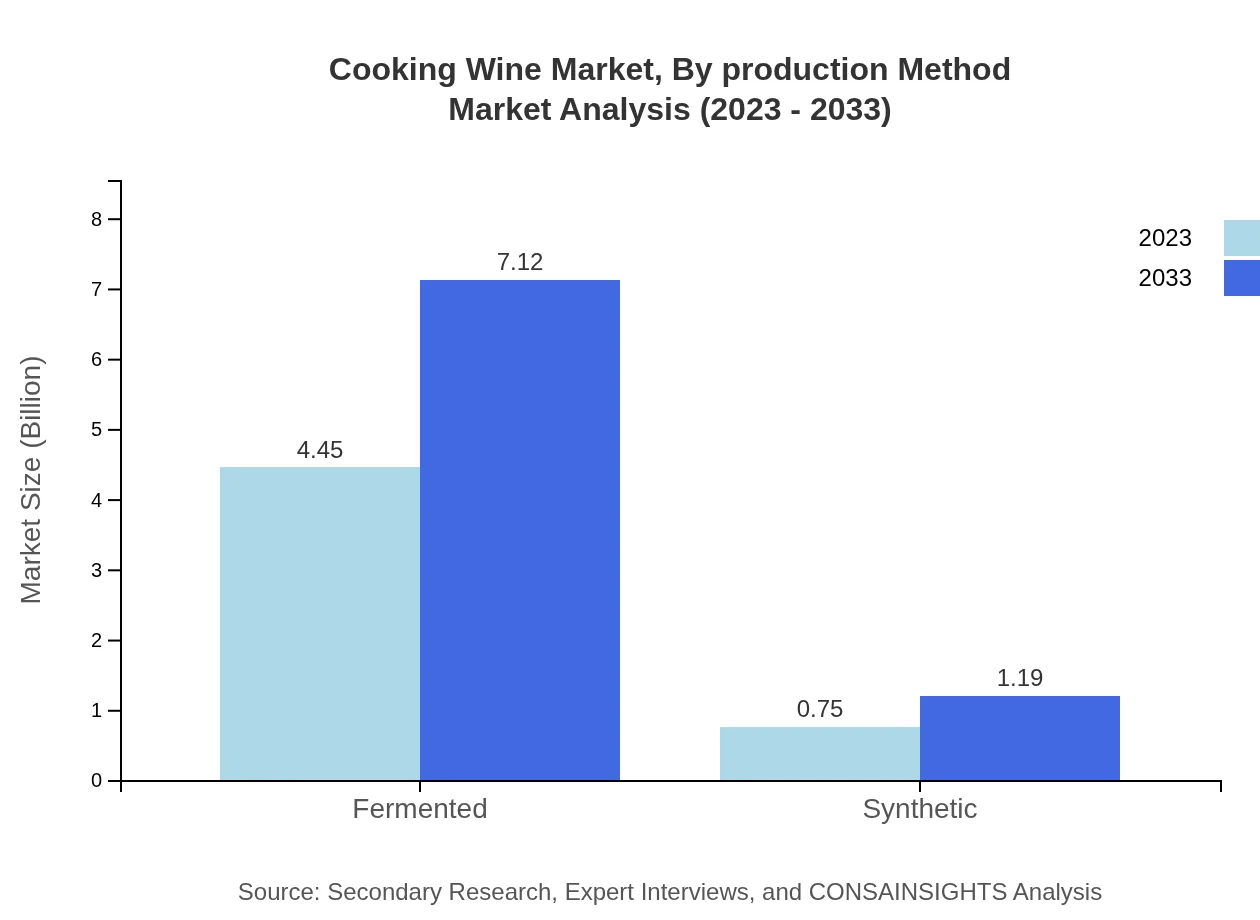

Cooking Wine Market Analysis By Production Method

The cooking wine market is divided into fermented and synthetic segments. The fermented category dominates, contributing significantly to flavor profiles, while the synthetic segment serves as an alternative, driven by convenience and cost-effectiveness. Demand for fermented cooking wines is expected to solidify its market share as consumers prioritize authenticity.

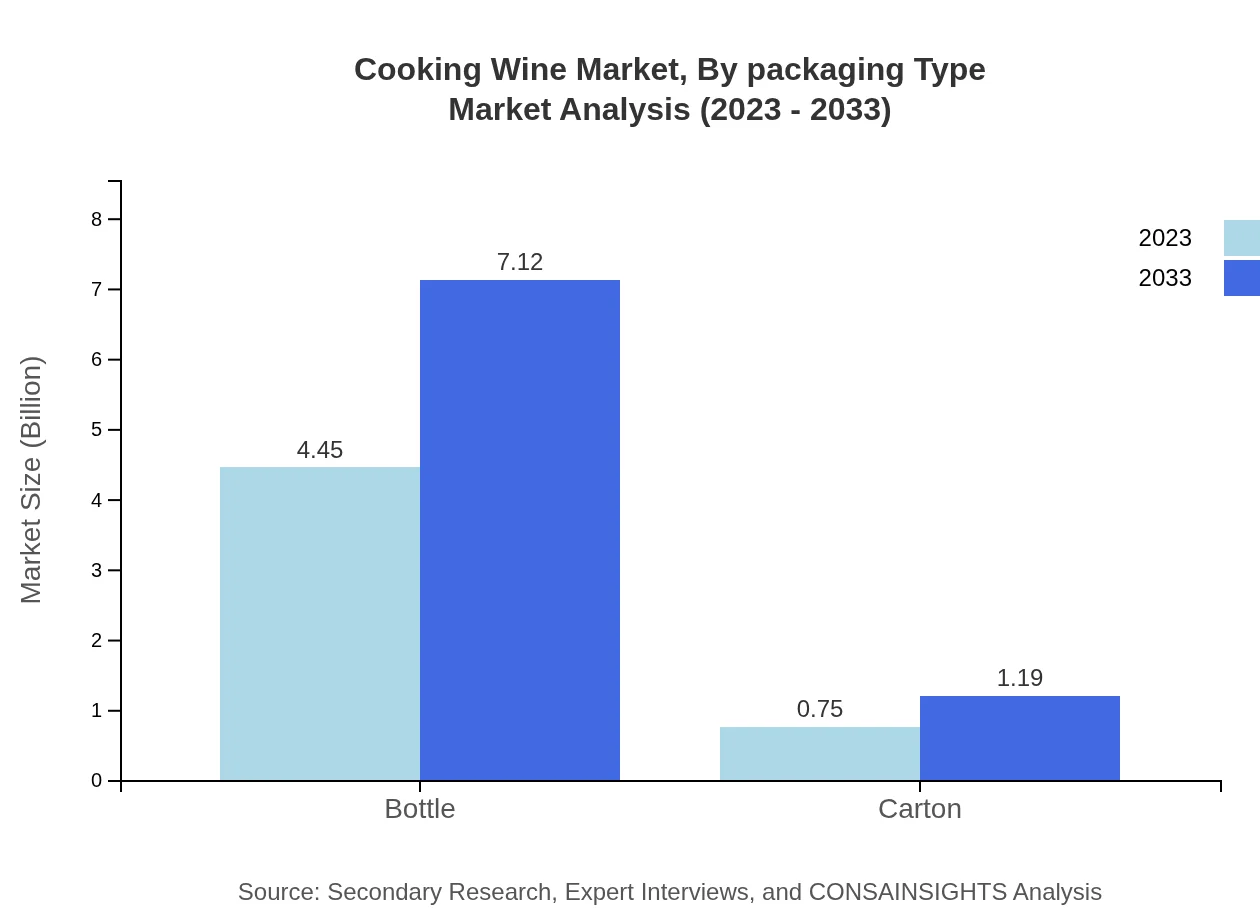

Cooking Wine Market Analysis By Packaging Type

Packaging plays a critical role in the cooking wine market's dynamics, with bottle packaging leading in market share at 85.67%, amounting to $4.45 billion in 2023 and expected to climb to $7.12 billion by 2033. Carton packaging trails with a significant share at 14.33%, projected to grow from $0.75 billion to $1.19 billion, catering to varying consumer preferences.

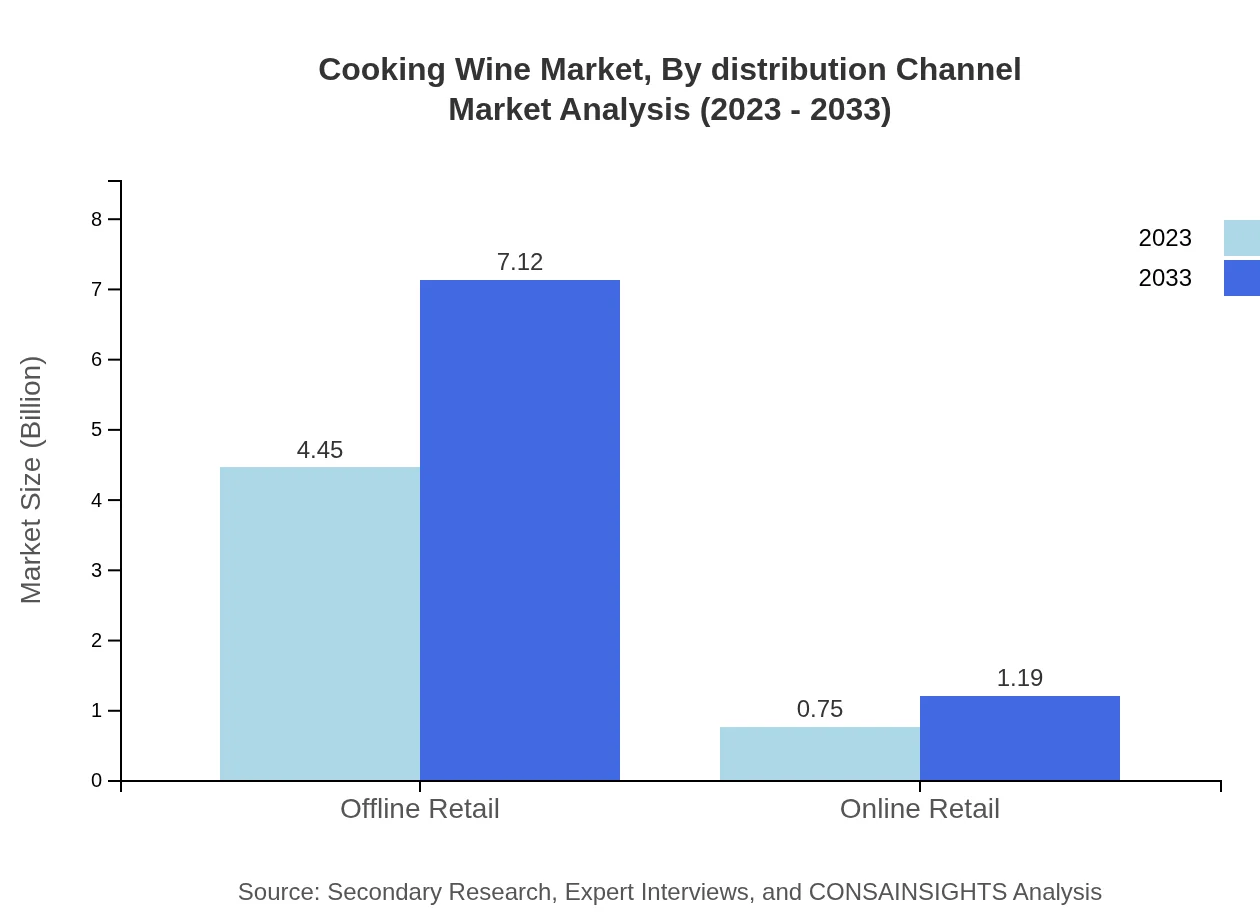

Cooking Wine Market Analysis By Distribution Channel

Distribution channels are vital in shaping consumer access to cooking wine. Offline retail accounts for $4.45 billion (85.67% share) in 2023, while online retail, currently valued at $0.75 billion (14.33% share), is poised for rapid growth, responding to shifting consumer buying habits.

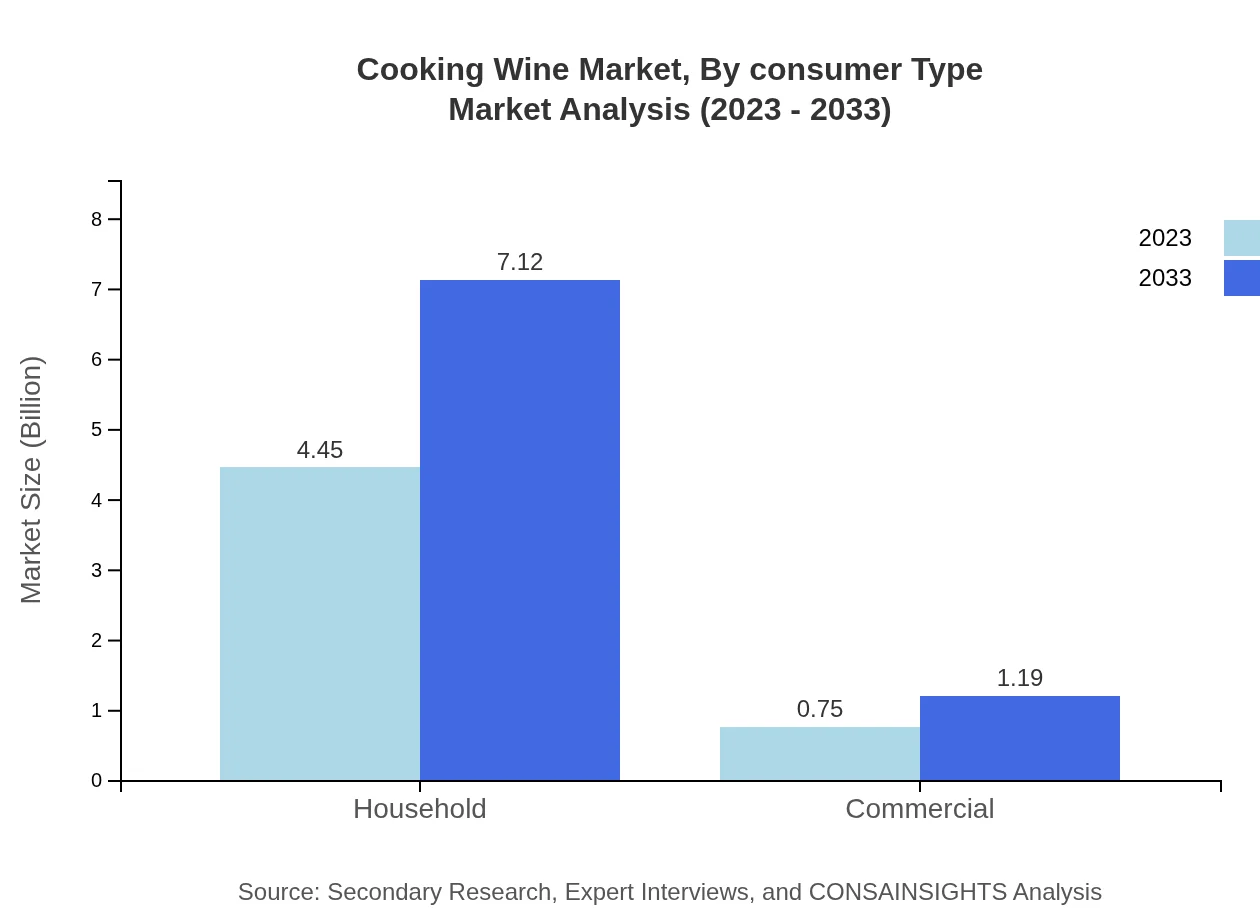

Cooking Wine Market Analysis By Consumer Type

The cooking wine market serves both household and commercial consumers. The household segment dominates, with a staggering 85.67% market share, estimated at $4.45 billion in 2023, forecasted to reach $7.12 billion by 2033. The commercial segment, though smaller at 14.33%, represents an important growth area, rising from $0.75 billion to $1.19 billion.

Cooking Wine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cooking Wine Industry

E&J Gallo Winery:

A leader in the wine industry, E&J Gallo boasts an extensive portfolio of cooking and culinary wines known for their quality and accessibility.Constellation Brands:

Constellation Brands is a significant player in the global wine market, producing a range of cooking wines that appeal to both gourmet chefs and home cooks.Pernod Ricard:

Pernod Ricard, famous for its international brands offers a portfolio of high-quality cooking wines that fit diverse culinary uses.Kraft Heinz:

Kraft Heinz offers specialty cooking wines, leveraging its strong presence in the food industry to enhance culinary experiences.Carojevic Winery:

A niche player, Carojevic Winery focuses on artisanal cooking wines that cater to upscale culinary markets.We're grateful to work with incredible clients.

FAQs

What is the market size of cooking Wine?

The global cooking-wine market is projected to grow from approximately $5.2 billion in 2023, with a CAGR of 4.7% expected until 2033. This growth reflects increasing consumer interest in culinary arts and premium cooking ingredients.

What are the key market players or companies in the cooking Wine industry?

Key players in the cooking-wine market include large wineries and food manufacturers. These companies typically offer a variety of cooking wines ranging from red and white cooking wines to specialty options, catering to diverse culinary needs.

What are the primary factors driving the growth in the cooking Wine industry?

Growth is driven by rising demand for gourmet and home-cooked meals, increasing culinary tourism, and the popularity of wine in cooking. Additionally, health trends promoting wine's benefits in food preparation contribute to this upward trajectory.

Which region is the fastest Growing in the cooking Wine?

Currently, North America leads the cooking-wine market at $1.84 billion in 2023, expanding to $2.94 billion by 2033. Europe follows closely with significant growth, moving from $1.71 billion to $2.73 billion in the same period.

Does ConsaInsights provide customized market report data for the cooking Wine industry?

Yes, ConsaInsights offers tailored market reports for the cooking-wine industry, allowing clients to access specific data, trends, and forecasts aligned with their strategic needs and operational focuses.

What deliverables can I expect from this cooking Wine market research project?

Clients can expect comprehensive reports including market size analytics, growth forecasts, competitive landscape assessments, consumer behavior insights, and tailored data visualizations, providing a clear overview of the cooking-wine market.

What are the market trends of cooking Wine?

Market trends include a growing preference for premium and organic cooking wines, increased online sales, and innovative packaging solutions. The rise of culinary enthusiasts is also influencing the diversification of cooking wine types available in the market.