Copper Cathode Market Report

Published Date: 02 February 2026 | Report Code: copper-cathode

Copper Cathode Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Copper Cathode market, focusing on market size, trends, and regional insights from 2023 to 2033. It offers forecasts, segment breakdowns, and identifies key players, delivering valuable data and projections for stakeholders in this sector.

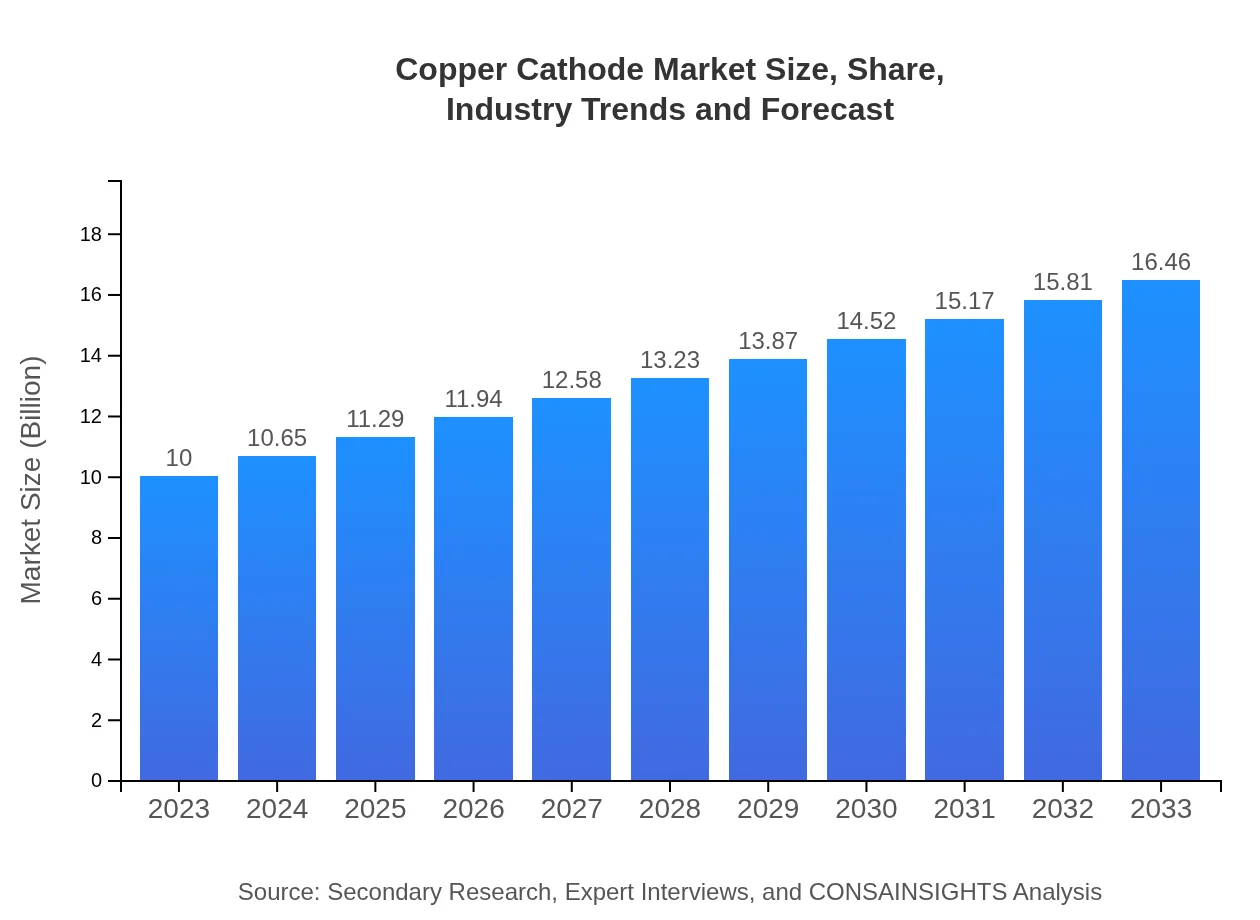

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Southern Copper Corporation, BHP Group Limited, Freeport-McMoRan Inc. |

| Last Modified Date | 02 February 2026 |

Copper Cathode Market Overview

Customize Copper Cathode Market Report market research report

- ✔ Get in-depth analysis of Copper Cathode market size, growth, and forecasts.

- ✔ Understand Copper Cathode's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Copper Cathode

What is the Market Size & CAGR of Copper Cathode market in 2033?

Copper Cathode Industry Analysis

Copper Cathode Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Copper Cathode Market Analysis Report by Region

Europe Copper Cathode Market Report:

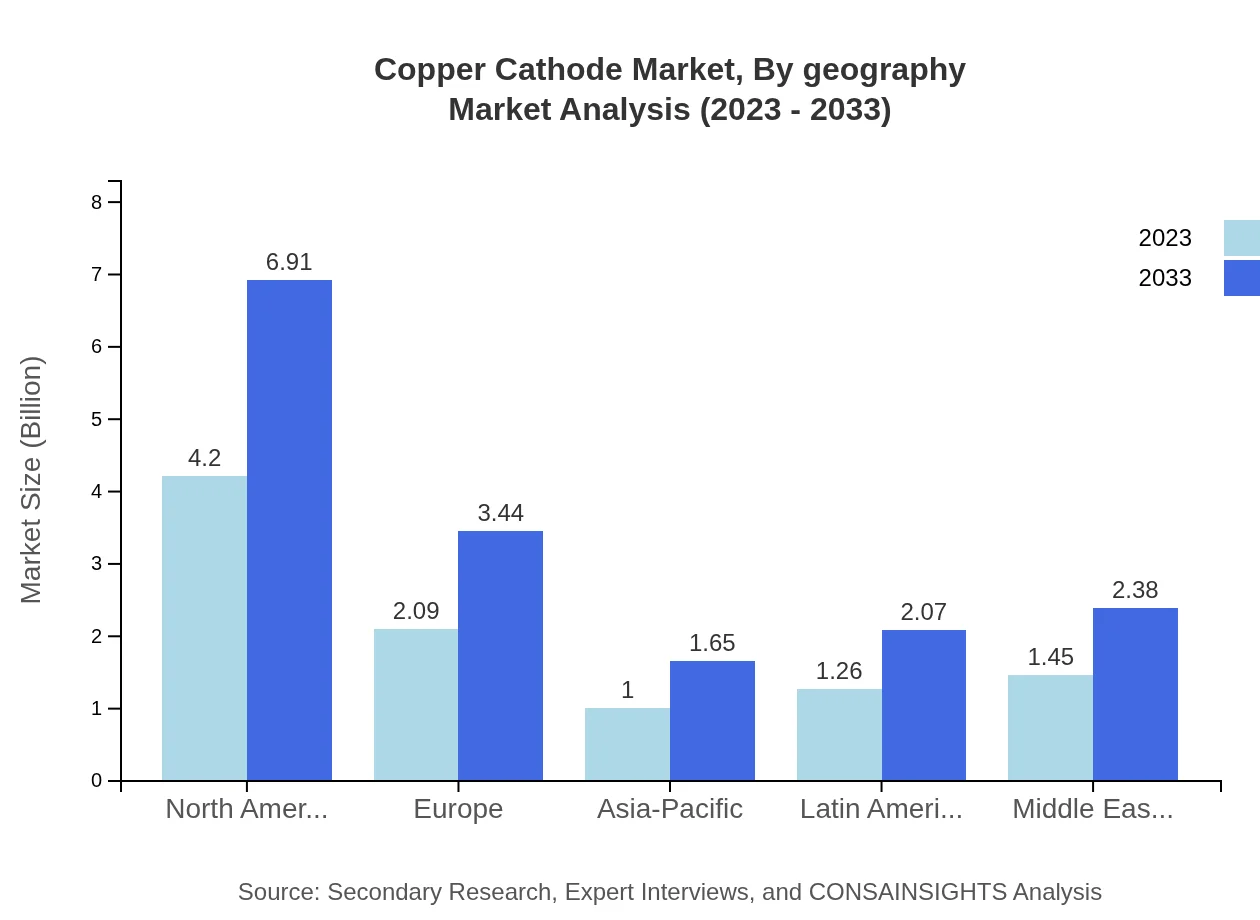

Europe's copper cathode market is primed for growth, anticipated to rise from $3.10 billion in 2023 to $5.11 billion by 2033. The region's focus on sustainable practices and recycling aligns with increasing raw material costs and regulatory pressures.Asia Pacific Copper Cathode Market Report:

The Asia-Pacific region is expected to see remarkable growth, with the market anticipated to grow from $1.76 billion in 2023 to $2.89 billion by 2033. Countries like China and India are major consumers due to rapid industrialization and infrastructure development. The electronics sector in this region also significantly drives demand.North America Copper Cathode Market Report:

The North American market will expand from $3.66 billion in 2023 to an estimated $6.02 billion by 2033. The United States and Canada are key players, with growth fueled by advancements in electrical infrastructure and rising automotive production, integrating more copper components.South America Copper Cathode Market Report:

In South America, the Copper Cathode market is projected to increase from $0.09 billion in 2023 to $0.15 billion by 2033, primarily due to mining activities in countries such as Chile and Peru. These nations are among the top copper producers globally, which positions them favorably in the market.Middle East & Africa Copper Cathode Market Report:

The Middle East and Africa's market is expected to grow from $1.39 billion in 2023 to $2.28 billion by 2033. Infrastructure development across countries in this region is spurring demand, alongside rising investments in electrical and renewable energy projects.Tell us your focus area and get a customized research report.

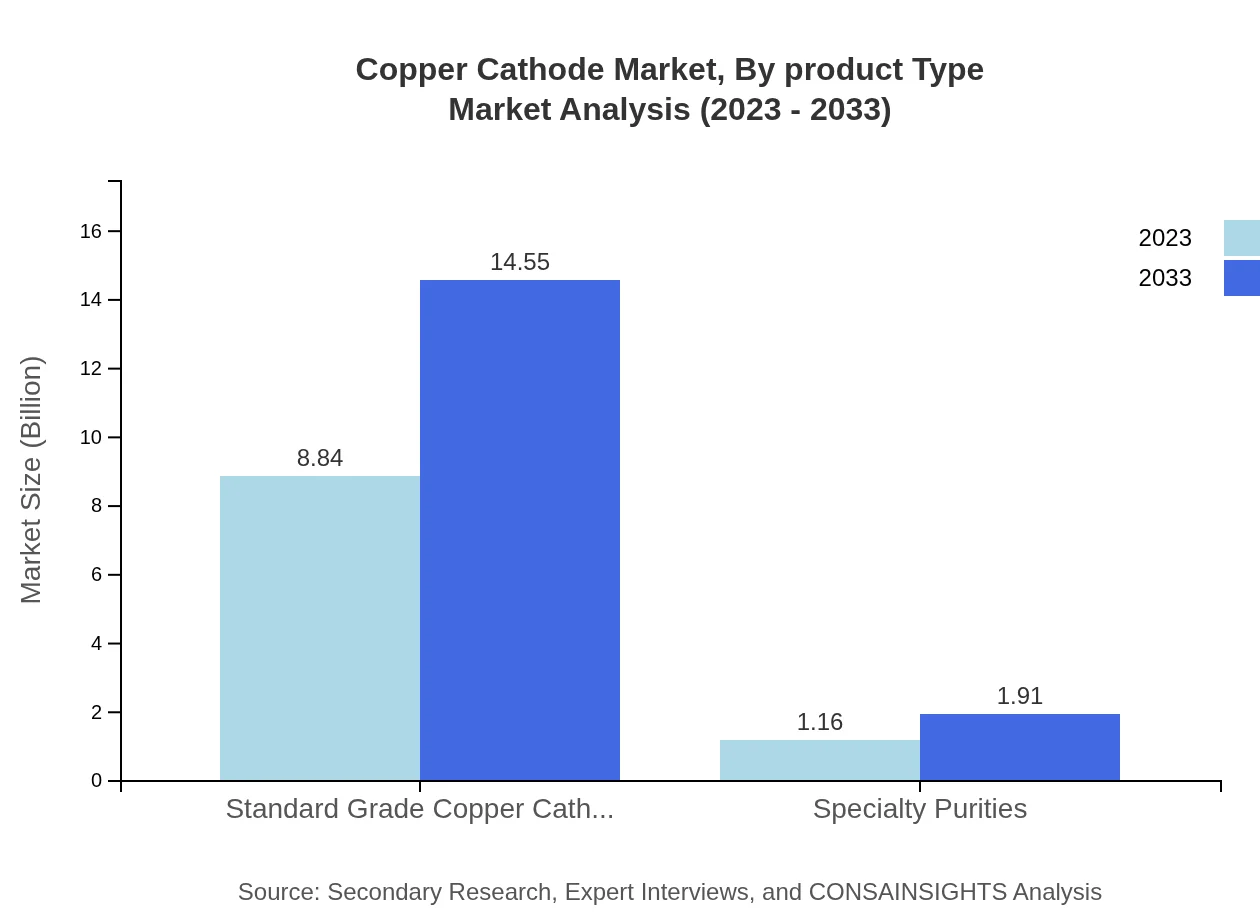

Copper Cathode Market Analysis By Product Type

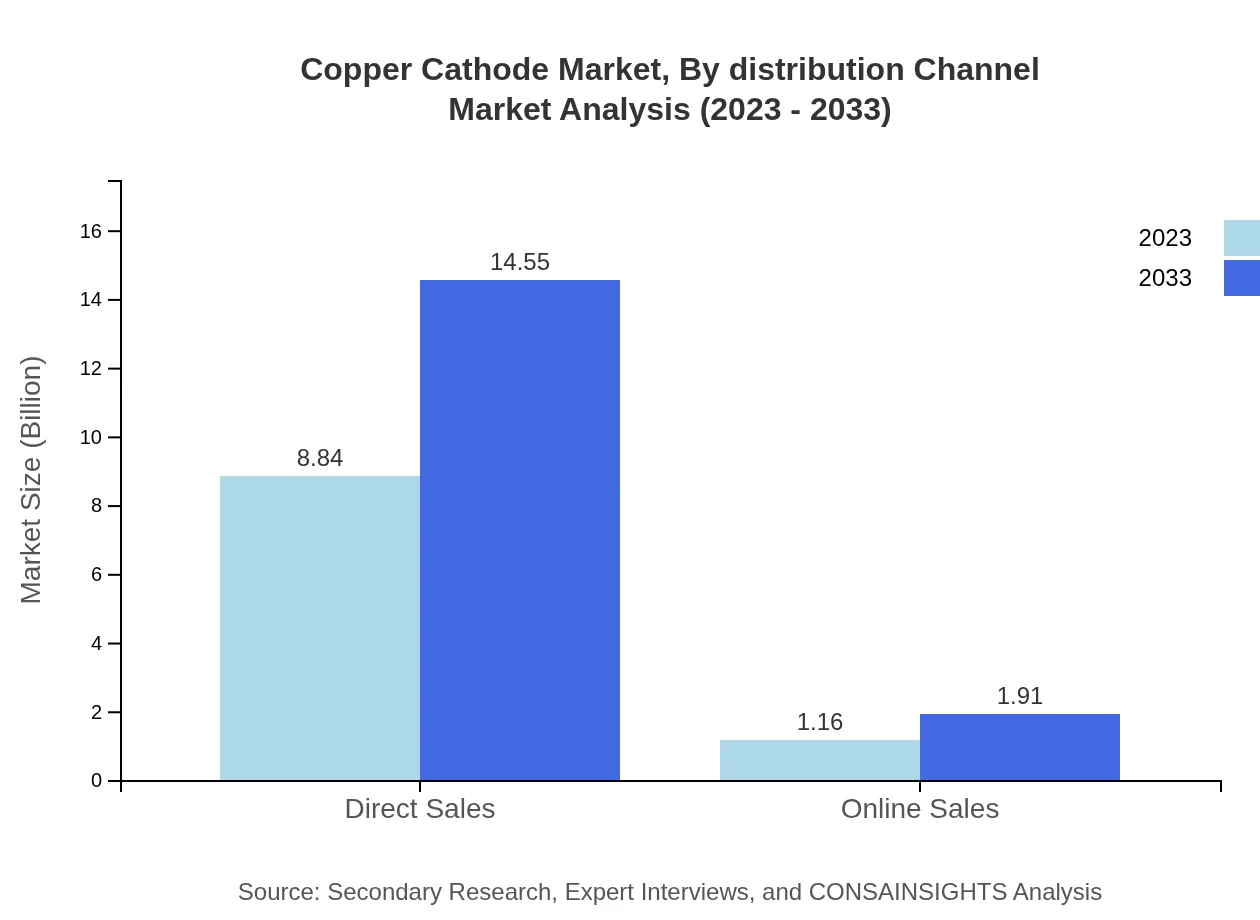

In 2023, the standard grade copper cathode market size is estimated at $8.84 billion, projected to reach $14.55 billion by 2033, holding an 88.4% market share. Specialty purities are smaller, starting at $1.16 billion in 2023 and rising to $1.91 billion by 2033, with an 11.6% market share. The dominance of standard grade indicates its crucial application across various industries.

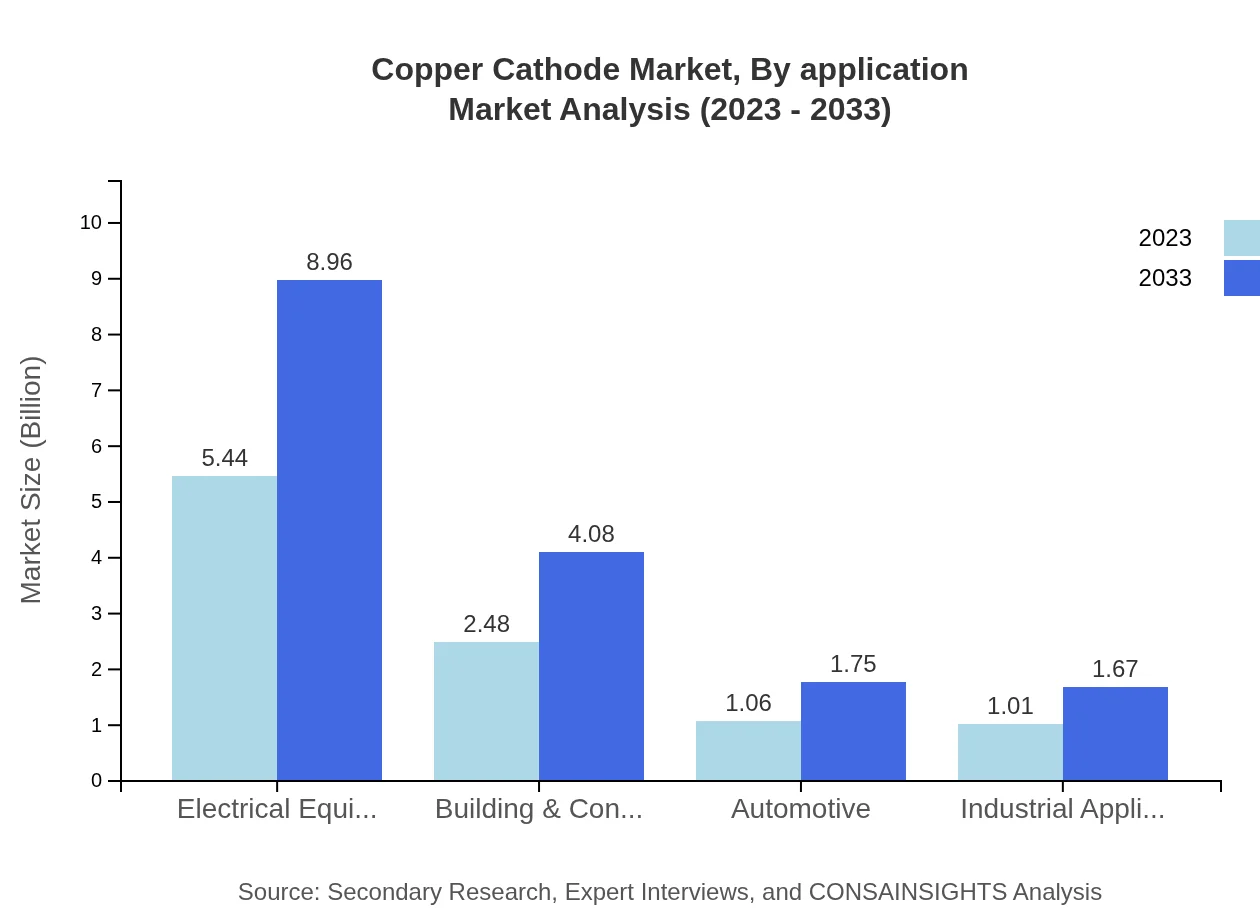

Copper Cathode Market Analysis By Application

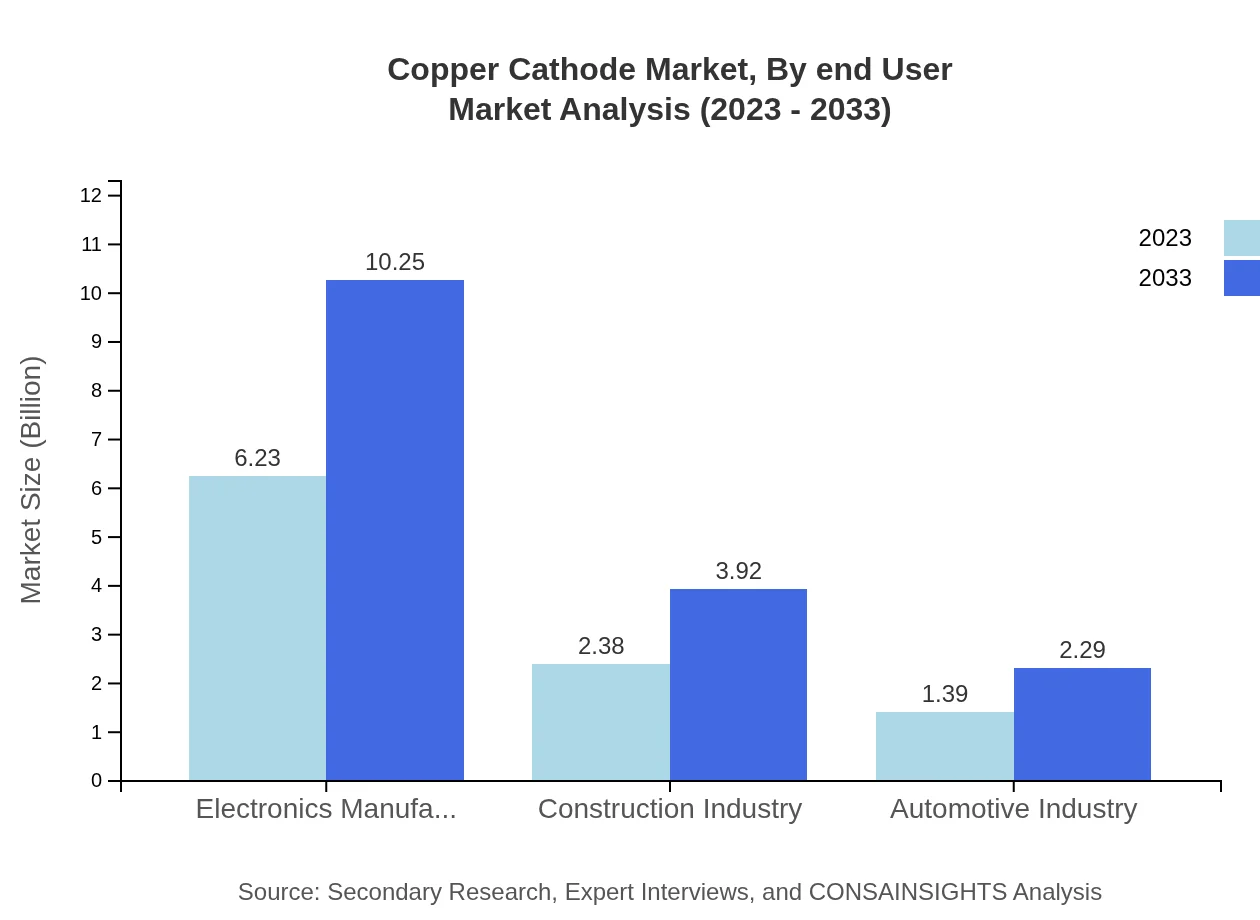

The electronics manufacturing sector leads, with a market size of $6.23 billion in 2023, anticipated to reach $10.25 billion by 2033, accounting for 62.27% market share. Construction follows, beginning at $2.38 billion and increasing to $3.92 billion, while automotive and industrial applications exhibit growth, indicating their importance as end users of copper cathode.

Copper Cathode Market Analysis By End User

The market segments include the electrical equipment sector which dominates with a market size of $5.44 billion in 2023, expected to grow to $8.96 billion, capturing 54.42%. Other sectors like building & construction, which stands at $2.48 billion, also show significant potential for growth. This diversification of end-users highlights copper's versatile applications.

Copper Cathode Market Analysis By Distribution Channel

Direct sales dominate the market with $8.84 billion in 2023, rising to $14.55 billion by 2033 while maintaining an 88.4% market share. Online sales, while currently smaller at $1.16 billion, are projected to reach $1.91 billion, reflecting a shift toward digital marketing and sales strategies in the industry.

Copper Cathode Market Analysis By Geography

Geographical segmentation shows North America leading with a size of $4.20 billion in 2023, then estimated at $6.91 billion by 2033. Europe and Asia-Pacific also show robust growth, with share percentages reflecting regional industry maturity and demand elasticity in the face of global economic trends.

Copper Cathode Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Copper Cathode Industry

Southern Copper Corporation:

One of the largest integrated copper producers in the world, Southern Copper Corporation operates mining, smelting, and refining facilities in the Americas and benefits from its strategic location and resource access.BHP Group Limited:

BHP is among the largest mining companies and has significant operations in copper production, consistently focusing on sustainability and operational excellence across its varied global sites.Freeport-McMoRan Inc.:

A leading international mining company, Freeport-McMoRan is heavily involved in copper production and is noted for its innovative extraction methods and investments in community development.We're grateful to work with incredible clients.

FAQs

What is the market size of copper Cathode?

The global copper cathode market was valued at approximately $10 billion in 2023, with a projected growth rate of 5% CAGR until 2033. By 2033, the market size is anticipated to exhibit significant expansion, reflecting increased demand and investment.

What are the key market players or companies in the copper Cathode industry?

Key players in the copper-cathode industry include major mining and metallurgical firms. These companies continually compete and innovate, focusing on sustainability and efficiency, which creates a dynamic market landscape.

What are the primary factors driving the growth in the copper cathode industry?

The growth of the copper cathode industry is driven by increased electrification, demand from renewable energy sectors, and technological advancements in manufacturing processes. Additionally, the construction and automotive industries are substantial contributors to demand.

Which region is the fastest Growing in the copper cathode market?

North America is projected to be the fastest-growing region, expanding from a market size of $3.66 billion in 2023 to approximately $6.02 billion by 2033. Following North America, Europe and Asia-Pacific also show considerable growth potential.

Does ConsaInsights provide customized market report data for the copper cathode industry?

Yes, ConsaInsights offers tailored market reports to cater to specific research needs within the copper cathode industry. Customized reports can include detailed analysis of market dynamics and regional trends.

What deliverables can I expect from this copper cathode market research project?

Deliverables from the copper cathode market research project may include comprehensive reports detailing market size, growth forecasts, segment analysis, regional insights, competitive landscape, and actionable strategies for market entry or expansion.

What are the market trends of the copper cathode industry?

Current market trends in the copper cathode industry include increasing adoption of electric vehicles, heightened focus on renewable energy, and innovations in recycling processes. Sustainability remains a key driver influencing market strategies and consumer preferences.