Coring

Published Date: 02 February 2026 | Report Code: coring

Coring Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the Coring market for the period 2024–2033, offering insights into market size, growth dynamics, regional performance, technological shifts, and product segmentation. It details industry trends, competitive landscapes, and strategic initiatives undertaken by leading companies, providing investors and stakeholders with a data-driven forecast and an in‐depth understanding of the future opportunities in this evolving market.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

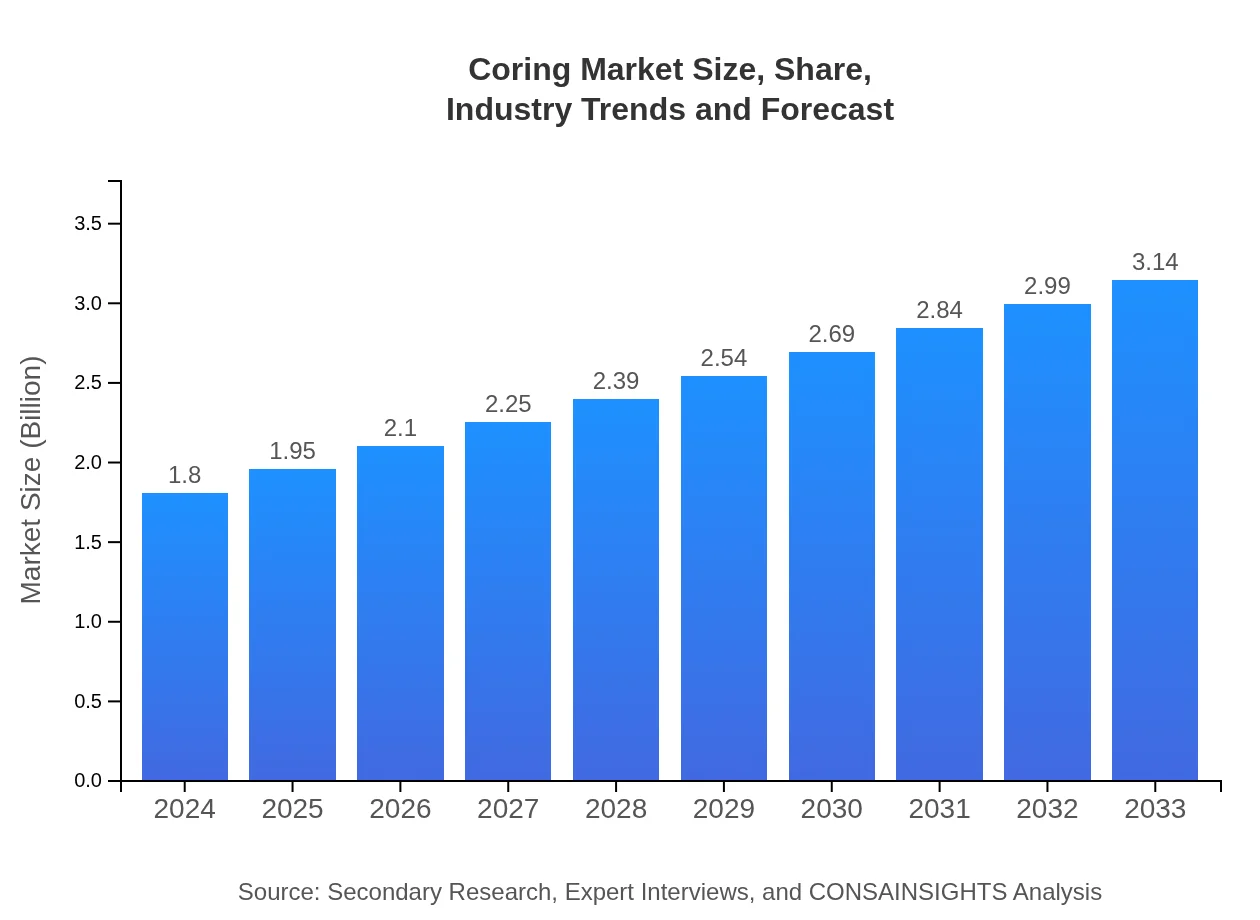

| 2024 Market Size | $1.80 Billion |

| CAGR (2024-2033) | 6.2% |

| 2033 Market Size | $3.14 Billion |

| Top Companies | DrillTech Innovations, Coring Solutions Inc., GeoCore Systems |

| Last Modified Date | 02 February 2026 |

Coring Market Overview

Customize Coring market research report

- ✔ Get in-depth analysis of Coring market size, growth, and forecasts.

- ✔ Understand Coring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Coring

What is the Market Size & CAGR of Coring market in 2024?

Coring Industry Analysis

Coring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Coring Market Analysis Report by Region

Europe Coring:

Europe is experiencing a positive shift towards sustainable and efficient drilling practices, with the market size expanding from 0.49 in 2024 to 0.85 in 2033. The region places a strong emphasis on technology adoption and stringent safety protocols, prompting companies to innovate continually. Government initiatives and robust industrial policies further underpin this growth, making Europe a critical market for advanced coring solutions.Asia Pacific Coring:

In the Asia Pacific region, the market has steadily expanded, with the market size increasing from 0.37 in 2024 to 0.65 in 2033. This growth is driven by rapid industrialization, significant infrastructure investments, and early adoption of automated drilling technologies. Countries in this region are focusing on modernizing their coring techniques and are supported by government policies that encourage high-tech investments, thereby fostering a conducive environment for market expansion.North America Coring:

North America continues to show a robust performance in the Coring market, with its market size expected to climb from 0.65 in 2024 to 1.14 in 2033. The region benefits from mature infrastructure, well-established regulatory frameworks, and considerable investment in R&D, all of which contribute to stable growth and the introduction of advanced drilling solutions.South America Coring:

South America is witnessing moderate growth as the market gradually evolves with increasing exploration activities and improved drilling methodologies. Although the overall market size is smaller relative to other regions, steady improvements in operational efficiencies and an influx of innovative technologies have bolstered market progress, presenting emerging opportunities for regional investors.Middle East & Africa Coring:

The Middle East and Africa exhibit promising growth potential with market values increasing from 0.17 in 2024 to 0.29 in 2033. This expansion is fueled by increased investments in energy and infrastructure projects, along with the gradual assimilation of modern drilling technologies. Despite certain economic and political challenges, the region is emerging as a key player in the global Coring market.Tell us your focus area and get a customized research report.

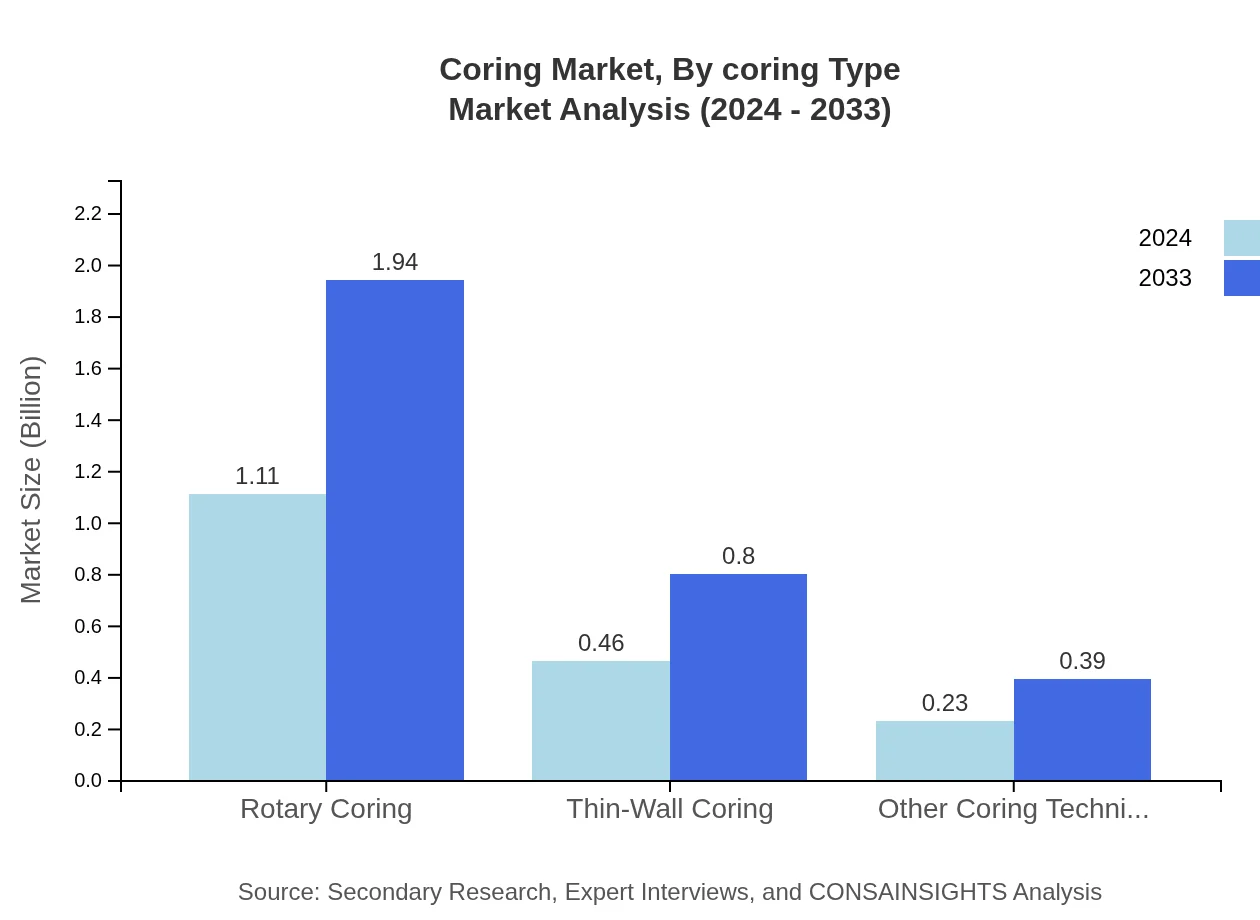

Coring Market Analysis By Coring Type

The segment by coring type encompasses a range of products that are vital to drilling operations. Core drilling rigs lead this category, demonstrating significant growth as market size is projected to move from 1.11 in 2024 to 1.94 in 2033 while maintaining a dominant share of 61.84%. In addition, core barrels and core sampling tools, which hold fixed market shares of 25.63% and 12.53% respectively, continue to benefit from incremental technological enhancements. These advancements ensure that each product type remains competitive and capable of meeting the evolving needs of modern drilling operations, thereby reinforcing overall market stability.

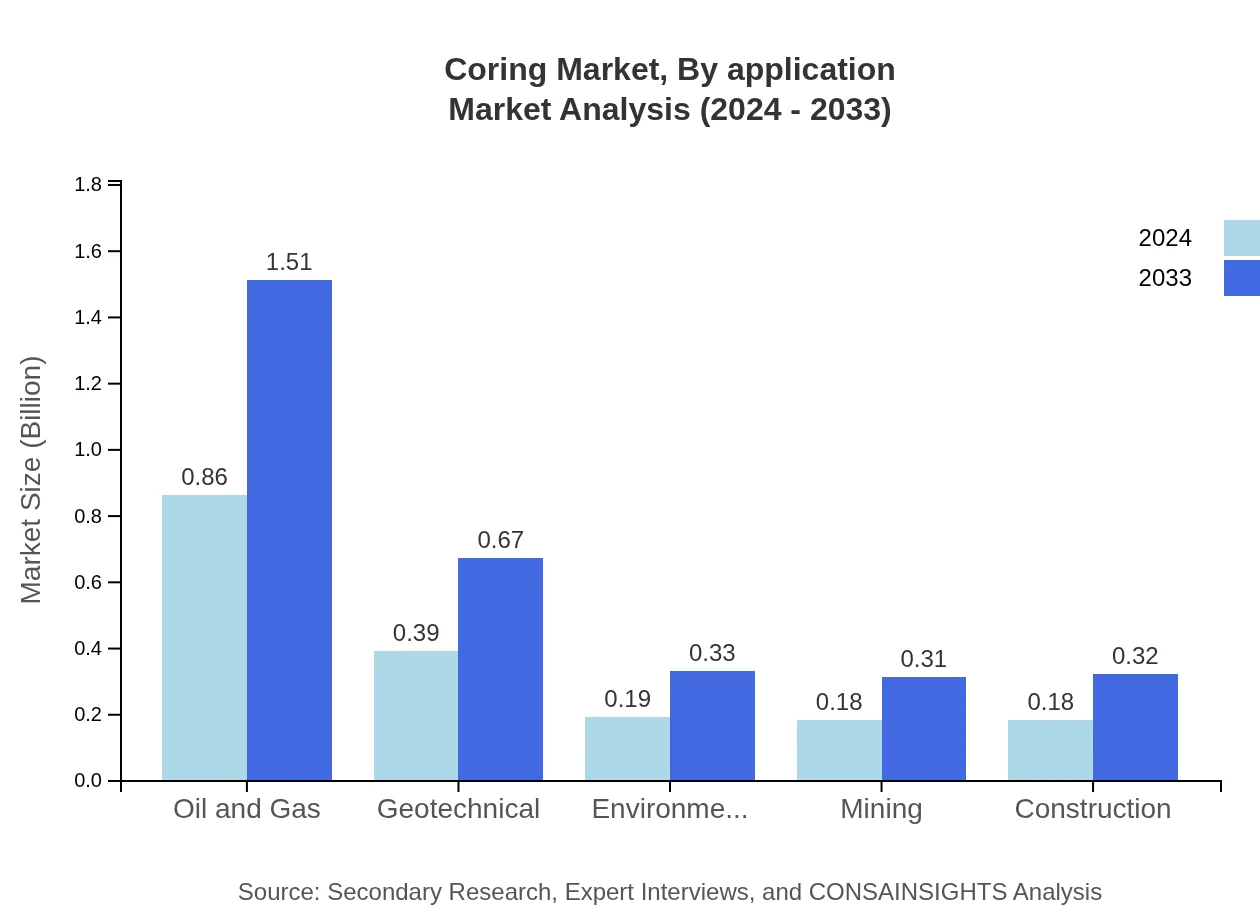

Coring Market Analysis By Application

The application segment of the Coring market is diverse, covering areas such as oil and gas, geotechnical studies, environmental monitoring, mining, and construction. The oil and gas sector is a key contributor, with its market share standing at 48.02%, as reflected by growth from 0.86 in 2024 to 1.51 in 2033. Other application areas maintain robust demand with shares of 21.5% for geotechnical uses, 10.37% for environmental projects, 10.04% for mining, and 10.07% for construction. This segmented approach enables companies to tailor their products and strategies to match specific industry needs, ensuring targeted and effective market penetration.

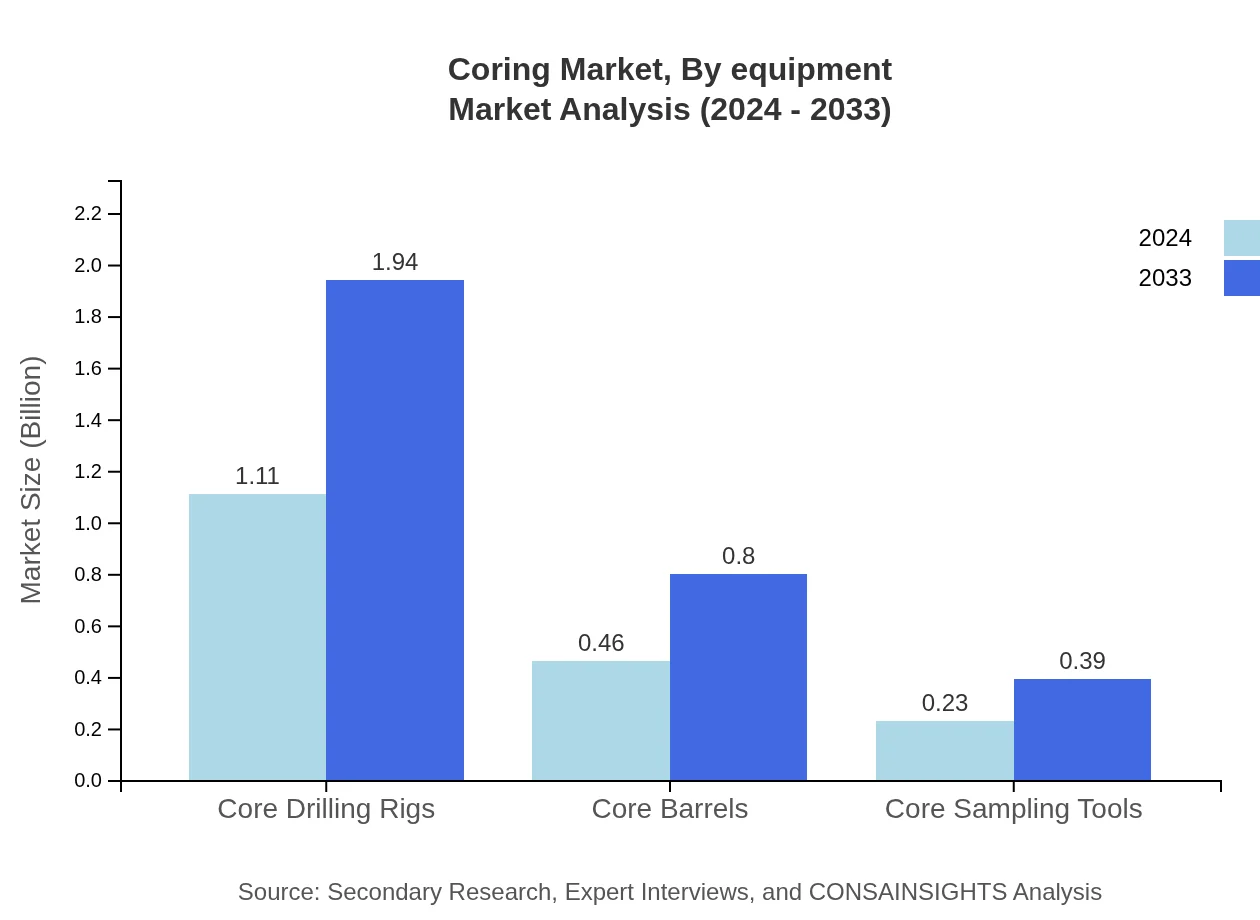

Coring Market Analysis By Equipment

This segment focuses on the performance of various drilling equipment types, including rotary coring, thin-wall coring, and other specialized coring techniques. Rotary coring holds a commanding market share of 61.84% and has shown impressive growth from 1.11 in 2024 to 1.94 in 2033. Thin-wall coring, with a steady share of 25.63%, and other coring techniques, maintaining a share of 12.53%, complement the overall equipment portfolio by offering niche technological advantages. The continual evolution in equipment design, influenced by precision engineering and automation, ensures that manufacturers can respond effectively to the increasing complexities of drilling operations.

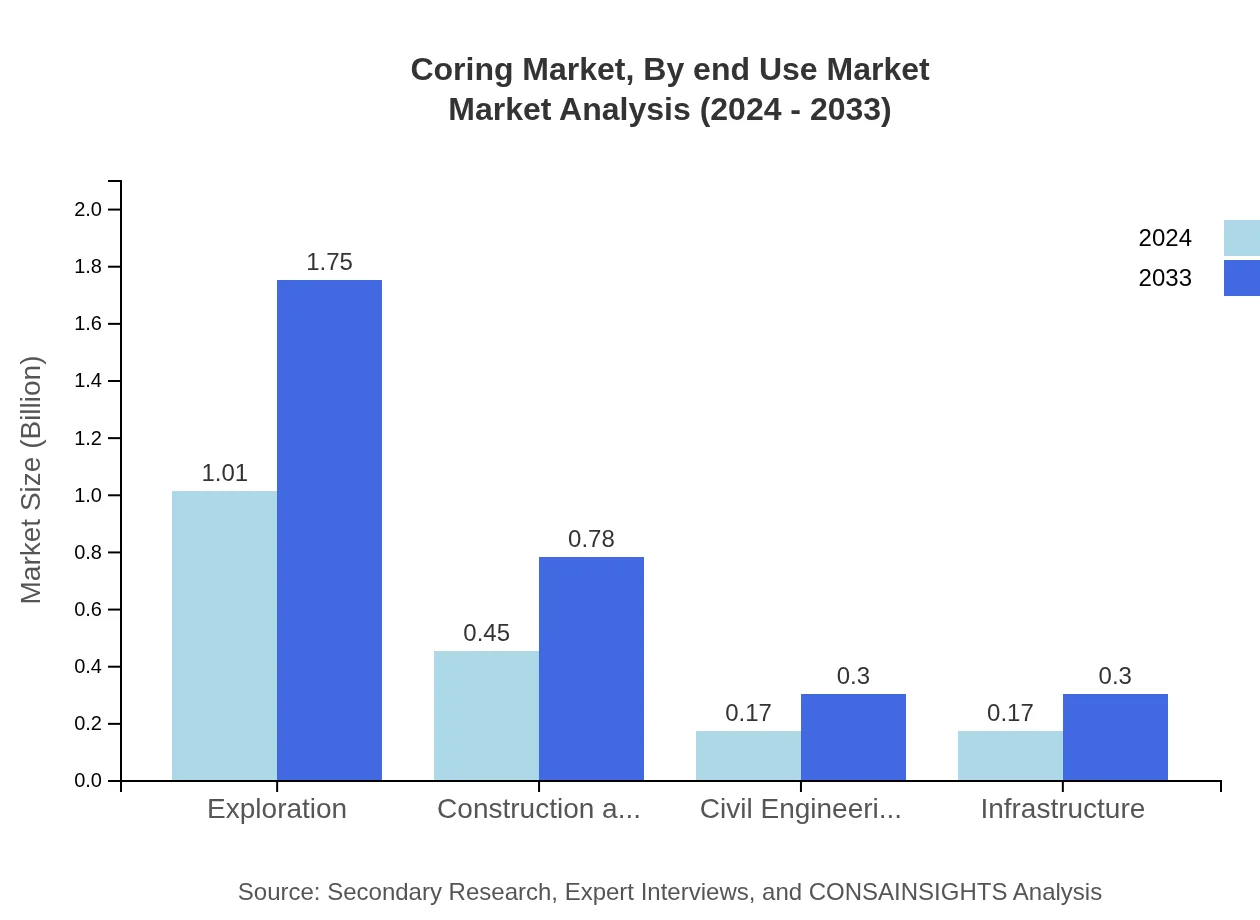

Coring Market Analysis By End Use Market

The end-use segment separates the market into critical areas such as exploration, construction and building, civil engineering, and infrastructure projects. Exploration is at the forefront with a market size growing from 1.01 in 2024 to 1.75 in 2033 and commanding a substantial share of 55.94%. Meanwhile, the construction and building sector, along with civil engineering and infrastructure, provide integral support by allocating dedicated resources for specialized drilling applications. This diversification within the end-use market helps spread risk and offers multiple revenue streams, enhancing overall market resilience and growth potential.

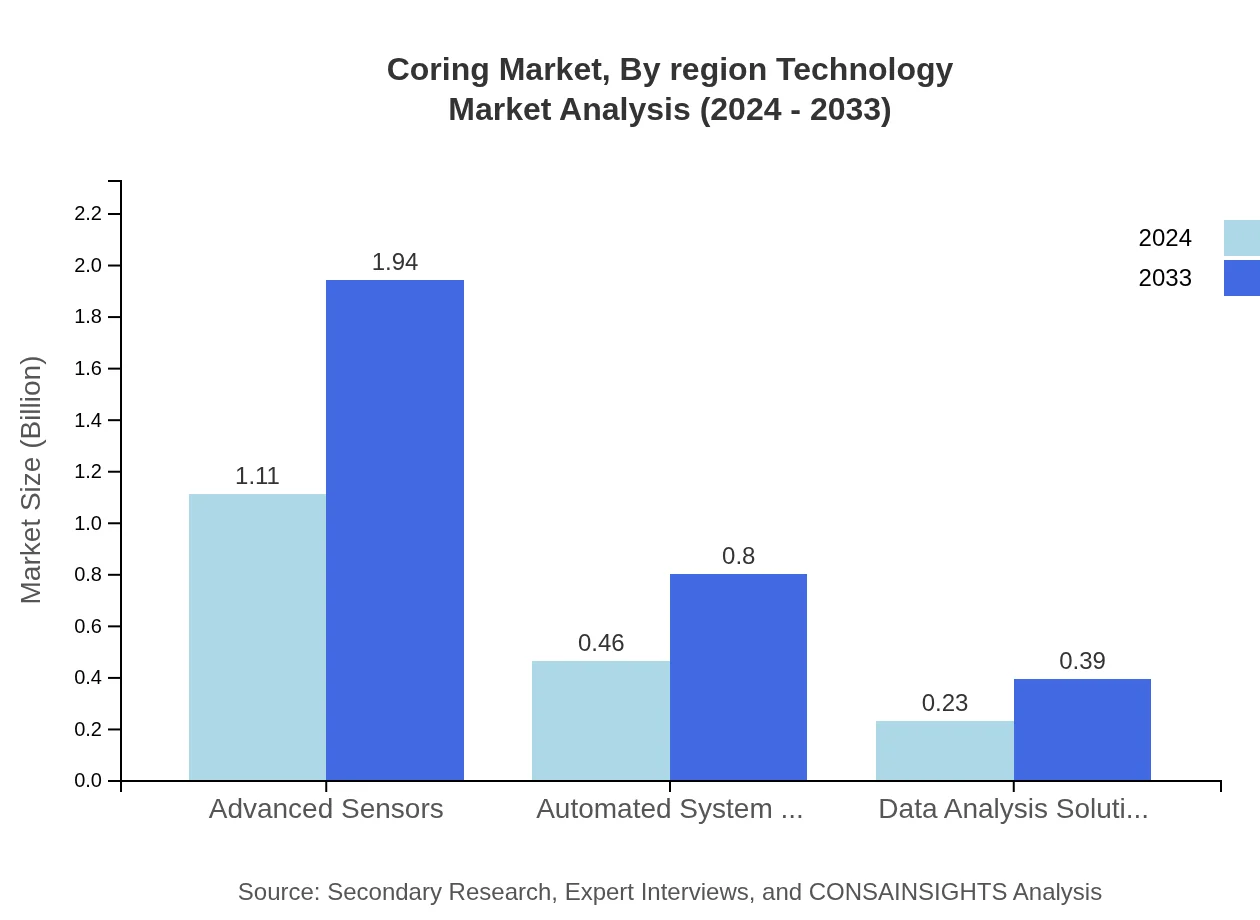

Coring Market Analysis By Region Technology

Technology is a critical driver in the Coring market, with segments focusing on advanced sensors, automated system technologies, and data analysis solutions. Advanced sensors, boasting a market share of 61.84%, are instrumental in ensuring real-time monitoring and improved operational precision. Automated systems, with a share of 25.63%, streamline workflows and reduce manual errors, while data analysis solutions, capturing a 12.53% share, empower companies with actionable insights. Collectively, these technological innovations are revolutionizing traditional drilling practices, ensuring that operations are more efficient, adaptable, and future-proof in a competitive landscape.

Coring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Coring Industry

DrillTech Innovations:

DrillTech Innovations is recognized globally for its breakthrough drilling solutions and continual focus on research and development. The company’s commitment to integrating advanced technologies with sustainable practices has positioned it as a market leader in the Coring industry.Coring Solutions Inc.:

A pioneer in state-of-the-art coring equipment, Coring Solutions Inc. has driven significant advancements within the industry. Its innovative product portfolio and strategic global partnerships foster market growth and operational excellence.GeoCore Systems:

GeoCore Systems specializes in comprehensive coring solutions that combine precision engineering with cutting-edge data analytics. Their integrated approach has set new benchmarks in operational efficiency and safety standards.We're grateful to work with incredible clients.

FAQs

What is the market size of coring?

The global coring market is projected to reach $1.8 billion by 2033, with a compound annual growth rate (CAGR) of 6.2% from 2024 onward. This growth reflects increasing demands across various industries such as oil and gas, geotechnical, and environmental.

What are the key market players or companies in this coring industry?

Key players in the coring market include leading companies that specialize in drilling equipment, oil and gas services, and geotechnical solutions. Their innovations and service offerings significantly contribute to the market's growth and technology advancement.

What are the primary factors driving the growth in the coring industry?

The growth in the coring industry is driven by factors like increased exploration activities in the oil and gas sector, advancements in drilling technologies, and expanding applications in environmental and construction projects, augmenting demand for coring services.

Which region is the fastest Growing in the coring market?

The fastest-growing region in the coring market is North America, projected to grow from $0.65 billion in 2024 to $1.14 billion by 2033. This growth reflects the region's robust oil and gas exploration activities and technological advancements.

Does Consainsights provide customized market report data for the coring industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the coring industry. This includes in-depth analysis of market trends, competitor insights, and segmentation to help businesses make informed decisions.

What deliverables can I expect from this coring market research project?

Deliverables from a coring market research project include comprehensive reports, data visualizations, market forecasts, competitive landscape analysis, and strategic recommendations tailored to your business goals in the coring sector.

What are the market trends of coring?

Current trends in the coring market include an emphasis on advanced drilling technologies, sustainable practices, and increasing use of automated systems and data analysis solutions that enhance operational efficiency and data accuracy.