Corn Starch Market Report

Published Date: 31 January 2026 | Report Code: corn-starch

Corn Starch Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Corn Starch market, including insights into market size, growth trends, regional dynamics, and competitive landscape. The forecast period extends from 2023 to 2033, offering valuable projections and industry analysis for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

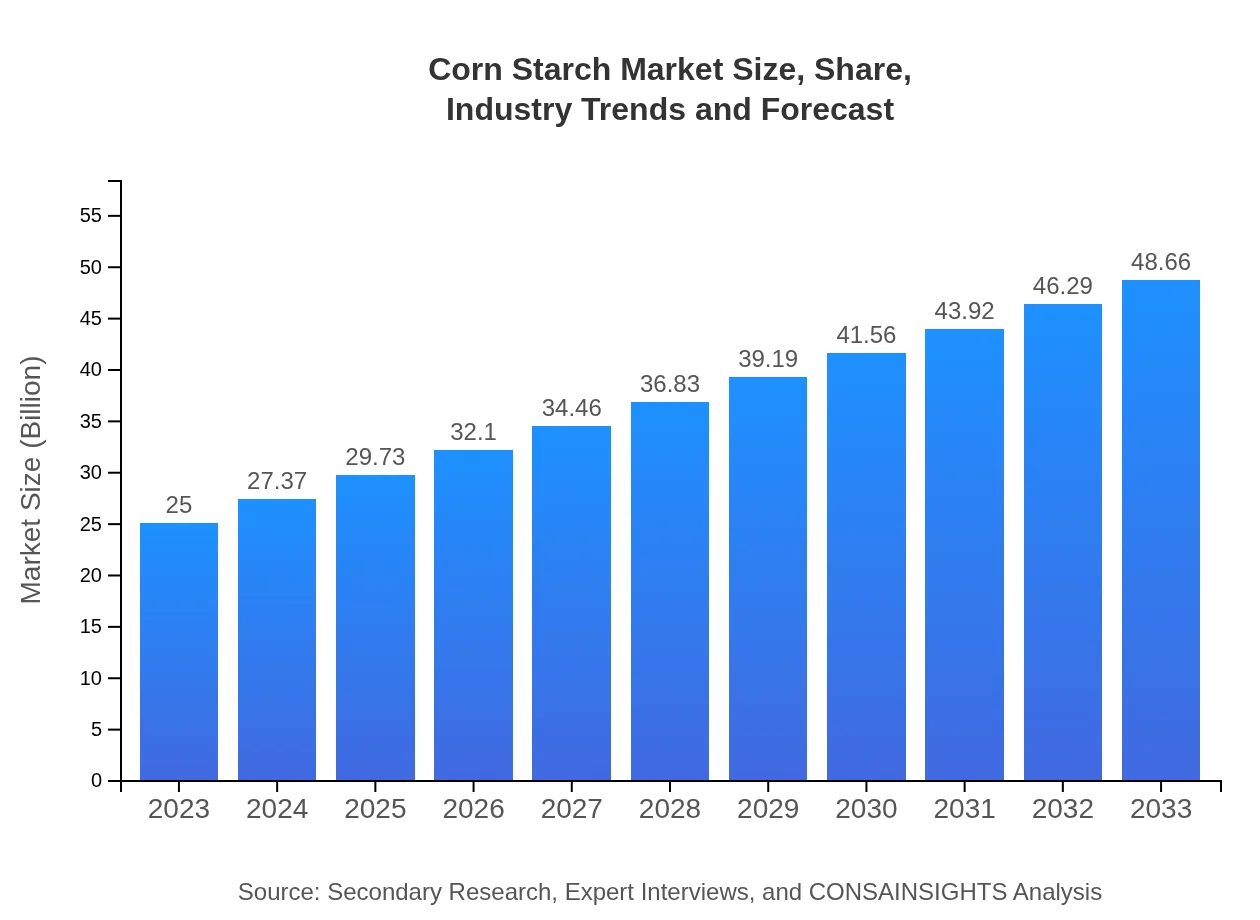

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $48.66 Billion |

| Top Companies | Cargill, Inc., Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle |

| Last Modified Date | 31 January 2026 |

Corn Starch Market Overview

Customize Corn Starch Market Report market research report

- ✔ Get in-depth analysis of Corn Starch market size, growth, and forecasts.

- ✔ Understand Corn Starch's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Corn Starch

What is the Market Size & CAGR of Corn Starch market in 2023?

Corn Starch Industry Analysis

Corn Starch Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Corn Starch Market Analysis Report by Region

Europe Corn Starch Market Report:

Europe's Corn Starch market amounted to $6.92 billion in 2023 and is anticipated to reach $13.47 billion by 2033. The region's focus on health and wellness, coupled with legislation favoring natural food additives, is fueling growth. Germany and France are key markets, with innovations in food technology leading the way.Asia Pacific Corn Starch Market Report:

In the Asia-Pacific region, the Corn Starch market was valued at $5.02 billion in 2023 and is projected to reach $9.77 billion by 2033. The growth is propelled by rising urbanization, increasing food consumption, and expanding industrial applications, particularly within the food sector. Countries like China and India are major contributors to market expansion, driven by enhanced agricultural practices and investment in processing technologies.North America Corn Starch Market Report:

In North America, the Corn Starch market was worth $8.38 billion in 2023, projected to grow to $16.31 billion by 2033. The U.S. is a significant contributor owing to a strong food processing sector. The trend toward clean label ingredients is driving the demand for natural corn starch, further supported by consumer preferences for gluten-free and organic products.South America Corn Starch Market Report:

The South American market for Corn Starch was valued at $2.33 billion in 2023 and is expected to reach $4.52 billion by 2033. The region benefits from abundant corn production and is seeing growth in the food and pharmaceutical applications of corn starch. Brazil and Argentina are leading markets, with agriculture-centric economies pushing demand higher for corn-based products.Middle East & Africa Corn Starch Market Report:

In the Middle East and Africa, the Corn Starch market was valued at $2.35 billion in 2023 and is projected to reach $4.58 billion by 2033. Growth is facilitated by rising demand for processed foods and growing industrial applications. The food sector's expansion, along with increasing dietary changes, is contributing to market developments across the region.Tell us your focus area and get a customized research report.

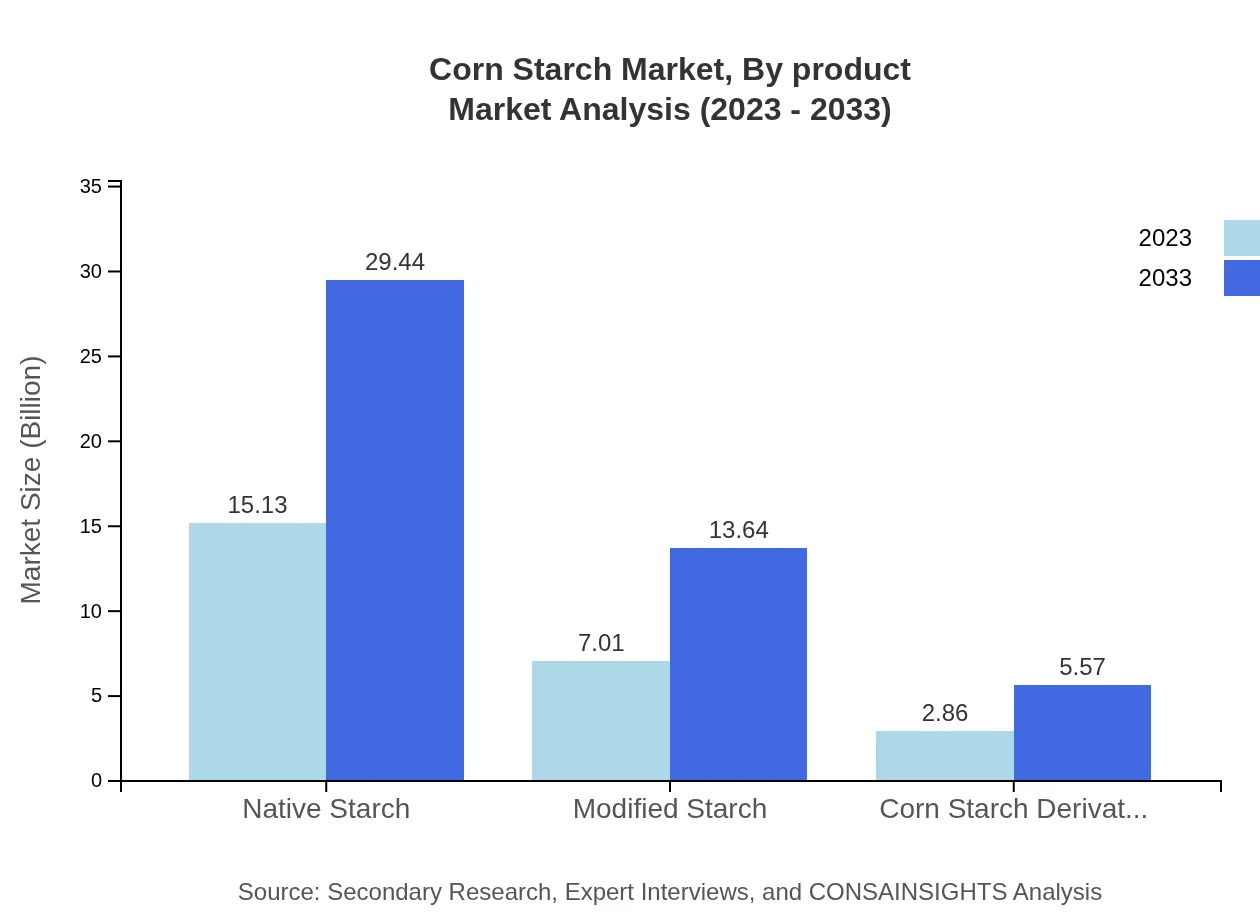

Corn Starch Market Analysis By Product

The major products in the Corn Starch market include Native Starch, Modified Starch, and Corn Starch Derivatives. Native starch produced from corn constitutes a large market share, accounting for 60.51% in 2023 with an expected increase through 2033. Modified starches have applications in processed foods, providing enhanced textures and functionalities. Corn Starch Derivatives used in pharmaceuticals and other sectors are also experiencing a growing market presence.

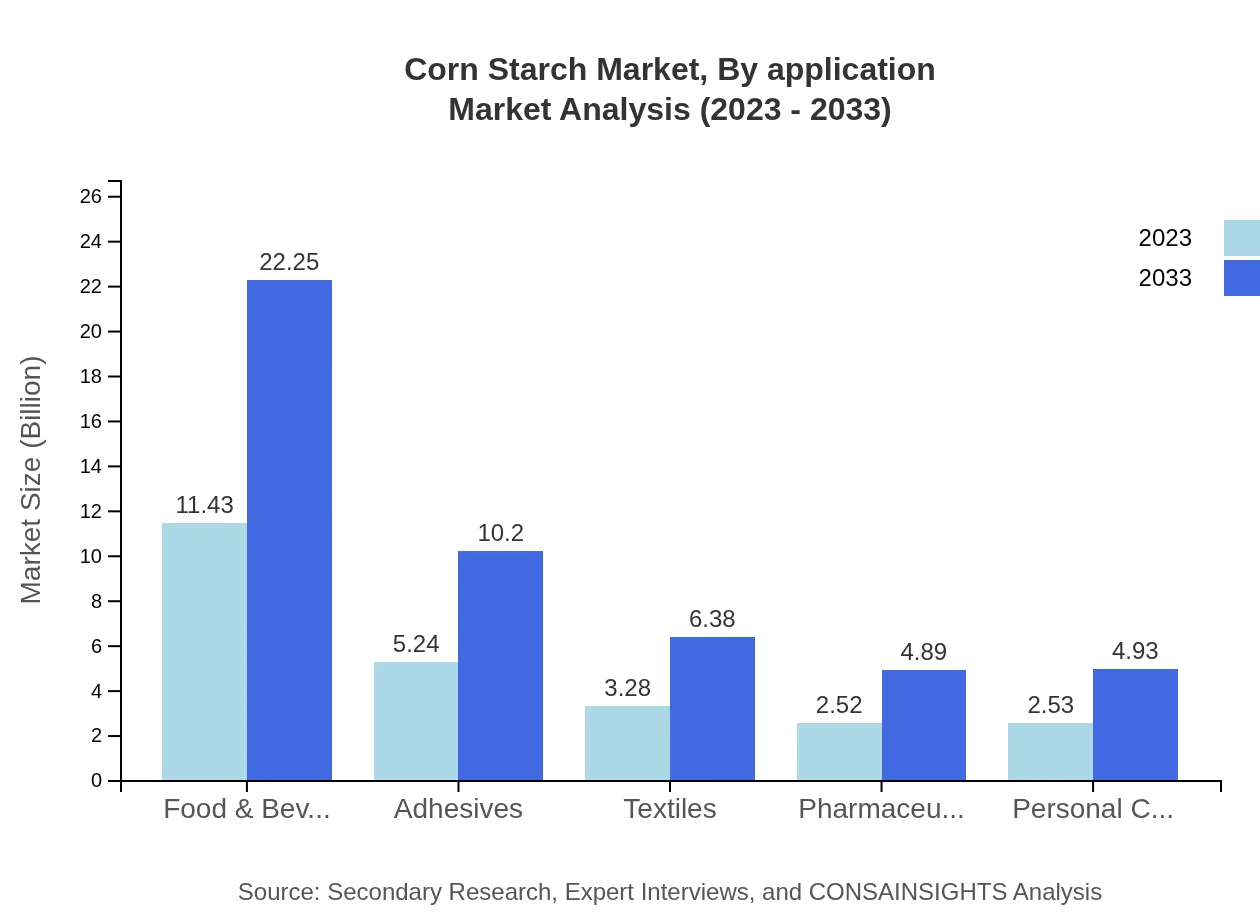

Corn Starch Market Analysis By Application

The significant applications of Corn Starch include Food & Beverage, Packaging, Construction, Automotive, and Pharmaceuticals. The Food & Beverage segment leads, representing 45.73% of the market in 2023, driven by increasing consumer preferences for convenience and clean label products. Packaging applications are also notable, growing rapidly due to sustainable sourcing.

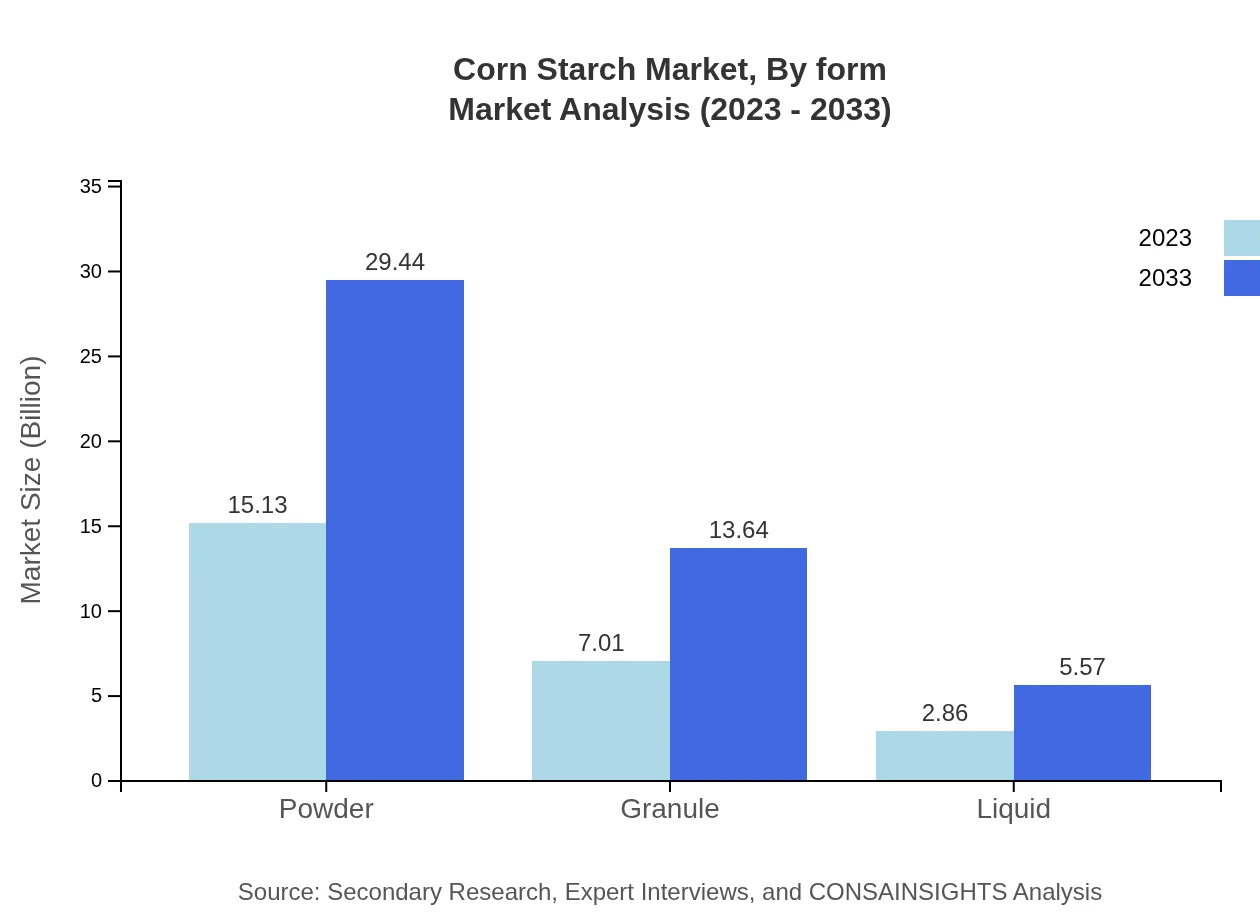

Corn Starch Market Analysis By Form

Corn Starch is available in various forms, predominantly in Powder, Granule, and Liquid forms. The Powder form has the largest market share due to its extended applications across food, beverages, and industrial processes, accounting for about 60.51% in 2023 and duplicating its market size by 2033. The Liquid and Granule forms are also pivotal, serving niche applications in food services and specialty industries.

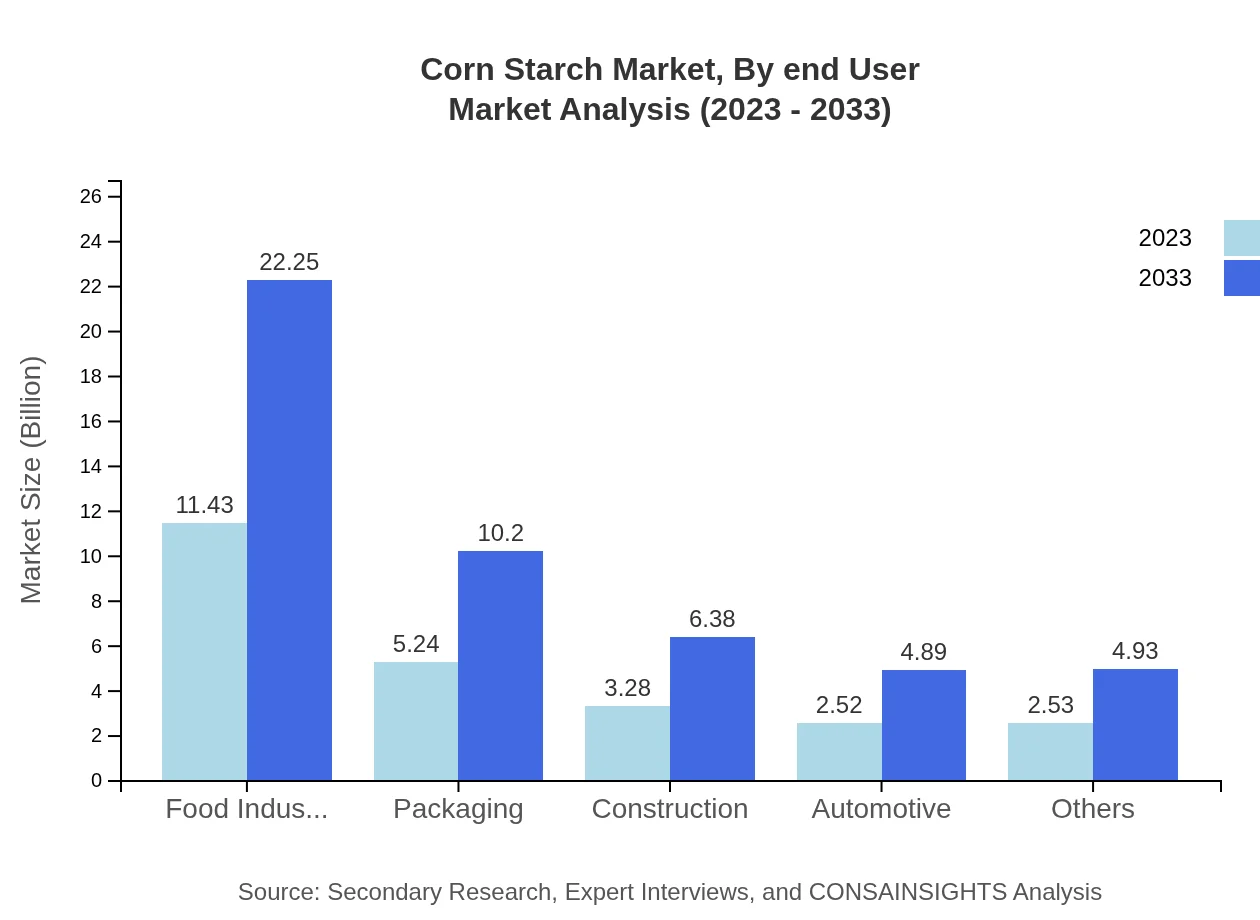

Corn Starch Market Analysis By End User

Major end-user industries utilizing Corn Starch include Food & Beverage, Textiles, Pharmaceuticals, and Personal Care. The Food & Beverage industry dominates the market, utilizing corn starch for binding, thickening, and stabilizing effects. The Pharmaceutical and Personal Care industries are increasingly integrating corn starch as natural excipients in formulations.

Corn Starch Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Corn Starch Industry

Cargill, Inc.:

Cargill is a global leader in corn starch production and innovation, providing tailored solutions for various industries, including food and beverage, pharmaceuticals, and personal care. Their commitment to sustainability and quality enhances their competitive edge in the market.Archer Daniels Midland Company (ADM):

ADM is a major player in the agricultural and food processing sector, known for its extensive corn processing capabilities. The company supplies high-quality corn starch while driving innovations in product development and applications across multiple sectors.Ingredion Incorporated:

Ingredion specializes in ingredient solutions and is a leading manufacturer of corn starch, providing diverse applications tailored to customer needs in food, beverage, and industrial markets. Their focus on sustainability trends positions them well for future growth.Tate & Lyle:

Tate & Lyle is known for its innovation and quality in corn starch production, particularly in food processing. They prioritize sustainable sourcing and ingredient transparency, aligning with modern consumer demands.We're grateful to work with incredible clients.

FAQs

What is the market size of corn Starch?

The corn starch market is projected to grow from $25 billion in 2023 to reach significant heights by 2033, exhibiting a CAGR of 6.7%. This growth reflects rising demand across various industries, driven predominantly by the food sector.

What are the key market players or companies in this corn Starch industry?

Key players in the corn starch market include global giants such as Archer Daniels Midland Company, Cargill, Ingredion Incorporated, and Tate & Lyle. These companies are instrumental in advancing technology and enhancing supply chains.

What are the primary factors driving the growth in the corn Starch industry?

Growth in the corn starch industry is driven by increasing demand in food processing, expanding applications in non-food sectors like packaging, and favorable government regulations supporting agricultural products, leading to enhanced production and innovation.

Which region is the fastest Growing in the corn Starch market?

The fastest-growing region in the corn-starch market is North America, projected to increase from $8.38 billion in 2023 to $16.31 billion by 2033. This region benefits from advanced agricultural practices and strong industrial demand.

Does ConsaInsights provide customized market report data for the corn Starch industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the corn-starch industry, allowing stakeholders to gain insights that align with their business strategies and market dynamics.

What deliverables can I expect from this corn Starch market research project?

From a corn-starch market research project, expect deliverables such as detailed market analysis, segmentation reports, competitive landscape insights, forecasts by region, and trends influencing growth, all designed to support informed decision-making.

What are the market trends of corn Starch?

Current market trends in corn-starch include rising preference for native and modified starches in food applications, innovative uses in biodegradable packaging, and increasing demand for clean-label products, reflecting consumer shifts towards natural ingredients.