Corneal Topographers Market Report

Published Date: 31 January 2026 | Report Code: corneal-topographers

Corneal Topographers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the corneal topographers market, detailing market trends, size forecasts, segmentations, and regional insights from 2023 to 2033.

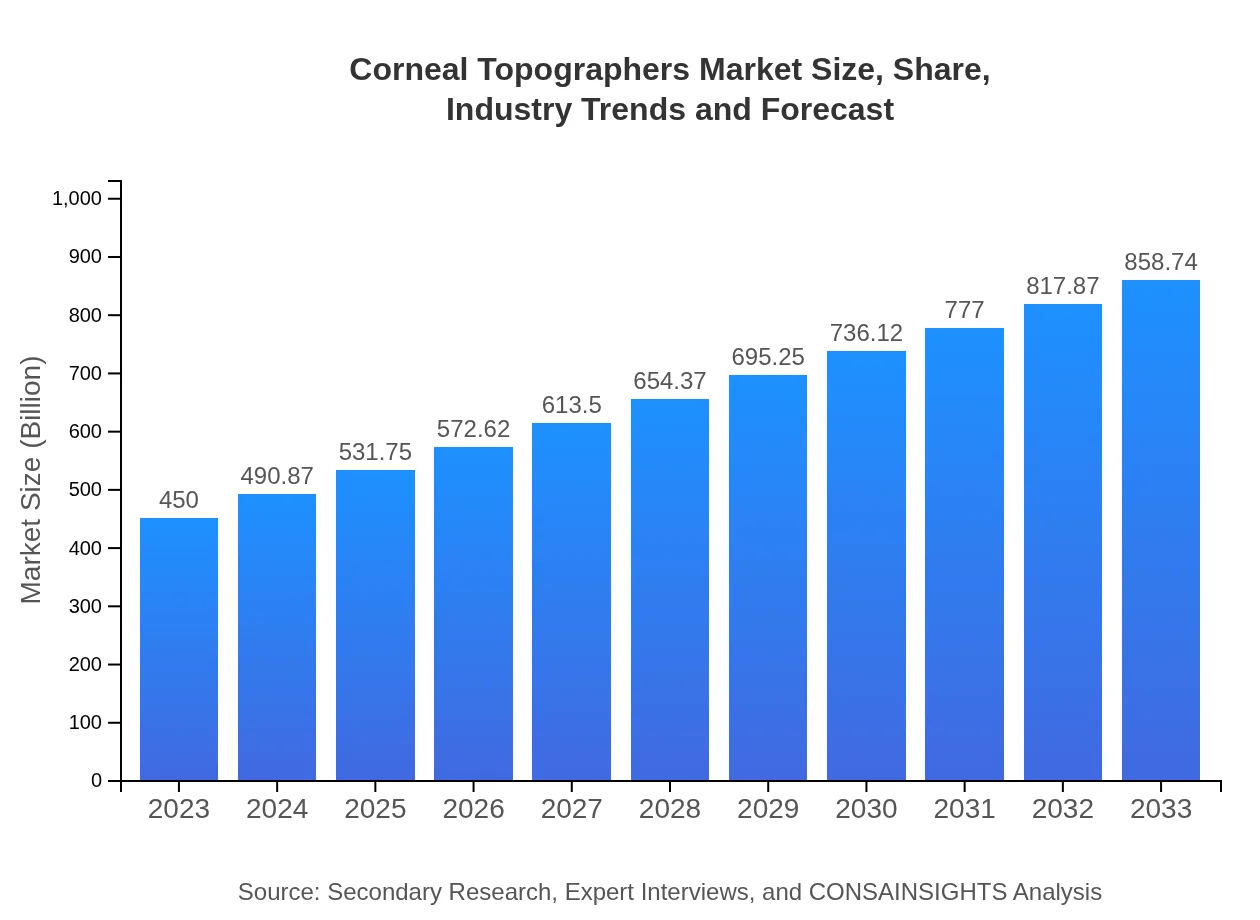

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $450.00 Million |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $858.74 Million |

| Top Companies | Topcon Corporation, Visantech, Abbott Medical Optics, Carl Zeiss AG, NIDEK Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Corneal Topographers Market Overview

Customize Corneal Topographers Market Report market research report

- ✔ Get in-depth analysis of Corneal Topographers market size, growth, and forecasts.

- ✔ Understand Corneal Topographers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Corneal Topographers

What is the Market Size & CAGR of Corneal Topographers market in 2023?

Corneal Topographers Industry Analysis

Corneal Topographers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Corneal Topographers Market Analysis Report by Region

Europe Corneal Topographers Market Report:

The European market is expected to expand from $140.81 million in 2023 to $268.70 million in 2033, driven by an aging population and increasing prevalence of eye disorders.Asia Pacific Corneal Topographers Market Report:

In the Asia Pacific region, the corneal topographers market is expected to grow from $84.64 million in 2023 to $161.53 million by 2033, propelled by increasing health awareness and investment in healthcare facilities.North America Corneal Topographers Market Report:

North America leads the market with a substantial valuation of $160.42 million in 2023, expected to reach $306.14 million by 2033, supported by advanced healthcare infrastructure and high adoption rates of new technologies.South America Corneal Topographers Market Report:

The South American market, though smaller, is valued at $23.76 million in 2023 and is projected to increase to $45.34 million by 2033, reflecting gradual but steady growth driven by improved access to eye care services.Middle East & Africa Corneal Topographers Market Report:

The Middle East and Africa market will grow from $40.37 million in 2023 to $77.03 million by 2033, as healthcare improvements and increased investment in medical technology become more prevalent.Tell us your focus area and get a customized research report.

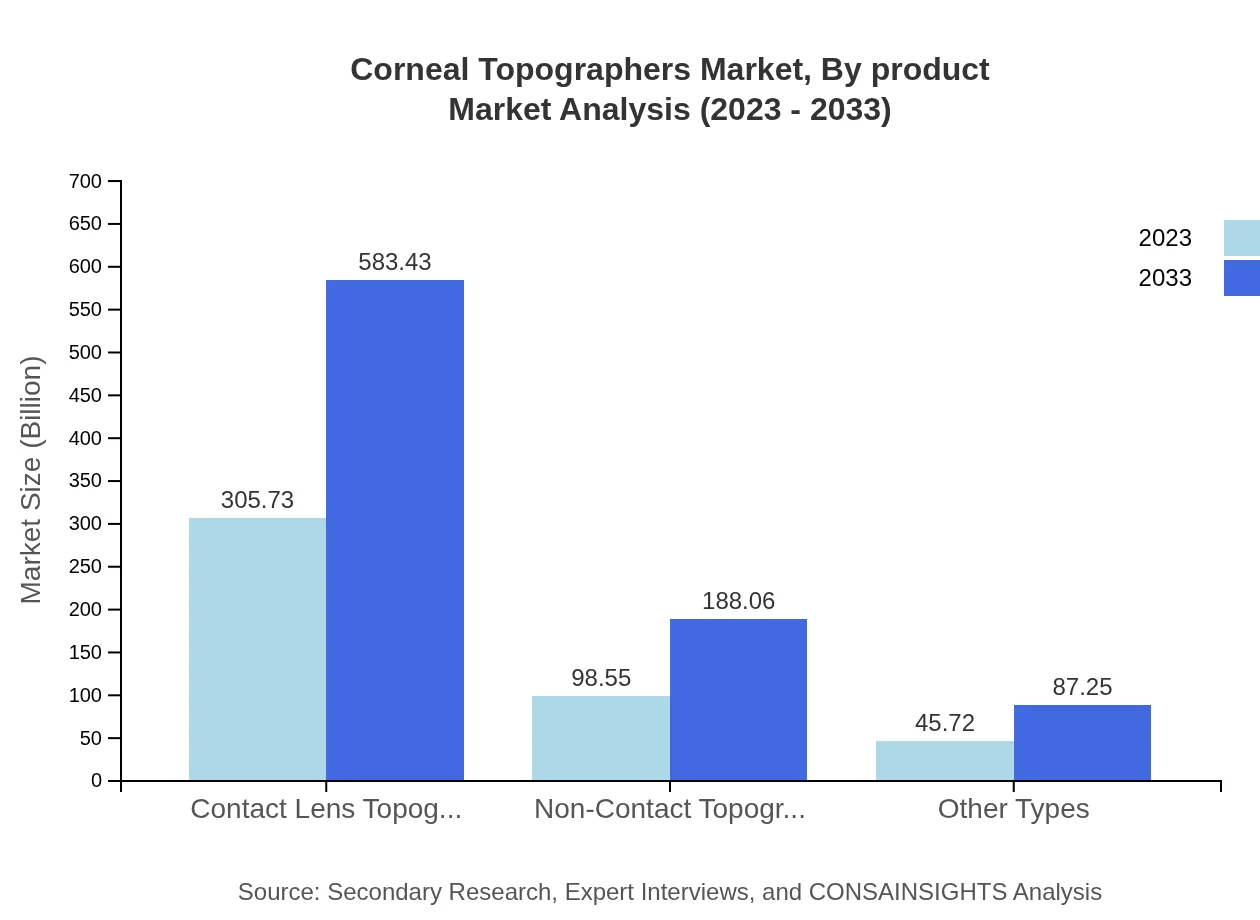

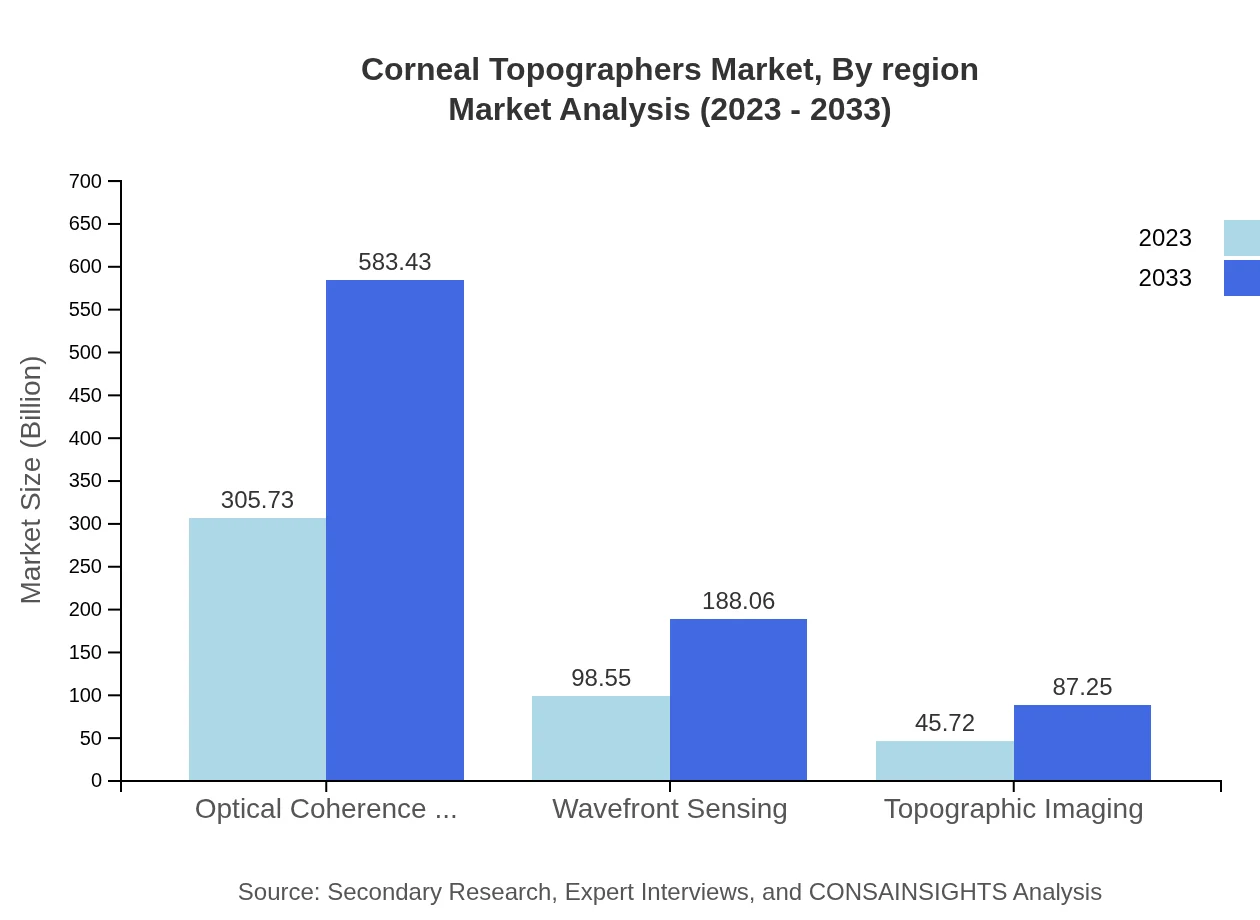

Corneal Topographers Market Analysis By Product

The product segment includes Optical Coherence Tomography (OCT), which garners the largest market share with a size of $305.73 million in 2023, projected to reach $583.43 million by 2033. Wavefront Sensing accounts for $98.55 million, with growth expected to $188.06 million, while Non-Contact Topographers and Topographic Imaging see similar growth trajectories.

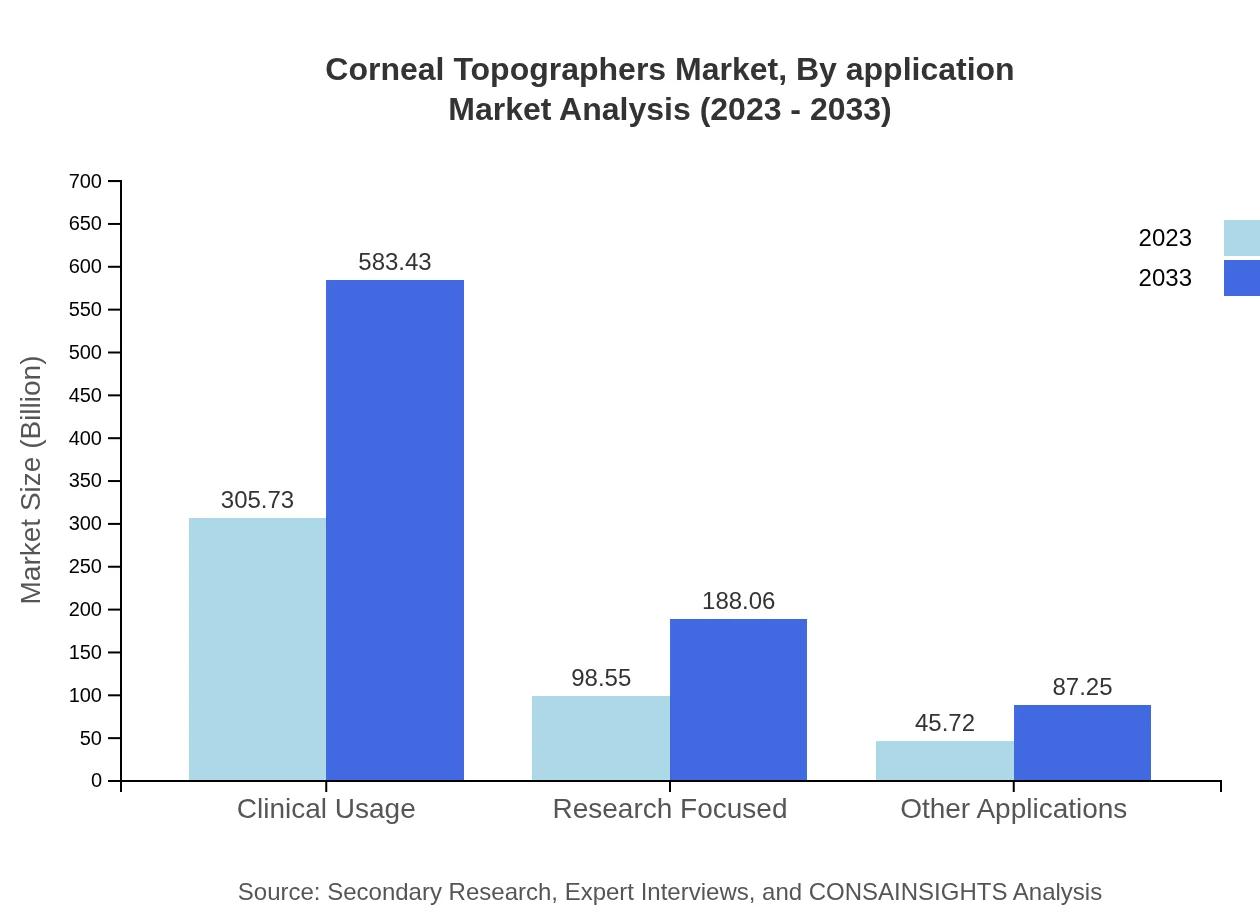

Corneal Topographers Market Analysis By Application

Key applications include Clinical Usage and Research Focused, both demonstrating healthy growth rates. Clinical Usage will increase from $305.73 million in 2023 to $583.43 million by 2033, whereas Research Focused applications will expand from $98.55 million to $188.06 million.

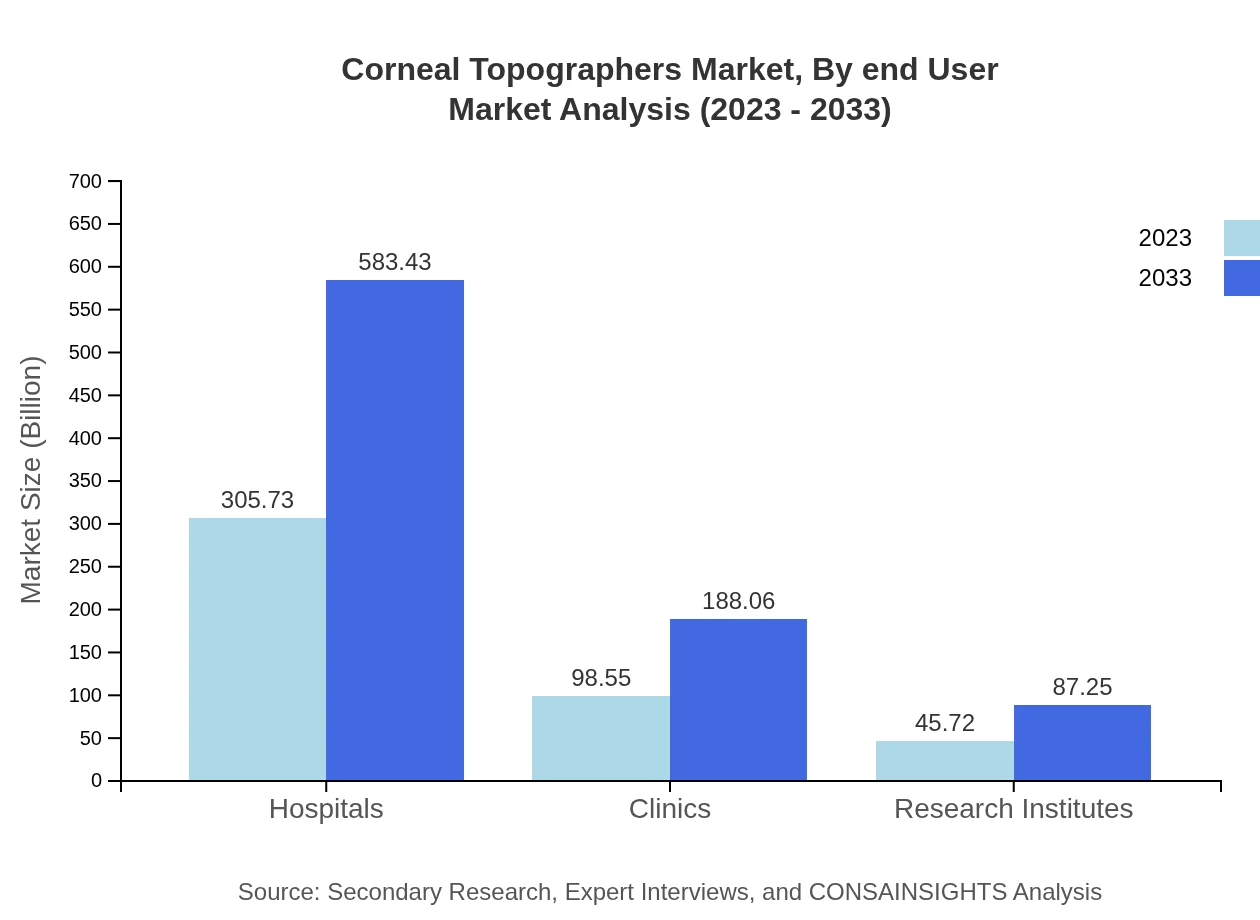

Corneal Topographers Market Analysis By End User

End-users are primarily hospitals and clinics, with hospitals projected to lead the market with a size of $305.73 million in 2023, growing to $583.43 million by 2033, while clinics are also poised for growth from $98.55 million to $188.06 million.

Corneal Topographers Market Analysis By Region

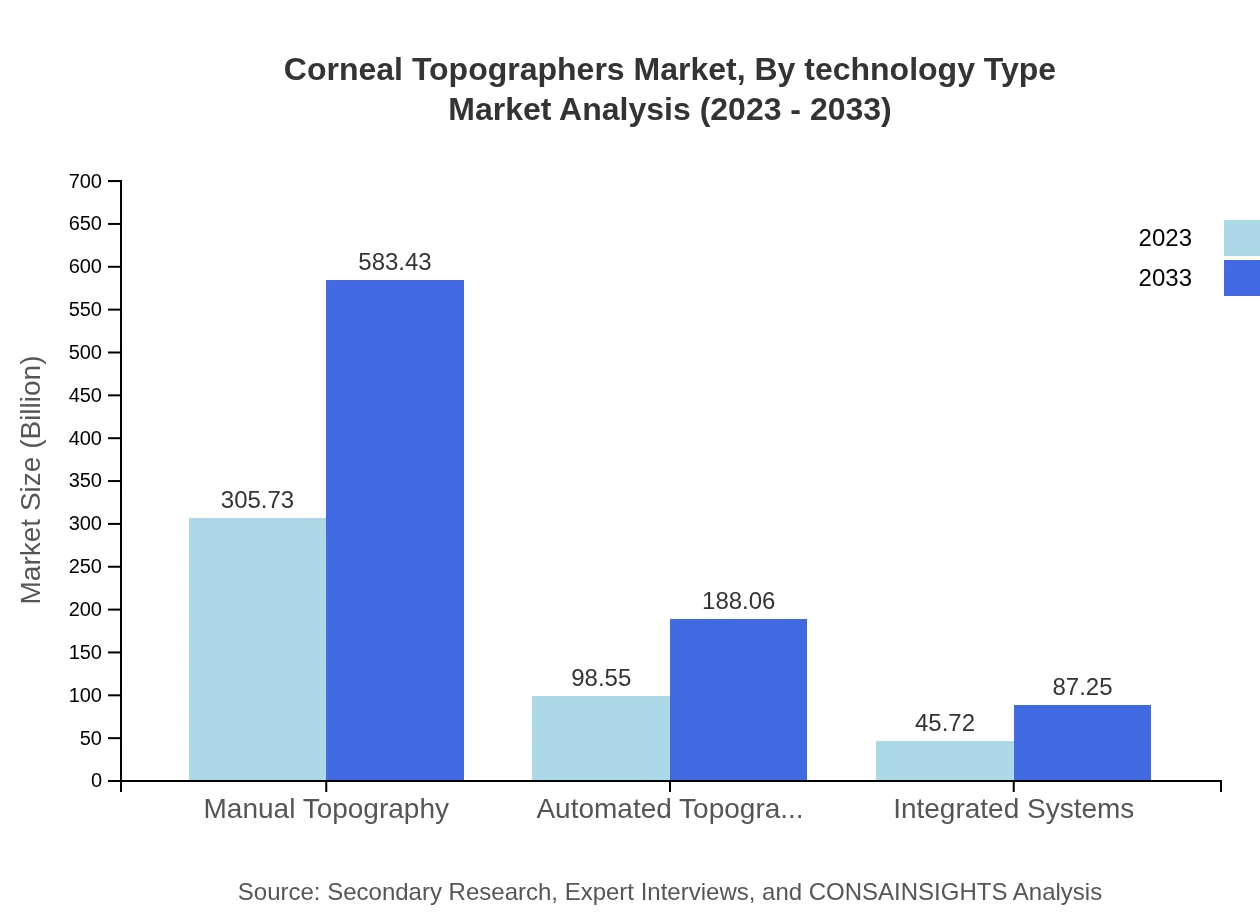

Focusing on technology, the market segments into Manual versus Automated Topography. Manual Topography is expected to maintain a strong share with $305.73 million in 2023 and grow similarly to Automated Topography, which will rise from $98.55 million to $188.06 million.

Corneal Topographers Market Analysis By Technology Type

The market for Integrated Systems and Other types will also rise, with Integrated Systems growing from $45.72 million to $87.25 million by 2033, indicating significant advancements are being made in creating comprehensive diagnostic systems for eye care.

Corneal Topographers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Corneal Topographers Industry

Topcon Corporation:

A leading global supplier of products and systems for the eye care sector, known for its innovative imaging technologies.Visantech:

Specializes in high-precision diagnostic systems, particularly in the field of ophthalmology.Abbott Medical Optics:

Offers a range of surgical and diagnostic products that enhance diagnosis and treatment for eye care professionals.Carl Zeiss AG:

Renowned for pioneering optoelectronic products and instruments for visual measurements in ophthalmology.NIDEK Co., Ltd.:

Focuses on a diverse range of ophthalmic and optometric products with a reputation for quality and innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of corneal topographers?

The global corneal topographers market is valued at approximately $450 million in 2023, with a projected CAGR of 6.5%, expected to grow significantly by 2033.

What are the key market players or companies in this corneal topographers industry?

Key players in the corneal topographers market include diverse companies specializing in ophthalmic technology, though specific company names were not provided in the report.

What are the primary factors driving the growth in the corneal topographers industry?

Primary factors driving growth include technological advancements in eye care, increasing prevalence of corneal diseases, and rising demand for precise diagnostic tools in ophthalmology.

Which region is the fastest Growing in the corneal topographers market?

North America is the fastest-growing region, with a market size of $160.42 million in 2023, projected to reach $306.14 million by 2033.

Does ConsaInsights provide customized market report data for the corneal topographers industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the corneal topographers industry.

What deliverables can I expect from this corneal topographers market research project?

Deliverables typically include comprehensive market analysis reports, growth forecasts, competitive landscape insights, and segment-wise market data.

What are the market trends of corneal topographers?

Current market trends include the rise in demand for advanced imaging technologies, increased integration of artificial intelligence in diagnostics, and enhanced focus on patient-centered care.