Cosmetic Packaging Market Report

Published Date: 22 January 2026 | Report Code: cosmetic-packaging

Cosmetic Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Cosmetic Packaging market, covering trends, technological advancements, market size, and CAGR from 2023 to 2033, alongside detailed regional insights and forecasts for growth and challenges.

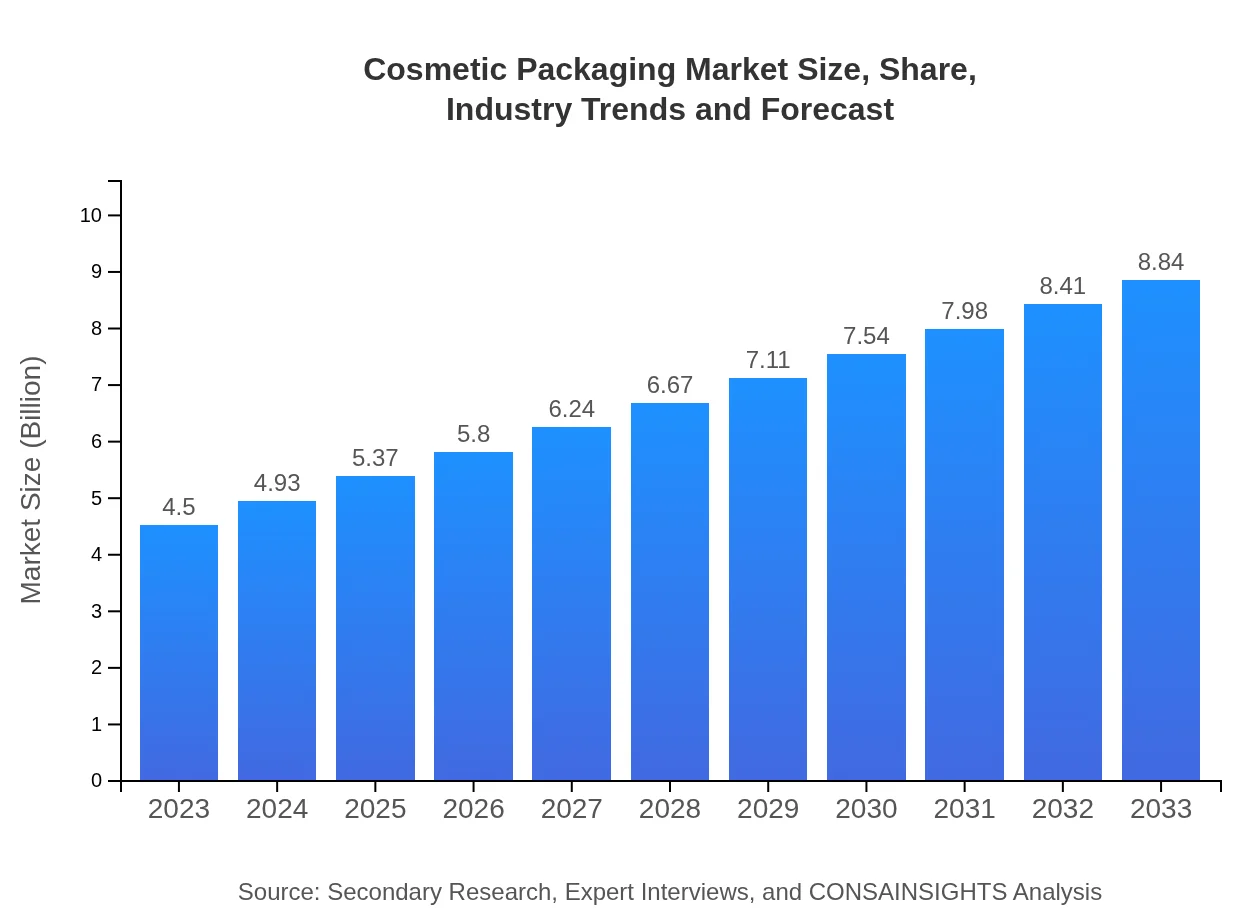

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | Amcor, Berry Global, Albea Group, Silgan Holdings, Owens-Illinois |

| Last Modified Date | 22 January 2026 |

Cosmetic Packaging Market Overview

Customize Cosmetic Packaging Market Report market research report

- ✔ Get in-depth analysis of Cosmetic Packaging market size, growth, and forecasts.

- ✔ Understand Cosmetic Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cosmetic Packaging

What is the Market Size & CAGR of Cosmetic Packaging market in 2023?

Cosmetic Packaging Industry Analysis

Cosmetic Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cosmetic Packaging Market Analysis Report by Region

Europe Cosmetic Packaging Market Report:

Europe’s Cosmetic Packaging market is expected to grow from $1.45 billion in 2023 to approximately $2.85 billion by 2033. The demand for premium cosmetic products in countries like France and Germany drives this growth. Additionally, European consumers are increasingly favoring brands that focus on sustainability, prompting a shift towards recyclable packaging materials.Asia Pacific Cosmetic Packaging Market Report:

In the Asia Pacific region, the Cosmetic Packaging market is expected to grow from $0.72 billion in 2023 to $1.42 billion by 2033. This growth is fueled by the increasing demand for beauty products in emerging markets like India and China, where a growing middle class has fueled a rise in cosmetic consumption. Manufacturers are focusing on personalized packaging solutions to target this expanding demographic.North America Cosmetic Packaging Market Report:

The North American market for Cosmetic Packaging will grow significantly from $1.68 billion in 2023 to around $3.30 billion by 2033. The U.S. leads this growth thanks to a strong consumer base that favors high-quality and innovative packaging. Many companies are also prioritizing sustainable practices, reflecting consumer preference for environmentally friendly products and materials.South America Cosmetic Packaging Market Report:

South America is projected to see the Cosmetic Packaging market increase from $0.16 billion in 2023 to $0.32 billion by 2033. The growth in this region is driven by the increasing interest in beauty products among local consumers and the introduction of international brands that are adapting their packaging to meet regional preferences. Eco-friendly packaging is also gaining traction as consumers become more aware of sustainable practices.Middle East & Africa Cosmetic Packaging Market Report:

In the Middle East and Africa, the market is forecasted to increase from $0.49 billion in 2023 to $0.97 billion by 2033. The beauty sector is expanding in this region, driven by rising disposable incomes and changing consumer habits. Companies are strategically focusing on regional preferences to capture market share.Tell us your focus area and get a customized research report.

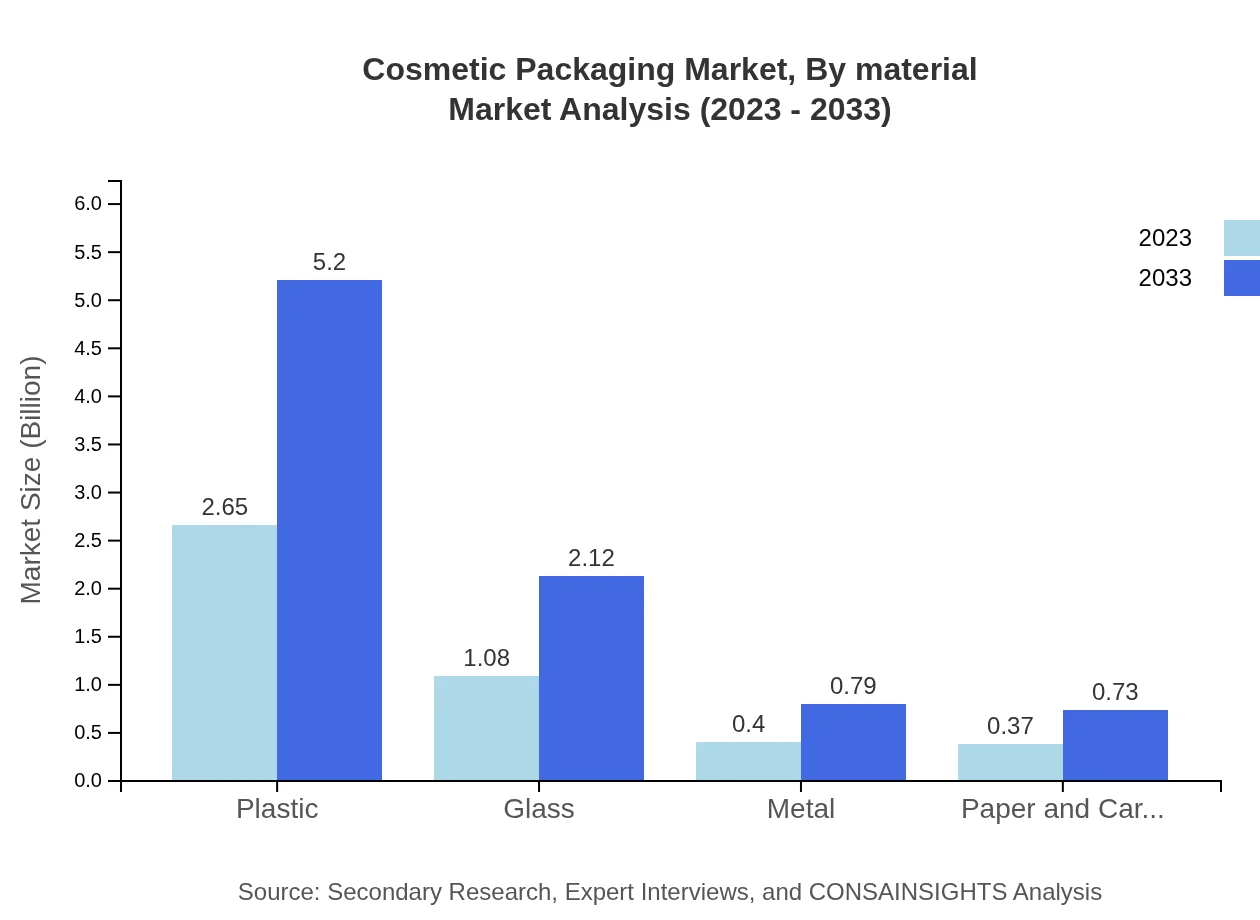

Cosmetic Packaging Market Analysis By Material

The Cosmetic Packaging market, classified by material types, shows notable dynamics. In 2023, plastic dominates with a market size of $2.65 billion, holding 58.8% market share, and is expected to grow to $5.20 billion by 2033. Glass follows with a size of $1.08 billion (23.98% share) projected to reach $2.12 billion. Metal and paper/cardboard each account for around 8.94% and 8.28% share respectively, with significant growth forecasts. Sustainable packaging options are rapidly rising, showcasing enhancements in consumer preferences.

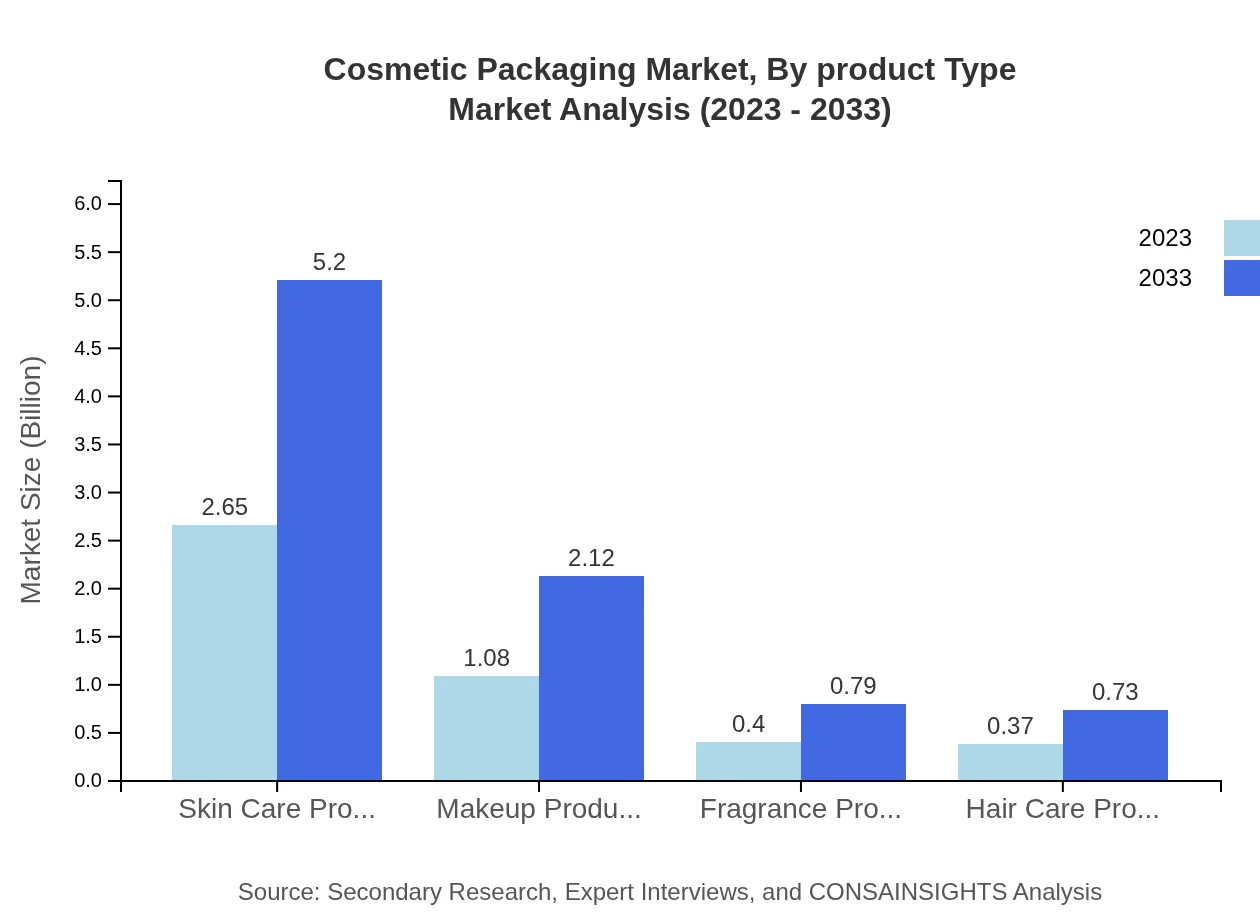

Cosmetic Packaging Market Analysis By Product Type

Products such as skin care, makeup, fragrances, and hair care provide significant diversity in the Cosmetic Packaging market. Skin care products lead the segment, with a size of $2.65 billion (58.8% share) in 2023, expected to grow to $5.20 billion by 2033. Makeup products contribute $1.08 billion (23.98% share) and are projected to reach $2.12 billion in the same period. Fragrance and hair care products follow, indicating a steady demand for specialized packaging solutions.

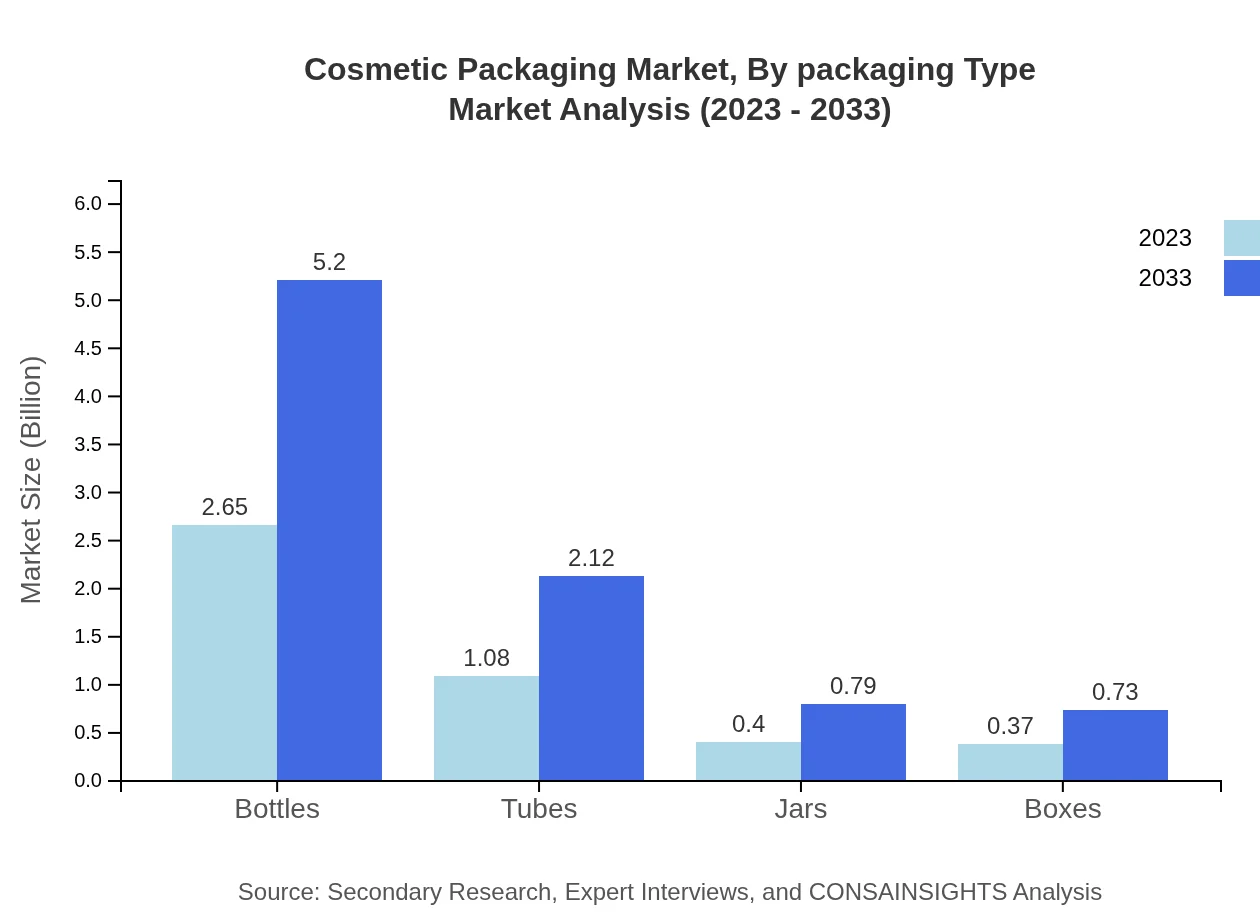

Cosmetic Packaging Market Analysis By Packaging Type

In terms of packaging types, bottles account for a dominant share as well, with $2.65 billion (58.8% share) in 2023, which will rise to $5.20 billion by 2033. Tubes and jars are also significant, with market sizes of $1.08 billion and $0.40 billion respectively, while boxes remain a smaller segment yet show consistent growth. Customization in packaging type presents manufacturers with an opportunity to cater to niche markets.

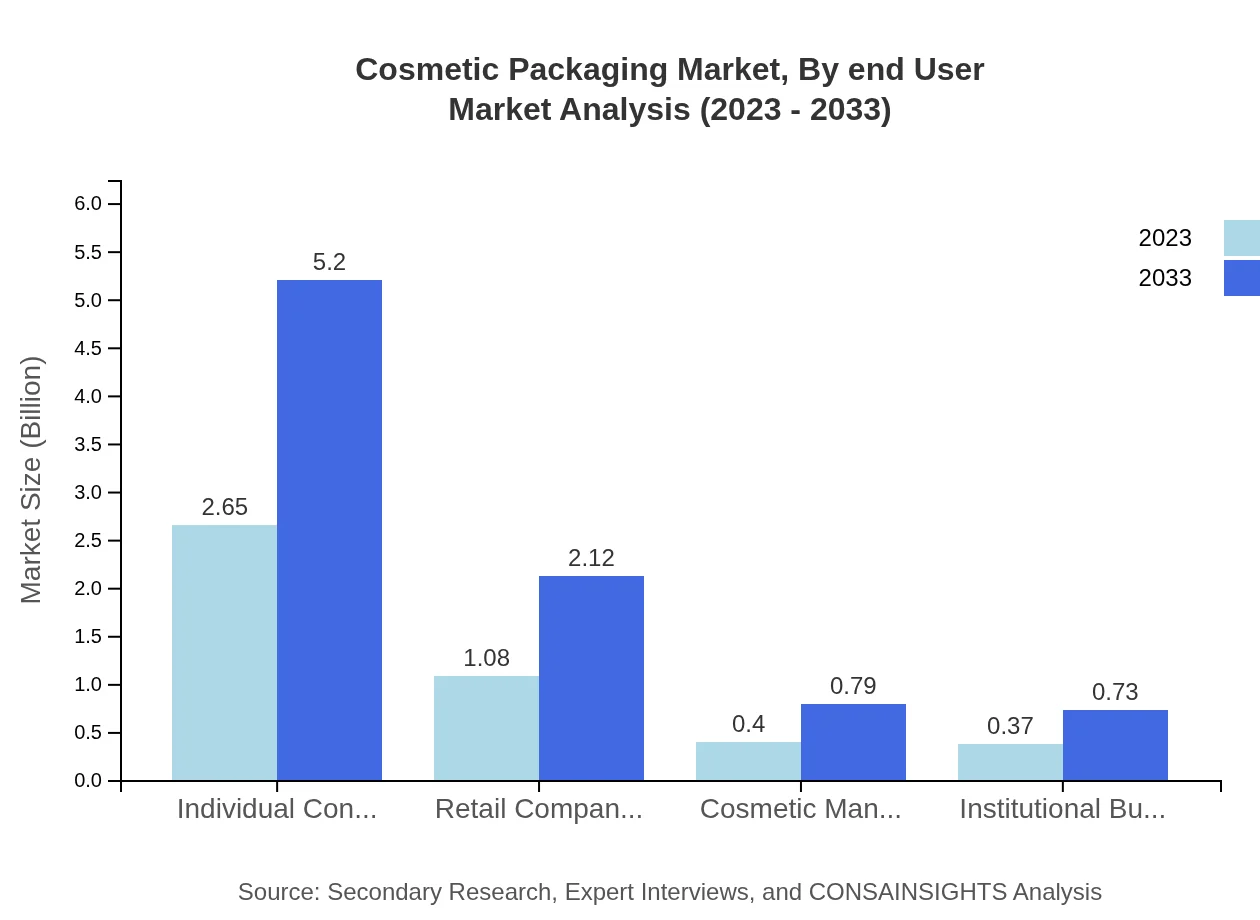

Cosmetic Packaging Market Analysis By End User

The Cosmetic Packaging market segmented by end-users reflects a clear customer base. Individual consumers dominate with $2.65 billion (58.8% share) in 2023, projected to grow to $5.20 billion in 2033. Retail companies following suit present $1.08 billion (23.98% share), reflecting the retail environment's strength. Meanwhile, institutional buyers make up about 8.28%, marking their presence in bulk purchasing options.

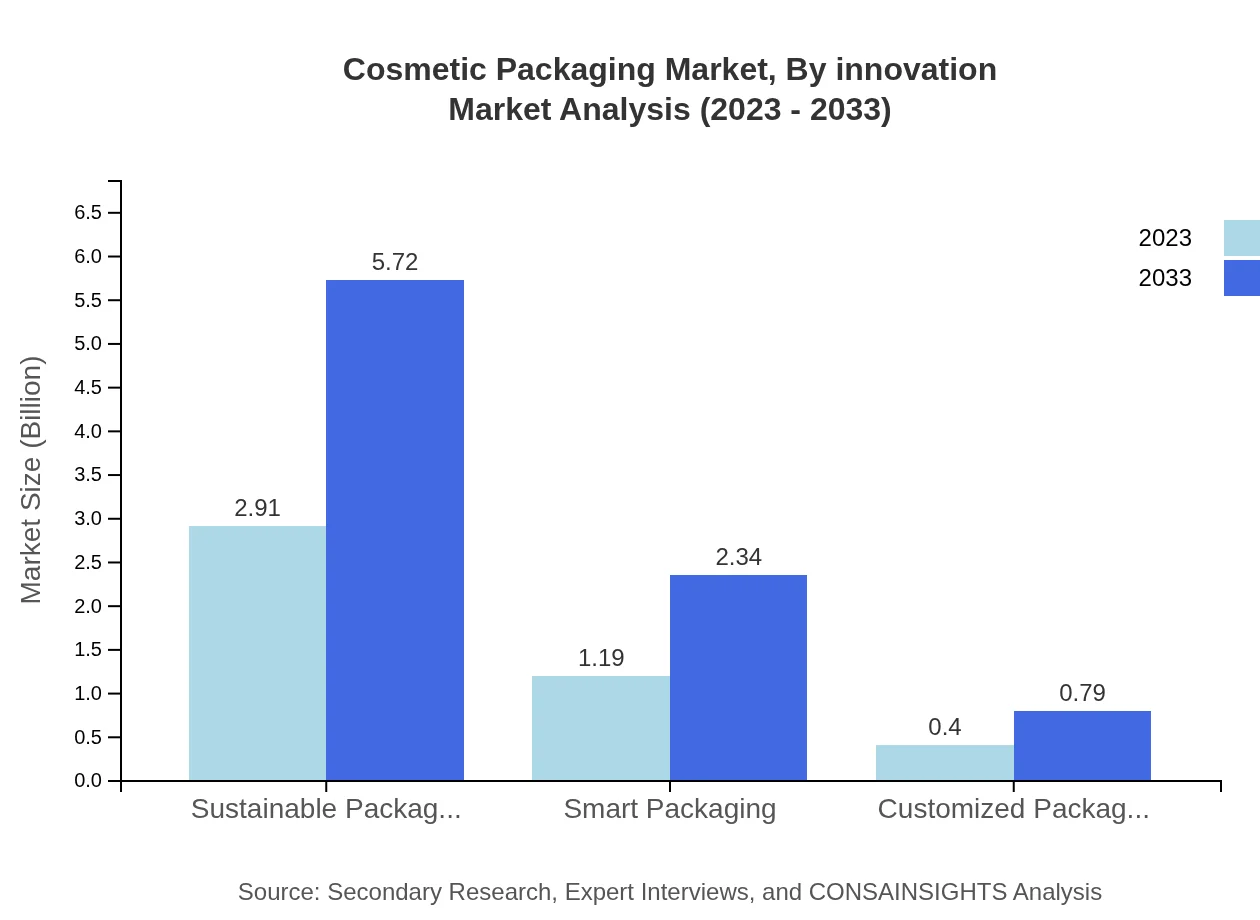

Cosmetic Packaging Market Analysis By Innovation

Innovation plays a crucial role in the Cosmetic Packaging market with areas such as smart packaging and sustainable solutions gaining traction. In 2023, sustainable packaging totals $2.91 billion (64.63% share), expected to grow significantly to $5.72 billion by 2033. Smart packaging solutions follow with a size of $1.19 billion (26.49%), indicating the demand for technologically advanced applications resonating with consumers.

Cosmetic Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cosmetic Packaging Industry

Amcor:

A global leader in packaging solutions, Amcor is at the forefront of sustainable packaging innovations, developing products that reduce environmental impact while meeting consumer needs.Berry Global:

Berry Global specializes in providing plastic packaging solutions, emphasizing innovation in product design and sustainability within the cosmetic industry.Albea Group:

Albea Group offers an extensive range of cosmetic packaging solutions and is renowned for its commitment to innovation and sustainable practices, catering to global beauty brands.Silgan Holdings:

Silgan Holdings focuses on metal packaging for various markets, providing high-quality solutions tailored for cosmetics with an emphasis on sustainability.Owens-Illinois:

This company specializes in glass packaging and is recognized for its sophisticated manufacturing capabilities and commitment to sustainability across its product lineup.We're grateful to work with incredible clients.

FAQs

What is the market size of cosmetic Packaging?

The global cosmetic packaging market is valued at $4.5 billion as of 2023, with a projected CAGR of 6.8% through 2033. Growth factors include increased demand for beauty products and sustainable packaging options, enhancing market potential.

What are the key market players or companies in the cosmetic Packaging industry?

Key players in the cosmetic packaging industry include leading manufacturers such as Amcor Plc, Berry Global Group, and AptarGroup. These companies dominate through innovative packaging solutions and sustainable practices, ensuring they meet consumer demand.

What are the primary factors driving the growth in the cosmetic packaging industry?

Key drivers include the increasing consumer awareness of sustainable packaging and the growing demand for cosmetic products. Technological innovations in packaging designs further contribute to market growth, catering to evolving consumer preferences.

Which region is the fastest Growing in the cosmetic packaging?

Asia-Pacific is emerging as the fastest-growing region in the cosmetic packaging market, with growth from $0.72 billion in 2023 to $1.42 billion by 2033. North America shows significant growth as well, projected to rise from $1.68 billion to $3.30 billion.

Does ConsaInsights provide customized market report data for the cosmetic packaging industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients. This allows businesses to obtain specific insights relevant to their strategies and operational challenges in the cosmetic packaging sector.

What deliverables can I expect from this cosmetic packaging market research project?

Deliverables include comprehensive market analysis reports, data on market size and forecasts, competitor analysis, and insights into consumer trends, ensuring you have a detailed understanding of the cosmetic packaging landscape.

What are the market trends of cosmetic packaging?

Current trends include a significant shift towards sustainable materials, smart packaging innovations, and customization. The demand for eco-friendly packaging solutions is driving the market, as companies adapt to consumer preferences.