Courier Express And Parcel Market Report

Published Date: 31 January 2026 | Report Code: courier-express-and-parcel

Courier Express And Parcel Market Size, Share, Industry Trends and Forecast to 2033

This report presents a detailed analysis of the Courier Express and Parcel market from 2023 to 2033, offering insights into market size, trends, regional performance, and key industry players. The analysis includes data-driven forecasts for growth, challenges, and technological advancements.

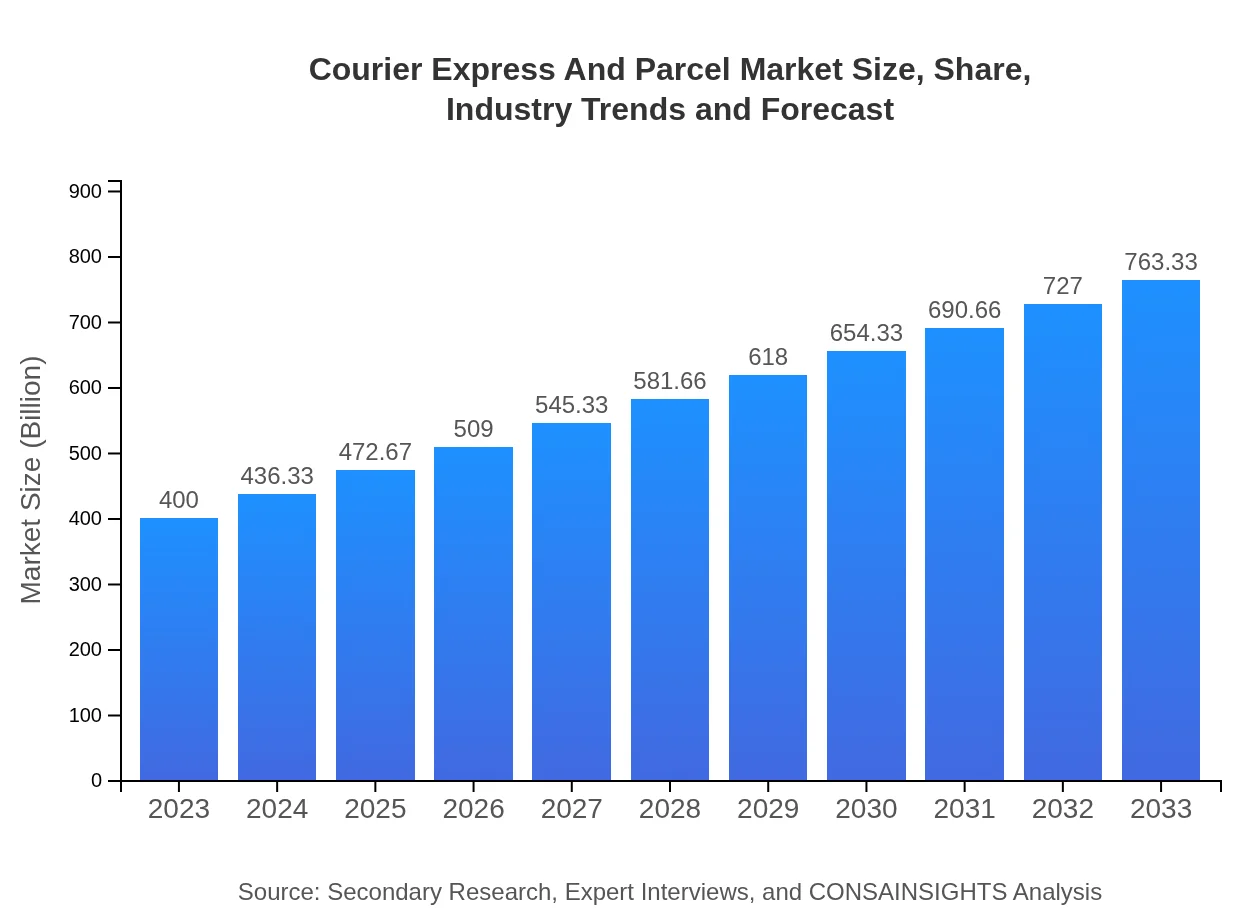

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $400.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $763.33 Billion |

| Top Companies | DHL Express, FedEx Corporation, UPS Inc., TNT Express |

| Last Modified Date | 31 January 2026 |

Courier Express And Parcel Market Overview

Customize Courier Express And Parcel Market Report market research report

- ✔ Get in-depth analysis of Courier Express And Parcel market size, growth, and forecasts.

- ✔ Understand Courier Express And Parcel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Courier Express And Parcel

What is the Market Size & CAGR of Courier Express And Parcel market in 2023 and 2033?

Courier Express And Parcel Industry Analysis

Courier Express And Parcel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Courier Express And Parcel Market Analysis Report by Region

Europe Courier Express And Parcel Market Report:

The European market is poised for substantial growth, with the size forecasted to increase from $109.32 billion in 2023 to $208.62 billion by 2033. The focus on sustainable delivery solutions and stringent regulations on transport emissions drive innovation, while diverse market players enhance competition.Asia Pacific Courier Express And Parcel Market Report:

The Asia Pacific region is projected to demonstrate outstanding growth in the Courier Express and Parcel market, with its market size expanding from $78.84 billion in 2023 to $150.45 billion by 2033. The surge in e-commerce activities, increased disposable incomes, and technological advancements in logistics are key drivers. Countries like China and India are showing remarkable demand due to urbanization and a growing middle class.North America Courier Express And Parcel Market Report:

North America holds a significant share of the global CEP market, projected to grow from $139.36 billion in 2023 to $265.94 billion by 2033. The strong demand for rapid delivery services and the high penetration of e-commerce have propelled market growth, along with investments in delivery innovations and logistics infrastructure.South America Courier Express And Parcel Market Report:

South America is expected to witness slow but steady growth, with market size growing from $36.56 billion in 2023 to $69.77 billion by 2033. Factors such as improving logistics infrastructure and growing e-commerce penetration in countries like Brazil and Argentina are contributing to this growth, albeit challenges remain in urban delivery efficiency.Middle East & Africa Courier Express And Parcel Market Report:

The Middle East and Africa region is witnessing gradual growth, with the market expanding from $35.92 billion in 2023 to $68.55 billion by 2033. Challenges like infrastructure deficits and regulatory issues are tempered by increasing investments in logistics and rising online shopping habits.Tell us your focus area and get a customized research report.

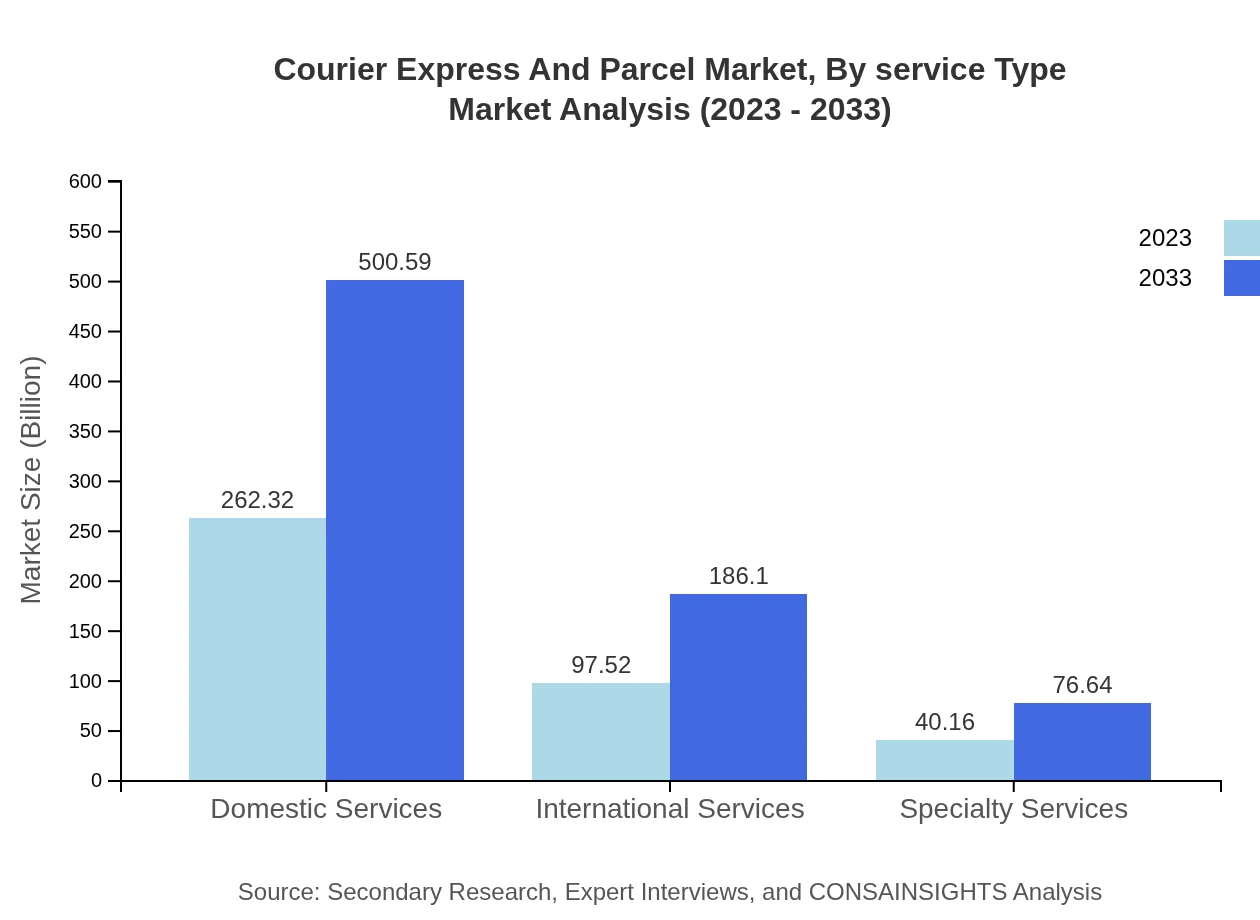

Courier Express And Parcel Market Analysis By Service Type

The market is divided into domestic and international services. Domestic services dominate, driven by local deliveries and growth in online retail. International services are gaining traction due to globalization and increased cross-border trade.

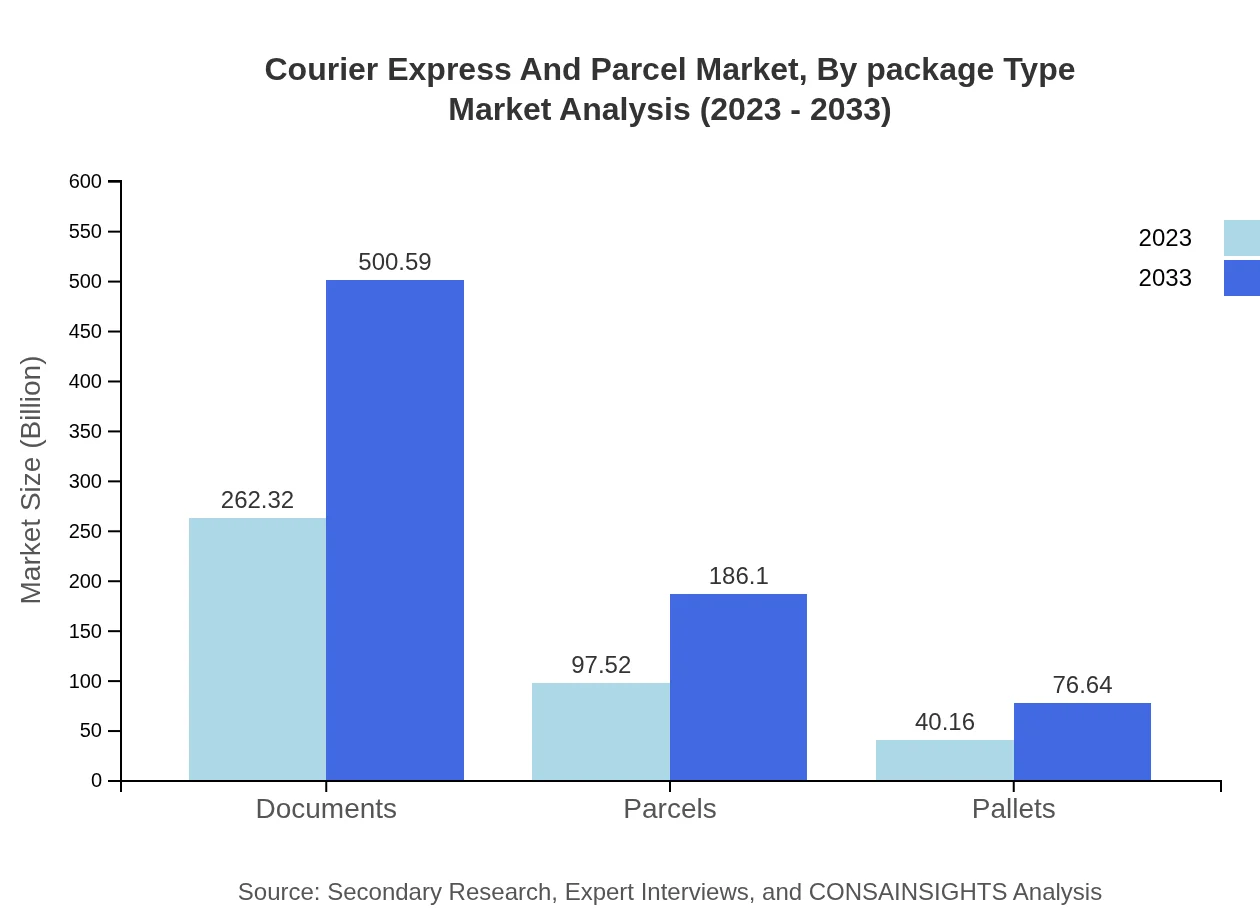

Courier Express And Parcel Market Analysis By Package Type

Package types primarily include documents, parcels, and pallets. Documents represent a substantial share due to their necessity in business communications, while parcels represent a growing segment, fueled by e-commerce.

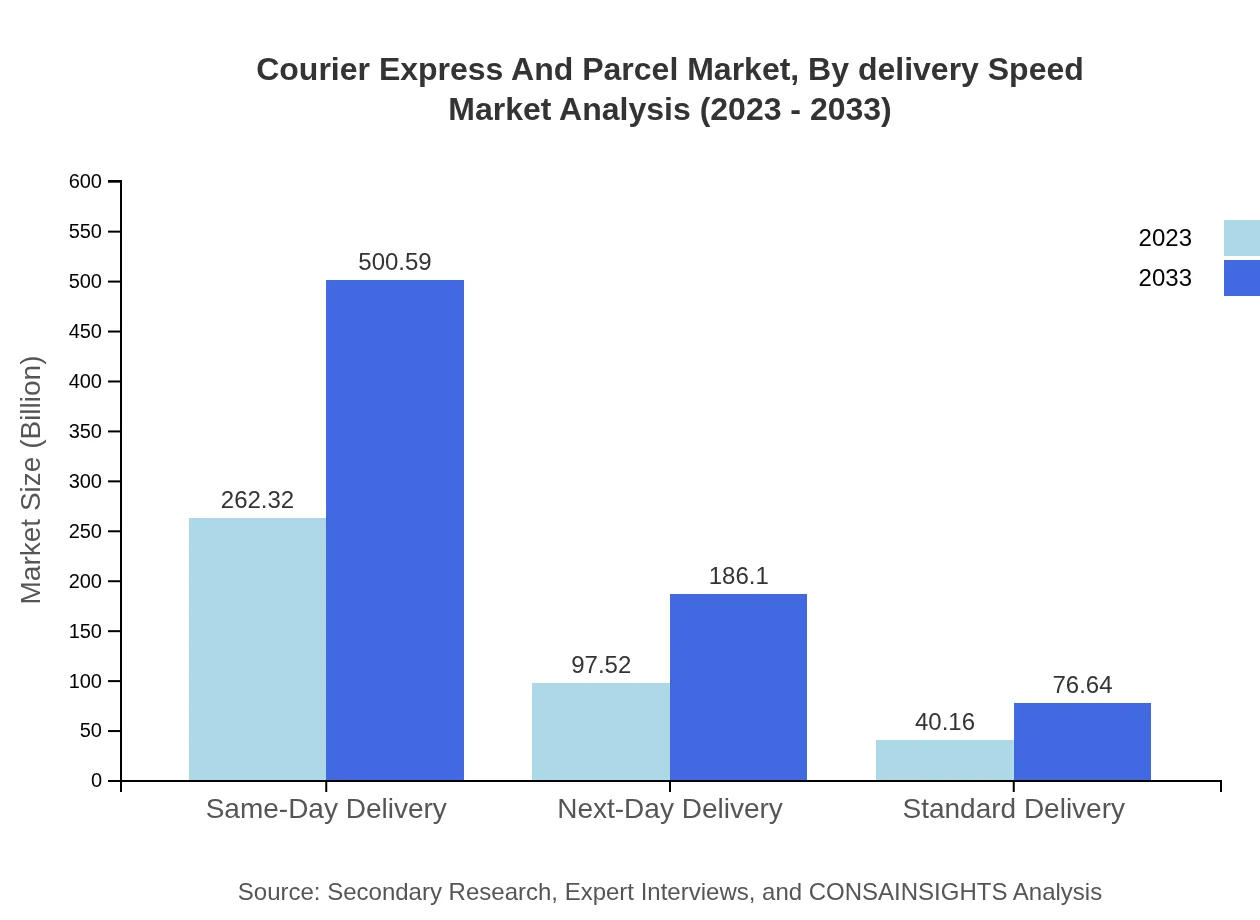

Courier Express And Parcel Market Analysis By Delivery Speed

Delivery speeds vary from same-day to standard delivery. Same-day services are increasingly popular among consumers, particularly in urban areas, as they seek immediate fulfillment of their orders.

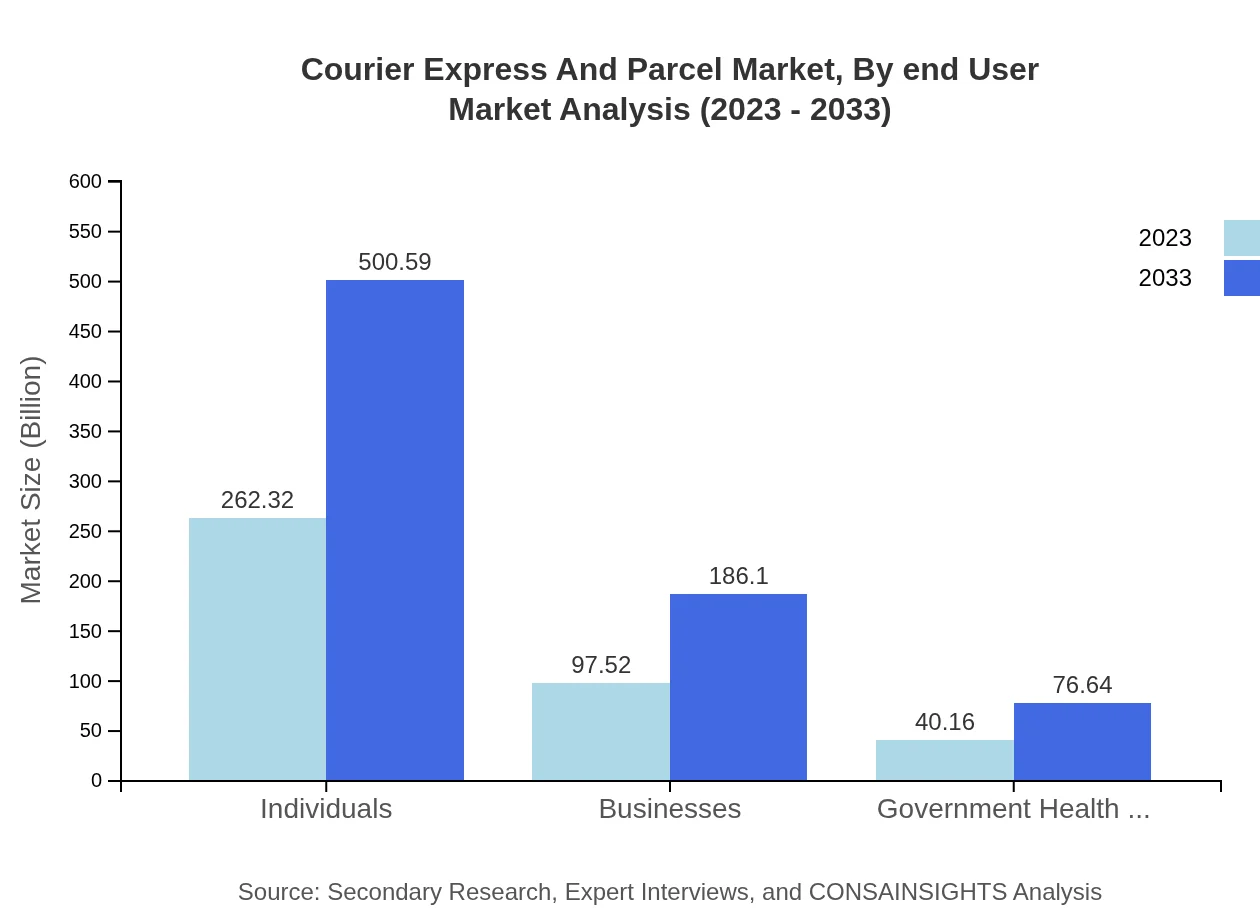

Courier Express And Parcel Market Analysis By End User

End-users include individuals, businesses, and government health & education sectors. The individual segment is growing significantly, driven by e-commerce sales, while businesses remain a substantial user base due to supply chain needs.

Courier Express And Parcel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Courier Express And Parcel Industry

DHL Express:

DHL is a global leader in the logistics industry, specializing in international express deliveries and providing innovative solutions for various sectors.FedEx Corporation:

FedEx is a pioneer in overnight shipping and logistics services, known for its comprehensive network and wide range of shipping options.UPS Inc.:

UPS offers both domestic and international delivery services, with a strong emphasis on reliability and technological advancements in logistics.TNT Express:

TNT specializes in international and domestic express delivery and is known for its strong presence in Europe and Asia.We're grateful to work with incredible clients.

FAQs

What is the market size of courier Express And Parcel?

The global Courier Express and Parcel market is valued at approximately $400 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.5% through 2033. This growth reflects the increasing demand for delivery services worldwide.

What are the key market players or companies in this courier Express And Parcel industry?

Key players in the courier, express, and parcel industry include FedEx, UPS, DHL, USPS, and various regional carriers. These companies dominate the market through extensive logistics networks and innovative delivery solutions.

What are the primary factors driving the growth in the courier Express And Parcel industry?

Growth in e-commerce, rising consumer expectations for quick deliveries, and global trade expansion are crucial factors driving the courier-express-and-parcel market. Additionally, technological advances in logistics and supply chain management contribute to market growth.

Which region is the fastest Growing in the courier Express And Parcel market?

The Asia-Pacific region is expected to witness the fastest growth in the courier-express-and-parcel market, expanding from $78.84 billion in 2023 to $150.45 billion by 2033, fueled by growing e-commerce and logistics investments.

Does ConsaInsights provide customized market report data for the courier Express And Parcel industry?

Yes, ConsaInsights offers tailored market reports that cater to specific needs within the courier-express-and-parcel industry, allowing businesses to gain strategic insights and make informed decisions based on precise market data.

What deliverables can I expect from this courier Express And Parcel market research project?

Deliverables from the market research project will include detailed reports, growth forecasts, competitive analyses, and segment breakdowns. Clients will receive actionable insights to challenge competitors effectively.

What are the market trends of courier Express And Parcel?

Current trends in the courier-express-and-parcel market include an increase in same-day delivery options, sustainability initiatives, and the adoption of advanced technologies like AI and automation to enhance efficiency and customer satisfaction.