Covid-19 Safety And Prevention Products Market Report

Published Date: 31 January 2026 | Report Code: covid-19-safety-and-prevention-products

Covid-19 Safety And Prevention Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Covid-19 Safety and Prevention Products market from 2023 to 2033, covering market size, growth trends, regional insights, and key players. It aims to equip stakeholders with valuable insights for strategic planning and decision-making.

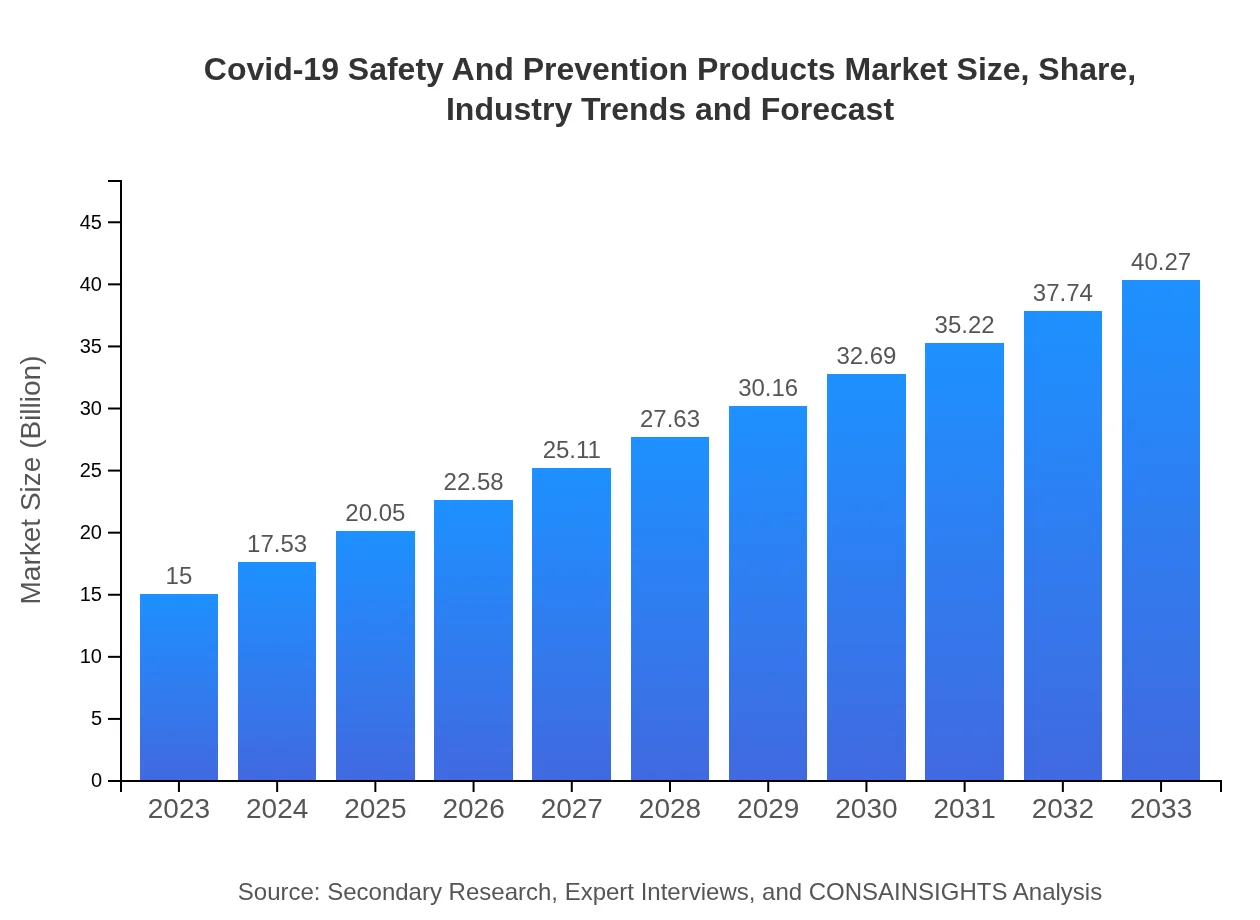

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $40.27 Billion |

| Top Companies | 3M, Honeywell , Caterpillar , Reckitt Benckiser |

| Last Modified Date | 31 January 2026 |

Covid-19 Safety And Prevention Products Market Overview

Customize Covid-19 Safety And Prevention Products Market Report market research report

- ✔ Get in-depth analysis of Covid-19 Safety And Prevention Products market size, growth, and forecasts.

- ✔ Understand Covid-19 Safety And Prevention Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Covid-19 Safety And Prevention Products

What is the Market Size & CAGR of Covid-19 Safety And Prevention Products market in 2023?

Covid-19 Safety And Prevention Products Industry Analysis

Covid-19 Safety And Prevention Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Covid-19 Safety And Prevention Products Market Analysis Report by Region

Europe Covid-19 Safety And Prevention Products Market Report:

The European market is anticipated to grow from USD 3.61 billion in 2023 to USD 9.70 billion in 2033. European countries are increasingly prioritizing health safety and hygiene, prompting a rise in the demand for PPE and sanitization products in various industry sectors.Asia Pacific Covid-19 Safety And Prevention Products Market Report:

In the Asia Pacific region, the market is projected to grow from USD 3.01 billion in 2023 to USD 8.09 billion in 2033, driven by increasing population density and heightened awareness regarding health and safety measures. Government initiatives promoting health standards and investments in healthcare infrastructure further fuel market growth.North America Covid-19 Safety And Prevention Products Market Report:

North America, leading the market, is forecasted to grow from USD 5.62 billion in 2023 to USD 15.09 billion in 2033. The surge is driven by high consumer spending on health safety products and stringent regulations mandating safety measures across various sectors.South America Covid-19 Safety And Prevention Products Market Report:

The South American market is expected to expand from USD 1.45 billion in 2023 to USD 3.88 billion by 2033. This growth is attributed to the rising prevalence of infectious diseases and the need for improved health safety infrastructure, especially in urban areas.Middle East & Africa Covid-19 Safety And Prevention Products Market Report:

In the Middle East and Africa, the market is projected to grow from USD 1.31 billion in 2023 to USD 3.51 billion by 2033. Factors contributing to this growth include increasing healthcare expenditure and the rising need for effective health safety protocols in the region.Tell us your focus area and get a customized research report.

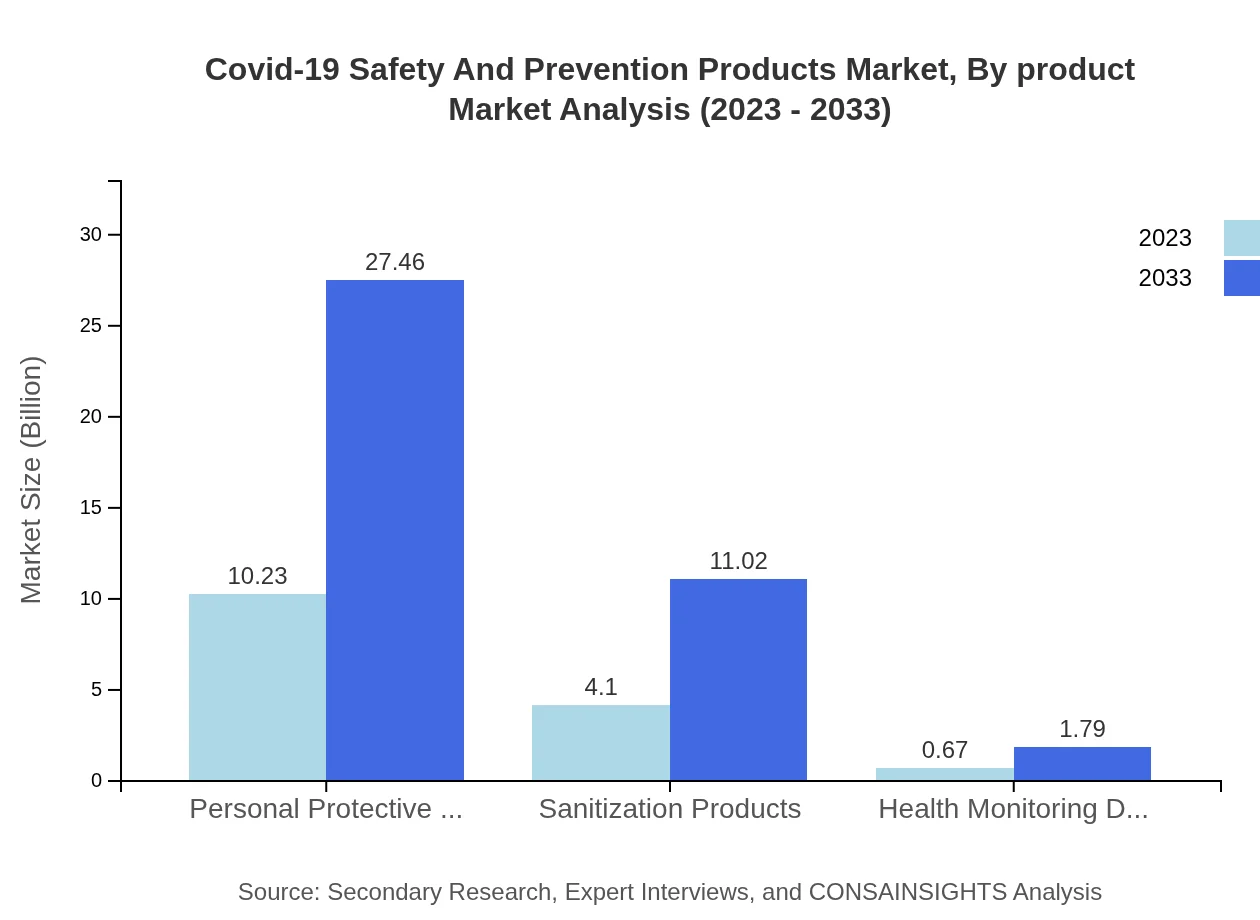

Covid-19 Safety And Prevention Products Market Analysis By Product

The market is predominantly driven by Personal Protective Equipment (PPE), which accounted for USD 10.23 billion in 2023, with a forecasted growth to USD 27.46 billion by 2033. Additionally, sanitization products and health monitoring devices are critical segments, reflecting growing consumer awareness regarding hygiene and health maintenance.

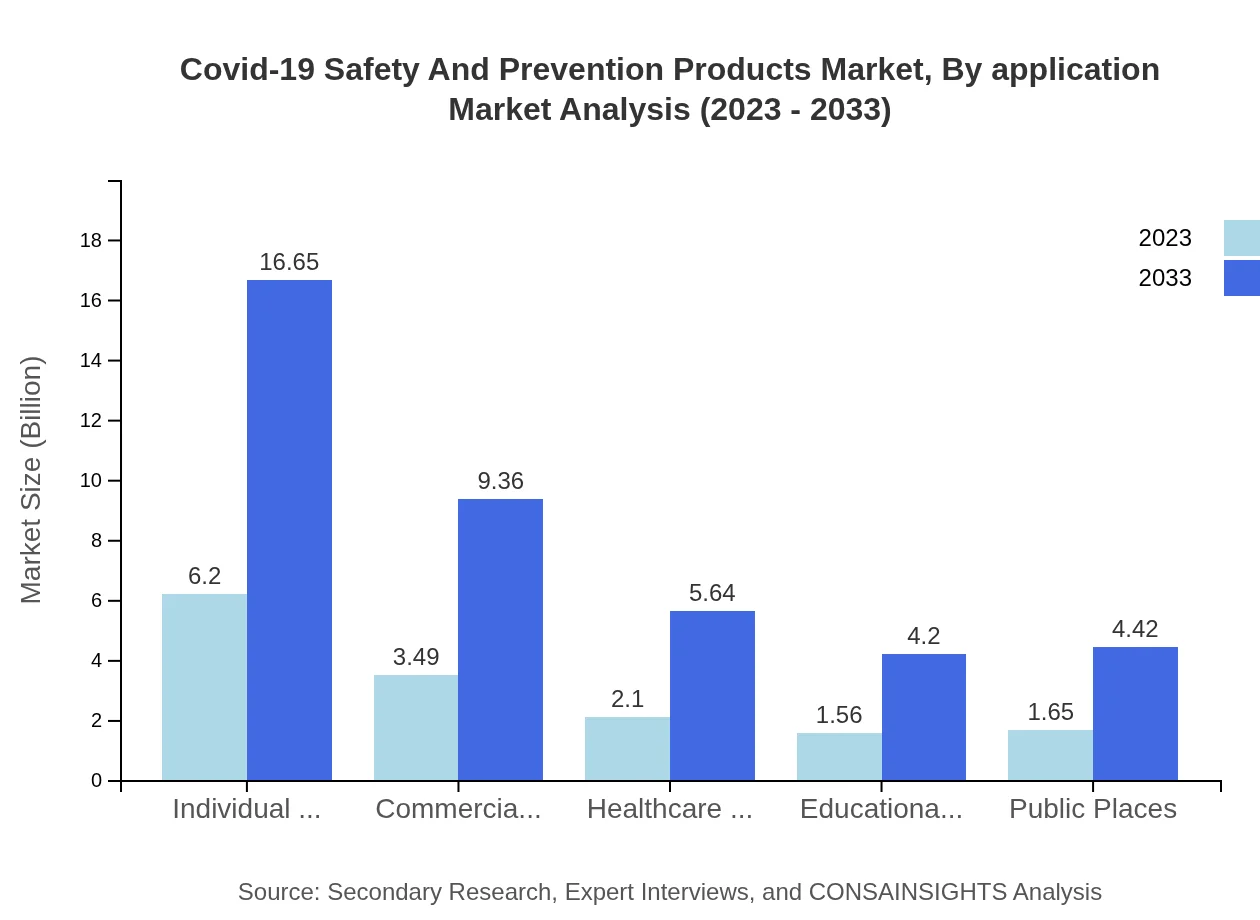

Covid-19 Safety And Prevention Products Market Analysis By Application

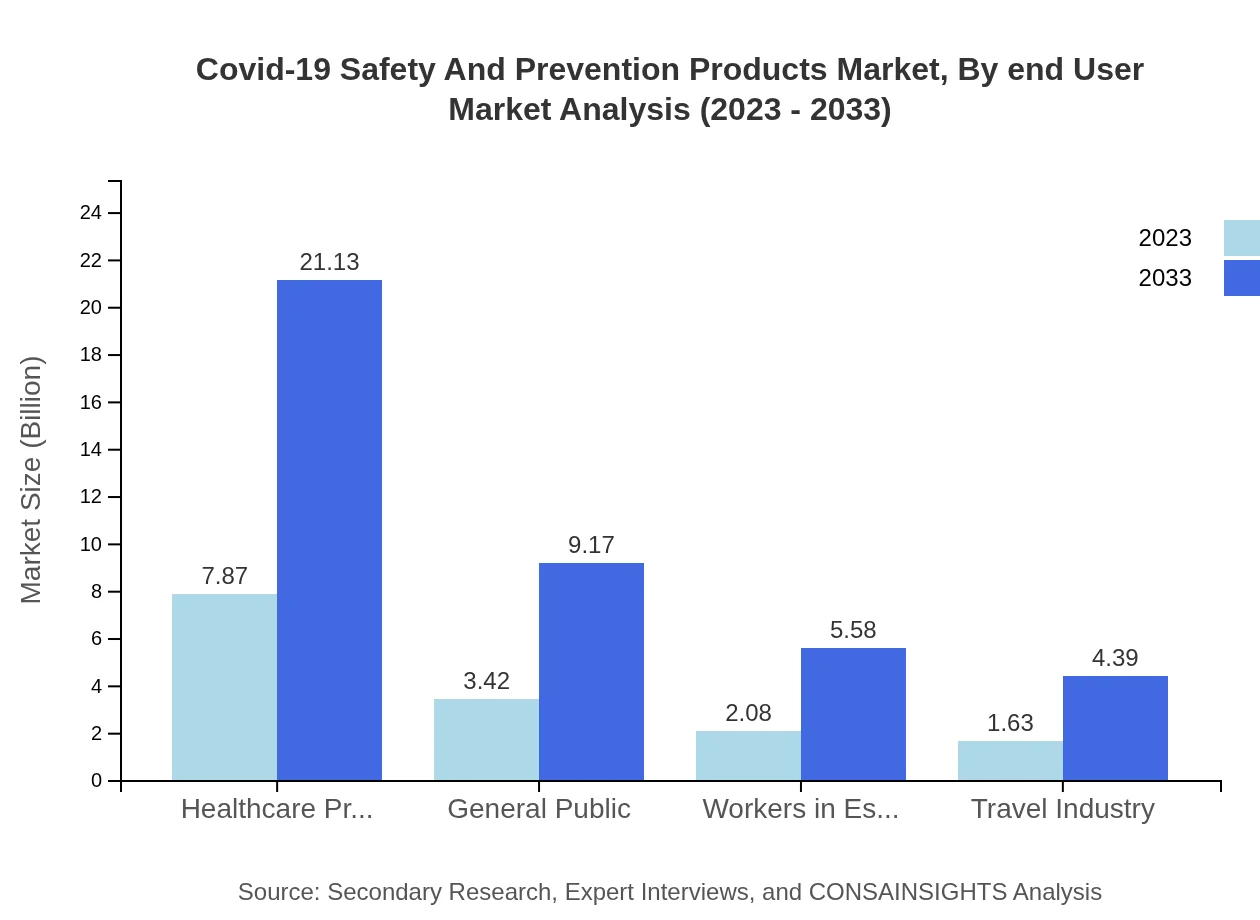

This market segment showcases varied applications across healthcare facilities, educational institutions, and essential service sectors, with healthcare professionals being the largest consumers, representing USD 7.87 billion in 2023. The education sector and general public also contribute to market demand significantly.

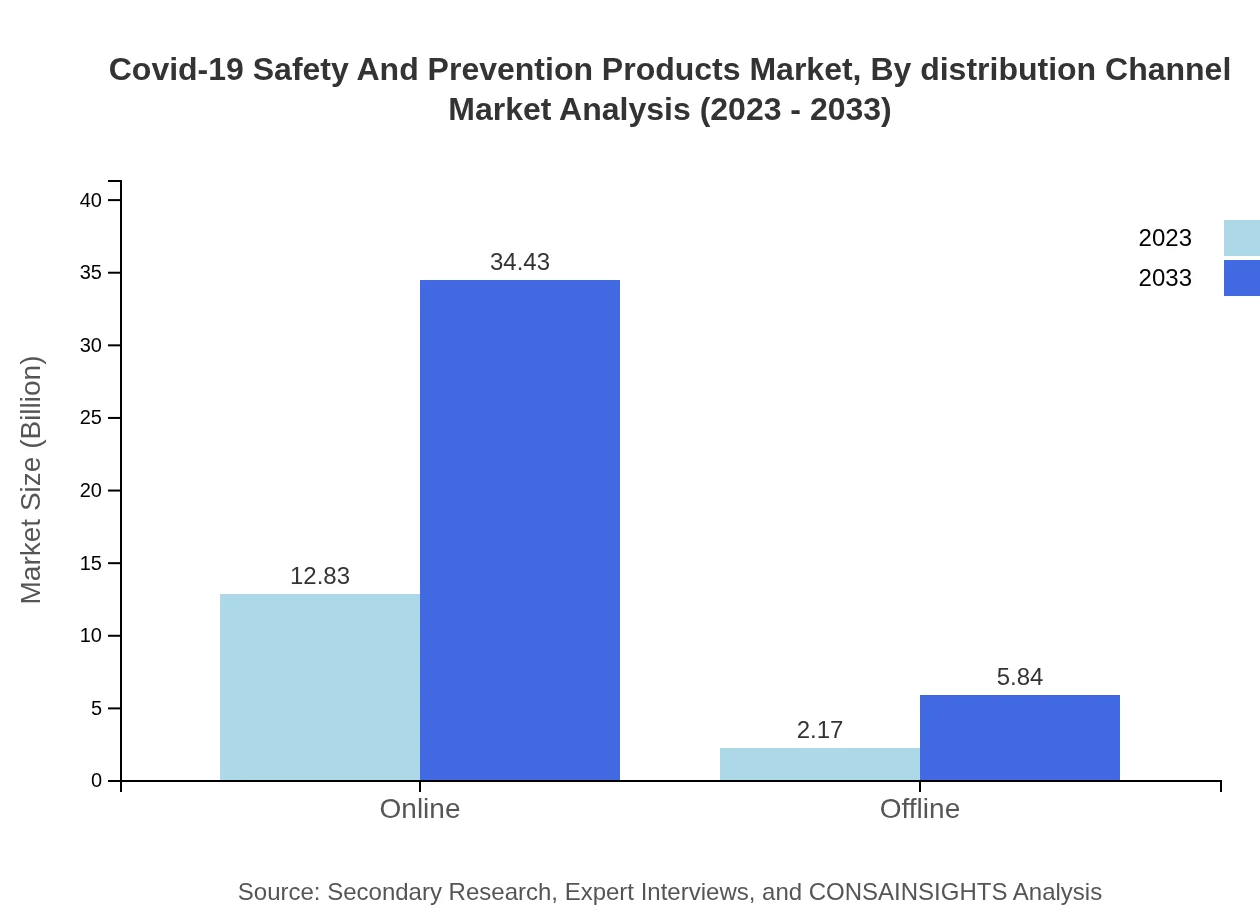

Covid-19 Safety And Prevention Products Market Analysis By Distribution Channel

The online distribution channel leads the market, representing USD 12.83 billion in 2023, a testament to shifting consumer purchasing preferences. Offline retail remains relevant, offering essential accessibility to products, especially in regions with limited internet penetration.

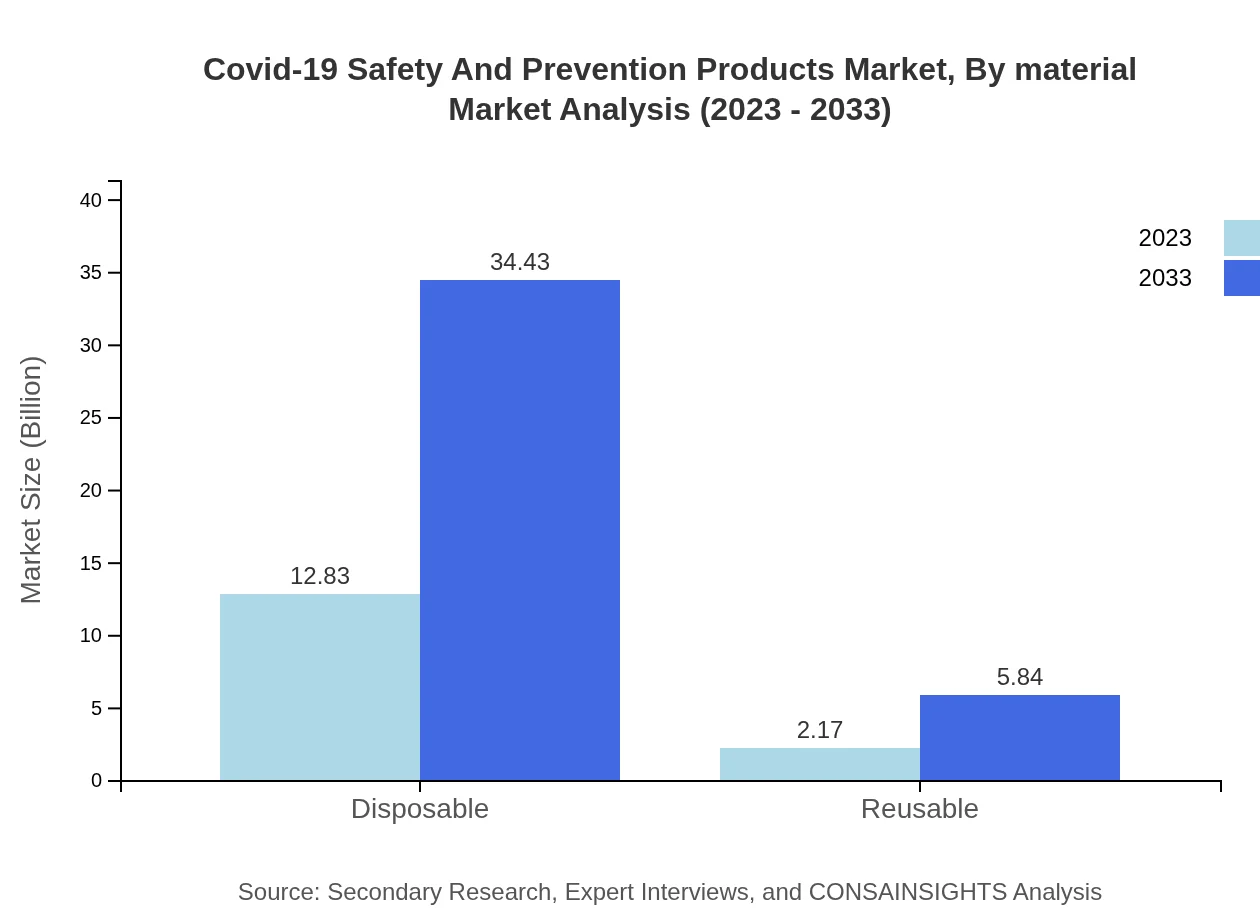

Covid-19 Safety And Prevention Products Market Analysis By Material

The choice of materials plays a crucial role in product efficacy. Disposable materials dominate the market with USD 12.83 billion in 2023 due to their convenience and effectiveness, while reusable materials are gaining ground as sustainability concerns rise.

Covid-19 Safety And Prevention Products Market Analysis By End User

Healthcare facilities are major end-users, consuming USD 2.10 billion in 2023. The general public and workers in essential services also contribute to market growth, with particular emphasis on personal and communal health safety protocols.

Covid-19 Safety And Prevention Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Covid-19 Safety And Prevention Products Industry

3M:

A leader in manufacturing PPE, 3M is known for its innovations in respiratory protection and has significantly contributed to pandemic safety measures across the globe.Honeywell :

Honeywell provides a wide range of safety and PPE solutions, playing a crucial role in ensuring worker safety across industries during the pandemic.Caterpillar :

While primarily known for heavy machinery, Caterpillar has also expanded into producing PPE and safety products essential during the Covid-19 crisis.Reckitt Benckiser:

Known for its sanitization products, Reckitt Benckiser has delivered significant contributions to cleaning and disinfection, essential for reducing virus transmission.We're grateful to work with incredible clients.

FAQs

What is the market size of Covid-19 Safety and Prevention Products?

The Covid-19 Safety and Prevention Products market has an estimated size of $15 billion in 2023, with an expected compound annual growth rate (CAGR) of 10% projected through to 2033.

What are the key market players or companies in the Covid-19 Safety and Prevention Products industry?

Key players in the Covid-19 Safety and Prevention Products market include major PPE manufacturers, sanitization product companies, and health monitor device developers. Their innovation and product offerings are crucial for addressing safety during the pandemic.

What are the primary factors driving the growth in the Covid-19 Safety and Prevention Products industry?

Primary drivers for growth in this market include heightened awareness of health safety, increased demand for personal protective equipment (PPE), and ongoing government health mandates. Additionally, technological advancements improve product effectiveness.

Which region is the fastest Growing in the Covid-19 Safety and Prevention Products market?

Asia Pacific is the fastest-growing region in the Covid-19 Safety and Prevention Products market, with a market growth from $3.01 billion in 2023 to $8.09 billion by 2033, reflecting significant investment in health infrastructure.

Does ConsaInsights provide customized market report data for the Covid-19 Safety and Prevention Products industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the Covid-19 Safety and Prevention Products industry, allowing for detailed insights specific to various segments.

What deliverables can I expect from this Covid-19 Safety and Prevention Products market research project?

Expect deliverables such as comprehensive market analysis, segmentation data, growth forecasts, competitive landscape reports, and tailored insights into market trends specific to various regions and product categories.

What are the market trends of Covid-19 Safety and Prevention Products?

Market trends include increased demand for high-quality PPE, growth in online sales channels, and a focus on eco-friendly sanitization products. Overall, a shift toward digital distribution is also evident.