Cranes Rental Market Report

Published Date: 22 January 2026 | Report Code: cranes-rental

Cranes Rental Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the cranes rental market, covering insights, trends, and projections from 2023 to 2033. It includes market size, growth rates, industry dynamics, regional insights, and key players shaping the landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

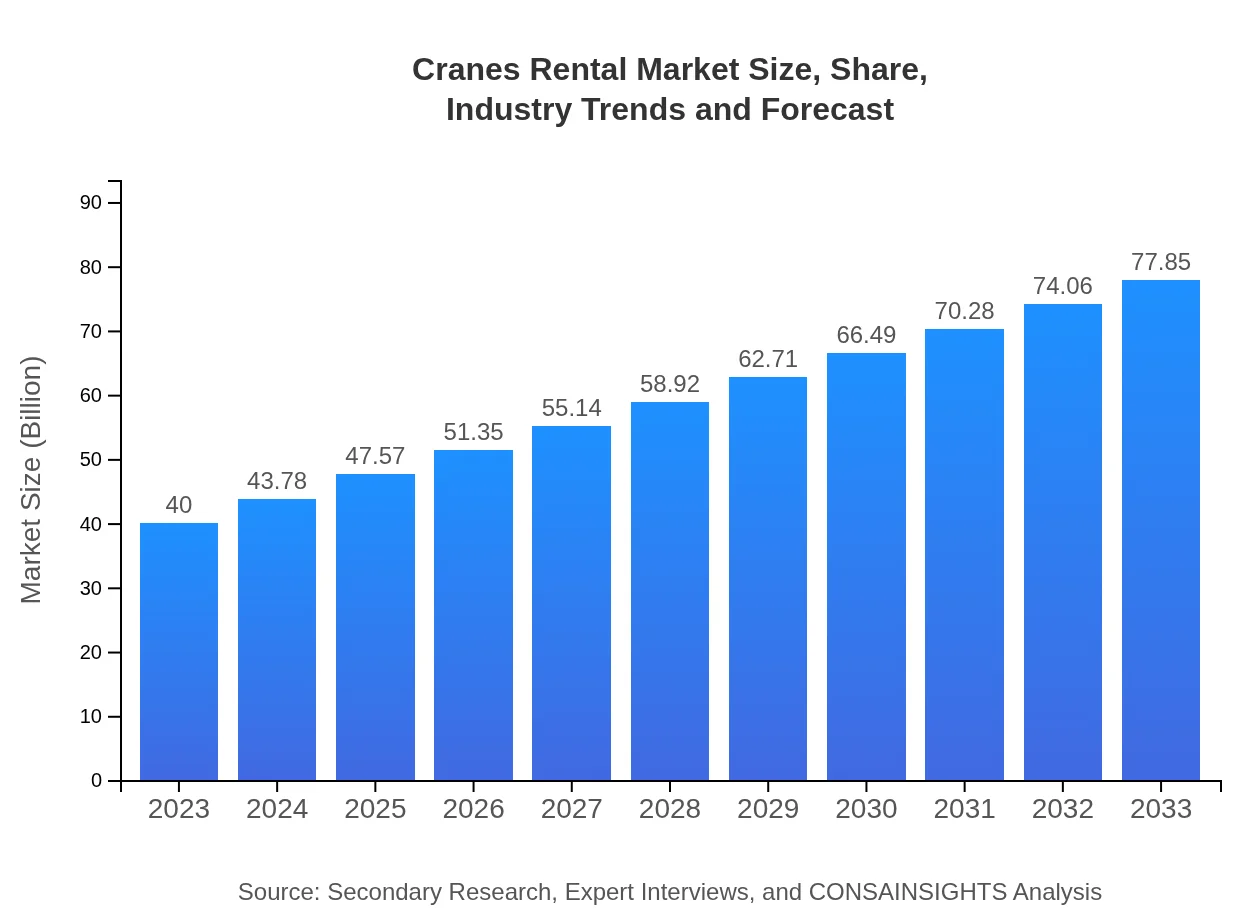

| 2023 Market Size | $40.00 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $77.85 Billion |

| Top Companies | United Rentals, Ashtead Group, Loxam, Hewden |

| Last Modified Date | 22 January 2026 |

Cranes Rental Market Overview

Customize Cranes Rental Market Report market research report

- ✔ Get in-depth analysis of Cranes Rental market size, growth, and forecasts.

- ✔ Understand Cranes Rental's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cranes Rental

What is the Market Size & CAGR of Cranes Rental market in 2023?

Cranes Rental Industry Analysis

Cranes Rental Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cranes Rental Market Analysis Report by Region

Europe Cranes Rental Market Report:

In Europe, the market size is estimated at $12.24 billion in 2023, with projections to reach $23.82 billion by 2033. The emphasis on green building practices and renovation projects post-pandemic is expected to bolster the cranes rental market.Asia Pacific Cranes Rental Market Report:

In the Asia Pacific region, the cranes rental market is projected to grow from $7.23 billion in 2023 to $14.07 billion by 2033, driven by robust infrastructure projects in countries like China and India. The increasing number of construction activities and urbanization trends support this growth.North America Cranes Rental Market Report:

North America leads the market with a valuation of $15.17 billion in 2023, projected to grow to $29.53 billion by 2033. The consistent demand from the construction industry, combined with a focus on infrastructure modernization, fuels this growth.South America Cranes Rental Market Report:

The South American market, starting at $2.35 billion in 2023, is expected to reach $4.57 billion by 2033. Key growth drivers include rising investments in mining and power generation projects within the region.Middle East & Africa Cranes Rental Market Report:

The Middle East and Africa region is anticipated to grow from $3.01 billion in 2023 to $5.86 billion by 2033, primarily due to ongoing mega construction projects and preparations for events like the World Expo 2025.Tell us your focus area and get a customized research report.

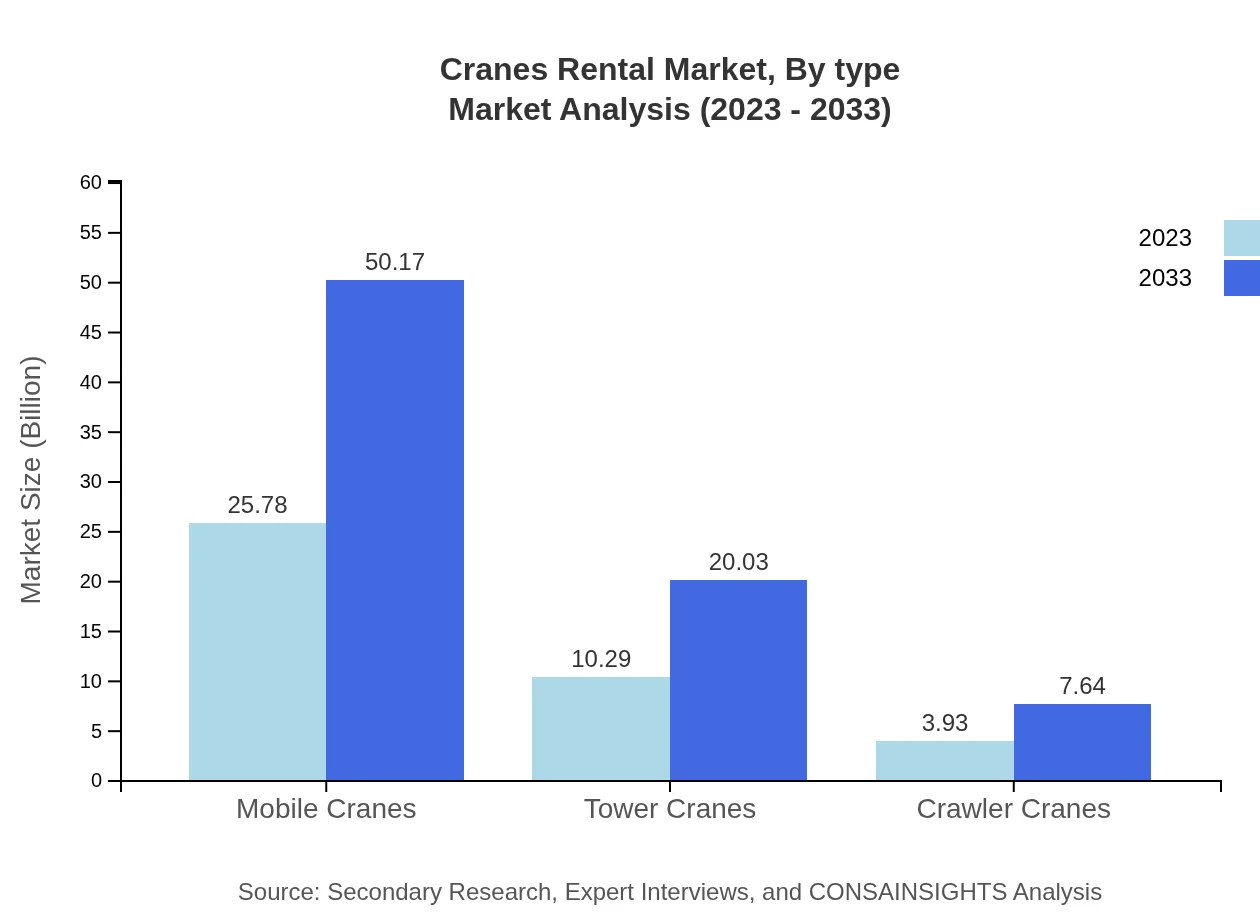

Cranes Rental Market Analysis By Type

Mobile cranes dominate the market, with a size of $25.78 billion in 2023, expanding to $50.17 billion by 2033, maintaining a market share of 64.45%. Tower cranes and crawler cranes follow, with respective sizes of $10.29 billion and $3.93 billion in 2023.

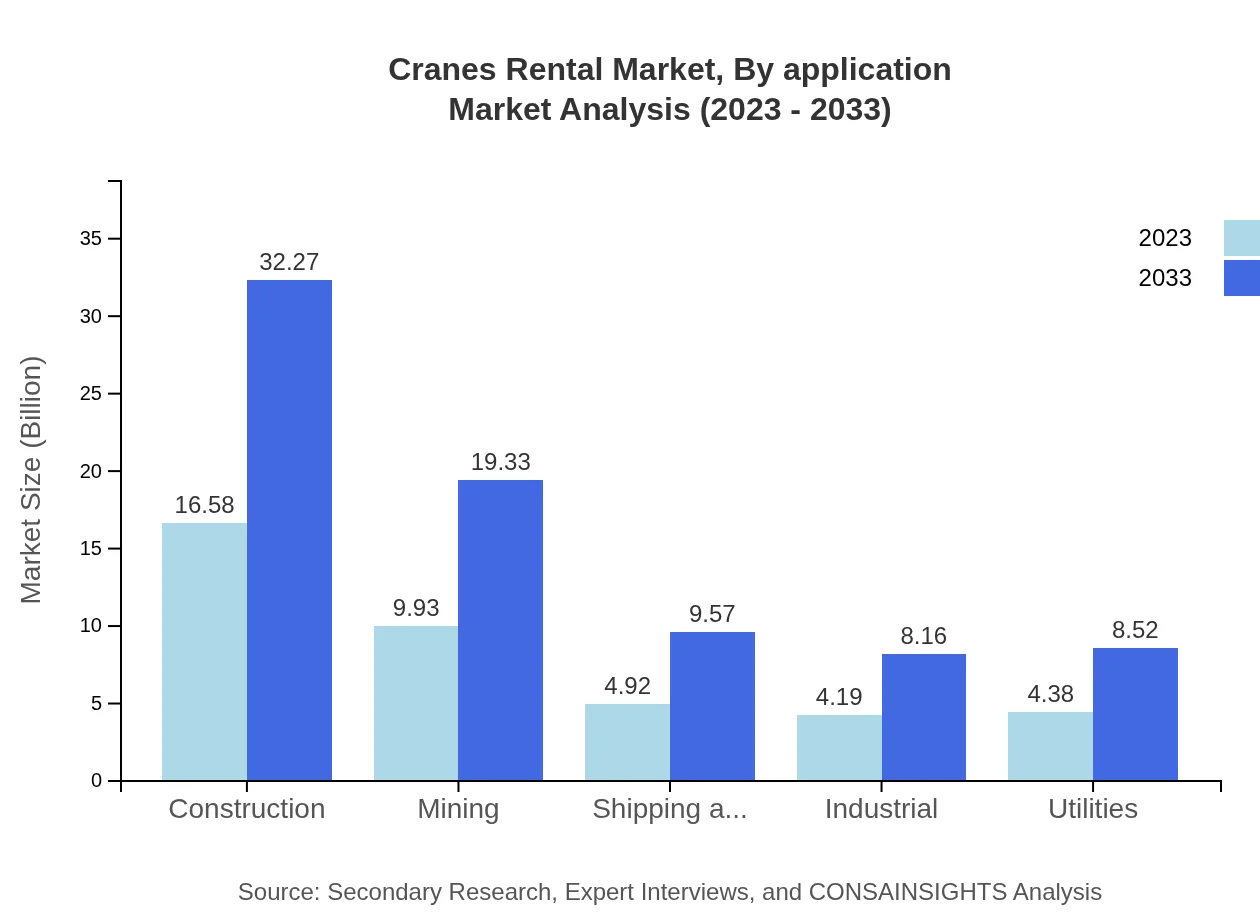

Cranes Rental Market Analysis By Application

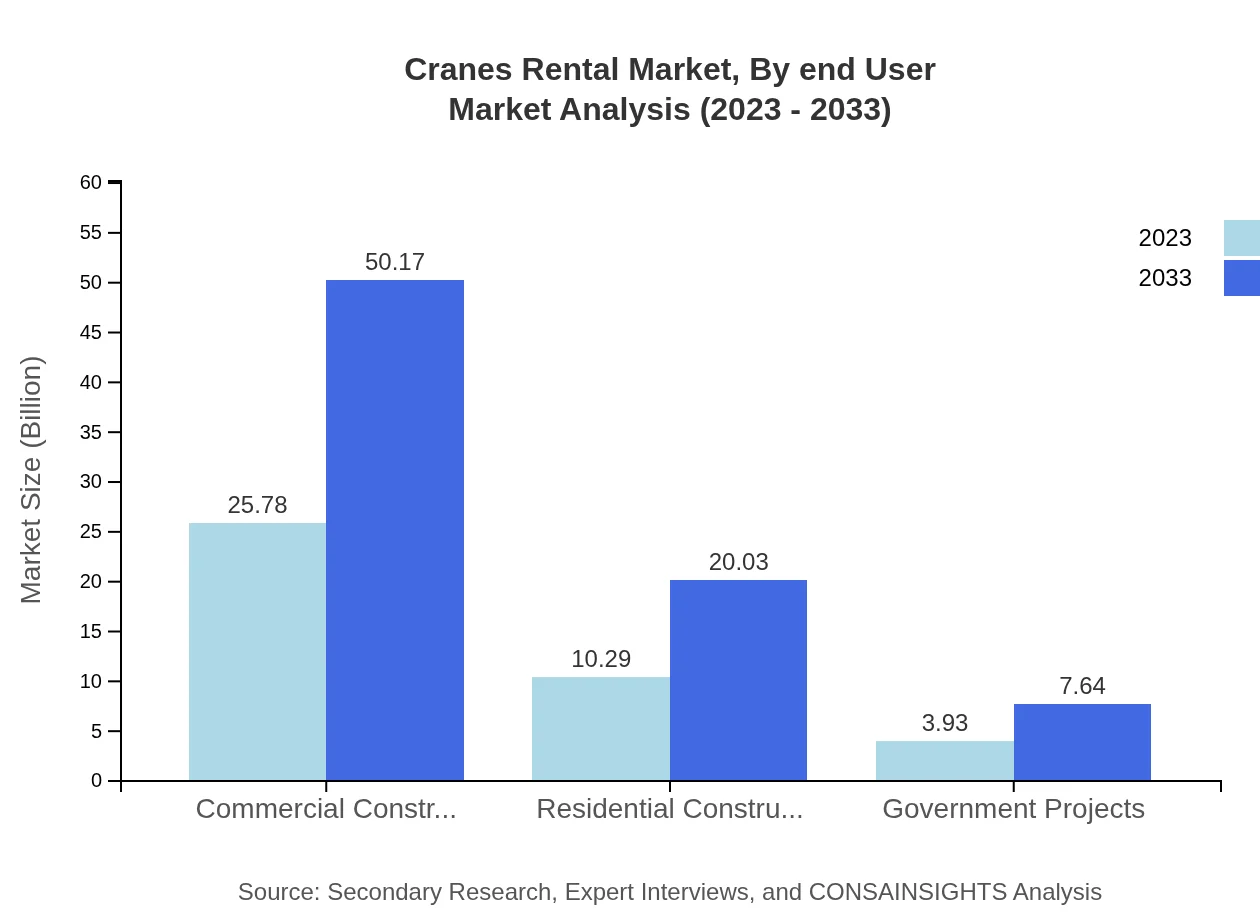

Commercial construction is the largest segment, comprising $25.78 billion of the market in 2023, projected to grow alongside residential construction and government projects, each contributing to overall market expansion.

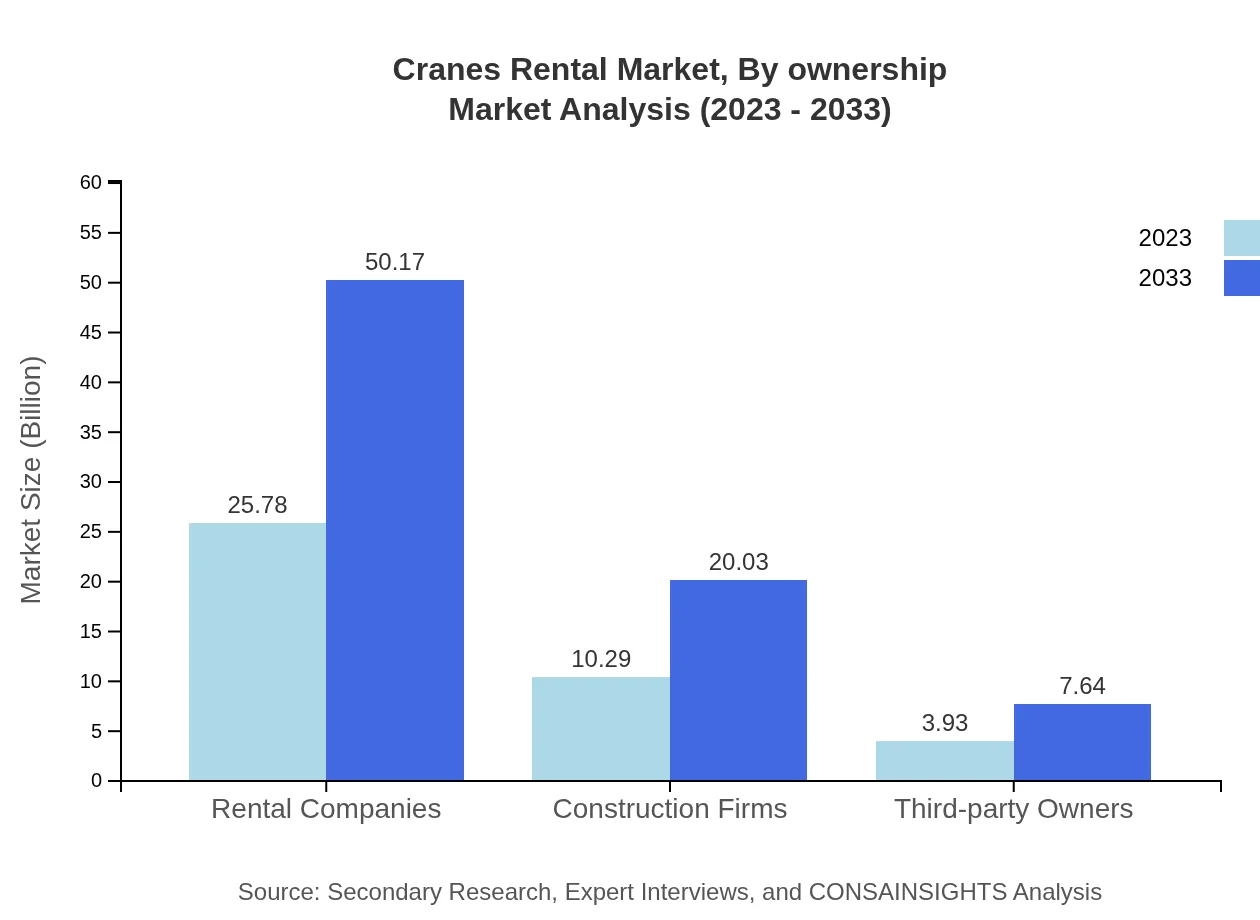

Cranes Rental Market Analysis By Ownership

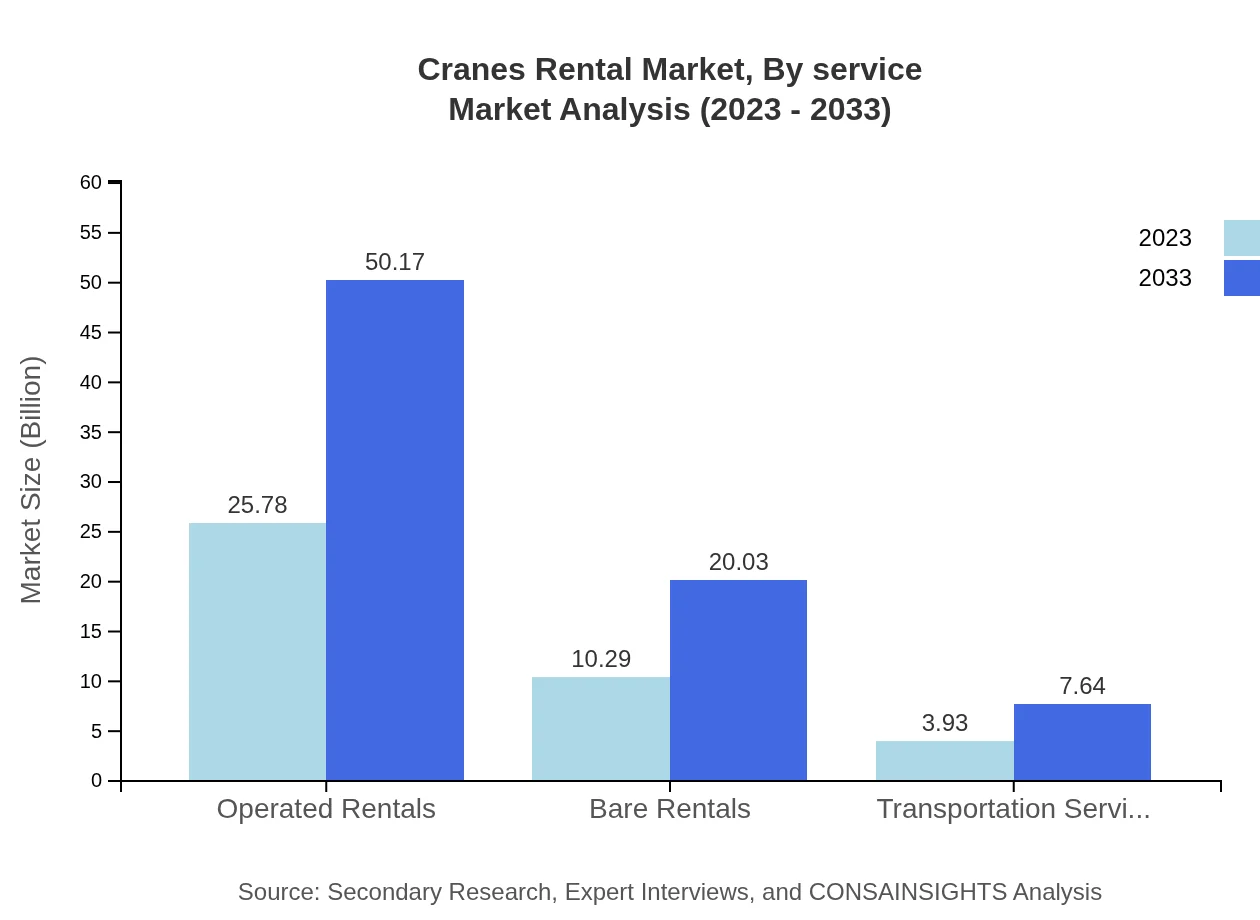

Operated rentals account for a significant market share of 64.45%, illustrating a trend towards rented-operated models rather than ownership. Bare rentals also maintain a notable share.

Cranes Rental Market Analysis By Service

Services provided encompass transportation services, driven by business growth in logistics and industrial sectors. The market reflects a diversified model, adapting to specific project demands.

Cranes Rental Market Analysis By End User

Key end-users include construction firms, which captured a market share of 25.73% in 2023. The rising demand from mining and utilities adds significant value to the cranes rental services.

Cranes Rental Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cranes Rental Industry

United Rentals:

As one of the largest equipment rental companies globally, United Rentals provides a wide range of cranes and construction equipment, focusing on maximizing uptime and reducing costs for customers.Ashtead Group:

Ashtead, operating under the Sunbelt Rentals brand, specializes in equipment rental solutions across various sectors, including construction and industrial, delivering high-quality cranes and customer services.Loxam:

Loxam is a prominent player in Europe, offering comprehensive crane rental services, renowned for operational excellence and extensive fleet capability across many construction projects.Hewden:

Hewden is well-known in the UK market, providing innovative rental solutions and a diverse equipment fleet, specializing in heavy machinery and cranes.We're grateful to work with incredible clients.

FAQs

What is the market size of cranes rental?

The cranes rental market is valued at approximately $40 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.7%. This growth reflects increasing demands across various sectors, particularly in construction and infrastructure.

What are the key market players or companies in this cranes rental industry?

Key players in the cranes rental industry include major companies like United Rentals, Sunbelt Rentals, and H&E Equipment Services. These companies dominate the market by offering a wide range of crane solutions and extensive rental services.

What are the primary factors driving the growth in the cranes rental industry?

The primary growth drivers in the cranes rental industry include increasing investments in infrastructure projects, rising urbanization, and a growing need for construction in developed and developing regions. Technological advancements in cranes also play a significant role.

Which region is the fastest Growing in the cranes rental?

In the cranes rental market, North America is the fastest-growing region, projected to increase from $15.17 billion in 2023 to $29.53 billion by 2033. Europe and Asia Pacific also show significant growth potential, particularly in construction activities.

Does ConsaInsights provide customized market report data for the cranes rental industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cranes rental industry, providing insights into market size, trends, and competitive analysis based on user requirements.

What deliverables can I expect from this cranes rental market research project?

Deliverables from the cranes rental market research project typically include comprehensive market reports, executive summaries, industry trends, competitive landscape analysis, and forecasts for market growth segmented by region and type.

What are the market trends of cranes rental?

Current trends in the cranes rental market include a shift towards environmentally friendly equipment, increased adoption of technology like telematics, and a growing preference for operated rentals. These trends reflect an evolving industry focused on efficiency and sustainability.