Crm Analytics Market Report

Published Date: 31 January 2026 | Report Code: crm-analytics

Crm Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the CRM Analytics market, including detailed insights into market size, trends, regional performance, and forecasts for 2023 to 2033. It aims to equip stakeholders with critical data and insights necessary for strategic decision-making.

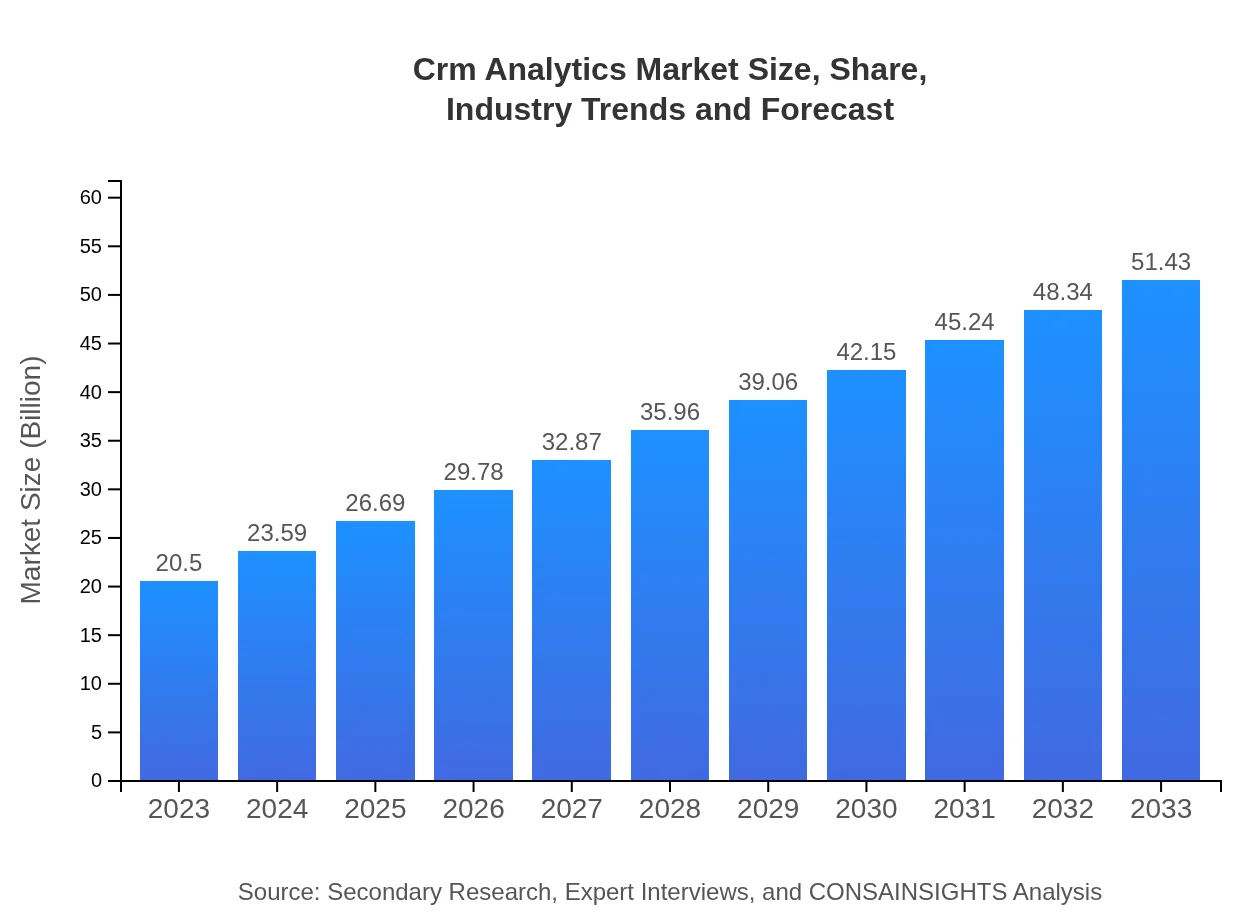

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $51.43 Billion |

| Top Companies | Salesforce, SAP, Oracle, Microsoft, HubSpot |

| Last Modified Date | 31 January 2026 |

Crm Analytics Market Overview

Customize Crm Analytics Market Report market research report

- ✔ Get in-depth analysis of Crm Analytics market size, growth, and forecasts.

- ✔ Understand Crm Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Crm Analytics

What is the Market Size & CAGR of Crm Analytics market in 2023?

Crm Analytics Industry Analysis

Crm Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Crm Analytics Market Analysis Report by Region

Europe Crm Analytics Market Report:

Europe's CRM Analytics market is projected to grow from $6.70 billion in 2023 to $16.80 billion by 2033. The region is experiencing a strong emphasis on customer engagement strategies and digitalization, pushing enterprises to leverage analytics for customer insights.Asia Pacific Crm Analytics Market Report:

The Asia Pacific region is anticipated to exhibit substantial growth, with the market size projected to reach $9.60 billion by 2033, growing from $3.83 billion in 2023. The increasing adoption of digital technologies by SMEs and large enterprises, coupled with a fast-growing retail sector, is propelling the demand for CRM Analytics solutions in the region.North America Crm Analytics Market Report:

North America is poised to remain the largest market for CRM Analytics, advancing from $7.26 billion in 2023 to $18.22 billion by 2033. The presence of major technology companies, high levels of investment in cloud services, and significant growth in customer data are crucial drivers of market expansion in this region.South America Crm Analytics Market Report:

In South America, the CRM Analytics market is expected to grow from $1.95 billion in 2023 to $4.89 billion by 2033. The rise in internet penetration and mobile phone usage is promoting digital transformation across various sectors, enhancing the adoption of analytics solutions within the region.Middle East & Africa Crm Analytics Market Report:

The Middle East and Africa market for CRM Analytics, though comparatively smaller, is expected to rise from $0.76 billion in 2023 to $1.92 billion by 2033. Growing economies are increasingly adopting CRM technologies to enhance customer experience and operational efficiency.Tell us your focus area and get a customized research report.

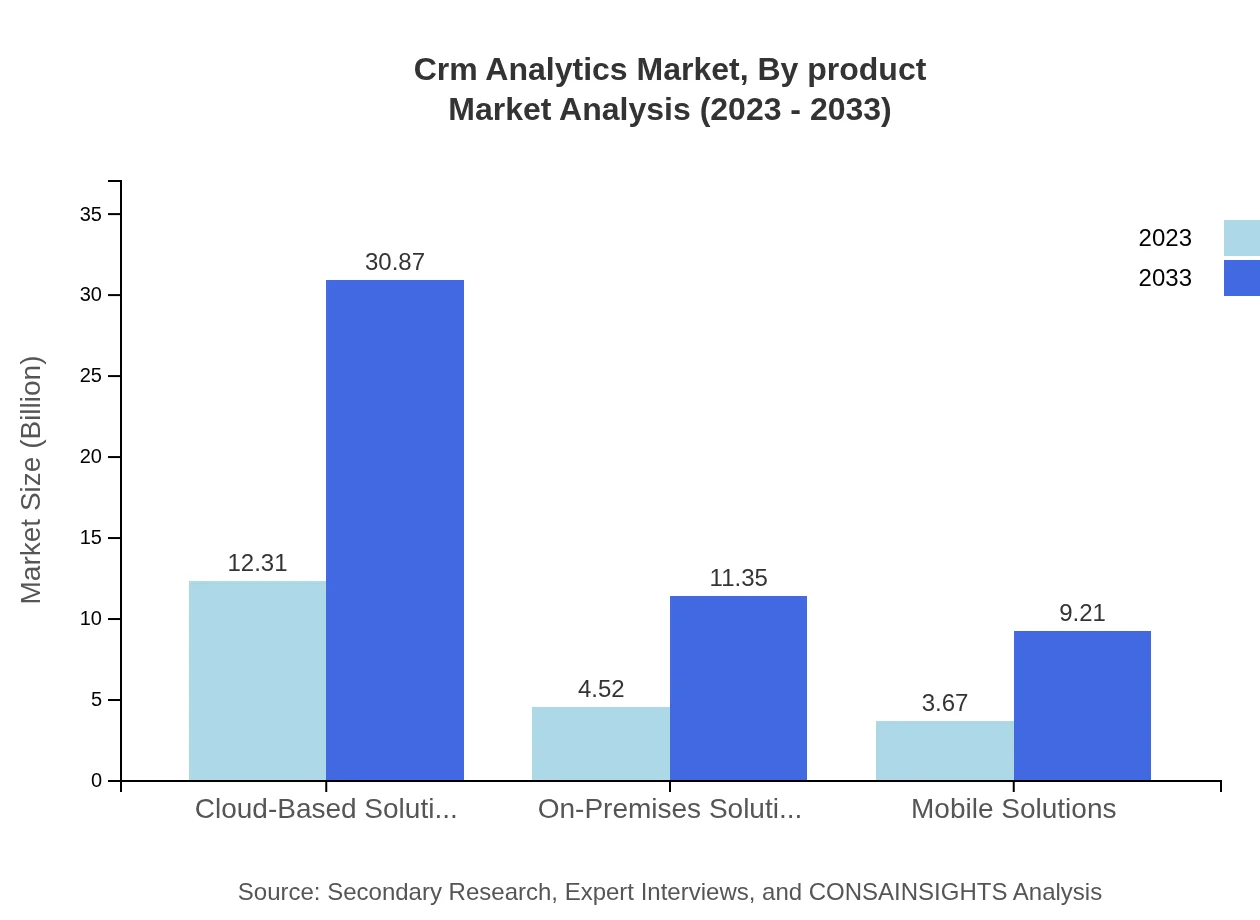

Crm Analytics Market Analysis By Product

The CRM Analytics market is segmented into cloud-based and on-premises solutions, focusing on businesses' evolving preferences. Cloud-based solutions dominate the market, projecting a strong growth from $12.31 billion in 2023 to $30.87 billion by 2033, while on-premises solutions are expected to grow from $4.52 billion to $11.35 billion during the same period.

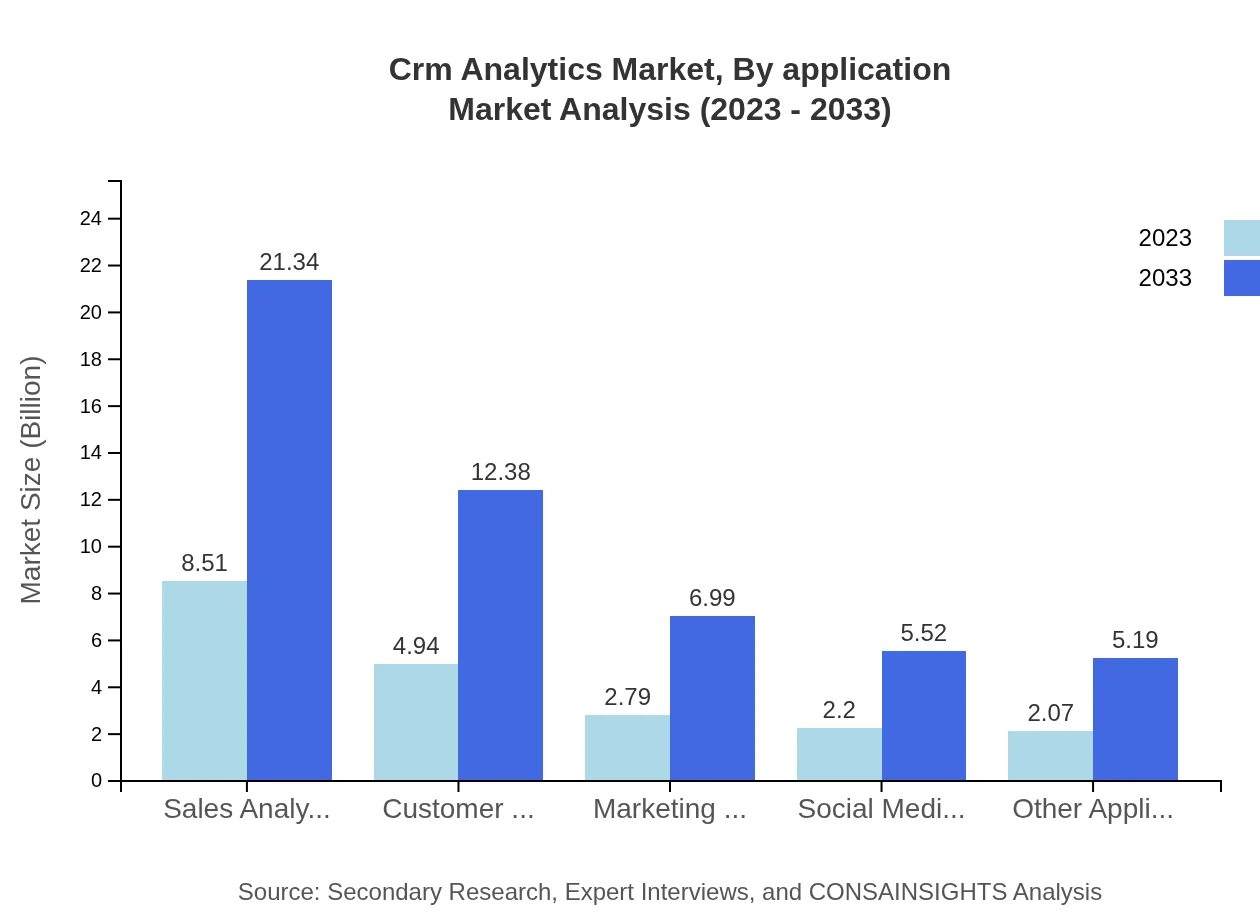

Crm Analytics Market Analysis By Application

Segmentation by application reveals that sales analytics and customer service analytics are crucial areas of focus. Sales analytics is projected to grow from $8.51 billion in 2023 to $21.34 billion by 2033, while customer service analytics would expand from $4.94 billion to $12.38 billion.

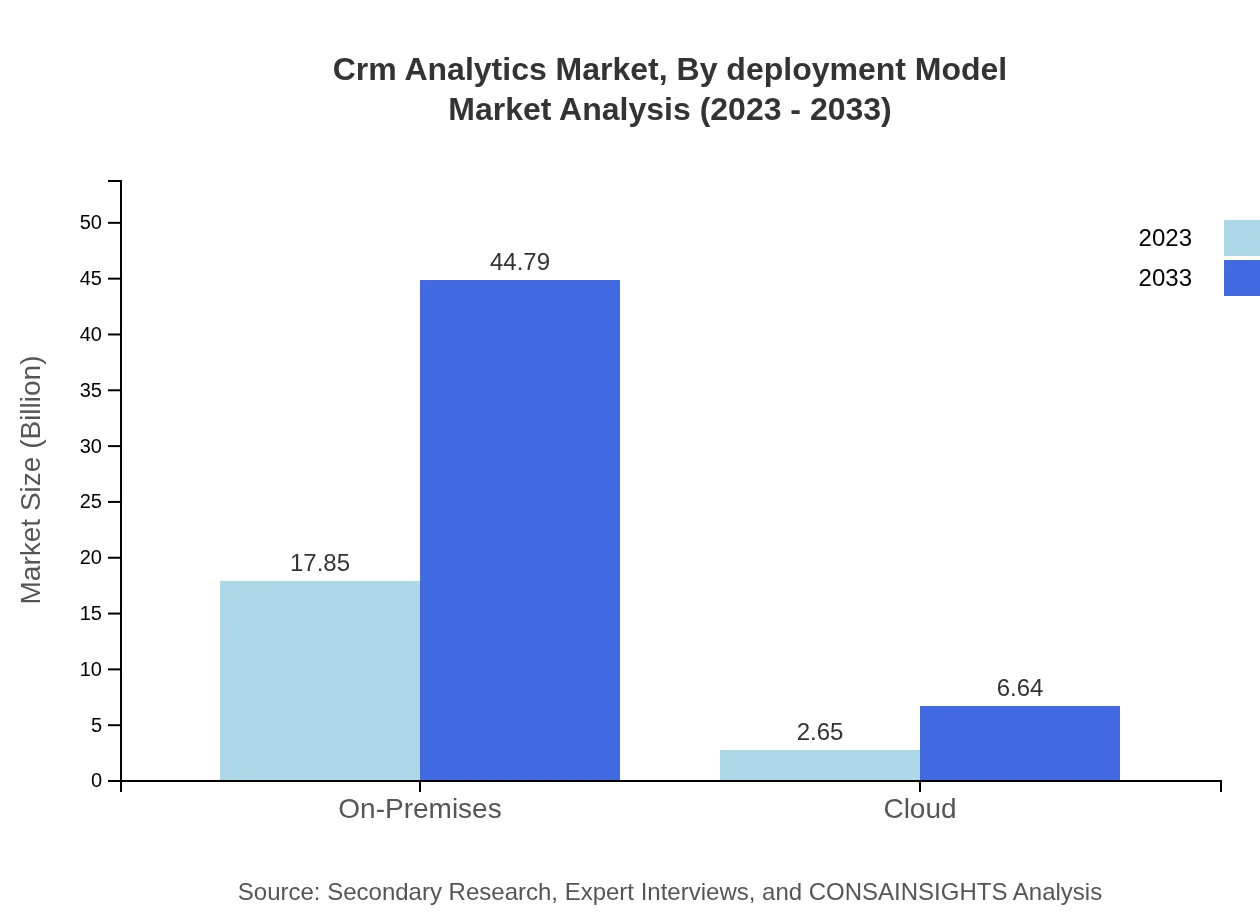

Crm Analytics Market Analysis By Deployment Model

Adopting a segmented approach to deployment models indicates that organizations are increasingly leaning towards cloud solutions due to their flexibility; reflecting a growth from $2.65 billion in 2023 to $6.64 billion by 2033 against the steady demand for on-premises solutions growing from $17.85 billion to $44.79 billion.

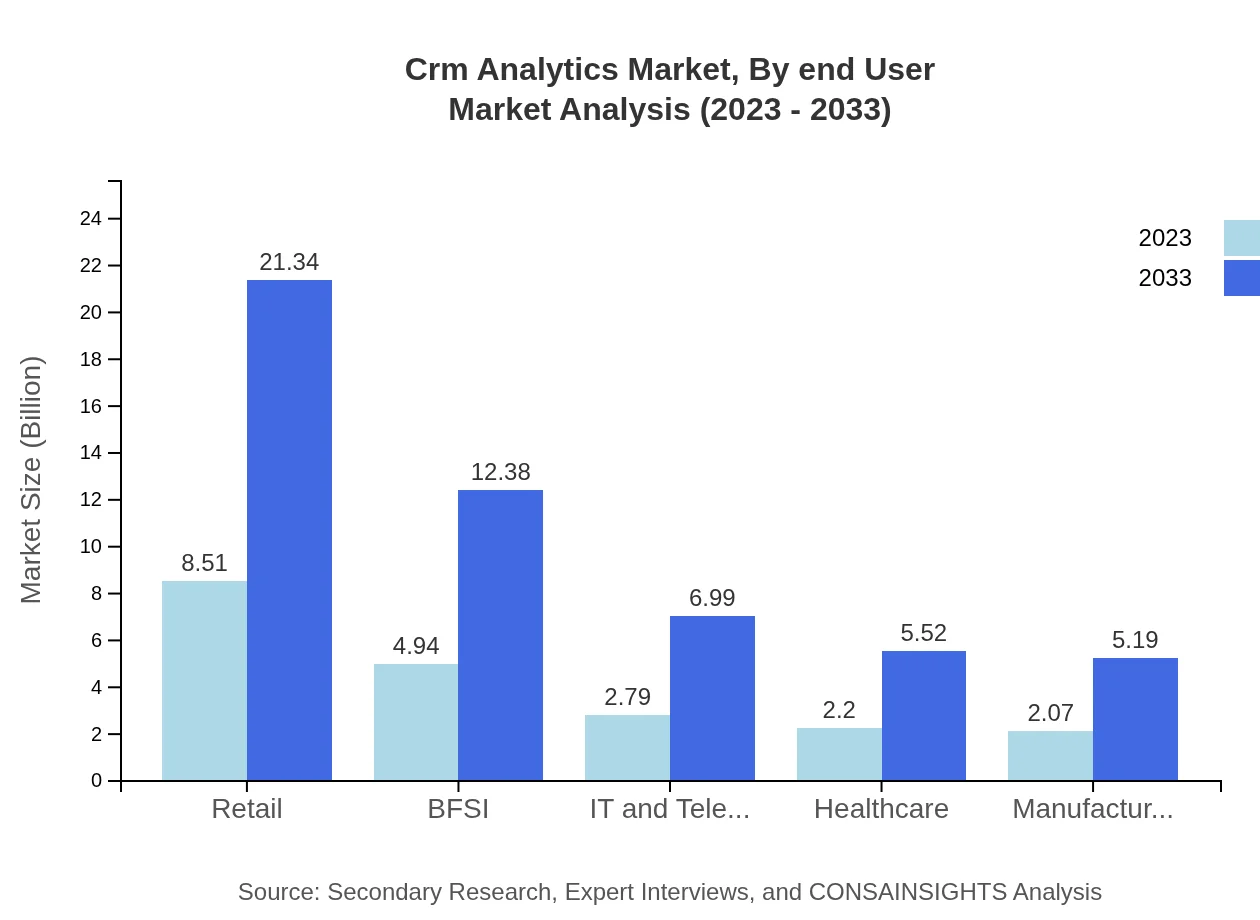

Crm Analytics Market Analysis By End User

Different end-user segments highlight diverse adoption levels. The retail sector is a considerable adopter, scaling from $8.51 billion in 2023 to $21.34 billion in 2033; BFSI follows closely, increasing from $4.94 billion to $12.38 billion.

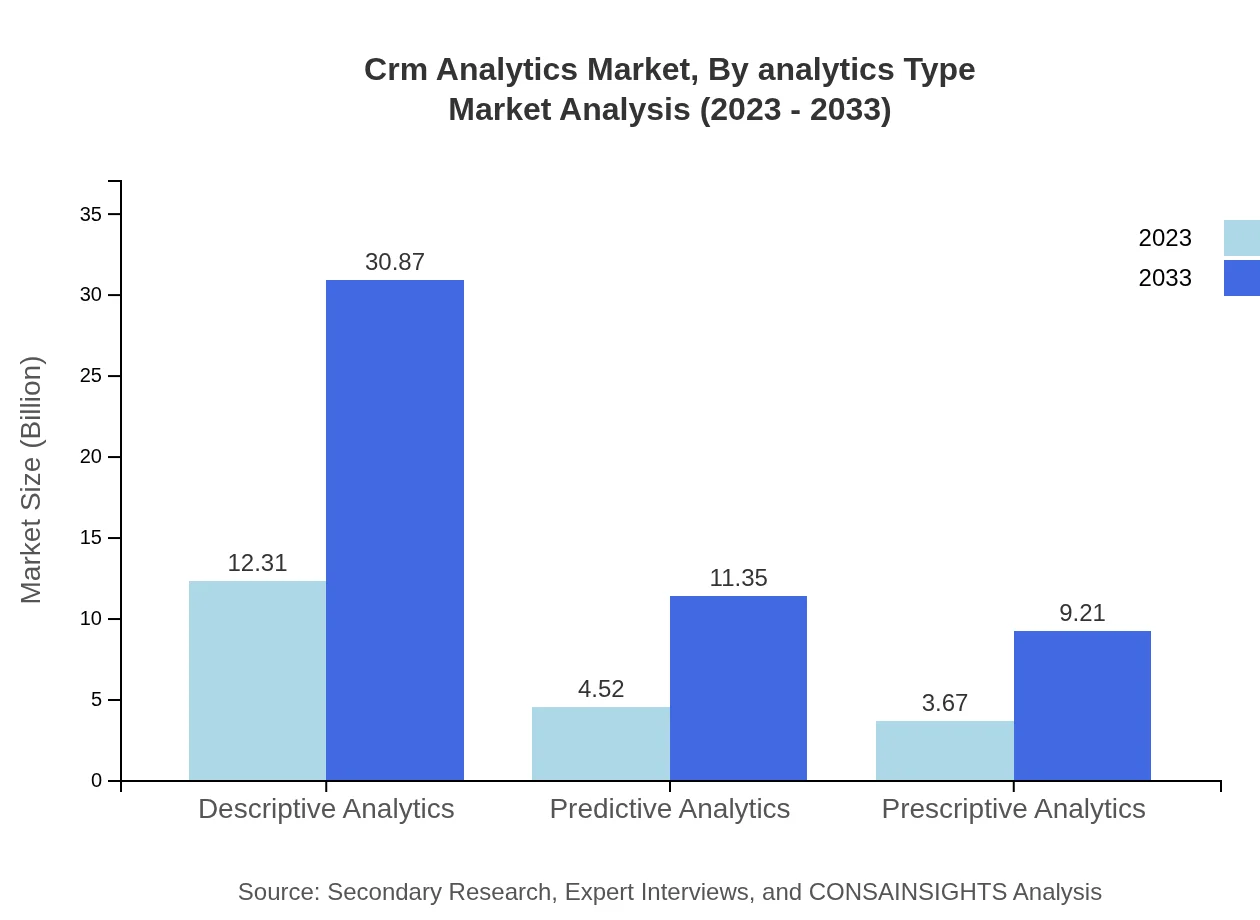

Crm Analytics Market Analysis By Analytics Type

This segmentation emphasizes the growth in descriptive analytics from $12.31 billion to $30.87 billion, driven by widespread use in customer behavior analysis while predictive analytics will grow from $4.52 billion to $11.35 billion as businesses seek to forecast future customer needs.

Crm Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Crm Analytics Industry

Salesforce:

Salesforce is a leading cloud-based CRM provider known for its innovative analytics solutions that help businesses leverage customer data effectively.SAP:

SAP provides a broad array of CRM solutions, utilizing advanced analytics to enhance customer relationships and drive business growth.Oracle:

Oracle offers comprehensive analytics tools integrated with its CRM solutions, enabling businesses to derive insights from customer data efficiently.Microsoft:

Microsoft's Dynamics 365 CRM integrates robust analytics features to empower organizations to improve customer engagement through actionable insights.HubSpot:

HubSpot is renowned for its user-friendly CRM platform that includes powerful analytics capabilities tailored for small and medium enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of CRM Analytics?

The CRM analytics market size is currently valued at approximately $20.5 billion in 2023, with a projected CAGR of 9.3%. By 2033, it is expected to significantly expand, reflecting growing demand across various industries.

What are the key market players or companies in the CRM Analytics industry?

Key players in the CRM analytics market include Salesforce, Adobe Inc., Microsoft Corp., SAP SE, and Oracle Corporation, which offer robust analytics solutions that help businesses enhance customer relationship management through data-driven insights.

What are the primary factors driving the growth in the CRM analytics industry?

The CRM analytics industry is primarily driven by the increasing need for personalized customer experiences, the growing importance of data analytics, and the rising prevalence of cloud-based solutions which enable real-time data processing and insights.

Which region is the fastest Growing in the CRM Analytics market?

The Asia Pacific region is currently the fastest-growing market for CRM analytics, projected to grow from $3.83 billion in 2023 to $9.60 billion by 2033, due to rapid digital transformation initiatives in the region.

Does ConsaInsights provide customized market report data for the CRM Analytics industry?

Yes, ConsaInsights provides customized market report data tailored to clients' specific needs within the CRM analytics industry, offering detailed insights, forecasts, and trends that align with unique business objectives.

What deliverables can I expect from this CRM Analytics market research project?

Deliverables from the CRM analytics market research project include comprehensive reports, market trend analysis, segmentation insights, regional data breakdown, and actionable recommendations to enhance decision-making.

What are the market trends of CRM Analytics?

Current trends in the CRM analytics market include increased adoption of artificial intelligence for predictive analytics, growing reliance on cloud-based solutions, and an emphasis on integrating multi-channel data to enrich customer insights.